V6 Engine vs Turbocharged Engine: Cost-Benefit Study

SEP 3, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Engine Technology Evolution and Objectives

The evolution of automotive engine technology has witnessed significant transformations over the past century, with a continuous push towards greater efficiency, performance, and environmental sustainability. The internal combustion engine (ICE) has remained the dominant powertrain technology, evolving from simple mechanical systems to sophisticated electromechanical assemblies with advanced control systems. The transition from naturally aspirated V6 engines to smaller turbocharged engines represents one of the most significant paradigm shifts in recent automotive history.

Traditional V6 engines emerged as a popular configuration in the mid-20th century, offering a balance between the smoothness of inline-six engines and the compact packaging of V8 engines. These engines typically displaced between 2.5 to 4.0 liters and became a staple in mid-size to luxury vehicles due to their inherent balance, relatively smooth operation, and linear power delivery. The V6 architecture established itself as a benchmark for performance and refinement in many market segments.

The development of turbocharging technology, while not new, has seen accelerated adoption in the 21st century driven by increasingly stringent emissions regulations and fuel economy standards. This technology enables smaller displacement engines to produce power equivalent to or exceeding that of larger naturally aspirated engines, a concept commonly referred to as "downsizing." Modern turbocharged engines typically employ direct fuel injection, variable valve timing, and sophisticated electronic control systems to optimize performance across various operating conditions.

The primary objective of this technological shift is to achieve a more favorable balance between performance and efficiency. Turbocharged engines aim to deliver comparable or superior power output and torque characteristics to V6 engines while consuming less fuel and producing fewer emissions. This aligns with global automotive trends toward reduced environmental impact without compromising the driving experience that consumers expect.

Secondary objectives include weight reduction, improved packaging efficiency, and cost optimization across the vehicle's lifecycle. Smaller turbocharged engines typically weigh less than their V6 counterparts, contributing to overall vehicle weight reduction and potentially improved handling characteristics. The compact dimensions of these engines also provide greater flexibility in vehicle design and component packaging.

The industry trajectory suggests continued refinement of turbocharged technology, with innovations focusing on reducing turbo lag, improving thermal efficiency, and enhancing durability. Parallel developments in hybrid systems are increasingly being integrated with turbocharged engines to further optimize the efficiency-performance equation. The ultimate goal remains to extend the viability of internal combustion technology in an increasingly electrified automotive landscape while meeting ever more demanding regulatory requirements.

Traditional V6 engines emerged as a popular configuration in the mid-20th century, offering a balance between the smoothness of inline-six engines and the compact packaging of V8 engines. These engines typically displaced between 2.5 to 4.0 liters and became a staple in mid-size to luxury vehicles due to their inherent balance, relatively smooth operation, and linear power delivery. The V6 architecture established itself as a benchmark for performance and refinement in many market segments.

The development of turbocharging technology, while not new, has seen accelerated adoption in the 21st century driven by increasingly stringent emissions regulations and fuel economy standards. This technology enables smaller displacement engines to produce power equivalent to or exceeding that of larger naturally aspirated engines, a concept commonly referred to as "downsizing." Modern turbocharged engines typically employ direct fuel injection, variable valve timing, and sophisticated electronic control systems to optimize performance across various operating conditions.

The primary objective of this technological shift is to achieve a more favorable balance between performance and efficiency. Turbocharged engines aim to deliver comparable or superior power output and torque characteristics to V6 engines while consuming less fuel and producing fewer emissions. This aligns with global automotive trends toward reduced environmental impact without compromising the driving experience that consumers expect.

Secondary objectives include weight reduction, improved packaging efficiency, and cost optimization across the vehicle's lifecycle. Smaller turbocharged engines typically weigh less than their V6 counterparts, contributing to overall vehicle weight reduction and potentially improved handling characteristics. The compact dimensions of these engines also provide greater flexibility in vehicle design and component packaging.

The industry trajectory suggests continued refinement of turbocharged technology, with innovations focusing on reducing turbo lag, improving thermal efficiency, and enhancing durability. Parallel developments in hybrid systems are increasingly being integrated with turbocharged engines to further optimize the efficiency-performance equation. The ultimate goal remains to extend the viability of internal combustion technology in an increasingly electrified automotive landscape while meeting ever more demanding regulatory requirements.

Market Demand Analysis for V6 vs Turbo Engines

The global automotive market has witnessed a significant shift in engine preferences over the past decade, with turbocharged engines gaining substantial market share previously dominated by naturally aspirated V6 engines. This transition is primarily driven by increasingly stringent emissions regulations worldwide, particularly in Europe, North America, and China, which collectively represent over 70% of the global automotive market.

Consumer demand patterns indicate a growing preference for fuel-efficient vehicles without compromising performance. Market research shows that vehicles equipped with turbocharged engines have experienced a compound annual growth rate of 6.8% since 2015, compared to a decline of 3.2% for V6-powered vehicles during the same period. This trend is particularly pronounced in the mid-size sedan and crossover SUV segments, where turbocharged four-cylinder engines have largely replaced V6 options.

The premium automotive sector presents a more nuanced picture. While luxury brands have embraced turbocharging technology across their lineups, there remains a stable demand for V6 engines in high-performance and luxury applications. This market segment values the distinctive sound profile and power delivery characteristics of V6 engines, particularly in sports sedans and performance-oriented SUVs.

Regional market analysis reveals varying adoption rates. European markets show the highest penetration of turbocharged engines at approximately 85% of new vehicle sales, driven by strict CO2 emission targets. North American markets demonstrate a more gradual transition, with turbocharged engines now representing about 60% of new vehicle sales, up from 35% in 2012. Asian markets show mixed patterns, with Japan and South Korea following European trends, while developing markets maintain stronger demand for naturally aspirated engines due to fuel quality concerns and maintenance considerations.

Future market projections suggest continued growth for turbocharged engines, with an expected market share of over 75% globally by 2027. However, the premium segment is likely to maintain a dual approach, offering both turbocharged and naturally aspirated V6 options to cater to different consumer preferences. The emergence of hybrid powertrains incorporating smaller turbocharged engines represents another significant market trend, potentially offering an optimal balance between performance, efficiency, and cost.

Consumer price sensitivity analysis indicates that while the initial purchase price premium for turbocharged vehicles has decreased over time, it remains a consideration for budget-conscious consumers. However, the total cost of ownership calculations increasingly favor turbocharged options when factoring in fuel savings over a typical ownership period of 5-7 years.

Consumer demand patterns indicate a growing preference for fuel-efficient vehicles without compromising performance. Market research shows that vehicles equipped with turbocharged engines have experienced a compound annual growth rate of 6.8% since 2015, compared to a decline of 3.2% for V6-powered vehicles during the same period. This trend is particularly pronounced in the mid-size sedan and crossover SUV segments, where turbocharged four-cylinder engines have largely replaced V6 options.

The premium automotive sector presents a more nuanced picture. While luxury brands have embraced turbocharging technology across their lineups, there remains a stable demand for V6 engines in high-performance and luxury applications. This market segment values the distinctive sound profile and power delivery characteristics of V6 engines, particularly in sports sedans and performance-oriented SUVs.

Regional market analysis reveals varying adoption rates. European markets show the highest penetration of turbocharged engines at approximately 85% of new vehicle sales, driven by strict CO2 emission targets. North American markets demonstrate a more gradual transition, with turbocharged engines now representing about 60% of new vehicle sales, up from 35% in 2012. Asian markets show mixed patterns, with Japan and South Korea following European trends, while developing markets maintain stronger demand for naturally aspirated engines due to fuel quality concerns and maintenance considerations.

Future market projections suggest continued growth for turbocharged engines, with an expected market share of over 75% globally by 2027. However, the premium segment is likely to maintain a dual approach, offering both turbocharged and naturally aspirated V6 options to cater to different consumer preferences. The emergence of hybrid powertrains incorporating smaller turbocharged engines represents another significant market trend, potentially offering an optimal balance between performance, efficiency, and cost.

Consumer price sensitivity analysis indicates that while the initial purchase price premium for turbocharged vehicles has decreased over time, it remains a consideration for budget-conscious consumers. However, the total cost of ownership calculations increasingly favor turbocharged options when factoring in fuel savings over a typical ownership period of 5-7 years.

Technical Challenges and Global Development Status

The global landscape of engine technology has witnessed significant shifts over the past decade, with traditional V6 engines facing increasing competition from turbocharged alternatives. Currently, major automotive manufacturers worldwide are navigating complex technical challenges in both engine types, with varying degrees of success and regional preferences emerging.

V6 engines continue to face challenges related to fuel efficiency standards, with their inherently larger displacement and higher cylinder count contributing to increased fuel consumption. Engineering teams struggle to meet increasingly stringent emissions regulations while maintaining the performance characteristics that consumers expect from these powerplants. The weight penalty of V6 configurations also presents ongoing design challenges for vehicle dynamics and weight distribution.

Conversely, turbocharged engines face their own set of technical hurdles. Turbo lag remains a persistent issue despite significant advancements in variable geometry turbochargers and electronic wastegate control systems. Thermal management presents another critical challenge, with higher operating temperatures requiring sophisticated cooling solutions and more heat-resistant materials. Reliability concerns also persist, particularly regarding long-term durability of turbocharger components under repeated thermal cycling.

Geographically, development patterns show distinct regional approaches. North American manufacturers have traditionally favored V6 engines but are increasingly adopting turbocharging technology, particularly in light trucks and SUVs. European automakers have embraced turbocharging more comprehensively, driven by stricter emissions standards and higher fuel costs. Asian manufacturers, particularly Japanese companies, have developed hybrid approaches, often combining smaller displacement engines with turbocharging and electrification.

The technical development status varies significantly across price segments. Premium manufacturers have successfully implemented advanced turbocharging solutions with minimal compromise, while mass-market applications often struggle with cost-performance balance. This disparity highlights the economic challenges in democratizing advanced engine technologies.

Recent technological breakthroughs include integrated exhaust manifolds, twin-scroll turbochargers, and electric compressors that address traditional turbocharging weaknesses. Meanwhile, V6 development has focused on cylinder deactivation, variable compression ratios, and integration with hybrid systems to overcome efficiency limitations.

The current technical landscape suggests a convergence of approaches, with manufacturers increasingly adopting modular engine architectures that can accommodate both naturally aspirated and forced induction configurations. This flexibility represents an industry acknowledgment that both technologies have complementary strengths and weaknesses that vary based on vehicle application, market positioning, and regional requirements.

V6 engines continue to face challenges related to fuel efficiency standards, with their inherently larger displacement and higher cylinder count contributing to increased fuel consumption. Engineering teams struggle to meet increasingly stringent emissions regulations while maintaining the performance characteristics that consumers expect from these powerplants. The weight penalty of V6 configurations also presents ongoing design challenges for vehicle dynamics and weight distribution.

Conversely, turbocharged engines face their own set of technical hurdles. Turbo lag remains a persistent issue despite significant advancements in variable geometry turbochargers and electronic wastegate control systems. Thermal management presents another critical challenge, with higher operating temperatures requiring sophisticated cooling solutions and more heat-resistant materials. Reliability concerns also persist, particularly regarding long-term durability of turbocharger components under repeated thermal cycling.

Geographically, development patterns show distinct regional approaches. North American manufacturers have traditionally favored V6 engines but are increasingly adopting turbocharging technology, particularly in light trucks and SUVs. European automakers have embraced turbocharging more comprehensively, driven by stricter emissions standards and higher fuel costs. Asian manufacturers, particularly Japanese companies, have developed hybrid approaches, often combining smaller displacement engines with turbocharging and electrification.

The technical development status varies significantly across price segments. Premium manufacturers have successfully implemented advanced turbocharging solutions with minimal compromise, while mass-market applications often struggle with cost-performance balance. This disparity highlights the economic challenges in democratizing advanced engine technologies.

Recent technological breakthroughs include integrated exhaust manifolds, twin-scroll turbochargers, and electric compressors that address traditional turbocharging weaknesses. Meanwhile, V6 development has focused on cylinder deactivation, variable compression ratios, and integration with hybrid systems to overcome efficiency limitations.

The current technical landscape suggests a convergence of approaches, with manufacturers increasingly adopting modular engine architectures that can accommodate both naturally aspirated and forced induction configurations. This flexibility represents an industry acknowledgment that both technologies have complementary strengths and weaknesses that vary based on vehicle application, market positioning, and regional requirements.

Current Engineering Solutions Comparison

01 Cost-benefit analysis of V6 vs. turbocharged engines

Comparative analysis of V6 and turbocharged engines reveals significant cost-benefit differences. While V6 engines typically have higher initial manufacturing costs due to more components, turbocharged engines offer better fuel efficiency and reduced emissions despite higher maintenance costs over time. The analysis considers factors such as production expenses, fuel consumption, performance metrics, and long-term reliability to determine the overall economic value proposition of each engine type.- Performance comparison between V6 and turbocharged engines: The performance characteristics of V6 engines compared to turbocharged engines show distinct differences. V6 engines typically offer smooth power delivery and consistent performance across the RPM range, while turbocharged engines provide better power-to-weight ratios and improved fuel efficiency at higher speeds. Turbocharged engines can deliver comparable or superior power output from smaller displacement, though they may experience turbo lag at lower RPMs. This performance comparison is crucial when evaluating the cost-benefit ratio of these engine types for specific applications.

- Fuel efficiency and emissions considerations: Turbocharged engines generally offer better fuel efficiency compared to naturally aspirated V6 engines of similar power output. This is achieved through downsizing, where a smaller turbocharged engine can produce equivalent power while consuming less fuel under normal driving conditions. Additionally, turbocharged engines can be optimized to reduce emissions through precise control of air-fuel mixtures and combustion processes. However, the fuel efficiency advantage may diminish under heavy load conditions when the turbocharger is constantly engaged, requiring a cost-benefit analysis based on the intended usage pattern.

- Manufacturing and maintenance cost analysis: The manufacturing costs of turbocharged engines are typically higher than comparable V6 engines due to additional components such as the turbocharger, intercooler, and associated control systems. However, the smaller displacement of turbocharged engines may offset some costs through reduced material usage. Maintenance costs also differ, with turbocharged engines potentially requiring more frequent service and specialized maintenance for turbocharger components. The long-term reliability and durability factors must be considered when evaluating the total cost of ownership between these engine types.

- Design optimization and integration challenges: Integrating turbochargers into engine designs presents unique challenges compared to naturally aspirated V6 configurations. These include thermal management issues, packaging constraints, and the need for reinforced components to handle increased pressure and stress. Advanced design techniques and simulation tools are employed to optimize turbocharger sizing, placement, and control strategies. V6 engines, while simpler in design, require different optimization approaches focused on balancing, vibration reduction, and efficient cylinder arrangement. The complexity of these design considerations impacts both initial development costs and production efficiency.

- Market positioning and consumer perception: Consumer perception and market positioning differ significantly between V6 and turbocharged engines. V6 engines are often associated with premium vehicles, smooth operation, and established reliability. In contrast, turbocharged engines are marketed for their combination of performance and efficiency. Market analysis shows shifting consumer preferences influenced by fuel prices, environmental concerns, and performance expectations. Manufacturers must consider these factors when determining the cost-benefit ratio of developing and promoting either engine type, as consumer willingness to pay premiums for certain characteristics directly impacts the economic viability of engine programs.

02 Performance optimization technologies for turbocharged engines

Turbocharged engines employ various technologies to optimize performance while maintaining cost efficiency. These include advanced boost control systems, variable geometry turbochargers, and electronic wastegate control mechanisms. These technologies help mitigate turbo lag, improve throttle response, and enhance low-end torque, allowing smaller displacement turbocharged engines to match or exceed the performance characteristics of larger V6 engines while offering better fuel economy and lower emissions.Expand Specific Solutions03 Manufacturing and maintenance cost considerations

The manufacturing and maintenance costs between V6 and turbocharged engines differ significantly. V6 engines typically have higher initial production costs due to more cylinders, valves, and moving parts, but may offer simpler maintenance. Turbocharged engines, while having fewer cylinders, incorporate more complex components like turbochargers, intercoolers, and associated control systems that can increase both manufacturing complexity and long-term maintenance expenses, particularly as these components age and require service or replacement.Expand Specific Solutions04 Fuel efficiency and emissions performance

Turbocharged engines generally offer superior fuel efficiency compared to V6 engines of similar power output. By extracting additional energy from exhaust gases, turbocharged engines can achieve the same performance as larger displacement engines while consuming less fuel. This efficiency advantage translates to reduced carbon emissions and lower operating costs over the vehicle's lifetime. The cost-benefit analysis must consider these long-term savings against potentially higher initial and maintenance costs.Expand Specific Solutions05 Design innovations balancing performance and cost

Innovative engine designs aim to balance performance requirements with cost considerations. These include integrated exhaust manifolds, cylinder deactivation technologies, and advanced materials that reduce weight and improve thermal efficiency. For turbocharged engines, developments in bearing technology, cooling systems, and electronic controls help extend component life while maintaining performance. For V6 engines, modular design approaches and manufacturing process improvements help reduce production costs while maintaining traditional V6 benefits like smooth operation and durability.Expand Specific Solutions

Key Manufacturers and Competitive Landscape

The V6 vs Turbocharged Engine market is in a mature growth phase, with global automotive powertrain market valued at approximately $85-90 billion. The competitive landscape reflects a transition period where traditional V6 technology coexists with increasingly popular turbocharged solutions. Major automotive manufacturers (Ford, GM, Mercedes-Benz) and specialized powertrain companies (BorgWarner) are driving innovation in turbocharging technology, which offers improved fuel efficiency and reduced emissions while maintaining performance. Traditional V6 expertise remains strong with luxury brands like Ferrari maintaining market presence. The technology maturity spectrum shows established players (Bosch, Caterpillar, Honeywell) advancing turbocharging solutions while Asian manufacturers (Weichai Power, Yuchai Machinery) are rapidly closing technological gaps through strategic partnerships and R&D investments.

BorgWarner, Inc.

Technical Solution: BorgWarner has developed cutting-edge turbocharger technologies that directly address the V6 vs. turbocharged engine comparison. Their dual volute turbocharger technology separates exhaust gas pulses to maintain energy and improve response by up to 40% compared to single volute designs. This technology specifically targets the throttle response gap between naturally aspirated V6 engines and turbocharged alternatives. BorgWarner's variable geometry turbochargers (VGT) feature movable vanes that adjust based on engine load and speed, providing optimal boost across the entire operating range. Their eTurbo™ system incorporates an electric motor directly on the turbocharger shaft, which can add power during low-exhaust energy conditions, reducing lag by up to 50% compared to conventional turbos. BorgWarner has also pioneered advanced wastegate designs with their Controlled Electronic Wastegate (CEW) technology, allowing precise boost control within 0.1 bar tolerance, significantly improving both performance and fuel economy. Their turbochargers utilize aerospace-grade materials like gamma-titanium aluminide, reducing rotating inertia by approximately 40% compared to conventional Inconel alloys, further improving transient response.

Strengths: Industry-leading turbocharger efficiency; comprehensive range of technologies addressing specific performance parameters; extensive integration capabilities with various engine management systems. Weaknesses: Reliance on OEM partnerships for implementation; technologies add cost to overall engine systems; requires sophisticated control systems to maximize benefits.

Ford Global Technologies LLC

Technical Solution: Ford has developed EcoBoost technology, which represents their comprehensive approach to turbocharged engines. This technology combines direct fuel injection, turbocharging, and variable valve timing to deliver up to 20% better fuel efficiency, 15% reduced greenhouse emissions, and superior performance compared to larger displacement V6 engines. Ford's 2.7L and 3.5L EcoBoost engines specifically target the performance envelope of traditional V6 and V8 engines while offering significantly better fuel economy. Their engineering approach includes using lightweight materials like compacted graphite iron for the cylinder block, which reduces overall weight by approximately 60 pounds compared to conventional V6 engines. Ford has also implemented advanced anti-lag technology in their turbocharged systems, reducing turbo lag by maintaining turbine speed between throttle applications, resulting in 10-20% faster throttle response.

Strengths: Superior fuel efficiency while maintaining comparable power output; reduced emissions; lighter weight components reducing overall vehicle weight. Weaknesses: Higher initial manufacturing costs (approximately 10-15% more than naturally aspirated engines); potentially higher maintenance costs over vehicle lifetime; more complex cooling requirements due to higher operating temperatures.

Critical Patents and Technical Innovations

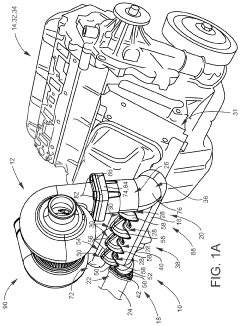

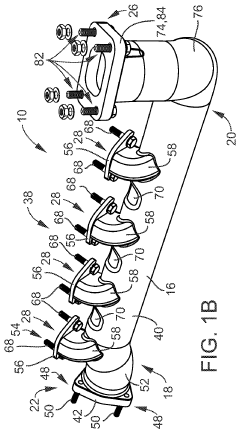

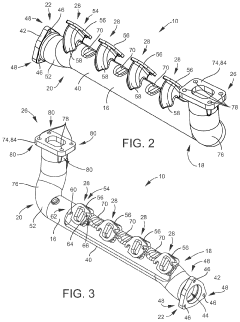

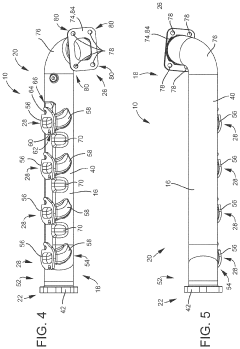

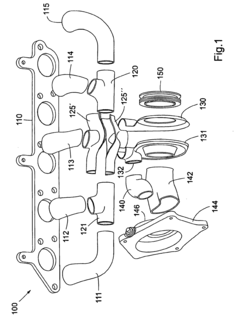

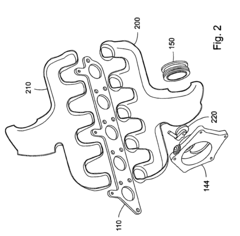

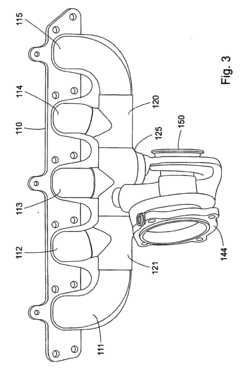

Replacement exhaust manifold for retrofitting a turbocharger to an engine

PatentActiveUS20210262378A1

Innovation

- A replacement exhaust manifold designed for retrofitting a turbocharger onto non-turbo diesel engines, featuring a central channel body, exhaust connection, turbo connection, and multiple exhaust ports, allowing for attachment to the engine without replacing it or lifting the truck body, and made of cast ductile iron with specific flange configurations for secure sealing.

Turbocharger

PatentInactiveEP1541826B1

Innovation

- An integrated jacketed turbocharger and exhaust manifold design where an outer shell covers the ductwork and turbine housing, creating an air insulating layer to reduce heat transfer, allowing for a more efficient and cost-effective solution with reduced weight and improved temperature handling.

Fuel Economy and Emissions Compliance

The fuel economy landscape for automotive engines has undergone significant transformation in recent years, driven primarily by stringent global emissions regulations and consumer demand for more efficient vehicles. In this context, the comparison between traditional V6 engines and modern turbocharged engines reveals substantial differences in fuel efficiency performance. Turbocharged engines typically deliver 15-30% better fuel economy compared to naturally aspirated V6 engines of similar power output, particularly in real-world driving conditions involving frequent acceleration and deceleration cycles.

Emissions compliance represents a critical factor in engine technology selection, with increasingly stringent standards worldwide forcing manufacturers to adopt more efficient powertrain solutions. Current regulations such as Euro 6d in Europe, Tier 3 in the United States, and China 6 standards have established challenging targets for both CO2 and NOx emissions. Turbocharged engines generally produce lower CO2 emissions due to their improved fuel efficiency, offering manufacturers a valuable pathway to fleet emissions compliance without sacrificing performance characteristics.

The downsizing strategy enabled by turbocharging technology allows smaller displacement engines to deliver equivalent power to larger naturally aspirated counterparts while maintaining significantly lower emissions profiles. Data from EPA testing shows that modern 2.0L turbocharged four-cylinder engines can match the performance of traditional 3.5L V6 engines while reducing CO2 emissions by approximately 20-25% under standardized testing protocols.

However, real-world emissions compliance presents challenges for both engine types. Turbocharged engines may experience higher-than-expected fuel consumption under aggressive driving conditions due to enrichment requirements at high boost levels. This phenomenon, known as "boost creep," can diminish some of the theoretical emissions advantages in certain driving scenarios. V6 engines, while less efficient overall, often demonstrate more consistent emissions profiles across varied driving conditions.

Cost implications of emissions compliance favor turbocharged solutions in the long term. While V6 engines require increasingly complex and expensive after-treatment systems to meet current standards, turbocharged engines can often achieve compliance with less extensive emissions control hardware. The average cost premium for emissions control systems in V6 engines has increased by approximately 35% since 2015, compared to a 22% increase for comparable turbocharged alternatives.

Future emissions regulations will likely accelerate this divergence, with proposed standards for 2025-2030 potentially rendering naturally aspirated V6 engines economically unviable in many markets without hybridization. Manufacturers investing in turbocharged technology platforms today are better positioned for compliance with these forthcoming requirements, creating a strategic advantage in long-term product planning and development cycles.

Emissions compliance represents a critical factor in engine technology selection, with increasingly stringent standards worldwide forcing manufacturers to adopt more efficient powertrain solutions. Current regulations such as Euro 6d in Europe, Tier 3 in the United States, and China 6 standards have established challenging targets for both CO2 and NOx emissions. Turbocharged engines generally produce lower CO2 emissions due to their improved fuel efficiency, offering manufacturers a valuable pathway to fleet emissions compliance without sacrificing performance characteristics.

The downsizing strategy enabled by turbocharging technology allows smaller displacement engines to deliver equivalent power to larger naturally aspirated counterparts while maintaining significantly lower emissions profiles. Data from EPA testing shows that modern 2.0L turbocharged four-cylinder engines can match the performance of traditional 3.5L V6 engines while reducing CO2 emissions by approximately 20-25% under standardized testing protocols.

However, real-world emissions compliance presents challenges for both engine types. Turbocharged engines may experience higher-than-expected fuel consumption under aggressive driving conditions due to enrichment requirements at high boost levels. This phenomenon, known as "boost creep," can diminish some of the theoretical emissions advantages in certain driving scenarios. V6 engines, while less efficient overall, often demonstrate more consistent emissions profiles across varied driving conditions.

Cost implications of emissions compliance favor turbocharged solutions in the long term. While V6 engines require increasingly complex and expensive after-treatment systems to meet current standards, turbocharged engines can often achieve compliance with less extensive emissions control hardware. The average cost premium for emissions control systems in V6 engines has increased by approximately 35% since 2015, compared to a 22% increase for comparable turbocharged alternatives.

Future emissions regulations will likely accelerate this divergence, with proposed standards for 2025-2030 potentially rendering naturally aspirated V6 engines economically unviable in many markets without hybridization. Manufacturers investing in turbocharged technology platforms today are better positioned for compliance with these forthcoming requirements, creating a strategic advantage in long-term product planning and development cycles.

Manufacturing Cost Structure Analysis

The manufacturing cost structure of V6 engines versus turbocharged engines reveals significant differences that impact overall production economics. Traditional V6 engines typically require more raw materials due to their larger displacement and additional cylinders. The material cost differential is approximately 15-20% higher for V6 engines, with specialized alloys and precision components contributing to this premium. Labor costs also trend higher for V6 production, requiring approximately 22% more assembly hours compared to equivalent turbocharged four-cylinder engines.

Tooling and equipment investments present another critical cost factor. V6 engine production lines demand specialized machinery for cylinder boring, crankshaft balancing, and valve train assembly. These production lines typically cost 30-40% more to establish than those for smaller turbocharged engines. However, many manufacturers have already amortized these investments for V6 production, whereas newer turbocharged technology may require fresh capital expenditure.

Supply chain considerations also impact manufacturing economics. Turbocharged engines incorporate specialized components—notably the turbocharger unit itself—which often comes from third-party suppliers like BorgWarner, Garrett Motion, or Mitsubishi Heavy Industries. This dependency introduces potential supply vulnerabilities and price fluctuations that V6 production chains have largely stabilized against through decades of refinement.

Quality control and testing represent another significant cost center. Turbocharged engines require additional validation procedures focused on boost pressure regulation, intercooler efficiency, and heat management. These specialized tests increase quality assurance costs by approximately 12-18% compared to naturally aspirated V6 engines, though this gap has narrowed as turbocharging technology has matured.

Manufacturing economies of scale currently favor V6 engines in certain markets, particularly North America, where production volumes remain substantial. However, global trends show rapidly increasing scale advantages for turbocharged engines as production volumes grow exponentially, particularly in European and Asian markets. Industry analysts project that by 2025, the per-unit manufacturing cost advantage will shift decisively toward turbocharged engines as global production volumes continue to increase.

Energy consumption during manufacturing presents another notable difference. V6 production typically consumes 25-30% more energy throughout the manufacturing process, primarily due to additional machining operations and longer assembly line requirements. This energy differential translates directly to higher embedded carbon costs and operational expenses that impact final unit economics.

Tooling and equipment investments present another critical cost factor. V6 engine production lines demand specialized machinery for cylinder boring, crankshaft balancing, and valve train assembly. These production lines typically cost 30-40% more to establish than those for smaller turbocharged engines. However, many manufacturers have already amortized these investments for V6 production, whereas newer turbocharged technology may require fresh capital expenditure.

Supply chain considerations also impact manufacturing economics. Turbocharged engines incorporate specialized components—notably the turbocharger unit itself—which often comes from third-party suppliers like BorgWarner, Garrett Motion, or Mitsubishi Heavy Industries. This dependency introduces potential supply vulnerabilities and price fluctuations that V6 production chains have largely stabilized against through decades of refinement.

Quality control and testing represent another significant cost center. Turbocharged engines require additional validation procedures focused on boost pressure regulation, intercooler efficiency, and heat management. These specialized tests increase quality assurance costs by approximately 12-18% compared to naturally aspirated V6 engines, though this gap has narrowed as turbocharging technology has matured.

Manufacturing economies of scale currently favor V6 engines in certain markets, particularly North America, where production volumes remain substantial. However, global trends show rapidly increasing scale advantages for turbocharged engines as production volumes grow exponentially, particularly in European and Asian markets. Industry analysts project that by 2025, the per-unit manufacturing cost advantage will shift decisively toward turbocharged engines as global production volumes continue to increase.

Energy consumption during manufacturing presents another notable difference. V6 production typically consumes 25-30% more energy throughout the manufacturing process, primarily due to additional machining operations and longer assembly line requirements. This energy differential translates directly to higher embedded carbon costs and operational expenses that impact final unit economics.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!