Analysis of Market Dynamics in mRNA Nanoparticle Industry

OCT 10, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

mRNA Nanoparticle Technology Evolution and Objectives

mRNA nanoparticle technology represents one of the most significant breakthroughs in modern medicine, with its development trajectory accelerating dramatically over the past decade. The technology's evolution began in the 1990s with fundamental research on mRNA delivery mechanisms, progressing through various experimental phases before reaching clinical applications in the 2010s. The COVID-19 pandemic served as a catalyst, propelling mRNA technology from promising research to mainstream therapeutic application at unprecedented speed.

The technological evolution of mRNA nanoparticles has been characterized by several key advancements. Initially, researchers focused on overcoming the inherent instability of mRNA molecules and their susceptibility to degradation. This led to innovations in nucleoside modifications and sequence optimization that significantly enhanced mRNA stability and reduced immunogenicity, allowing for more efficient translation in vivo.

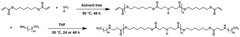

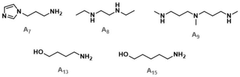

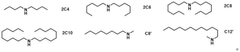

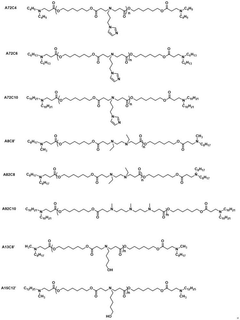

Parallel to these developments, delivery systems evolved from basic lipid formulations to sophisticated lipid nanoparticles (LNPs) with precisely engineered compositions. These advanced LNPs feature optimized ionizable lipids, helper phospholipids, cholesterol, and PEG-lipids in specific ratios, enabling targeted delivery and controlled release of mRNA cargo. Recent innovations include the development of polymer-based nanoparticles and hybrid systems that combine multiple delivery technologies.

The current technological landscape is increasingly focused on enhancing specificity, reducing side effects, and expanding the therapeutic window of mRNA nanoparticle treatments. Researchers are exploring novel formulations that can target specific cell types or tissues, as well as controlled-release mechanisms that can optimize the pharmacokinetics of mRNA therapeutics.

Looking forward, the primary objectives in this field include developing mRNA nanoparticles with improved stability at various temperatures, reducing production costs to enhance accessibility, and expanding applications beyond vaccines to include protein replacement therapies, cancer immunotherapies, and genetic disease treatments. There is also significant interest in creating multi-functional nanoparticles capable of delivering combination therapies or responding to specific biological triggers.

The convergence of mRNA technology with advances in nanotechnology, computational biology, and high-throughput screening methods is expected to accelerate innovation in this space. As these technologies mature, the goal is to establish mRNA nanoparticles as a versatile platform technology capable of addressing a wide range of medical needs with unprecedented precision and efficacy.

The technological evolution of mRNA nanoparticles has been characterized by several key advancements. Initially, researchers focused on overcoming the inherent instability of mRNA molecules and their susceptibility to degradation. This led to innovations in nucleoside modifications and sequence optimization that significantly enhanced mRNA stability and reduced immunogenicity, allowing for more efficient translation in vivo.

Parallel to these developments, delivery systems evolved from basic lipid formulations to sophisticated lipid nanoparticles (LNPs) with precisely engineered compositions. These advanced LNPs feature optimized ionizable lipids, helper phospholipids, cholesterol, and PEG-lipids in specific ratios, enabling targeted delivery and controlled release of mRNA cargo. Recent innovations include the development of polymer-based nanoparticles and hybrid systems that combine multiple delivery technologies.

The current technological landscape is increasingly focused on enhancing specificity, reducing side effects, and expanding the therapeutic window of mRNA nanoparticle treatments. Researchers are exploring novel formulations that can target specific cell types or tissues, as well as controlled-release mechanisms that can optimize the pharmacokinetics of mRNA therapeutics.

Looking forward, the primary objectives in this field include developing mRNA nanoparticles with improved stability at various temperatures, reducing production costs to enhance accessibility, and expanding applications beyond vaccines to include protein replacement therapies, cancer immunotherapies, and genetic disease treatments. There is also significant interest in creating multi-functional nanoparticles capable of delivering combination therapies or responding to specific biological triggers.

The convergence of mRNA technology with advances in nanotechnology, computational biology, and high-throughput screening methods is expected to accelerate innovation in this space. As these technologies mature, the goal is to establish mRNA nanoparticles as a versatile platform technology capable of addressing a wide range of medical needs with unprecedented precision and efficacy.

Market Demand Analysis for mRNA Nanoparticle Therapeutics

The mRNA nanoparticle therapeutics market has experienced unprecedented growth following the successful deployment of COVID-19 vaccines. Current market analysis indicates that the global mRNA therapeutics market reached approximately $40 billion in 2021, with projections suggesting a compound annual growth rate of 28% through 2028. This remarkable expansion reflects both immediate pandemic-driven demand and growing recognition of the platform's broader therapeutic potential.

Primary market demand stems from infectious disease prevention, where mRNA vaccines have demonstrated exceptional efficacy. The COVID-19 pandemic established proof-of-concept at unprecedented scale, with billions of doses administered globally. This success has catalyzed investment in mRNA platforms for other infectious diseases including influenza, HIV, Zika, and emerging pathogens, representing a substantial market opportunity estimated at $25 billion by 2026.

Oncology represents another significant growth vector, with several mRNA-based cancer vaccines and immunotherapies in late-stage clinical trials. Industry analysts project the oncology segment of mRNA therapeutics to reach $15 billion by 2027, driven by personalized cancer vaccines and combination therapies. The ability to rapidly design and manufacture patient-specific treatments aligns perfectly with precision medicine trends, creating substantial market pull.

Rare genetic disorders constitute a third major demand segment. The programmable nature of mRNA therapeutics offers potential treatments for thousands of monogenic disorders currently lacking effective interventions. Though individually rare, collectively these diseases affect millions worldwide, representing a specialized but lucrative market estimated at $10 billion by 2028.

Healthcare systems globally are demonstrating willingness to pay premium prices for mRNA therapeutics that demonstrate significant clinical benefits. Average treatment costs range from $500-$2,000 for vaccines to $50,000-$200,000 for personalized cancer therapies, with payers increasingly developing specialized reimbursement frameworks for these novel modalities.

Regional market analysis reveals differential growth patterns. North America currently dominates with 45% market share, followed by Europe at 30%. However, Asia-Pacific markets are expected to grow at the fastest rate (32% CAGR) through 2028, driven by expanding healthcare infrastructure, increasing R&D investments, and growing middle-class populations with greater healthcare access.

Key market constraints include cold chain logistics requirements, manufacturing scalability challenges, and regulatory uncertainties surrounding novel delivery systems. However, technological innovations in lipid nanoparticle formulations are progressively addressing stability issues, potentially expanding market reach into regions with limited cold chain infrastructure.

Consumer sentiment analysis indicates growing acceptance of mRNA technology following widespread COVID-19 vaccine adoption, though education gaps remain regarding mechanism of action and safety profiles. Healthcare provider surveys show 78% express interest in expanding mRNA therapeutic applications beyond vaccines, signaling strong professional endorsement driving future market growth.

Primary market demand stems from infectious disease prevention, where mRNA vaccines have demonstrated exceptional efficacy. The COVID-19 pandemic established proof-of-concept at unprecedented scale, with billions of doses administered globally. This success has catalyzed investment in mRNA platforms for other infectious diseases including influenza, HIV, Zika, and emerging pathogens, representing a substantial market opportunity estimated at $25 billion by 2026.

Oncology represents another significant growth vector, with several mRNA-based cancer vaccines and immunotherapies in late-stage clinical trials. Industry analysts project the oncology segment of mRNA therapeutics to reach $15 billion by 2027, driven by personalized cancer vaccines and combination therapies. The ability to rapidly design and manufacture patient-specific treatments aligns perfectly with precision medicine trends, creating substantial market pull.

Rare genetic disorders constitute a third major demand segment. The programmable nature of mRNA therapeutics offers potential treatments for thousands of monogenic disorders currently lacking effective interventions. Though individually rare, collectively these diseases affect millions worldwide, representing a specialized but lucrative market estimated at $10 billion by 2028.

Healthcare systems globally are demonstrating willingness to pay premium prices for mRNA therapeutics that demonstrate significant clinical benefits. Average treatment costs range from $500-$2,000 for vaccines to $50,000-$200,000 for personalized cancer therapies, with payers increasingly developing specialized reimbursement frameworks for these novel modalities.

Regional market analysis reveals differential growth patterns. North America currently dominates with 45% market share, followed by Europe at 30%. However, Asia-Pacific markets are expected to grow at the fastest rate (32% CAGR) through 2028, driven by expanding healthcare infrastructure, increasing R&D investments, and growing middle-class populations with greater healthcare access.

Key market constraints include cold chain logistics requirements, manufacturing scalability challenges, and regulatory uncertainties surrounding novel delivery systems. However, technological innovations in lipid nanoparticle formulations are progressively addressing stability issues, potentially expanding market reach into regions with limited cold chain infrastructure.

Consumer sentiment analysis indicates growing acceptance of mRNA technology following widespread COVID-19 vaccine adoption, though education gaps remain regarding mechanism of action and safety profiles. Healthcare provider surveys show 78% express interest in expanding mRNA therapeutic applications beyond vaccines, signaling strong professional endorsement driving future market growth.

Technical Challenges in mRNA Nanoparticle Development

The development of mRNA nanoparticle technology faces several significant technical challenges that currently limit its widespread application and commercial scalability. One of the primary obstacles is the inherent instability of mRNA molecules, which are highly susceptible to degradation by ubiquitous ribonucleases. This necessitates sophisticated delivery systems and storage solutions that can maintain integrity throughout manufacturing, distribution, and administration processes.

Lipid nanoparticle (LNP) formulation, while proven effective in recent vaccine applications, presents complex manufacturing challenges. The precise control of lipid ratios, particle size distribution, and encapsulation efficiency requires highly specialized equipment and expertise. Current production methods often struggle with batch-to-batch consistency at industrial scales, creating regulatory hurdles and quality control issues that impact market expansion.

Cold chain requirements represent another significant technical barrier. Most mRNA-LNP formulations require ultra-cold storage conditions (-70°C to -20°C), creating substantial logistical challenges and infrastructure demands, particularly in developing regions. This temperature sensitivity limits global accessibility and increases overall deployment costs, constraining market penetration in resource-limited settings.

Immunogenicity concerns persist as a technical challenge, with potential inflammatory responses to both the mRNA components and delivery vehicles. While beneficial in vaccine applications, these immunostimulatory properties can be problematic for therapeutic applications requiring repeated dosing. Engineering mRNA sequences and delivery systems to modulate immune activation remains technically challenging.

Targeted delivery represents perhaps the most significant hurdle for expanding beyond vaccine applications into therapeutics. Current nanoparticle systems show preferential distribution to the liver, limiting efficacy for other tissue targets. Developing tissue-specific targeting mechanisms without compromising stability or triggering immune clearance requires sophisticated bioengineering approaches not yet fully realized.

Scale-up manufacturing presents multifaceted challenges, from sourcing high-quality raw materials to maintaining aseptic conditions throughout production. The complex multi-step manufacturing process involves specialized equipment and expertise, creating bottlenecks in production capacity. Limited manufacturing infrastructure globally restricts market growth and contributes to high production costs.

Regulatory frameworks for this novel technology continue to evolve, creating uncertainty in development pathways. The complexity of characterizing nanoparticle products to regulatory standards requires advanced analytical methods still under development. Demonstrating consistency, stability, and safety across production batches remains technically demanding.

Intellectual property landscapes present additional complications, with overlapping patent claims on delivery technologies potentially restricting innovation and market entry. Navigating this complex IP environment requires significant legal and technical expertise, creating barriers particularly for smaller market entrants.

Lipid nanoparticle (LNP) formulation, while proven effective in recent vaccine applications, presents complex manufacturing challenges. The precise control of lipid ratios, particle size distribution, and encapsulation efficiency requires highly specialized equipment and expertise. Current production methods often struggle with batch-to-batch consistency at industrial scales, creating regulatory hurdles and quality control issues that impact market expansion.

Cold chain requirements represent another significant technical barrier. Most mRNA-LNP formulations require ultra-cold storage conditions (-70°C to -20°C), creating substantial logistical challenges and infrastructure demands, particularly in developing regions. This temperature sensitivity limits global accessibility and increases overall deployment costs, constraining market penetration in resource-limited settings.

Immunogenicity concerns persist as a technical challenge, with potential inflammatory responses to both the mRNA components and delivery vehicles. While beneficial in vaccine applications, these immunostimulatory properties can be problematic for therapeutic applications requiring repeated dosing. Engineering mRNA sequences and delivery systems to modulate immune activation remains technically challenging.

Targeted delivery represents perhaps the most significant hurdle for expanding beyond vaccine applications into therapeutics. Current nanoparticle systems show preferential distribution to the liver, limiting efficacy for other tissue targets. Developing tissue-specific targeting mechanisms without compromising stability or triggering immune clearance requires sophisticated bioengineering approaches not yet fully realized.

Scale-up manufacturing presents multifaceted challenges, from sourcing high-quality raw materials to maintaining aseptic conditions throughout production. The complex multi-step manufacturing process involves specialized equipment and expertise, creating bottlenecks in production capacity. Limited manufacturing infrastructure globally restricts market growth and contributes to high production costs.

Regulatory frameworks for this novel technology continue to evolve, creating uncertainty in development pathways. The complexity of characterizing nanoparticle products to regulatory standards requires advanced analytical methods still under development. Demonstrating consistency, stability, and safety across production batches remains technically demanding.

Intellectual property landscapes present additional complications, with overlapping patent claims on delivery technologies potentially restricting innovation and market entry. Navigating this complex IP environment requires significant legal and technical expertise, creating barriers particularly for smaller market entrants.

Current mRNA Nanoparticle Delivery Solutions

01 mRNA delivery systems and nanoparticle formulations

Various nanoparticle formulations have been developed for efficient mRNA delivery to target cells. These formulations typically include lipid nanoparticles (LNPs), polymeric nanoparticles, and hybrid systems that protect mRNA from degradation and facilitate cellular uptake. The design of these delivery systems focuses on optimizing transfection efficiency, reducing toxicity, and enhancing the stability of the mRNA cargo. Advanced formulations may incorporate targeting ligands to improve tissue-specific delivery.- mRNA delivery systems and formulation technologies: Various delivery systems and formulation technologies have been developed for mRNA nanoparticles to enhance stability, cellular uptake, and therapeutic efficacy. These include lipid nanoparticles (LNPs), polymeric nanoparticles, and hybrid systems that protect mRNA from degradation and facilitate targeted delivery to specific tissues. Advanced formulation techniques incorporate specialized lipids, polymers, and surface modifications to optimize pharmacokinetic properties and reduce immunogenicity.

- Market growth drivers and therapeutic applications: The mRNA nanoparticle market is experiencing rapid growth driven by successful vaccine applications and expanding therapeutic potential. Key growth factors include increasing investment in mRNA technology, rising prevalence of chronic diseases, and growing demand for personalized medicine. Therapeutic applications extend beyond vaccines to include cancer immunotherapy, protein replacement therapies, and treatment of genetic disorders, creating diverse market opportunities across multiple disease areas.

- Manufacturing challenges and scale-up solutions: Manufacturing mRNA nanoparticles at commercial scale presents significant challenges including maintaining consistency, purity, and stability. Innovations in continuous manufacturing processes, automated production systems, and quality control methodologies are addressing these challenges. Advanced analytical techniques for characterization and standardized production protocols are being developed to ensure batch-to-batch consistency and regulatory compliance while reducing production costs.

- Competitive landscape and strategic partnerships: The mRNA nanoparticle market features intense competition among established pharmaceutical companies, biotechnology startups, and academic institutions. Strategic partnerships, licensing agreements, and mergers and acquisitions are reshaping the competitive landscape. Companies are forming collaborations to combine complementary technologies, expand manufacturing capabilities, and accelerate clinical development. These strategic alliances are critical for addressing market challenges and capitalizing on emerging opportunities.

- Regulatory considerations and market access strategies: Regulatory frameworks for mRNA nanoparticle products are evolving as the technology advances. Companies must navigate complex approval pathways that vary by region and therapeutic application. Market access strategies include early engagement with regulatory authorities, development of robust clinical data packages, and implementation of risk management plans. Pricing and reimbursement considerations, intellectual property protection, and adherence to evolving guidelines are critical factors affecting commercial success in this dynamic market environment.

02 Manufacturing technologies and scale-up processes

The manufacturing of mRNA nanoparticles involves complex processes including mRNA synthesis, purification, and encapsulation within nanoparticles. Recent technological advancements have focused on improving production efficiency, quality control, and scale-up capabilities to meet growing market demands. Continuous manufacturing processes, microfluidic technologies, and automated systems have been developed to enhance batch consistency and reduce production costs while maintaining product quality.Expand Specific Solutions03 Therapeutic applications and clinical developments

mRNA nanoparticles are being developed for various therapeutic applications including vaccines, cancer immunotherapy, protein replacement therapies, and genetic disorder treatments. Clinical trials have demonstrated promising results in terms of safety, efficacy, and immune response. The success of mRNA-based COVID-19 vaccines has accelerated interest in this technology platform for addressing other infectious diseases and medical conditions, expanding the potential market for mRNA therapeutics.Expand Specific Solutions04 Market trends and competitive landscape

The mRNA nanoparticles market is experiencing rapid growth driven by successful vaccine deployments and increasing investments in research and development. Key market players are expanding their capabilities through strategic partnerships, mergers, and acquisitions. Regional market dynamics show varying adoption rates based on regulatory frameworks, healthcare infrastructure, and investment climates. Emerging economies are showing increased interest in developing domestic mRNA manufacturing capabilities to ensure supply chain resilience.Expand Specific Solutions05 Regulatory considerations and intellectual property landscape

The regulatory framework for mRNA nanoparticle products continues to evolve as more products enter clinical trials and commercial markets. Regulatory agencies are developing specialized guidelines for evaluating the safety and efficacy of these novel therapeutics. The intellectual property landscape is increasingly complex, with patents covering mRNA modifications, delivery systems, manufacturing processes, and specific therapeutic applications. Strategic patent filings and freedom-to-operate analyses are critical for companies operating in this competitive space.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The mRNA nanoparticle industry is currently in a growth phase, characterized by rapid technological advancement and expanding applications beyond COVID-19 vaccines. The global market is projected to reach significant scale, driven by therapeutic applications in oncology, infectious diseases, and rare genetic disorders. Leading players like BioNTech, Moderna, and CAS Center for Excellence in Molecular Cell Science demonstrate advanced technological maturity in lipid nanoparticle delivery systems. Traditional pharmaceutical companies (Merck) are entering through strategic partnerships, while academic institutions (Zhejiang University, KAIST, Sichuan University) contribute fundamental research. Regional competition is intensifying with Chinese companies (CanSino Biologics, Regis Biotechnology) rapidly developing capabilities to challenge Western incumbents, creating a dynamic competitive landscape poised for consolidation as the technology matures.

ModernaTX, Inc.

Technical Solution: Moderna has pioneered the LNP (Lipid Nanoparticle) delivery system for mRNA therapeutics, featuring proprietary ionizable lipids that enable efficient cellular uptake and endosomal escape. Their platform incorporates SM-102 ionizable lipids, cholesterol, DSPC, and PEG2000-DMG in precise ratios, creating nanoparticles with optimal size (80-100nm) for tissue penetration. Moderna's manufacturing process employs microfluidic mixing technology that ensures consistent particle size distribution and high encapsulation efficiency (>90%). Their LNPs demonstrate enhanced stability with shelf-life exceeding 6 months at refrigerated temperatures, addressing a critical challenge in mRNA therapeutics. The company has developed specialized formulations for different tissue targeting, including liver-directed and immune cell-directed variants, expanding the therapeutic potential beyond vaccines to protein replacement therapies and cancer immunotherapies.

Strengths: Industry-leading encapsulation efficiency and stability profiles; extensive clinical validation through COVID-19 vaccine; versatile platform adaptable to multiple therapeutic areas. Weaknesses: Higher production costs compared to traditional therapeutics; potential cold chain requirements limiting global distribution; some formulations show inflammatory responses requiring careful dosing strategies.

BioNTech SE

Technical Solution: BioNTech has developed an advanced LNP-mRNA platform featuring ALC-0315 aminolipids that demonstrate superior endosomal escape properties. Their technology employs a proprietary microfluidic mixing process that creates uniform nanoparticles (70-100nm) with high batch-to-batch consistency. BioNTech's formulation includes specialized helper lipids that enhance stability and reduce immunogenicity of the carrier system. The company has pioneered targeted delivery approaches using receptor-specific ligands conjugated to their LNPs, allowing for tissue-specific mRNA delivery beyond the default liver tropism. Their manufacturing platform incorporates continuous processing techniques that improve scalability while maintaining critical quality attributes. BioNTech has also developed lyophilization techniques that improve thermal stability of their mRNA-LNP formulations, potentially enabling storage at higher temperatures than conventional formulations. Their platform demonstrates versatility across therapeutic areas including infectious diseases, oncology, and protein replacement therapies.

Strengths: Proven technology platform with regulatory approval; strong intellectual property portfolio covering key aspects of mRNA delivery; established manufacturing infrastructure with significant capacity. Weaknesses: Reliance on cold-chain logistics for some formulations; higher cost structure compared to conventional therapeutics; potential for lipid component accumulation with repeated dosing requiring optimization.

Breakthrough Patents in Lipid Nanoparticle Technology

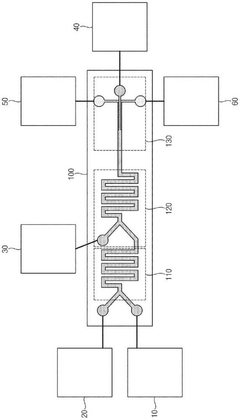

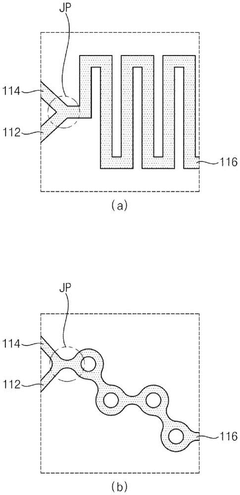

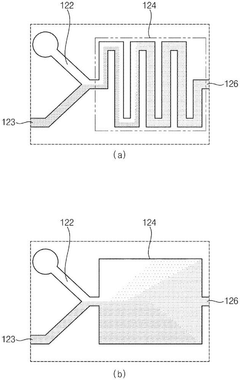

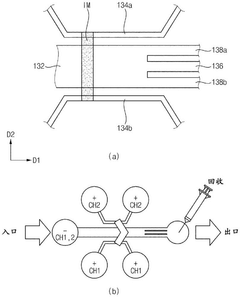

Chip for producing lipid nanoparticles, lipid nanoparticle production system and lipid nanoparticle production method containing the same

PatentActiveCN116322959B

Innovation

- A chip system is designed that contains mixing, diluting and concentrating parts. The active ingredients and lipid raw materials are mixed through the mixing part, the diluting part dilutes the mixed solution, and the lipid nanoparticles are realized in the concentrating part using ion exchange channels and buffer solution channels. Condensation and acquisition.

Polymer for mRNA delivery, lipid/polymer hybrid nanoparticle using same, and preparation method and application thereof

PatentActiveCN118755084A

Innovation

- By adding hydrophobic group modification and auxiliary lipid DOTAP to the PBAE polymer, the formula composition of the nanoparticles is optimized to improve the physical encapsulation efficiency and cellular uptake ability of nucleic acids, form lipid/polymer hybrid nanoparticles, and promote the incorporation of mRNA. Delivery inside and outside.

Regulatory Framework for mRNA-based Therapeutics

The regulatory landscape for mRNA-based therapeutics has evolved significantly in recent years, particularly accelerated by the COVID-19 pandemic which prompted expedited review processes for mRNA vaccines. Currently, regulatory frameworks across major markets exhibit varying degrees of maturity and specificity for mRNA nanoparticle products, creating a complex environment for industry stakeholders.

In the United States, the FDA has established a multi-tiered approach for mRNA therapeutics regulation, primarily through the Center for Biologics Evaluation and Research (CBER) and the Center for Drug Evaluation and Research (CDER). The regulatory pathway typically involves Investigational New Drug (IND) applications, followed by Biologics License Applications (BLA) for market approval. Recent guidance documents specifically address lipid nanoparticle delivery systems for nucleic acid therapeutics, acknowledging the unique characteristics of mRNA formulations.

The European Medicines Agency (EMA) has implemented the Advanced Therapy Medicinal Products (ATMP) framework, which encompasses mRNA-based therapeutics. The Committee for Advanced Therapies (CAT) provides specialized oversight for these novel modalities. The EMA has also established accelerated assessment procedures for products addressing unmet medical needs, which has benefited several mRNA therapeutic candidates.

In Asia, regulatory approaches vary considerably. Japan's Pharmaceuticals and Medical Devices Agency (PMDA) has created the SAKIGAKE designation system to expedite innovative therapies, including mRNA products. China's National Medical Products Administration (NMPA) has recently updated its guidelines to accommodate novel therapeutic modalities, though specific mRNA regulatory pathways remain in development.

Key regulatory challenges for the mRNA nanoparticle industry include standardization of analytical methods for characterizing lipid nanoparticles, establishing appropriate stability testing protocols, and developing consistent safety evaluation frameworks for immunogenicity assessment. The novelty of mRNA delivery systems presents unique challenges in determining appropriate reference standards and control strategies.

Global harmonization efforts are underway through initiatives like the International Council for Harmonisation (ICH) and collaborative discussions between major regulatory bodies. These efforts aim to establish consistent quality requirements, safety assessment protocols, and manufacturing standards specific to mRNA therapeutics, potentially reducing regulatory burden for global development programs.

As the field advances, regulatory frameworks are expected to evolve toward more tailored approaches for mRNA therapeutics, with increased focus on platform-based assessments that could streamline development of multiple products using similar delivery technologies.

In the United States, the FDA has established a multi-tiered approach for mRNA therapeutics regulation, primarily through the Center for Biologics Evaluation and Research (CBER) and the Center for Drug Evaluation and Research (CDER). The regulatory pathway typically involves Investigational New Drug (IND) applications, followed by Biologics License Applications (BLA) for market approval. Recent guidance documents specifically address lipid nanoparticle delivery systems for nucleic acid therapeutics, acknowledging the unique characteristics of mRNA formulations.

The European Medicines Agency (EMA) has implemented the Advanced Therapy Medicinal Products (ATMP) framework, which encompasses mRNA-based therapeutics. The Committee for Advanced Therapies (CAT) provides specialized oversight for these novel modalities. The EMA has also established accelerated assessment procedures for products addressing unmet medical needs, which has benefited several mRNA therapeutic candidates.

In Asia, regulatory approaches vary considerably. Japan's Pharmaceuticals and Medical Devices Agency (PMDA) has created the SAKIGAKE designation system to expedite innovative therapies, including mRNA products. China's National Medical Products Administration (NMPA) has recently updated its guidelines to accommodate novel therapeutic modalities, though specific mRNA regulatory pathways remain in development.

Key regulatory challenges for the mRNA nanoparticle industry include standardization of analytical methods for characterizing lipid nanoparticles, establishing appropriate stability testing protocols, and developing consistent safety evaluation frameworks for immunogenicity assessment. The novelty of mRNA delivery systems presents unique challenges in determining appropriate reference standards and control strategies.

Global harmonization efforts are underway through initiatives like the International Council for Harmonisation (ICH) and collaborative discussions between major regulatory bodies. These efforts aim to establish consistent quality requirements, safety assessment protocols, and manufacturing standards specific to mRNA therapeutics, potentially reducing regulatory burden for global development programs.

As the field advances, regulatory frameworks are expected to evolve toward more tailored approaches for mRNA therapeutics, with increased focus on platform-based assessments that could streamline development of multiple products using similar delivery technologies.

Manufacturing Scalability and Cost Analysis

The manufacturing scalability of mRNA nanoparticle technologies represents a critical bottleneck in the industry's growth trajectory. Current production methods, primarily developed for clinical trials and limited commercial applications, face significant challenges when scaled to meet global demand. The lipid nanoparticle (LNP) formulation process requires precise control of mixing parameters, temperature conditions, and particle size distribution—factors that become increasingly difficult to maintain at industrial scales.

Production costs remain prohibitively high, with raw materials accounting for approximately 30-40% of total manufacturing expenses. The specialized lipids required for LNP formulation can cost between $50,000-100,000 per kilogram, while the enzymatic processes for mRNA synthesis utilize expensive nucleotides and capping reagents. These material costs create substantial barriers to price reduction and widespread accessibility.

Equipment requirements present another scaling challenge. The transition from laboratory-scale microfluidic devices to industrial-scale production necessitates substantial capital investment. Companies must develop or acquire specialized mixing technologies, purification systems, and quality control infrastructure capable of maintaining product consistency across batches measured in liters rather than milliliters.

Regulatory considerations further complicate manufacturing scale-up. The complex nature of mRNA-LNP products requires extensive characterization and validation of each production step. Changes in manufacturing scale often necessitate additional clinical data to demonstrate equivalence, adding time and cost to the development process. The industry currently lacks fully harmonized standards for analytical methods and specifications across different regulatory jurisdictions.

Supply chain vulnerabilities have emerged as a significant concern following pandemic-related disruptions. Key raw materials, including modified nucleotides, capping reagents, and specialized lipids, often rely on limited supplier networks. Geographic concentration of manufacturing expertise and facilities, primarily in North America and Europe, creates additional resilience risks for global supply.

Emerging technologies offer promising solutions to these manufacturing challenges. Continuous processing systems are beginning to replace batch production methods, potentially reducing facility footprints and capital requirements while improving process control. Advances in enzymatic mRNA synthesis and purification techniques may reduce production costs by 40-60% within the next five years, according to industry projections.

Production costs remain prohibitively high, with raw materials accounting for approximately 30-40% of total manufacturing expenses. The specialized lipids required for LNP formulation can cost between $50,000-100,000 per kilogram, while the enzymatic processes for mRNA synthesis utilize expensive nucleotides and capping reagents. These material costs create substantial barriers to price reduction and widespread accessibility.

Equipment requirements present another scaling challenge. The transition from laboratory-scale microfluidic devices to industrial-scale production necessitates substantial capital investment. Companies must develop or acquire specialized mixing technologies, purification systems, and quality control infrastructure capable of maintaining product consistency across batches measured in liters rather than milliliters.

Regulatory considerations further complicate manufacturing scale-up. The complex nature of mRNA-LNP products requires extensive characterization and validation of each production step. Changes in manufacturing scale often necessitate additional clinical data to demonstrate equivalence, adding time and cost to the development process. The industry currently lacks fully harmonized standards for analytical methods and specifications across different regulatory jurisdictions.

Supply chain vulnerabilities have emerged as a significant concern following pandemic-related disruptions. Key raw materials, including modified nucleotides, capping reagents, and specialized lipids, often rely on limited supplier networks. Geographic concentration of manufacturing expertise and facilities, primarily in North America and Europe, creates additional resilience risks for global supply.

Emerging technologies offer promising solutions to these manufacturing challenges. Continuous processing systems are beginning to replace batch production methods, potentially reducing facility footprints and capital requirements while improving process control. Advances in enzymatic mRNA synthesis and purification techniques may reduce production costs by 40-60% within the next five years, according to industry projections.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!