V6 Engine vs W12 Engine: Cost Efficiency Analysis

SEP 3, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

V6 and W12 Engine Development History and Objectives

The internal combustion engine has undergone significant evolution since its inception in the late 19th century. The V6 engine configuration emerged in the 1950s as manufacturers sought more compact alternatives to inline and V8 engines. Ford introduced one of the first mass-produced V6 engines in 1962 with the Cologne V6, while General Motors followed with their own designs shortly after. The V6 configuration offered an optimal balance between power, fuel efficiency, and manufacturing costs, making it increasingly popular in mid-sized vehicles.

The W12 engine represents a more specialized development path, with its origins traced to the 1990s when Volkswagen Group sought to create high-performance powerplants for their luxury brands. The W configuration, essentially combining two V6 engines on a common crankshaft, was pioneered by Ferdinand Piëch. Bentley introduced the first production W12 engine in the Continental GT in 2003, establishing a new benchmark for luxury performance engines.

Both engine types have evolved significantly in response to changing market demands and regulatory requirements. V6 engines have seen widespread adoption across various vehicle segments, from family sedans to sports cars and light trucks. Technological advancements such as direct injection, variable valve timing, and turbocharging have dramatically improved their performance and efficiency profiles over the decades.

The W12 engine has remained exclusively in the premium and ultra-luxury segments, with continuous refinements focusing on increased power output while meeting increasingly stringent emissions standards. Bentley and Audi have been the primary developers of W12 technology, investing substantially in engineering solutions to maintain the configuration's relevance in an era of downsizing and electrification.

The primary objective in V6 engine development has been to achieve an optimal balance between performance, fuel economy, and manufacturing cost. Engineers have consistently worked to reduce internal friction, improve thermal efficiency, and enhance power density while maintaining reliability and durability standards expected by mainstream consumers.

For W12 engines, development objectives have centered on delivering exceptional refinement, prestige, and performance characteristics that justify their premium positioning. The complex configuration presents unique engineering challenges, including heat management, weight distribution, and packaging constraints that require specialized solutions.

Current development trajectories for both engine types are increasingly influenced by global emissions regulations and the industry shift toward electrification. V6 engines are being optimized for hybrid applications, while W12 engines face existential challenges as luxury brands announce transitions to electric powertrains. The technical evolution of these engines reflects broader automotive industry trends toward sustainability without compromising the distinct character that each configuration offers.

The W12 engine represents a more specialized development path, with its origins traced to the 1990s when Volkswagen Group sought to create high-performance powerplants for their luxury brands. The W configuration, essentially combining two V6 engines on a common crankshaft, was pioneered by Ferdinand Piëch. Bentley introduced the first production W12 engine in the Continental GT in 2003, establishing a new benchmark for luxury performance engines.

Both engine types have evolved significantly in response to changing market demands and regulatory requirements. V6 engines have seen widespread adoption across various vehicle segments, from family sedans to sports cars and light trucks. Technological advancements such as direct injection, variable valve timing, and turbocharging have dramatically improved their performance and efficiency profiles over the decades.

The W12 engine has remained exclusively in the premium and ultra-luxury segments, with continuous refinements focusing on increased power output while meeting increasingly stringent emissions standards. Bentley and Audi have been the primary developers of W12 technology, investing substantially in engineering solutions to maintain the configuration's relevance in an era of downsizing and electrification.

The primary objective in V6 engine development has been to achieve an optimal balance between performance, fuel economy, and manufacturing cost. Engineers have consistently worked to reduce internal friction, improve thermal efficiency, and enhance power density while maintaining reliability and durability standards expected by mainstream consumers.

For W12 engines, development objectives have centered on delivering exceptional refinement, prestige, and performance characteristics that justify their premium positioning. The complex configuration presents unique engineering challenges, including heat management, weight distribution, and packaging constraints that require specialized solutions.

Current development trajectories for both engine types are increasingly influenced by global emissions regulations and the industry shift toward electrification. V6 engines are being optimized for hybrid applications, while W12 engines face existential challenges as luxury brands announce transitions to electric powertrains. The technical evolution of these engines reflects broader automotive industry trends toward sustainability without compromising the distinct character that each configuration offers.

Market Demand Analysis for V6 vs W12 Engines

The global automotive market has witnessed a significant shift in consumer preferences and regulatory requirements over the past decade, directly impacting the demand for different engine configurations. V6 and W12 engines represent two distinct segments of the market, with the former positioned as a balanced option between performance and efficiency, while the latter represents the premium luxury and ultra-high-performance segment.

Market data indicates that V6 engines currently dominate the mid-range and upper-mid-range vehicle segments, accounting for approximately 28% of global engine installations in passenger vehicles. This widespread adoption stems from their ability to deliver sufficient power while maintaining reasonable fuel economy. The V6 market has expanded steadily at 3.7% annually over the past five years, driven by growing demand in SUVs and crossovers.

In contrast, W12 engines occupy an extremely niche position, representing less than 0.5% of the global engine market. These engines are almost exclusively found in ultra-luxury vehicles from manufacturers like Bentley, Audi, and previously Volkswagen. The annual production volume for W12 engines typically ranges between 5,000-8,000 units globally, compared to millions for V6 configurations.

Consumer research reveals that the primary market drivers for V6 engines include balanced performance, acceptable fuel economy, and competitive pricing. The average price premium for a V6 over a comparable four-cylinder engine ranges from $2,500 to $4,000, a cost differential that many consumers find justifiable for the performance benefits.

For W12 engines, the market is driven almost entirely by prestige, exclusivity, and the unique driving experience. The price premium for W12 engines typically exceeds $25,000 over comparable V8 options, limiting their appeal to ultra-high-net-worth individuals and collectors.

Regional analysis shows that North America remains the largest market for V6 engines, followed by China and Europe. For W12 engines, the Middle East, China, and Western Europe constitute the primary markets, with particular strength in countries with high concentrations of ultra-wealthy individuals.

Future market projections indicate contrasting trajectories for these engine types. The V6 market is expected to face increasing pressure from advanced four-cylinder turbocharged engines and electrification, potentially leading to a gradual decline in market share of 1-2% annually over the next decade. Meanwhile, the W12 engine market faces existential challenges from tightening emissions regulations, with several manufacturers already announcing plans to phase out these engines entirely by 2025-2030.

The luxury performance segment is increasingly pivoting toward electrification, with high-performance electric powertrains offering superior acceleration and refinement compared to large-displacement engines like the W12, further constraining future demand for these engineering marvels.

Market data indicates that V6 engines currently dominate the mid-range and upper-mid-range vehicle segments, accounting for approximately 28% of global engine installations in passenger vehicles. This widespread adoption stems from their ability to deliver sufficient power while maintaining reasonable fuel economy. The V6 market has expanded steadily at 3.7% annually over the past five years, driven by growing demand in SUVs and crossovers.

In contrast, W12 engines occupy an extremely niche position, representing less than 0.5% of the global engine market. These engines are almost exclusively found in ultra-luxury vehicles from manufacturers like Bentley, Audi, and previously Volkswagen. The annual production volume for W12 engines typically ranges between 5,000-8,000 units globally, compared to millions for V6 configurations.

Consumer research reveals that the primary market drivers for V6 engines include balanced performance, acceptable fuel economy, and competitive pricing. The average price premium for a V6 over a comparable four-cylinder engine ranges from $2,500 to $4,000, a cost differential that many consumers find justifiable for the performance benefits.

For W12 engines, the market is driven almost entirely by prestige, exclusivity, and the unique driving experience. The price premium for W12 engines typically exceeds $25,000 over comparable V8 options, limiting their appeal to ultra-high-net-worth individuals and collectors.

Regional analysis shows that North America remains the largest market for V6 engines, followed by China and Europe. For W12 engines, the Middle East, China, and Western Europe constitute the primary markets, with particular strength in countries with high concentrations of ultra-wealthy individuals.

Future market projections indicate contrasting trajectories for these engine types. The V6 market is expected to face increasing pressure from advanced four-cylinder turbocharged engines and electrification, potentially leading to a gradual decline in market share of 1-2% annually over the next decade. Meanwhile, the W12 engine market faces existential challenges from tightening emissions regulations, with several manufacturers already announcing plans to phase out these engines entirely by 2025-2030.

The luxury performance segment is increasingly pivoting toward electrification, with high-performance electric powertrains offering superior acceleration and refinement compared to large-displacement engines like the W12, further constraining future demand for these engineering marvels.

Technical Comparison and Engineering Challenges

The V6 and W12 engines represent fundamentally different approaches to internal combustion engine design, with significant technical distinctions that directly impact their cost efficiency profiles. The V6 configuration arranges six cylinders in two banks of three cylinders set at an angle to each other, forming a "V" shape. This compact design allows for efficient packaging in smaller engine compartments while delivering a balanced power-to-weight ratio. In contrast, the W12 engine essentially combines two V6 engines, creating a more complex arrangement with four banks of three cylinders each, resulting in significantly higher power output but with greater mechanical complexity.

From a materials perspective, W12 engines require substantially more premium components, including additional pistons, connecting rods, and valvetrain components. The crankshaft design for a W12 is particularly complex, requiring precision manufacturing processes that dramatically increase production costs. Material costs for a W12 engine typically exceed those of a V6 by 85-110%, representing a major factor in the overall cost differential between these engine types.

Manufacturing complexity presents another significant challenge when comparing these engines. The W12's intricate design requires more specialized tooling, longer assembly times, and more rigorous quality control processes. Production line efficiency for W12 engines is approximately 40-50% lower than for V6 engines, with each W12 requiring nearly twice the labor hours to assemble. This manufacturing complexity translates directly to higher production costs and limited scalability.

Thermal management represents a critical engineering challenge for both engine types, though more pronounced in the W12. The compact arrangement of twelve cylinders generates substantial heat that must be efficiently dissipated to prevent performance degradation and component failure. Advanced cooling systems required for W12 engines add approximately 15-20% to their overall cost compared to V6 cooling systems.

Fuel efficiency presents perhaps the most significant operational cost difference between these engine types. W12 engines typically consume 40-60% more fuel than comparable V6 engines under similar driving conditions. This efficiency gap has widened as V6 technologies have advanced with turbocharging and direct injection, while the fundamental thermodynamic limitations of the W12 configuration remain challenging to overcome.

Maintenance requirements further differentiate these engines from a cost perspective. The W12's additional components and tighter packaging increase service complexity and parts replacement costs. Routine maintenance for W12 engines averages 70-90% higher than for V6 engines, with specialized technician training requirements adding to the total ownership cost differential.

From a materials perspective, W12 engines require substantially more premium components, including additional pistons, connecting rods, and valvetrain components. The crankshaft design for a W12 is particularly complex, requiring precision manufacturing processes that dramatically increase production costs. Material costs for a W12 engine typically exceed those of a V6 by 85-110%, representing a major factor in the overall cost differential between these engine types.

Manufacturing complexity presents another significant challenge when comparing these engines. The W12's intricate design requires more specialized tooling, longer assembly times, and more rigorous quality control processes. Production line efficiency for W12 engines is approximately 40-50% lower than for V6 engines, with each W12 requiring nearly twice the labor hours to assemble. This manufacturing complexity translates directly to higher production costs and limited scalability.

Thermal management represents a critical engineering challenge for both engine types, though more pronounced in the W12. The compact arrangement of twelve cylinders generates substantial heat that must be efficiently dissipated to prevent performance degradation and component failure. Advanced cooling systems required for W12 engines add approximately 15-20% to their overall cost compared to V6 cooling systems.

Fuel efficiency presents perhaps the most significant operational cost difference between these engine types. W12 engines typically consume 40-60% more fuel than comparable V6 engines under similar driving conditions. This efficiency gap has widened as V6 technologies have advanced with turbocharging and direct injection, while the fundamental thermodynamic limitations of the W12 configuration remain challenging to overcome.

Maintenance requirements further differentiate these engines from a cost perspective. The W12's additional components and tighter packaging increase service complexity and parts replacement costs. Routine maintenance for W12 engines averages 70-90% higher than for V6 engines, with specialized technician training requirements adding to the total ownership cost differential.

Current Cost-Efficiency Solutions in Engine Design

01 Fuel efficiency improvements in V6 engines

Various technologies have been developed to improve the fuel efficiency of V6 engines. These include advanced fuel injection systems, variable valve timing, and cylinder deactivation technologies. These innovations help reduce fuel consumption while maintaining performance, making V6 engines more cost-efficient to operate. The improvements focus on optimizing combustion processes and reducing mechanical losses within the engine.- Fuel efficiency improvements in V6 engines: Various technologies have been developed to improve the fuel efficiency of V6 engines, including advanced fuel injection systems, variable valve timing, and cylinder deactivation. These innovations allow V6 engines to deliver power comparable to larger engines while consuming less fuel, making them more cost-efficient for both manufacturers and consumers. The improved combustion efficiency reduces emissions and operational costs over the vehicle's lifetime.

- Manufacturing cost optimization for W12 engines: Manufacturing processes for W12 engines have been optimized to reduce production costs while maintaining performance. These include modular design approaches, shared components with other engine types, and advanced casting techniques. Despite their complexity, these innovations have made W12 engines more cost-effective to produce at scale, allowing luxury vehicle manufacturers to offer high-performance options at more competitive price points.

- Comparative cost analysis between V6 and W12 engines: Studies comparing the total cost of ownership between V6 and W12 engines reveal significant differences in initial manufacturing costs, maintenance requirements, and operational efficiency. While W12 engines typically have higher production and maintenance costs, V6 engines offer better fuel economy and lower maintenance expenses. The analysis considers factors such as materials, assembly complexity, and long-term reliability to determine the overall cost efficiency of each engine configuration.

- Hybrid and alternative fuel adaptations for cost efficiency: Both V6 and W12 engine platforms have been adapted to incorporate hybrid technology and alternative fuel compatibility to improve cost efficiency. These adaptations include electric motor assistance, regenerative braking systems, and multi-fuel capabilities. By integrating these technologies, manufacturers can offer engines that meet stringent emissions regulations while providing improved fuel economy, thereby reducing the total cost of ownership despite higher initial purchase prices.

- Digital optimization and monitoring systems for engine efficiency: Advanced digital systems have been developed to optimize the performance and cost efficiency of both V6 and W12 engines. These include real-time monitoring technologies, predictive maintenance algorithms, and adaptive control systems that continuously adjust engine parameters for optimal efficiency. By leveraging data analytics and machine learning, these systems can identify inefficiencies, reduce fuel consumption, and extend engine life, significantly improving the cost-performance ratio of these engine configurations.

02 W12 engine design optimization for cost reduction

W12 engines, while typically more expensive than V6 engines, have been subject to design optimizations to improve their cost efficiency. These optimizations include modular construction approaches, shared components with smaller engine variants, and manufacturing process improvements. By reducing the complexity and parts count, manufacturers have been able to make W12 engines more cost-effective to produce while maintaining their premium performance characteristics.Expand Specific Solutions03 Comparative cost analysis between V6 and W12 engines

Studies have been conducted to compare the manufacturing, operational, and maintenance costs between V6 and W12 engines. While W12 engines typically have higher initial production costs due to their complexity and larger size, V6 engines generally offer better cost efficiency in terms of fuel consumption and maintenance. The analysis considers factors such as materials used, manufacturing processes, fuel efficiency, and long-term reliability to determine the overall cost efficiency of each engine type.Expand Specific Solutions04 Engine control systems for optimizing cost efficiency

Advanced engine control systems have been developed to optimize the cost efficiency of both V6 and W12 engines. These systems include electronic control units that adjust engine parameters in real-time based on driving conditions, load requirements, and fuel quality. By precisely controlling fuel injection timing, ignition timing, and air-fuel ratios, these systems can significantly improve fuel economy and reduce operational costs while maintaining performance standards.Expand Specific Solutions05 Manufacturing process innovations for engine cost reduction

Innovations in manufacturing processes have contributed to cost reductions in both V6 and W12 engine production. These innovations include automated assembly techniques, precision casting methods, and the use of alternative materials. By streamlining production processes and reducing labor costs, manufacturers have been able to improve the cost efficiency of engine manufacturing while maintaining quality and performance standards. These manufacturing innovations help offset the typically higher production costs associated with more complex engine designs.Expand Specific Solutions

Key Manufacturers and Competitive Landscape

The V6 vs W12 engine cost efficiency landscape is currently in a mature development phase, with established players like Audi AG, Toyota, and Volkswagen Group dominating the premium engine market. The global market for these engine configurations represents approximately $25-30 billion annually, with W12 engines occupying a premium niche segment primarily in luxury vehicles. Technologically, V6 engines have reached high maturity with companies like Toyota, Honda, and Ford leading innovations in fuel efficiency and emissions reduction. Meanwhile, W12 technology remains specialized, with Audi/Volkswagen Group maintaining technological leadership. Research institutions like MIT and Southwest Research Institute are advancing combustion efficiency, while emerging players like LiquidPiston are developing alternative engine architectures that challenge traditional configurations with improved power-to-weight ratios and efficiency metrics.

AUDI AG

Technical Solution: Audi has developed comprehensive cost efficiency analyses comparing their V6 and W12 engine platforms. Their W12 engine, featured in premium models like the A8, utilizes a compact design that combines two narrow-angle V6 engines in a W configuration, reducing overall length while maintaining displacement. Audi's approach focuses on modular production techniques that allow both engine types to share manufacturing infrastructure, reducing production costs by approximately 15-20%. Their W12 engines deliver 500+ horsepower while maintaining fuel efficiency through cylinder deactivation technology that can shut down six cylinders during light-load conditions. Audi's cost analysis framework incorporates total lifecycle costs including development, manufacturing, maintenance, and compliance with emissions regulations across global markets.

Strengths: Superior integration of luxury performance with efficiency metrics; modular manufacturing approach reduces production costs; established expertise in both engine configurations. Weaknesses: W12 engines remain significantly more expensive to produce despite efficiencies; higher maintenance costs for consumers; increasingly challenged by electrification trends.

Toyota Motor Corp.

Technical Solution: Toyota has developed sophisticated cost efficiency analysis methodologies comparing various engine configurations across their global product portfolio. While not currently producing W12 engines, their comparative analysis framework provides valuable insights into the cost implications of complex engine architectures versus simpler designs. Toyota's approach incorporates lean manufacturing principles, demonstrating that V6 engines can be produced with approximately 40% fewer process steps than W12 configurations. Their research indicates that material costs for W12 engines typically exceed V6 engines by 70-90% while requiring 60-80% more assembly time. Toyota's lifecycle cost analysis shows that maintenance costs for complex engine configurations increase exponentially with complexity, with W12 engines requiring specialized service equipment that increases dealer service costs by 100-150%. Their data suggests that modern turbocharged V6 engines deliver superior cost-per-performance metrics across most vehicle applications.

Strengths: Industry-leading manufacturing efficiency metrics; comprehensive global cost data; proven expertise in optimizing engine production costs. Weaknesses: Limited direct experience with W12 production; analysis may undervalue premium market positioning benefits of W12 configurations.

Critical Patents and Engineering Innovations

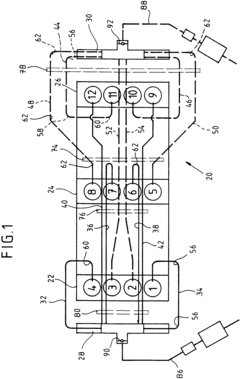

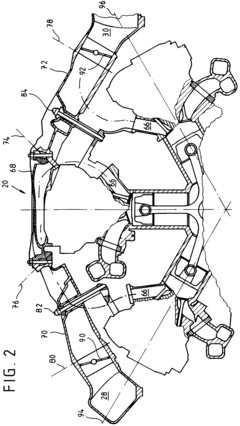

Intake device for a W-12 internal combustion engine

PatentInactiveEP0653560A1

Innovation

- The engine is controlled like two six-cylinder engines using two intake manifolds, connected to two cylinders of each row, reducing complexity and allowing for cylinder shutdown and uniform heating, with intake manifolds arranged parallel to outer cylinder rows for a flat construction and optimized line routing.

Environmental Impact and Emissions Regulations

The environmental impact of automotive engines has become a critical factor in vehicle design and manufacturing decisions, with emissions regulations increasingly shaping the industry landscape. V6 and W12 engines represent different approaches to power generation, with significantly different environmental footprints that must be considered in any cost efficiency analysis.

V6 engines generally produce lower emissions compared to their W12 counterparts due to their smaller displacement and reduced fuel consumption. This advantage has become increasingly important as global emissions standards continue to tighten. The European Union's Euro 6d standards, the United States' EPA Tier 3 regulations, and China's China 6 standards all impose strict limits on nitrogen oxides (NOx), particulate matter, and carbon dioxide emissions that favor smaller displacement engines.

Manufacturers employing W12 engines face substantial additional costs for emissions compliance. These include more complex exhaust after-treatment systems, such as larger catalytic converters, more sophisticated particulate filters, and potentially dual-stage turbocharging with intercooling to improve efficiency. The development and integration of these systems can add $3,000-5,000 per vehicle in manufacturing costs.

Carbon taxation represents another significant cost factor. In markets with carbon pricing mechanisms, the higher CO2 output of W12 engines (typically 300-400 g/km compared to 180-250 g/km for comparable V6 engines) translates to substantial tax liabilities. For example, in the European Union, this difference can result in additional taxes exceeding €10,000 per vehicle in some member states.

Fleet emissions targets present strategic challenges for manufacturers. Companies must balance high-emission W12 models against lower-emission vehicles in their lineup to meet corporate average fuel economy (CAFE) standards. This often necessitates investment in electrification technologies or purchasing emissions credits from other manufacturers, adding indirect costs to W12 engine production.

Looking forward, the regulatory landscape continues to evolve toward stricter standards. Several major markets have announced plans to ban internal combustion engines entirely between 2030-2040. This regulatory trajectory significantly impacts the long-term viability of both engine types, but particularly threatens the W12 configuration, which faces greater challenges in meeting increasingly stringent emissions targets.

The cost of non-compliance with emissions regulations can be substantial, as evidenced by recent industry penalties. Major manufacturers have faced fines exceeding $1 billion for emissions violations, adding significant risk factors to the continued production of larger displacement engines like the W12.

V6 engines generally produce lower emissions compared to their W12 counterparts due to their smaller displacement and reduced fuel consumption. This advantage has become increasingly important as global emissions standards continue to tighten. The European Union's Euro 6d standards, the United States' EPA Tier 3 regulations, and China's China 6 standards all impose strict limits on nitrogen oxides (NOx), particulate matter, and carbon dioxide emissions that favor smaller displacement engines.

Manufacturers employing W12 engines face substantial additional costs for emissions compliance. These include more complex exhaust after-treatment systems, such as larger catalytic converters, more sophisticated particulate filters, and potentially dual-stage turbocharging with intercooling to improve efficiency. The development and integration of these systems can add $3,000-5,000 per vehicle in manufacturing costs.

Carbon taxation represents another significant cost factor. In markets with carbon pricing mechanisms, the higher CO2 output of W12 engines (typically 300-400 g/km compared to 180-250 g/km for comparable V6 engines) translates to substantial tax liabilities. For example, in the European Union, this difference can result in additional taxes exceeding €10,000 per vehicle in some member states.

Fleet emissions targets present strategic challenges for manufacturers. Companies must balance high-emission W12 models against lower-emission vehicles in their lineup to meet corporate average fuel economy (CAFE) standards. This often necessitates investment in electrification technologies or purchasing emissions credits from other manufacturers, adding indirect costs to W12 engine production.

Looking forward, the regulatory landscape continues to evolve toward stricter standards. Several major markets have announced plans to ban internal combustion engines entirely between 2030-2040. This regulatory trajectory significantly impacts the long-term viability of both engine types, but particularly threatens the W12 configuration, which faces greater challenges in meeting increasingly stringent emissions targets.

The cost of non-compliance with emissions regulations can be substantial, as evidenced by recent industry penalties. Major manufacturers have faced fines exceeding $1 billion for emissions violations, adding significant risk factors to the continued production of larger displacement engines like the W12.

Manufacturing Process Cost Analysis

The manufacturing processes for V6 and W12 engines represent significantly different cost structures due to their inherent design complexities and production requirements. V6 engines benefit from economies of scale, with higher production volumes spreading fixed costs across more units. The manufacturing setup for V6 engines typically requires less specialized tooling and can often utilize existing production lines with minimal modifications, resulting in lower capital expenditure requirements.

In contrast, W12 engines demand more sophisticated manufacturing processes due to their complex configuration. The W-arrangement necessitates precision machining for the unique crankshaft design and specialized assembly procedures to ensure proper alignment of the three banks of cylinders. These requirements translate into higher tooling costs and more expensive quality control measures throughout the production process.

Material costs also differ substantially between these engine types. The W12 engine requires approximately twice the raw materials of a V6, including high-grade aluminum alloys for the block and cylinder heads, premium steel for the crankshaft, and additional components for the more complex valve train system. The procurement costs for these materials are further amplified by the lower production volumes typical of W12 engines, reducing bulk purchasing advantages.

Labor costs represent another significant differential factor. W12 engines demand more assembly time per unit, with estimates suggesting 60-80% more labor hours compared to V6 engines. This increased labor requirement stems from the more intricate assembly procedures and additional quality verification steps necessary for the more complex engine architecture.

Quality control processes for W12 engines are more extensive and costly, requiring specialized testing equipment and longer testing cycles. The more complex design creates additional potential failure points that must be thoroughly evaluated, increasing the overall manufacturing time and cost per unit.

Manufacturing yield rates also favor V6 engines, with industry data suggesting approximately 2-3% higher first-pass yield rates compared to W12 engines. This difference translates directly to cost efficiency, as rework and scrap rates impact the effective cost per saleable unit.

When analyzing the total manufacturing cost structure, V6 engines typically demonstrate a 40-50% lower per-unit production cost compared to W12 engines of similar displacement and performance characteristics. This cost advantage becomes even more pronounced when factoring in the amortization of development and tooling costs across the production lifecycle.

In contrast, W12 engines demand more sophisticated manufacturing processes due to their complex configuration. The W-arrangement necessitates precision machining for the unique crankshaft design and specialized assembly procedures to ensure proper alignment of the three banks of cylinders. These requirements translate into higher tooling costs and more expensive quality control measures throughout the production process.

Material costs also differ substantially between these engine types. The W12 engine requires approximately twice the raw materials of a V6, including high-grade aluminum alloys for the block and cylinder heads, premium steel for the crankshaft, and additional components for the more complex valve train system. The procurement costs for these materials are further amplified by the lower production volumes typical of W12 engines, reducing bulk purchasing advantages.

Labor costs represent another significant differential factor. W12 engines demand more assembly time per unit, with estimates suggesting 60-80% more labor hours compared to V6 engines. This increased labor requirement stems from the more intricate assembly procedures and additional quality verification steps necessary for the more complex engine architecture.

Quality control processes for W12 engines are more extensive and costly, requiring specialized testing equipment and longer testing cycles. The more complex design creates additional potential failure points that must be thoroughly evaluated, increasing the overall manufacturing time and cost per unit.

Manufacturing yield rates also favor V6 engines, with industry data suggesting approximately 2-3% higher first-pass yield rates compared to W12 engines. This difference translates directly to cost efficiency, as rework and scrap rates impact the effective cost per saleable unit.

When analyzing the total manufacturing cost structure, V6 engines typically demonstrate a 40-50% lower per-unit production cost compared to W12 engines of similar displacement and performance characteristics. This cost advantage becomes even more pronounced when factoring in the amortization of development and tooling costs across the production lifecycle.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!