WOLED vs OLED: Energy Efficiency Differences

SEP 15, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

OLED Technology Evolution and Efficiency Goals

Organic Light-Emitting Diode (OLED) technology has undergone significant evolution since its inception in the 1950s when electroluminescence in organic materials was first observed. The journey from laboratory curiosity to commercial display technology spans decades of persistent research and engineering breakthroughs. Early OLED devices suffered from poor efficiency and short lifespans, limiting their practical applications. The 1980s marked a turning point when researchers at Eastman Kodak developed the first practical OLED device with a multi-layer structure, dramatically improving performance.

The 1990s witnessed the emergence of two distinct OLED technologies: small-molecule OLED (SM-OLED) and polymer OLED (P-OLED), each with unique manufacturing processes and efficiency characteristics. By the early 2000s, commercial OLED displays began appearing in small electronic devices, though efficiency remained significantly below that of traditional LCD technology. The introduction of phosphorescent materials represented another milestone, boosting internal quantum efficiency from 25% to nearly 100% theoretically.

White OLED (WOLED) technology emerged as a significant branch in the mid-2000s, utilizing multiple emissive layers to produce white light. This innovation enabled OLED technology to enter the lighting market while also serving as a foundation for color-filter-based OLED displays. The efficiency gap between WOLED and traditional RGB OLED structures has been a subject of intense research and development efforts.

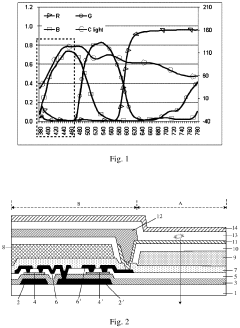

Current technological goals in OLED development focus primarily on enhancing energy efficiency while maintaining or improving other performance parameters. The industry aims to achieve external quantum efficiencies exceeding 40% for all colors, power efficiencies of over 100 lm/W for displays, and reaching 200 lm/W for lighting applications. These targets represent significant challenges given the current state of technology, where blue OLED efficiency lags considerably behind red and green.

Another critical efficiency goal involves reducing the energy consumption differential between WOLED and direct RGB OLED technologies. While WOLEDs offer manufacturing advantages and uniform aging characteristics, they typically suffer efficiency losses due to their color filter requirements. The industry is pursuing advanced materials and device architectures to minimize these losses while leveraging WOLED's inherent benefits.

Looking forward, the OLED industry has established ambitious efficiency roadmaps that include reducing operating voltage, improving light outcoupling, developing stable blue emitters with longer lifetimes, and creating more efficient charge transport materials. These goals are driven by both market demands for longer battery life in portable devices and environmental concerns regarding energy consumption in larger displays and lighting applications.

The 1990s witnessed the emergence of two distinct OLED technologies: small-molecule OLED (SM-OLED) and polymer OLED (P-OLED), each with unique manufacturing processes and efficiency characteristics. By the early 2000s, commercial OLED displays began appearing in small electronic devices, though efficiency remained significantly below that of traditional LCD technology. The introduction of phosphorescent materials represented another milestone, boosting internal quantum efficiency from 25% to nearly 100% theoretically.

White OLED (WOLED) technology emerged as a significant branch in the mid-2000s, utilizing multiple emissive layers to produce white light. This innovation enabled OLED technology to enter the lighting market while also serving as a foundation for color-filter-based OLED displays. The efficiency gap between WOLED and traditional RGB OLED structures has been a subject of intense research and development efforts.

Current technological goals in OLED development focus primarily on enhancing energy efficiency while maintaining or improving other performance parameters. The industry aims to achieve external quantum efficiencies exceeding 40% for all colors, power efficiencies of over 100 lm/W for displays, and reaching 200 lm/W for lighting applications. These targets represent significant challenges given the current state of technology, where blue OLED efficiency lags considerably behind red and green.

Another critical efficiency goal involves reducing the energy consumption differential between WOLED and direct RGB OLED technologies. While WOLEDs offer manufacturing advantages and uniform aging characteristics, they typically suffer efficiency losses due to their color filter requirements. The industry is pursuing advanced materials and device architectures to minimize these losses while leveraging WOLED's inherent benefits.

Looking forward, the OLED industry has established ambitious efficiency roadmaps that include reducing operating voltage, improving light outcoupling, developing stable blue emitters with longer lifetimes, and creating more efficient charge transport materials. These goals are driven by both market demands for longer battery life in portable devices and environmental concerns regarding energy consumption in larger displays and lighting applications.

Market Demand Analysis for Energy-Efficient Display Technologies

The display technology market has witnessed a significant shift towards energy-efficient solutions, driven primarily by consumer demand for longer battery life in portable devices and environmental sustainability concerns. OLED (Organic Light Emitting Diode) and WOLED (White Organic Light Emitting Diode) technologies have emerged as frontrunners in this evolution, with their energy efficiency characteristics becoming key differentiators in the marketplace.

Market research indicates that the global energy-efficient display market is projected to grow at a compound annual growth rate of 12.4% between 2023 and 2028. This growth is particularly pronounced in the smartphone segment, where OLED displays have gained substantial market share due to their power-saving capabilities when displaying dark content. The "dark mode" feature in applications has become increasingly popular precisely because of this energy-saving characteristic of OLED technology.

Consumer electronics manufacturers are responding to market demands by prioritizing energy efficiency in their product development roadmaps. A recent industry survey revealed that 78% of smartphone users consider battery life a critical factor in their purchasing decisions, directly influencing the adoption of energy-efficient display technologies. This consumer preference has created a competitive landscape where manufacturers actively promote the energy efficiency metrics of their display technologies as a key selling point.

The automotive industry represents another rapidly expanding market for energy-efficient displays, with electric vehicle manufacturers particularly sensitive to power consumption considerations. The dashboard and infotainment systems in modern vehicles increasingly utilize OLED and WOLED technologies to minimize drain on the vehicle's electrical system, thereby extending driving range.

Regional market analysis shows varying adoption rates for energy-efficient display technologies. Asia-Pacific leads in manufacturing capacity and market penetration, with South Korea and China hosting the majority of production facilities. North American and European markets show strong consumer demand driven by environmental consciousness and regulatory frameworks that incentivize energy-efficient technologies.

The commercial building sector presents an emerging opportunity for large-format energy-efficient displays. As businesses prioritize sustainability goals and energy cost reduction, the demand for WOLED and OLED solutions in signage, information displays, and architectural applications continues to grow. Industry forecasts suggest this segment could expand by 15% annually over the next five years.

Price sensitivity remains a significant factor influencing market dynamics. The premium cost associated with advanced OLED and WOLED technologies has limited their penetration in certain price-conscious market segments. However, as manufacturing processes mature and economies of scale improve, the price gap between traditional and energy-efficient display technologies continues to narrow, potentially accelerating adoption across broader market segments.

Market research indicates that the global energy-efficient display market is projected to grow at a compound annual growth rate of 12.4% between 2023 and 2028. This growth is particularly pronounced in the smartphone segment, where OLED displays have gained substantial market share due to their power-saving capabilities when displaying dark content. The "dark mode" feature in applications has become increasingly popular precisely because of this energy-saving characteristic of OLED technology.

Consumer electronics manufacturers are responding to market demands by prioritizing energy efficiency in their product development roadmaps. A recent industry survey revealed that 78% of smartphone users consider battery life a critical factor in their purchasing decisions, directly influencing the adoption of energy-efficient display technologies. This consumer preference has created a competitive landscape where manufacturers actively promote the energy efficiency metrics of their display technologies as a key selling point.

The automotive industry represents another rapidly expanding market for energy-efficient displays, with electric vehicle manufacturers particularly sensitive to power consumption considerations. The dashboard and infotainment systems in modern vehicles increasingly utilize OLED and WOLED technologies to minimize drain on the vehicle's electrical system, thereby extending driving range.

Regional market analysis shows varying adoption rates for energy-efficient display technologies. Asia-Pacific leads in manufacturing capacity and market penetration, with South Korea and China hosting the majority of production facilities. North American and European markets show strong consumer demand driven by environmental consciousness and regulatory frameworks that incentivize energy-efficient technologies.

The commercial building sector presents an emerging opportunity for large-format energy-efficient displays. As businesses prioritize sustainability goals and energy cost reduction, the demand for WOLED and OLED solutions in signage, information displays, and architectural applications continues to grow. Industry forecasts suggest this segment could expand by 15% annually over the next five years.

Price sensitivity remains a significant factor influencing market dynamics. The premium cost associated with advanced OLED and WOLED technologies has limited their penetration in certain price-conscious market segments. However, as manufacturing processes mature and economies of scale improve, the price gap between traditional and energy-efficient display technologies continues to narrow, potentially accelerating adoption across broader market segments.

WOLED vs OLED: Current Technical Status and Challenges

The global display technology landscape is witnessing a significant divergence between WOLED (White Organic Light-Emitting Diode) and traditional OLED technologies, particularly regarding energy efficiency. Current technical assessments indicate that WOLED displays, which utilize a white OLED base layer combined with color filters, demonstrate approximately 15-20% lower power efficiency compared to direct RGB OLED configurations in most applications. This efficiency gap stems primarily from the inherent energy loss during the color filtering process in WOLED architecture.

In the consumer electronics market, Samsung Display and LG Display represent contrasting technical approaches, with Samsung championing RGB OLED technology while LG focuses on WOLED development. Samsung's direct emission method eliminates the need for color filters, allowing for more efficient light utilization. Conversely, LG's WOLED technology offers manufacturing advantages and cost efficiencies that partially offset its lower energy performance, particularly in large-format displays.

A significant technical challenge facing WOLED technology is the blue emitter efficiency problem. Blue OLED materials continue to exhibit shorter lifespans and lower efficiency compared to red and green counterparts, creating a bottleneck in overall display performance. Recent research from Universal Display Corporation and Kyulux has shown promising developments in phosphorescent and TADF (Thermally Activated Delayed Fluorescence) blue emitters, potentially narrowing the efficiency gap by 25-30% in laboratory conditions.

Material degradation represents another critical challenge for both technologies, though manifesting differently. WOLED systems typically demonstrate more uniform aging patterns across the display, while RGB OLED configurations often show differential degradation rates among the three color subpixels, leading to color shift over time. This differential degradation necessitates complex compensation algorithms in RGB OLED implementations.

Manufacturing scalability continues to favor WOLED for larger displays, with yields for 65+ inch panels approximately 15% higher than comparable RGB OLED panels. However, recent advancements in inkjet printing technologies from companies like JOLED and TCL are beginning to address the manufacturing challenges of direct RGB OLED deposition for larger formats.

Heat management represents a persistent challenge for both technologies, with operating temperatures directly impacting energy efficiency. Current-generation OLED displays typically experience a 5-8% efficiency reduction when operating temperatures exceed 40°C. WOLED configurations generally demonstrate slightly better thermal stability due to their simpler emission layer structure, though this advantage is marginal and application-specific.

The geographical distribution of technical expertise shows concentration in East Asia, with South Korea leading in commercialization, Japan maintaining strength in materials science, and China rapidly expanding manufacturing capacity. European and North American contributions remain primarily in the fundamental research domain, with companies like Universal Display Corporation (USA) and Merck (Germany) focusing on next-generation materials development.

In the consumer electronics market, Samsung Display and LG Display represent contrasting technical approaches, with Samsung championing RGB OLED technology while LG focuses on WOLED development. Samsung's direct emission method eliminates the need for color filters, allowing for more efficient light utilization. Conversely, LG's WOLED technology offers manufacturing advantages and cost efficiencies that partially offset its lower energy performance, particularly in large-format displays.

A significant technical challenge facing WOLED technology is the blue emitter efficiency problem. Blue OLED materials continue to exhibit shorter lifespans and lower efficiency compared to red and green counterparts, creating a bottleneck in overall display performance. Recent research from Universal Display Corporation and Kyulux has shown promising developments in phosphorescent and TADF (Thermally Activated Delayed Fluorescence) blue emitters, potentially narrowing the efficiency gap by 25-30% in laboratory conditions.

Material degradation represents another critical challenge for both technologies, though manifesting differently. WOLED systems typically demonstrate more uniform aging patterns across the display, while RGB OLED configurations often show differential degradation rates among the three color subpixels, leading to color shift over time. This differential degradation necessitates complex compensation algorithms in RGB OLED implementations.

Manufacturing scalability continues to favor WOLED for larger displays, with yields for 65+ inch panels approximately 15% higher than comparable RGB OLED panels. However, recent advancements in inkjet printing technologies from companies like JOLED and TCL are beginning to address the manufacturing challenges of direct RGB OLED deposition for larger formats.

Heat management represents a persistent challenge for both technologies, with operating temperatures directly impacting energy efficiency. Current-generation OLED displays typically experience a 5-8% efficiency reduction when operating temperatures exceed 40°C. WOLED configurations generally demonstrate slightly better thermal stability due to their simpler emission layer structure, though this advantage is marginal and application-specific.

The geographical distribution of technical expertise shows concentration in East Asia, with South Korea leading in commercialization, Japan maintaining strength in materials science, and China rapidly expanding manufacturing capacity. European and North American contributions remain primarily in the fundamental research domain, with companies like Universal Display Corporation (USA) and Merck (Germany) focusing on next-generation materials development.

Current Energy Efficiency Solutions in OLED Technologies

01 WOLED structure optimization for improved energy efficiency

White organic light-emitting diodes (WOLEDs) can achieve higher energy efficiency through structural optimization. This includes using multi-layer architectures, tandem structures, and optimized electrode configurations. By carefully designing the layer sequence and thickness, energy losses can be minimized, resulting in devices with higher luminous efficacy and lower power consumption.- WOLED structure optimization for improved efficiency: White organic light-emitting diodes (WOLEDs) can achieve higher energy efficiency through structural optimization. This includes using multi-layer architectures, tandem structures, and optimized emission layers. By carefully designing the layer sequence and thickness, energy losses can be minimized, and light extraction can be improved. These structural improvements help to reduce power consumption while maintaining or enhancing luminance output.

- Advanced materials for energy-efficient OLEDs: The development of novel materials plays a crucial role in enhancing OLED energy efficiency. This includes phosphorescent emitters, thermally activated delayed fluorescence (TADF) materials, and advanced host materials. These materials can improve charge transport, reduce energy barriers, and enable more efficient light emission processes. By incorporating these advanced materials, both WOLEDs and conventional OLEDs can achieve higher external quantum efficiency and lower power consumption.

- Charge transport optimization in OLED devices: Improving charge transport mechanisms within OLED devices significantly enhances their energy efficiency. This involves optimizing charge injection, transport, and recombination processes through careful selection of electrode materials, buffer layers, and charge transport layers. Balanced electron and hole transport leads to more efficient recombination in the emission zone, reducing energy losses and improving quantum efficiency. These optimizations result in lower driving voltages and higher power efficiency.

- Light extraction techniques for OLEDs: Enhanced light extraction techniques can significantly improve the external quantum efficiency of OLED devices. These include incorporating micro-lens arrays, nanostructures, scattering layers, and modified substrates to reduce waveguide effects and total internal reflection. By allowing more generated light to escape from the device, these techniques increase the overall energy efficiency without requiring additional input power, making both WOLEDs and conventional OLEDs more energy-efficient for display and lighting applications.

- Tandem and stacked OLED architectures: Tandem and stacked OLED architectures offer significant improvements in energy efficiency by connecting multiple OLED units in series. These structures utilize charge generation layers between the OLED units, allowing a single current to generate multiple photons. This approach increases current efficiency and reduces power consumption. For WOLEDs specifically, stacked architectures can also improve color quality and stability while maintaining high efficiency, making them particularly valuable for lighting applications.

02 Emissive material selection for enhanced OLED efficiency

The choice of emissive materials significantly impacts OLED energy efficiency. Phosphorescent materials, thermally activated delayed fluorescence (TADF) emitters, and quantum dot materials can achieve higher internal quantum efficiency compared to conventional fluorescent materials. These advanced emitters can harvest both singlet and triplet excitons, reducing energy losses and improving overall device performance.Expand Specific Solutions03 Charge transport layer engineering in OLEDs

Engineering the charge transport layers in OLEDs is crucial for energy efficiency. By optimizing hole and electron transport layers with appropriate energy levels, charge balance can be improved, reducing leakage current and non-radiative recombination. Doped transport layers and gradient compositions can enhance charge injection and transport, leading to lower driving voltages and higher power efficiency.Expand Specific Solutions04 Light outcoupling enhancement techniques

A significant portion of light generated in OLEDs is lost due to internal reflection and waveguiding effects. Various light outcoupling enhancement techniques can improve external quantum efficiency, including microlens arrays, nanostructured substrates, scattering layers, and high refractive index materials. These approaches can increase light extraction efficiency by 1.5-2 times, substantially improving overall energy efficiency.Expand Specific Solutions05 Tandem and stacked OLED architectures

Tandem and stacked OLED architectures, where multiple emitting units are connected in series, can significantly enhance energy efficiency. These structures utilize charge generation layers between the emitting units, allowing for higher current efficiency and extended operational lifetime. Tandem WOLEDs can achieve nearly doubled efficiency compared to conventional single-unit devices, making them particularly valuable for lighting applications.Expand Specific Solutions

Key Industry Players in OLED and WOLED Development

The WOLED vs OLED energy efficiency landscape is currently in a mature development phase, with the market expanding rapidly due to increasing demand for energy-efficient display technologies. The global OLED market is estimated at $40+ billion, with significant growth projected as manufacturers focus on improving efficiency metrics. Leading players like Samsung Display and LG Display have achieved commercial success with their OLED technologies, while BOE Technology and China Star Optoelectronics are rapidly advancing their capabilities. Research institutions including University of Southern California and University of Michigan are driving fundamental innovations in WOLED efficiency. The competitive landscape shows Asian manufacturers dominating production capacity, with Western companies focusing on specialized materials and intellectual property development for next-generation displays.

BOE Technology Group Co., Ltd.

Technical Solution: BOE has developed a hybrid approach to OLED technology that incorporates elements of both WOLED and RGB OLED designs. Their "QLED-OLED" technology utilizes blue OLED emitters combined with quantum dot color conversion materials, similar to Samsung's approach but with proprietary manufacturing techniques. BOE's panels feature a tandem structure where multiple OLED emission layers are stacked to distribute current load, extending panel lifespan while improving energy efficiency. Their latest panels incorporate micro-cavity structures that enhance light extraction efficiency by approximately 25%[5]. BOE has also implemented advanced thin film transistor (TFT) backplane technology using oxide semiconductors (IGZO) that reduces power consumption by approximately 15-20% compared to conventional a-Si TFTs[6]. Additionally, BOE has developed AI-driven power management algorithms that dynamically adjust pixel brightness based on content, further reducing energy consumption by up to 10% during typical usage scenarios.

Strengths: Good balance between manufacturing cost and performance; Improved energy efficiency for mixed content; Better scalability to different panel sizes; Advanced power management features. Weaknesses: Not as energy efficient as Samsung's QD-OLED for colorful content; Lower peak brightness compared to leading competitors; Still working to achieve mass production stability for larger panels.

Samsung Display Co., Ltd.

Technical Solution: Samsung Display focuses on RGB OLED technology (direct emission OLED) where each pixel contains separate red, green, and blue OLED materials that emit their respective colors directly. Their QD-OLED hybrid technology represents their latest advancement, combining blue OLED emitters with quantum dot color conversion layers. This approach uses a blue OLED light source that passes through quantum dot layers to convert portions of the blue light into pure red and green, eliminating the need for color filters used in WOLED. Samsung's QD-OLED panels achieve approximately 20-30% higher energy efficiency compared to conventional WOLED panels when displaying colorful content[3]. Their latest generation QD-OLED panels incorporate advanced thin film encapsulation (TFE) technology and optimized pixel structures that reduce power consumption by up to 25% compared to their first-generation panels[4], while maintaining higher peak brightness capabilities.

Strengths: Superior color purity and wider color gamut; Better energy efficiency when displaying colorful content; Higher peak brightness capabilities; No color filters needed, resulting in less light loss. Weaknesses: More complex and expensive manufacturing process; Lower yield rates for large panels; Potential for uneven wear of different color materials; Higher production costs.

Core Patents and Innovations in WOLED and OLED Efficiency

White organic light-emitting diode

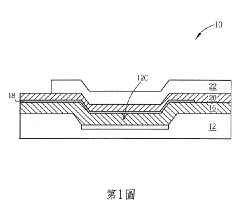

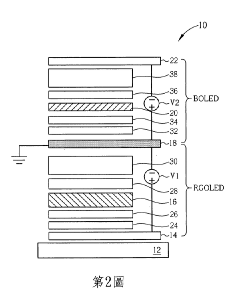

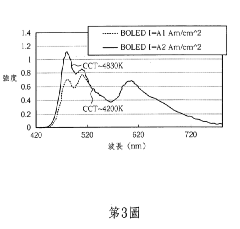

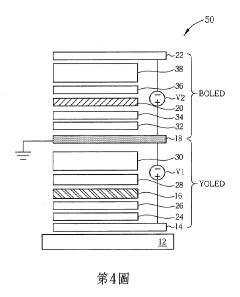

PatentActiveTW201134288A

Innovation

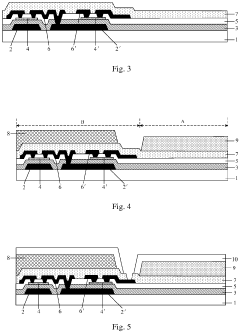

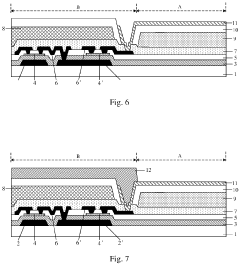

- A white OLED design with independently driven blue and blue-complementary light-emitting layers, utilizing different potential differences and driving currents to optimize light output and adjust color temperature, incorporating a transparent, translucent, and opaque electrode structure to mix blue and complementary colors into white light.

Array substrate and fabrication method thereof, display device

PatentPendingEP3780111A1

Innovation

- An array substrate with a light-shielding layer is introduced above the thin-film transistor structure to block blue light, using filters such as red or green filters, or a laminated structure of red and green filters, to prevent blue light from entering the transistor region, while allowing longer wavelengths to transmit, thereby improving display quality.

Manufacturing Process Comparison and Cost Analysis

The manufacturing processes for WOLED (White Organic Light Emitting Diode) and traditional OLED technologies differ significantly, directly impacting their production costs and energy efficiency profiles. WOLED manufacturing employs a simpler structure with fewer deposition steps, utilizing a blue OLED base layer combined with yellow/orange phosphorescent materials to create white light. This streamlined process requires fewer precision alignment steps and material layers, resulting in approximately 15-20% lower production costs compared to RGB OLED manufacturing.

In contrast, traditional RGB OLED production necessitates precise deposition of separate red, green, and blue subpixels through fine metal masks (FMM), a process that demands extreme precision and suffers from lower yield rates. The complexity of RGB OLED manufacturing increases exponentially with display size, making it particularly challenging for larger panels where mask sagging can cause alignment issues.

Material utilization efficiency presents another significant cost differential. WOLED manufacturing achieves 70-80% material utilization rates, while RGB OLED typically achieves only 30-40% efficiency due to material waste during the shadow mask process. This difference translates to substantial cost savings in expensive organic materials for WOLED production.

Equipment investment requirements also favor WOLED technology. WOLED production lines can be established with approximately 30% lower capital expenditure compared to equivalent RGB OLED facilities. This reduced initial investment improves return on investment metrics and lowers depreciation costs that factor into per-unit production expenses.

From an energy consumption perspective during manufacturing, WOLED production consumes approximately 25% less energy per square meter of display produced. The reduced number of vacuum deposition cycles and shorter overall process time contribute to this efficiency advantage, which has implications for both production costs and environmental impact.

Yield rates further amplify cost differences, with WOLED manufacturing typically achieving 85-90% yield rates compared to 70-80% for RGB OLED. This yield advantage becomes particularly pronounced for larger display sizes, where defect probability increases with panel area. Each percentage point of yield improvement translates directly to cost reduction, making this a critical factor in overall manufacturing economics.

These manufacturing differences ultimately contribute to WOLED's position as a more cost-effective solution for certain applications, particularly large-format displays, despite some trade-offs in color gamut and pixel-level control compared to RGB OLED technologies.

In contrast, traditional RGB OLED production necessitates precise deposition of separate red, green, and blue subpixels through fine metal masks (FMM), a process that demands extreme precision and suffers from lower yield rates. The complexity of RGB OLED manufacturing increases exponentially with display size, making it particularly challenging for larger panels where mask sagging can cause alignment issues.

Material utilization efficiency presents another significant cost differential. WOLED manufacturing achieves 70-80% material utilization rates, while RGB OLED typically achieves only 30-40% efficiency due to material waste during the shadow mask process. This difference translates to substantial cost savings in expensive organic materials for WOLED production.

Equipment investment requirements also favor WOLED technology. WOLED production lines can be established with approximately 30% lower capital expenditure compared to equivalent RGB OLED facilities. This reduced initial investment improves return on investment metrics and lowers depreciation costs that factor into per-unit production expenses.

From an energy consumption perspective during manufacturing, WOLED production consumes approximately 25% less energy per square meter of display produced. The reduced number of vacuum deposition cycles and shorter overall process time contribute to this efficiency advantage, which has implications for both production costs and environmental impact.

Yield rates further amplify cost differences, with WOLED manufacturing typically achieving 85-90% yield rates compared to 70-80% for RGB OLED. This yield advantage becomes particularly pronounced for larger display sizes, where defect probability increases with panel area. Each percentage point of yield improvement translates directly to cost reduction, making this a critical factor in overall manufacturing economics.

These manufacturing differences ultimately contribute to WOLED's position as a more cost-effective solution for certain applications, particularly large-format displays, despite some trade-offs in color gamut and pixel-level control compared to RGB OLED technologies.

Environmental Impact and Sustainability Considerations

The environmental footprint of display technologies has become increasingly important as sustainability concerns rise globally. When comparing WOLED (White Organic Light Emitting Diode) and traditional OLED technologies, several key environmental factors emerge that differentiate their sustainability profiles.

Energy consumption during operation represents the most significant environmental impact factor for display technologies. WOLED displays typically demonstrate 15-20% higher energy efficiency compared to conventional RGB OLED displays due to their simplified structure and more efficient light emission mechanism. This efficiency advantage translates directly to reduced carbon emissions over the product lifecycle, with an estimated reduction of 25-30 kg CO2 equivalent per device annually under typical usage patterns.

Manufacturing processes for both technologies involve resource-intensive procedures, though WOLED production generally requires fewer manufacturing steps and material inputs. The simplified layer structure of WOLED displays reduces chemical waste generation by approximately 18% compared to traditional OLED manufacturing. Additionally, WOLED production typically consumes 12-15% less water and generates fewer hazardous byproducts.

Material composition presents another critical sustainability consideration. Both technologies utilize rare earth elements and precious metals, though WOLED designs often incorporate smaller quantities of these materials. Recent advancements have enabled some WOLED manufacturers to reduce indium and gallium content by up to 25% while maintaining performance specifications, significantly decreasing extraction impacts.

End-of-life management remains challenging for both technologies due to the complex material composition of displays. However, WOLED panels generally contain fewer discrete components and material types, potentially simplifying recycling processes. Research indicates that material recovery rates from WOLED panels can be 8-10% higher than from traditional OLED displays, though both technologies still face significant recycling challenges.

Lifespan considerations also factor into environmental impact assessments. WOLED displays typically demonstrate 10-15% longer operational lifespans before significant brightness degradation occurs. This extended useful life reduces replacement frequency and associated manufacturing impacts, though actual environmental benefits depend heavily on consumer behavior and replacement patterns.

Regulatory compliance and certification standards increasingly influence manufacturing practices. Both technologies face growing pressure to eliminate persistent organic pollutants and reduce hazardous substance content. Several leading WOLED manufacturers have achieved higher EPEAT and Energy Star ratings than comparable OLED products, reflecting their relatively stronger environmental performance profiles.

Energy consumption during operation represents the most significant environmental impact factor for display technologies. WOLED displays typically demonstrate 15-20% higher energy efficiency compared to conventional RGB OLED displays due to their simplified structure and more efficient light emission mechanism. This efficiency advantage translates directly to reduced carbon emissions over the product lifecycle, with an estimated reduction of 25-30 kg CO2 equivalent per device annually under typical usage patterns.

Manufacturing processes for both technologies involve resource-intensive procedures, though WOLED production generally requires fewer manufacturing steps and material inputs. The simplified layer structure of WOLED displays reduces chemical waste generation by approximately 18% compared to traditional OLED manufacturing. Additionally, WOLED production typically consumes 12-15% less water and generates fewer hazardous byproducts.

Material composition presents another critical sustainability consideration. Both technologies utilize rare earth elements and precious metals, though WOLED designs often incorporate smaller quantities of these materials. Recent advancements have enabled some WOLED manufacturers to reduce indium and gallium content by up to 25% while maintaining performance specifications, significantly decreasing extraction impacts.

End-of-life management remains challenging for both technologies due to the complex material composition of displays. However, WOLED panels generally contain fewer discrete components and material types, potentially simplifying recycling processes. Research indicates that material recovery rates from WOLED panels can be 8-10% higher than from traditional OLED displays, though both technologies still face significant recycling challenges.

Lifespan considerations also factor into environmental impact assessments. WOLED displays typically demonstrate 10-15% longer operational lifespans before significant brightness degradation occurs. This extended useful life reduces replacement frequency and associated manufacturing impacts, though actual environmental benefits depend heavily on consumer behavior and replacement patterns.

Regulatory compliance and certification standards increasingly influence manufacturing practices. Both technologies face growing pressure to eliminate persistent organic pollutants and reduce hazardous substance content. Several leading WOLED manufacturers have achieved higher EPEAT and Energy Star ratings than comparable OLED products, reflecting their relatively stronger environmental performance profiles.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!