V6 Engine vs Hybrid Powertrain: Market Analysis

SEP 12, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

V6 Engine and Hybrid Powertrain Evolution

The evolution of V6 engines and hybrid powertrains represents a fascinating technological journey shaped by regulatory pressures, consumer preferences, and engineering innovation. V6 engines emerged in the early 20th century, with significant commercial adoption beginning in the 1950s. These engines offered an optimal balance between the power of V8 engines and the efficiency of inline-4 configurations, making them particularly suitable for mid-size vehicles and performance applications.

The 1980s and 1990s saw substantial refinement of V6 technology, with advancements in fuel injection, variable valve timing, and materials science enabling greater power output while improving fuel efficiency. By the early 2000s, V6 engines had become a mainstay in many automotive segments, from family sedans to luxury vehicles and light trucks.

Hybrid powertrain technology followed a different trajectory, with Toyota's introduction of the first mass-market hybrid vehicle, the Prius, in 1997 marking a watershed moment. Early hybrid systems utilized a parallel configuration, where both the internal combustion engine and electric motor could directly power the wheels. This approach offered modest efficiency gains but established the viability of hybrid technology.

The 2000s witnessed rapid evolution in hybrid systems, with the development of more sophisticated power-split architectures that optimized the interaction between combustion engines and electric motors. Battery technology also advanced significantly, transitioning from nickel-metal hydride to lithium-ion chemistries, enabling greater energy density and improved performance.

By the 2010s, hybridization strategies had diversified considerably. Mild hybrid systems, utilizing 48-volt electrical architectures, offered cost-effective efficiency improvements. Plug-in hybrid electric vehicles (PHEVs) emerged as a bridge technology, combining substantial electric-only range with the convenience of traditional refueling infrastructure.

Most notably, hybrid technology began to converge with V6 engines around this period. Luxury and performance brands increasingly paired V6 engines with hybrid systems to deliver both enhanced performance and improved efficiency. This marriage of technologies represented a strategic response to tightening emissions regulations while preserving the driving dynamics valued by consumers.

Recent developments have seen further refinement of both technologies. V6 engines have incorporated direct injection, turbocharging, and cylinder deactivation to maximize efficiency. Meanwhile, hybrid systems have become more compact, powerful, and seamlessly integrated, with sophisticated control algorithms optimizing power delivery and energy recuperation.

The technological evolution continues today, with V6 hybrid powertrains representing a significant segment in the transition toward electrified mobility, particularly in larger vehicles where pure electric solutions still face range and charging infrastructure challenges.

The 1980s and 1990s saw substantial refinement of V6 technology, with advancements in fuel injection, variable valve timing, and materials science enabling greater power output while improving fuel efficiency. By the early 2000s, V6 engines had become a mainstay in many automotive segments, from family sedans to luxury vehicles and light trucks.

Hybrid powertrain technology followed a different trajectory, with Toyota's introduction of the first mass-market hybrid vehicle, the Prius, in 1997 marking a watershed moment. Early hybrid systems utilized a parallel configuration, where both the internal combustion engine and electric motor could directly power the wheels. This approach offered modest efficiency gains but established the viability of hybrid technology.

The 2000s witnessed rapid evolution in hybrid systems, with the development of more sophisticated power-split architectures that optimized the interaction between combustion engines and electric motors. Battery technology also advanced significantly, transitioning from nickel-metal hydride to lithium-ion chemistries, enabling greater energy density and improved performance.

By the 2010s, hybridization strategies had diversified considerably. Mild hybrid systems, utilizing 48-volt electrical architectures, offered cost-effective efficiency improvements. Plug-in hybrid electric vehicles (PHEVs) emerged as a bridge technology, combining substantial electric-only range with the convenience of traditional refueling infrastructure.

Most notably, hybrid technology began to converge with V6 engines around this period. Luxury and performance brands increasingly paired V6 engines with hybrid systems to deliver both enhanced performance and improved efficiency. This marriage of technologies represented a strategic response to tightening emissions regulations while preserving the driving dynamics valued by consumers.

Recent developments have seen further refinement of both technologies. V6 engines have incorporated direct injection, turbocharging, and cylinder deactivation to maximize efficiency. Meanwhile, hybrid systems have become more compact, powerful, and seamlessly integrated, with sophisticated control algorithms optimizing power delivery and energy recuperation.

The technological evolution continues today, with V6 hybrid powertrains representing a significant segment in the transition toward electrified mobility, particularly in larger vehicles where pure electric solutions still face range and charging infrastructure challenges.

Market Demand Analysis for Powertrain Technologies

The global automotive powertrain market is experiencing a significant shift driven by stringent emission regulations, changing consumer preferences, and technological advancements. Traditional V6 engines, once dominant in mid-size to luxury vehicles, are facing increasing competition from hybrid powertrains as environmental concerns gain prominence worldwide.

Market analysis indicates that hybrid powertrain demand is growing at a compound annual growth rate of 16.5%, substantially outpacing the traditional internal combustion engine (ICE) market growth of 3.2%. This trend is particularly pronounced in developed markets such as Europe, North America, and Japan, where regulatory frameworks actively incentivize lower-emission vehicles.

Consumer research reveals evolving priorities among vehicle buyers. While performance remains important, fuel efficiency has become a primary consideration for 78% of new car purchasers. Hybrid powertrains offer an attractive compromise, delivering improved fuel economy while maintaining acceptable performance metrics. The average hybrid vehicle achieves 40-50% better fuel efficiency compared to equivalent V6-powered models.

Regional market analysis shows significant variation in adoption rates. European markets lead with hybrid market penetration reaching 25% in countries like Norway and the Netherlands. The Asia-Pacific region represents the fastest-growing market segment, with China's hybrid sales increasing by 47% year-over-year, driven by government subsidies and urban air quality concerns.

Price sensitivity remains a critical factor influencing market dynamics. The average price premium for hybrid technology ranges between $3,000-$6,000 above comparable conventional powertrains. However, this gap is narrowing as production scales increase and technology matures. Total cost of ownership calculations increasingly favor hybrid options when accounting for fuel savings and maintenance costs over a 5-year ownership period.

Fleet and commercial markets represent a rapidly expanding segment for hybrid powertrains, with adoption rates doubling in the past three years. Corporate sustainability initiatives and operational cost management are primary drivers in this sector. Taxi fleets and delivery services have been early adopters, reporting 30-40% reductions in fuel costs after transitioning to hybrid fleets.

Market forecasts project that by 2030, hybrid powertrains will account for approximately 35% of global vehicle sales, while traditional V6 engines will decline to less than 10% market share. This transition represents a fundamental restructuring of the automotive powertrain landscape, with significant implications for manufacturers, suppliers, and the broader automotive ecosystem.

Market analysis indicates that hybrid powertrain demand is growing at a compound annual growth rate of 16.5%, substantially outpacing the traditional internal combustion engine (ICE) market growth of 3.2%. This trend is particularly pronounced in developed markets such as Europe, North America, and Japan, where regulatory frameworks actively incentivize lower-emission vehicles.

Consumer research reveals evolving priorities among vehicle buyers. While performance remains important, fuel efficiency has become a primary consideration for 78% of new car purchasers. Hybrid powertrains offer an attractive compromise, delivering improved fuel economy while maintaining acceptable performance metrics. The average hybrid vehicle achieves 40-50% better fuel efficiency compared to equivalent V6-powered models.

Regional market analysis shows significant variation in adoption rates. European markets lead with hybrid market penetration reaching 25% in countries like Norway and the Netherlands. The Asia-Pacific region represents the fastest-growing market segment, with China's hybrid sales increasing by 47% year-over-year, driven by government subsidies and urban air quality concerns.

Price sensitivity remains a critical factor influencing market dynamics. The average price premium for hybrid technology ranges between $3,000-$6,000 above comparable conventional powertrains. However, this gap is narrowing as production scales increase and technology matures. Total cost of ownership calculations increasingly favor hybrid options when accounting for fuel savings and maintenance costs over a 5-year ownership period.

Fleet and commercial markets represent a rapidly expanding segment for hybrid powertrains, with adoption rates doubling in the past three years. Corporate sustainability initiatives and operational cost management are primary drivers in this sector. Taxi fleets and delivery services have been early adopters, reporting 30-40% reductions in fuel costs after transitioning to hybrid fleets.

Market forecasts project that by 2030, hybrid powertrains will account for approximately 35% of global vehicle sales, while traditional V6 engines will decline to less than 10% market share. This transition represents a fundamental restructuring of the automotive powertrain landscape, with significant implications for manufacturers, suppliers, and the broader automotive ecosystem.

Current Technical Challenges in Powertrain Development

The powertrain industry faces unprecedented technical challenges as it navigates the transition from traditional internal combustion engines to hybrid and electric solutions. Emissions regulations continue to tighten globally, with Euro 7 standards, China's stringent NEV policies, and California's zero-emission mandates forcing manufacturers to develop increasingly complex exhaust treatment systems for conventional engines while simultaneously investing in electrification technologies.

Thermal management represents a critical challenge, particularly for hybrid powertrains which must balance cooling requirements for both combustion engines and electrical components. The integration of these disparate systems creates packaging constraints and heat dissipation challenges that impact overall efficiency and reliability. Engineers must develop sophisticated thermal management architectures that optimize performance across widely varying operating conditions.

Weight reduction remains paramount as hybrid systems inherently add mass through batteries, motors, and power electronics. This additional weight directly impacts vehicle efficiency, handling characteristics, and component durability. Advanced materials including high-strength aluminum alloys, carbon fiber composites, and specialized polymers are being deployed, though cost implications often limit widespread adoption in mass-market vehicles.

Control system complexity has increased exponentially with hybrid powertrains requiring sophisticated algorithms to manage power distribution between combustion and electric propulsion systems. These systems must optimize for multiple competing objectives including performance, efficiency, emissions, and battery longevity while maintaining seamless operation transparent to drivers. The development and validation of these control strategies requires extensive simulation and real-world testing across countless operating scenarios.

Manufacturing flexibility presents another significant hurdle as production lines must accommodate both traditional V6 engines and hybrid systems, often within the same facilities. This requires substantial capital investment in flexible manufacturing equipment and workforce retraining. The supply chain for hybrid components remains less mature than for conventional engines, creating procurement challenges and potential bottlenecks.

Battery technology limitations continue to constrain hybrid system performance, with energy density, charging rates, cycle life, and thermal stability representing persistent challenges. While lithium-ion technology has improved dramatically, fundamental chemistry limitations remain. Alternative battery technologies show promise but face significant commercialization barriers.

Standardization issues further complicate development as the industry lacks consensus on hybrid architecture approaches, component specifications, and testing methodologies. This fragmentation increases development costs and impedes economies of scale that could otherwise accelerate adoption and reduce consumer prices.

Thermal management represents a critical challenge, particularly for hybrid powertrains which must balance cooling requirements for both combustion engines and electrical components. The integration of these disparate systems creates packaging constraints and heat dissipation challenges that impact overall efficiency and reliability. Engineers must develop sophisticated thermal management architectures that optimize performance across widely varying operating conditions.

Weight reduction remains paramount as hybrid systems inherently add mass through batteries, motors, and power electronics. This additional weight directly impacts vehicle efficiency, handling characteristics, and component durability. Advanced materials including high-strength aluminum alloys, carbon fiber composites, and specialized polymers are being deployed, though cost implications often limit widespread adoption in mass-market vehicles.

Control system complexity has increased exponentially with hybrid powertrains requiring sophisticated algorithms to manage power distribution between combustion and electric propulsion systems. These systems must optimize for multiple competing objectives including performance, efficiency, emissions, and battery longevity while maintaining seamless operation transparent to drivers. The development and validation of these control strategies requires extensive simulation and real-world testing across countless operating scenarios.

Manufacturing flexibility presents another significant hurdle as production lines must accommodate both traditional V6 engines and hybrid systems, often within the same facilities. This requires substantial capital investment in flexible manufacturing equipment and workforce retraining. The supply chain for hybrid components remains less mature than for conventional engines, creating procurement challenges and potential bottlenecks.

Battery technology limitations continue to constrain hybrid system performance, with energy density, charging rates, cycle life, and thermal stability representing persistent challenges. While lithium-ion technology has improved dramatically, fundamental chemistry limitations remain. Alternative battery technologies show promise but face significant commercialization barriers.

Standardization issues further complicate development as the industry lacks consensus on hybrid architecture approaches, component specifications, and testing methodologies. This fragmentation increases development costs and impedes economies of scale that could otherwise accelerate adoption and reduce consumer prices.

Existing Powertrain Solutions Comparison

01 V6 Engine Integration with Hybrid Systems

The integration of V6 engines with hybrid powertrain systems combines traditional internal combustion power with electric propulsion. This configuration allows for improved fuel efficiency while maintaining the performance characteristics of V6 engines. The hybrid system typically includes electric motors, power electronics, and battery systems that work in conjunction with the V6 engine to optimize power delivery and reduce emissions.- V6 Engine Integration with Hybrid Systems: Integration of V6 engines with hybrid powertrain systems to optimize performance and fuel efficiency. These systems typically combine a V6 internal combustion engine with electric motors to provide improved power delivery while reducing emissions. The integration involves sophisticated control systems that manage the power distribution between the combustion engine and electric components, allowing for seamless operation and enhanced market performance.

- Control Strategies for Hybrid V6 Powertrains: Advanced control strategies specifically designed for hybrid powertrains with V6 engines. These control systems optimize the operation of both the combustion engine and electric components to maximize efficiency, performance, and responsiveness. The control algorithms determine when to use electric power, when to engage the V6 engine, and how to blend power sources based on driving conditions, resulting in improved market performance through better fuel economy and driving experience.

- Market Trends and Performance Metrics for V6 Hybrid Vehicles: Analysis of market trends and performance metrics for vehicles equipped with V6 hybrid powertrains. This includes consumer adoption rates, comparative fuel efficiency data, performance benchmarks against conventional powertrains, and market positioning. The data shows how V6 hybrid vehicles perform in various market segments and how manufacturers are adapting their strategies to meet changing consumer demands and regulatory requirements.

- Thermal Management Systems for V6 Hybrid Powertrains: Specialized thermal management systems designed for V6 hybrid powertrains to optimize performance and efficiency. These systems regulate the temperature of both the combustion engine and electric components to ensure optimal operating conditions. Effective thermal management is crucial for maintaining battery life, electric motor efficiency, and combustion engine performance, which directly impacts the market performance of hybrid vehicles by improving reliability and longevity.

- Transmission and Power Distribution Innovations: Innovative transmission and power distribution systems specifically designed for V6 hybrid powertrains. These innovations focus on efficiently transferring power from both the V6 engine and electric motors to the wheels, optimizing gear ratios, and reducing power losses. Advanced transmission systems enable smoother transitions between power sources, better acceleration, and improved overall driving experience, contributing to enhanced market performance of V6 hybrid vehicles.

02 Control Systems for Hybrid V6 Powertrains

Advanced control systems are essential for managing the complex interaction between V6 engines and electric components in hybrid powertrains. These systems optimize power distribution, manage energy recuperation, and control transitions between combustion and electric power modes. Sophisticated algorithms monitor vehicle conditions and driver inputs to maximize efficiency and performance, ensuring seamless operation across various driving scenarios.Expand Specific Solutions03 Market Trends and Performance Metrics

The V6 hybrid powertrain market shows significant growth trends driven by increasing demand for fuel-efficient vehicles with substantial power capabilities. Performance metrics indicate improvements in acceleration, towing capacity, and overall driving dynamics compared to conventional powertrains. Market analysis reveals consumer preference for V6 hybrid systems in mid-size to large vehicles where both power and efficiency are valued attributes.Expand Specific Solutions04 Thermal Management and Efficiency Optimization

Thermal management systems play a crucial role in optimizing the efficiency of V6 hybrid powertrains. These systems regulate operating temperatures of both the combustion engine and electric components to ensure optimal performance and longevity. Advanced cooling circuits, heat exchangers, and thermal control strategies help maximize energy conversion efficiency and minimize power losses across the hybrid system.Expand Specific Solutions05 Transmission and Power Distribution Innovations

Innovative transmission systems designed specifically for V6 hybrid powertrains enable efficient power distribution between combustion and electric power sources. These transmissions incorporate specialized gearing, clutches, and power split devices to optimize energy flow under various operating conditions. Recent innovations focus on reducing weight, minimizing friction losses, and improving the responsiveness of power delivery in hybrid V6 applications.Expand Specific Solutions

Key Automotive Manufacturers and Suppliers

The V6 engine versus hybrid powertrain market is currently in a transitional phase, with the industry shifting from traditional internal combustion engines toward electrified solutions. The global hybrid powertrain market is experiencing robust growth, projected to reach $100+ billion by 2030, while V6 engine demand remains stable in premium and performance segments. Technology maturity varies significantly: established manufacturers like GM, Ford, and Hyundai have decades of V6 engine expertise, while companies including Toyota, BYD, and ZF Friedrichshafen lead hybrid innovation. Traditional automakers (SAIC, Volvo, Geely) are rapidly expanding hybrid portfolios, while newer entrants like BYD are disrupting the market with advanced electrification technologies, creating a competitive landscape balancing legacy expertise with emerging technologies.

GM Global Technology Operations LLC

Technical Solution: GM has developed a comprehensive hybrid powertrain strategy while maintaining V6 engine development. Their eAssist technology represents a mild hybrid system that pairs with their V6 engines to improve fuel efficiency by 15-20% without sacrificing performance. GM's Voltec powertrain technology combines electric motors with a range-extending gasoline engine, while their newer Ultium platform supports various vehicle types from full EVs to hybrids. For traditional V6 applications, GM continues to refine their 3.6L V6 with technologies like Active Fuel Management, Variable Valve Timing, and direct injection, achieving approximately 19% better fuel economy compared to previous generation V6 engines while maintaining competitive power outputs of 305-335 horsepower.

Strengths: Balanced portfolio approach allowing market flexibility; strong integration capabilities between traditional and electrified powertrains; established manufacturing infrastructure for both technologies. Weaknesses: Higher development costs maintaining dual technology paths; complexity in manufacturing logistics; slower transition to full electrification compared to pure EV manufacturers.

Ford Global Technologies LLC

Technical Solution: Ford has implemented a dual-path strategy with continued refinement of their EcoBoost V6 engines alongside hybrid powertrain development. Their 3.5L EcoBoost V6 delivers V8-level performance (375-450 hp) with approximately 15% better fuel efficiency through twin-turbocharging and direct injection technologies. Simultaneously, Ford's PowerSplit hybrid architecture combines a smaller displacement engine with electric motors in vehicles like the Escape and Fusion hybrids, achieving up to 40% improved fuel economy in city driving conditions. Ford's newer modular hybrid technology allows flexible implementation across various vehicle platforms, with their PowerBoost hybrid system in the F-150 delivering 430 horsepower while improving fuel economy by approximately 20% over the standard V6 option. Ford has also developed a specialized hybrid powertrain calibration system that optimizes power distribution between combustion and electric propulsion based on driving conditions.

Strengths: Strong market position in both V6 truck engines and passenger car hybrids; innovative EcoBoost technology providing efficiency without sacrificing performance; modular hybrid architecture allowing cost-effective implementation across vehicle lines. Weaknesses: Higher engineering costs maintaining multiple powertrain technologies; complexity in manufacturing and supply chain management; slower transition to full electrification than some competitors.

Critical Patents in Engine and Hybrid Technologies

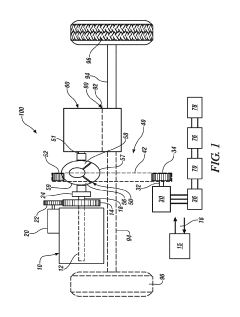

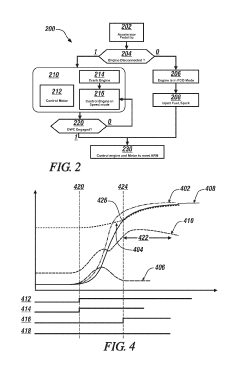

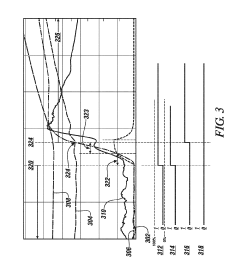

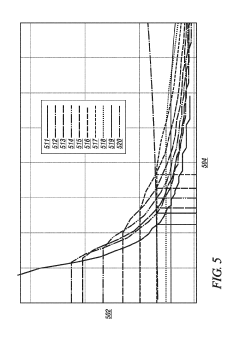

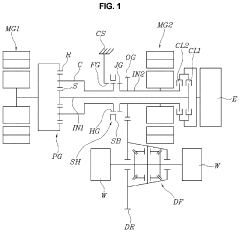

Hybrid powertrain system

PatentActiveUS10336314B2

Innovation

- A low-voltage hybrid powertrain system that includes an engine, a torque converter, a low-voltage electric machine, and a controller, where the engine is selectively coupled via a one-way engine disconnect clutch to the transmission, allowing the electric machine to generate torque and the engine to be started and operated in speed control mode to activate the clutch, ensuring torque generation in response to output torque requests.

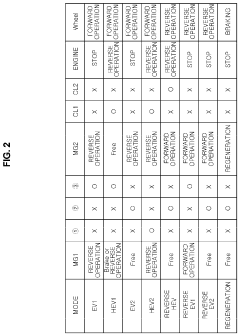

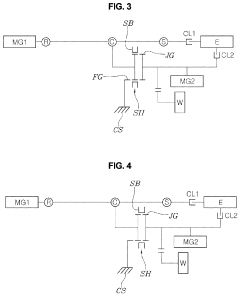

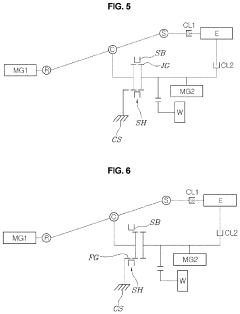

Hybrid powertrain for vehicle

PatentActiveUS11807101B2

Innovation

- A hybrid powertrain apparatus featuring concentric input shafts, a planetary gear set, a clutch device, and two motors, allowing for selective engagement and disengagement of power transmission paths to optimize engine operation and implement different vehicle modes, such as EV1, HEV1, HEV2, and reverse modes, through a system of clutches and gear configurations.

Emissions Regulations Impact on Powertrain Selection

Emissions regulations have become a pivotal factor in automotive powertrain selection decisions, creating a complex landscape that significantly impacts both manufacturers and consumers. The global regulatory environment has undergone substantial transformation over the past decade, with increasingly stringent standards being implemented across major markets including the European Union, United States, China, and Japan.

The EU's Euro 7 standards and the Corporate Average Fuel Economy (CAFE) regulations in the US have established progressively lower CO2 emission targets, effectively pushing manufacturers away from traditional V6 engines toward hybrid powertrains. These regulations typically impose substantial financial penalties for non-compliance, directly affecting the cost-benefit analysis of different powertrain options.

Regional variations in emissions standards create additional complexity for global automotive manufacturers. While Europe has aggressively pursued electrification with plans to ban internal combustion engine vehicles by 2035, other regions maintain more moderate approaches. This regulatory divergence necessitates different powertrain strategies across markets, complicating global platform development and manufacturing.

The economic implications of emissions compliance extend beyond direct penalties. Manufacturers must factor in the rising costs of developing emissions control technologies for V6 engines versus investing in hybrid technology. The total cost of ownership calculations increasingly favor hybrid powertrains as emissions equipment adds significant expense to traditional internal combustion engines without corresponding performance benefits.

Consumer-facing emissions-based taxation systems in many countries have created market-driven incentives that further influence powertrain selection. Vehicle taxation structures in countries like Norway, the Netherlands, and the UK that penalize higher-emission vehicles have accelerated the market shift toward hybrid powertrains by directly affecting consumer purchase decisions through financial incentives.

The regulatory timeline creates additional pressure, with manufacturers needing to plan product cycles against a backdrop of evolving standards. The typical 5-7 year development cycle for new powertrains means decisions made today must anticipate regulatory requirements that may not be fully defined yet, pushing many manufacturers toward hybrid solutions as a hedging strategy against future regulatory uncertainty.

Corporate sustainability commitments have emerged as a complementary driver alongside formal regulations. Many automotive companies have established voluntary emissions reduction targets that exceed regulatory requirements, further accelerating the transition from V6 engines to hybrid powertrains as part of broader corporate environmental strategies.

The EU's Euro 7 standards and the Corporate Average Fuel Economy (CAFE) regulations in the US have established progressively lower CO2 emission targets, effectively pushing manufacturers away from traditional V6 engines toward hybrid powertrains. These regulations typically impose substantial financial penalties for non-compliance, directly affecting the cost-benefit analysis of different powertrain options.

Regional variations in emissions standards create additional complexity for global automotive manufacturers. While Europe has aggressively pursued electrification with plans to ban internal combustion engine vehicles by 2035, other regions maintain more moderate approaches. This regulatory divergence necessitates different powertrain strategies across markets, complicating global platform development and manufacturing.

The economic implications of emissions compliance extend beyond direct penalties. Manufacturers must factor in the rising costs of developing emissions control technologies for V6 engines versus investing in hybrid technology. The total cost of ownership calculations increasingly favor hybrid powertrains as emissions equipment adds significant expense to traditional internal combustion engines without corresponding performance benefits.

Consumer-facing emissions-based taxation systems in many countries have created market-driven incentives that further influence powertrain selection. Vehicle taxation structures in countries like Norway, the Netherlands, and the UK that penalize higher-emission vehicles have accelerated the market shift toward hybrid powertrains by directly affecting consumer purchase decisions through financial incentives.

The regulatory timeline creates additional pressure, with manufacturers needing to plan product cycles against a backdrop of evolving standards. The typical 5-7 year development cycle for new powertrains means decisions made today must anticipate regulatory requirements that may not be fully defined yet, pushing many manufacturers toward hybrid solutions as a hedging strategy against future regulatory uncertainty.

Corporate sustainability commitments have emerged as a complementary driver alongside formal regulations. Many automotive companies have established voluntary emissions reduction targets that exceed regulatory requirements, further accelerating the transition from V6 engines to hybrid powertrains as part of broader corporate environmental strategies.

Total Cost of Ownership Analysis

The Total Cost of Ownership (TCO) analysis reveals significant differences between traditional V6 engines and hybrid powertrains over their respective lifecycles. Initial acquisition costs typically favor V6 engines, with average price premiums for hybrid vehicles ranging from $3,000 to $7,000 depending on vehicle class and manufacturer. However, this initial cost differential begins to narrow when examining long-term ownership expenses.

Fuel economy represents the most substantial area of savings for hybrid powertrains. Current market data indicates that hybrid vehicles achieve 20-40% better fuel efficiency compared to their V6 counterparts. Based on average annual driving distances of 15,000 miles and current fuel prices, hybrid owners can expect to save approximately $800-1,200 annually in fuel costs, allowing for investment recovery within 3-6 years depending on driving patterns.

Maintenance costs present a more complex picture. Hybrid vehicles generally require less frequent brake service due to regenerative braking systems, resulting in 30-50% longer brake component lifespans. However, specialized hybrid components such as high-voltage batteries introduce unique maintenance considerations. Battery replacement costs, though decreasing annually by approximately 8-10%, still represent a significant expense ranging from $1,500-4,000 depending on vehicle model and warranty coverage.

Insurance premiums typically run 5-15% higher for hybrid vehicles due to more expensive replacement parts and specialized repair requirements. This translates to an additional $100-300 annually for most consumers, partially offsetting fuel savings.

Depreciation patterns have evolved significantly in recent years. While hybrids historically suffered from accelerated depreciation due to battery concerns, current market trends show hybrid vehicles retaining 5-10% more value after five years compared to equivalent V6 models, particularly in markets with high fuel prices or environmental incentives.

Government incentives substantially impact TCO calculations. Federal tax credits ranging from $2,500-7,500, combined with state and local incentives, can effectively neutralize the initial price premium in many markets. Corporate fleet buyers often realize additional benefits through tax advantages and sustainability reporting benefits.

When aggregating these factors across a typical 8-year ownership period, hybrid powertrains demonstrate a 10-15% lower total cost of ownership compared to V6 engines in most use cases, with the advantage increasing significantly for high-mileage drivers and in regions with higher fuel costs or stronger environmental incentives.

Fuel economy represents the most substantial area of savings for hybrid powertrains. Current market data indicates that hybrid vehicles achieve 20-40% better fuel efficiency compared to their V6 counterparts. Based on average annual driving distances of 15,000 miles and current fuel prices, hybrid owners can expect to save approximately $800-1,200 annually in fuel costs, allowing for investment recovery within 3-6 years depending on driving patterns.

Maintenance costs present a more complex picture. Hybrid vehicles generally require less frequent brake service due to regenerative braking systems, resulting in 30-50% longer brake component lifespans. However, specialized hybrid components such as high-voltage batteries introduce unique maintenance considerations. Battery replacement costs, though decreasing annually by approximately 8-10%, still represent a significant expense ranging from $1,500-4,000 depending on vehicle model and warranty coverage.

Insurance premiums typically run 5-15% higher for hybrid vehicles due to more expensive replacement parts and specialized repair requirements. This translates to an additional $100-300 annually for most consumers, partially offsetting fuel savings.

Depreciation patterns have evolved significantly in recent years. While hybrids historically suffered from accelerated depreciation due to battery concerns, current market trends show hybrid vehicles retaining 5-10% more value after five years compared to equivalent V6 models, particularly in markets with high fuel prices or environmental incentives.

Government incentives substantially impact TCO calculations. Federal tax credits ranging from $2,500-7,500, combined with state and local incentives, can effectively neutralize the initial price premium in many markets. Corporate fleet buyers often realize additional benefits through tax advantages and sustainability reporting benefits.

When aggregating these factors across a typical 8-year ownership period, hybrid powertrains demonstrate a 10-15% lower total cost of ownership compared to V6 engines in most use cases, with the advantage increasing significantly for high-mileage drivers and in regions with higher fuel costs or stronger environmental incentives.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!