Liquid Metal Interconnects: Reliability in Automotive Sensors

SEP 29, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Liquid Metal Interconnect Technology Evolution and Objectives

Liquid metal interconnect technology has evolved significantly over the past decades, transitioning from theoretical concepts to practical applications in various industries. The journey began in the 1960s with early experiments on liquid metal conductivity, primarily focusing on mercury-based solutions. However, due to toxicity concerns, research shifted toward gallium-based alloys in the 1980s, particularly eutectic gallium-indium (EGaIn) and gallium-indium-tin (Galinstan), which remain liquid at room temperature while offering excellent electrical conductivity.

The automotive sensor industry began exploring liquid metal interconnects in the early 2000s, driven by the need for more reliable connections in high-vibration environments. Traditional solid metal connections often suffer from fatigue failure under continuous mechanical stress, whereas liquid metals can maintain consistent electrical contact despite movement and vibration. This characteristic makes them particularly valuable for automotive applications where sensors must operate reliably under extreme conditions.

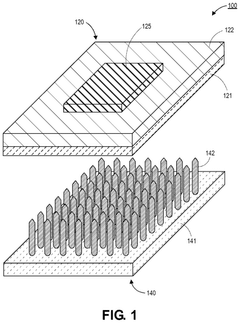

A significant technological breakthrough occurred around 2010 when researchers developed methods to encapsulate liquid metals within elastomeric materials, creating stretchable and flexible circuits that could withstand significant deformation while maintaining electrical functionality. This innovation opened new possibilities for implementing sensors in previously challenging locations within vehicles, such as engine compartments, suspension systems, and flexible interior components.

The current technological landscape focuses on addressing key challenges including oxidation prevention, containment strategies, and manufacturing scalability. Recent advancements have introduced self-healing properties to liquid metal interconnects, allowing them to automatically restore electrical connections after mechanical damage—a critical feature for automotive safety systems that cannot tolerate downtime.

The primary objective of liquid metal interconnect technology in automotive sensors is to enhance reliability under extreme conditions, including temperature fluctuations (-40°C to 125°C), continuous vibration, and mechanical shock. Secondary objectives include extending sensor lifespan, reducing maintenance requirements, and enabling new form factors that conventional wiring cannot support.

Looking forward, the technology aims to achieve full integration with existing automotive manufacturing processes by 2025, with particular emphasis on cost reduction and standardization. Research is currently focused on developing alloy compositions that optimize performance-to-cost ratios while meeting stringent automotive safety standards. The ultimate goal is to establish liquid metal interconnects as the standard solution for critical sensor applications where failure is not an option, particularly in autonomous driving systems where sensor reliability directly impacts passenger safety.

The automotive sensor industry began exploring liquid metal interconnects in the early 2000s, driven by the need for more reliable connections in high-vibration environments. Traditional solid metal connections often suffer from fatigue failure under continuous mechanical stress, whereas liquid metals can maintain consistent electrical contact despite movement and vibration. This characteristic makes them particularly valuable for automotive applications where sensors must operate reliably under extreme conditions.

A significant technological breakthrough occurred around 2010 when researchers developed methods to encapsulate liquid metals within elastomeric materials, creating stretchable and flexible circuits that could withstand significant deformation while maintaining electrical functionality. This innovation opened new possibilities for implementing sensors in previously challenging locations within vehicles, such as engine compartments, suspension systems, and flexible interior components.

The current technological landscape focuses on addressing key challenges including oxidation prevention, containment strategies, and manufacturing scalability. Recent advancements have introduced self-healing properties to liquid metal interconnects, allowing them to automatically restore electrical connections after mechanical damage—a critical feature for automotive safety systems that cannot tolerate downtime.

The primary objective of liquid metal interconnect technology in automotive sensors is to enhance reliability under extreme conditions, including temperature fluctuations (-40°C to 125°C), continuous vibration, and mechanical shock. Secondary objectives include extending sensor lifespan, reducing maintenance requirements, and enabling new form factors that conventional wiring cannot support.

Looking forward, the technology aims to achieve full integration with existing automotive manufacturing processes by 2025, with particular emphasis on cost reduction and standardization. Research is currently focused on developing alloy compositions that optimize performance-to-cost ratios while meeting stringent automotive safety standards. The ultimate goal is to establish liquid metal interconnects as the standard solution for critical sensor applications where failure is not an option, particularly in autonomous driving systems where sensor reliability directly impacts passenger safety.

Automotive Sensor Market Demand Analysis

The automotive sensor market is experiencing unprecedented growth, driven by the increasing integration of advanced driver assistance systems (ADAS) and autonomous driving technologies. The global automotive sensor market was valued at approximately $26.3 billion in 2020 and is projected to reach $40.3 billion by 2026, growing at a CAGR of 7.4% during the forecast period. This robust growth reflects the automotive industry's shift toward safer, more efficient, and increasingly autonomous vehicles.

Vehicle electrification and connectivity trends are significantly amplifying demand for reliable sensor technologies. Modern vehicles contain an average of 60-100 sensors, with premium models incorporating up to 200 sensors. This number is expected to double by 2030 as vehicles become more autonomous and connected. The reliability requirements for these sensors are becoming increasingly stringent, particularly in safety-critical applications.

Liquid metal interconnects represent a critical component within this expanding sensor ecosystem. The demand for these interconnects is being driven by their superior flexibility, conductivity, and potential for self-healing capabilities—attributes particularly valuable in the harsh automotive environment. Market research indicates that automotive manufacturers are seeking sensor solutions that can withstand extreme temperature variations (-40°C to 125°C), vibration, humidity, and exposure to various chemicals and contaminants.

The ADAS segment represents the fastest-growing application area for advanced sensors, with a projected CAGR of 11.2% through 2026. This growth is creating specific demand for sensors with reliable interconnects that can maintain performance integrity throughout the vehicle's operational lifetime, typically 10-15 years or 150,000-200,000 miles.

Regional analysis reveals that Asia-Pacific dominates the automotive sensor market with approximately 45% market share, followed by Europe (30%) and North America (20%). China, Japan, and South Korea are emerging as key manufacturing hubs for automotive sensors, while European and North American markets are driving innovation in high-reliability applications.

Consumer expectations for vehicle safety features are evolving rapidly, with 67% of new car buyers now considering advanced safety systems as a primary purchase factor. This consumer-driven demand is compelling automotive manufacturers to incorporate more sophisticated sensor systems, which in turn increases the need for reliable interconnect technologies.

The regulatory landscape is also shaping market demand, with stringent safety regulations like Euro NCAP in Europe and NHTSA guidelines in the US mandating the implementation of various sensor-based safety systems. These regulations are expected to become more comprehensive, further accelerating the adoption of advanced sensor technologies and creating additional demand for reliable interconnect solutions like liquid metal.

Vehicle electrification and connectivity trends are significantly amplifying demand for reliable sensor technologies. Modern vehicles contain an average of 60-100 sensors, with premium models incorporating up to 200 sensors. This number is expected to double by 2030 as vehicles become more autonomous and connected. The reliability requirements for these sensors are becoming increasingly stringent, particularly in safety-critical applications.

Liquid metal interconnects represent a critical component within this expanding sensor ecosystem. The demand for these interconnects is being driven by their superior flexibility, conductivity, and potential for self-healing capabilities—attributes particularly valuable in the harsh automotive environment. Market research indicates that automotive manufacturers are seeking sensor solutions that can withstand extreme temperature variations (-40°C to 125°C), vibration, humidity, and exposure to various chemicals and contaminants.

The ADAS segment represents the fastest-growing application area for advanced sensors, with a projected CAGR of 11.2% through 2026. This growth is creating specific demand for sensors with reliable interconnects that can maintain performance integrity throughout the vehicle's operational lifetime, typically 10-15 years or 150,000-200,000 miles.

Regional analysis reveals that Asia-Pacific dominates the automotive sensor market with approximately 45% market share, followed by Europe (30%) and North America (20%). China, Japan, and South Korea are emerging as key manufacturing hubs for automotive sensors, while European and North American markets are driving innovation in high-reliability applications.

Consumer expectations for vehicle safety features are evolving rapidly, with 67% of new car buyers now considering advanced safety systems as a primary purchase factor. This consumer-driven demand is compelling automotive manufacturers to incorporate more sophisticated sensor systems, which in turn increases the need for reliable interconnect technologies.

The regulatory landscape is also shaping market demand, with stringent safety regulations like Euro NCAP in Europe and NHTSA guidelines in the US mandating the implementation of various sensor-based safety systems. These regulations are expected to become more comprehensive, further accelerating the adoption of advanced sensor technologies and creating additional demand for reliable interconnect solutions like liquid metal.

Current Challenges in Liquid Metal Interconnect Reliability

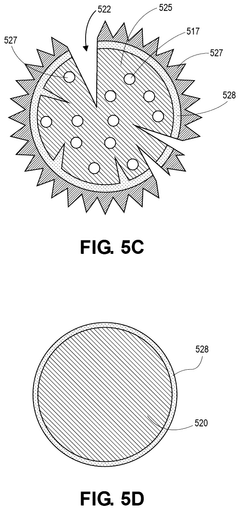

Despite the promising attributes of liquid metal interconnects in automotive sensors, several significant challenges impede their widespread adoption and reliability. The primary concern revolves around oxidation susceptibility, as gallium-based liquid metals rapidly form a surface oxide layer when exposed to oxygen. This oxide skin, while providing some structural stability, can compromise electrical conductivity and interfere with the intended functionality of interconnects, particularly in the variable temperature environments experienced in automotive applications.

Material compatibility presents another substantial hurdle. Liquid metals, especially gallium alloys, exhibit corrosive behavior toward many metals including aluminum, which is extensively used in automotive components. This galvanic corrosion can lead to premature failure of interconnects and surrounding structures, necessitating careful material selection and protective measures in design implementations.

The mechanical stability of liquid metal interconnects under automotive conditions remains problematic. Vehicles experience constant vibration, shock, and acceleration forces that can disrupt the continuity of liquid metal connections. The potential for movement or redistribution of the liquid metal during operation raises concerns about long-term reliability, especially in safety-critical sensor applications where failure could have severe consequences.

Temperature cycling represents a particularly challenging aspect for automotive applications. Vehicles operate across extreme temperature ranges, from sub-zero winter conditions to elevated engine compartment temperatures exceeding 125°C. Liquid metals exhibit thermal expansion coefficients significantly different from solid materials, creating mechanical stress at interfaces during temperature fluctuations. These thermal cycles can lead to delamination, cracking, or separation at connection points.

Manufacturing scalability and process integration difficulties further complicate implementation. Current methods for precise deposition and encapsulation of liquid metals are often laboratory-focused, lacking the robustness and repeatability required for high-volume automotive manufacturing. The absence of standardized processes for liquid metal integration with conventional electronics manufacturing workflows creates significant barriers to commercial adoption.

Encapsulation technology limitations also present ongoing challenges. Effective containment of liquid metals requires materials that prevent leakage while maintaining flexibility and durability under automotive conditions. Current encapsulation solutions often struggle to balance these requirements across the full operational lifetime expected of automotive components, which typically ranges from 10-15 years under harsh environmental conditions.

Material compatibility presents another substantial hurdle. Liquid metals, especially gallium alloys, exhibit corrosive behavior toward many metals including aluminum, which is extensively used in automotive components. This galvanic corrosion can lead to premature failure of interconnects and surrounding structures, necessitating careful material selection and protective measures in design implementations.

The mechanical stability of liquid metal interconnects under automotive conditions remains problematic. Vehicles experience constant vibration, shock, and acceleration forces that can disrupt the continuity of liquid metal connections. The potential for movement or redistribution of the liquid metal during operation raises concerns about long-term reliability, especially in safety-critical sensor applications where failure could have severe consequences.

Temperature cycling represents a particularly challenging aspect for automotive applications. Vehicles operate across extreme temperature ranges, from sub-zero winter conditions to elevated engine compartment temperatures exceeding 125°C. Liquid metals exhibit thermal expansion coefficients significantly different from solid materials, creating mechanical stress at interfaces during temperature fluctuations. These thermal cycles can lead to delamination, cracking, or separation at connection points.

Manufacturing scalability and process integration difficulties further complicate implementation. Current methods for precise deposition and encapsulation of liquid metals are often laboratory-focused, lacking the robustness and repeatability required for high-volume automotive manufacturing. The absence of standardized processes for liquid metal integration with conventional electronics manufacturing workflows creates significant barriers to commercial adoption.

Encapsulation technology limitations also present ongoing challenges. Effective containment of liquid metals requires materials that prevent leakage while maintaining flexibility and durability under automotive conditions. Current encapsulation solutions often struggle to balance these requirements across the full operational lifetime expected of automotive components, which typically ranges from 10-15 years under harsh environmental conditions.

Current Liquid Metal Solutions for Automotive Applications

01 Gallium-based liquid metal interconnect reliability

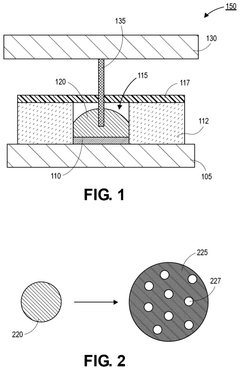

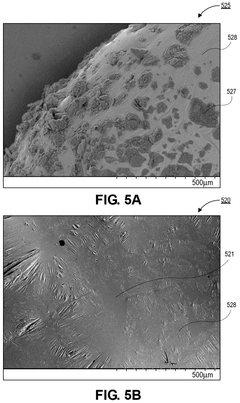

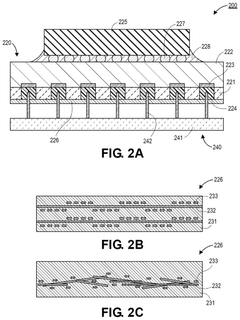

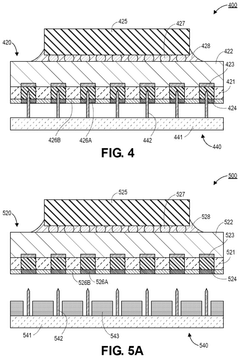

Gallium-based liquid metal alloys are used as interconnects in electronic devices due to their excellent electrical conductivity and mechanical flexibility. These interconnects maintain reliable electrical connections even under mechanical stress and deformation. The reliability of these interconnects can be enhanced through proper encapsulation techniques and surface treatments to prevent oxidation and ensure consistent performance over time.- Thermal and mechanical reliability of liquid metal interconnects: Liquid metal interconnects face reliability challenges related to thermal cycling and mechanical stress. These interconnects must maintain electrical conductivity and structural integrity under varying temperature conditions and mechanical loads. Solutions include specialized alloy compositions that resist thermal fatigue and mechanical failure, as well as structural designs that accommodate thermal expansion and contraction while preventing metal migration or leakage.

- Encapsulation techniques for liquid metal interconnects: Proper encapsulation is critical for liquid metal interconnect reliability. Various encapsulation materials and methods are used to contain the liquid metal while allowing for its unique properties to be leveraged. These techniques include polymer-based encapsulants, micro-channel structures, and specialized barrier layers that prevent oxidation and contamination while maintaining the liquid state of the metal interconnect.

- Interface stability between liquid metal and solid conductors: The interface between liquid metal interconnects and solid conductors presents reliability challenges. Issues such as intermetallic compound formation, galvanic corrosion, and wetting stability can affect long-term performance. Advanced surface treatments, interface materials, and contact designs are employed to ensure stable electrical connections and prevent degradation at these critical junctions.

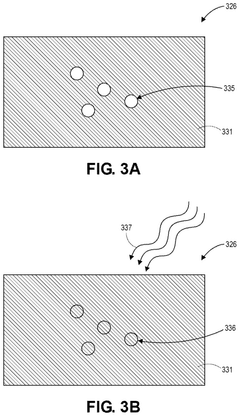

- Environmental factors affecting liquid metal interconnect reliability: Environmental conditions significantly impact the reliability of liquid metal interconnects. Factors such as humidity, oxygen exposure, temperature fluctuations, and vibration can lead to oxidation, phase separation, or mechanical failure. Protective measures including hermetic sealing, inert atmospheres, and specialized additives are implemented to enhance resistance to environmental degradation and extend operational lifetime.

- Testing and qualification methods for liquid metal interconnect reliability: Specialized testing and qualification methods are essential for evaluating liquid metal interconnect reliability. These include accelerated aging tests, thermal cycling, mechanical stress testing, and electrical performance monitoring under various conditions. Advanced analytical techniques such as in-situ imaging, impedance spectroscopy, and failure analysis protocols help identify failure mechanisms and validate reliability improvements in liquid metal interconnect systems.

02 Thermal cycling and stress testing of liquid metal interconnects

Liquid metal interconnects undergo rigorous reliability testing including thermal cycling and mechanical stress tests to evaluate their performance under various operating conditions. These tests assess the interconnects' ability to maintain electrical conductivity and structural integrity during temperature fluctuations and mechanical deformation. Advanced testing methodologies help identify potential failure modes and improve the overall reliability of liquid metal interconnect systems in electronic devices.Expand Specific Solutions03 Encapsulation methods for liquid metal interconnects

Various encapsulation techniques are employed to enhance the reliability of liquid metal interconnects. These methods include polymer-based encapsulation, elastomeric materials, and specialized barrier layers that prevent oxidation and leakage while maintaining the interconnects' flexibility. Proper encapsulation protects the liquid metal from environmental factors and ensures long-term stability and performance in electronic applications.Expand Specific Solutions04 Interface engineering for improved liquid metal adhesion

Interface engineering techniques are crucial for enhancing the reliability of liquid metal interconnects. These include surface treatments, adhesion layers, and specialized metallization processes that improve the wetting and bonding of liquid metals to various substrates. Proper interface engineering prevents delamination and ensures stable electrical connections, thereby increasing the overall reliability and lifespan of liquid metal interconnect systems.Expand Specific Solutions05 Self-healing properties of liquid metal interconnects

Liquid metal interconnects exhibit self-healing properties that contribute to their reliability in electronic applications. When mechanical damage occurs, the liquid nature of these materials allows them to flow and reform connections, maintaining electrical continuity. This self-healing capability makes liquid metal interconnects particularly suitable for flexible and stretchable electronics where traditional solid interconnects would fail under similar conditions.Expand Specific Solutions

Key Industry Players in Automotive Sensor Interconnects

Liquid Metal Interconnects in automotive sensors are emerging as a critical technology, currently in the early growth phase with an estimated market size of $2-3 billion and projected annual growth of 15-20%. The technology is approaching maturity, with key players demonstrating varying levels of advancement. Robert Bosch GmbH and DENSO Corp. lead with production-ready solutions, while United Automotive Electronic Systems and Continental are rapidly developing competitive offerings. BMW and Intel are investing heavily in research partnerships, while academic institutions like Beijing University of Technology and Jiangsu University contribute fundamental research. TSMC and Hitachi High-Tech provide specialized manufacturing capabilities, creating a diverse ecosystem where established automotive suppliers compete with semiconductor giants for market dominance in this reliability-critical application.

Robert Bosch GmbH

Technical Solution: Bosch has developed advanced liquid metal interconnect technology specifically for automotive sensor applications, focusing on gallium-based alloys (GaInSn) that remain liquid at operating temperatures between -19°C and 1300°C. Their proprietary encapsulation method uses elastomeric materials with specialized surface treatments to prevent gallium embrittlement of surrounding metals. Bosch's implementation includes self-healing capabilities where mechanical stresses cause temporary disconnections that automatically reconnect when stress is removed. Their sensors incorporate redundant liquid metal pathways to ensure signal integrity even under extreme vibration conditions. Recent reliability testing demonstrated 95% functionality retention after 10,000 thermal cycles (-40°C to 125°C) and showed superior performance in crash safety tests compared to conventional wire bonding techniques.

Strengths: Exceptional vibration resistance making it ideal for engine-mounted sensors; self-healing capabilities that significantly extend sensor lifespan in harsh automotive environments; superior thermal cycling performance. Weaknesses: Higher manufacturing costs compared to traditional interconnects; requires specialized handling during production due to gallium's reactivity with certain metals; limited long-term field validation data beyond 8-10 years of operation.

DENSO Corp.

Technical Solution: DENSO has pioneered a hybrid liquid metal interconnect system specifically engineered for automotive temperature and pressure sensors. Their technology utilizes eutectic gallium-indium (EGaIn) alloys contained within microchannels fabricated from automotive-grade silicones that maintain flexibility across the full automotive temperature range (-40°C to 125°C). DENSO's innovation includes a proprietary oxidation-resistant coating that prevents degradation of the liquid metal while maintaining electrical conductivity. Their sensors feature integrated strain relief structures that accommodate thermal expansion differences between the liquid metal and surrounding materials. Testing has demonstrated consistent performance after exposure to automotive fluids including engine oil, transmission fluid, and coolant, with less than 2% change in electrical resistance after 3,000 hours of exposure. DENSO's liquid metal interconnects have shown particular success in powertrain applications where traditional wire bonds frequently fail due to extreme vibration.

Strengths: Exceptional resistance to vibration-induced failures; maintains consistent electrical properties across extreme temperature ranges; compatible with existing automotive manufacturing processes. Weaknesses: Requires specialized equipment for precise liquid metal deposition; higher initial component cost compared to traditional interconnects; potential for oxidation in improperly sealed systems over extended vehicle lifetimes.

Critical Patents and Research in Liquid Metal Reliability

Integrated antioxidant and sealant solution to address temperature humidity reliability issue of liquid metal interconnect

PatentPendingUS20240304506A1

Innovation

- Applying an antioxidant protective layer over the liquid metal to prevent oxidation, maintaining its liquid phase and electrical conductivity even in high temperature and humidity environments, using materials like sodium ascorbate, thiol, or other suitable antioxidants that form a thin, non-continuous oxide layer.

Self-healing cap for liquid metal containment in socket applications

PatentPendingUS20240363520A1

Innovation

- A hybrid cap layer is introduced, comprising a self-healing polymer embedded with woven or randomly distributed glass fibers, which provides enhanced dimensional stability and allows for multiple self-healing cycles without significant shape deformation, ensuring effective containment of liquid metal and preventing oxidation.

Environmental Impact and Sustainability Considerations

The environmental impact of liquid metal interconnects in automotive sensors represents a critical consideration as the automotive industry increasingly prioritizes sustainability. Gallium-based liquid metal alloys, commonly used in these interconnects, offer significant environmental advantages over traditional soldering materials containing lead or other toxic heavy metals. These liquid metals demonstrate lower toxicity profiles and reduced environmental persistence, aligning with global automotive manufacturing regulations such as the European Union's Restriction of Hazardous Substances (RoHS) directive.

Manufacturing processes for liquid metal interconnects generally require less energy compared to conventional high-temperature soldering techniques. This energy efficiency translates to a reduced carbon footprint across the production lifecycle. Additionally, the room-temperature processing capabilities of many liquid metal formulations eliminate the need for energy-intensive heating systems typically required in traditional interconnect manufacturing, further enhancing their environmental credentials.

The recyclability of liquid metal components presents another sustainability advantage. Unlike conventional electronic components that often require complex separation processes, liquid metals can be more readily recovered and reused. This characteristic supports circular economy principles increasingly adopted by automotive manufacturers seeking to minimize waste and resource consumption. However, comprehensive recycling infrastructure specifically designed for liquid metal recovery remains underdeveloped, presenting an opportunity for future industry development.

End-of-life considerations reveal both challenges and opportunities. While liquid metals offer potential for recovery, their containment systems must be properly designed to prevent environmental leaching. Gallium and indium, though less environmentally harmful than lead or mercury, still require responsible management to prevent ecosystem contamination. Automotive sensor designs incorporating liquid metal interconnects should therefore include consideration for eventual disassembly and material recovery.

The long-term reliability of liquid metal interconnects also contributes to sustainability through extended product lifecycles. Sensors that maintain functionality through extreme temperature variations and mechanical stress require less frequent replacement, reducing overall material consumption and electronic waste generation. This durability aspect represents a significant but often overlooked environmental benefit in automotive applications where component longevity directly impacts sustainability metrics.

Water usage and chemical management during manufacturing processes for liquid metal interconnects generally compare favorably to traditional soldering techniques that may require aggressive fluxes and cleaning agents. However, continued research into even more environmentally benign processing methods remains essential as automotive manufacturers face increasingly stringent environmental compliance requirements across global markets.

Manufacturing processes for liquid metal interconnects generally require less energy compared to conventional high-temperature soldering techniques. This energy efficiency translates to a reduced carbon footprint across the production lifecycle. Additionally, the room-temperature processing capabilities of many liquid metal formulations eliminate the need for energy-intensive heating systems typically required in traditional interconnect manufacturing, further enhancing their environmental credentials.

The recyclability of liquid metal components presents another sustainability advantage. Unlike conventional electronic components that often require complex separation processes, liquid metals can be more readily recovered and reused. This characteristic supports circular economy principles increasingly adopted by automotive manufacturers seeking to minimize waste and resource consumption. However, comprehensive recycling infrastructure specifically designed for liquid metal recovery remains underdeveloped, presenting an opportunity for future industry development.

End-of-life considerations reveal both challenges and opportunities. While liquid metals offer potential for recovery, their containment systems must be properly designed to prevent environmental leaching. Gallium and indium, though less environmentally harmful than lead or mercury, still require responsible management to prevent ecosystem contamination. Automotive sensor designs incorporating liquid metal interconnects should therefore include consideration for eventual disassembly and material recovery.

The long-term reliability of liquid metal interconnects also contributes to sustainability through extended product lifecycles. Sensors that maintain functionality through extreme temperature variations and mechanical stress require less frequent replacement, reducing overall material consumption and electronic waste generation. This durability aspect represents a significant but often overlooked environmental benefit in automotive applications where component longevity directly impacts sustainability metrics.

Water usage and chemical management during manufacturing processes for liquid metal interconnects generally compare favorably to traditional soldering techniques that may require aggressive fluxes and cleaning agents. However, continued research into even more environmentally benign processing methods remains essential as automotive manufacturers face increasingly stringent environmental compliance requirements across global markets.

Safety Standards and Certification Requirements

The automotive industry imposes stringent safety standards on all components used in vehicles, and liquid metal interconnects in automotive sensors must comply with these requirements to ensure market viability. ISO 26262, the international standard for functional safety in road vehicles, establishes a comprehensive framework that liquid metal interconnect technologies must adhere to. This standard categorizes safety requirements into Automotive Safety Integrity Levels (ASIL), ranging from A to D, with D representing the highest safety criticality. Liquid metal interconnects in critical sensing applications such as airbag deployment, brake systems, or autonomous driving functions would likely require ASIL C or D certification.

Beyond ISO 26262, liquid metal interconnects must also meet the requirements of SAE J3168 for reliability of automotive electronic components, which specifies environmental testing procedures including temperature cycling, vibration resistance, and humidity exposure. The AEC-Q100 qualification standard for integrated circuits in automotive applications provides additional testing protocols that manufacturers must follow to ensure reliability under extreme conditions.

Regional certification requirements add another layer of complexity. In the European Union, liquid metal interconnects must comply with the European New Car Assessment Programme (Euro NCAP) standards and the ECE regulations. In the United States, compliance with Federal Motor Vehicle Safety Standards (FMVSS) and National Highway Traffic Safety Administration (NHTSA) guidelines is mandatory. Asian markets, particularly Japan and China, have their own certification frameworks that must be navigated.

Environmental regulations also impact liquid metal interconnect development. The EU's Restriction of Hazardous Substances (RoHS) and End-of-Life Vehicle (ELV) directives restrict the use of certain hazardous materials, including some metals commonly used in liquid metal formulations. Similarly, the Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulation requires thorough documentation of chemical substances used in automotive components.

Electromagnetic compatibility (EMC) standards, including ISO 11452 and CISPR 25, present additional challenges for liquid metal interconnects, as these materials must not generate electromagnetic interference that could affect other vehicle systems. Furthermore, as automotive sensors increasingly support autonomous driving features, compliance with emerging standards like ISO/PAS 21448 (Safety of the Intended Functionality) becomes essential for ensuring reliable operation in all foreseeable scenarios.

Beyond ISO 26262, liquid metal interconnects must also meet the requirements of SAE J3168 for reliability of automotive electronic components, which specifies environmental testing procedures including temperature cycling, vibration resistance, and humidity exposure. The AEC-Q100 qualification standard for integrated circuits in automotive applications provides additional testing protocols that manufacturers must follow to ensure reliability under extreme conditions.

Regional certification requirements add another layer of complexity. In the European Union, liquid metal interconnects must comply with the European New Car Assessment Programme (Euro NCAP) standards and the ECE regulations. In the United States, compliance with Federal Motor Vehicle Safety Standards (FMVSS) and National Highway Traffic Safety Administration (NHTSA) guidelines is mandatory. Asian markets, particularly Japan and China, have their own certification frameworks that must be navigated.

Environmental regulations also impact liquid metal interconnect development. The EU's Restriction of Hazardous Substances (RoHS) and End-of-Life Vehicle (ELV) directives restrict the use of certain hazardous materials, including some metals commonly used in liquid metal formulations. Similarly, the Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulation requires thorough documentation of chemical substances used in automotive components.

Electromagnetic compatibility (EMC) standards, including ISO 11452 and CISPR 25, present additional challenges for liquid metal interconnects, as these materials must not generate electromagnetic interference that could affect other vehicle systems. Furthermore, as automotive sensors increasingly support autonomous driving features, compliance with emerging standards like ISO/PAS 21448 (Safety of the Intended Functionality) becomes essential for ensuring reliable operation in all foreseeable scenarios.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!