Volumetric Additive Manufacturing For Rapid Prototyping Of Medical Implants

SEP 3, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

VAM Technology Background and Objectives

Volumetric Additive Manufacturing (VAM) represents a paradigm shift in the field of 3D printing technology, emerging from the convergence of photopolymerization techniques and advanced optical engineering. Unlike traditional layer-by-layer additive manufacturing methods, VAM enables the simultaneous solidification of an entire volume of photosensitive resin, dramatically reducing production time from hours to minutes or even seconds. This revolutionary approach has evolved significantly since its conceptual introduction in the early 2010s, with major technological breakthroughs occurring between 2017 and 2021.

The medical implant industry has long faced challenges in producing patient-specific devices with complex geometries while maintaining biocompatibility and mechanical integrity. Conventional manufacturing methods often require extensive lead times, limiting their application in urgent clinical scenarios. VAM technology addresses these limitations by offering unprecedented speed and precision in fabricating intricate structures, making it particularly valuable for rapid prototyping of customized medical implants.

Current technological trends indicate a growing emphasis on multi-material capabilities and resolution enhancement in VAM systems. The integration of computational tomography with volumetric printing techniques has enabled direct translation of patient imaging data into printable models, streamlining the workflow from diagnosis to implant production. Additionally, recent developments in photosensitive biomaterials compatible with VAM processes have expanded the range of potential medical applications.

The primary technical objectives for VAM in medical implant manufacturing include achieving sub-micron resolution for cellular-level features, developing biocompatible resins with tunable mechanical properties, and establishing reliable quality control protocols for clinical validation. Furthermore, there is a pressing need to overcome current limitations in build volume while maintaining high resolution, as many orthopedic and craniofacial implants require substantial dimensions.

Looking forward, the technology roadmap for VAM in medical applications focuses on integrating real-time feedback systems for quality assurance, expanding material libraries to include biodegradable and bioactive compounds, and developing hybrid manufacturing approaches that combine volumetric printing with other fabrication techniques. These advancements aim to position VAM as a cornerstone technology in personalized medicine, enabling on-demand production of implants tailored to individual patient anatomy.

The ultimate goal of VAM technology development for medical implants is to establish a comprehensive platform that seamlessly connects medical imaging, computational design, rapid manufacturing, and clinical implementation, thereby revolutionizing the standard of care for patients requiring implantable medical devices.

The medical implant industry has long faced challenges in producing patient-specific devices with complex geometries while maintaining biocompatibility and mechanical integrity. Conventional manufacturing methods often require extensive lead times, limiting their application in urgent clinical scenarios. VAM technology addresses these limitations by offering unprecedented speed and precision in fabricating intricate structures, making it particularly valuable for rapid prototyping of customized medical implants.

Current technological trends indicate a growing emphasis on multi-material capabilities and resolution enhancement in VAM systems. The integration of computational tomography with volumetric printing techniques has enabled direct translation of patient imaging data into printable models, streamlining the workflow from diagnosis to implant production. Additionally, recent developments in photosensitive biomaterials compatible with VAM processes have expanded the range of potential medical applications.

The primary technical objectives for VAM in medical implant manufacturing include achieving sub-micron resolution for cellular-level features, developing biocompatible resins with tunable mechanical properties, and establishing reliable quality control protocols for clinical validation. Furthermore, there is a pressing need to overcome current limitations in build volume while maintaining high resolution, as many orthopedic and craniofacial implants require substantial dimensions.

Looking forward, the technology roadmap for VAM in medical applications focuses on integrating real-time feedback systems for quality assurance, expanding material libraries to include biodegradable and bioactive compounds, and developing hybrid manufacturing approaches that combine volumetric printing with other fabrication techniques. These advancements aim to position VAM as a cornerstone technology in personalized medicine, enabling on-demand production of implants tailored to individual patient anatomy.

The ultimate goal of VAM technology development for medical implants is to establish a comprehensive platform that seamlessly connects medical imaging, computational design, rapid manufacturing, and clinical implementation, thereby revolutionizing the standard of care for patients requiring implantable medical devices.

Market Analysis for Medical Implant Rapid Prototyping

The global market for medical implant rapid prototyping is experiencing significant growth, driven by increasing demand for personalized medical solutions and advancements in additive manufacturing technologies. The market was valued at approximately $1.25 billion in 2022 and is projected to reach $3.7 billion by 2030, representing a compound annual growth rate (CAGR) of 14.5% during the forecast period.

Demographic shifts, particularly aging populations in developed economies, are fueling market expansion as the prevalence of chronic conditions requiring implantable medical devices increases. North America currently dominates the market with a 42% share, followed by Europe at 31% and Asia-Pacific at 21%, with the latter showing the fastest growth trajectory due to improving healthcare infrastructure and rising disposable incomes.

The orthopedic segment represents the largest application area, accounting for approximately 38% of the market share, followed by dental implants (27%), cardiovascular implants (18%), and neurological implants (12%). This distribution reflects the high prevalence of musculoskeletal disorders and the technical suitability of volumetric additive manufacturing for complex bone structures.

Customer demand is increasingly focused on reduced lead times, with healthcare providers seeking solutions that can deliver custom implants within 24-48 hours versus traditional manufacturing methods that typically require 2-4 weeks. This time-sensitive requirement creates significant market opportunities for volumetric additive manufacturing technologies that can dramatically accelerate production cycles.

Cost considerations remain a critical factor influencing market adoption. While the average cost of traditionally manufactured custom implants ranges from $3,000 to $15,000 depending on complexity, rapid prototyping technologies have the potential to reduce these costs by 30-50% at scale. However, initial investment barriers and reimbursement challenges continue to constrain market penetration in cost-sensitive healthcare systems.

Regulatory frameworks significantly impact market dynamics, with the FDA's 510(k) clearance process and the EU's Medical Device Regulation (MDR) setting stringent requirements for patient-specific implants. Companies demonstrating compliance with these regulations while maintaining production efficiency gain substantial competitive advantages in this highly regulated market environment.

The market shows strong correlation with technological advancements in biocompatible materials, with PEEK, titanium alloys, and bioactive ceramics dominating current applications. Emerging bioabsorbable and composite materials are expected to expand application possibilities and drive new market segments over the next five years.

Demographic shifts, particularly aging populations in developed economies, are fueling market expansion as the prevalence of chronic conditions requiring implantable medical devices increases. North America currently dominates the market with a 42% share, followed by Europe at 31% and Asia-Pacific at 21%, with the latter showing the fastest growth trajectory due to improving healthcare infrastructure and rising disposable incomes.

The orthopedic segment represents the largest application area, accounting for approximately 38% of the market share, followed by dental implants (27%), cardiovascular implants (18%), and neurological implants (12%). This distribution reflects the high prevalence of musculoskeletal disorders and the technical suitability of volumetric additive manufacturing for complex bone structures.

Customer demand is increasingly focused on reduced lead times, with healthcare providers seeking solutions that can deliver custom implants within 24-48 hours versus traditional manufacturing methods that typically require 2-4 weeks. This time-sensitive requirement creates significant market opportunities for volumetric additive manufacturing technologies that can dramatically accelerate production cycles.

Cost considerations remain a critical factor influencing market adoption. While the average cost of traditionally manufactured custom implants ranges from $3,000 to $15,000 depending on complexity, rapid prototyping technologies have the potential to reduce these costs by 30-50% at scale. However, initial investment barriers and reimbursement challenges continue to constrain market penetration in cost-sensitive healthcare systems.

Regulatory frameworks significantly impact market dynamics, with the FDA's 510(k) clearance process and the EU's Medical Device Regulation (MDR) setting stringent requirements for patient-specific implants. Companies demonstrating compliance with these regulations while maintaining production efficiency gain substantial competitive advantages in this highly regulated market environment.

The market shows strong correlation with technological advancements in biocompatible materials, with PEEK, titanium alloys, and bioactive ceramics dominating current applications. Emerging bioabsorbable and composite materials are expected to expand application possibilities and drive new market segments over the next five years.

Current VAM Challenges in Medical Applications

Despite the promising potential of Volumetric Additive Manufacturing (VAM) for medical implant production, several significant challenges currently limit its widespread clinical implementation. Resolution constraints remain a primary technical barrier, as medical implants often require microscale features and complex internal structures that push the boundaries of current VAM capabilities. Most commercial VAM systems achieve resolutions between 50-100 μm, which falls short of the sub-10 μm precision needed for certain implant applications, particularly those involving microvascular networks or cellular-scale features.

Material biocompatibility presents another substantial hurdle. The photopolymers and resins commonly used in VAM processes must meet stringent biocompatibility standards for implantation. Current FDA-approved photocurable materials for VAM are limited, with many exhibiting cytotoxicity concerns or insufficient mechanical properties for load-bearing applications. Additionally, achieving multi-material capabilities—essential for creating implants with spatially varied mechanical properties—remains technically challenging in volumetric printing approaches.

Process repeatability and quality control pose significant challenges in medical manufacturing contexts. The complex photochemistry involved in VAM can lead to batch-to-batch variations, with environmental factors such as ambient temperature and humidity affecting polymerization kinetics. This variability complicates regulatory approval pathways, as medical devices require consistent manufacturing processes with well-characterized outcomes.

Sterilization compatibility represents another critical challenge. Medical implants must withstand sterilization procedures without compromising structural integrity or biocompatibility. Many photopolymers used in VAM degrade under standard sterilization methods such as gamma irradiation or autoclave processing, necessitating the development of specialized materials or post-processing techniques.

Scaling limitations also restrict clinical translation. While VAM offers impressive speed advantages for small objects, the physics of light projection and resin curing create constraints on maximum printable volumes. Most current systems are limited to objects smaller than 5 cm³, whereas many orthopedic and craniofacial implants require substantially larger dimensions.

Regulatory hurdles compound these technical challenges. The pathway to FDA approval for additively manufactured implants remains complex, with limited precedent specifically for VAM-produced devices. Manufacturers must demonstrate process validation, material safety, and long-term performance through extensive testing protocols that are still evolving for these novel manufacturing approaches.

Addressing these interconnected challenges requires coordinated research efforts across materials science, optical engineering, and regulatory science to realize VAM's full potential in personalized medical implant manufacturing.

Material biocompatibility presents another substantial hurdle. The photopolymers and resins commonly used in VAM processes must meet stringent biocompatibility standards for implantation. Current FDA-approved photocurable materials for VAM are limited, with many exhibiting cytotoxicity concerns or insufficient mechanical properties for load-bearing applications. Additionally, achieving multi-material capabilities—essential for creating implants with spatially varied mechanical properties—remains technically challenging in volumetric printing approaches.

Process repeatability and quality control pose significant challenges in medical manufacturing contexts. The complex photochemistry involved in VAM can lead to batch-to-batch variations, with environmental factors such as ambient temperature and humidity affecting polymerization kinetics. This variability complicates regulatory approval pathways, as medical devices require consistent manufacturing processes with well-characterized outcomes.

Sterilization compatibility represents another critical challenge. Medical implants must withstand sterilization procedures without compromising structural integrity or biocompatibility. Many photopolymers used in VAM degrade under standard sterilization methods such as gamma irradiation or autoclave processing, necessitating the development of specialized materials or post-processing techniques.

Scaling limitations also restrict clinical translation. While VAM offers impressive speed advantages for small objects, the physics of light projection and resin curing create constraints on maximum printable volumes. Most current systems are limited to objects smaller than 5 cm³, whereas many orthopedic and craniofacial implants require substantially larger dimensions.

Regulatory hurdles compound these technical challenges. The pathway to FDA approval for additively manufactured implants remains complex, with limited precedent specifically for VAM-produced devices. Manufacturers must demonstrate process validation, material safety, and long-term performance through extensive testing protocols that are still evolving for these novel manufacturing approaches.

Addressing these interconnected challenges requires coordinated research efforts across materials science, optical engineering, and regulatory science to realize VAM's full potential in personalized medical implant manufacturing.

Current VAM Solutions for Medical Implants

01 Light-based volumetric additive manufacturing techniques

Light-based volumetric additive manufacturing involves using light to cure photosensitive resins in a volumetric manner, allowing for rapid creation of three-dimensional objects without the need for layer-by-layer processing. These techniques include holographic stereolithography, computed axial lithography, and other photopolymerization methods that can simultaneously solidify entire volumes of material, significantly reducing production time compared to traditional additive manufacturing methods.- Light-based volumetric additive manufacturing techniques: Light-based volumetric additive manufacturing involves using photopolymerization to create 3D objects by selectively curing photosensitive resins. These techniques include stereolithography (SLA), digital light processing (DLP), and computed axial lithography (CAL), which enable the creation of complex structures with high resolution. The process typically involves projecting light patterns into a volume of photocurable resin to solidify specific regions, allowing for rapid prototyping without the need for layer-by-layer building.

- Material development for volumetric additive manufacturing: Advanced materials specifically formulated for volumetric additive manufacturing processes are essential for achieving desired mechanical properties, resolution, and build speed. These materials include specialized photopolymers, composite resins, and hybrid materials that can be rapidly cured while maintaining structural integrity. Research focuses on developing materials with improved optical properties, reduced shrinkage, and enhanced functional characteristics to expand the applications of volumetric additive manufacturing in rapid prototyping.

- System integration and hardware configurations: Volumetric additive manufacturing systems require sophisticated hardware configurations that integrate light sources, projection systems, material handling mechanisms, and control software. These systems may incorporate multiple projectors, rotating build platforms, or specialized optics to achieve volumetric fabrication. The hardware design focuses on maximizing build volume, improving resolution, and reducing manufacturing time while maintaining precision and repeatability for rapid prototyping applications.

- Process optimization and control methods: Optimization of volumetric additive manufacturing processes involves developing sophisticated control algorithms, calibration methods, and feedback systems to ensure accurate and repeatable results. These methods include real-time monitoring of curing processes, adaptive exposure strategies, and compensation techniques for optical distortions. Advanced software tools enable precise control over energy distribution, curing kinetics, and thermal management, resulting in improved build quality and reduced production time for rapid prototyping applications.

- Applications and industry-specific implementations: Volumetric additive manufacturing technologies are being adapted for various industry-specific applications, including medical device prototyping, custom tooling, aerospace components, and consumer products. These implementations often require specialized workflows, material formulations, and post-processing techniques tailored to specific industry requirements. The technology enables rapid iteration of complex designs, functional testing of prototypes, and small-batch production with reduced lead times compared to traditional manufacturing methods.

02 Material formulations for volumetric 3D printing

Specialized material formulations are essential for successful volumetric additive manufacturing. These include photopolymer resins with specific viscosity, curing characteristics, and optical properties that enable volumetric solidification. Advanced formulations may incorporate nanoparticles, functional additives, or multiple components that react to different stimuli, allowing for the creation of parts with gradient properties or complex internal structures in a single manufacturing step.Expand Specific Solutions03 Equipment and hardware systems for volumetric manufacturing

Specialized equipment for volumetric additive manufacturing includes advanced projection systems, rotating build platforms, and synchronized multi-beam light sources. These systems often incorporate precision optics, high-resolution digital light processing units, and sophisticated motion control mechanisms. The hardware is designed to project patterned light into transparent resin vats or to coordinate multiple energy sources for rapid, volumetric solidification of materials without the mechanical constraints of layer-by-layer processes.Expand Specific Solutions04 Software and computational methods for volumetric printing

Advanced computational methods are crucial for volumetric additive manufacturing, including algorithms for tomographic reconstruction, volumetric data processing, and real-time control systems. These software solutions convert 3D models into appropriate light patterns or energy distributions needed for volumetric solidification. Machine learning approaches may optimize manufacturing parameters based on desired part characteristics, material properties, and production constraints, enabling more efficient and accurate rapid prototyping.Expand Specific Solutions05 Applications and integration of volumetric manufacturing in rapid prototyping

Volumetric additive manufacturing offers significant advantages for rapid prototyping applications, including dramatically reduced production times, elimination of support structures, and the ability to create complex internal geometries. This technology is particularly valuable in fields requiring quick iteration of designs, such as medical device development, custom consumer products, and aerospace components. Integration with existing manufacturing workflows may involve hybrid approaches combining volumetric techniques with traditional methods to optimize both speed and precision.Expand Specific Solutions

Key Industry Players in Medical VAM

Volumetric Additive Manufacturing (VAM) for medical implants is currently in the early growth stage, with the market expected to expand significantly as the technology matures. The global market for 3D printed medical implants is projected to reach approximately $4-5 billion by 2027, driven by increasing demand for patient-specific solutions. Technologically, VAM is transitioning from experimental to commercial applications, with varying degrees of maturity across players. Leading companies like Stratasys and Johnson & Johnson (through DePuy) have established commercial platforms, while academic institutions (Cornell, EPFL, Tsinghua) continue fundamental research. Emerging specialists such as NanoHive Medical and Readily3D are developing novel VAM approaches specifically for implant applications. The ecosystem shows a balanced mix of established medical device manufacturers, 3D printing incumbents, and innovative startups, indicating a competitive but collaborative landscape focused on clinical translation and regulatory approval.

DePuy Ireland Unlimited Co.

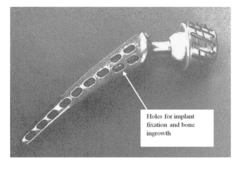

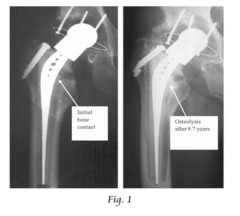

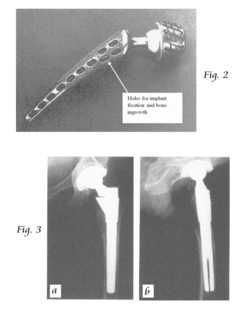

Technical Solution: DePuy has developed an integrated volumetric additive manufacturing platform specifically for orthopedic implant applications. Their system combines digital light processing technology with proprietary biocompatible materials to create patient-specific implants with complex internal architectures. DePuy's approach integrates directly with their surgical planning software, enabling seamless workflow from patient imaging to final implant production. Their technology achieves high resolution (75-100 microns) while maintaining production speeds suitable for clinical timelines. DePuy has pioneered the development of gradient structures that mimic the transition from cortical to cancellous bone, enhancing implant integration and load distribution. Their proprietary surface treatments create micro-textures that promote cellular attachment and differentiation, accelerating the osseointegration process[6]. DePuy has also developed specialized post-processing techniques that ensure implants meet rigorous regulatory requirements for mechanical properties, biocompatibility, and sterility while preserving the complex features enabled by volumetric manufacturing.

Strengths: Comprehensive integration with surgical planning and instrumentation systems; extensive clinical validation data; established regulatory pathways for bringing additively manufactured implants to market. Weaknesses: Relatively closed ecosystem limits material flexibility; higher costs compared to generic manufacturing platforms; longer development cycles for new material formulations.

NanoHive Medical LLC

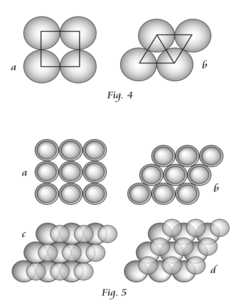

Technical Solution: NanoHive Medical has developed a specialized volumetric additive manufacturing platform focused exclusively on orthopedic and spinal implants. Their proprietary Hive™ technology creates biomimetic lattice structures with nanoscale features that enhance osseointegration and cellular attachment. Using a combination of two-photon polymerization and digital light processing, NanoHive achieves exceptional resolution (down to 200nm) while maintaining practical production speeds for clinical applications. Their manufacturing process incorporates patient-specific data to create customized implants with optimized mechanical properties that match surrounding tissue characteristics. NanoHive's technology enables the production of implants with precisely controlled porosity gradients that promote bone ingrowth while maintaining structural integrity under physiological loads[5]. Their proprietary bioactive surface treatments further enhance cellular attachment and differentiation, accelerating the healing process. The company has developed specialized titanium and PEEK-based materials that combine excellent biocompatibility with mechanical properties tailored for specific anatomical locations.

Strengths: Unparalleled precision in creating nanoscale features that enhance biological integration; specialized focus on orthopedic applications provides deep domain expertise; comprehensive workflow from imaging to final implant. Weaknesses: More limited application range compared to general-purpose systems; higher production costs for small-batch manufacturing; requires specialized post-processing for certain materials.

Critical Patents and Innovations in Medical VAM

Orthopaedic implants and methods of forming implant structures

PatentInactiveUS20120191200A1

Innovation

- The use of engineered porosity in orthopaedic implants, specifically through additive manufacturing techniques, to modify the effective moduli of the implants by creating closed-cell porous microstructures, which reduces the flexural rigidity and matches the elastic properties of the surrounding bone, thereby minimizing stress shielding and bone loss.

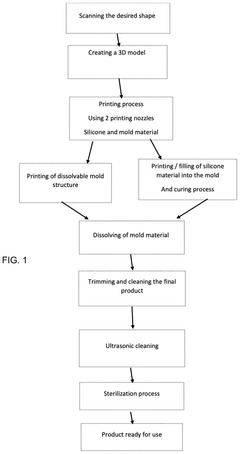

On-the-fly molding

PatentPendingUS20250153399A1

Innovation

- A method using additive manufacturing to fabricate a mold and fill it with heat-curable medical grade silicone, which is then heated and repeated until the object is complete, allowing for rapid and accurate production of customized implants.

Regulatory Framework for 3D Printed Medical Implants

The regulatory landscape for 3D printed medical implants represents a complex and evolving framework that manufacturers must navigate to bring volumetric additive manufacturing (VAM) products to market. The U.S. Food and Drug Administration (FDA) has established a comprehensive regulatory pathway for these devices, primarily through the Center for Devices and Radiological Health (CDRH). Medical implants typically fall under Class II or Class III medical devices, requiring either 510(k) clearance or Premarket Approval (PMA), depending on their risk profile and novelty.

For VAM-produced implants, the FDA has developed specific guidance documents addressing the unique considerations of additively manufactured medical devices. These guidelines emphasize the importance of process validation, material characterization, and quality control throughout the manufacturing workflow. Manufacturers must demonstrate that their VAM processes consistently produce implants meeting predetermined specifications and safety standards.

The European regulatory framework has undergone significant transformation with the implementation of the Medical Device Regulation (MDR) in 2021, replacing the previous Medical Device Directive. The MDR imposes stricter requirements for clinical evaluation, post-market surveillance, and technical documentation for all medical devices, including 3D printed implants. Notably, the regulation introduces the concept of "qualified person" responsible for regulatory compliance and enhances traceability requirements through Unique Device Identification (UDI) systems.

In Asia, regulatory approaches vary significantly. Japan's Pharmaceuticals and Medical Devices Agency (PMDA) has established specific pathways for innovative medical technologies, including additive manufacturing. China's National Medical Products Administration (NMPA) has also developed regulations for 3D printed medical devices, though these frameworks continue to evolve as the technology advances.

A critical aspect of the regulatory framework is the establishment of international standards. Organizations such as ASTM International and ISO have developed specific standards for additive manufacturing processes, materials, and quality assurance. For instance, ASTM F3091 addresses standard specifications for powder bed fusion of polymeric materials, while ISO/ASTM 52900 standardizes terminology for additive manufacturing technologies.

Regulatory bodies increasingly recognize the need for adaptive frameworks that can accommodate the rapid innovation in VAM technologies. The FDA's Digital Health Software Precertification Program and similar initiatives aim to streamline the regulatory process for digital technologies supporting medical device manufacturing, including the software components essential to VAM systems.

Post-market surveillance requirements represent another crucial regulatory consideration. Manufacturers must implement robust systems for tracking device performance, adverse events, and long-term outcomes. This is particularly important for VAM-produced implants, where the long-term performance data continues to accumulate as the technology matures.

For VAM-produced implants, the FDA has developed specific guidance documents addressing the unique considerations of additively manufactured medical devices. These guidelines emphasize the importance of process validation, material characterization, and quality control throughout the manufacturing workflow. Manufacturers must demonstrate that their VAM processes consistently produce implants meeting predetermined specifications and safety standards.

The European regulatory framework has undergone significant transformation with the implementation of the Medical Device Regulation (MDR) in 2021, replacing the previous Medical Device Directive. The MDR imposes stricter requirements for clinical evaluation, post-market surveillance, and technical documentation for all medical devices, including 3D printed implants. Notably, the regulation introduces the concept of "qualified person" responsible for regulatory compliance and enhances traceability requirements through Unique Device Identification (UDI) systems.

In Asia, regulatory approaches vary significantly. Japan's Pharmaceuticals and Medical Devices Agency (PMDA) has established specific pathways for innovative medical technologies, including additive manufacturing. China's National Medical Products Administration (NMPA) has also developed regulations for 3D printed medical devices, though these frameworks continue to evolve as the technology advances.

A critical aspect of the regulatory framework is the establishment of international standards. Organizations such as ASTM International and ISO have developed specific standards for additive manufacturing processes, materials, and quality assurance. For instance, ASTM F3091 addresses standard specifications for powder bed fusion of polymeric materials, while ISO/ASTM 52900 standardizes terminology for additive manufacturing technologies.

Regulatory bodies increasingly recognize the need for adaptive frameworks that can accommodate the rapid innovation in VAM technologies. The FDA's Digital Health Software Precertification Program and similar initiatives aim to streamline the regulatory process for digital technologies supporting medical device manufacturing, including the software components essential to VAM systems.

Post-market surveillance requirements represent another crucial regulatory consideration. Manufacturers must implement robust systems for tracking device performance, adverse events, and long-term outcomes. This is particularly important for VAM-produced implants, where the long-term performance data continues to accumulate as the technology matures.

Biocompatibility and Material Science Advancements

The evolution of biocompatible materials for medical implants has undergone significant transformation with the advent of Volumetric Additive Manufacturing (VAM). Traditional biomaterials such as titanium alloys, stainless steel, and polymers like PEEK have been the mainstay of implant manufacturing. However, VAM technologies have expanded the material palette considerably, enabling the use of novel biocompatible resins, hydrogels, and composite materials that were previously difficult to process using conventional manufacturing methods.

Recent advancements in photopolymer chemistry have yielded materials specifically designed for VAM that meet stringent biocompatibility requirements according to ISO 10993 standards. These materials demonstrate reduced cytotoxicity, minimal inflammatory response, and enhanced osseointegration properties. Particularly noteworthy is the development of hybrid materials combining ceramic particles with photocurable polymers, creating composites that mimic the mechanical and biological properties of natural bone tissue.

Material science innovations have also addressed the persistent challenge of degradation kinetics in bioresorbable implants. New VAM-compatible materials now offer predictable degradation profiles that synchronize with tissue healing rates, a critical factor for temporary implant applications. This represents a significant advancement over earlier generations of bioresorbable materials that often exhibited unpredictable degradation behaviors in vivo.

Surface modification techniques have evolved in parallel with material development. Researchers have successfully implemented methods to functionalize the surfaces of VAM-printed implants with bioactive molecules, growth factors, and antimicrobial agents. These modifications enhance cell adhesion, proliferation, and differentiation while reducing infection risks—a common complication in implant procedures.

The mechanical property customization capabilities of VAM materials constitute another breakthrough area. Through precise control of crosslinking density, filler content, and microstructural features, materials can now be tailored to match the specific mechanical requirements of different anatomical locations. This addresses the long-standing issue of mechanical mismatch between implants and surrounding tissues, which often leads to stress shielding and eventual implant failure.

Regulatory pathways for novel VAM materials have begun to crystallize, with several materials receiving FDA clearance for specific applications. This regulatory progress has accelerated clinical translation, with early clinical trials demonstrating promising outcomes for patient-specific implants manufactured using these advanced materials. The convergence of material science innovations with VAM technologies is creating unprecedented opportunities for personalized implant solutions with enhanced biocompatibility profiles.

Recent advancements in photopolymer chemistry have yielded materials specifically designed for VAM that meet stringent biocompatibility requirements according to ISO 10993 standards. These materials demonstrate reduced cytotoxicity, minimal inflammatory response, and enhanced osseointegration properties. Particularly noteworthy is the development of hybrid materials combining ceramic particles with photocurable polymers, creating composites that mimic the mechanical and biological properties of natural bone tissue.

Material science innovations have also addressed the persistent challenge of degradation kinetics in bioresorbable implants. New VAM-compatible materials now offer predictable degradation profiles that synchronize with tissue healing rates, a critical factor for temporary implant applications. This represents a significant advancement over earlier generations of bioresorbable materials that often exhibited unpredictable degradation behaviors in vivo.

Surface modification techniques have evolved in parallel with material development. Researchers have successfully implemented methods to functionalize the surfaces of VAM-printed implants with bioactive molecules, growth factors, and antimicrobial agents. These modifications enhance cell adhesion, proliferation, and differentiation while reducing infection risks—a common complication in implant procedures.

The mechanical property customization capabilities of VAM materials constitute another breakthrough area. Through precise control of crosslinking density, filler content, and microstructural features, materials can now be tailored to match the specific mechanical requirements of different anatomical locations. This addresses the long-standing issue of mechanical mismatch between implants and surrounding tissues, which often leads to stress shielding and eventual implant failure.

Regulatory pathways for novel VAM materials have begun to crystallize, with several materials receiving FDA clearance for specific applications. This regulatory progress has accelerated clinical translation, with early clinical trials demonstrating promising outcomes for patient-specific implants manufactured using these advanced materials. The convergence of material science innovations with VAM technologies is creating unprecedented opportunities for personalized implant solutions with enhanced biocompatibility profiles.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!