Liquid Metal Interconnect: Market Dynamics in Consumer Electronics

SEP 29, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Liquid Metal Interconnect Technology Evolution and Objectives

Liquid metal interconnect technology represents a significant evolution in the field of electronic connections, emerging from traditional metal soldering techniques that have dominated the industry for decades. The journey of this technology began with the exploration of gallium-based alloys in the early 2000s, which demonstrated unique properties of maintaining liquid state at room temperature while offering excellent electrical conductivity. This breakthrough opened new possibilities for flexible, self-healing electronic connections that were previously unattainable with conventional solid metal interconnects.

The technological trajectory has been marked by several key advancements, particularly in material composition refinement. Early liquid metal formulations faced challenges with oxidation and metal surface compatibility, limiting their practical applications. However, research breakthroughs around 2010-2015 led to improved gallium-indium-tin alloys (Galinstan) and gallium-indium eutectic (EGaIn) that demonstrated enhanced stability and reduced reactivity with common electronic materials.

Recent developments have focused on addressing the encapsulation challenges, with significant progress in polymer-based containment systems that prevent leakage while maintaining the beneficial properties of liquid metals. This has coincided with miniaturization efforts, enabling liquid metal integration into increasingly compact consumer electronic devices where traditional interconnect solutions face physical limitations.

The primary objective of liquid metal interconnect technology in consumer electronics is to overcome the fundamental limitations of rigid connections in an era demanding greater flexibility, durability, and performance. Specifically, the technology aims to enable truly flexible electronic devices that can withstand repeated bending and folding without connection failure—a critical requirement for next-generation foldable smartphones, wearable technology, and conformable electronics.

Another key objective is enhancing thermal management capabilities in high-performance consumer devices. Liquid metals offer superior thermal conductivity compared to conventional interconnect materials, potentially resolving heat dissipation challenges that currently limit processing power in compact devices like smartphones and ultrabook computers.

Looking forward, the technology roadmap includes objectives for achieving mass production compatibility, with particular focus on developing automated assembly processes that can reliably implement liquid metal interconnects at scale. Parallel efforts are directed toward long-term stability improvements, aiming to extend the operational lifespan of liquid metal connections to match or exceed that of traditional soldered joints, especially under variable environmental conditions and mechanical stress scenarios common in consumer electronic usage.

The technological trajectory has been marked by several key advancements, particularly in material composition refinement. Early liquid metal formulations faced challenges with oxidation and metal surface compatibility, limiting their practical applications. However, research breakthroughs around 2010-2015 led to improved gallium-indium-tin alloys (Galinstan) and gallium-indium eutectic (EGaIn) that demonstrated enhanced stability and reduced reactivity with common electronic materials.

Recent developments have focused on addressing the encapsulation challenges, with significant progress in polymer-based containment systems that prevent leakage while maintaining the beneficial properties of liquid metals. This has coincided with miniaturization efforts, enabling liquid metal integration into increasingly compact consumer electronic devices where traditional interconnect solutions face physical limitations.

The primary objective of liquid metal interconnect technology in consumer electronics is to overcome the fundamental limitations of rigid connections in an era demanding greater flexibility, durability, and performance. Specifically, the technology aims to enable truly flexible electronic devices that can withstand repeated bending and folding without connection failure—a critical requirement for next-generation foldable smartphones, wearable technology, and conformable electronics.

Another key objective is enhancing thermal management capabilities in high-performance consumer devices. Liquid metals offer superior thermal conductivity compared to conventional interconnect materials, potentially resolving heat dissipation challenges that currently limit processing power in compact devices like smartphones and ultrabook computers.

Looking forward, the technology roadmap includes objectives for achieving mass production compatibility, with particular focus on developing automated assembly processes that can reliably implement liquid metal interconnects at scale. Parallel efforts are directed toward long-term stability improvements, aiming to extend the operational lifespan of liquid metal connections to match or exceed that of traditional soldered joints, especially under variable environmental conditions and mechanical stress scenarios common in consumer electronic usage.

Consumer Electronics Market Demand Analysis for Liquid Metal Solutions

The consumer electronics market has demonstrated a significant shift towards more compact, powerful, and versatile devices over the past decade. This evolution has created substantial demand for advanced interconnect solutions that can accommodate increasingly complex internal architectures while maintaining reliability under various operating conditions. Liquid metal interconnects represent a revolutionary approach to addressing these challenges, offering superior electrical conductivity, thermal management capabilities, and mechanical flexibility compared to traditional solid metal connections.

Market research indicates that smartphone manufacturers are particularly interested in liquid metal interconnect technology, with an estimated demand growth rate outpacing traditional interconnect solutions. This interest stems from the persistent consumer demand for thinner devices with larger batteries and more processing power, creating engineering challenges that conventional interconnects struggle to solve efficiently. The foldable and flexible display segment presents an especially promising application area, where traditional rigid interconnects create reliability issues at flex points.

Wearable technology represents another high-growth segment driving demand for liquid metal solutions. As smartwatches, fitness trackers, and medical monitoring devices become more sophisticated while maintaining or reducing their form factors, the need for reliable, space-efficient interconnects becomes critical. The ability of liquid metal to conform to complex geometries while maintaining consistent electrical properties makes it particularly valuable in these applications.

The gaming hardware market has also shown interest in liquid metal solutions, primarily for thermal interface applications between processors and cooling systems. This segment values the superior thermal conductivity of liquid metals, which enables more effective heat dissipation from increasingly powerful gaming hardware. Market analysis suggests that high-end gaming laptops and consoles could be early adopters of more extensive liquid metal interconnect implementations.

Enterprise electronics, particularly in data center applications, represent a growing market for liquid metal interconnect technology. The continuous push for higher computing density and power efficiency in server environments creates thermal management challenges that liquid metal solutions are uniquely positioned to address. Market projections indicate that this segment could become a significant driver of liquid metal adoption as data center operators seek to optimize performance per watt metrics.

Consumer demand for more environmentally sustainable electronics is also influencing interconnect technology choices. Liquid metal solutions potentially offer advantages in recyclability and reduced use of rare earth elements compared to some conventional interconnect technologies, aligning with growing consumer preference for more environmentally responsible products.

Market research indicates that smartphone manufacturers are particularly interested in liquid metal interconnect technology, with an estimated demand growth rate outpacing traditional interconnect solutions. This interest stems from the persistent consumer demand for thinner devices with larger batteries and more processing power, creating engineering challenges that conventional interconnects struggle to solve efficiently. The foldable and flexible display segment presents an especially promising application area, where traditional rigid interconnects create reliability issues at flex points.

Wearable technology represents another high-growth segment driving demand for liquid metal solutions. As smartwatches, fitness trackers, and medical monitoring devices become more sophisticated while maintaining or reducing their form factors, the need for reliable, space-efficient interconnects becomes critical. The ability of liquid metal to conform to complex geometries while maintaining consistent electrical properties makes it particularly valuable in these applications.

The gaming hardware market has also shown interest in liquid metal solutions, primarily for thermal interface applications between processors and cooling systems. This segment values the superior thermal conductivity of liquid metals, which enables more effective heat dissipation from increasingly powerful gaming hardware. Market analysis suggests that high-end gaming laptops and consoles could be early adopters of more extensive liquid metal interconnect implementations.

Enterprise electronics, particularly in data center applications, represent a growing market for liquid metal interconnect technology. The continuous push for higher computing density and power efficiency in server environments creates thermal management challenges that liquid metal solutions are uniquely positioned to address. Market projections indicate that this segment could become a significant driver of liquid metal adoption as data center operators seek to optimize performance per watt metrics.

Consumer demand for more environmentally sustainable electronics is also influencing interconnect technology choices. Liquid metal solutions potentially offer advantages in recyclability and reduced use of rare earth elements compared to some conventional interconnect technologies, aligning with growing consumer preference for more environmentally responsible products.

Current Technological Landscape and Implementation Challenges

Liquid metal interconnect technology currently stands at a pivotal juncture in consumer electronics manufacturing. The landscape is characterized by significant advancements in gallium-based alloys, particularly Ga-In-Sn compositions, which demonstrate exceptional electrical conductivity while maintaining fluidity at room temperature. These properties have positioned liquid metal as a promising alternative to traditional copper and gold interconnects in flexible and wearable electronics.

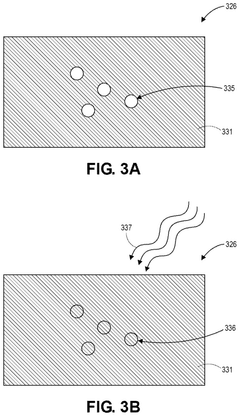

The implementation of liquid metal interconnects faces several critical challenges that have limited widespread commercial adoption. Foremost among these is the issue of oxidation, as gallium-based alloys rapidly form an oxide layer when exposed to air, affecting conductivity and long-term reliability. This necessitates sophisticated encapsulation techniques that add complexity to manufacturing processes.

Compatibility with existing semiconductor fabrication infrastructure presents another significant hurdle. Current production lines are optimized for solid metal deposition and patterning, requiring substantial modifications to accommodate liquid metal integration. The capital expenditure required for such transitions has deterred many manufacturers from early adoption despite the potential performance benefits.

Scalability remains a persistent challenge, particularly in achieving consistent deposition thickness and pattern resolution at high volumes. While laboratory demonstrations have shown impressive results in creating intricate circuits with liquid metal, translating these processes to mass production environments has proven difficult. The viscosity and surface tension properties that make liquid metals attractive also complicate their handling in automated manufacturing systems.

The geographical distribution of liquid metal interconnect technology development shows concentration in East Asia, particularly South Korea and China, where major electronics manufacturers have established dedicated research divisions. North American contributions are primarily from academic institutions and specialized startups, while European engagement focuses on niche applications in medical devices and automotive electronics.

Regulatory considerations add another layer of complexity, as some gallium alloys contain elements subject to environmental restrictions in certain markets. This has necessitated research into alternative compositions that maintain desirable electrical properties while meeting global compliance standards.

Cost factors currently position liquid metal interconnects at a premium compared to conventional solutions, with raw material expenses approximately 3-5 times higher than copper equivalents. However, this gap is narrowing as production volumes increase and recycling processes improve, suggesting a potential inflection point for broader adoption within the next 3-5 years if technical challenges can be adequately addressed.

The implementation of liquid metal interconnects faces several critical challenges that have limited widespread commercial adoption. Foremost among these is the issue of oxidation, as gallium-based alloys rapidly form an oxide layer when exposed to air, affecting conductivity and long-term reliability. This necessitates sophisticated encapsulation techniques that add complexity to manufacturing processes.

Compatibility with existing semiconductor fabrication infrastructure presents another significant hurdle. Current production lines are optimized for solid metal deposition and patterning, requiring substantial modifications to accommodate liquid metal integration. The capital expenditure required for such transitions has deterred many manufacturers from early adoption despite the potential performance benefits.

Scalability remains a persistent challenge, particularly in achieving consistent deposition thickness and pattern resolution at high volumes. While laboratory demonstrations have shown impressive results in creating intricate circuits with liquid metal, translating these processes to mass production environments has proven difficult. The viscosity and surface tension properties that make liquid metals attractive also complicate their handling in automated manufacturing systems.

The geographical distribution of liquid metal interconnect technology development shows concentration in East Asia, particularly South Korea and China, where major electronics manufacturers have established dedicated research divisions. North American contributions are primarily from academic institutions and specialized startups, while European engagement focuses on niche applications in medical devices and automotive electronics.

Regulatory considerations add another layer of complexity, as some gallium alloys contain elements subject to environmental restrictions in certain markets. This has necessitated research into alternative compositions that maintain desirable electrical properties while meeting global compliance standards.

Cost factors currently position liquid metal interconnects at a premium compared to conventional solutions, with raw material expenses approximately 3-5 times higher than copper equivalents. However, this gap is narrowing as production volumes increase and recycling processes improve, suggesting a potential inflection point for broader adoption within the next 3-5 years if technical challenges can be adequately addressed.

Contemporary Liquid Metal Interconnect Implementation Strategies

01 Liquid metal interconnect materials and compositions

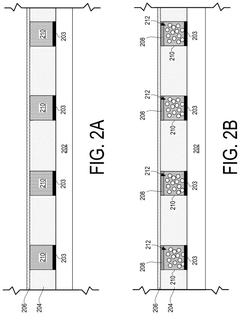

Liquid metal materials, such as gallium-based alloys, can be used as interconnects in electronic devices due to their excellent electrical conductivity and ability to maintain connectivity during mechanical deformation. These materials offer advantages including self-healing properties, flexibility, and the ability to form reliable electrical connections at low temperatures. Various compositions and formulations have been developed to optimize properties such as melting point, adhesion, and oxidation resistance.- Liquid metal interconnect materials and compositions: Liquid metal materials, such as gallium-based alloys, can be used as interconnects in electronic devices. These materials offer advantages including high electrical conductivity, thermal stability, and the ability to form reliable connections even under mechanical stress. The liquid nature allows for self-healing properties and adaptation to dimensional changes during thermal cycling, making them particularly valuable for flexible electronics applications.

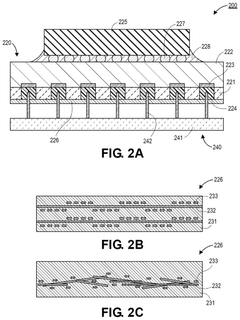

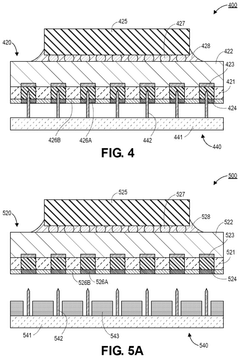

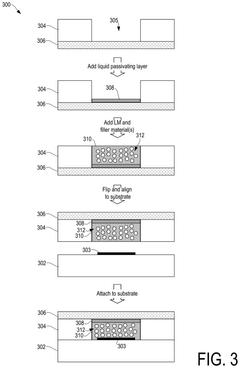

- Fabrication methods for liquid metal interconnects: Various techniques have been developed for fabricating liquid metal interconnects, including microfluidic injection, printing processes, and selective deposition methods. These processes enable precise placement of liquid metal within predefined channels or vias. Surface treatment methods can be employed to control wetting behavior and ensure proper confinement of the liquid metal within designated interconnect regions, preventing undesired spreading or leakage.

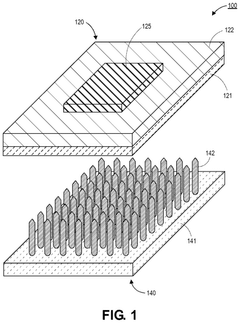

- Integration of liquid metal interconnects in semiconductor devices: Liquid metal interconnects can be integrated into semiconductor devices to provide electrical connections between different components or layers. This integration involves specialized encapsulation techniques to contain the liquid metal while maintaining its beneficial properties. The implementation may include creating channels, vias, or reservoirs within the semiconductor structure to house the liquid metal while ensuring compatibility with existing semiconductor manufacturing processes.

- Interconnect structures using liquid metal for improved reliability: Specialized interconnect structures have been designed to leverage the unique properties of liquid metals for enhanced reliability. These structures may incorporate containment features, wetting layers, or composite designs that combine liquid and solid elements. The resulting interconnects can better withstand thermal cycling, mechanical stress, and vibration compared to traditional solid interconnects, leading to improved device longevity and performance in harsh operating environments.

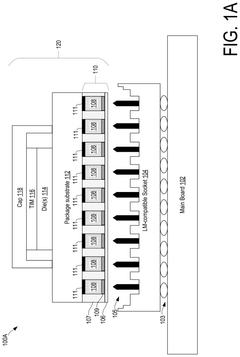

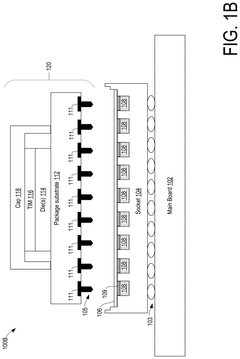

- Packaging technologies incorporating liquid metal interconnects: Advanced packaging technologies utilize liquid metal interconnects to address challenges in modern electronic assemblies. These include flip-chip configurations, 3D stacking, and system-in-package designs where liquid metal provides adaptable connections between components. The self-conforming nature of liquid metals enables accommodation of coefficient of thermal expansion mismatches between different materials, reducing stress and improving reliability in complex multi-material packages.

02 Manufacturing methods for liquid metal interconnects

Various manufacturing techniques have been developed for creating liquid metal interconnects, including printing, injection, encapsulation, and patterning methods. These processes enable precise placement and confinement of liquid metals within electronic structures. Advanced techniques include microfluidic delivery systems, template-assisted deposition, and surface treatment methods to control wetting and adhesion properties of liquid metals on different substrate materials.Expand Specific Solutions03 Integration of liquid metal interconnects in semiconductor devices

Liquid metal interconnects can be integrated into semiconductor devices to create reliable electrical connections between components. This integration involves specialized techniques for interfacing liquid metals with traditional semiconductor materials and addressing challenges related to thermal management, electrical performance, and mechanical stability. Applications include advanced packaging, 3D integration, and high-performance computing devices where conventional interconnects face limitations.Expand Specific Solutions04 Flexible and stretchable liquid metal interconnect systems

Liquid metals enable the creation of flexible and stretchable interconnect systems that can maintain electrical connectivity during bending, stretching, and other mechanical deformations. These systems typically incorporate liquid metals within elastomeric substrates or microchannels to create compliant electrical pathways. Applications include wearable electronics, soft robotics, and medical devices where traditional rigid interconnects would fail under mechanical stress.Expand Specific Solutions05 Reliability and performance enhancement techniques

Various methods have been developed to enhance the reliability and performance of liquid metal interconnects, including encapsulation strategies to prevent oxidation and leakage, surface treatments to improve adhesion and wetting characteristics, and composite approaches that combine liquid metals with other materials. These techniques address challenges such as thermal cycling stability, electromigration resistance, and long-term reliability in diverse operating environments.Expand Specific Solutions

Leading Companies and Competitive Landscape Analysis

The liquid metal interconnect market in consumer electronics is currently in a growth phase, with increasing demand driven by miniaturization trends and flexible device requirements. Market size is expanding rapidly as major players like Apple, Samsung, and Intel explore applications in next-generation electronics. Technologically, the field remains in early-to-mid maturity, with significant R&D ongoing. Leading companies demonstrate varying levels of advancement: Intel and TSMC focus on high-performance computing applications, Apple and Samsung target consumer device integration, while academic institutions like MIT and Tsinghua University contribute fundamental research. Specialized materials firms like Indium Corporation provide essential components, creating a diverse competitive landscape balancing established semiconductor giants with innovative materials specialists.

Apple, Inc.

Technical Solution: Apple has pioneered liquid metal interconnect technology in consumer electronics through its exclusive licensing agreement with Liquidmetal Technologies. The company has developed proprietary manufacturing processes that allow for the creation of ultra-thin, highly conductive liquid metal pathways between components. Apple's implementation focuses on miniaturization and reliability, using liquid metal alloys (primarily zirconium-based) that remain amorphous at room temperature while offering electrical conductivity comparable to traditional copper interconnects. Their approach involves precision deposition techniques that enable the creation of self-healing interconnects that can reform after mechanical stress, addressing a key failure point in conventional electronics. Apple has integrated this technology into several product lines to reduce internal space requirements while improving signal integrity and power efficiency.

Strengths: Proprietary manufacturing processes provide competitive advantage; enables thinner device profiles; self-healing properties improve durability and product lifespan. Weaknesses: Higher production costs compared to traditional interconnects; requires specialized equipment; limited scalability for mass production.

Sony Group Corp.

Technical Solution: Sony has developed a proprietary liquid metal interconnect technology called "LiquidLink" specifically designed for high-performance consumer electronics requiring exceptional thermal management. Their approach utilizes eutectic gallium-indium-tin alloys with nano-engineered surface treatments that enhance wetting properties and prevent oxidation. Sony's implementation focuses on creating thermally responsive interconnects that can efficiently transfer both electrical signals and heat, addressing two critical challenges in modern electronics simultaneously. The manufacturing process involves precision micro-dispensing systems that can create interconnect patterns with feature sizes below 50 microns. Sony has integrated this technology into their premium audio equipment and gaming consoles, where it provides superior electrical performance while helping manage heat dissipation from high-power components. Their research has demonstrated up to 40% improvement in thermal conductivity compared to traditional copper interconnects while maintaining comparable electrical properties.

Strengths: Dual functionality as both electrical and thermal conductor; excellent performance in high-power density applications; compatible with existing manufacturing infrastructure. Weaknesses: More complex quality control requirements; higher material costs; potential for phase separation in certain environmental conditions.

Critical Patents and Technical Innovations in Liquid Metal Interconnects

Self-healing cap for liquid metal containment in socket applications

PatentPendingUS20240363520A1

Innovation

- A hybrid cap layer is introduced, comprising a self-healing polymer embedded with woven or randomly distributed glass fibers, which provides enhanced dimensional stability and allows for multiple self-healing cycles without significant shape deformation, ensuring effective containment of liquid metal and preventing oxidation.

Liquid metal socket interconnects with liquid passivation layer and filler materials

PatentPendingUS20250079278A1

Innovation

- Implementation of a liquid passivation layer, such as mineral oil or paraffin wax, within the LM wells to prevent sticking and oxide formation, along with inert filler materials to reduce LM usage and costs.

Supply Chain Considerations for Liquid Metal Integration

The integration of liquid metal interconnect technology into consumer electronics manufacturing requires a robust and specialized supply chain framework. Current supply chains are primarily optimized for traditional soldering and copper-based interconnect technologies, necessitating significant adaptations for liquid metal implementation. Material sourcing presents the first critical challenge, as gallium-based alloys require specialized mining and refinement processes with limited global suppliers concentrated in China, which controls approximately 95% of the world's gallium production, creating potential geopolitical vulnerabilities.

Processing and handling infrastructure represents another substantial hurdle, as liquid metals demand specialized equipment for storage, dispensing, and integration that differs markedly from conventional electronics manufacturing setups. The thixotropic properties of these materials necessitate precise temperature control systems and specialized dispensing mechanisms that few contract manufacturers currently possess. This equipment gap creates significant barriers to entry for smaller manufacturers and increases dependency on a limited number of specialized facilities.

Quality control and testing methodologies for liquid metal interconnects remain underdeveloped compared to traditional soldering techniques. The industry lacks standardized testing protocols for verifying connection integrity, long-term reliability, and performance under various environmental conditions. This testing infrastructure gap increases production risks and potentially extends development timelines for consumer electronics manufacturers adopting this technology.

Logistics considerations also present unique challenges, as gallium-based alloys require temperature-controlled transportation and specialized containment systems to prevent oxidation and contamination. These requirements increase shipping costs and complexity compared to conventional electronic components, potentially affecting just-in-time manufacturing models prevalent in consumer electronics production.

Workforce development represents a frequently overlooked supply chain consideration, as liquid metal integration requires specialized training for manufacturing personnel. The handling techniques, quality assessment methods, and safety protocols differ substantially from traditional interconnect technologies, necessitating investment in workforce education and certification programs to ensure proper implementation.

Regulatory compliance adds another layer of complexity, particularly regarding environmental considerations and end-of-life product management. While gallium-based alloys offer potential sustainability advantages over lead-based solders, recycling infrastructure for these materials remains underdeveloped, creating potential bottlenecks in circular economy initiatives for consumer electronics manufacturers committed to sustainability goals.

Processing and handling infrastructure represents another substantial hurdle, as liquid metals demand specialized equipment for storage, dispensing, and integration that differs markedly from conventional electronics manufacturing setups. The thixotropic properties of these materials necessitate precise temperature control systems and specialized dispensing mechanisms that few contract manufacturers currently possess. This equipment gap creates significant barriers to entry for smaller manufacturers and increases dependency on a limited number of specialized facilities.

Quality control and testing methodologies for liquid metal interconnects remain underdeveloped compared to traditional soldering techniques. The industry lacks standardized testing protocols for verifying connection integrity, long-term reliability, and performance under various environmental conditions. This testing infrastructure gap increases production risks and potentially extends development timelines for consumer electronics manufacturers adopting this technology.

Logistics considerations also present unique challenges, as gallium-based alloys require temperature-controlled transportation and specialized containment systems to prevent oxidation and contamination. These requirements increase shipping costs and complexity compared to conventional electronic components, potentially affecting just-in-time manufacturing models prevalent in consumer electronics production.

Workforce development represents a frequently overlooked supply chain consideration, as liquid metal integration requires specialized training for manufacturing personnel. The handling techniques, quality assessment methods, and safety protocols differ substantially from traditional interconnect technologies, necessitating investment in workforce education and certification programs to ensure proper implementation.

Regulatory compliance adds another layer of complexity, particularly regarding environmental considerations and end-of-life product management. While gallium-based alloys offer potential sustainability advantages over lead-based solders, recycling infrastructure for these materials remains underdeveloped, creating potential bottlenecks in circular economy initiatives for consumer electronics manufacturers committed to sustainability goals.

Environmental and Recyclability Aspects of Liquid Metal Technologies

The environmental impact of liquid metal technologies in consumer electronics represents a critical consideration as these materials gain traction in interconnect applications. Gallium-based liquid metals, particularly gallium-indium alloys (GaIn), demonstrate significant environmental advantages over traditional soldering materials like lead-based or even lead-free alternatives. These liquid metals are non-toxic and pose minimal health risks during manufacturing, usage, and disposal phases, contrasting sharply with the well-documented environmental hazards associated with lead-based solders.

Recyclability presents a compelling advantage for liquid metal interconnects. The relatively low melting points of gallium alloys (typically below 30°C) facilitate easy separation and recovery during the recycling process. This characteristic enables more efficient recovery of valuable components from electronic waste compared to conventional soldering technologies that require high-temperature processing with associated energy costs and potential toxic emissions.

The life cycle assessment (LCA) of liquid metal interconnects reveals promising sustainability metrics. Manufacturing processes for gallium-based liquid metals generally require less energy than traditional solder production, resulting in a reduced carbon footprint. Additionally, the room-temperature application of these materials eliminates the need for energy-intensive heating during assembly processes, further enhancing their environmental profile in consumer electronics manufacturing.

Regulatory frameworks worldwide are increasingly emphasizing electronic waste management and hazardous substance reduction. Liquid metal technologies align well with directives such as the European Union's Restriction of Hazardous Substances (RoHS) and Waste Electrical and Electronic Equipment (WEEE) regulations. As environmental compliance becomes more stringent globally, manufacturers adopting liquid metal interconnects may gain competitive advantages through simplified regulatory compliance and reduced environmental liability.

Resource sustainability represents another critical dimension. While gallium is not considered rare in absolute terms, its production is primarily tied to aluminum refining as a byproduct. Current global production capacity may face challenges if liquid metal adoption accelerates rapidly across the consumer electronics sector. Industry stakeholders are exploring more efficient extraction methods and investigating alternative liquid metal formulations that utilize more abundant elements to ensure long-term supply chain sustainability.

End-of-life considerations for liquid metal interconnects demonstrate promising characteristics for circular economy models. The reversible nature of these interconnects—their ability to transition between solid and liquid states at relatively low temperatures—creates opportunities for product designs that facilitate disassembly, repair, and component reuse. This property could significantly extend product lifecycles and reduce electronic waste generation, addressing a major environmental challenge in the consumer electronics industry.

Recyclability presents a compelling advantage for liquid metal interconnects. The relatively low melting points of gallium alloys (typically below 30°C) facilitate easy separation and recovery during the recycling process. This characteristic enables more efficient recovery of valuable components from electronic waste compared to conventional soldering technologies that require high-temperature processing with associated energy costs and potential toxic emissions.

The life cycle assessment (LCA) of liquid metal interconnects reveals promising sustainability metrics. Manufacturing processes for gallium-based liquid metals generally require less energy than traditional solder production, resulting in a reduced carbon footprint. Additionally, the room-temperature application of these materials eliminates the need for energy-intensive heating during assembly processes, further enhancing their environmental profile in consumer electronics manufacturing.

Regulatory frameworks worldwide are increasingly emphasizing electronic waste management and hazardous substance reduction. Liquid metal technologies align well with directives such as the European Union's Restriction of Hazardous Substances (RoHS) and Waste Electrical and Electronic Equipment (WEEE) regulations. As environmental compliance becomes more stringent globally, manufacturers adopting liquid metal interconnects may gain competitive advantages through simplified regulatory compliance and reduced environmental liability.

Resource sustainability represents another critical dimension. While gallium is not considered rare in absolute terms, its production is primarily tied to aluminum refining as a byproduct. Current global production capacity may face challenges if liquid metal adoption accelerates rapidly across the consumer electronics sector. Industry stakeholders are exploring more efficient extraction methods and investigating alternative liquid metal formulations that utilize more abundant elements to ensure long-term supply chain sustainability.

End-of-life considerations for liquid metal interconnects demonstrate promising characteristics for circular economy models. The reversible nature of these interconnects—their ability to transition between solid and liquid states at relatively low temperatures—creates opportunities for product designs that facilitate disassembly, repair, and component reuse. This property could significantly extend product lifecycles and reduce electronic waste generation, addressing a major environmental challenge in the consumer electronics industry.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!