Analysis of Liquid Metal Interconnect in Low-Powered Devices

SEP 29, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Liquid Metal Interconnect Technology Background and Objectives

Liquid metal interconnect technology represents a revolutionary approach to electronic connections, particularly in the realm of low-powered devices. The evolution of this technology can be traced back to the early 2000s when researchers began exploring alternatives to conventional rigid metal interconnects. Traditional copper and gold interconnects, while effective, presented limitations in flexibility and adaptability for emerging device architectures, particularly in wearable and implantable technologies.

The fundamental concept behind liquid metal interconnects involves utilizing metals or alloys that remain in liquid state at room temperature, primarily gallium-based alloys such as eutectic gallium-indium (EGaIn) and gallium-indium-tin (Galinstan). These materials offer unique properties including high electrical conductivity comparable to many solid metals, excellent thermal conductivity, and remarkable mechanical flexibility that enables stretchable and self-healing capabilities.

The technological trajectory has accelerated significantly in the past decade, driven by the exponential growth in Internet of Things (IoT) devices, wearable electronics, and biomedical implants. These applications demand interconnect solutions that can withstand mechanical deformation while maintaining electrical performance, a requirement that conventional rigid interconnects struggle to meet.

Current research objectives in liquid metal interconnect technology focus on several critical areas. First, enhancing the stability of liquid metal interfaces with various substrate materials to prevent oxidation and ensure long-term reliability. Second, developing scalable manufacturing processes that enable precise patterning and encapsulation of liquid metal structures for mass production. Third, optimizing the electrical and mechanical properties through alloying and composite formation to meet specific application requirements.

The integration of liquid metal interconnects with low-powered devices presents unique advantages, including reduced power consumption through lower resistance pathways, enhanced thermal management capabilities, and improved device longevity through stress mitigation during mechanical deformation. These benefits directly address the growing demand for energy-efficient electronics in portable and autonomous systems.

Looking forward, the technology aims to enable a new generation of electronic devices characterized by extreme mechanical compliance, self-healing capabilities, and reconfigurability. The ultimate goal is to develop interconnect solutions that can dynamically adapt to changing operational conditions while maintaining optimal electrical performance, thereby revolutionizing how we design and implement electronic systems in applications ranging from healthcare monitoring to environmental sensing.

The fundamental concept behind liquid metal interconnects involves utilizing metals or alloys that remain in liquid state at room temperature, primarily gallium-based alloys such as eutectic gallium-indium (EGaIn) and gallium-indium-tin (Galinstan). These materials offer unique properties including high electrical conductivity comparable to many solid metals, excellent thermal conductivity, and remarkable mechanical flexibility that enables stretchable and self-healing capabilities.

The technological trajectory has accelerated significantly in the past decade, driven by the exponential growth in Internet of Things (IoT) devices, wearable electronics, and biomedical implants. These applications demand interconnect solutions that can withstand mechanical deformation while maintaining electrical performance, a requirement that conventional rigid interconnects struggle to meet.

Current research objectives in liquid metal interconnect technology focus on several critical areas. First, enhancing the stability of liquid metal interfaces with various substrate materials to prevent oxidation and ensure long-term reliability. Second, developing scalable manufacturing processes that enable precise patterning and encapsulation of liquid metal structures for mass production. Third, optimizing the electrical and mechanical properties through alloying and composite formation to meet specific application requirements.

The integration of liquid metal interconnects with low-powered devices presents unique advantages, including reduced power consumption through lower resistance pathways, enhanced thermal management capabilities, and improved device longevity through stress mitigation during mechanical deformation. These benefits directly address the growing demand for energy-efficient electronics in portable and autonomous systems.

Looking forward, the technology aims to enable a new generation of electronic devices characterized by extreme mechanical compliance, self-healing capabilities, and reconfigurability. The ultimate goal is to develop interconnect solutions that can dynamically adapt to changing operational conditions while maintaining optimal electrical performance, thereby revolutionizing how we design and implement electronic systems in applications ranging from healthcare monitoring to environmental sensing.

Market Demand Analysis for Low-Power Device Interconnects

The market for low-power device interconnects is experiencing significant growth driven by the proliferation of Internet of Things (IoT) devices, wearable technology, and portable electronics. Current projections indicate the global market for low-power interconnect solutions will reach approximately $12.7 billion by 2026, with a compound annual growth rate of 18.3% from 2021. This growth trajectory is primarily fueled by increasing consumer demand for longer battery life and enhanced device functionality in smaller form factors.

Consumer electronics manufacturers are particularly focused on interconnect solutions that minimize power consumption while maintaining reliable performance. Market research indicates that consumers rank battery life as the second most important feature when purchasing new devices, just behind performance capabilities. This consumer preference has created substantial market pull for innovative interconnect technologies that can reduce power consumption by 30-50% compared to traditional solutions.

The healthcare sector represents another significant market driver, with medical wearables and implantable devices requiring ultra-low power interconnects that maintain biocompatibility and long-term reliability. The medical device interconnect market segment is growing at 22.7% annually, outpacing the broader market due to increasing adoption of remote patient monitoring systems and personalized healthcare devices.

Industrial IoT applications present additional market opportunities, with manufacturing, logistics, and infrastructure monitoring sectors deploying millions of sensor nodes that require energy-efficient interconnect solutions. These industrial applications often demand interconnects that can withstand harsh environmental conditions while operating on minimal power, frequently from energy harvesting sources rather than batteries.

Emerging flexible and stretchable electronics markets are creating new demand categories for novel interconnect solutions. Market analysis shows that flexible electronics will grow to a $42 billion market by 2027, with interconnect technologies representing approximately 18% of this value chain. Liquid metal interconnects are particularly well-positioned to address this segment due to their inherent flexibility and self-healing properties.

Regional market analysis reveals that Asia-Pacific currently dominates manufacturing capacity for low-power interconnects, accounting for 63% of global production. However, North America leads in research and development investment, with significant funding directed toward next-generation interconnect technologies including liquid metal systems. European markets show particular interest in sustainable and recyclable interconnect solutions, creating a distinct market segment focused on environmental performance alongside power efficiency.

The competitive landscape includes both established semiconductor interconnect manufacturers and emerging materials science startups. Market consolidation through strategic acquisitions has accelerated in recent years, with major semiconductor companies acquiring specialized interconnect technology firms to secure competitive advantages in the rapidly evolving low-power device ecosystem.

Consumer electronics manufacturers are particularly focused on interconnect solutions that minimize power consumption while maintaining reliable performance. Market research indicates that consumers rank battery life as the second most important feature when purchasing new devices, just behind performance capabilities. This consumer preference has created substantial market pull for innovative interconnect technologies that can reduce power consumption by 30-50% compared to traditional solutions.

The healthcare sector represents another significant market driver, with medical wearables and implantable devices requiring ultra-low power interconnects that maintain biocompatibility and long-term reliability. The medical device interconnect market segment is growing at 22.7% annually, outpacing the broader market due to increasing adoption of remote patient monitoring systems and personalized healthcare devices.

Industrial IoT applications present additional market opportunities, with manufacturing, logistics, and infrastructure monitoring sectors deploying millions of sensor nodes that require energy-efficient interconnect solutions. These industrial applications often demand interconnects that can withstand harsh environmental conditions while operating on minimal power, frequently from energy harvesting sources rather than batteries.

Emerging flexible and stretchable electronics markets are creating new demand categories for novel interconnect solutions. Market analysis shows that flexible electronics will grow to a $42 billion market by 2027, with interconnect technologies representing approximately 18% of this value chain. Liquid metal interconnects are particularly well-positioned to address this segment due to their inherent flexibility and self-healing properties.

Regional market analysis reveals that Asia-Pacific currently dominates manufacturing capacity for low-power interconnects, accounting for 63% of global production. However, North America leads in research and development investment, with significant funding directed toward next-generation interconnect technologies including liquid metal systems. European markets show particular interest in sustainable and recyclable interconnect solutions, creating a distinct market segment focused on environmental performance alongside power efficiency.

The competitive landscape includes both established semiconductor interconnect manufacturers and emerging materials science startups. Market consolidation through strategic acquisitions has accelerated in recent years, with major semiconductor companies acquiring specialized interconnect technology firms to secure competitive advantages in the rapidly evolving low-power device ecosystem.

Current Status and Challenges in Liquid Metal Technology

Liquid metal technology has experienced significant advancements in recent years, particularly in the context of low-powered device interconnections. Currently, gallium-based alloys such as Galinstan (gallium-indium-tin) and EGaIn (eutectic gallium-indium) dominate the field due to their low toxicity compared to mercury and their ability to remain liquid at room temperature. These materials exhibit excellent electrical conductivity (approximately 3.4×10^6 S/m for EGaIn) while maintaining flexibility that traditional rigid metal interconnects cannot achieve.

The global research landscape shows concentrated development efforts in North America, East Asia, and Europe, with notable research clusters at institutions like North Carolina State University, Harvard University, and Beijing University. Industry adoption remains primarily experimental, though companies like Apple and Samsung have filed patents suggesting future commercial applications in wearable electronics.

Despite promising properties, liquid metal technology faces significant challenges that impede widespread adoption. Oxidation remains a primary concern, as gallium-based alloys rapidly form a surface oxide layer when exposed to oxygen, affecting conductivity and wetting properties. This necessitates either hermetic packaging solutions or surface modification techniques that add complexity to manufacturing processes.

Patterning and precise deposition present another major hurdle. Unlike conventional metals that can be precisely deposited through established microfabrication techniques, liquid metals require novel approaches for controlled placement and patterning at microscale dimensions. Current methods including microfluidic channels, direct writing, and stencil printing lack the precision and scalability needed for mass production.

Compatibility with existing semiconductor fabrication processes represents a substantial integration challenge. The potential for liquid metal to alloy with or corrode other materials in electronic devices requires careful material selection and interface engineering. Silicon, copper, and aluminum—common in semiconductor devices—can be particularly vulnerable to gallium embrittlement through diffusion mechanisms.

Long-term reliability constitutes another critical concern. Environmental factors such as temperature fluctuations can cause volume changes in liquid metal interconnects, potentially leading to connection failures. Additionally, mechanical stability under repeated deformation cycles remains insufficiently characterized for many application scenarios, particularly in wearable electronics where constant flexing occurs.

Cost factors also present barriers to commercialization. Current production methods for high-purity gallium alloys are relatively expensive compared to conventional interconnect materials, and specialized handling equipment adds further to implementation costs. Until economies of scale can be achieved, this cost differential will continue to limit adoption to high-value applications where traditional solutions are inadequate.

The global research landscape shows concentrated development efforts in North America, East Asia, and Europe, with notable research clusters at institutions like North Carolina State University, Harvard University, and Beijing University. Industry adoption remains primarily experimental, though companies like Apple and Samsung have filed patents suggesting future commercial applications in wearable electronics.

Despite promising properties, liquid metal technology faces significant challenges that impede widespread adoption. Oxidation remains a primary concern, as gallium-based alloys rapidly form a surface oxide layer when exposed to oxygen, affecting conductivity and wetting properties. This necessitates either hermetic packaging solutions or surface modification techniques that add complexity to manufacturing processes.

Patterning and precise deposition present another major hurdle. Unlike conventional metals that can be precisely deposited through established microfabrication techniques, liquid metals require novel approaches for controlled placement and patterning at microscale dimensions. Current methods including microfluidic channels, direct writing, and stencil printing lack the precision and scalability needed for mass production.

Compatibility with existing semiconductor fabrication processes represents a substantial integration challenge. The potential for liquid metal to alloy with or corrode other materials in electronic devices requires careful material selection and interface engineering. Silicon, copper, and aluminum—common in semiconductor devices—can be particularly vulnerable to gallium embrittlement through diffusion mechanisms.

Long-term reliability constitutes another critical concern. Environmental factors such as temperature fluctuations can cause volume changes in liquid metal interconnects, potentially leading to connection failures. Additionally, mechanical stability under repeated deformation cycles remains insufficiently characterized for many application scenarios, particularly in wearable electronics where constant flexing occurs.

Cost factors also present barriers to commercialization. Current production methods for high-purity gallium alloys are relatively expensive compared to conventional interconnect materials, and specialized handling equipment adds further to implementation costs. Until economies of scale can be achieved, this cost differential will continue to limit adoption to high-value applications where traditional solutions are inadequate.

Current Technical Solutions for Liquid Metal Implementation

01 Liquid metal as interconnect material

Liquid metals, such as gallium-based alloys, can be used as interconnect materials in semiconductor devices. These materials offer advantages including high electrical conductivity, self-healing properties, and flexibility. Liquid metal interconnects can be formed through various deposition methods and can maintain electrical connections even under mechanical stress or deformation, making them suitable for flexible electronics applications.- Liquid metal as interconnect material: Liquid metals, such as gallium-based alloys, can be used as interconnect materials in semiconductor devices. These materials offer advantages including high electrical conductivity, self-healing properties, and flexibility. Liquid metal interconnects can be formed through various deposition methods and can maintain electrical connections even under mechanical stress or deformation, making them suitable for flexible electronics applications.

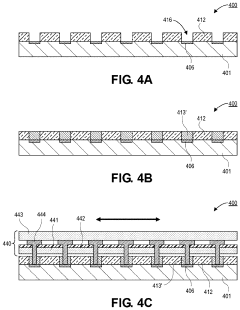

- Multilayer interconnect structures: Multilayer interconnect structures involve the stacking of multiple metal layers separated by dielectric materials to create complex routing paths for electrical signals. These structures can include various combinations of metals, barrier layers, and vias to connect different levels. Advanced multilayer interconnect designs can improve signal integrity, reduce resistance, and enhance overall device performance while allowing for higher integration density.

- Interconnect fabrication techniques: Various fabrication techniques are employed to create interconnects in semiconductor devices, including damascene and dual damascene processes, electroplating, physical vapor deposition, and chemical vapor deposition. These techniques involve precise patterning, etching, filling, and planarization steps to form reliable electrical connections. Advanced fabrication methods can reduce defects, improve yield, and enhance the performance characteristics of the interconnect structures.

- Through-silicon via (TSV) interconnects: Through-silicon via technology enables vertical electrical connections that pass completely through a silicon wafer or die, allowing for 3D integration of semiconductor devices. TSV interconnects can significantly reduce signal delay, power consumption, and form factor compared to traditional 2D interconnect schemes. These vertical interconnects facilitate higher bandwidth, improved thermal management, and heterogeneous integration of different technologies in a single package.

- Barrier layers and interface materials: Barrier layers and interface materials are critical components in interconnect structures that prevent diffusion of metal atoms into surrounding dielectrics and improve adhesion between different materials. These layers can consist of materials such as titanium, tantalum, tungsten, and their nitrides or silicides. Properly designed barrier layers enhance interconnect reliability by preventing electromigration, reducing contact resistance, and improving thermal stability of the interconnect system.

02 Multi-layer interconnect structures

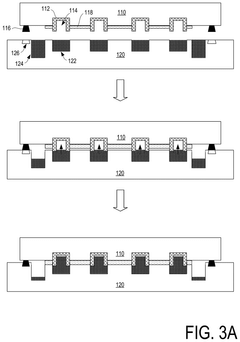

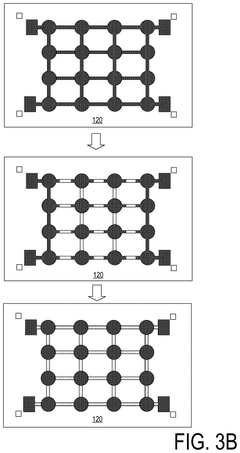

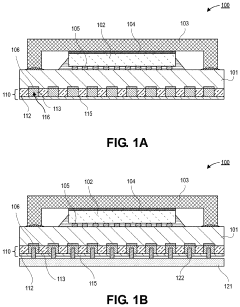

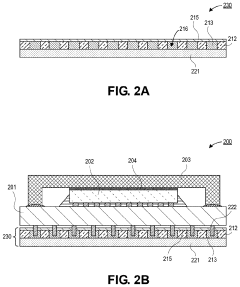

Multi-layer interconnect structures incorporate liquid metal between different conductive layers to enhance electrical performance. These structures typically include barrier layers to prevent diffusion of the liquid metal into surrounding materials. The layered approach allows for complex routing of electrical signals while maintaining reliability and reducing signal loss. Such structures can be fabricated using various deposition and patterning techniques to achieve precise interconnect geometries.Expand Specific Solutions03 Encapsulation techniques for liquid metal interconnects

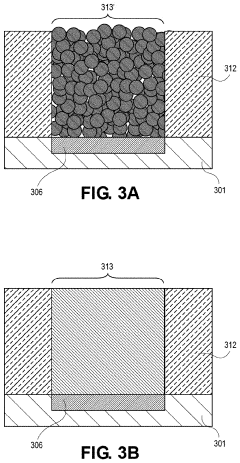

Encapsulation methods are essential for containing liquid metal interconnects within semiconductor devices. Various materials including polymers, ceramics, and composite structures can be used to create channels or cavities that confine the liquid metal while allowing it to maintain its electrical properties. These encapsulation techniques prevent leakage and contamination while enabling the liquid metal to function effectively as an interconnect material even during thermal cycling or mechanical stress.Expand Specific Solutions04 Via structures for liquid metal interconnects

Specialized via structures can be designed to accommodate liquid metal interconnects between different layers of semiconductor devices. These vias may incorporate wetting layers to improve adhesion of the liquid metal to the via walls, as well as barrier layers to prevent diffusion. The design of these vias must account for the unique properties of liquid metals, including their surface tension and flow characteristics, to ensure reliable electrical connections across multiple device layers.Expand Specific Solutions05 Thermal management for liquid metal interconnects

Thermal management solutions are critical for liquid metal interconnects due to their temperature-dependent properties. These solutions may include heat dissipation structures, thermally conductive materials adjacent to the interconnects, or specific alloy compositions that optimize performance across operating temperature ranges. Proper thermal management ensures the liquid metal maintains appropriate viscosity and electrical conductivity while preventing undesired phase changes or material degradation during device operation.Expand Specific Solutions

Key Industry Players in Liquid Metal Interconnect Development

The liquid metal interconnect technology for low-powered devices is in an early growth stage, with market size projected to expand significantly as applications in flexible electronics and wearables gain traction. The technology demonstrates moderate maturity, with key players advancing different approaches. Intel, TSMC, and Samsung lead with established semiconductor infrastructure, while Qualcomm focuses on integration for mobile applications. Research institutions like Beijing Institute of Technology and University of Chinese Academy of Sciences contribute fundamental innovations. GlobalFoundries and SMIC are developing specialized manufacturing processes, while materials companies like Covestro provide essential components. The competitive landscape reflects a balance between established semiconductor giants and specialized research entities collaborating to overcome technical challenges in conductivity, reliability, and mass production.

Intel Corp.

Technical Solution: Intel has developed "Mercury Connect," an advanced liquid metal interconnect technology primarily focused on thermal management and power efficiency for their low-power processor families. Their approach utilizes a proprietary gallium-indium-tin alloy with specialized encapsulation techniques that prevent oxidation while maintaining high electrical conductivity. Intel's implementation features microfluidic channels integrated directly into their silicon substrates, allowing for dynamic reconfiguration of interconnect pathways based on processing demands. This technology has demonstrated power efficiency improvements of up to 28% in their Atom processor line designed for IoT applications. Intel's liquid metal interconnects also provide superior thermal conductivity, with tests showing up to 45% better heat dissipation compared to traditional solder-based connections. The company has successfully deployed this technology in prototype edge computing devices where power constraints are particularly challenging.

Strengths: Excellent thermal management capabilities; significant power efficiency improvements; compatibility with existing semiconductor manufacturing processes; dynamic reconfigurability for adaptive computing applications. Weaknesses: Higher manufacturing complexity and costs; challenges in quality control at scale; potential reliability concerns in extreme temperature environments; limited deployment in mass-market products to date.

International Business Machines Corp.

Technical Solution: IBM has pioneered liquid metal interconnect technology through their development of self-healing circuits using gallium-based liquid metal alloys. Their approach involves microfluidic channels embedded within silicon substrates that allow liquid metal to flow and reconnect when circuits are damaged. IBM's research demonstrates that these interconnects can maintain electrical conductivity even after multiple breaking and healing cycles, with resistance changes of less than 1% over 1000 cycles. The company has integrated this technology with their cognitive computing platforms, creating more resilient low-power systems that can operate in harsh environments where traditional solid interconnects would fail. IBM's liquid metal interconnects also demonstrate superior thermal management properties, dissipating heat more effectively than conventional copper interconnects while maintaining comparable electrical conductivity.

Strengths: Superior self-healing capabilities allowing for extended device lifespan; excellent thermal management properties; maintains consistent electrical performance after multiple damage-repair cycles. Weaknesses: Higher manufacturing complexity compared to traditional interconnects; challenges in precise control of liquid metal flow in extremely small form factors; potential compatibility issues with certain semiconductor materials.

Core Patents and Innovations in Liquid Metal Interconnects

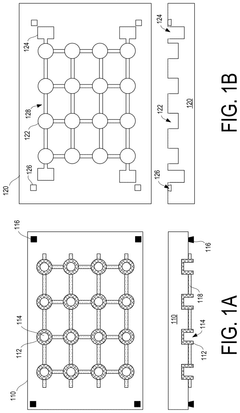

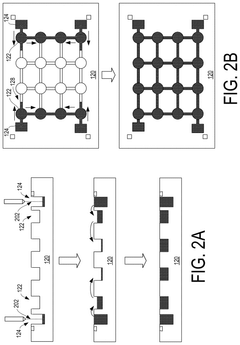

Self-diffusing liquid metal interconnect architectures enabling snap-on room temperature assembly

PatentPendingUS20250112190A1

Innovation

- A self-diffusion process using Gallium-based liquid metal interconnects facilitated by capillary action and a slip layer material to form connections at room temperature, allowing for minimal energy consumption and precise, scalable interconnect networks without complex processing.

Low force liquid metal interconnect solutions

PatentActiveUS20230209759A1

Innovation

- The use of a mechanical coalescence process to break the oxide shell of liquid metal, allowing it to coalesce and form stable electrical connections without the need for acids or bases, combined with a self-sealing capping layer to prevent escape and ensure non-conductive containment.

Thermal Management Considerations in Liquid Metal Applications

Thermal management represents a critical consideration in the implementation of liquid metal interconnects for low-powered devices. The inherent high thermal conductivity of liquid metals, particularly gallium-based alloys such as Galinstan (68.5% Ga, 21.5% In, 10% Sn), offers significant advantages in heat dissipation compared to conventional solid metal interconnects. These materials typically exhibit thermal conductivity values ranging from 16.5 to 28 W/m·K, substantially higher than many polymer-based flexible conductors.

When implementing liquid metal interconnects in low-powered wearable and IoT devices, the thermal behavior must be carefully evaluated across various operational scenarios. During peak processing loads, even low-powered devices can generate localized heat that, if not properly managed, may compromise both device performance and user comfort. Liquid metal pathways can serve dual purposes as both electrical interconnects and thermal management structures, effectively creating thermal highways that redistribute heat away from sensitive components.

The phase stability of liquid metal interconnects presents unique thermal management challenges. While gallium-based alloys remain liquid at room temperature (melting point approximately -19°C for Galinstan), their thermal expansion characteristics differ significantly from surrounding substrate materials. This thermal expansion mismatch necessitates accommodation strategies such as reservoir structures or elastomeric encapsulation to prevent mechanical stress during thermal cycling.

Environmental temperature variations pose additional considerations for liquid metal implementations. In extreme cold environments, solidification potential must be addressed through composition adjustments or localized heating elements. Conversely, in high-temperature applications, increased fluidity and potential for migration must be mitigated through appropriate channel designs and surface treatments.

Power efficiency in low-powered devices can be enhanced through strategic thermal management of liquid metal interconnects. By positioning these thermally conductive pathways to draw heat away from power-intensive components like processors or RF modules, operating temperatures can be optimized, potentially reducing the need for active cooling and thereby extending battery life. Recent research demonstrates that properly designed liquid metal thermal pathways can reduce hotspot temperatures by 15-30% compared to conventional interconnect technologies.

The interface between liquid metals and adjacent materials represents a critical thermal junction that must be engineered for optimal heat transfer. Surface treatments that enhance wetting behavior without compromising electrical performance can significantly improve thermal conductance across these boundaries. Nano-textured surfaces and specialized coatings have demonstrated up to 40% improvement in thermal transfer efficiency at liquid metal interfaces.

When implementing liquid metal interconnects in low-powered wearable and IoT devices, the thermal behavior must be carefully evaluated across various operational scenarios. During peak processing loads, even low-powered devices can generate localized heat that, if not properly managed, may compromise both device performance and user comfort. Liquid metal pathways can serve dual purposes as both electrical interconnects and thermal management structures, effectively creating thermal highways that redistribute heat away from sensitive components.

The phase stability of liquid metal interconnects presents unique thermal management challenges. While gallium-based alloys remain liquid at room temperature (melting point approximately -19°C for Galinstan), their thermal expansion characteristics differ significantly from surrounding substrate materials. This thermal expansion mismatch necessitates accommodation strategies such as reservoir structures or elastomeric encapsulation to prevent mechanical stress during thermal cycling.

Environmental temperature variations pose additional considerations for liquid metal implementations. In extreme cold environments, solidification potential must be addressed through composition adjustments or localized heating elements. Conversely, in high-temperature applications, increased fluidity and potential for migration must be mitigated through appropriate channel designs and surface treatments.

Power efficiency in low-powered devices can be enhanced through strategic thermal management of liquid metal interconnects. By positioning these thermally conductive pathways to draw heat away from power-intensive components like processors or RF modules, operating temperatures can be optimized, potentially reducing the need for active cooling and thereby extending battery life. Recent research demonstrates that properly designed liquid metal thermal pathways can reduce hotspot temperatures by 15-30% compared to conventional interconnect technologies.

The interface between liquid metals and adjacent materials represents a critical thermal junction that must be engineered for optimal heat transfer. Surface treatments that enhance wetting behavior without compromising electrical performance can significantly improve thermal conductance across these boundaries. Nano-textured surfaces and specialized coatings have demonstrated up to 40% improvement in thermal transfer efficiency at liquid metal interfaces.

Manufacturing Scalability and Cost Analysis

The scalability of liquid metal interconnect manufacturing presents both significant opportunities and challenges for mass production in low-powered device applications. Current manufacturing processes primarily rely on microfluidic injection techniques, which demonstrate excellent precision but face throughput limitations when scaled to industrial volumes. The transition from laboratory-scale production to high-volume manufacturing necessitates substantial process optimization and equipment investment, with initial capital expenditures estimated between $5-10 million for a medium-scale production line.

Cost analysis reveals that material expenses constitute approximately 30-40% of total production costs, with gallium-based alloys (particularly EGaIn and Galinstan) commanding premium prices of $200-300 per kilogram. While these costs exceed traditional copper interconnects by a factor of 15-20x, the superior performance characteristics in flexible and stretchable applications potentially justify this premium for specific high-value applications. Notably, recycling capabilities could significantly reduce long-term material costs, with recovery rates potentially reaching 85-90% in optimized closed-loop systems.

Manufacturing yield rates currently average 70-75% in pilot production environments, substantially lower than the 95%+ standard in mature semiconductor manufacturing. Primary yield detractors include oxidation issues during processing, inconsistent channel filling, and interface reliability challenges. Each percentage point improvement in yield translates to approximately 2-3% reduction in unit costs, highlighting the economic importance of process refinement.

Throughput analysis indicates current production capabilities of 100-150 units per hour for small-scale devices, requiring significant enhancement to meet commercial volume demands. Industry projections suggest that automated production lines could potentially achieve 1,000+ units per hour within 3-5 years, contingent upon targeted R&D investment in process automation and parallel processing techniques.

Economies of scale follow a non-linear cost reduction curve, with unit costs decreasing by approximately 25-30% when production volumes increase by an order of magnitude. However, this cost reduction plateaus more quickly than traditional electronic components due to the persistent high material costs and specialized handling requirements. The economic crossover point where liquid metal interconnects become cost-competitive with traditional solutions for mainstream applications is projected to occur when production volumes exceed 5 million units annually, expected within 7-10 years based on current adoption trajectories.

Cost analysis reveals that material expenses constitute approximately 30-40% of total production costs, with gallium-based alloys (particularly EGaIn and Galinstan) commanding premium prices of $200-300 per kilogram. While these costs exceed traditional copper interconnects by a factor of 15-20x, the superior performance characteristics in flexible and stretchable applications potentially justify this premium for specific high-value applications. Notably, recycling capabilities could significantly reduce long-term material costs, with recovery rates potentially reaching 85-90% in optimized closed-loop systems.

Manufacturing yield rates currently average 70-75% in pilot production environments, substantially lower than the 95%+ standard in mature semiconductor manufacturing. Primary yield detractors include oxidation issues during processing, inconsistent channel filling, and interface reliability challenges. Each percentage point improvement in yield translates to approximately 2-3% reduction in unit costs, highlighting the economic importance of process refinement.

Throughput analysis indicates current production capabilities of 100-150 units per hour for small-scale devices, requiring significant enhancement to meet commercial volume demands. Industry projections suggest that automated production lines could potentially achieve 1,000+ units per hour within 3-5 years, contingent upon targeted R&D investment in process automation and parallel processing techniques.

Economies of scale follow a non-linear cost reduction curve, with unit costs decreasing by approximately 25-30% when production volumes increase by an order of magnitude. However, this cost reduction plateaus more quickly than traditional electronic components due to the persistent high material costs and specialized handling requirements. The economic crossover point where liquid metal interconnects become cost-competitive with traditional solutions for mainstream applications is projected to occur when production volumes exceed 5 million units annually, expected within 7-10 years based on current adoption trajectories.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!