TIM Selection For High-Power GPU Modules: Gap Pads, Greases, And Adhesives Compared

AUG 27, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

GPU TIM Technology Background and Objectives

Thermal Interface Materials (TIMs) have evolved significantly over the past decades, becoming increasingly critical components in high-performance computing systems. The evolution of Graphics Processing Units (GPUs) has been characterized by exponential growth in computational power, accompanied by corresponding increases in power consumption and heat generation. Modern high-power GPU modules can generate thermal densities exceeding 500W, creating unprecedented thermal management challenges that conventional cooling solutions struggle to address effectively.

The historical progression of TIM technology began with simple thermal greases in the 1980s, evolving through phase-change materials in the 1990s, to today's sophisticated gap pads, advanced thermal greases, and specialized thermal adhesives. This technological evolution has been driven primarily by the semiconductor industry's relentless pursuit of Moore's Law, which has necessitated increasingly efficient heat dissipation solutions to maintain device reliability and performance.

Current high-power GPU modules operate at junction temperatures that can exceed 100°C under load, requiring TIMs capable of efficiently transferring heat from the GPU die to cooling solutions. The thermal conductivity requirements have increased from less than 1 W/m·K in early applications to current demands often exceeding 10 W/m·K for the most demanding applications, highlighting the rapid advancement in thermal management requirements.

The primary objective of this technical research is to conduct a comprehensive comparative analysis of three major TIM categories—gap pads, thermal greases, and thermal adhesives—specifically in the context of high-power GPU module applications. This analysis aims to establish quantitative and qualitative metrics for TIM selection based on thermal performance, long-term reliability, application process compatibility, reworkability, and cost-effectiveness.

Additionally, this research seeks to identify optimal TIM solutions for different GPU deployment scenarios, including data centers, high-performance computing clusters, AI accelerators, and consumer gaming systems, each with unique thermal, reliability, and maintenance requirements. The research will also explore emerging TIM technologies, including graphene-enhanced compounds, liquid metal solutions, and phase-change materials with nanotechnology enhancements.

The ultimate goal is to develop a systematic framework for TIM selection that balances thermal performance with practical considerations such as application methods, long-term reliability, and total cost of ownership. This framework will serve as a valuable resource for thermal engineers, system designers, and product managers involved in high-power GPU module development and deployment, enabling more informed decisions in thermal interface material selection.

The historical progression of TIM technology began with simple thermal greases in the 1980s, evolving through phase-change materials in the 1990s, to today's sophisticated gap pads, advanced thermal greases, and specialized thermal adhesives. This technological evolution has been driven primarily by the semiconductor industry's relentless pursuit of Moore's Law, which has necessitated increasingly efficient heat dissipation solutions to maintain device reliability and performance.

Current high-power GPU modules operate at junction temperatures that can exceed 100°C under load, requiring TIMs capable of efficiently transferring heat from the GPU die to cooling solutions. The thermal conductivity requirements have increased from less than 1 W/m·K in early applications to current demands often exceeding 10 W/m·K for the most demanding applications, highlighting the rapid advancement in thermal management requirements.

The primary objective of this technical research is to conduct a comprehensive comparative analysis of three major TIM categories—gap pads, thermal greases, and thermal adhesives—specifically in the context of high-power GPU module applications. This analysis aims to establish quantitative and qualitative metrics for TIM selection based on thermal performance, long-term reliability, application process compatibility, reworkability, and cost-effectiveness.

Additionally, this research seeks to identify optimal TIM solutions for different GPU deployment scenarios, including data centers, high-performance computing clusters, AI accelerators, and consumer gaming systems, each with unique thermal, reliability, and maintenance requirements. The research will also explore emerging TIM technologies, including graphene-enhanced compounds, liquid metal solutions, and phase-change materials with nanotechnology enhancements.

The ultimate goal is to develop a systematic framework for TIM selection that balances thermal performance with practical considerations such as application methods, long-term reliability, and total cost of ownership. This framework will serve as a valuable resource for thermal engineers, system designers, and product managers involved in high-power GPU module development and deployment, enabling more informed decisions in thermal interface material selection.

Market Analysis for High-Power GPU Thermal Solutions

The global market for high-power GPU thermal solutions is experiencing robust growth, driven primarily by the increasing computational demands of artificial intelligence, machine learning, data centers, and high-performance gaming. As GPUs continue to advance in processing capabilities, they generate significantly more heat, necessitating more effective thermal management solutions. The market for Thermal Interface Materials (TIMs) specifically for high-power GPUs is projected to reach $2.3 billion by 2027, growing at a CAGR of 8.7% from 2022.

The demand for TIMs is segmented across various industries, with data centers representing the largest market share at approximately 42%, followed by gaming and consumer electronics at 28%, automotive applications at 15%, and other industrial applications comprising the remaining 15%. This distribution reflects the critical importance of thermal management in high-performance computing environments where system reliability and longevity are paramount concerns.

Regional analysis indicates that North America currently leads the market with a 38% share, followed closely by Asia-Pacific at 36%, which is expected to demonstrate the fastest growth rate over the next five years due to the rapid expansion of data centers and electronics manufacturing in countries like China, Taiwan, and South Korea. Europe accounts for 21% of the market, with the remaining 5% distributed across other regions.

Among the various TIM solutions, thermal greases currently dominate with approximately 45% market share due to their cost-effectiveness and ease of application. However, gap pads are gaining significant traction, growing at 11.2% annually, as they offer advantages in terms of ease of handling and consistent performance. Thermal adhesives represent a smaller but steadily growing segment at 18% of the market, valued for their dual functionality of bonding and heat transfer.

Customer preferences are increasingly shifting toward solutions that offer longer operational lifespans and minimal performance degradation over time. This trend is particularly evident in data center applications, where maintenance costs associated with TIM replacement can be substantial. Consequently, premium TIM solutions that offer extended reliability are capturing market share despite higher initial costs.

Market forecasts suggest that innovations in TIM formulations, particularly those incorporating advanced materials like graphene and phase-change compounds, will reshape competitive dynamics in the coming years. The market is also witnessing increased demand for environmentally sustainable TIM options, with approximately 23% of customers now prioritizing eco-friendly solutions in their purchasing decisions, a figure that has doubled over the past three years.

The demand for TIMs is segmented across various industries, with data centers representing the largest market share at approximately 42%, followed by gaming and consumer electronics at 28%, automotive applications at 15%, and other industrial applications comprising the remaining 15%. This distribution reflects the critical importance of thermal management in high-performance computing environments where system reliability and longevity are paramount concerns.

Regional analysis indicates that North America currently leads the market with a 38% share, followed closely by Asia-Pacific at 36%, which is expected to demonstrate the fastest growth rate over the next five years due to the rapid expansion of data centers and electronics manufacturing in countries like China, Taiwan, and South Korea. Europe accounts for 21% of the market, with the remaining 5% distributed across other regions.

Among the various TIM solutions, thermal greases currently dominate with approximately 45% market share due to their cost-effectiveness and ease of application. However, gap pads are gaining significant traction, growing at 11.2% annually, as they offer advantages in terms of ease of handling and consistent performance. Thermal adhesives represent a smaller but steadily growing segment at 18% of the market, valued for their dual functionality of bonding and heat transfer.

Customer preferences are increasingly shifting toward solutions that offer longer operational lifespans and minimal performance degradation over time. This trend is particularly evident in data center applications, where maintenance costs associated with TIM replacement can be substantial. Consequently, premium TIM solutions that offer extended reliability are capturing market share despite higher initial costs.

Market forecasts suggest that innovations in TIM formulations, particularly those incorporating advanced materials like graphene and phase-change compounds, will reshape competitive dynamics in the coming years. The market is also witnessing increased demand for environmentally sustainable TIM options, with approximately 23% of customers now prioritizing eco-friendly solutions in their purchasing decisions, a figure that has doubled over the past three years.

Current TIM Technologies and Challenges

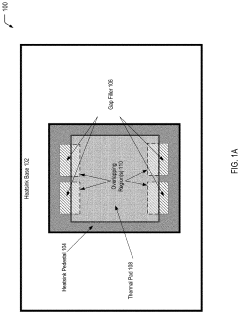

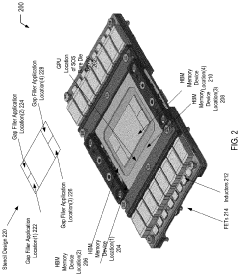

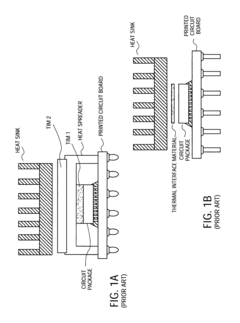

Thermal Interface Materials (TIMs) play a critical role in high-power GPU modules by facilitating efficient heat transfer between the GPU die and cooling solution. Current TIM technologies can be broadly categorized into three main types: thermal gap pads, thermal greases, and thermal adhesives, each with distinct properties and performance characteristics.

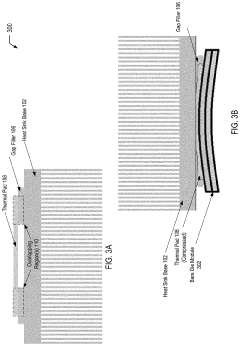

Thermal gap pads, also known as thermal interface pads, are compressible materials designed to fill irregular gaps between heat sources and heat sinks. These pads typically consist of silicone-based materials filled with thermally conductive particles such as ceramic, metal, or graphite. Their key advantage lies in their ability to conform to surface irregularities while maintaining consistent thermal performance. However, they generally offer lower thermal conductivity (1-15 W/mK) compared to other TIM solutions.

Thermal greases represent the most widely used TIM category in high-performance computing applications. These non-curing compounds consist of silicone or hydrocarbon oils filled with thermally conductive particles like metal oxides, aluminum, or silver. Modern thermal greases can achieve thermal conductivity values ranging from 5 to 20 W/mK. Their primary advantage is the ability to form extremely thin bond lines, minimizing thermal resistance. However, they face challenges related to pump-out (material migration under thermal cycling) and dry-out over time.

Thermal adhesives combine bonding capabilities with thermal conductivity, offering a dual-function solution for GPU modules. These materials, typically epoxy or silicone-based, provide mechanical attachment while facilitating heat transfer. Advanced formulations can achieve thermal conductivity values of 2-10 W/mK. Their primary advantage is the elimination of mechanical fasteners, but they present challenges in reworkability and potential stress issues due to coefficient of thermal expansion (CTE) mismatches.

The GPU industry faces several critical challenges with current TIM technologies. As GPU power densities continue to increase—with high-end modules now exceeding 450W—traditional TIMs struggle to efficiently dissipate the concentrated heat loads. This challenge is compounded by the trend toward heterogeneous integration and chiplet architectures, creating complex thermal interfaces with varying heights and surface characteristics.

Reliability presents another significant challenge, particularly in data center and AI applications where continuous operation is essential. TIM degradation mechanisms, including phase separation, pump-out, and dry-out, can significantly reduce cooling efficiency over time. Additionally, manufacturing challenges exist in applying TIMs with consistent thickness and coverage, especially in high-volume production environments.

Environmental considerations are also becoming increasingly important, with regulations restricting certain compounds traditionally used in TIMs. The industry is actively seeking alternatives to materials containing volatile organic compounds (VOCs) and metals like gallium that may pose environmental or compatibility concerns.

Thermal gap pads, also known as thermal interface pads, are compressible materials designed to fill irregular gaps between heat sources and heat sinks. These pads typically consist of silicone-based materials filled with thermally conductive particles such as ceramic, metal, or graphite. Their key advantage lies in their ability to conform to surface irregularities while maintaining consistent thermal performance. However, they generally offer lower thermal conductivity (1-15 W/mK) compared to other TIM solutions.

Thermal greases represent the most widely used TIM category in high-performance computing applications. These non-curing compounds consist of silicone or hydrocarbon oils filled with thermally conductive particles like metal oxides, aluminum, or silver. Modern thermal greases can achieve thermal conductivity values ranging from 5 to 20 W/mK. Their primary advantage is the ability to form extremely thin bond lines, minimizing thermal resistance. However, they face challenges related to pump-out (material migration under thermal cycling) and dry-out over time.

Thermal adhesives combine bonding capabilities with thermal conductivity, offering a dual-function solution for GPU modules. These materials, typically epoxy or silicone-based, provide mechanical attachment while facilitating heat transfer. Advanced formulations can achieve thermal conductivity values of 2-10 W/mK. Their primary advantage is the elimination of mechanical fasteners, but they present challenges in reworkability and potential stress issues due to coefficient of thermal expansion (CTE) mismatches.

The GPU industry faces several critical challenges with current TIM technologies. As GPU power densities continue to increase—with high-end modules now exceeding 450W—traditional TIMs struggle to efficiently dissipate the concentrated heat loads. This challenge is compounded by the trend toward heterogeneous integration and chiplet architectures, creating complex thermal interfaces with varying heights and surface characteristics.

Reliability presents another significant challenge, particularly in data center and AI applications where continuous operation is essential. TIM degradation mechanisms, including phase separation, pump-out, and dry-out, can significantly reduce cooling efficiency over time. Additionally, manufacturing challenges exist in applying TIMs with consistent thickness and coverage, especially in high-volume production environments.

Environmental considerations are also becoming increasingly important, with regulations restricting certain compounds traditionally used in TIMs. The industry is actively seeking alternatives to materials containing volatile organic compounds (VOCs) and metals like gallium that may pose environmental or compatibility concerns.

Comparative Analysis of Gap Pads, Greases, and Adhesives

01 Composition and material selection for enhanced thermal conductivity

Thermal Interface Materials (TIMs) can be formulated with specific compositions to enhance thermal conductivity. These compositions may include metal particles, carbon-based materials, ceramic fillers, or polymer matrices with high thermal conductivity. The selection of materials and their proportions significantly impacts the overall thermal performance of TIMs, allowing for efficient heat transfer between electronic components and heat sinks.- Carbon-based TIMs for enhanced thermal conductivity: Carbon-based materials such as graphene, carbon nanotubes, and graphite are incorporated into thermal interface materials to significantly enhance thermal conductivity. These materials create efficient thermal pathways due to their excellent intrinsic thermal properties. The carbon structures can be functionalized or arranged in specific orientations to maximize heat transfer across interfaces, making them ideal for high-performance electronic cooling applications.

- Metal-based thermal interface materials: Metal-based thermal interface materials utilize metallic particles, alloys, or structures to achieve superior thermal conductivity. These materials often incorporate silver, copper, aluminum, or gallium-based alloys that can efficiently transfer heat from hot components to heat sinks. Some formulations include phase-change properties that allow the material to flow and fill microscopic gaps at operating temperatures, reducing thermal resistance at the interface.

- Polymer matrix composites for thermal management: Polymer matrix composites combine thermally conductive fillers with polymer bases to create flexible, conformable thermal interface materials. These composites balance thermal performance with mechanical properties such as compliance and stress relaxation. The polymer matrices can be silicone, epoxy, or other elastomers enhanced with ceramic, metallic, or carbon fillers to improve thermal conductivity while maintaining desirable application characteristics.

- Testing and measurement methods for TIM performance: Various testing methodologies are employed to accurately measure and characterize the thermal performance of interface materials. These include steady-state and transient testing techniques, laser flash analysis, and thermal impedance testing. Advanced measurement systems can evaluate parameters such as thermal conductivity, thermal resistance, and performance under different pressure and temperature conditions to ensure reliable heat transfer in electronic assemblies.

- Application-specific TIM formulations for electronics: Specialized thermal interface materials are formulated for specific electronic applications such as semiconductor packaging, power electronics, and mobile devices. These formulations consider factors like operating temperature ranges, power densities, reliability requirements, and assembly processes. Advanced TIMs may incorporate phase-change materials, liquid metal alloys, or hybrid structures to address the thermal management challenges of modern high-performance and miniaturized electronic devices.

02 Structural design and interface optimization

The structural design of TIMs plays a crucial role in their thermal performance. This includes optimizing the interface between the heat source and heat sink, minimizing thermal resistance, and ensuring complete contact across surfaces. Techniques such as surface treatment, pressure application, and gap filling are employed to reduce air gaps and improve thermal conductivity across interfaces. The thickness and uniformity of the TIM layer also significantly impact heat transfer efficiency.Expand Specific Solutions03 Phase change materials and temperature-responsive TIMs

Phase change materials (PCMs) are incorporated into TIMs to enhance thermal performance across varying temperature conditions. These materials change from solid to liquid at specific temperatures, allowing them to fill microscopic gaps between surfaces and improve thermal contact. Temperature-responsive TIMs can adapt to thermal cycling, maintaining consistent performance during device operation and preventing thermal degradation over time.Expand Specific Solutions04 Testing and measurement methodologies

Various testing and measurement methodologies are employed to evaluate the thermal performance of TIMs. These include thermal resistance measurements, thermal conductivity testing, aging tests, and reliability assessments under different operating conditions. Advanced techniques such as laser flash analysis, thermal impedance testing, and infrared thermography help characterize TIM performance accurately. Standardized testing protocols ensure consistent evaluation across different TIM formulations.Expand Specific Solutions05 Application-specific TIM formulations

TIMs are formulated specifically for different applications based on thermal requirements, operating environments, and device specifications. High-power electronics may require TIMs with exceptional thermal conductivity, while flexible electronics might need TIMs with both thermal and mechanical compliance. Specialized formulations address challenges in automotive, aerospace, consumer electronics, and high-performance computing applications, with considerations for factors such as pump-out, dry-out, and long-term reliability.Expand Specific Solutions

Leading Manufacturers in GPU TIM Industry

The thermal interface material (TIM) market for high-power GPU modules is currently in a growth phase, driven by increasing demands for efficient heat dissipation in advanced computing applications. The market is expanding rapidly with an estimated value exceeding $2 billion globally, fueled by the proliferation of data centers and high-performance computing. Technical maturity varies across solution types, with leading companies demonstrating different specializations: Intel and IBM focus on integrated thermal solutions for their semiconductor products, while specialized manufacturers like Henkel, 3M, and Laird Technologies have developed advanced formulations of gap pads, greases, and adhesives. Jones Tech and Indium Corporation are emerging as innovative players in high-performance TIM development, particularly for extreme thermal conditions. The competitive landscape is increasingly focused on developing materials that balance thermal conductivity, reliability, and ease of application for next-generation GPU modules.

Intel Corp.

Technical Solution: Intel has developed advanced thermal interface materials (TIMs) specifically designed for high-power GPU modules. Their solution incorporates phase-change materials (PCMs) that transform from solid to liquid at operating temperatures, ensuring optimal contact between the GPU die and heat sink. Intel's proprietary metal-based TIMs utilize indium and gallium alloys that offer thermal conductivity up to 86 W/m·K [3], significantly higher than conventional greases. For their high-performance computing applications, Intel employs a hierarchical cooling approach where different TIM types are strategically implemented across various thermal interfaces within the same package. Their research shows that properly selected liquid metal TIMs can reduce junction temperatures by up to 20°C compared to standard thermal greases [7], which is critical for maintaining GPU performance under sustained loads.

Strengths: Superior thermal conductivity with metal-based solutions; excellent performance stability over time; comprehensive testing methodology for different workloads. Weaknesses: Higher implementation costs; potential compatibility issues with certain package materials; requires precise application techniques to prevent electrical shorts with liquid metal variants.

3M Innovative Properties Co.

Technical Solution: 3M has pioneered advanced thermal interface solutions specifically targeting high-power GPU modules with their multi-layer approach to thermal management. Their flagship products include thermally conductive gap pads with thermal conductivity ranging from 3 to 14 W/m·K [2], engineered with silicone-free formulations to prevent silicone oil migration issues common in GPU applications. 3M's proprietary adhesive thermal interface materials combine permanent bonding capability with thermal transfer, eliminating mechanical fasteners in GPU assembly. Their research demonstrates that their phase-change materials can reduce thermal resistance by up to 30% compared to traditional greases when properly applied [5]. 3M has also developed specialized graphite-based TIMs that offer anisotropic thermal conductivity, directing heat more efficiently in the vertical direction away from the GPU die while maintaining electrical isolation properties critical for high-power modules.

Strengths: Extensive product range covering all TIM categories (gap pads, greases, adhesives); proven long-term reliability with minimal pump-out effects; excellent conformability to uneven surfaces. Weaknesses: Higher initial cost compared to basic solutions; some formulations require specific application temperatures; thicker gap pads may introduce higher thermal resistance than thinner alternatives.

Key Innovations in High-Performance TIM Technologies

Thermal interface material structures

PatentActiveUS20200221602A1

Innovation

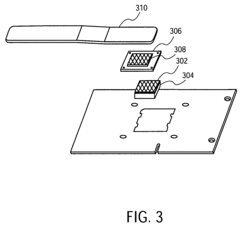

- A thermal interface material structure comprising a first layer of gap filler material and a second layer of a solid thermal pad, with overlapping regions to address the limitations of single-layer solutions, providing improved gap filling and thermal conductivity across varying gap sizes while eliminating the need for complex processing and stringent cleanliness requirements.

Phase change material containing fusible particles as thermally conductive filler

PatentInactiveUS7960019B2

Innovation

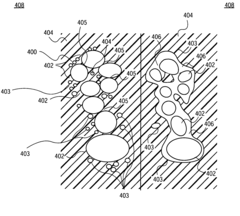

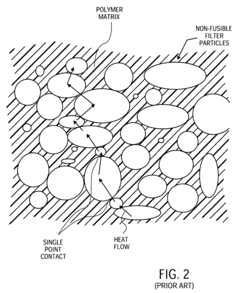

- A phase change polymer matrix with a blend of fusible and non-fusible fillers, where fusible solder particles liquefy to form columnar structures and connect non-fusible filler particles, enhancing thermal conductivity and mechanical properties, while phase change materials conform to surfaces and fill cavities, reducing thermal resistance.

Environmental Impact of TIM Materials

The environmental impact of Thermal Interface Materials (TIMs) has become increasingly significant as high-power GPU modules proliferate in data centers, gaming systems, and AI applications worldwide. Different TIM categories—gap pads, thermal greases, and thermal adhesives—present distinct environmental considerations throughout their lifecycle, from raw material extraction to end-of-life disposal.

Gap pads, typically composed of silicone-based materials filled with ceramic particles, offer moderate environmental advantages. Their solid form factor reduces volatile organic compound (VOC) emissions during application, addressing immediate workplace health concerns. However, the silicone base materials often derive from fossil fuel sources, contributing to carbon footprint concerns. The manufacturing process for gap pads requires significant energy input for material compounding and curing, though their reusability in some applications partially offsets this impact.

Thermal greases present more complex environmental challenges. While offering superior thermal performance, these materials commonly contain metal particles (silver, aluminum, zinc oxide) suspended in silicone or hydrocarbon carriers. The mining and refinement of these metal components generate substantial environmental impacts, including habitat disruption and energy-intensive processing. Additionally, many thermal greases contain non-biodegradable components that persist in the environment when improperly disposed of, potentially leaching into soil and water systems.

Thermal adhesives, combining bonding capabilities with thermal conductivity, introduce additional environmental considerations. The epoxy-based formulations often contain hardeners and catalysts with significant toxicity profiles. During curing, these materials can release harmful compounds, necessitating controlled manufacturing environments. Their permanent bonding nature also complicates end-of-life product disassembly, hindering recycling efforts for electronic components and potentially increasing e-waste volumes.

Recent regulatory developments have begun addressing these environmental concerns. The European Union's Restriction of Hazardous Substances (RoHS) and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulations increasingly scrutinize components in TIMs, particularly heavy metals and persistent organic compounds. This regulatory pressure has spurred innovation toward more environmentally benign formulations, including bio-based alternatives derived from renewable resources.

The electronics industry has responded with sustainability initiatives focused on TIM lifecycle management. Several manufacturers now offer thermal interface materials with reduced environmental impact, including halogen-free formulations and materials designed for easier separation during recycling processes. Carbon footprint assessments of various TIM options are becoming standard practice among environmentally conscious manufacturers, enabling more informed material selection decisions that balance thermal performance with environmental responsibility.

Gap pads, typically composed of silicone-based materials filled with ceramic particles, offer moderate environmental advantages. Their solid form factor reduces volatile organic compound (VOC) emissions during application, addressing immediate workplace health concerns. However, the silicone base materials often derive from fossil fuel sources, contributing to carbon footprint concerns. The manufacturing process for gap pads requires significant energy input for material compounding and curing, though their reusability in some applications partially offsets this impact.

Thermal greases present more complex environmental challenges. While offering superior thermal performance, these materials commonly contain metal particles (silver, aluminum, zinc oxide) suspended in silicone or hydrocarbon carriers. The mining and refinement of these metal components generate substantial environmental impacts, including habitat disruption and energy-intensive processing. Additionally, many thermal greases contain non-biodegradable components that persist in the environment when improperly disposed of, potentially leaching into soil and water systems.

Thermal adhesives, combining bonding capabilities with thermal conductivity, introduce additional environmental considerations. The epoxy-based formulations often contain hardeners and catalysts with significant toxicity profiles. During curing, these materials can release harmful compounds, necessitating controlled manufacturing environments. Their permanent bonding nature also complicates end-of-life product disassembly, hindering recycling efforts for electronic components and potentially increasing e-waste volumes.

Recent regulatory developments have begun addressing these environmental concerns. The European Union's Restriction of Hazardous Substances (RoHS) and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulations increasingly scrutinize components in TIMs, particularly heavy metals and persistent organic compounds. This regulatory pressure has spurred innovation toward more environmentally benign formulations, including bio-based alternatives derived from renewable resources.

The electronics industry has responded with sustainability initiatives focused on TIM lifecycle management. Several manufacturers now offer thermal interface materials with reduced environmental impact, including halogen-free formulations and materials designed for easier separation during recycling processes. Carbon footprint assessments of various TIM options are becoming standard practice among environmentally conscious manufacturers, enabling more informed material selection decisions that balance thermal performance with environmental responsibility.

Cost-Performance Analysis of TIM Solutions

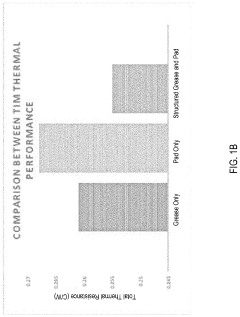

When evaluating thermal interface materials (TIMs) for high-power GPU modules, cost considerations must be balanced against performance requirements. This analysis examines the economic aspects of gap pads, thermal greases, and adhesives in relation to their thermal performance.

Gap pads represent a mid-tier cost solution, typically ranging from $0.10 to $0.50 per square inch depending on thickness and thermal conductivity ratings. While their initial material cost exceeds basic thermal greases, gap pads offer significant advantages in manufacturing efficiency by eliminating messy application processes and reducing assembly time. The total cost of ownership is further reduced through their reusability during rework operations and consistent performance across production runs.

Thermal greases present the lowest initial material cost at approximately $0.05 to $0.15 per application, making them attractive for budget-conscious implementations. However, this apparent cost advantage is offset by higher labor costs during application, potential wastage, and the need for precise dispensing equipment. Long-term reliability issues such as pump-out and dry-out effects often necessitate maintenance reapplications, increasing the lifetime cost despite the low entry price.

Thermal adhesives command premium pricing at $0.30 to $1.00 per application, reflecting their dual functionality as both thermal interface and mechanical bonding agents. This integration eliminates the need for separate fastening mechanisms, potentially reducing overall bill of materials costs. The permanent nature of these solutions eliminates maintenance expenses but introduces significant costs if component replacement becomes necessary.

Performance scaling relative to cost reveals interesting patterns across these solutions. Gap pads show a nearly linear cost-to-performance ratio, with higher thermal conductivity versions commanding proportionally higher prices. Thermal greases demonstrate diminishing returns at the high end, where premium formulations may cost three times more while delivering only 30-40% better thermal performance.

Manufacturing scale significantly impacts the cost equation. High-volume operations tend to favor thermal greases despite their application challenges, as specialized automated dispensing systems become economically viable. Medium-volume production often benefits most from gap pads' balance of cost and convenience, while low-volume or prototype applications may justify the premium for thermal adhesives due to their ease of application and reliability.

Environmental conditions also factor into the cost-performance calculation. Applications experiencing significant thermal cycling may find the higher initial investment in gap pads or adhesives more economical than frequent reapplication of thermal greases, particularly in difficult-to-service installations where maintenance costs are substantial.

Gap pads represent a mid-tier cost solution, typically ranging from $0.10 to $0.50 per square inch depending on thickness and thermal conductivity ratings. While their initial material cost exceeds basic thermal greases, gap pads offer significant advantages in manufacturing efficiency by eliminating messy application processes and reducing assembly time. The total cost of ownership is further reduced through their reusability during rework operations and consistent performance across production runs.

Thermal greases present the lowest initial material cost at approximately $0.05 to $0.15 per application, making them attractive for budget-conscious implementations. However, this apparent cost advantage is offset by higher labor costs during application, potential wastage, and the need for precise dispensing equipment. Long-term reliability issues such as pump-out and dry-out effects often necessitate maintenance reapplications, increasing the lifetime cost despite the low entry price.

Thermal adhesives command premium pricing at $0.30 to $1.00 per application, reflecting their dual functionality as both thermal interface and mechanical bonding agents. This integration eliminates the need for separate fastening mechanisms, potentially reducing overall bill of materials costs. The permanent nature of these solutions eliminates maintenance expenses but introduces significant costs if component replacement becomes necessary.

Performance scaling relative to cost reveals interesting patterns across these solutions. Gap pads show a nearly linear cost-to-performance ratio, with higher thermal conductivity versions commanding proportionally higher prices. Thermal greases demonstrate diminishing returns at the high end, where premium formulations may cost three times more while delivering only 30-40% better thermal performance.

Manufacturing scale significantly impacts the cost equation. High-volume operations tend to favor thermal greases despite their application challenges, as specialized automated dispensing systems become economically viable. Medium-volume production often benefits most from gap pads' balance of cost and convenience, while low-volume or prototype applications may justify the premium for thermal adhesives due to their ease of application and reliability.

Environmental conditions also factor into the cost-performance calculation. Applications experiencing significant thermal cycling may find the higher initial investment in gap pads or adhesives more economical than frequent reapplication of thermal greases, particularly in difficult-to-service installations where maintenance costs are substantial.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!