Liquid Metal Interconnect and Advanced Polymer Electrolytes

SEP 29, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Liquid Metal and Polymer Electrolyte Technology Background

Liquid metals, particularly gallium-based alloys, have emerged as revolutionary materials in the field of flexible electronics due to their unique combination of metallic conductivity and fluidic properties. The history of liquid metal research dates back to the early 20th century, but significant advancements have occurred primarily in the last two decades. Gallium and its alloys, such as eutectic gallium-indium (EGaIn) and gallium-indium-tin (Galinstan), have gained prominence due to their low toxicity, negligible vapor pressure, and remarkable electrical conductivity comparable to many solid metals while maintaining fluidity at room temperature.

The evolution of liquid metal technology has been driven by increasing demands for flexible, stretchable, and self-healing electronic systems that can withstand mechanical deformation without performance degradation. This represents a significant departure from conventional rigid electronics based on solid conductors like copper and aluminum, which typically fail under mechanical strain.

Concurrently, polymer electrolytes have undergone substantial development since the 1970s, when the ionic conductivity of polymer-salt complexes was first discovered. These materials have evolved from simple polymer-salt mixtures to sophisticated composite systems incorporating various additives to enhance ionic conductivity, mechanical properties, and electrochemical stability.

The convergence of liquid metal interconnect technology with advanced polymer electrolytes represents a promising frontier in materials science, particularly for applications requiring both electronic and ionic conductivity in flexible formats. This intersection addresses critical challenges in energy storage, bioelectronics, and soft robotics, where traditional rigid components limit functionality and durability.

Current technological trends indicate a shift toward multi-functional materials that can simultaneously serve as structural supports, electrical conductors, and ion transport media. The integration of liquid metals with polymer electrolytes enables unique capabilities such as self-healing interfaces, reconfigurable circuits, and conformable energy storage solutions that adapt to dynamic operating environments.

The global research landscape shows accelerating interest in these technologies, with significant contributions from institutions in North America, East Asia, and Europe. Publication trends reveal a compound annual growth rate exceeding 15% in research output related to liquid metal electronics and advanced polymer electrolytes over the past five years, signaling robust scientific momentum in this field.

Technical objectives in this domain include enhancing the stability of liquid metal-polymer interfaces, improving the ionic conductivity of polymer electrolytes at ambient temperatures, developing manufacturing methods compatible with existing electronics production infrastructure, and creating standardized characterization protocols for these novel material systems.

The evolution of liquid metal technology has been driven by increasing demands for flexible, stretchable, and self-healing electronic systems that can withstand mechanical deformation without performance degradation. This represents a significant departure from conventional rigid electronics based on solid conductors like copper and aluminum, which typically fail under mechanical strain.

Concurrently, polymer electrolytes have undergone substantial development since the 1970s, when the ionic conductivity of polymer-salt complexes was first discovered. These materials have evolved from simple polymer-salt mixtures to sophisticated composite systems incorporating various additives to enhance ionic conductivity, mechanical properties, and electrochemical stability.

The convergence of liquid metal interconnect technology with advanced polymer electrolytes represents a promising frontier in materials science, particularly for applications requiring both electronic and ionic conductivity in flexible formats. This intersection addresses critical challenges in energy storage, bioelectronics, and soft robotics, where traditional rigid components limit functionality and durability.

Current technological trends indicate a shift toward multi-functional materials that can simultaneously serve as structural supports, electrical conductors, and ion transport media. The integration of liquid metals with polymer electrolytes enables unique capabilities such as self-healing interfaces, reconfigurable circuits, and conformable energy storage solutions that adapt to dynamic operating environments.

The global research landscape shows accelerating interest in these technologies, with significant contributions from institutions in North America, East Asia, and Europe. Publication trends reveal a compound annual growth rate exceeding 15% in research output related to liquid metal electronics and advanced polymer electrolytes over the past five years, signaling robust scientific momentum in this field.

Technical objectives in this domain include enhancing the stability of liquid metal-polymer interfaces, improving the ionic conductivity of polymer electrolytes at ambient temperatures, developing manufacturing methods compatible with existing electronics production infrastructure, and creating standardized characterization protocols for these novel material systems.

Market Analysis for Flexible Electronics Applications

The flexible electronics market is experiencing unprecedented growth, driven by increasing demand for wearable devices, foldable displays, and soft robotics. Current market valuations place the global flexible electronics sector at approximately $29.28 billion as of 2022, with projections indicating a compound annual growth rate (CAGR) of 11.9% through 2030. This remarkable expansion is particularly relevant for liquid metal interconnect and advanced polymer electrolyte technologies, which address critical challenges in creating truly flexible, stretchable electronic systems.

Consumer electronics represents the largest application segment, accounting for roughly 43% of the flexible electronics market. Within this segment, smartphones with flexible displays and wearable health monitoring devices are driving significant demand for advanced interconnect solutions that can withstand repeated bending and stretching while maintaining electrical performance. The healthcare sector follows closely, with flexible bioelectronics for patient monitoring showing a CAGR of 15.7%, outpacing the overall market growth.

Regionally, Asia-Pacific dominates the flexible electronics landscape, representing approximately 51% of the global market share. This dominance stems from the concentration of electronics manufacturing infrastructure in countries like South Korea, Japan, China, and Taiwan. North America and Europe follow with 24% and 19% market shares respectively, with particular strength in research and development of next-generation materials including advanced polymer electrolytes.

The automotive industry presents an emerging high-potential market for liquid metal interconnect technologies, with applications in smart dashboards, flexible sensors, and conformable lighting systems. This sector is projected to grow at 14.2% CAGR through 2028, representing a significant opportunity for technology deployment.

Key market drivers include miniaturization demands, energy efficiency requirements, and the growing need for biocompatible electronics in medical applications. Consumer preference for lightweight, portable, and aesthetically pleasing devices further accelerates market expansion. The integration of flexible electronics with Internet of Things (IoT) technologies is creating additional market opportunities, with smart packaging and flexible RFID systems showing particular promise.

Market challenges include high manufacturing costs, with flexible electronic components typically commanding a 30-40% premium over rigid counterparts. Scalability of production processes for liquid metal interconnects remains problematic, with current techniques limiting mass production capabilities. Additionally, concerns regarding long-term reliability and environmental stability of polymer electrolytes in diverse operating conditions represent significant market barriers that must be addressed through continued research and development efforts.

Consumer electronics represents the largest application segment, accounting for roughly 43% of the flexible electronics market. Within this segment, smartphones with flexible displays and wearable health monitoring devices are driving significant demand for advanced interconnect solutions that can withstand repeated bending and stretching while maintaining electrical performance. The healthcare sector follows closely, with flexible bioelectronics for patient monitoring showing a CAGR of 15.7%, outpacing the overall market growth.

Regionally, Asia-Pacific dominates the flexible electronics landscape, representing approximately 51% of the global market share. This dominance stems from the concentration of electronics manufacturing infrastructure in countries like South Korea, Japan, China, and Taiwan. North America and Europe follow with 24% and 19% market shares respectively, with particular strength in research and development of next-generation materials including advanced polymer electrolytes.

The automotive industry presents an emerging high-potential market for liquid metal interconnect technologies, with applications in smart dashboards, flexible sensors, and conformable lighting systems. This sector is projected to grow at 14.2% CAGR through 2028, representing a significant opportunity for technology deployment.

Key market drivers include miniaturization demands, energy efficiency requirements, and the growing need for biocompatible electronics in medical applications. Consumer preference for lightweight, portable, and aesthetically pleasing devices further accelerates market expansion. The integration of flexible electronics with Internet of Things (IoT) technologies is creating additional market opportunities, with smart packaging and flexible RFID systems showing particular promise.

Market challenges include high manufacturing costs, with flexible electronic components typically commanding a 30-40% premium over rigid counterparts. Scalability of production processes for liquid metal interconnects remains problematic, with current techniques limiting mass production capabilities. Additionally, concerns regarding long-term reliability and environmental stability of polymer electrolytes in diverse operating conditions represent significant market barriers that must be addressed through continued research and development efforts.

Current Challenges in Liquid Metal Interconnect Technology

Despite significant advancements in liquid metal interconnect technology, several critical challenges continue to impede its widespread industrial adoption. The primary obstacle remains the inherent oxidation tendency of liquid metals, particularly gallium-based alloys, when exposed to air. This oxidation creates a thin but mechanically robust oxide layer that alters electrical conductivity and interfacial properties, compromising long-term reliability in electronic applications. The oxide formation process is particularly problematic in dynamic systems where interconnects must maintain consistent performance during mechanical deformation.

Compatibility issues between liquid metals and substrate materials present another significant challenge. Many common electronic substrates experience corrosion or unwanted alloying when in direct contact with gallium-based liquid metals. This chemical incompatibility necessitates specialized encapsulation strategies or surface treatments, adding complexity and cost to manufacturing processes. Silicon, copper, and aluminum—materials fundamental to conventional electronics—are particularly vulnerable to gallium embrittlement through diffusion and intermetallic compound formation.

Precise patterning and controlled deposition of liquid metal interconnects at micro and nanoscales remain technically demanding. Traditional lithographic approaches are often incompatible with liquid metals due to their unique rheological properties and surface tension characteristics. While microfluidic approaches show promise, they face limitations in achieving the resolution necessary for advanced electronics, typically struggling below 10-micron feature sizes.

The mechanical stability of liquid metal interconnects under repeated deformation cycles represents a persistent reliability concern. Although liquid metals theoretically offer superior flexibility compared to solid conductors, practical implementations often suffer from delamination, leakage, or changes in electrical resistance after extended cycling. This is particularly problematic in wearable electronics and biomedical applications where thousands of deformation cycles are expected during product lifetime.

Integration challenges with conventional electronic manufacturing processes further limit industrial adoption. Current semiconductor fabrication facilities are optimized for solid materials, and incorporating liquid components requires significant modifications to established workflows. Temperature sensitivity during soldering or bonding processes, potential contamination risks, and quality control complexities all contribute to manufacturing hesitancy.

Lastly, environmental and toxicity concerns persist with certain liquid metal compositions. While gallium itself has low toxicity, some alloy components like indium face supply chain constraints and sustainability questions. Additionally, the long-term environmental impact of liquid metal electronic waste remains inadequately studied, raising regulatory uncertainties that discourage commercial investment.

Compatibility issues between liquid metals and substrate materials present another significant challenge. Many common electronic substrates experience corrosion or unwanted alloying when in direct contact with gallium-based liquid metals. This chemical incompatibility necessitates specialized encapsulation strategies or surface treatments, adding complexity and cost to manufacturing processes. Silicon, copper, and aluminum—materials fundamental to conventional electronics—are particularly vulnerable to gallium embrittlement through diffusion and intermetallic compound formation.

Precise patterning and controlled deposition of liquid metal interconnects at micro and nanoscales remain technically demanding. Traditional lithographic approaches are often incompatible with liquid metals due to their unique rheological properties and surface tension characteristics. While microfluidic approaches show promise, they face limitations in achieving the resolution necessary for advanced electronics, typically struggling below 10-micron feature sizes.

The mechanical stability of liquid metal interconnects under repeated deformation cycles represents a persistent reliability concern. Although liquid metals theoretically offer superior flexibility compared to solid conductors, practical implementations often suffer from delamination, leakage, or changes in electrical resistance after extended cycling. This is particularly problematic in wearable electronics and biomedical applications where thousands of deformation cycles are expected during product lifetime.

Integration challenges with conventional electronic manufacturing processes further limit industrial adoption. Current semiconductor fabrication facilities are optimized for solid materials, and incorporating liquid components requires significant modifications to established workflows. Temperature sensitivity during soldering or bonding processes, potential contamination risks, and quality control complexities all contribute to manufacturing hesitancy.

Lastly, environmental and toxicity concerns persist with certain liquid metal compositions. While gallium itself has low toxicity, some alloy components like indium face supply chain constraints and sustainability questions. Additionally, the long-term environmental impact of liquid metal electronic waste remains inadequately studied, raising regulatory uncertainties that discourage commercial investment.

Current Technical Solutions and Implementation Methods

01 Liquid metal interconnects for flexible electronics

Liquid metals, particularly gallium-based alloys, are used as interconnects in flexible and stretchable electronic devices. These materials maintain electrical conductivity even when deformed, making them ideal for applications requiring flexibility. The liquid metal can be encapsulated in polymer channels or microfluidic structures to create stable yet flexible electrical connections. This technology enables the development of wearable electronics, flexible displays, and stretchable circuits that can withstand mechanical stress while maintaining functionality.- Liquid metal interconnect technologies for flexible electronics: Liquid metals, particularly gallium-based alloys, are used as interconnects in flexible and stretchable electronic devices due to their unique combination of high electrical conductivity and mechanical flexibility. These interconnects maintain electrical performance during bending, stretching, and other deformations. The liquid nature allows self-healing properties when mechanical damage occurs, making them ideal for wearable electronics, flexible displays, and other applications requiring resilient electrical connections.

- Advanced polymer electrolytes for energy storage devices: Advanced polymer electrolytes serve as ion-conducting media in batteries, fuel cells, and other electrochemical devices. These materials combine the mechanical stability of polymers with ionic conductivity needed for efficient energy storage. Innovations include incorporating nanofillers, plasticizers, and ionic liquids to enhance conductivity while maintaining dimensional stability. Solid polymer electrolytes offer advantages over liquid electrolytes including improved safety, reduced leakage risk, and compatibility with flexible form factors for next-generation energy storage solutions.

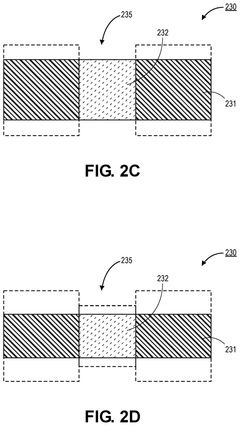

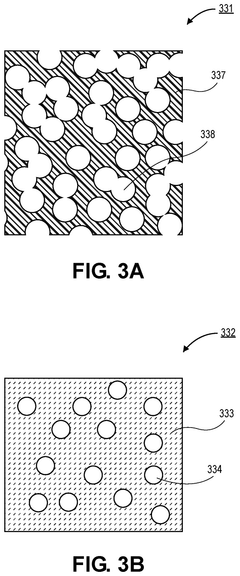

- Composite materials combining liquid metals and polymers: Hybrid materials that integrate liquid metals within polymer matrices create unique composites with both electrical conductivity and mechanical flexibility. These composites can be engineered to have self-healing properties, controlled stiffness, and tunable electrical characteristics. Manufacturing techniques include microfluidic patterning, direct writing, and emulsion-based approaches. Applications range from soft robotics and artificial skin to electromagnetic shielding and thermal management systems that require both electrical functionality and mechanical compliance.

- Interface engineering between liquid metals and polymer electrolytes: The interface between liquid metal interconnects and polymer electrolytes presents unique challenges and opportunities. Surface treatments, coupling agents, and specialized additives are used to improve adhesion, reduce interfacial resistance, and prevent undesired reactions. Innovations include creating controlled oxide layers on liquid metals, functionalizing polymer surfaces, and developing gradient interfaces that smoothly transition between the different material properties. These interface engineering approaches are critical for creating stable, long-lasting connections in flexible energy storage and electronic devices.

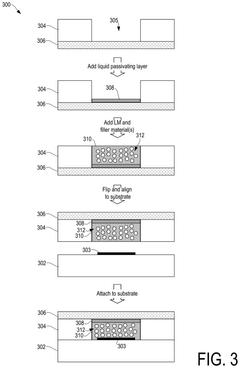

- Manufacturing processes for integrated liquid metal-polymer systems: Specialized manufacturing techniques have been developed to integrate liquid metals with polymer electrolytes in production settings. These include microfluidic encapsulation, direct printing of liquid metal patterns, selective wetting approaches, and laser-assisted patterning. Advanced processes enable precise control over liquid metal geometry, polymer crosslinking, and interface formation. Innovations in manufacturing equipment and process parameters allow for scalable production of complex architectures combining the unique properties of both material classes for applications in flexible batteries, sensors, and other electronic devices.

02 Advanced polymer electrolytes for energy storage

Advanced polymer electrolytes are being developed to enhance the performance of batteries and other energy storage devices. These electrolytes typically combine polymers with ionic conductors to create materials that offer improved ionic conductivity, mechanical stability, and safety compared to traditional liquid electrolytes. Innovations include cross-linked polymer networks, polymer-ceramic composites, and gel polymer electrolytes that provide better interfacial contact with electrodes. These materials enable the development of safer, more efficient batteries with higher energy density and longer cycle life.Expand Specific Solutions03 Integration of liquid metals with polymer electrolytes

The combination of liquid metal interconnects with advanced polymer electrolytes creates hybrid systems with unique properties. This integration allows for the development of fully flexible energy storage and conversion devices. The liquid metal provides excellent electrical conductivity and deformability, while the polymer electrolyte offers ionic conductivity and serves as a separator. These hybrid systems can be used in applications such as flexible batteries, supercapacitors, and fuel cells, where both electrical connections and ionic transport are required in a deformable structure.Expand Specific Solutions04 Self-healing conductive materials

Self-healing conductive materials combine liquid metals with specially designed polymers to create interconnects that can automatically repair damage. When the material is cut or torn, the liquid metal flows to bridge the gap, restoring electrical conductivity. The polymer matrix provides mechanical support and can also exhibit self-healing properties through various mechanisms such as hydrogen bonding, dynamic covalent chemistry, or encapsulated healing agents. These materials are particularly valuable for applications in harsh environments or where maintenance is difficult, as they can extend the operational lifetime of electronic devices.Expand Specific Solutions05 Thermal management in liquid metal-polymer systems

Thermal management is a critical aspect of liquid metal and polymer electrolyte systems. Liquid metals offer excellent thermal conductivity, which can be utilized to dissipate heat from electronic components. Polymer electrolytes can be engineered with thermal stability to withstand temperature fluctuations during device operation. Advanced composite materials combining liquid metals with thermally conductive polymers provide both electrical and thermal pathways. These systems enable efficient heat dissipation in high-power electronics and energy storage devices, preventing thermal runaway and extending device lifetime.Expand Specific Solutions

Leading Research Institutions and Industrial Players

The liquid metal interconnect and advanced polymer electrolytes market is currently in a growth phase, with increasing applications in flexible electronics, energy storage, and biomedical devices. The global market size is projected to reach significant expansion due to rising demand for high-performance batteries and flexible electronic components. Leading industrial players like LG Energy Solution, Saft Groupe, and PolyPlus Battery are advancing commercialization efforts, while research institutions such as Arizona State University, KAIST, and the Chinese Academy of Sciences are driving fundamental innovations. Technical maturity varies across applications, with polymer electrolytes for batteries approaching commercial readiness while liquid metal interconnects for flexible electronics still face challenges in durability and mass production. Collaborative efforts between academic institutions and industry partners are accelerating development toward market-ready solutions.

Asahi Kasei Corp.

Technical Solution: Asahi Kasei has developed advanced polymer electrolytes based on their expertise in materials science and membrane technology. Their flagship technology centers on microporous polyolefin membranes modified with functional polymers to create hybrid organic-inorganic electrolyte systems. These electrolytes feature a three-dimensional network structure that provides mechanical stability while facilitating ion transport through specialized conductive pathways. Asahi Kasei's proprietary surface modification techniques enable strong adhesion between the polymer electrolyte and electrodes, reducing interfacial resistance that typically limits solid-state battery performance. Their polymer electrolytes incorporate flame-retardant additives that significantly enhance safety compared to conventional liquid electrolytes. The company has also developed specialized manufacturing processes for ultra-thin polymer electrolyte films (as thin as 10 microns) that reduce internal resistance while maintaining mechanical integrity. These advanced polymer electrolytes have been successfully integrated into commercial battery products, demonstrating stable cycling performance at high charge/discharge rates and improved safety characteristics under abuse conditions. Asahi Kasei continues to refine their polymer electrolyte technology through partnerships with major battery manufacturers and automotive companies.

Strengths: Excellent mechanical properties that prevent internal short circuits even under physical stress. Simplified battery design and manufacturing due to the solid-state nature of the electrolyte. Weaknesses: Lower ionic conductivity at room temperature compared to liquid electrolytes, requiring optimization of operating conditions. Challenges with achieving uniform contact at electrode-electrolyte interfaces during large-scale manufacturing.

Arizona State University

Technical Solution: Arizona State University has pioneered significant research in liquid metal interconnects through their Flexible Electronics and Display Center. Their approach focuses on room-temperature liquid metals, particularly gallium-based alloys like eutectic gallium-indium (EGaIn) and gallium-indium-tin (Galinstan), which remain liquid at room temperature while offering excellent electrical conductivity. ASU researchers have developed innovative patterning techniques for these liquid metals, including direct writing, microfluidic channels, and selective wetting methods that enable precise control of liquid metal geometries. Their technology incorporates oxide skin formation on liquid metal surfaces to maintain structural stability while preserving electrical functionality. ASU has also demonstrated self-healing capabilities in their liquid metal interconnects, where damaged connections can automatically restore conductivity through the liquid metal's inherent flowability. These interconnects have been successfully integrated into flexible displays, wearable electronics, and soft robotics applications.

Strengths: Superior flexibility and stretchability compared to solid conductors, allowing for deformation without performance degradation. Self-healing capability provides enhanced durability and reliability in dynamic applications. Weaknesses: Challenges with long-term encapsulation to prevent oxidation and environmental contamination. Potential toxicity concerns with some gallium compounds requiring careful handling and containment.

Key Patents and Scientific Breakthroughs

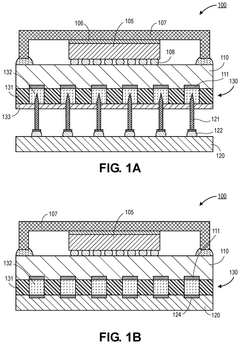

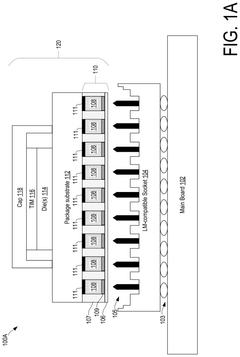

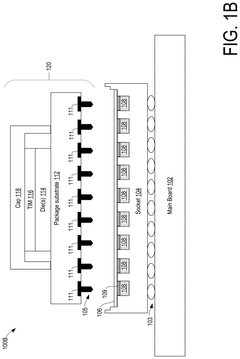

Low z-height separable liquid metal based electrical interconnect

PatentPendingUS20250149414A1

Innovation

- The implementation of a liquid metal carrier array (LMCA) with a low Poisson's ratio substrate and a compressible liquid metal, which allows for minimal change in well width during compression, preventing liquid metal extrusion and maintaining electrical integrity.

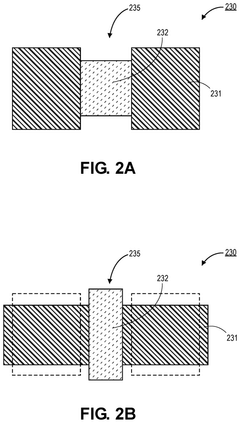

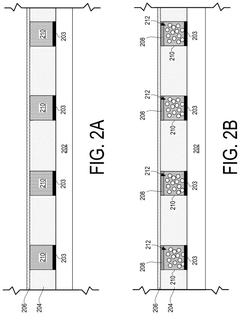

Liquid metal socket interconnects with liquid passivation layer and filler materials

PatentPendingUS20250079278A1

Innovation

- Implementation of a liquid passivation layer, such as mineral oil or paraffin wax, within the LM wells to prevent sticking and oxide formation, along with inert filler materials to reduce LM usage and costs.

Environmental Impact and Sustainability Considerations

The environmental implications of liquid metal interconnects and advanced polymer electrolytes warrant careful consideration as these technologies gain prominence in flexible electronics and energy storage systems. Liquid metal-based technologies, particularly those utilizing gallium-based alloys, present both advantages and challenges from a sustainability perspective. Unlike traditional electronic materials containing lead or mercury, gallium-based liquid metals exhibit significantly lower toxicity profiles, reducing potential environmental hazards during production, use, and disposal phases.

However, the extraction and processing of gallium and other constituent metals still carry substantial environmental footprints. Mining operations for these materials can lead to habitat disruption, water pollution, and energy-intensive refining processes. The carbon footprint associated with gallium production is particularly concerning, as it is typically obtained as a byproduct of aluminum and zinc processing, which are energy-intensive industries heavily reliant on fossil fuels in many regions.

Advanced polymer electrolytes similarly present a mixed environmental profile. Their development often aims to replace conventional liquid electrolytes containing volatile organic compounds and lithium hexafluorophosphate, which pose significant environmental and safety risks. The shift toward solid-state polymer systems reduces these immediate hazards and can potentially extend device lifespans, thereby decreasing electronic waste generation.

Recyclability remains a critical challenge for both technologies. Current liquid metal recovery processes are not widely implemented at industrial scales, while polymer electrolytes often incorporate complex chemical modifications that complicate end-of-life processing. Research into closed-loop systems for these materials is still in nascent stages, though promising approaches include selective dissolution methods for liquid metal recovery and chemical depolymerization techniques for polymer electrolytes.

Life cycle assessment (LCA) studies indicate that the environmental benefits of these technologies may outweigh their impacts when considering full product lifespans. Flexible electronics incorporating liquid metal interconnects can enable thinner, more durable devices that consume fewer resources during manufacturing and generate less waste. Similarly, advanced polymer electrolytes can enhance battery longevity and safety, reducing replacement frequency and associated resource consumption.

Future sustainability improvements will likely focus on developing bio-based polymers for electrolyte applications, implementing green chemistry principles in liquid metal processing, and designing products with disassembly and material recovery in mind. Regulatory frameworks worldwide are increasingly emphasizing extended producer responsibility, which may accelerate industry adoption of more sustainable practices throughout the supply chain for these emerging materials.

However, the extraction and processing of gallium and other constituent metals still carry substantial environmental footprints. Mining operations for these materials can lead to habitat disruption, water pollution, and energy-intensive refining processes. The carbon footprint associated with gallium production is particularly concerning, as it is typically obtained as a byproduct of aluminum and zinc processing, which are energy-intensive industries heavily reliant on fossil fuels in many regions.

Advanced polymer electrolytes similarly present a mixed environmental profile. Their development often aims to replace conventional liquid electrolytes containing volatile organic compounds and lithium hexafluorophosphate, which pose significant environmental and safety risks. The shift toward solid-state polymer systems reduces these immediate hazards and can potentially extend device lifespans, thereby decreasing electronic waste generation.

Recyclability remains a critical challenge for both technologies. Current liquid metal recovery processes are not widely implemented at industrial scales, while polymer electrolytes often incorporate complex chemical modifications that complicate end-of-life processing. Research into closed-loop systems for these materials is still in nascent stages, though promising approaches include selective dissolution methods for liquid metal recovery and chemical depolymerization techniques for polymer electrolytes.

Life cycle assessment (LCA) studies indicate that the environmental benefits of these technologies may outweigh their impacts when considering full product lifespans. Flexible electronics incorporating liquid metal interconnects can enable thinner, more durable devices that consume fewer resources during manufacturing and generate less waste. Similarly, advanced polymer electrolytes can enhance battery longevity and safety, reducing replacement frequency and associated resource consumption.

Future sustainability improvements will likely focus on developing bio-based polymers for electrolyte applications, implementing green chemistry principles in liquid metal processing, and designing products with disassembly and material recovery in mind. Regulatory frameworks worldwide are increasingly emphasizing extended producer responsibility, which may accelerate industry adoption of more sustainable practices throughout the supply chain for these emerging materials.

Manufacturing Scalability and Cost Analysis

The scalability of manufacturing processes for liquid metal interconnects and advanced polymer electrolytes presents significant challenges that directly impact commercial viability. Current laboratory-scale production methods for liquid metal interconnects typically involve manual injection or printing techniques that are difficult to scale for mass production. The transition to industrial-scale manufacturing requires substantial process engineering to maintain the quality and performance of these interconnects while increasing throughput.

For liquid metal interconnects, the primary manufacturing bottlenecks include precise encapsulation, prevention of oxidation during processing, and ensuring consistent electrical performance across large production batches. Automated dispensing systems and roll-to-roll processing show promise for scaling production, but require significant capital investment estimated at $5-10 million for initial production lines capable of producing 100,000 units monthly.

Advanced polymer electrolytes face different scaling challenges, particularly in achieving consistent ionic conductivity and mechanical properties across large production volumes. Current synthesis methods often involve solvent-based processes that are both environmentally problematic and costly when scaled. Alternative solvent-free processing techniques are emerging but remain 30-40% more expensive than traditional methods.

Cost analysis reveals that material expenses constitute approximately 60% of production costs for liquid metal systems, with gallium-based alloys being particularly expensive at $200-300 per kilogram. Economies of scale could potentially reduce this to $150-200 per kilogram at production volumes exceeding 10 tons annually. For polymer electrolytes, specialty monomers and additives represent 45-55% of total costs, with processing and quality control accounting for much of the remainder.

Energy consumption during manufacturing presents another significant cost factor, especially for polymer electrolyte production which requires carefully controlled thermal processing. Current estimates suggest energy costs of $0.15-0.25 per unit for liquid metal interconnects and $0.30-0.45 per unit for advanced polymer electrolytes at medium production scales.

Achieving price competitiveness with existing technologies requires production volumes of at least 500,000 units annually, at which point per-unit costs could decrease by 30-40%. Industry projections suggest that with optimized manufacturing processes and material supply chains, production costs could reach parity with conventional alternatives within 3-5 years, making these technologies commercially viable for mainstream applications beyond current niche markets.

For liquid metal interconnects, the primary manufacturing bottlenecks include precise encapsulation, prevention of oxidation during processing, and ensuring consistent electrical performance across large production batches. Automated dispensing systems and roll-to-roll processing show promise for scaling production, but require significant capital investment estimated at $5-10 million for initial production lines capable of producing 100,000 units monthly.

Advanced polymer electrolytes face different scaling challenges, particularly in achieving consistent ionic conductivity and mechanical properties across large production volumes. Current synthesis methods often involve solvent-based processes that are both environmentally problematic and costly when scaled. Alternative solvent-free processing techniques are emerging but remain 30-40% more expensive than traditional methods.

Cost analysis reveals that material expenses constitute approximately 60% of production costs for liquid metal systems, with gallium-based alloys being particularly expensive at $200-300 per kilogram. Economies of scale could potentially reduce this to $150-200 per kilogram at production volumes exceeding 10 tons annually. For polymer electrolytes, specialty monomers and additives represent 45-55% of total costs, with processing and quality control accounting for much of the remainder.

Energy consumption during manufacturing presents another significant cost factor, especially for polymer electrolyte production which requires carefully controlled thermal processing. Current estimates suggest energy costs of $0.15-0.25 per unit for liquid metal interconnects and $0.30-0.45 per unit for advanced polymer electrolytes at medium production scales.

Achieving price competitiveness with existing technologies requires production volumes of at least 500,000 units annually, at which point per-unit costs could decrease by 30-40%. Industry projections suggest that with optimized manufacturing processes and material supply chains, production costs could reach parity with conventional alternatives within 3-5 years, making these technologies commercially viable for mainstream applications beyond current niche markets.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!