Role of Market Dynamics in mRNA Lipid Nanoparticle Innovation

OCT 10, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

mRNA LNP Technology Evolution and Objectives

mRNA lipid nanoparticle (LNP) technology represents one of the most significant breakthroughs in modern pharmaceutical delivery systems, with its prominence dramatically accelerated by the COVID-19 pandemic. The evolution of this technology spans over three decades, beginning in the 1990s with early lipid-based delivery systems primarily focused on DNA delivery. The transition to mRNA delivery systems gained momentum in the early 2000s when researchers recognized mRNA's potential advantages over DNA, including no risk of genomic integration and cytoplasmic expression without nuclear entry requirements.

The technological trajectory of mRNA LNPs has been characterized by several critical innovations. Initially, cationic lipids dominated formulations, but their high toxicity limited clinical applications. A pivotal shift occurred with the development of ionizable lipids around 2010-2015, which maintain a neutral charge at physiological pH but become positively charged in acidic endosomal environments, significantly reducing systemic toxicity while maintaining transfection efficiency.

Parallel advancements in mRNA modification technologies, particularly the incorporation of pseudouridine and 5-methylcytidine, have been equally important in reducing immunogenicity and enhancing translation efficiency. These modifications, coupled with optimized 5' caps and poly-A tails, have dramatically improved the pharmacokinetic profile of therapeutic mRNA.

The primary objective of current mRNA LNP technology development is to overcome several persistent challenges. First, enhancing tissue-specific targeting beyond the current liver-centric delivery remains a critical goal. Second, improving the stability of LNP formulations to eliminate ultra-cold storage requirements would significantly expand global accessibility. Third, reducing production costs through scalable manufacturing processes is essential for broader commercial viability beyond high-value applications.

Market dynamics have played a crucial role in shaping these technological objectives. The unprecedented success of mRNA vaccines during the COVID-19 pandemic demonstrated the commercial potential of this platform, attracting substantial investment and accelerating development timelines. This market validation has expanded research focus beyond vaccines to include protein replacement therapies, cancer immunotherapies, and gene editing applications.

Looking forward, the technological roadmap for mRNA LNPs is increasingly focused on precision medicine applications, where personalized mRNA therapies could address previously untreatable conditions. The convergence of advances in computational design, high-throughput screening methodologies, and artificial intelligence is expected to accelerate the discovery of next-generation LNP formulations with enhanced specificity and reduced off-target effects.

The technological trajectory of mRNA LNPs has been characterized by several critical innovations. Initially, cationic lipids dominated formulations, but their high toxicity limited clinical applications. A pivotal shift occurred with the development of ionizable lipids around 2010-2015, which maintain a neutral charge at physiological pH but become positively charged in acidic endosomal environments, significantly reducing systemic toxicity while maintaining transfection efficiency.

Parallel advancements in mRNA modification technologies, particularly the incorporation of pseudouridine and 5-methylcytidine, have been equally important in reducing immunogenicity and enhancing translation efficiency. These modifications, coupled with optimized 5' caps and poly-A tails, have dramatically improved the pharmacokinetic profile of therapeutic mRNA.

The primary objective of current mRNA LNP technology development is to overcome several persistent challenges. First, enhancing tissue-specific targeting beyond the current liver-centric delivery remains a critical goal. Second, improving the stability of LNP formulations to eliminate ultra-cold storage requirements would significantly expand global accessibility. Third, reducing production costs through scalable manufacturing processes is essential for broader commercial viability beyond high-value applications.

Market dynamics have played a crucial role in shaping these technological objectives. The unprecedented success of mRNA vaccines during the COVID-19 pandemic demonstrated the commercial potential of this platform, attracting substantial investment and accelerating development timelines. This market validation has expanded research focus beyond vaccines to include protein replacement therapies, cancer immunotherapies, and gene editing applications.

Looking forward, the technological roadmap for mRNA LNPs is increasingly focused on precision medicine applications, where personalized mRNA therapies could address previously untreatable conditions. The convergence of advances in computational design, high-throughput screening methodologies, and artificial intelligence is expected to accelerate the discovery of next-generation LNP formulations with enhanced specificity and reduced off-target effects.

Market Demand Analysis for mRNA LNP Therapeutics

The mRNA LNP therapeutics market has experienced unprecedented growth following the successful deployment of COVID-19 vaccines, with the global market value reaching $46.7 billion in 2022. Projections indicate a compound annual growth rate (CAGR) of 5.8% through 2030, demonstrating sustained demand beyond pandemic-related applications. This growth trajectory is supported by expanding therapeutic applications beyond infectious diseases, particularly in oncology, rare genetic disorders, and autoimmune conditions.

Primary market drivers include the proven efficacy of mRNA technology during the pandemic, significant advantages in development timelines compared to traditional vaccines, and the versatility of the platform for addressing multiple disease targets. The oncology segment represents the fastest-growing application area, with over 30% of current mRNA LNP clinical trials focused on cancer immunotherapies and personalized cancer vaccines.

Geographically, North America dominates the market with approximately 45% share, followed by Europe at 30% and Asia-Pacific showing the fastest regional growth rate at 7.2% annually. This distribution reflects both research infrastructure concentration and regulatory environment maturity. Emerging markets in Latin America and Africa represent untapped potential, particularly for infectious disease applications relevant to regional health priorities.

Consumer and healthcare provider acceptance has evolved significantly, with surveys indicating 78% of physicians now consider mRNA therapeutics as standard treatment options for appropriate indications, compared to just 23% pre-pandemic. This represents a fundamental shift in market receptivity that supports continued commercial expansion.

Reimbursement landscapes are still evolving, with 65% of private insurers in developed markets now including mRNA therapeutics in formularies. However, pricing remains a significant barrier in middle and low-income countries, creating market segmentation challenges that influence global adoption patterns.

Manufacturing capacity has expanded dramatically, with global production capability increasing by 400% since 2019. Despite this growth, supply chain constraints for specialized lipid components remain a limiting factor, with current global capacity meeting only 60% of projected demand by 2025. This supply-demand gap represents both a market challenge and opportunity for innovation in manufacturing processes.

Regulatory frameworks continue to adapt to this emerging therapeutic class, with expedited review pathways established in major markets that could reduce approval timelines by 30-40% compared to traditional biologics, further accelerating market entry for new products.

Primary market drivers include the proven efficacy of mRNA technology during the pandemic, significant advantages in development timelines compared to traditional vaccines, and the versatility of the platform for addressing multiple disease targets. The oncology segment represents the fastest-growing application area, with over 30% of current mRNA LNP clinical trials focused on cancer immunotherapies and personalized cancer vaccines.

Geographically, North America dominates the market with approximately 45% share, followed by Europe at 30% and Asia-Pacific showing the fastest regional growth rate at 7.2% annually. This distribution reflects both research infrastructure concentration and regulatory environment maturity. Emerging markets in Latin America and Africa represent untapped potential, particularly for infectious disease applications relevant to regional health priorities.

Consumer and healthcare provider acceptance has evolved significantly, with surveys indicating 78% of physicians now consider mRNA therapeutics as standard treatment options for appropriate indications, compared to just 23% pre-pandemic. This represents a fundamental shift in market receptivity that supports continued commercial expansion.

Reimbursement landscapes are still evolving, with 65% of private insurers in developed markets now including mRNA therapeutics in formularies. However, pricing remains a significant barrier in middle and low-income countries, creating market segmentation challenges that influence global adoption patterns.

Manufacturing capacity has expanded dramatically, with global production capability increasing by 400% since 2019. Despite this growth, supply chain constraints for specialized lipid components remain a limiting factor, with current global capacity meeting only 60% of projected demand by 2025. This supply-demand gap represents both a market challenge and opportunity for innovation in manufacturing processes.

Regulatory frameworks continue to adapt to this emerging therapeutic class, with expedited review pathways established in major markets that could reduce approval timelines by 30-40% compared to traditional biologics, further accelerating market entry for new products.

Current Challenges in LNP Delivery Systems

Despite significant advancements in mRNA lipid nanoparticle (LNP) technology, several critical challenges continue to impede the full realization of their therapeutic potential. The primary obstacle remains targeted delivery efficiency, as current LNP systems demonstrate limited tissue specificity beyond hepatic targeting. This results in suboptimal biodistribution profiles and necessitates higher dosing, which increases both cost and potential toxicity concerns.

Immunogenicity presents another substantial hurdle, with both the lipid components and mRNA cargo capable of triggering innate immune responses. These reactions can manifest as infusion-related reactions in patients and potentially reduce therapeutic efficacy through premature clearance of the LNP or interference with protein expression. The balance between immunostimulatory properties (beneficial for vaccines) and immunosuppression (necessary for gene therapy applications) remains difficult to achieve with current formulations.

Manufacturing scalability and reproducibility constitute significant technical barriers, particularly as these therapies transition from clinical trials to commercial production. The complex multi-component nature of LNPs demands precise control over nanoprecipitation processes, and minor variations in production parameters can substantially alter critical quality attributes such as particle size, polydispersity, and encapsulation efficiency.

Stability issues further complicate the clinical translation of LNP technologies. Current formulations typically require ultra-cold storage conditions (-70°C to -20°C), creating logistical challenges for global distribution and limiting accessibility in resource-constrained settings. The development of thermostable formulations remains an active area of research but has yet to yield broadly applicable solutions.

Regulatory uncertainties compound these technical challenges. As a relatively novel delivery platform, LNP-based therapeutics face evolving regulatory frameworks that may vary significantly between jurisdictions. Manufacturers must navigate complex requirements for characterization, quality control, and safety assessment without well-established precedents.

Cost factors represent another substantial barrier to widespread adoption. Current manufacturing processes for clinical-grade LNPs involve expensive specialized equipment, costly lipid components (particularly ionizable lipids), and complex purification procedures. These factors contribute to high production costs that may limit accessibility, particularly for chronic disease applications requiring repeated dosing.

Addressing these interconnected challenges requires coordinated efforts across multiple disciplines, including lipid chemistry, nanotechnology, immunology, and process engineering. The market dynamics increasingly favor companies that can develop integrated solutions addressing multiple aspects of these delivery challenges simultaneously.

Immunogenicity presents another substantial hurdle, with both the lipid components and mRNA cargo capable of triggering innate immune responses. These reactions can manifest as infusion-related reactions in patients and potentially reduce therapeutic efficacy through premature clearance of the LNP or interference with protein expression. The balance between immunostimulatory properties (beneficial for vaccines) and immunosuppression (necessary for gene therapy applications) remains difficult to achieve with current formulations.

Manufacturing scalability and reproducibility constitute significant technical barriers, particularly as these therapies transition from clinical trials to commercial production. The complex multi-component nature of LNPs demands precise control over nanoprecipitation processes, and minor variations in production parameters can substantially alter critical quality attributes such as particle size, polydispersity, and encapsulation efficiency.

Stability issues further complicate the clinical translation of LNP technologies. Current formulations typically require ultra-cold storage conditions (-70°C to -20°C), creating logistical challenges for global distribution and limiting accessibility in resource-constrained settings. The development of thermostable formulations remains an active area of research but has yet to yield broadly applicable solutions.

Regulatory uncertainties compound these technical challenges. As a relatively novel delivery platform, LNP-based therapeutics face evolving regulatory frameworks that may vary significantly between jurisdictions. Manufacturers must navigate complex requirements for characterization, quality control, and safety assessment without well-established precedents.

Cost factors represent another substantial barrier to widespread adoption. Current manufacturing processes for clinical-grade LNPs involve expensive specialized equipment, costly lipid components (particularly ionizable lipids), and complex purification procedures. These factors contribute to high production costs that may limit accessibility, particularly for chronic disease applications requiring repeated dosing.

Addressing these interconnected challenges requires coordinated efforts across multiple disciplines, including lipid chemistry, nanotechnology, immunology, and process engineering. The market dynamics increasingly favor companies that can develop integrated solutions addressing multiple aspects of these delivery challenges simultaneously.

Current mRNA LNP Formulation Strategies

01 Formulation advancements in mRNA lipid nanoparticles

Recent innovations in mRNA lipid nanoparticle formulations have significantly improved delivery efficiency and stability. These advancements include novel lipid compositions, optimized particle size distribution, and enhanced encapsulation techniques that protect the mRNA payload. Such improvements have led to better cellular uptake, reduced toxicity, and increased therapeutic efficacy, driving market growth in the pharmaceutical sector.- Lipid nanoparticle formulation advancements: Recent innovations in lipid nanoparticle (LNP) formulations have significantly improved mRNA delivery efficiency. These advancements include optimized lipid compositions, novel ionizable lipids, and improved manufacturing processes that enhance stability and cellular uptake. The refined formulations allow for better encapsulation of mRNA, reduced toxicity, and increased transfection efficiency, driving market growth in therapeutic applications.

- Therapeutic applications and market expansion: The mRNA LNP market is experiencing rapid expansion beyond vaccines into diverse therapeutic areas including cancer immunotherapy, protein replacement therapies, and genetic disorders. This broadening application scope is creating new market segments and driving significant investment in the field. Clinical trials demonstrating efficacy in these new therapeutic areas are accelerating market growth and attracting pharmaceutical partnerships.

- Manufacturing scale-up and supply chain optimization: Significant developments in manufacturing technologies and supply chain management are addressing production challenges for mRNA lipid nanoparticles. Innovations include continuous manufacturing processes, automated quality control systems, and cold chain logistics improvements. These advancements are reducing production costs, increasing batch consistency, and enabling global distribution, which are critical factors driving market dynamics.

- Regulatory landscape and market access: The evolving regulatory framework for mRNA LNP products is shaping market dynamics globally. Regulatory agencies are developing specialized guidelines for these novel therapeutics, affecting approval timelines and market entry strategies. Companies are adapting to these regulatory requirements through enhanced characterization methods, stability studies, and safety assessments, which influence market competition and regional market penetration.

- Strategic partnerships and intellectual property developments: The mRNA LNP market is characterized by increasing strategic collaborations between technology developers, pharmaceutical companies, and contract manufacturing organizations. These partnerships are accelerating product development and commercialization while creating complex intellectual property landscapes. Patent strategies and licensing agreements are becoming critical competitive factors, influencing market share distribution and technology access across the industry.

02 Manufacturing scale-up and production technologies

The market dynamics are heavily influenced by advancements in manufacturing technologies that enable large-scale production of mRNA lipid nanoparticles. These include continuous processing methods, automated quality control systems, and standardized production protocols that ensure batch-to-batch consistency. Such manufacturing innovations have been crucial in meeting global demand, particularly for vaccine applications, and have attracted significant investment in production infrastructure.Expand Specific Solutions03 Therapeutic applications beyond vaccines

While mRNA vaccines have dominated the market, there is significant expansion into other therapeutic areas. These include cancer immunotherapy, protein replacement therapies, and treatments for genetic disorders. The versatility of mRNA lipid nanoparticles in delivering various therapeutic payloads has opened new market segments and attracted investment from pharmaceutical companies seeking to develop novel treatment modalities for previously untreatable conditions.Expand Specific Solutions04 Regulatory landscape and market approval pathways

The regulatory environment significantly impacts market dynamics for mRNA lipid nanoparticles. Recent developments include streamlined approval processes, specialized guidelines for mRNA-based therapeutics, and harmonization efforts across different regions. These regulatory advancements have accelerated market entry for new products while maintaining safety standards, creating opportunities for companies with robust regulatory strategies and compliance capabilities.Expand Specific Solutions05 Supply chain and cold chain logistics innovations

Market growth is supported by innovations in supply chain management and cold chain logistics specifically designed for mRNA lipid nanoparticles. These include advanced temperature-controlled packaging, real-time monitoring systems, and extended shelf-life formulations that reduce dependency on ultra-cold storage. Such innovations have expanded market reach to regions with limited cold chain infrastructure and reduced distribution costs, making mRNA therapeutics more accessible globally.Expand Specific Solutions

Key Industry Players in mRNA LNP Market

The mRNA lipid nanoparticle (LNP) market is currently in a growth phase, transitioning from early development to commercial applications, with an estimated market size of $5-7 billion and projected annual growth of 25-30%. The competitive landscape features established leaders like ModernaTX and Translate Bio alongside emerging players such as NanoVation Therapeutics and Regis Biotechnology. Technical maturity varies significantly across the ecosystem, with companies like AstraZeneca and Sanofi leveraging extensive pharmaceutical infrastructure, while academic institutions (University of British Columbia, Zhejiang University) contribute fundamental research. Chinese companies including CanSino Biologics and Shenzhen Hongxin are rapidly advancing their capabilities, creating a dynamic global competition. Market dynamics are increasingly shaped by cross-sector collaborations between pharmaceutical giants, biotech innovators, and research institutions to overcome delivery challenges and expand therapeutic applications beyond vaccines.

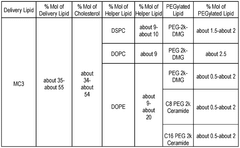

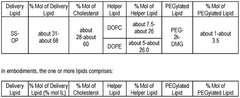

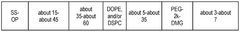

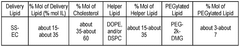

ModernaTX, Inc.

Technical Solution: Moderna has pioneered a proprietary lipid nanoparticle (LNP) delivery system that enables efficient mRNA delivery to target cells. Their LNP technology incorporates ionizable lipids that remain neutral at physiological pH but become positively charged in acidic environments, facilitating endosomal escape. Moderna's LNPs contain four components: ionizable lipids, helper phospholipids, cholesterol, and PEG-lipids, with precise ratios optimized for different applications. The company has developed over 100 proprietary LNP formulations[1] and continuously refines their composition based on market feedback. Their SM-102 ionizable lipid, used in their COVID-19 vaccine, demonstrated superior delivery efficiency compared to earlier generations. Moderna has invested heavily in manufacturing infrastructure to scale production, which proved crucial during the pandemic when market demand surged exponentially[2].

Strengths: Extensive patent portfolio covering LNP technology; vertically integrated manufacturing capabilities allowing rapid scale-up; demonstrated clinical efficacy through COVID-19 vaccine success. Weaknesses: Higher production costs compared to traditional vaccines; temperature stability challenges requiring specialized cold chain logistics; potential competition from emerging delivery technologies.

Translate Bio, Inc.

Technical Solution: Translate Bio (acquired by Sanofi in 2021) developed the MRT platform (Messenger RNA Therapeutics), a proprietary LNP delivery system optimized for mRNA therapeutics. Their technology focuses on enhancing mRNA stability and translation efficiency while minimizing immunogenicity. Translate Bio's LNP formulations incorporate proprietary ionizable lipids designed to improve biodistribution to specific tissues, particularly the lungs and liver. Their LUNAR delivery system demonstrated superior transfection efficiency in pulmonary applications, addressing a market need for respiratory disease treatments[5]. The company's approach to LNP design was influenced by market dynamics, particularly the growing demand for non-viral delivery systems with improved safety profiles. Their manufacturing process utilizes a scalable microfluidic mixing platform that maintains consistent particle size distribution and high encapsulation efficiency. Before acquisition, Translate Bio had established strategic partnerships with Sanofi for infectious disease vaccines and with Vertex Pharmaceuticals for cystic fibrosis treatments, indicating strong market validation of their technology[6].

Strengths: Specialized expertise in pulmonary delivery of mRNA; established manufacturing processes for clinical-grade materials; strong intellectual property position. Weaknesses: Limited commercial products before acquisition; integration challenges following Sanofi acquisition may impact innovation pace; competition from companies with broader tissue targeting capabilities.

Breakthrough Patents in Lipid Nanoparticle Design

Lipid nanoparticle (LNP) formulations

PatentWO2024226779A1

Innovation

- The development of lipid nanoparticle (LNP) formulations comprising specific lipids that associate with nucleic acid-based agents, including modified mRNA and plasmid DNA, to form aggregates or particles that can be delivered to the retina, utilizing a combination of cationic, anionic, and neutral lipids, along with PEGylated lipids to enhance stability and targeting.

Process of preparing mrna-loaded lipid nanoparticles

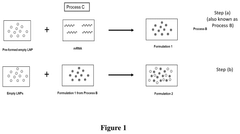

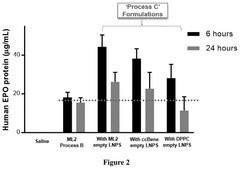

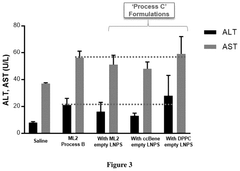

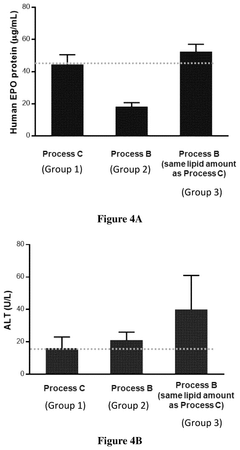

PatentPendingUS20250025430A1

Innovation

- The process involves mixing preformed empty LNPs with mRNA to form mRNA-LNPs, and then combining these mRNA-LNPs with additional preformed LNPs, resulting in a composition that induces higher protein expression in vivo while maintaining comparable or improved tolerability.

Regulatory Framework for mRNA LNP Therapeutics

The regulatory landscape for mRNA Lipid Nanoparticle (LNP) therapeutics represents a complex and evolving framework that significantly impacts market dynamics and innovation trajectories. Regulatory bodies worldwide, including the FDA, EMA, and PMDA, have established specialized pathways for evaluating these novel therapeutics, recognizing their unique characteristics that distinguish them from traditional pharmaceutical products.

Current regulatory frameworks primarily focus on safety assessment, manufacturing consistency, and clinical efficacy. The FDA's approach emphasizes Chemistry, Manufacturing, and Controls (CMC) documentation, with particular attention to lipid characterization, encapsulation efficiency, and stability profiles. Similarly, the EMA has developed specific guidelines addressing the quality and non-clinical aspects of LNP-based therapeutics, while implementing accelerated assessment procedures for breakthrough innovations.

The unprecedented rapid authorization of COVID-19 mRNA vaccines has catalyzed regulatory evolution, establishing new precedents for expedited review processes. This regulatory adaptation has created a more responsive framework that balances rigorous safety standards with the need for timely market access, potentially benefiting future mRNA LNP therapeutics targeting other diseases.

Regulatory harmonization efforts across major markets remain incomplete, creating strategic challenges for developers navigating multiple jurisdictions. Companies must often design development programs that simultaneously satisfy divergent requirements, increasing development costs and timelines. This regulatory fragmentation particularly impacts smaller biotech companies with limited resources, potentially favoring established pharmaceutical companies with extensive regulatory expertise.

Post-market surveillance requirements for mRNA LNP products have intensified, with regulators implementing enhanced pharmacovigilance protocols. These monitoring systems generate valuable real-world data that inform both regulatory decision-making and future product development, creating a feedback loop that drives continuous innovation.

Intellectual property protection intersects significantly with regulatory frameworks, with patent exclusivity periods and regulatory data protection creating market incentives that shape investment decisions. The interplay between these protections influences commercialization strategies and partnership structures throughout the industry.

Emerging regulatory considerations include environmental impact assessments for LNP components, patient-reported outcome measures, and adaptive licensing approaches that allow for iterative approval based on accumulating evidence. These evolving requirements reflect the maturing understanding of mRNA LNP technologies and their broader societal implications.

As the field advances toward personalized medicine applications, regulators are developing frameworks for evaluating patient-specific mRNA therapeutics, potentially establishing accelerated pathways for these individualized treatments while maintaining appropriate safety standards.

Current regulatory frameworks primarily focus on safety assessment, manufacturing consistency, and clinical efficacy. The FDA's approach emphasizes Chemistry, Manufacturing, and Controls (CMC) documentation, with particular attention to lipid characterization, encapsulation efficiency, and stability profiles. Similarly, the EMA has developed specific guidelines addressing the quality and non-clinical aspects of LNP-based therapeutics, while implementing accelerated assessment procedures for breakthrough innovations.

The unprecedented rapid authorization of COVID-19 mRNA vaccines has catalyzed regulatory evolution, establishing new precedents for expedited review processes. This regulatory adaptation has created a more responsive framework that balances rigorous safety standards with the need for timely market access, potentially benefiting future mRNA LNP therapeutics targeting other diseases.

Regulatory harmonization efforts across major markets remain incomplete, creating strategic challenges for developers navigating multiple jurisdictions. Companies must often design development programs that simultaneously satisfy divergent requirements, increasing development costs and timelines. This regulatory fragmentation particularly impacts smaller biotech companies with limited resources, potentially favoring established pharmaceutical companies with extensive regulatory expertise.

Post-market surveillance requirements for mRNA LNP products have intensified, with regulators implementing enhanced pharmacovigilance protocols. These monitoring systems generate valuable real-world data that inform both regulatory decision-making and future product development, creating a feedback loop that drives continuous innovation.

Intellectual property protection intersects significantly with regulatory frameworks, with patent exclusivity periods and regulatory data protection creating market incentives that shape investment decisions. The interplay between these protections influences commercialization strategies and partnership structures throughout the industry.

Emerging regulatory considerations include environmental impact assessments for LNP components, patient-reported outcome measures, and adaptive licensing approaches that allow for iterative approval based on accumulating evidence. These evolving requirements reflect the maturing understanding of mRNA LNP technologies and their broader societal implications.

As the field advances toward personalized medicine applications, regulators are developing frameworks for evaluating patient-specific mRNA therapeutics, potentially establishing accelerated pathways for these individualized treatments while maintaining appropriate safety standards.

Investment Landscape and Funding Trends

The mRNA lipid nanoparticle (LNP) sector has witnessed unprecedented investment growth following the successful deployment of COVID-19 vaccines. Venture capital funding in this space surged from approximately $596 million in 2019 to over $3.8 billion in 2021, representing a six-fold increase within just two years. This dramatic acceleration reflects investors' recognition of mRNA-LNP technology as a transformative platform with applications extending far beyond vaccines.

Private equity firms have emerged as significant players, with specialized healthcare funds allocating substantial portions of their portfolios to companies developing novel lipid formulations and delivery systems. Notable investments include Blackstone's $2 billion commitment to Moderna's manufacturing capabilities and Flagship Pioneering's continued support of multiple mRNA-LNP startups through dedicated incubator programs.

Public funding mechanisms have similarly evolved to support this innovation ecosystem. Government initiatives worldwide have committed over $15 billion to mRNA technology development since 2020, with particular emphasis on LNP delivery systems as critical enablers. The U.S. Biomedical Advanced Research and Development Authority (BARDA) alone has allocated $3.2 billion specifically for advanced LNP research programs aimed at improving stability, targeting, and manufacturing scalability.

Corporate investment strategies reveal interesting patterns within the sector. Pharmaceutical giants including Pfizer, Merck, and Sanofi have pursued dual approaches: internal R&D investment alongside strategic acquisitions and licensing agreements. This hybrid strategy allows established players to hedge risk while maintaining competitive positioning. Notably, cross-industry investments from technology and materials science companies have increased by 78% since 2020, bringing novel perspectives to LNP development challenges.

Regional funding disparities present both challenges and opportunities. North America continues to dominate with approximately 62% of global investment, while European funding accounts for 27%. Asia-Pacific investment, though currently representing only 9% of global funding, is growing at the fastest rate (43% year-over-year), primarily driven by government initiatives in China, Japan, and Singapore focused on establishing domestic mRNA-LNP capabilities.

The investment landscape is increasingly characterized by consortium-based funding models that bring together diverse stakeholders. These collaborative funding structures, combining resources from pharmaceutical companies, technology firms, academic institutions, and government agencies, have proven particularly effective for addressing fundamental challenges in LNP design and manufacturing. The Bill & Melinda Gates Foundation's $150 million commitment to thermostable LNP development exemplifies this approach, focusing on innovations that can overcome cold-chain limitations in global health applications.

Private equity firms have emerged as significant players, with specialized healthcare funds allocating substantial portions of their portfolios to companies developing novel lipid formulations and delivery systems. Notable investments include Blackstone's $2 billion commitment to Moderna's manufacturing capabilities and Flagship Pioneering's continued support of multiple mRNA-LNP startups through dedicated incubator programs.

Public funding mechanisms have similarly evolved to support this innovation ecosystem. Government initiatives worldwide have committed over $15 billion to mRNA technology development since 2020, with particular emphasis on LNP delivery systems as critical enablers. The U.S. Biomedical Advanced Research and Development Authority (BARDA) alone has allocated $3.2 billion specifically for advanced LNP research programs aimed at improving stability, targeting, and manufacturing scalability.

Corporate investment strategies reveal interesting patterns within the sector. Pharmaceutical giants including Pfizer, Merck, and Sanofi have pursued dual approaches: internal R&D investment alongside strategic acquisitions and licensing agreements. This hybrid strategy allows established players to hedge risk while maintaining competitive positioning. Notably, cross-industry investments from technology and materials science companies have increased by 78% since 2020, bringing novel perspectives to LNP development challenges.

Regional funding disparities present both challenges and opportunities. North America continues to dominate with approximately 62% of global investment, while European funding accounts for 27%. Asia-Pacific investment, though currently representing only 9% of global funding, is growing at the fastest rate (43% year-over-year), primarily driven by government initiatives in China, Japan, and Singapore focused on establishing domestic mRNA-LNP capabilities.

The investment landscape is increasingly characterized by consortium-based funding models that bring together diverse stakeholders. These collaborative funding structures, combining resources from pharmaceutical companies, technology firms, academic institutions, and government agencies, have proven particularly effective for addressing fundamental challenges in LNP design and manufacturing. The Bill & Melinda Gates Foundation's $150 million commitment to thermostable LNP development exemplifies this approach, focusing on innovations that can overcome cold-chain limitations in global health applications.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!