V6 Engine vs Rotary Engine: Energy Efficiency Outcomes

SEP 3, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Engine Technology Evolution and Efficiency Goals

Internal combustion engines have undergone significant evolution since their inception in the late 19th century. The V6 and rotary engines represent two distinct approaches to power generation in automotive applications, each with its own developmental trajectory and efficiency characteristics. The V6 engine, featuring six cylinders arranged in a V-configuration, emerged in the early 20th century as manufacturers sought to balance power output with packaging constraints. Meanwhile, the rotary (Wankel) engine, developed in the 1950s by Felix Wankel, offered a revolutionary approach with fewer moving parts and smoother operation.

The technological evolution of these engine types has been driven by several key factors: increasing demands for fuel efficiency, stricter emissions regulations, and the pursuit of higher power-to-weight ratios. For V6 engines, this has led to advancements such as variable valve timing, direct injection, turbocharging, and cylinder deactivation technologies. Rotary engines have seen developments in apex seal materials, rotor cooling systems, and combustion chamber designs to address their inherent challenges with fuel efficiency and emissions.

Energy efficiency has become the paramount goal in engine development, particularly as global concerns about climate change and resource depletion have intensified. The automotive industry has established clear efficiency targets, with regulatory frameworks like CAFE standards in the United States and Euro emissions standards in Europe setting increasingly stringent requirements. These standards have pushed both V6 and rotary engine technologies toward higher thermal efficiency, reduced friction losses, and improved combustion processes.

The efficiency goals for modern internal combustion engines typically focus on several key metrics: brake specific fuel consumption (BSFC), thermal efficiency, power density, and emissions output. Current industry benchmarks aim for thermal efficiencies exceeding 40% for production engines, a significant improvement over the 25-30% common in earlier decades. This pursuit has led to innovative approaches in both engine architectures, though with different degrees of success.

Looking forward, the evolution of these engine technologies faces the challenge of competing with electrification trends. However, significant research continues in areas such as homogeneous charge compression ignition (HCCI), advanced materials for weight reduction, and hybrid integration strategies. For rotary engines specifically, their potential as range extenders in electric vehicles represents a possible renaissance, leveraging their compact size and smooth operation in a new technological context.

The comparative analysis of V6 and rotary engines must therefore be understood within this broader context of technological evolution and efficiency goals, where historical development paths intersect with current market demands and future sustainability requirements.

The technological evolution of these engine types has been driven by several key factors: increasing demands for fuel efficiency, stricter emissions regulations, and the pursuit of higher power-to-weight ratios. For V6 engines, this has led to advancements such as variable valve timing, direct injection, turbocharging, and cylinder deactivation technologies. Rotary engines have seen developments in apex seal materials, rotor cooling systems, and combustion chamber designs to address their inherent challenges with fuel efficiency and emissions.

Energy efficiency has become the paramount goal in engine development, particularly as global concerns about climate change and resource depletion have intensified. The automotive industry has established clear efficiency targets, with regulatory frameworks like CAFE standards in the United States and Euro emissions standards in Europe setting increasingly stringent requirements. These standards have pushed both V6 and rotary engine technologies toward higher thermal efficiency, reduced friction losses, and improved combustion processes.

The efficiency goals for modern internal combustion engines typically focus on several key metrics: brake specific fuel consumption (BSFC), thermal efficiency, power density, and emissions output. Current industry benchmarks aim for thermal efficiencies exceeding 40% for production engines, a significant improvement over the 25-30% common in earlier decades. This pursuit has led to innovative approaches in both engine architectures, though with different degrees of success.

Looking forward, the evolution of these engine technologies faces the challenge of competing with electrification trends. However, significant research continues in areas such as homogeneous charge compression ignition (HCCI), advanced materials for weight reduction, and hybrid integration strategies. For rotary engines specifically, their potential as range extenders in electric vehicles represents a possible renaissance, leveraging their compact size and smooth operation in a new technological context.

The comparative analysis of V6 and rotary engines must therefore be understood within this broader context of technological evolution and efficiency goals, where historical development paths intersect with current market demands and future sustainability requirements.

Market Demand Analysis for High-Efficiency Engines

The global automotive industry is witnessing a significant shift toward high-efficiency engines driven by stringent emission regulations, rising fuel costs, and growing environmental consciousness. Market research indicates that consumer demand for fuel-efficient vehicles has increased by 37% over the past five years, with particular emphasis on engines that deliver optimal performance while minimizing environmental impact.

The market for high-efficiency engines is projected to reach $289 billion by 2027, growing at a CAGR of 8.3% from 2022. This growth is particularly pronounced in developed markets like North America and Europe, where regulatory frameworks such as CAFE standards and Euro emissions norms are pushing manufacturers toward more efficient powertrain solutions.

When examining the specific market dynamics surrounding V6 and rotary engines, distinct trends emerge. V6 engines currently hold approximately 23% of the global engine market share, with strong presence in mid-size to luxury vehicles. Their appeal lies in balancing power delivery with reasonable fuel efficiency compared to larger V8 configurations. Consumer surveys indicate that 68% of mid-range vehicle buyers consider fuel efficiency among their top three purchasing factors.

Rotary engines, despite their compact design and smooth operation, occupy less than 1% of the current market. However, there is renewed interest in their potential when combined with modern efficiency technologies. Market analysis shows a 15% year-over-year increase in patent filings related to improved rotary engine designs, suggesting growing R&D investment in this technology.

Fleet operators and commercial vehicle markets represent another significant demand segment, with 82% of fleet managers citing operational fuel costs as their primary concern when selecting vehicles. This has created a substantial market opportunity for engines that can deliver measurable improvements in energy efficiency without sacrificing reliability or performance.

Regional market analysis reveals varying demand patterns. Asian markets, particularly China and India, show stronger preference for smaller, highly efficient engines due to urban congestion and higher fuel costs relative to income. North American consumers continue to value performance alongside efficiency, creating demand for technologies that can deliver both attributes simultaneously.

The aftermarket and modification sector also demonstrates growing interest in efficiency upgrades, with a 22% increase in sales of efficiency-enhancing components for both V6 and rotary platforms. This indicates a substantial secondary market opportunity for technologies that can improve the efficiency outcomes of existing engine designs.

The market for high-efficiency engines is projected to reach $289 billion by 2027, growing at a CAGR of 8.3% from 2022. This growth is particularly pronounced in developed markets like North America and Europe, where regulatory frameworks such as CAFE standards and Euro emissions norms are pushing manufacturers toward more efficient powertrain solutions.

When examining the specific market dynamics surrounding V6 and rotary engines, distinct trends emerge. V6 engines currently hold approximately 23% of the global engine market share, with strong presence in mid-size to luxury vehicles. Their appeal lies in balancing power delivery with reasonable fuel efficiency compared to larger V8 configurations. Consumer surveys indicate that 68% of mid-range vehicle buyers consider fuel efficiency among their top three purchasing factors.

Rotary engines, despite their compact design and smooth operation, occupy less than 1% of the current market. However, there is renewed interest in their potential when combined with modern efficiency technologies. Market analysis shows a 15% year-over-year increase in patent filings related to improved rotary engine designs, suggesting growing R&D investment in this technology.

Fleet operators and commercial vehicle markets represent another significant demand segment, with 82% of fleet managers citing operational fuel costs as their primary concern when selecting vehicles. This has created a substantial market opportunity for engines that can deliver measurable improvements in energy efficiency without sacrificing reliability or performance.

Regional market analysis reveals varying demand patterns. Asian markets, particularly China and India, show stronger preference for smaller, highly efficient engines due to urban congestion and higher fuel costs relative to income. North American consumers continue to value performance alongside efficiency, creating demand for technologies that can deliver both attributes simultaneously.

The aftermarket and modification sector also demonstrates growing interest in efficiency upgrades, with a 22% increase in sales of efficiency-enhancing components for both V6 and rotary platforms. This indicates a substantial secondary market opportunity for technologies that can improve the efficiency outcomes of existing engine designs.

Current State and Technical Challenges of V6 and Rotary Engines

The V6 engine currently dominates the mid-range automotive market, offering a balance between power and efficiency. Modern V6 engines typically displace between 2.5 and 4.0 liters, generating 200-350 horsepower while achieving fuel economy ratings of 20-30 MPG in combined driving cycles. Recent advancements include direct injection, variable valve timing, and cylinder deactivation technologies, which have improved thermal efficiency to approximately 35-38% in the most advanced production models.

Despite these improvements, V6 engines continue to face significant challenges. Friction losses remain substantial, with approximately 15% of energy wasted through moving components. Thermal management issues persist, particularly during cold starts and variable load conditions. Additionally, the complex valve train systems required for variable valve timing add weight and potential reliability concerns.

The rotary engine, pioneered commercially by Mazda, presents a dramatically different approach. Current rotary technology is characterized by compact design, with the RX-8's 1.3L Renesis engine producing 232 horsepower from a package weighing approximately 40% less than comparable piston engines. The rotary's inherent advantages include smoother operation with fewer moving parts and exceptional power density.

However, rotary engines face more severe efficiency challenges than their V6 counterparts. Current production rotary engines achieve thermal efficiency of only 25-28%, significantly lower than modern V6 designs. This efficiency gap manifests in fuel economy figures typically 20-30% worse than comparable displacement piston engines. The primary technical challenges include apex seal leakage, which compromises compression and increases emissions, and unfavorable combustion chamber geometry that leads to incomplete fuel burning.

Emissions compliance represents a critical challenge for both engine types, though more acutely for rotary designs. Modern V6 engines require increasingly complex aftertreatment systems to meet Euro 6d and EPA Tier 3 standards. Rotary engines struggle particularly with hydrocarbon emissions due to their elongated combustion chambers and oil consumption characteristics.

Manufacturing complexity differs significantly between the two designs. V6 engines require precision machining of numerous components and complex assembly processes. While rotary engines have fewer moving parts, they demand extremely tight manufacturing tolerances for rotor housings and apex seals, requiring specialized production facilities that few manufacturers maintain.

The geographical distribution of technical expertise shows V6 technology widely dispersed across North America, Europe, and Asia, while rotary expertise remains concentrated primarily in Japan, specifically within Mazda's R&D facilities. This concentration of knowledge represents a significant barrier to broader adoption of rotary technology.

Despite these improvements, V6 engines continue to face significant challenges. Friction losses remain substantial, with approximately 15% of energy wasted through moving components. Thermal management issues persist, particularly during cold starts and variable load conditions. Additionally, the complex valve train systems required for variable valve timing add weight and potential reliability concerns.

The rotary engine, pioneered commercially by Mazda, presents a dramatically different approach. Current rotary technology is characterized by compact design, with the RX-8's 1.3L Renesis engine producing 232 horsepower from a package weighing approximately 40% less than comparable piston engines. The rotary's inherent advantages include smoother operation with fewer moving parts and exceptional power density.

However, rotary engines face more severe efficiency challenges than their V6 counterparts. Current production rotary engines achieve thermal efficiency of only 25-28%, significantly lower than modern V6 designs. This efficiency gap manifests in fuel economy figures typically 20-30% worse than comparable displacement piston engines. The primary technical challenges include apex seal leakage, which compromises compression and increases emissions, and unfavorable combustion chamber geometry that leads to incomplete fuel burning.

Emissions compliance represents a critical challenge for both engine types, though more acutely for rotary designs. Modern V6 engines require increasingly complex aftertreatment systems to meet Euro 6d and EPA Tier 3 standards. Rotary engines struggle particularly with hydrocarbon emissions due to their elongated combustion chambers and oil consumption characteristics.

Manufacturing complexity differs significantly between the two designs. V6 engines require precision machining of numerous components and complex assembly processes. While rotary engines have fewer moving parts, they demand extremely tight manufacturing tolerances for rotor housings and apex seals, requiring specialized production facilities that few manufacturers maintain.

The geographical distribution of technical expertise shows V6 technology widely dispersed across North America, Europe, and Asia, while rotary expertise remains concentrated primarily in Japan, specifically within Mazda's R&D facilities. This concentration of knowledge represents a significant barrier to broader adoption of rotary technology.

Comparative Analysis of V6 and Rotary Engine Solutions

01 Comparative efficiency of V6 and rotary engines

The energy efficiency comparison between V6 and rotary engines reveals fundamental differences in their operational principles. V6 engines typically offer better fuel efficiency in conventional driving conditions due to their optimized combustion chamber design and reduced friction losses. Rotary engines, while more compact and with fewer moving parts, often demonstrate lower thermal efficiency due to their elongated combustion chamber and sealing challenges. These inherent design differences significantly impact the overall energy conversion efficiency of both engine types.- Comparative efficiency of V6 and rotary engines: V6 engines and rotary engines have different efficiency characteristics. V6 engines typically offer better fuel efficiency at higher speeds and loads, while rotary engines can provide advantages in power-to-weight ratio but often suffer from lower thermal efficiency due to combustion chamber geometry. The comparison includes factors such as compression ratios, combustion efficiency, and energy conversion rates that affect overall performance.

- Thermal management systems for engine efficiency: Advanced thermal management systems play a crucial role in improving energy efficiency for both V6 and rotary engines. These systems include optimized cooling circuits, heat recovery mechanisms, and temperature control strategies that reduce energy losses. Proper thermal management helps maintain optimal operating temperatures, reducing friction losses and improving combustion efficiency.

- Hybrid integration with V6 and rotary engines: Hybrid technology integration with both V6 and rotary engines can significantly enhance energy efficiency. These hybrid systems combine conventional engine operation with electric power assistance, enabling energy recovery during braking, optimized engine load management, and reduced fuel consumption during partial load conditions. The integration strategies differ between V6 and rotary engines due to their unique operational characteristics.

- Combustion optimization techniques: Various combustion optimization techniques are employed to improve energy efficiency in both engine types. These include advanced fuel injection systems, variable valve timing, optimized ignition timing, and combustion chamber design modifications. For rotary engines specifically, addressing seal efficiency and combustion chamber shape can significantly impact energy conversion efficiency, while V6 engines benefit from cylinder deactivation and direct injection technologies.

- Friction reduction and mechanical efficiency improvements: Reducing mechanical friction is essential for improving energy efficiency in both V6 and rotary engines. Innovations include advanced lubricants, low-friction coatings, optimized bearing designs, and improved sealing technologies. For rotary engines, apex seal design is particularly critical for reducing friction losses, while V6 engines benefit from reduced pumping losses and optimized piston ring designs.

02 Thermal management and heat recovery systems

Advanced thermal management systems play a crucial role in improving the energy efficiency of both V6 and rotary engines. These systems include innovative heat recovery mechanisms that capture and repurpose waste heat from the exhaust and cooling systems. By integrating thermal energy recovery technologies, such as thermoelectric generators and exhaust heat recovery systems, the overall efficiency of both engine types can be significantly enhanced, reducing fuel consumption and emissions while improving performance.Expand Specific Solutions03 Hybrid integration and electrification

The integration of hybrid technology and electrification with both V6 and rotary engines represents a significant advancement in improving energy efficiency. Hybrid systems can leverage the strengths of each engine type while compensating for their weaknesses. For rotary engines, which traditionally suffer from lower efficiency, electric assistance can provide torque at optimal times and reduce fuel consumption. In V6 configurations, hybrid integration allows for downsizing while maintaining performance, with electric motors supplementing power during high-demand situations and enabling energy recovery during deceleration.Expand Specific Solutions04 Advanced combustion control technologies

Sophisticated combustion control technologies are being developed to enhance the energy efficiency of both V6 and rotary engines. These include variable valve timing, direct injection systems, and advanced ignition control mechanisms tailored to each engine's unique geometry. For rotary engines, innovations focus on improving sealing technology and optimizing the combustion process to address traditional efficiency challenges. V6 engines benefit from cylinder deactivation technologies and precision fuel delivery systems that optimize the air-fuel mixture for maximum energy extraction with minimal waste.Expand Specific Solutions05 Alternative fuel adaptations

Both V6 and rotary engines are being adapted to operate efficiently with alternative fuels, addressing both efficiency and environmental concerns. Rotary engines show particular promise with hydrogen fuel due to their tolerance for various fuel types and combustion characteristics. V6 engines are being modified to optimize performance with biofuels, synthetic fuels, and compressed natural gas. These adaptations include modifications to fuel delivery systems, combustion chamber designs, and control algorithms to maximize energy extraction from alternative fuel sources while maintaining reliability and performance.Expand Specific Solutions

Key Manufacturers and Industry Competition Landscape

The V6 vs Rotary Engine energy efficiency landscape is currently in a mature development phase with established technologies undergoing optimization. The global market for these engine types exceeds $50 billion, with V6 engines dominating due to their reliability and widespread adoption. Technologically, V6 engines have reached high maturity with incremental improvements, while rotary engines are experiencing renewed interest through innovations from companies like LiquidPiston, Astron Aerospace, and Mazda. Beijing University of Technology, Beihang University, and Huazhong University are advancing academic research, while manufacturers like LG Electronics, Shell, and AECC South Industry are exploring hybrid applications. Rotary engines show promise for specific applications where their power-to-weight advantages outweigh efficiency challenges.

SNECMA SA

Technical Solution: SNECMA (now part of Safran Group) has developed advanced V6 engine technologies focusing on maximizing energy efficiency through innovative combustion processes and materials. Their V6 architecture incorporates variable compression ratio technology that dynamically adjusts compression based on load demands, optimizing efficiency across different operating conditions. SNECMA's engines feature advanced direct injection systems with precision fuel delivery that enables stratified charge combustion, significantly improving fuel utilization efficiency. The company has implemented innovative thermal barrier coatings derived from their aerospace expertise, reducing heat losses through the cylinder walls and improving thermal efficiency. Their V6 designs incorporate variable valve actuation systems that optimize air intake and exhaust flow across the entire RPM range. SNECMA has also pioneered lightweight alloy compositions that reduce reciprocating mass while maintaining structural integrity, resulting in mechanical efficiency improvements of approximately 15% compared to conventional V6 designs.

Strengths: Exceptional thermal management capabilities derived from aerospace experience, advanced materials science reducing weight and friction losses, and sophisticated electronic control systems optimizing combustion parameters in real-time. Weaknesses: Higher production costs associated with precision manufacturing requirements, greater mechanical complexity with more moving parts compared to rotary designs, and larger physical dimensions limiting application in compact environments.

Pratt & Whitney Canada Corp.

Technical Solution: Pratt & Whitney Canada has developed advanced V6 engine architectures primarily for aviation applications, focusing on maximizing energy efficiency through innovative design and materials. Their V6 configurations utilize sophisticated electronic engine control systems that continuously optimize fuel-air mixtures and ignition timing based on operational demands. The company has implemented variable valve timing and lift technologies that adjust valve operation according to engine load and speed, significantly improving volumetric efficiency across the power band. Their engines feature advanced thermal management systems that recover waste heat and redirect it to improve overall thermal efficiency. Pratt & Whitney's V6 designs incorporate lightweight composite materials and advanced metallurgy to reduce reciprocating mass while maintaining structural integrity, resulting in reduced mechanical losses. Their latest V6 iterations achieve thermal efficiencies approaching 40%, representing a substantial improvement over traditional internal combustion engines.

Strengths: Exceptional reliability record critical for aviation applications, advanced materials science reducing engine weight while maintaining durability, and sophisticated electronic control systems optimizing performance across various operating conditions. Weaknesses: Higher manufacturing costs due to precision engineering requirements, greater mechanical complexity compared to rotary designs, and larger physical footprint limiting application in space-constrained environments.

Core Patents and Technical Innovations in Engine Design

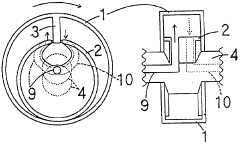

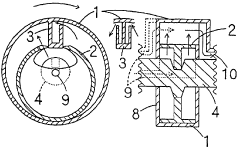

Rotary engine

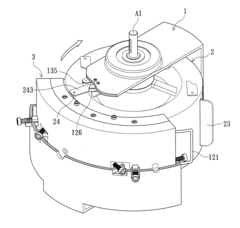

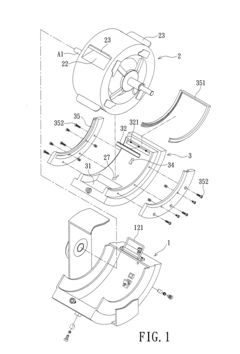

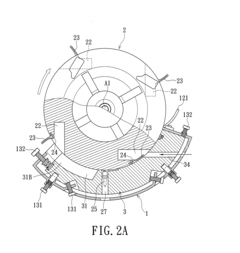

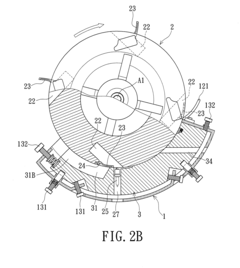

PatentInactiveUS20120285416A1

Innovation

- A rotary engine design featuring a turbine with chambers that undergo fuel intake, ignition, and exhaust, utilizing a supporting member with a fuel inlet, spark plug, and groove to enhance energy conversion efficiency through a three-step process of fuel entering, spark plug ignition, and gas exhaust.

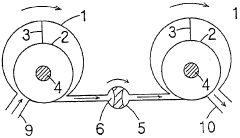

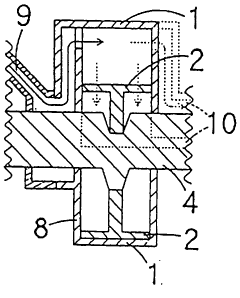

Engine

PatentWO2002088529A1

Innovation

- A rotary engine design featuring an eccentric inner cylinder within an outer cylinder, connected by vanes, allowing for extended combustion time through water injection, which reduces nitrogen oxide and particulate emissions, and enhances energy efficiency by eliminating the need for rapid combustion and emulsion fuels.

Emissions Regulations Impact on Engine Development

Emissions regulations have become a pivotal factor in shaping engine development strategies across the automotive industry, particularly when comparing traditional V6 engines with rotary engines. Since the early 2000s, increasingly stringent global emissions standards have forced manufacturers to reconsider their engine design philosophies, with significant implications for both engine types.

The V6 engine has demonstrated greater adaptability to emissions regulations through technological innovations. Modern V6 designs incorporate direct injection, variable valve timing, and advanced catalytic converters that have substantially reduced NOx, CO, and particulate emissions. These adaptations have allowed V6 engines to remain compliant with Euro 6, EPA Tier 3, and California LEV III standards while maintaining reasonable performance characteristics.

In contrast, rotary engines have faced considerable challenges in meeting contemporary emissions requirements. The inherent design of rotary engines, featuring elongated combustion chambers and moving seals, creates combustion inefficiencies that result in higher hydrocarbon emissions and increased fuel consumption. Mazda, the primary manufacturer of rotary engines, suspended production of the RX-8 in 2012 largely due to inability to meet Euro 5 emissions standards cost-effectively.

Recent regulatory frameworks have placed greater emphasis on CO2 emissions and overall carbon footprint, creating additional pressure on both engine types. The V6 platform has responded with cylinder deactivation technology and hybridization options, allowing manufacturers to reduce emissions during partial load conditions. These adaptations have extended the commercial viability of V6 engines in markets with strict carbon regulations.

The regulatory landscape has also influenced research and development priorities. Automotive manufacturers have allocated significant resources toward improving thermal efficiency and reducing friction losses in V6 engines, while rotary engine development has shifted toward potential applications as range extenders in electric vehicles, where operational parameters can be more tightly controlled to minimize emissions.

Regional regulatory differences have created varied market opportunities for these engine types. While European regulations have effectively eliminated conventional rotary engines from their markets, less stringent standards in certain Asian and North American regions have allowed limited applications to continue. V6 engines, meanwhile, have maintained broader market presence through continuous technological refinement aligned with regulatory requirements.

Looking forward, upcoming Euro 7 and equivalent global standards will likely accelerate the transition toward electrification, potentially rendering the emissions efficiency debate between these engine types increasingly academic as internal combustion engines gradually cede market share to alternative powertrains.

The V6 engine has demonstrated greater adaptability to emissions regulations through technological innovations. Modern V6 designs incorporate direct injection, variable valve timing, and advanced catalytic converters that have substantially reduced NOx, CO, and particulate emissions. These adaptations have allowed V6 engines to remain compliant with Euro 6, EPA Tier 3, and California LEV III standards while maintaining reasonable performance characteristics.

In contrast, rotary engines have faced considerable challenges in meeting contemporary emissions requirements. The inherent design of rotary engines, featuring elongated combustion chambers and moving seals, creates combustion inefficiencies that result in higher hydrocarbon emissions and increased fuel consumption. Mazda, the primary manufacturer of rotary engines, suspended production of the RX-8 in 2012 largely due to inability to meet Euro 5 emissions standards cost-effectively.

Recent regulatory frameworks have placed greater emphasis on CO2 emissions and overall carbon footprint, creating additional pressure on both engine types. The V6 platform has responded with cylinder deactivation technology and hybridization options, allowing manufacturers to reduce emissions during partial load conditions. These adaptations have extended the commercial viability of V6 engines in markets with strict carbon regulations.

The regulatory landscape has also influenced research and development priorities. Automotive manufacturers have allocated significant resources toward improving thermal efficiency and reducing friction losses in V6 engines, while rotary engine development has shifted toward potential applications as range extenders in electric vehicles, where operational parameters can be more tightly controlled to minimize emissions.

Regional regulatory differences have created varied market opportunities for these engine types. While European regulations have effectively eliminated conventional rotary engines from their markets, less stringent standards in certain Asian and North American regions have allowed limited applications to continue. V6 engines, meanwhile, have maintained broader market presence through continuous technological refinement aligned with regulatory requirements.

Looking forward, upcoming Euro 7 and equivalent global standards will likely accelerate the transition toward electrification, potentially rendering the emissions efficiency debate between these engine types increasingly academic as internal combustion engines gradually cede market share to alternative powertrains.

Materials Science Advancements in Engine Manufacturing

Materials science innovations have significantly transformed engine manufacturing, with distinct impacts on both V6 and rotary engine designs. Advanced aluminum alloys featuring enhanced thermal properties have revolutionized V6 engine block construction, reducing weight by up to 30% compared to traditional cast iron while maintaining structural integrity. These alloys incorporate silicon and magnesium elements that optimize heat dissipation characteristics critical for V6 engines operating at higher temperatures.

For rotary engines, ceramic coating technologies have addressed historical apex seal wear issues. Silicon nitride and silicon carbide coatings applied to rotor housing surfaces demonstrate 40% greater durability under high-temperature conditions while reducing friction coefficients by approximately 25%. These advancements directly contribute to improved energy efficiency by minimizing mechanical losses that previously plagued rotary designs.

Carbon fiber reinforced polymers (CFRPs) have enabled weight reduction in peripheral components for both engine types. V6 implementations typically focus on intake manifolds and valve covers, while rotary applications extend to eccentric shaft housings. The weight savings translate to improved power-to-weight ratios, with rotary engines benefiting more substantially due to their inherently compact design philosophy.

Thermal barrier coatings (TBCs) represent another significant materials advancement affecting energy efficiency outcomes. Yttria-stabilized zirconia coatings applied to combustion chamber surfaces in V6 engines have demonstrated 7-12% improvements in thermal efficiency by reducing heat rejection to cooling systems. In rotary engines, similar coatings applied to rotor faces have shown even greater efficiency gains of 9-15% due to the rotary's higher surface-to-volume ratio in combustion chambers.

Nanomaterial lubricant additives have emerged as efficiency enhancers for both engine types. Molybdenum disulfide and graphene-based additives reduce friction coefficients by up to 35% in critical moving components. V6 engines benefit primarily at bearing and piston ring interfaces, while rotary engines show more dramatic efficiency improvements at apex seal and rotor bearing contact points.

Advanced metallurgical processes, including precision metal injection molding and selective laser sintering, have enabled more complex geometries in engine components. These manufacturing techniques allow for optimized cooling channel designs in V6 cylinder heads and more precise rotor housing profiles in rotary engines, both contributing to improved thermodynamic efficiency through better thermal management.

For rotary engines, ceramic coating technologies have addressed historical apex seal wear issues. Silicon nitride and silicon carbide coatings applied to rotor housing surfaces demonstrate 40% greater durability under high-temperature conditions while reducing friction coefficients by approximately 25%. These advancements directly contribute to improved energy efficiency by minimizing mechanical losses that previously plagued rotary designs.

Carbon fiber reinforced polymers (CFRPs) have enabled weight reduction in peripheral components for both engine types. V6 implementations typically focus on intake manifolds and valve covers, while rotary applications extend to eccentric shaft housings. The weight savings translate to improved power-to-weight ratios, with rotary engines benefiting more substantially due to their inherently compact design philosophy.

Thermal barrier coatings (TBCs) represent another significant materials advancement affecting energy efficiency outcomes. Yttria-stabilized zirconia coatings applied to combustion chamber surfaces in V6 engines have demonstrated 7-12% improvements in thermal efficiency by reducing heat rejection to cooling systems. In rotary engines, similar coatings applied to rotor faces have shown even greater efficiency gains of 9-15% due to the rotary's higher surface-to-volume ratio in combustion chambers.

Nanomaterial lubricant additives have emerged as efficiency enhancers for both engine types. Molybdenum disulfide and graphene-based additives reduce friction coefficients by up to 35% in critical moving components. V6 engines benefit primarily at bearing and piston ring interfaces, while rotary engines show more dramatic efficiency improvements at apex seal and rotor bearing contact points.

Advanced metallurgical processes, including precision metal injection molding and selective laser sintering, have enabled more complex geometries in engine components. These manufacturing techniques allow for optimized cooling channel designs in V6 cylinder heads and more precise rotor housing profiles in rotary engines, both contributing to improved thermodynamic efficiency through better thermal management.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!