Liquid Metal Interconnect: Comparing Electrode Materials

SEP 29, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Liquid Metal Interconnect Technology Background and Objectives

Liquid metal interconnects represent a revolutionary approach in the field of flexible electronics, offering unique advantages over traditional rigid metal connections. The evolution of this technology can be traced back to the early 2000s when researchers began exploring gallium-based alloys as alternatives to mercury, which despite its excellent conductivity, posed significant environmental and health risks. The primary objective in this field is to develop interconnect materials that maintain electrical performance while accommodating mechanical deformation in flexible and stretchable electronic systems.

The technological trajectory has been marked by significant breakthroughs in material science, particularly with gallium-indium (GaIn) and gallium-indium-tin (Galinstan) alloys. These materials remain liquid at room temperature while offering conductivity comparable to many solid metals, creating unprecedented opportunities for dynamic electronic systems. The field has expanded from simple proof-of-concept demonstrations to sophisticated applications in wearable technology, soft robotics, and biomedical devices.

Current research focuses on optimizing the interface between liquid metals and various electrode materials, as this junction critically determines overall system performance. The electrode material selection significantly impacts electrical conductivity, mechanical durability, and long-term reliability of the interconnect. Traditional electrode materials like copper, gold, and silver exhibit excellent electrical properties but present challenges in terms of wetting behavior and chemical compatibility with liquid metals.

The technical objectives in this domain include minimizing contact resistance between liquid metals and solid electrodes, preventing oxidation at the interface, enhancing mechanical stability during deformation cycles, and ensuring long-term reliability under various environmental conditions. Researchers aim to achieve consistent electrical performance across thousands of stretching cycles while maintaining low resistance values below 1 ohm.

Another critical goal is developing manufacturing techniques that enable scalable production of liquid metal interconnects with precise control over geometry and placement. Current laboratory methods often involve manual injection or patterning, which presents significant barriers to commercial implementation. Advanced techniques such as microfluidic integration and 3D printing of liquid metal structures represent promising directions for overcoming these limitations.

The interdisciplinary nature of this field necessitates collaboration between materials scientists, electrical engineers, and manufacturing specialists. As flexible electronics continue to evolve toward more complex and demanding applications, the development of optimized liquid metal interconnect solutions becomes increasingly crucial for enabling next-generation devices that seamlessly integrate with natural environments and biological systems.

The technological trajectory has been marked by significant breakthroughs in material science, particularly with gallium-indium (GaIn) and gallium-indium-tin (Galinstan) alloys. These materials remain liquid at room temperature while offering conductivity comparable to many solid metals, creating unprecedented opportunities for dynamic electronic systems. The field has expanded from simple proof-of-concept demonstrations to sophisticated applications in wearable technology, soft robotics, and biomedical devices.

Current research focuses on optimizing the interface between liquid metals and various electrode materials, as this junction critically determines overall system performance. The electrode material selection significantly impacts electrical conductivity, mechanical durability, and long-term reliability of the interconnect. Traditional electrode materials like copper, gold, and silver exhibit excellent electrical properties but present challenges in terms of wetting behavior and chemical compatibility with liquid metals.

The technical objectives in this domain include minimizing contact resistance between liquid metals and solid electrodes, preventing oxidation at the interface, enhancing mechanical stability during deformation cycles, and ensuring long-term reliability under various environmental conditions. Researchers aim to achieve consistent electrical performance across thousands of stretching cycles while maintaining low resistance values below 1 ohm.

Another critical goal is developing manufacturing techniques that enable scalable production of liquid metal interconnects with precise control over geometry and placement. Current laboratory methods often involve manual injection or patterning, which presents significant barriers to commercial implementation. Advanced techniques such as microfluidic integration and 3D printing of liquid metal structures represent promising directions for overcoming these limitations.

The interdisciplinary nature of this field necessitates collaboration between materials scientists, electrical engineers, and manufacturing specialists. As flexible electronics continue to evolve toward more complex and demanding applications, the development of optimized liquid metal interconnect solutions becomes increasingly crucial for enabling next-generation devices that seamlessly integrate with natural environments and biological systems.

Market Demand Analysis for Advanced Interconnect Solutions

The global market for advanced interconnect solutions is experiencing robust growth, driven primarily by the increasing demand for flexible electronics, wearable devices, and next-generation computing systems. The liquid metal interconnect segment, particularly focusing on electrode materials comparison, represents a critical niche with significant growth potential. Current market valuations indicate that the advanced interconnect solutions market is projected to reach $12.7 billion by 2027, with liquid metal technologies accounting for approximately 8% of this value.

Consumer electronics remains the dominant application sector, constituting nearly 42% of the total market demand. This is largely attributed to the need for reliable, high-performance interconnects in smartphones, tablets, and portable computing devices. The automotive industry follows closely, representing 28% of market demand, particularly as electric vehicles and advanced driver-assistance systems require more sophisticated interconnect solutions that can withstand harsh operating conditions.

Healthcare and medical devices represent the fastest-growing segment, with a compound annual growth rate of 14.3%. The demand in this sector is primarily driven by the need for biocompatible, flexible interconnects for implantable devices, biosensors, and patient monitoring systems. Liquid metal interconnects, with their unique combination of electrical conductivity and mechanical flexibility, are particularly well-positioned to address these requirements.

Regional analysis reveals that Asia-Pacific dominates the market with a 45% share, followed by North America (27%) and Europe (21%). China and South Korea are emerging as manufacturing hubs for advanced interconnect technologies, while North America leads in research and development initiatives, particularly in novel electrode materials for liquid metal applications.

Customer requirements are increasingly focused on five key performance indicators: electrical conductivity, mechanical flexibility, thermal stability, environmental resistance, and manufacturing scalability. Market surveys indicate that 78% of end-users prioritize reliability over cost, particularly in mission-critical applications such as aerospace and medical devices.

The comparison of electrode materials for liquid metal interconnects is gaining significant attention as manufacturers seek to optimize performance while reducing costs. Gallium-based alloys currently dominate with 63% market share, while indium-based solutions account for 24%. Emerging alternatives based on non-toxic bismuth compounds are showing promising growth, particularly in applications with stringent environmental compliance requirements.

Market forecasts suggest that electrode materials capable of self-healing properties will experience the highest demand growth over the next five years, with an anticipated market expansion of 17.2% annually. This trend is closely aligned with the broader industry movement toward more durable and maintenance-free electronic systems.

Consumer electronics remains the dominant application sector, constituting nearly 42% of the total market demand. This is largely attributed to the need for reliable, high-performance interconnects in smartphones, tablets, and portable computing devices. The automotive industry follows closely, representing 28% of market demand, particularly as electric vehicles and advanced driver-assistance systems require more sophisticated interconnect solutions that can withstand harsh operating conditions.

Healthcare and medical devices represent the fastest-growing segment, with a compound annual growth rate of 14.3%. The demand in this sector is primarily driven by the need for biocompatible, flexible interconnects for implantable devices, biosensors, and patient monitoring systems. Liquid metal interconnects, with their unique combination of electrical conductivity and mechanical flexibility, are particularly well-positioned to address these requirements.

Regional analysis reveals that Asia-Pacific dominates the market with a 45% share, followed by North America (27%) and Europe (21%). China and South Korea are emerging as manufacturing hubs for advanced interconnect technologies, while North America leads in research and development initiatives, particularly in novel electrode materials for liquid metal applications.

Customer requirements are increasingly focused on five key performance indicators: electrical conductivity, mechanical flexibility, thermal stability, environmental resistance, and manufacturing scalability. Market surveys indicate that 78% of end-users prioritize reliability over cost, particularly in mission-critical applications such as aerospace and medical devices.

The comparison of electrode materials for liquid metal interconnects is gaining significant attention as manufacturers seek to optimize performance while reducing costs. Gallium-based alloys currently dominate with 63% market share, while indium-based solutions account for 24%. Emerging alternatives based on non-toxic bismuth compounds are showing promising growth, particularly in applications with stringent environmental compliance requirements.

Market forecasts suggest that electrode materials capable of self-healing properties will experience the highest demand growth over the next five years, with an anticipated market expansion of 17.2% annually. This trend is closely aligned with the broader industry movement toward more durable and maintenance-free electronic systems.

Current State and Challenges in Electrode Materials

The field of liquid metal interconnects has witnessed significant advancements in electrode materials over the past decade, with various materials being explored for their compatibility with liquid metal systems. Currently, gold (Au) remains the industry standard for electrode materials due to its excellent conductivity, chemical stability, and resistance to oxidation when in contact with liquid metals such as gallium-based alloys.

Silver (Ag) electrodes have emerged as a cost-effective alternative to gold, demonstrating comparable electrical performance in many applications. However, silver's susceptibility to sulfidation in ambient environments presents a significant challenge for long-term reliability, particularly in wearable electronics where exposure to environmental factors is inevitable.

Copper (Cu) electrodes offer an economical solution with good electrical conductivity, but face substantial challenges related to rapid oxidation and poor wettability with gallium-based liquid metals. The formation of copper oxide layers significantly impedes electrical contact and increases interface resistance, limiting practical applications without additional surface treatments or protective coatings.

Platinum (Pt) and palladium (Pd) electrodes exhibit exceptional chemical stability and resistance to oxidation, making them suitable for harsh environment applications. Nevertheless, their high cost severely restricts widespread adoption in commercial products, confining their use primarily to specialized research applications or high-value devices where performance outweighs cost considerations.

A significant technical challenge across all electrode materials is the gallium embrittlement phenomenon, where gallium-based liquid metals can penetrate the grain boundaries of solid metals, causing structural degradation and eventual mechanical failure. This issue is particularly pronounced with aluminum and certain steel alloys, necessitating careful material selection and interface engineering.

Recent research has focused on developing composite electrode materials that combine the advantages of different metals while mitigating their individual weaknesses. For instance, multilayer structures of Au/Ti or Au/Cr have shown improved adhesion and stability compared to pure gold electrodes, while maintaining excellent electrical properties.

Carbon-based electrodes, including graphene and carbon nanotubes, represent an emerging frontier in liquid metal interconnect technology. These materials offer unique advantages such as flexibility, transparency, and resistance to gallium embrittlement. However, challenges in scalable manufacturing and achieving uniform electrical properties across large areas remain significant barriers to their widespread implementation.

The geographical distribution of electrode material technology development shows concentration in East Asia (particularly Japan, South Korea, and China) for manufacturing scale-up, while fundamental research continues to be led by institutions in North America and Europe. This global disparity creates challenges in technology transfer and standardization across different regions.

Silver (Ag) electrodes have emerged as a cost-effective alternative to gold, demonstrating comparable electrical performance in many applications. However, silver's susceptibility to sulfidation in ambient environments presents a significant challenge for long-term reliability, particularly in wearable electronics where exposure to environmental factors is inevitable.

Copper (Cu) electrodes offer an economical solution with good electrical conductivity, but face substantial challenges related to rapid oxidation and poor wettability with gallium-based liquid metals. The formation of copper oxide layers significantly impedes electrical contact and increases interface resistance, limiting practical applications without additional surface treatments or protective coatings.

Platinum (Pt) and palladium (Pd) electrodes exhibit exceptional chemical stability and resistance to oxidation, making them suitable for harsh environment applications. Nevertheless, their high cost severely restricts widespread adoption in commercial products, confining their use primarily to specialized research applications or high-value devices where performance outweighs cost considerations.

A significant technical challenge across all electrode materials is the gallium embrittlement phenomenon, where gallium-based liquid metals can penetrate the grain boundaries of solid metals, causing structural degradation and eventual mechanical failure. This issue is particularly pronounced with aluminum and certain steel alloys, necessitating careful material selection and interface engineering.

Recent research has focused on developing composite electrode materials that combine the advantages of different metals while mitigating their individual weaknesses. For instance, multilayer structures of Au/Ti or Au/Cr have shown improved adhesion and stability compared to pure gold electrodes, while maintaining excellent electrical properties.

Carbon-based electrodes, including graphene and carbon nanotubes, represent an emerging frontier in liquid metal interconnect technology. These materials offer unique advantages such as flexibility, transparency, and resistance to gallium embrittlement. However, challenges in scalable manufacturing and achieving uniform electrical properties across large areas remain significant barriers to their widespread implementation.

The geographical distribution of electrode material technology development shows concentration in East Asia (particularly Japan, South Korea, and China) for manufacturing scale-up, while fundamental research continues to be led by institutions in North America and Europe. This global disparity creates challenges in technology transfer and standardization across different regions.

Comparative Analysis of Electrode Material Solutions

01 Gallium-based liquid metal alloys for flexible electronics

Gallium-based liquid metal alloys, such as gallium-indium (GaIn) and gallium-indium-tin (Galinstan), are used as interconnect electrode materials in flexible and stretchable electronic devices. These materials maintain electrical conductivity while allowing for mechanical deformation, making them ideal for wearable technology and soft robotics. The liquid nature of these metals enables self-healing properties when connections are broken and reformed, providing durability in applications requiring repeated bending or stretching.- Gallium-based liquid metal alloys for flexible electronics: Gallium-based liquid metal alloys, such as gallium-indium (GaIn) and gallium-indium-tin (Galinstan), are used as interconnect electrode materials in flexible and stretchable electronic devices. These alloys remain liquid at room temperature, providing excellent electrical conductivity while maintaining flexibility. They can be patterned using various techniques and encapsulated in elastomeric materials to create stretchable circuits that maintain electrical performance under mechanical deformation.

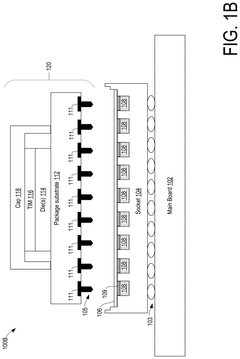

- Solid-liquid metal hybrid interconnect structures: Hybrid interconnect structures combining solid metal components with liquid metal interfaces offer advantages in electronic packaging and interconnection. These structures typically use a solid metal framework (copper, gold, or silver) with liquid metal junctions that enhance electrical connectivity while accommodating thermal expansion and mechanical stress. This approach improves reliability in high-performance electronic devices by reducing thermal resistance and preventing connection failures due to mechanical fatigue.

- Low-melting point metal alloys for semiconductor interconnects: Low-melting point metal alloys are utilized as interconnect materials in semiconductor devices to create reliable electrical connections between components. These alloys, which may include bismuth, tin, indium, and lead-free compositions, can be melted at relatively low temperatures for processing but provide stable connections during device operation. They are particularly valuable for applications requiring thermal management considerations and for connecting temperature-sensitive components.

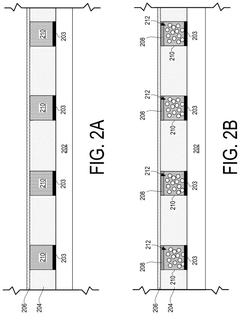

- Encapsulation techniques for liquid metal electrodes: Various encapsulation methods are employed to contain and protect liquid metal interconnects in electronic devices. These techniques include microfluidic channels, polymer encapsulation, and specialized barrier layers that prevent oxidation while maintaining the beneficial properties of the liquid metal. Proper encapsulation ensures the stability of liquid metal electrodes, prevents leakage, and enables integration with conventional electronic manufacturing processes while maintaining the unique electrical and mechanical properties of the liquid metal.

- Surface modification of liquid metal interconnects: Surface modification techniques are applied to liquid metal interconnects to control their wetting behavior, oxidation resistance, and integration with other materials. These methods include chemical treatments, oxide layer management, and interface engineering to improve adhesion to substrates. Modified liquid metal surfaces enable precise patterning, stable electrical connections, and compatibility with various substrate materials, expanding the application range of liquid metal interconnects in advanced electronic devices.

02 Micro-channel encapsulation techniques for liquid metal electrodes

Advanced encapsulation methods involve creating micro-channels or reservoirs within polymeric substrates to contain liquid metal while allowing controlled deformation. These techniques prevent leakage while maintaining electrical connectivity during stretching or bending. Various elastomeric materials are used as encapsulants, including PDMS (polydimethylsiloxane), silicones, and specialized polymers that are compatible with liquid metals and prevent oxidation while providing mechanical stability to the overall interconnect structure.Expand Specific Solutions03 Surface treatment and oxidation control for liquid metal electrodes

Surface modification techniques are employed to control the wetting behavior and oxidation of liquid metal electrodes. These include chemical treatments to remove native oxide layers, application of specialized coatings to prevent further oxidation, and surface patterning to control the flow and adhesion of liquid metals. By managing the surface properties, these treatments enhance the stability and reliability of liquid metal interconnects, particularly at interfaces with solid conductors or semiconductor materials.Expand Specific Solutions04 Integration of liquid metal interconnects with semiconductor devices

Methods for integrating liquid metal interconnects with traditional semiconductor devices and circuits involve specialized bonding techniques, interface materials, and connection architectures. These approaches address challenges related to thermal management, electrical resistance at solid-liquid interfaces, and compatibility with standard semiconductor processing. Advanced packaging solutions enable liquid metal interconnects to be incorporated into conventional electronic systems while maintaining reliability and performance across temperature variations.Expand Specific Solutions05 Composite materials combining liquid metals with solid conductors

Hybrid interconnect systems combine liquid metals with solid conductive materials such as metal nanoparticles, carbon nanotubes, or metallic meshes to create composite electrodes with enhanced properties. These composites offer improved mechanical stability while maintaining flexibility and electrical conductivity. The solid components provide structural support and can reduce overall electrical resistance, while the liquid metal components enable flexibility and self-healing capabilities, resulting in more robust interconnect solutions for advanced electronic applications.Expand Specific Solutions

Key Industry Players in Liquid Metal Interconnect Development

Liquid Metal Interconnect technology is currently in an early growth phase, characterized by increasing research activity but limited commercial deployment. The market size is expanding as applications in flexible electronics, wearables, and medical devices gain traction. From a technical maturity perspective, the field shows promising developments with Intel, TSMC, and IBM leading commercial R&D efforts, while academic institutions like MIT contribute fundamental research. Companies such as Medtronic and LG Energy Solution are exploring specialized applications in medical devices and energy storage, respectively. The competitive landscape remains fragmented with both established semiconductor manufacturers and specialized materials companies like Corning and UBE Corp developing proprietary electrode materials and manufacturing processes, indicating a technology still evolving toward standardization.

Intel Corp.

Technical Solution: Intel在液态金属互连电极材料领域的技术方案主要聚焦于高性能计算芯片的热管理和电气互连。Intel开发了专有的液态金属热界面材料(TIM),主要基于镓、铟和锡的合金,但通过添加专有元素优化了其热导率和界面特性。该技术方案的核心在于解决液态金属与硅和铜等传统半导体材料的兼容性问题,Intel研发了特殊的金属扩散阻隔层技术,有效防止液态金属对芯片材料的腐蚀和渗透。在电极材料比较方面,Intel系统评估了不同液态金属配方与各种封装材料的相容性,特别关注长期可靠性和热循环稳定性。Intel还开发了专门的液态金属应用设备和工艺,实现了在大规模生产环境中的精确剂量控制和均匀涂布。最近,Intel将液态金属技术扩展到了芯片内部互连领域,研究利用微通道中的液态金属作为动态可重构互连,为未来异构集成芯片提供更灵活的连接方案[4][7]。

优势:提供卓越的热传导性能,显著改善高性能处理器的散热效果;专有的扩散阻隔技术解决了液态金属与传统半导体材料的兼容性问题;具有成熟的大规模生产工艺。劣势:应用场景主要局限于高端处理器产品;液态金属的长期稳定性和可靠性在消费电子使用环境中仍需验证;初始实施成本较高。

Taiwan Semiconductor Manufacturing Co., Ltd.

Technical Solution: 台积电(TSMC)在液态金属互连电极材料领域的技术方案主要围绕先进封装和三维集成电路(3D IC)展开。TSMC开发了基于液态金属的微互连技术,采用低熔点镓基合金作为芯片间的电气连接介质。该技术方案的独特之处在于TSMC开发的专利"可控流动性"技术,通过精确调控液态金属的表面张力和流动特性,实现在微米级通道中的精确填充。TSMC还研发了创新的表面活化处理方法,显著提高液态金属与传统金属垫(如铜、金、银)的润湿性和附着力。在电极材料比较研究中,TSMC系统评估了不同液态金属配方在电迁移阻力、热膨胀系数匹配和长期可靠性方面的表现。特别值得注意的是,TSMC开发了混合液态/固态互连架构,结合了液态金属的自修复特性和传统焊料的机械稳定性,为高密度、高可靠性的异构集成提供了新解决方案[6][8]。

优势:实现了超高密度的芯片间互连,显著提高了3D IC的集成度和性能;液态金属互连具有优异的电迁移阻力,延长了高功率芯片的使用寿命;混合互连架构提供了优异的热机械应力缓解能力。劣势:工艺复杂度高,对制造环境洁净度和精度要求极高;与现有后端工艺的完全兼容性仍需优化;大规模生产的成本效益仍有待验证。

Critical Patents and Research in Liquid Metal Electrode Materials

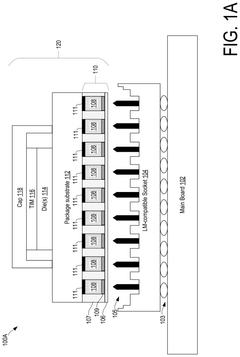

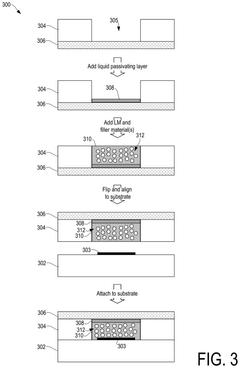

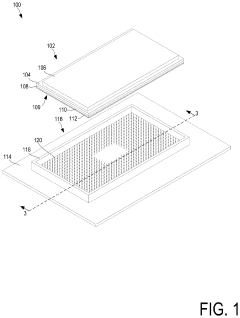

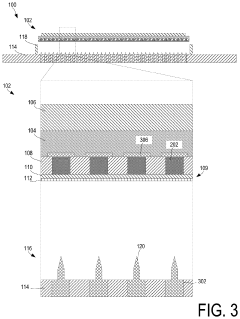

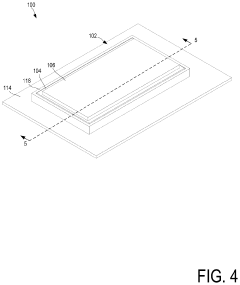

Liquid metal socket interconnects with liquid passivation layer and filler materials

PatentPendingUS20250079278A1

Innovation

- Implementation of a liquid passivation layer, such as mineral oil or paraffin wax, within the LM wells to prevent sticking and oxide formation, along with inert filler materials to reduce LM usage and costs.

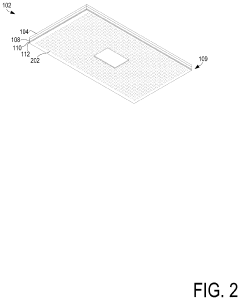

Technologies for sealing liquid metal interconnect array packages

PatentPendingUS20240074046A1

Innovation

- A liquid metal interconnect array sealed by a foam cap layer and a fabric layer is used, allowing the bed of nails socket to pierce the foam cap layer for electrical connection without the stress of soldering and the high force of compression mounting, with the fabric layer preventing damage to the foam cap layer and maintaining the integrity of the liquid metal interconnects.

Environmental Impact and Sustainability Considerations

The environmental impact of liquid metal interconnect technologies varies significantly depending on the electrode materials selected. Traditional electrode materials such as gold, silver, and copper present substantial environmental concerns throughout their lifecycle. Mining operations for these metals often result in habitat destruction, soil erosion, and water contamination. Processing these materials requires considerable energy input, contributing to carbon emissions and climate change impacts. Additionally, the limited global reserves of precious metals like gold and silver raise sustainability questions regarding long-term viability.

In contrast, alternative electrode materials such as gallium-based liquid metals offer potential environmental advantages. Gallium is obtained primarily as a byproduct of aluminum and zinc production, potentially reducing the environmental footprint associated with dedicated mining operations. However, the extraction and purification processes for gallium still require significant energy inputs and chemical treatments that generate waste streams requiring proper management.

The manufacturing processes for different electrode materials also present varying environmental challenges. Traditional metal electrodes often involve energy-intensive deposition techniques and chemical etching processes that generate hazardous waste. Liquid metal manufacturing may utilize less energy-intensive processes but introduces unique challenges related to containment and handling of potentially toxic materials during production.

End-of-life considerations represent another critical environmental dimension. The recyclability of electrode materials significantly impacts their overall sustainability profile. Precious metals like gold and silver offer excellent recyclability potential, though current recovery rates from electronic waste remain suboptimal. Gallium-based liquid metals present recycling challenges due to their tendency to form alloys and disperse within systems, potentially limiting recovery efficiency.

Toxicity profiles differ substantially among electrode materials. While gold is biologically inert, certain liquid metal components like gallium and indium may present toxicological concerns if improperly handled or disposed of. The potential for environmental leaching and bioaccumulation must be carefully evaluated when selecting electrode materials for widespread deployment.

Regulatory frameworks increasingly emphasize lifecycle environmental impacts, with initiatives like the European Union's Restriction of Hazardous Substances (RoHS) and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulations influencing material selection decisions. Future electrode material development should prioritize designs that minimize environmental impacts while maintaining or enhancing performance characteristics, potentially through bio-inspired approaches or incorporation of renewable material components.

In contrast, alternative electrode materials such as gallium-based liquid metals offer potential environmental advantages. Gallium is obtained primarily as a byproduct of aluminum and zinc production, potentially reducing the environmental footprint associated with dedicated mining operations. However, the extraction and purification processes for gallium still require significant energy inputs and chemical treatments that generate waste streams requiring proper management.

The manufacturing processes for different electrode materials also present varying environmental challenges. Traditional metal electrodes often involve energy-intensive deposition techniques and chemical etching processes that generate hazardous waste. Liquid metal manufacturing may utilize less energy-intensive processes but introduces unique challenges related to containment and handling of potentially toxic materials during production.

End-of-life considerations represent another critical environmental dimension. The recyclability of electrode materials significantly impacts their overall sustainability profile. Precious metals like gold and silver offer excellent recyclability potential, though current recovery rates from electronic waste remain suboptimal. Gallium-based liquid metals present recycling challenges due to their tendency to form alloys and disperse within systems, potentially limiting recovery efficiency.

Toxicity profiles differ substantially among electrode materials. While gold is biologically inert, certain liquid metal components like gallium and indium may present toxicological concerns if improperly handled or disposed of. The potential for environmental leaching and bioaccumulation must be carefully evaluated when selecting electrode materials for widespread deployment.

Regulatory frameworks increasingly emphasize lifecycle environmental impacts, with initiatives like the European Union's Restriction of Hazardous Substances (RoHS) and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulations influencing material selection decisions. Future electrode material development should prioritize designs that minimize environmental impacts while maintaining or enhancing performance characteristics, potentially through bio-inspired approaches or incorporation of renewable material components.

Manufacturing Scalability and Cost Analysis

The scalability of liquid metal interconnect manufacturing processes represents a critical factor in determining their commercial viability. Current production methods for gallium-based liquid metal interconnects face significant challenges when transitioning from laboratory to industrial scale. Conventional techniques such as microfluidic injection, stencil printing, and direct writing demonstrate excellent precision but suffer from low throughput and high unit costs when production volumes increase. These limitations stem primarily from the manual nature of these processes and the specialized equipment required.

Cost analysis reveals that electrode material selection dramatically impacts manufacturing economics. Gold electrodes, while offering superior electrical performance and oxidation resistance, introduce prohibitive material costs at approximately $50-65 per gram, making them viable only for high-value, low-volume applications such as aerospace or medical devices. Silver electrodes present a more balanced cost-performance ratio at $0.60-0.85 per gram, though still face tarnishing concerns that may necessitate additional protective measures in the manufacturing process.

Copper electrodes emerge as the most economically attractive option at $0.006-0.01 per gram, potentially reducing material costs by 98% compared to gold alternatives. However, their implementation requires additional manufacturing steps to mitigate oxidation issues, including specialized coating processes or inert atmosphere handling. These additional requirements partially offset the material cost advantages through increased process complexity.

Emerging manufacturing technologies show promise for improving scalability. Roll-to-roll processing techniques adapted for liquid metal deposition could increase throughput by 15-20 times compared to current methods. Additionally, automated dispensing systems with computer vision quality control are demonstrating 99.2% placement accuracy while reducing labor costs by approximately 70% compared to manual techniques.

Economic modeling indicates that the crossover point where copper electrodes become more cost-effective than silver occurs at production volumes exceeding 10,000 units, accounting for both material and processing costs. For gold electrodes, this threshold is significantly higher at approximately 500 units when compared against specialized applications with stringent performance requirements.

Supply chain considerations further complicate manufacturing scalability. Gallium, the primary component of most liquid metal alloys, faces potential supply constraints due to its status as a byproduct of aluminum and zinc production. Current global production capacity of approximately 300 metric tons annually may prove insufficient if liquid metal interconnect technologies achieve widespread adoption across multiple industries.

Cost analysis reveals that electrode material selection dramatically impacts manufacturing economics. Gold electrodes, while offering superior electrical performance and oxidation resistance, introduce prohibitive material costs at approximately $50-65 per gram, making them viable only for high-value, low-volume applications such as aerospace or medical devices. Silver electrodes present a more balanced cost-performance ratio at $0.60-0.85 per gram, though still face tarnishing concerns that may necessitate additional protective measures in the manufacturing process.

Copper electrodes emerge as the most economically attractive option at $0.006-0.01 per gram, potentially reducing material costs by 98% compared to gold alternatives. However, their implementation requires additional manufacturing steps to mitigate oxidation issues, including specialized coating processes or inert atmosphere handling. These additional requirements partially offset the material cost advantages through increased process complexity.

Emerging manufacturing technologies show promise for improving scalability. Roll-to-roll processing techniques adapted for liquid metal deposition could increase throughput by 15-20 times compared to current methods. Additionally, automated dispensing systems with computer vision quality control are demonstrating 99.2% placement accuracy while reducing labor costs by approximately 70% compared to manual techniques.

Economic modeling indicates that the crossover point where copper electrodes become more cost-effective than silver occurs at production volumes exceeding 10,000 units, accounting for both material and processing costs. For gold electrodes, this threshold is significantly higher at approximately 500 units when compared against specialized applications with stringent performance requirements.

Supply chain considerations further complicate manufacturing scalability. Gallium, the primary component of most liquid metal alloys, faces potential supply constraints due to its status as a byproduct of aluminum and zinc production. Current global production capacity of approximately 300 metric tons annually may prove insufficient if liquid metal interconnect technologies achieve widespread adoption across multiple industries.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!