Liquid Metal Interconnect: Innovations in Electronic Displays

SEP 29, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Liquid Metal Interconnect Background and Objectives

Liquid metal interconnect technology represents a significant evolution in the field of electronic displays, emerging from decades of research in conductive materials and flexible electronics. The concept of using liquid metals for electrical connections dates back to the early 2000s, when researchers began exploring alternatives to traditional rigid copper traces for next-generation display technologies. This technological trajectory has been driven by increasing demands for displays with enhanced flexibility, durability, and form factor versatility.

The development of liquid metal interconnects has been accelerated by limitations in conventional connection technologies. Traditional solder joints and copper traces face significant challenges in flexible and stretchable display applications, including mechanical fatigue, cracking under repeated bending, and inability to maintain conductivity when stretched. These limitations have created a technological gap that liquid metal solutions aim to address.

Gallium-based alloys have emerged as the primary material platform for liquid metal interconnects, with eutectic gallium-indium (EGaIn) and gallium-indium-tin (Galinstan) leading commercial applications. These alloys maintain liquid state at room temperature while offering electrical conductivity comparable to many conventional metals, creating new possibilities for display interconnect design.

The evolution of this technology has been marked by several key breakthroughs, including methods to control oxide skin formation, techniques for precise deposition and patterning, and encapsulation strategies to prevent leakage and environmental degradation. Recent innovations have focused on integration with existing display manufacturing processes and scaling production for commercial viability.

The primary objective of liquid metal interconnect technology is to enable a new generation of electronic displays with unprecedented mechanical properties. This includes truly foldable displays that can withstand hundreds of thousands of folding cycles, stretchable displays that maintain functionality when elongated by 30% or more, and conformable displays that can adapt to complex three-dimensional surfaces.

Additional technical goals include developing interconnect solutions that maintain stable electrical performance under mechanical deformation, creating manufacturing processes compatible with existing display production infrastructure, and ensuring long-term reliability in consumer electronics environments. The technology also aims to support higher resolution displays by enabling finer pitch connections between display components.

From a commercial perspective, liquid metal interconnects seek to unlock new product categories in wearable displays, medical monitoring devices, and next-generation smartphones with revolutionary form factors. The ultimate vision is to remove the mechanical constraints that have historically limited display design, allowing truly seamless integration of visual interfaces into everyday objects and environments.

The development of liquid metal interconnects has been accelerated by limitations in conventional connection technologies. Traditional solder joints and copper traces face significant challenges in flexible and stretchable display applications, including mechanical fatigue, cracking under repeated bending, and inability to maintain conductivity when stretched. These limitations have created a technological gap that liquid metal solutions aim to address.

Gallium-based alloys have emerged as the primary material platform for liquid metal interconnects, with eutectic gallium-indium (EGaIn) and gallium-indium-tin (Galinstan) leading commercial applications. These alloys maintain liquid state at room temperature while offering electrical conductivity comparable to many conventional metals, creating new possibilities for display interconnect design.

The evolution of this technology has been marked by several key breakthroughs, including methods to control oxide skin formation, techniques for precise deposition and patterning, and encapsulation strategies to prevent leakage and environmental degradation. Recent innovations have focused on integration with existing display manufacturing processes and scaling production for commercial viability.

The primary objective of liquid metal interconnect technology is to enable a new generation of electronic displays with unprecedented mechanical properties. This includes truly foldable displays that can withstand hundreds of thousands of folding cycles, stretchable displays that maintain functionality when elongated by 30% or more, and conformable displays that can adapt to complex three-dimensional surfaces.

Additional technical goals include developing interconnect solutions that maintain stable electrical performance under mechanical deformation, creating manufacturing processes compatible with existing display production infrastructure, and ensuring long-term reliability in consumer electronics environments. The technology also aims to support higher resolution displays by enabling finer pitch connections between display components.

From a commercial perspective, liquid metal interconnects seek to unlock new product categories in wearable displays, medical monitoring devices, and next-generation smartphones with revolutionary form factors. The ultimate vision is to remove the mechanical constraints that have historically limited display design, allowing truly seamless integration of visual interfaces into everyday objects and environments.

Market Analysis for Advanced Display Technologies

The advanced display technology market is experiencing unprecedented growth, driven by innovations like liquid metal interconnects that are revolutionizing electronic displays. The global display market is projected to reach $169 billion by 2025, with a compound annual growth rate of 3.7%. Liquid metal interconnect technology specifically addresses the expanding flexible and stretchable display segment, which is growing at 15% annually - significantly outpacing traditional display technologies.

Consumer electronics remains the dominant application sector, accounting for approximately 65% of advanced display technology adoption. Smartphones and tablets continue to drive volume demand, while emerging applications in wearable technology and automotive displays represent the fastest-growing segments with 22% and 18% annual growth respectively. The integration of liquid metal interconnects is particularly valuable in these high-growth sectors due to their superior flexibility and conductivity properties.

Regional analysis reveals Asia-Pacific as the manufacturing powerhouse, producing over 70% of global display technologies, with South Korea, Japan, and Taiwan leading in innovation. However, North America and Europe are increasingly important markets for premium display technologies, particularly those incorporating advanced materials like liquid metal. China has emerged as both a major producer and consumer, with domestic display production capacity increasing by 35% in the past three years.

Market segmentation shows OLED technology currently dominating the premium display market with a 43% share, while LCD maintains leadership in mid-range applications with 51% market share. Liquid metal interconnect technology is positioned to enhance both technologies by addressing key limitations in flexibility, durability, and production efficiency. Industry forecasts suggest that displays incorporating advanced interconnect materials like liquid metals could capture 25% of the premium display market within five years.

Consumer demand trends indicate growing preference for displays with higher resolution, improved durability, and enhanced form factors including foldable and rollable designs. These preferences align perfectly with the capabilities enabled by liquid metal interconnect technology. Market research shows consumers are willing to pay a 15-20% premium for devices featuring advanced display technologies that offer tangible improvements in durability and flexibility.

The competitive landscape is characterized by intense rivalry among established display manufacturers and materials science companies developing proprietary interconnect solutions. Strategic partnerships between material developers and display manufacturers have increased by 40% in the past two years, highlighting the collaborative approach needed to bring liquid metal interconnect technology to market at scale.

Consumer electronics remains the dominant application sector, accounting for approximately 65% of advanced display technology adoption. Smartphones and tablets continue to drive volume demand, while emerging applications in wearable technology and automotive displays represent the fastest-growing segments with 22% and 18% annual growth respectively. The integration of liquid metal interconnects is particularly valuable in these high-growth sectors due to their superior flexibility and conductivity properties.

Regional analysis reveals Asia-Pacific as the manufacturing powerhouse, producing over 70% of global display technologies, with South Korea, Japan, and Taiwan leading in innovation. However, North America and Europe are increasingly important markets for premium display technologies, particularly those incorporating advanced materials like liquid metal. China has emerged as both a major producer and consumer, with domestic display production capacity increasing by 35% in the past three years.

Market segmentation shows OLED technology currently dominating the premium display market with a 43% share, while LCD maintains leadership in mid-range applications with 51% market share. Liquid metal interconnect technology is positioned to enhance both technologies by addressing key limitations in flexibility, durability, and production efficiency. Industry forecasts suggest that displays incorporating advanced interconnect materials like liquid metals could capture 25% of the premium display market within five years.

Consumer demand trends indicate growing preference for displays with higher resolution, improved durability, and enhanced form factors including foldable and rollable designs. These preferences align perfectly with the capabilities enabled by liquid metal interconnect technology. Market research shows consumers are willing to pay a 15-20% premium for devices featuring advanced display technologies that offer tangible improvements in durability and flexibility.

The competitive landscape is characterized by intense rivalry among established display manufacturers and materials science companies developing proprietary interconnect solutions. Strategic partnerships between material developers and display manufacturers have increased by 40% in the past two years, highlighting the collaborative approach needed to bring liquid metal interconnect technology to market at scale.

Current Challenges in Liquid Metal Implementation

Despite the promising potential of liquid metal interconnects in electronic displays, several significant challenges currently impede their widespread implementation. The high surface tension of liquid metals, particularly gallium-based alloys, creates difficulties in precise patterning and controlled deposition. When exposed to air, these materials rapidly form an oxide layer that, while providing some stability, complicates the manufacturing process and potentially affects electrical performance over time.

Compatibility issues with existing electronic components present another major hurdle. Liquid metals can be corrosive to certain metals commonly used in electronics, particularly aluminum, which limits integration possibilities with conventional display architectures. This necessitates the development of specialized protective layers or alternative material combinations that can withstand prolonged contact with liquid metal elements.

The temperature sensitivity of liquid metal interconnects poses challenges for both manufacturing and operation. Many display applications require stability across a wide temperature range, from cold outdoor environments to heat-generating internal components. Current liquid metal formulations exhibit significant changes in viscosity and electrical properties across these temperature ranges, potentially affecting display performance and reliability.

Scalability remains a critical concern for mass production. While laboratory demonstrations have shown promising results, translating these into high-volume manufacturing processes presents considerable engineering challenges. Current deposition methods lack the precision and repeatability required for commercial display production, particularly for high-resolution applications where interconnect dimensions must be precisely controlled.

Encapsulation technologies represent another significant technical barrier. Containing liquid metals within flexible or stretchable displays requires advanced materials that can prevent leakage while maintaining mechanical properties. Current encapsulation solutions often compromise either the mechanical flexibility or introduce electrical resistance that diminishes performance advantages.

Long-term reliability testing has revealed concerns about metal migration and potential for short circuits in certain configurations. Under electrical stress and temperature cycling, liquid metal interconnects may gradually degrade or shift position, affecting display performance over time. This behavior is particularly problematic for consumer electronics where years of reliable operation are expected.

Environmental and safety considerations also present implementation challenges. Some liquid metal formulations contain elements with toxicity concerns, requiring careful handling during manufacturing and appropriate end-of-life recycling solutions. Regulatory frameworks for these materials remain underdeveloped in many regions, creating uncertainty for manufacturers considering adoption.

Compatibility issues with existing electronic components present another major hurdle. Liquid metals can be corrosive to certain metals commonly used in electronics, particularly aluminum, which limits integration possibilities with conventional display architectures. This necessitates the development of specialized protective layers or alternative material combinations that can withstand prolonged contact with liquid metal elements.

The temperature sensitivity of liquid metal interconnects poses challenges for both manufacturing and operation. Many display applications require stability across a wide temperature range, from cold outdoor environments to heat-generating internal components. Current liquid metal formulations exhibit significant changes in viscosity and electrical properties across these temperature ranges, potentially affecting display performance and reliability.

Scalability remains a critical concern for mass production. While laboratory demonstrations have shown promising results, translating these into high-volume manufacturing processes presents considerable engineering challenges. Current deposition methods lack the precision and repeatability required for commercial display production, particularly for high-resolution applications where interconnect dimensions must be precisely controlled.

Encapsulation technologies represent another significant technical barrier. Containing liquid metals within flexible or stretchable displays requires advanced materials that can prevent leakage while maintaining mechanical properties. Current encapsulation solutions often compromise either the mechanical flexibility or introduce electrical resistance that diminishes performance advantages.

Long-term reliability testing has revealed concerns about metal migration and potential for short circuits in certain configurations. Under electrical stress and temperature cycling, liquid metal interconnects may gradually degrade or shift position, affecting display performance over time. This behavior is particularly problematic for consumer electronics where years of reliable operation are expected.

Environmental and safety considerations also present implementation challenges. Some liquid metal formulations contain elements with toxicity concerns, requiring careful handling during manufacturing and appropriate end-of-life recycling solutions. Regulatory frameworks for these materials remain underdeveloped in many regions, creating uncertainty for manufacturers considering adoption.

Current Liquid Metal Interconnect Solutions

01 Liquid metal interconnect structures in semiconductor devices

Liquid metal interconnects provide improved electrical connections in semiconductor devices. These interconnects utilize liquid metals such as gallium, indium, or their alloys to form conductive pathways between components. The liquid nature of these metals allows for flexibility and self-healing properties, making them ideal for applications requiring resilience to mechanical stress. These interconnects can be formed through various deposition methods and can be encapsulated to prevent leakage while maintaining their advantageous properties.- Liquid metal interconnect materials and compositions: Liquid metal materials, such as gallium-based alloys, can be used as interconnects in electronic devices due to their unique properties including high electrical conductivity and mechanical flexibility. These materials remain in a liquid state at operating temperatures, allowing for self-healing connections and adaptation to mechanical stress. The composition can be tailored with various metal additives to optimize properties like melting point, wettability, and oxidation resistance for specific applications.

- Fabrication methods for liquid metal interconnects: Various techniques have been developed for fabricating liquid metal interconnects, including microfluidic injection, printing processes, and selective deposition methods. These approaches enable precise placement of liquid metal within predefined channels or vias. Surface treatment methods can be employed to control the flow and adhesion of liquid metal to specific surfaces. Encapsulation techniques are also used to contain the liquid metal and prevent leakage while maintaining electrical connectivity.

- Integration of liquid metal interconnects in semiconductor devices: Liquid metal interconnects can be integrated into semiconductor devices to provide flexible connections between components. These interconnects offer advantages in applications requiring thermal management, as they can efficiently conduct heat away from sensitive components. The integration process often involves creating channels or reservoirs within the semiconductor package to contain the liquid metal while maintaining electrical isolation from other components. This approach is particularly valuable for advanced packaging technologies like 3D integration and chiplets.

- Reliability and performance enhancements for liquid metal interconnects: To improve the reliability of liquid metal interconnects, various enhancement techniques have been developed. These include surface treatments to prevent oxidation and improve adhesion, barrier layers to prevent diffusion into surrounding materials, and specialized encapsulation methods to contain the liquid metal under thermal and mechanical stress. Performance can be further enhanced through alloying with other metals to optimize electrical conductivity, thermal stability, and mechanical properties. These enhancements address challenges such as electromigration resistance and long-term stability.

- Applications of liquid metal interconnects in flexible and stretchable electronics: Liquid metal interconnects are particularly valuable in flexible and stretchable electronic applications due to their ability to maintain electrical connectivity during bending, stretching, and other mechanical deformations. These interconnects enable the development of wearable devices, soft robotics, and conformable sensors that can adapt to irregular surfaces or body movements. The self-healing nature of liquid metals allows for recovery from mechanical damage, enhancing the durability of flexible electronic systems under repeated deformation cycles.

02 Manufacturing methods for liquid metal interconnects

Various manufacturing techniques are employed to create liquid metal interconnects in electronic devices. These methods include selective deposition, injection molding, printing techniques, and microfluidic channel formation. The manufacturing processes often involve creating channels or cavities that are subsequently filled with liquid metal alloys. Surface treatments may be applied to control wetting properties and ensure proper adhesion of the liquid metal to the substrate. These techniques enable the precise placement and confinement of liquid metals within the interconnect structures.Expand Specific Solutions03 Encapsulation and containment systems for liquid metal interconnects

Effective containment of liquid metals is crucial for reliable interconnect performance. Encapsulation systems utilize various materials including polymers, elastomers, and specialized barrier layers to prevent leakage while maintaining electrical conductivity. These systems often incorporate flexible materials that can accommodate the fluid nature of liquid metals while providing mechanical stability. The encapsulation designs may include multiple layers with different functions such as adhesion promotion, diffusion barriers, and external protection. Advanced containment strategies enable the use of liquid metal interconnects in diverse applications including flexible electronics.Expand Specific Solutions04 Integration of liquid metal interconnects with traditional semiconductor processes

Integrating liquid metal interconnects with conventional semiconductor manufacturing processes presents both challenges and opportunities. Compatibility issues with standard CMOS processes must be addressed, including temperature constraints, material interactions, and process sequence modifications. Hybrid approaches that combine traditional solid interconnects with liquid metal segments can leverage the advantages of both technologies. Special interface structures may be required to ensure reliable electrical contact between liquid metals and conventional metal conductors. These integration strategies enable the incorporation of liquid metal interconnects into established semiconductor device architectures.Expand Specific Solutions05 Applications and advantages of liquid metal interconnects in advanced electronics

Liquid metal interconnects offer unique advantages for specialized electronic applications. Their self-healing properties make them ideal for flexible and stretchable electronics where mechanical deformation is expected. The high electrical conductivity of liquid metals enables high-performance connections with low resistance. These interconnects are particularly valuable in applications requiring thermal management, as they can simultaneously conduct electricity and transfer heat. Emerging applications include wearable devices, biomedical implants, reconfigurable electronics, and high-reliability systems where traditional solid interconnects may fail under mechanical or thermal stress.Expand Specific Solutions

Leading Companies in Liquid Metal Display Innovation

The liquid metal interconnect technology for electronic displays is in an early growth phase, with significant R&D activity but limited commercial deployment. The market is projected to expand rapidly as this technology addresses critical flexibility and durability challenges in next-generation displays. Key players include established electronics giants Samsung Display, BOE Technology, and Sharp, who are leveraging their manufacturing infrastructure, alongside specialized materials innovators like Merck Patent GmbH and Semiconductor Energy Laboratory. Universities such as MIT and Tsinghua are contributing fundamental research. The technology is approaching commercial viability, with companies like Japan Display and Sony developing prototypes that demonstrate superior performance in foldable and stretchable display applications compared to traditional rigid interconnects.

Samsung Electronics Co., Ltd.

Technical Solution: Samsung has pioneered liquid metal interconnect technology for flexible displays through their Liquid Metal Alloy Conductor (LMAC) system. This technology utilizes gallium-based alloys with controlled viscosity and surface tension properties to create self-healing electrical pathways in foldable and stretchable displays. Their approach incorporates microfluidic channels within elastomeric substrates, where the liquid metal maintains electrical conductivity even under extreme mechanical deformation (up to 300% strain). Samsung has integrated this technology with their AMOLED displays, enabling multi-fold designs without performance degradation. The company has developed proprietary encapsulation techniques to prevent oxidation and leakage of the liquid metal, ensuring long-term reliability. Recent innovations include temperature-stabilized liquid metal composites that maintain consistent electrical properties across operating temperature ranges of -20°C to 60°C.

Strengths: Superior flexibility and stretchability compared to conventional solid interconnects; self-healing capability that automatically restores electrical connections after mechanical damage; compatibility with existing display manufacturing processes. Weaknesses: Higher production costs compared to traditional interconnect technologies; potential for metal migration under certain electrical conditions; challenges in mass production scaling.

Sony Group Corp.

Technical Solution: Sony has developed a proprietary liquid metal interconnect technology called "FluidLink" specifically designed for high-resolution flexible displays. Their approach utilizes a non-toxic bismuth-indium alloy with a carefully controlled melting point just above room temperature. This allows the interconnects to be solid during normal operation but become liquid during flexing, effectively eliminating mechanical stress on the connections. Sony's innovation includes a multi-layer encapsulation system that prevents oxidation while maintaining flexibility. The company has integrated this technology into prototype rollable OLED displays with 4K resolution, demonstrating pixel densities exceeding 600 PPI while maintaining electrical integrity through thousands of rolling cycles. Sony's research has also focused on optimizing the interface between liquid metal and traditional solid-state electronics, developing specialized transition zones that minimize contact resistance and ensure stable electrical performance across temperature variations.

Strengths: Phase-change capability provides excellent mechanical reliability; compatibility with high-resolution display requirements; lower toxicity compared to gallium-based alternatives. Weaknesses: Narrower operating temperature range than some competing technologies; higher manufacturing complexity due to precise temperature control requirements; potential for performance degradation in extreme environmental conditions.

Key Patents and Research in Liquid Metal Electronics

Precursor compositions for the deposition of electrically conductive features

PatentInactiveUS6951666B2

Innovation

- Development of precursor compositions comprising molecular metal precursors, solvents, micron-sized particles, nanoparticles, and additives that can be deposited using thick-film methods, allowing for low decomposition temperatures and high conductivity, with the ability to form conductive features on various substrates, including organic ones, using low processing temperatures and short heating times.

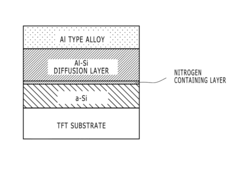

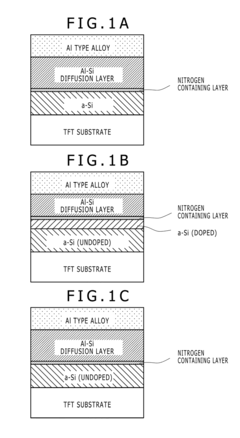

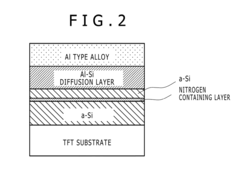

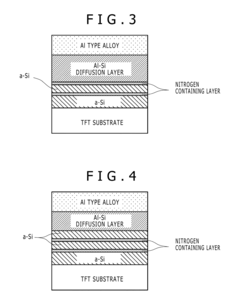

Interconnection structure, a thin film transistor substrate, and a manufacturing method thereof, as well as a display device

PatentInactiveUS8299614B2

Innovation

- A direct contact technique using a laminate structure with an (N, C, F) layer and an Al—Si diffusion layer, where nitrogen, carbon, and fluorine elements are bonded with Si, allowing direct contact between the Al type alloy film and the semiconductor layer without a barrier metal, formed by sequential deposition and thermal hysteresis.

Manufacturing Scalability Assessment

The scalability of liquid metal interconnect manufacturing represents a critical factor in determining the commercial viability of this technology for electronic display applications. Current manufacturing processes for liquid metal interconnects face significant challenges when transitioning from laboratory-scale production to mass manufacturing environments. The primary obstacle lies in maintaining consistent material properties and performance across large production volumes while ensuring cost-effectiveness.

Traditional manufacturing methods for electronic displays rely on established processes for solid metal conductors, which benefit from decades of industrial optimization. In contrast, liquid metal interconnect manufacturing requires specialized equipment for handling, injecting, and encapsulating these materials under controlled conditions. The rheological properties of liquid metals, particularly gallium-based alloys, necessitate precise temperature control throughout the manufacturing process to prevent premature solidification or excessive fluidity.

Yield rates present another significant challenge, with current pilot production lines demonstrating inconsistent results when scaled beyond small batches. Industry data suggests yield rates between 65-78% for liquid metal interconnect production, compared to 90-95% for conventional solid metal interconnects in display technologies. This disparity significantly impacts production economics and must be addressed before widespread adoption becomes feasible.

Equipment compatibility represents an additional hurdle, as existing display manufacturing infrastructure requires substantial modification to accommodate liquid metal processing. The capital expenditure required for such modifications presents a barrier to entry for many manufacturers, particularly those with established production lines for conventional display technologies.

Supply chain considerations also affect scalability, with the limited availability of high-purity gallium and other constituent metals potentially constraining production volumes. Current global production of gallium stands at approximately 300 metric tons annually, with electronic applications already consuming a significant portion of this supply.

Recent advancements in automated dispensing systems and microfluidic handling technologies show promise for improving manufacturing throughput. Several research institutions and industrial partners have demonstrated semi-automated production lines capable of processing liquid metal interconnects at moderate scales, with throughput rates approaching 60-70% of conventional technologies.

Cost modeling indicates that economies of scale could eventually make liquid metal interconnect manufacturing competitive with traditional methods, particularly as production volumes increase and specialized equipment becomes more widely available. However, this economic crossover point likely requires production volumes exceeding 500,000 units annually, a threshold that may be challenging for new market entrants to achieve without significant investment.

Traditional manufacturing methods for electronic displays rely on established processes for solid metal conductors, which benefit from decades of industrial optimization. In contrast, liquid metal interconnect manufacturing requires specialized equipment for handling, injecting, and encapsulating these materials under controlled conditions. The rheological properties of liquid metals, particularly gallium-based alloys, necessitate precise temperature control throughout the manufacturing process to prevent premature solidification or excessive fluidity.

Yield rates present another significant challenge, with current pilot production lines demonstrating inconsistent results when scaled beyond small batches. Industry data suggests yield rates between 65-78% for liquid metal interconnect production, compared to 90-95% for conventional solid metal interconnects in display technologies. This disparity significantly impacts production economics and must be addressed before widespread adoption becomes feasible.

Equipment compatibility represents an additional hurdle, as existing display manufacturing infrastructure requires substantial modification to accommodate liquid metal processing. The capital expenditure required for such modifications presents a barrier to entry for many manufacturers, particularly those with established production lines for conventional display technologies.

Supply chain considerations also affect scalability, with the limited availability of high-purity gallium and other constituent metals potentially constraining production volumes. Current global production of gallium stands at approximately 300 metric tons annually, with electronic applications already consuming a significant portion of this supply.

Recent advancements in automated dispensing systems and microfluidic handling technologies show promise for improving manufacturing throughput. Several research institutions and industrial partners have demonstrated semi-automated production lines capable of processing liquid metal interconnects at moderate scales, with throughput rates approaching 60-70% of conventional technologies.

Cost modeling indicates that economies of scale could eventually make liquid metal interconnect manufacturing competitive with traditional methods, particularly as production volumes increase and specialized equipment becomes more widely available. However, this economic crossover point likely requires production volumes exceeding 500,000 units annually, a threshold that may be challenging for new market entrants to achieve without significant investment.

Environmental Impact and Sustainability Considerations

The environmental impact of liquid metal interconnect technology in electronic displays represents a critical consideration in the broader context of sustainable electronics development. Traditional display manufacturing processes rely heavily on materials like indium tin oxide (ITO), which involve energy-intensive extraction and processing methods with significant ecological footprints. Liquid metal interconnects offer promising alternatives that could substantially reduce these environmental burdens.

The production of liquid metal alloys typically requires lower processing temperatures compared to conventional metallic conductors, potentially reducing energy consumption during manufacturing. Gallium-based liquid metal alloys, commonly used in this technology, have melting points near room temperature, eliminating the need for high-temperature processing that contributes to carbon emissions in traditional electronics manufacturing.

Waste reduction presents another significant environmental advantage. Liquid metal deposition techniques often achieve higher material utilization efficiency than conventional methods, minimizing the generation of hazardous waste. Additionally, the self-healing properties of liquid metals may extend device lifespans, addressing the growing electronic waste crisis by reducing replacement frequency.

Resource conservation merits particular attention in sustainability assessments. While gallium and indium are relatively rare elements, their implementation in liquid metal interconnects may actually improve resource efficiency through more precise application methods and reduced material requirements per device. However, comprehensive life cycle assessments are needed to quantify these benefits accurately.

End-of-life considerations reveal both challenges and opportunities. The recoverability of liquid metals from disposed electronic displays could potentially establish new recycling pathways, though specialized processes would be required. Research into non-toxic liquid metal formulations is advancing to address concerns about potential environmental contamination from improper disposal.

Regulatory frameworks worldwide are increasingly emphasizing electronic product sustainability, with the European Union's Restriction of Hazardous Substances (RoHS) Directive and similar regulations influencing material selection in display technologies. Manufacturers adopting liquid metal interconnect technology must navigate these evolving requirements while demonstrating improved environmental performance.

The industry faces a critical challenge in balancing immediate manufacturing advantages against long-term ecological impacts. Future research should prioritize developing liquid metal formulations with minimal environmental toxicity while maintaining optimal electronic performance, establishing efficient recycling protocols, and conducting comprehensive comparative life cycle analyses against conventional technologies.

The production of liquid metal alloys typically requires lower processing temperatures compared to conventional metallic conductors, potentially reducing energy consumption during manufacturing. Gallium-based liquid metal alloys, commonly used in this technology, have melting points near room temperature, eliminating the need for high-temperature processing that contributes to carbon emissions in traditional electronics manufacturing.

Waste reduction presents another significant environmental advantage. Liquid metal deposition techniques often achieve higher material utilization efficiency than conventional methods, minimizing the generation of hazardous waste. Additionally, the self-healing properties of liquid metals may extend device lifespans, addressing the growing electronic waste crisis by reducing replacement frequency.

Resource conservation merits particular attention in sustainability assessments. While gallium and indium are relatively rare elements, their implementation in liquid metal interconnects may actually improve resource efficiency through more precise application methods and reduced material requirements per device. However, comprehensive life cycle assessments are needed to quantify these benefits accurately.

End-of-life considerations reveal both challenges and opportunities. The recoverability of liquid metals from disposed electronic displays could potentially establish new recycling pathways, though specialized processes would be required. Research into non-toxic liquid metal formulations is advancing to address concerns about potential environmental contamination from improper disposal.

Regulatory frameworks worldwide are increasingly emphasizing electronic product sustainability, with the European Union's Restriction of Hazardous Substances (RoHS) Directive and similar regulations influencing material selection in display technologies. Manufacturers adopting liquid metal interconnect technology must navigate these evolving requirements while demonstrating improved environmental performance.

The industry faces a critical challenge in balancing immediate manufacturing advantages against long-term ecological impacts. Future research should prioritize developing liquid metal formulations with minimal environmental toxicity while maintaining optimal electronic performance, establishing efficient recycling protocols, and conducting comprehensive comparative life cycle analyses against conventional technologies.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!