Regulatory Perspectives on Liquid Metal Interconnect Technologies

SEP 29, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Liquid Metal Interconnect Technology Background and Objectives

Liquid metal interconnect technology represents a revolutionary approach to creating flexible, stretchable, and reconfigurable electronic connections. Originating from early metallurgical research in the 1950s and 1960s, this technology has evolved significantly over the past two decades with the emergence of microfluidics and soft electronics. The fundamental concept involves utilizing metals or alloys that remain in liquid state at room temperature, such as gallium-based alloys (e.g., eutectic gallium-indium, Galinstan), to create conductive pathways that can maintain electrical performance under mechanical deformation.

The evolution of this technology has been driven by increasing demands for wearable electronics, soft robotics, and biomedical devices that require components capable of withstanding repeated mechanical stress while maintaining electrical functionality. Traditional rigid interconnect technologies based on copper traces or solid metal wires have fundamental limitations in applications requiring flexibility, stretchability, or reconfigurability.

Liquid metal interconnects offer unique advantages including self-healing properties, reconfigurability, and the ability to maintain conductivity under extreme deformation conditions exceeding 300% strain in some implementations. These characteristics make them particularly valuable for next-generation electronic systems that interface with biological tissues or operate in dynamic mechanical environments.

The primary technical objectives in this field include developing reliable encapsulation methods to prevent oxidation and leakage, improving patterning techniques for precise deposition, enhancing adhesion to various substrate materials, and ensuring long-term stability under operational conditions. Additionally, there are significant efforts to reduce the relatively high cost of gallium-based alloys and identify alternative liquid metal compositions with improved properties.

Recent technological trends indicate a convergence of liquid metal interconnects with 3D printing technologies, enabling direct fabrication of complex three-dimensional stretchable circuits. There is also growing interest in hybrid approaches that combine liquid metals with conventional electronics to create systems that leverage the advantages of both technologies.

The regulatory landscape surrounding liquid metal interconnects remains relatively underdeveloped, particularly regarding biocompatibility standards and environmental considerations. As these technologies move closer to commercial applications in medical devices and consumer electronics, establishing clear regulatory frameworks becomes increasingly important to ensure safety and reliability while enabling innovation.

Looking forward, the field is expected to advance toward standardized manufacturing processes, improved integration with conventional electronics, and expanded applications in healthcare monitoring, soft robotics, and reconfigurable computing architectures. The development of comprehensive regulatory guidelines specific to liquid metal technologies will be crucial for facilitating this transition from research laboratories to commercial products.

The evolution of this technology has been driven by increasing demands for wearable electronics, soft robotics, and biomedical devices that require components capable of withstanding repeated mechanical stress while maintaining electrical functionality. Traditional rigid interconnect technologies based on copper traces or solid metal wires have fundamental limitations in applications requiring flexibility, stretchability, or reconfigurability.

Liquid metal interconnects offer unique advantages including self-healing properties, reconfigurability, and the ability to maintain conductivity under extreme deformation conditions exceeding 300% strain in some implementations. These characteristics make them particularly valuable for next-generation electronic systems that interface with biological tissues or operate in dynamic mechanical environments.

The primary technical objectives in this field include developing reliable encapsulation methods to prevent oxidation and leakage, improving patterning techniques for precise deposition, enhancing adhesion to various substrate materials, and ensuring long-term stability under operational conditions. Additionally, there are significant efforts to reduce the relatively high cost of gallium-based alloys and identify alternative liquid metal compositions with improved properties.

Recent technological trends indicate a convergence of liquid metal interconnects with 3D printing technologies, enabling direct fabrication of complex three-dimensional stretchable circuits. There is also growing interest in hybrid approaches that combine liquid metals with conventional electronics to create systems that leverage the advantages of both technologies.

The regulatory landscape surrounding liquid metal interconnects remains relatively underdeveloped, particularly regarding biocompatibility standards and environmental considerations. As these technologies move closer to commercial applications in medical devices and consumer electronics, establishing clear regulatory frameworks becomes increasingly important to ensure safety and reliability while enabling innovation.

Looking forward, the field is expected to advance toward standardized manufacturing processes, improved integration with conventional electronics, and expanded applications in healthcare monitoring, soft robotics, and reconfigurable computing architectures. The development of comprehensive regulatory guidelines specific to liquid metal technologies will be crucial for facilitating this transition from research laboratories to commercial products.

Market Demand Analysis for Liquid Metal Interconnects

The global market for liquid metal interconnect technologies is experiencing significant growth driven by the increasing demand for flexible electronics, wearable devices, and advanced medical implants. Current market analysis indicates that the electronics sector represents the largest application segment, with consumer electronics manufacturers actively seeking innovative interconnect solutions that can withstand mechanical stress while maintaining electrical performance.

The healthcare and medical device industry presents a particularly promising market opportunity, with liquid metal interconnects enabling the development of next-generation implantable devices, biosensors, and diagnostic equipment. These applications require biocompatible materials that can interface with biological tissues while providing reliable electrical connections in dynamic environments.

Automotive and aerospace industries are emerging as significant market segments, driven by the need for high-reliability interconnects that can withstand extreme temperatures, vibration, and mechanical stress. The self-healing properties of liquid metal interconnects make them particularly valuable in these high-stakes applications where connection failure could have catastrophic consequences.

Regional market analysis reveals that North America currently leads in liquid metal interconnect adoption, primarily due to strong research infrastructure and early commercial applications. However, the Asia-Pacific region is projected to demonstrate the fastest growth rate, supported by expanding electronics manufacturing capabilities and increasing investment in advanced materials research.

Market barriers include concerns regarding long-term reliability, toxicity of certain liquid metal compositions, and manufacturing scalability. Regulatory uncertainties across different jurisdictions create additional market entry challenges, particularly for medical applications where approval processes are stringent and time-consuming.

Customer demand patterns indicate growing interest in environmentally friendly liquid metal formulations that avoid toxic elements like mercury and lead. This trend aligns with global regulatory movements toward restricting hazardous substances in electronic products.

Supply chain analysis reveals potential bottlenecks in the sourcing of specialized alloy components and manufacturing equipment capable of precise liquid metal deposition. These constraints may impact market growth rates in the near term until manufacturing processes mature and achieve economies of scale.

Market forecasts suggest that as regulatory frameworks become more defined and manufacturing processes standardize, the liquid metal interconnect market will experience accelerated growth, particularly in applications requiring extreme flexibility, self-healing capabilities, and operation in harsh environments.

The healthcare and medical device industry presents a particularly promising market opportunity, with liquid metal interconnects enabling the development of next-generation implantable devices, biosensors, and diagnostic equipment. These applications require biocompatible materials that can interface with biological tissues while providing reliable electrical connections in dynamic environments.

Automotive and aerospace industries are emerging as significant market segments, driven by the need for high-reliability interconnects that can withstand extreme temperatures, vibration, and mechanical stress. The self-healing properties of liquid metal interconnects make them particularly valuable in these high-stakes applications where connection failure could have catastrophic consequences.

Regional market analysis reveals that North America currently leads in liquid metal interconnect adoption, primarily due to strong research infrastructure and early commercial applications. However, the Asia-Pacific region is projected to demonstrate the fastest growth rate, supported by expanding electronics manufacturing capabilities and increasing investment in advanced materials research.

Market barriers include concerns regarding long-term reliability, toxicity of certain liquid metal compositions, and manufacturing scalability. Regulatory uncertainties across different jurisdictions create additional market entry challenges, particularly for medical applications where approval processes are stringent and time-consuming.

Customer demand patterns indicate growing interest in environmentally friendly liquid metal formulations that avoid toxic elements like mercury and lead. This trend aligns with global regulatory movements toward restricting hazardous substances in electronic products.

Supply chain analysis reveals potential bottlenecks in the sourcing of specialized alloy components and manufacturing equipment capable of precise liquid metal deposition. These constraints may impact market growth rates in the near term until manufacturing processes mature and achieve economies of scale.

Market forecasts suggest that as regulatory frameworks become more defined and manufacturing processes standardize, the liquid metal interconnect market will experience accelerated growth, particularly in applications requiring extreme flexibility, self-healing capabilities, and operation in harsh environments.

Current Status and Technical Challenges in Liquid Metal Implementation

Liquid metal interconnect technologies have gained significant attention in recent years due to their unique properties and potential applications in flexible electronics, wearable devices, and biomedical implants. Currently, the global landscape of liquid metal implementation shows varying degrees of development across different regions, with North America, East Asia, and Europe leading in research and commercialization efforts.

The primary liquid metal alloys being investigated include gallium-based alloys (such as EGaIn and Galinstan) which remain liquid at room temperature while offering excellent electrical conductivity. These materials present a promising alternative to traditional rigid copper interconnects, particularly for applications requiring flexibility and stretchability. However, despite the theoretical advantages, widespread industrial adoption remains limited due to several technical challenges.

One of the most significant barriers to implementation is oxidation. Gallium-based liquid metals rapidly form an oxide skin when exposed to air, which affects their flowability and electrical performance. While this oxide layer provides some stability to the liquid metal structures, it also complicates the patterning and deposition processes required for reliable interconnect formation. Current solutions involve working in oxygen-free environments or developing specialized surface treatments, both adding complexity to manufacturing processes.

Compatibility with existing electronic components and manufacturing workflows presents another major challenge. The integration of liquid metal interconnects with conventional semiconductor technologies requires addressing issues of metal migration, potential corrosion of adjacent materials, and ensuring stable electrical connections between liquid and solid conductors. The interface between liquid metals and traditional electronic components remains a critical area requiring further development.

Scalability concerns also persist in the current implementation landscape. While laboratory demonstrations have shown promising results, translating these into high-volume manufacturing processes with consistent quality control remains problematic. The precise deposition and encapsulation of liquid metals at industrial scales has not yet been fully resolved, limiting commercial viability.

Encapsulation technologies represent another technical hurdle. Effective containment of liquid metals requires materials that prevent leakage while maintaining flexibility and durability over the product lifecycle. Current elastomeric encapsulants show promising results but face challenges in long-term reliability and hermeticity, particularly under mechanical stress or temperature fluctuations.

Regulatory frameworks for liquid metal technologies remain underdeveloped in most jurisdictions, creating uncertainty for manufacturers. The toxicity concerns around gallium and other constituent elements, while generally lower than mercury-based alternatives, still require comprehensive safety assessments before widespread adoption can occur. This regulatory ambiguity further complicates the path to commercialization for many potential applications.

The primary liquid metal alloys being investigated include gallium-based alloys (such as EGaIn and Galinstan) which remain liquid at room temperature while offering excellent electrical conductivity. These materials present a promising alternative to traditional rigid copper interconnects, particularly for applications requiring flexibility and stretchability. However, despite the theoretical advantages, widespread industrial adoption remains limited due to several technical challenges.

One of the most significant barriers to implementation is oxidation. Gallium-based liquid metals rapidly form an oxide skin when exposed to air, which affects their flowability and electrical performance. While this oxide layer provides some stability to the liquid metal structures, it also complicates the patterning and deposition processes required for reliable interconnect formation. Current solutions involve working in oxygen-free environments or developing specialized surface treatments, both adding complexity to manufacturing processes.

Compatibility with existing electronic components and manufacturing workflows presents another major challenge. The integration of liquid metal interconnects with conventional semiconductor technologies requires addressing issues of metal migration, potential corrosion of adjacent materials, and ensuring stable electrical connections between liquid and solid conductors. The interface between liquid metals and traditional electronic components remains a critical area requiring further development.

Scalability concerns also persist in the current implementation landscape. While laboratory demonstrations have shown promising results, translating these into high-volume manufacturing processes with consistent quality control remains problematic. The precise deposition and encapsulation of liquid metals at industrial scales has not yet been fully resolved, limiting commercial viability.

Encapsulation technologies represent another technical hurdle. Effective containment of liquid metals requires materials that prevent leakage while maintaining flexibility and durability over the product lifecycle. Current elastomeric encapsulants show promising results but face challenges in long-term reliability and hermeticity, particularly under mechanical stress or temperature fluctuations.

Regulatory frameworks for liquid metal technologies remain underdeveloped in most jurisdictions, creating uncertainty for manufacturers. The toxicity concerns around gallium and other constituent elements, while generally lower than mercury-based alternatives, still require comprehensive safety assessments before widespread adoption can occur. This regulatory ambiguity further complicates the path to commercialization for many potential applications.

Current Technical Solutions for Liquid Metal Interconnects

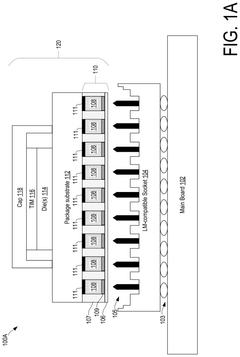

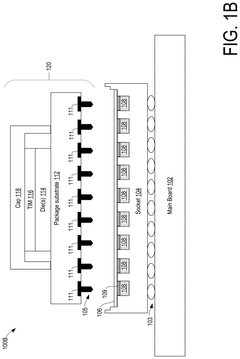

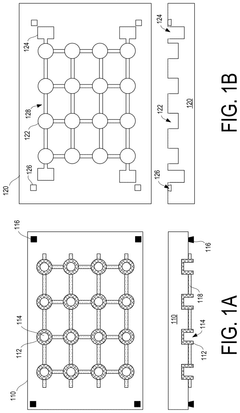

01 Liquid metal interconnect structures in semiconductor devices

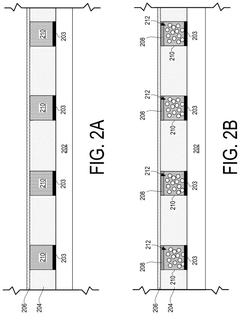

Liquid metal materials are used to form interconnect structures in semiconductor devices, providing improved electrical conductivity and thermal performance. These interconnects can be formed by depositing liquid metal into trenches or vias in semiconductor substrates. The liquid metal can maintain its fluid properties while providing reliable electrical connections between components, offering advantages over traditional solid metal interconnects in terms of flexibility and resistance to mechanical stress.- Liquid metal interconnect materials and compositions: Liquid metal materials, such as gallium-based alloys, are used as interconnect materials in electronic devices due to their unique properties including high electrical conductivity, low melting points, and self-healing capabilities. These materials can flow and maintain electrical connections even during mechanical deformation, making them ideal for flexible and stretchable electronics. The composition of these liquid metals can be tailored to achieve specific properties such as improved wettability, reduced oxidation, and enhanced thermal conductivity.

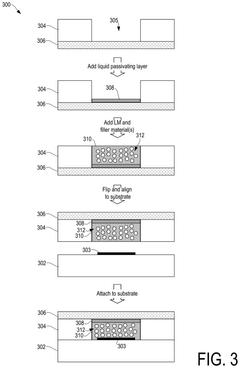

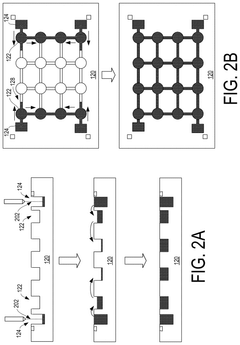

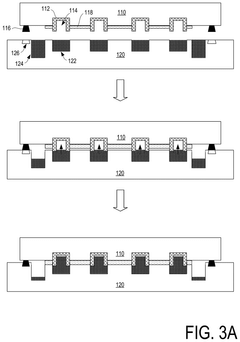

- Fabrication methods for liquid metal interconnects: Various fabrication techniques are employed to create liquid metal interconnects, including microfluidic injection, printing, and patterning methods. These processes involve precise deposition of liquid metal into channels or vias, often using specialized equipment to control the flow and placement of the material. Surface treatments may be applied to improve adhesion and prevent leakage. Advanced techniques include selective wetting, masked deposition, and in-situ alloying to create complex interconnect structures with high reliability and performance.

- Integration of liquid metal interconnects in semiconductor devices: Liquid metal interconnects can be integrated into semiconductor devices to provide enhanced electrical connections between components. This integration involves specialized packaging techniques, interface engineering, and thermal management solutions. The liquid metal can fill gaps between die and substrate, reducing thermal resistance and improving signal integrity. These interconnects can replace traditional solder bumps or wire bonds in advanced packaging applications, offering advantages in terms of electrical performance, thermal management, and mechanical reliability.

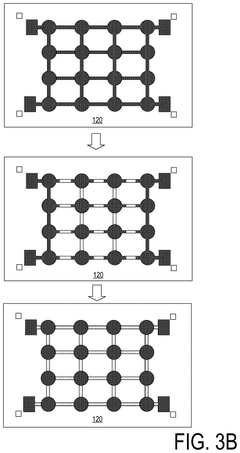

- Flexible and stretchable liquid metal interconnect systems: Liquid metals enable the development of flexible and stretchable interconnect systems that can maintain electrical functionality during bending, stretching, and other mechanical deformations. These systems typically incorporate elastomeric substrates or encapsulation materials that contain channels or reservoirs for the liquid metal. The unique properties of liquid metals allow for self-healing of electrical connections after mechanical damage, making them ideal for wearable electronics, soft robotics, and other applications requiring mechanical compliance while maintaining electrical functionality.

- Reliability and performance enhancement techniques: Various methods are employed to enhance the reliability and performance of liquid metal interconnects, including surface modification, alloying, and encapsulation techniques. These approaches address challenges such as oxidation, metal embrittlement, and electromigration. Advanced packaging designs incorporate features to prevent liquid metal leakage while maintaining electrical and thermal performance. Testing methodologies have been developed to evaluate the long-term reliability of liquid metal interconnects under various environmental conditions and mechanical stresses, ensuring their suitability for commercial applications.

02 Manufacturing methods for liquid metal interconnects

Various manufacturing techniques are employed to create liquid metal interconnects, including deposition, patterning, and encapsulation processes. These methods involve creating channels or cavities in substrates, filling them with liquid metal alloys, and sealing them to prevent leakage. Advanced techniques such as selective wetting, microfluidic injection, and surface treatment are used to control the placement and flow of liquid metals during the manufacturing process.Expand Specific Solutions03 Encapsulation and containment of liquid metal interconnects

Specialized encapsulation techniques are essential for containing liquid metal interconnects within electronic devices. These methods involve using polymer or ceramic materials to create sealed channels that prevent leakage while maintaining the electrical properties of the liquid metal. The encapsulation materials must be compatible with the liquid metal to prevent unwanted chemical reactions while providing mechanical stability and protection from environmental factors.Expand Specific Solutions04 Liquid metal alloys for flexible and stretchable electronics

Specific liquid metal alloys, such as gallium-based compounds, are used in flexible and stretchable electronic applications. These alloys remain liquid at room temperature while providing excellent electrical conductivity, making them ideal for wearable devices and other applications requiring mechanical flexibility. The interconnects can stretch, bend, and deform while maintaining electrical functionality, enabling new form factors for electronic devices that can conform to non-planar surfaces.Expand Specific Solutions05 Integration of liquid metal interconnects with conventional electronics

Methods for integrating liquid metal interconnects with traditional electronic components and manufacturing processes have been developed. These techniques address challenges such as interface compatibility, thermal management, and reliability concerns when combining liquid and solid conductors. Special interface structures and bonding methods enable liquid metal interconnects to be incorporated into conventional semiconductor manufacturing flows, allowing for hybrid systems that leverage the advantages of both technologies.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The liquid metal interconnect technology market is currently in an early growth phase, characterized by increasing R&D investments but limited commercial deployment. The global market size remains relatively modest, estimated below $500 million, but shows promising annual growth rates of 15-20% driven by semiconductor packaging innovations. From a technical maturity perspective, the regulatory landscape remains complex and evolving. Industry leaders Intel, TSMC, and Samsung are advancing proprietary liquid metal solutions for high-performance computing applications, while specialized materials companies like MacDermid Enthone and Applied Materials are developing enabling technologies. Semiconductor foundries including GlobalFoundries, SMIC, and QUALCOMM are exploring integration pathways, though regulatory concerns regarding environmental impact and reliability standards remain significant barriers to widespread adoption.

Intel Corp.

Technical Solution: Intel has pioneered liquid metal interconnect technologies to address the challenges of traditional copper interconnects as transistor dimensions continue to shrink. Their approach involves using gallium-based liquid metal alloys as an alternative to solid metal interconnects. Intel's research focuses on developing encapsulation techniques to prevent liquid metal oxidation and ensure compatibility with existing semiconductor manufacturing processes. They have demonstrated successful implementation of liquid metal interconnects in test chips, showing reduced resistance and improved electromigration resistance compared to copper interconnects[1][3]. Intel has also developed specialized deposition methods that allow precise placement of liquid metal within nanoscale channels, addressing one of the key challenges in liquid metal integration. Their regulatory compliance strategy includes extensive materials characterization and safety protocols to meet both environmental and worker safety regulations across global markets.

Strengths: Superior electrical conductivity compared to traditional interconnects; improved reliability due to self-healing properties of liquid metals; compatibility with existing manufacturing infrastructure. Weaknesses: Challenges with containing liquid metals within designated pathways; potential regulatory hurdles related to toxicity of some liquid metal components; thermal expansion issues that may affect long-term stability.

Applied Materials, Inc.

Technical Solution: Applied Materials has developed specialized equipment and processes for implementing liquid metal interconnect technologies in semiconductor manufacturing. Their approach focuses on gallium-based liquid metal alloys that remain liquid at chip operating temperatures. Applied Materials' technology includes proprietary deposition systems that enable precise placement of liquid metals within nanoscale trenches and vias, addressing one of the key manufacturing challenges[6]. They have created specialized encapsulation materials that prevent oxidation and contain the liquid metal while maintaining electrical performance. Their equipment incorporates advanced monitoring systems to ensure regulatory compliance during manufacturing, with particular attention to preventing environmental contamination. Applied Materials has conducted extensive materials compatibility testing to ensure liquid metal interconnects can be integrated with existing semiconductor materials and processes without degradation. They have also developed specialized cleaning and waste management protocols that address regulatory concerns about the handling and disposal of liquid metal materials across different jurisdictions[7].

Strengths: Comprehensive manufacturing solution that addresses the entire process flow; specialized equipment designed specifically for liquid metal handling; established relationships with regulatory bodies that facilitate compliance. Weaknesses: High capital equipment costs for implementation; challenges with process integration into existing manufacturing lines; potential regulatory variations across different geographic markets.

Critical Patents and Technical Literature Analysis

Liquid metal socket interconnects with liquid passivation layer and filler materials

PatentPendingUS20250079278A1

Innovation

- Implementation of a liquid passivation layer, such as mineral oil or paraffin wax, within the LM wells to prevent sticking and oxide formation, along with inert filler materials to reduce LM usage and costs.

Self-diffusing liquid metal interconnect architectures enabling snap-on room temperature assembly

PatentPendingUS20250112190A1

Innovation

- A self-diffusion process using Gallium-based liquid metal interconnects facilitated by capillary action and a slip layer material to form connections at room temperature, allowing for minimal energy consumption and precise, scalable interconnect networks without complex processing.

Regulatory Framework and Compliance Requirements

The regulatory landscape for liquid metal interconnect technologies spans multiple jurisdictions and encompasses various safety, environmental, and performance standards. At the international level, organizations such as the International Electrotechnical Commission (IEC) and the International Organization for Standardization (ISO) have established baseline requirements that influence national regulations. These standards primarily address electrical safety, material toxicity, and reliability parameters that manufacturers must adhere to when developing liquid metal interconnect solutions.

In the United States, the regulatory framework is primarily governed by the Federal Communications Commission (FCC) for electromagnetic compatibility, the Environmental Protection Agency (EPA) for environmental impact assessment, and the Consumer Product Safety Commission (CPSC) for consumer safety. Notably, liquid metal technologies containing gallium and indium alloys must comply with the Restriction of Hazardous Substances (RoHS) directive, which limits the use of certain hazardous materials in electronic equipment.

The European Union implements more stringent regulations through the REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) framework, which requires manufacturers to register and evaluate the safety of chemical substances used in their products. For liquid metal interconnects, this necessitates comprehensive documentation of material properties, potential environmental impacts, and disposal protocols. Additionally, the EU's Waste Electrical and Electronic Equipment (WEEE) directive mandates specific end-of-life management practices for products containing liquid metal components.

Asian markets, particularly Japan and South Korea, have established their own regulatory frameworks that often emphasize recyclability and material recovery. Japan's J-MOSS (Japanese Material Declaration for RoHS) and South Korea's K-RoHS impose additional reporting requirements for manufacturers utilizing liquid metal technologies in consumer electronics and telecommunications infrastructure.

Compliance testing protocols for liquid metal interconnects typically include leachability tests, thermal cycling reliability assessments, and accelerated aging studies. These tests evaluate the potential for metal migration, oxidation resistance, and long-term stability under various environmental conditions. Manufacturers must demonstrate that their liquid metal interconnect solutions maintain performance integrity throughout the product lifecycle while posing minimal risk to human health and the environment.

Emerging regulatory trends indicate a shift toward lifecycle assessment approaches, where manufacturers are increasingly required to account for the environmental footprint of liquid metal technologies from raw material extraction through disposal. This holistic regulatory perspective emphasizes the importance of designing interconnect solutions that facilitate material recovery and minimize waste generation, aligning with global sustainability initiatives and circular economy principles.

In the United States, the regulatory framework is primarily governed by the Federal Communications Commission (FCC) for electromagnetic compatibility, the Environmental Protection Agency (EPA) for environmental impact assessment, and the Consumer Product Safety Commission (CPSC) for consumer safety. Notably, liquid metal technologies containing gallium and indium alloys must comply with the Restriction of Hazardous Substances (RoHS) directive, which limits the use of certain hazardous materials in electronic equipment.

The European Union implements more stringent regulations through the REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) framework, which requires manufacturers to register and evaluate the safety of chemical substances used in their products. For liquid metal interconnects, this necessitates comprehensive documentation of material properties, potential environmental impacts, and disposal protocols. Additionally, the EU's Waste Electrical and Electronic Equipment (WEEE) directive mandates specific end-of-life management practices for products containing liquid metal components.

Asian markets, particularly Japan and South Korea, have established their own regulatory frameworks that often emphasize recyclability and material recovery. Japan's J-MOSS (Japanese Material Declaration for RoHS) and South Korea's K-RoHS impose additional reporting requirements for manufacturers utilizing liquid metal technologies in consumer electronics and telecommunications infrastructure.

Compliance testing protocols for liquid metal interconnects typically include leachability tests, thermal cycling reliability assessments, and accelerated aging studies. These tests evaluate the potential for metal migration, oxidation resistance, and long-term stability under various environmental conditions. Manufacturers must demonstrate that their liquid metal interconnect solutions maintain performance integrity throughout the product lifecycle while posing minimal risk to human health and the environment.

Emerging regulatory trends indicate a shift toward lifecycle assessment approaches, where manufacturers are increasingly required to account for the environmental footprint of liquid metal technologies from raw material extraction through disposal. This holistic regulatory perspective emphasizes the importance of designing interconnect solutions that facilitate material recovery and minimize waste generation, aligning with global sustainability initiatives and circular economy principles.

Environmental and Safety Considerations for Liquid Metal Applications

The implementation of liquid metal technologies in interconnect applications necessitates careful consideration of environmental and safety factors. Gallium-based liquid metals, while offering superior electrical and thermal conductivity, present unique challenges regarding toxicity and environmental impact. Unlike mercury, gallium and its alloys exhibit significantly lower toxicity levels, making them more suitable for commercial applications. However, regulatory frameworks across different regions impose varying restrictions on their use, storage, and disposal.

Environmental concerns primarily revolve around the potential leaching of liquid metal components into soil and water systems. Gallium itself has limited environmental mobility, but certain alloys containing elements like indium may pose greater ecological risks. Current research indicates minimal bioaccumulation in aquatic organisms, yet long-term studies remain limited. Regulatory bodies, including the EPA in the United States and the European Chemicals Agency, continue to evaluate these materials under evolving chemical management protocols.

Workplace safety represents another critical dimension for liquid metal applications. Direct skin contact with gallium-based alloys can cause temporary staining and irritation, necessitating appropriate handling protocols. The oxidation layer that forms on liquid metal surfaces may contain metal oxides requiring proper ventilation systems in manufacturing environments. OSHA guidelines recommend specific personal protective equipment, including chemical-resistant gloves and eye protection, when handling these materials in industrial settings.

Disposal considerations for liquid metal technologies must align with electronic waste management regulations. The recoverability of gallium from end-of-life products presents both an environmental benefit and a regulatory challenge. Current e-waste directives, particularly in the EU under the WEEE framework, do not specifically address liquid metal components, creating potential regulatory gaps. Industry stakeholders are actively engaging with policymakers to develop appropriate classification and handling protocols for these novel materials.

Risk assessment methodologies for liquid metal technologies continue to evolve as applications expand beyond laboratory settings. Manufacturers must conduct comprehensive material safety evaluations, considering both normal operating conditions and potential failure scenarios. Thermal runaway events, while rare, require specific containment strategies due to the unique properties of liquid metals at elevated temperatures. Regulatory compliance in this domain necessitates proactive engagement with standards organizations to establish appropriate testing protocols.

Consumer safety considerations extend beyond manufacturing to end-user interactions with liquid metal-enabled devices. Product designers must implement robust encapsulation techniques to prevent accidental exposure, particularly in consumer electronics applications. Regulatory certifications for such products increasingly require demonstration of leak-proof designs and accelerated aging tests to verify long-term containment integrity under various environmental conditions.

Environmental concerns primarily revolve around the potential leaching of liquid metal components into soil and water systems. Gallium itself has limited environmental mobility, but certain alloys containing elements like indium may pose greater ecological risks. Current research indicates minimal bioaccumulation in aquatic organisms, yet long-term studies remain limited. Regulatory bodies, including the EPA in the United States and the European Chemicals Agency, continue to evaluate these materials under evolving chemical management protocols.

Workplace safety represents another critical dimension for liquid metal applications. Direct skin contact with gallium-based alloys can cause temporary staining and irritation, necessitating appropriate handling protocols. The oxidation layer that forms on liquid metal surfaces may contain metal oxides requiring proper ventilation systems in manufacturing environments. OSHA guidelines recommend specific personal protective equipment, including chemical-resistant gloves and eye protection, when handling these materials in industrial settings.

Disposal considerations for liquid metal technologies must align with electronic waste management regulations. The recoverability of gallium from end-of-life products presents both an environmental benefit and a regulatory challenge. Current e-waste directives, particularly in the EU under the WEEE framework, do not specifically address liquid metal components, creating potential regulatory gaps. Industry stakeholders are actively engaging with policymakers to develop appropriate classification and handling protocols for these novel materials.

Risk assessment methodologies for liquid metal technologies continue to evolve as applications expand beyond laboratory settings. Manufacturers must conduct comprehensive material safety evaluations, considering both normal operating conditions and potential failure scenarios. Thermal runaway events, while rare, require specific containment strategies due to the unique properties of liquid metals at elevated temperatures. Regulatory compliance in this domain necessitates proactive engagement with standards organizations to establish appropriate testing protocols.

Consumer safety considerations extend beyond manufacturing to end-user interactions with liquid metal-enabled devices. Product designers must implement robust encapsulation techniques to prevent accidental exposure, particularly in consumer electronics applications. Regulatory certifications for such products increasingly require demonstration of leak-proof designs and accelerated aging tests to verify long-term containment integrity under various environmental conditions.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!