Contribution of Patents to mRNA Nanoparticle System Development

OCT 10, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

mRNA Nanoparticle Technology Evolution and Objectives

The evolution of mRNA nanoparticle technology represents one of the most significant advancements in modern medicine, culminating in the rapid development of COVID-19 vaccines. This technological journey began in the 1990s with the pioneering work of Katalin Karikó and Drew Weissman, who discovered methods to modify mRNA to reduce immunogenicity, a breakthrough that laid the foundation for therapeutic applications of mRNA.

Patents have played a crucial role in shaping this technological landscape. Early patents focused on basic mRNA modification techniques, while subsequent innovations addressed delivery challenges through lipid nanoparticle (LNP) formulations. The patent landscape reveals a clear progression from fundamental research to application-specific innovations, with key patents from companies like Moderna, BioNTech, and CureVac establishing technological territories and driving competitive development.

The primary objective of mRNA nanoparticle technology development has been to create stable, efficient delivery systems that protect mRNA from degradation while facilitating cellular uptake and expression. This goal has driven innovations in LNP composition, including the development of ionizable lipids, PEGylated lipids, and structural lipids that together form the complex architecture of modern mRNA delivery vehicles.

Patent analysis reveals several technological inflection points, including the development of nucleoside-modified mRNA (2005-2010), advanced LNP formulations (2010-2015), and manufacturing scale-up technologies (2015-2020). Each phase has been characterized by increasingly specific patent claims that reflect growing understanding of structure-function relationships in mRNA nanoparticle systems.

The COVID-19 pandemic accelerated technology development and patent activity, with emergency use authorizations creating new precedents for rapid clinical implementation. This period saw a surge in patents addressing cold-chain logistics, stability enhancements, and manufacturing processes, demonstrating how crisis can drive technological evolution.

Looking forward, the technology aims to expand beyond vaccines to therapeutics for genetic diseases, cancer, and regenerative medicine. Patent trends indicate growing interest in targeted delivery systems, self-amplifying mRNA, and combination approaches that integrate mRNA technology with other therapeutic modalities.

Understanding this patent-driven evolution provides critical context for future innovation in the field, highlighting both technological opportunities and potential freedom-to-operate challenges that will shape the next generation of mRNA nanoparticle systems.

Patents have played a crucial role in shaping this technological landscape. Early patents focused on basic mRNA modification techniques, while subsequent innovations addressed delivery challenges through lipid nanoparticle (LNP) formulations. The patent landscape reveals a clear progression from fundamental research to application-specific innovations, with key patents from companies like Moderna, BioNTech, and CureVac establishing technological territories and driving competitive development.

The primary objective of mRNA nanoparticle technology development has been to create stable, efficient delivery systems that protect mRNA from degradation while facilitating cellular uptake and expression. This goal has driven innovations in LNP composition, including the development of ionizable lipids, PEGylated lipids, and structural lipids that together form the complex architecture of modern mRNA delivery vehicles.

Patent analysis reveals several technological inflection points, including the development of nucleoside-modified mRNA (2005-2010), advanced LNP formulations (2010-2015), and manufacturing scale-up technologies (2015-2020). Each phase has been characterized by increasingly specific patent claims that reflect growing understanding of structure-function relationships in mRNA nanoparticle systems.

The COVID-19 pandemic accelerated technology development and patent activity, with emergency use authorizations creating new precedents for rapid clinical implementation. This period saw a surge in patents addressing cold-chain logistics, stability enhancements, and manufacturing processes, demonstrating how crisis can drive technological evolution.

Looking forward, the technology aims to expand beyond vaccines to therapeutics for genetic diseases, cancer, and regenerative medicine. Patent trends indicate growing interest in targeted delivery systems, self-amplifying mRNA, and combination approaches that integrate mRNA technology with other therapeutic modalities.

Understanding this patent-driven evolution provides critical context for future innovation in the field, highlighting both technological opportunities and potential freedom-to-operate challenges that will shape the next generation of mRNA nanoparticle systems.

Market Demand Analysis for mRNA Therapeutics

The mRNA therapeutics market has witnessed unprecedented growth following the successful deployment of COVID-19 vaccines, establishing a robust foundation for future expansion. Current market valuations indicate that the global mRNA therapeutics market reached approximately $40 billion in 2021, with projections suggesting growth to $101 billion by 2028, representing a compound annual growth rate (CAGR) of 14.2%. This remarkable trajectory reflects the transformative potential of mRNA technology beyond vaccines.

Patient demand for personalized medicine solutions has significantly contributed to market growth. The ability of mRNA therapeutics to address previously untreatable conditions has created substantial market pull, particularly in oncology, rare genetic disorders, and infectious diseases. Cancer treatment represents the largest application segment, accounting for nearly 38% of the market share, driven by the potential for highly targeted immunotherapies.

Healthcare systems worldwide are increasingly recognizing the economic benefits of mRNA-based preventive interventions compared to treating established diseases. This shift in healthcare economics has created favorable reimbursement environments in major markets, further stimulating demand. The reduced production timelines of mRNA therapeutics compared to traditional biologics also address urgent public health needs, as demonstrated during the pandemic response.

Regional analysis reveals North America dominates the market with approximately 42% share, followed by Europe at 31%. However, Asia-Pacific markets are expected to grow at the highest CAGR of 16.8% through 2028, driven by increasing healthcare expenditure and expanding biotechnology infrastructure in countries like China, Japan, and South Korea.

The nanoparticle delivery systems essential for mRNA therapeutics have become a critical focus area for market development. Lipid nanoparticles (LNPs) currently dominate the delivery technology segment with over 65% market share, though polymeric and hybrid nanoparticle systems are gaining traction due to potential advantages in stability and targeting capabilities.

Industry surveys indicate that pharmaceutical executives consider patent protection for nanoparticle delivery systems as the most significant factor influencing investment decisions in mRNA platform development. This underscores the strategic importance of intellectual property in this rapidly evolving field, with companies actively seeking to build comprehensive patent portfolios covering novel delivery technologies.

Consumer awareness and acceptance of mRNA technology have dramatically improved following COVID-19 vaccine rollouts, creating a more receptive market environment for future therapeutic applications. This shift in public perception has accelerated clinical trial recruitment and regulatory pathways for mRNA-based treatments across multiple therapeutic areas.

Patient demand for personalized medicine solutions has significantly contributed to market growth. The ability of mRNA therapeutics to address previously untreatable conditions has created substantial market pull, particularly in oncology, rare genetic disorders, and infectious diseases. Cancer treatment represents the largest application segment, accounting for nearly 38% of the market share, driven by the potential for highly targeted immunotherapies.

Healthcare systems worldwide are increasingly recognizing the economic benefits of mRNA-based preventive interventions compared to treating established diseases. This shift in healthcare economics has created favorable reimbursement environments in major markets, further stimulating demand. The reduced production timelines of mRNA therapeutics compared to traditional biologics also address urgent public health needs, as demonstrated during the pandemic response.

Regional analysis reveals North America dominates the market with approximately 42% share, followed by Europe at 31%. However, Asia-Pacific markets are expected to grow at the highest CAGR of 16.8% through 2028, driven by increasing healthcare expenditure and expanding biotechnology infrastructure in countries like China, Japan, and South Korea.

The nanoparticle delivery systems essential for mRNA therapeutics have become a critical focus area for market development. Lipid nanoparticles (LNPs) currently dominate the delivery technology segment with over 65% market share, though polymeric and hybrid nanoparticle systems are gaining traction due to potential advantages in stability and targeting capabilities.

Industry surveys indicate that pharmaceutical executives consider patent protection for nanoparticle delivery systems as the most significant factor influencing investment decisions in mRNA platform development. This underscores the strategic importance of intellectual property in this rapidly evolving field, with companies actively seeking to build comprehensive patent portfolios covering novel delivery technologies.

Consumer awareness and acceptance of mRNA technology have dramatically improved following COVID-19 vaccine rollouts, creating a more receptive market environment for future therapeutic applications. This shift in public perception has accelerated clinical trial recruitment and regulatory pathways for mRNA-based treatments across multiple therapeutic areas.

Current Patent Landscape and Technical Barriers

The mRNA nanoparticle patent landscape has experienced exponential growth since 2010, with a significant acceleration following the COVID-19 pandemic. Currently, over 4,000 patents and applications specifically address mRNA delivery systems, with lipid nanoparticles (LNPs) dominating approximately 65% of these intellectual property assets. Key patent holders include pharmaceutical giants like Moderna, BioNTech, and CureVac, alongside specialized delivery technology companies such as Acuitas Therapeutics and Arbutus Biopharma.

Patent concentration reveals geographical disparities, with the United States leading at 42% of global filings, followed by Europe (27%), China (18%), and Japan (8%). This distribution reflects not only R&D investment patterns but also strategic market protection priorities among industry leaders. The patent landscape demonstrates clustering around four critical technical components: lipid chemistry, formulation processes, mRNA stabilization techniques, and targeted delivery mechanisms.

Despite significant progress, several technical barriers persist in the development of mRNA nanoparticle systems. Foremost among these is the challenge of immunogenicity, where both the lipid components and mRNA payload can trigger unwanted immune responses. Patents addressing this issue have increased by 78% in the past three years, yet comprehensive solutions remain elusive. Another major hurdle involves stability limitations, with current technologies struggling to maintain mRNA integrity without cold-chain requirements, restricting global distribution potential.

Manufacturing scalability represents another significant barrier, with patents revealing competing approaches to overcome production bottlenecks. Current continuous flow microfluidic technologies, while promising, face challenges in maintaining consistent nanoparticle size distribution at industrial scales. Additionally, targeted delivery remains problematic, with most existing patents focusing on liver delivery while other tissues and organs present substantial targeting difficulties.

Regulatory barriers intersect with technical challenges, creating complex patent strategies. Companies are increasingly filing patents that address regulatory concerns preemptively, particularly around characterization methods and quality control processes. The patent thicket in this space has led to significant litigation, with over 15 major patent disputes currently active, potentially impeding innovation through legal uncertainty.

Cross-licensing agreements have emerged as a partial solution to navigate this complex landscape, with approximately 30 major agreements established since 2018. However, small innovators often face significant barriers to entry due to the consolidated nature of foundational patents controlling key aspects of mRNA delivery technology.

Patent concentration reveals geographical disparities, with the United States leading at 42% of global filings, followed by Europe (27%), China (18%), and Japan (8%). This distribution reflects not only R&D investment patterns but also strategic market protection priorities among industry leaders. The patent landscape demonstrates clustering around four critical technical components: lipid chemistry, formulation processes, mRNA stabilization techniques, and targeted delivery mechanisms.

Despite significant progress, several technical barriers persist in the development of mRNA nanoparticle systems. Foremost among these is the challenge of immunogenicity, where both the lipid components and mRNA payload can trigger unwanted immune responses. Patents addressing this issue have increased by 78% in the past three years, yet comprehensive solutions remain elusive. Another major hurdle involves stability limitations, with current technologies struggling to maintain mRNA integrity without cold-chain requirements, restricting global distribution potential.

Manufacturing scalability represents another significant barrier, with patents revealing competing approaches to overcome production bottlenecks. Current continuous flow microfluidic technologies, while promising, face challenges in maintaining consistent nanoparticle size distribution at industrial scales. Additionally, targeted delivery remains problematic, with most existing patents focusing on liver delivery while other tissues and organs present substantial targeting difficulties.

Regulatory barriers intersect with technical challenges, creating complex patent strategies. Companies are increasingly filing patents that address regulatory concerns preemptively, particularly around characterization methods and quality control processes. The patent thicket in this space has led to significant litigation, with over 15 major patent disputes currently active, potentially impeding innovation through legal uncertainty.

Cross-licensing agreements have emerged as a partial solution to navigate this complex landscape, with approximately 30 major agreements established since 2018. However, small innovators often face significant barriers to entry due to the consolidated nature of foundational patents controlling key aspects of mRNA delivery technology.

Leading mRNA Delivery System Patent Solutions

01 Lipid nanoparticle formulations for mRNA delivery

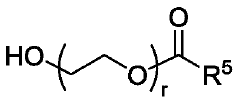

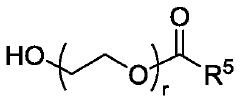

Lipid nanoparticles (LNPs) serve as effective delivery vehicles for mRNA therapeutics. These formulations typically consist of ionizable lipids, helper lipids, cholesterol, and PEG-lipids that encapsulate and protect mRNA molecules. The composition and structure of these lipid components can be optimized to enhance cellular uptake, endosomal escape, and overall transfection efficiency. Advanced LNP formulations enable targeted delivery to specific tissues and improved stability of the encapsulated mRNA cargo.- Lipid nanoparticle formulations for mRNA delivery: Lipid nanoparticles (LNPs) serve as effective delivery vehicles for mRNA therapeutics. These formulations typically consist of ionizable lipids, helper lipids, cholesterol, and PEG-lipids that encapsulate and protect mRNA molecules. The composition and structure of these lipid components can be optimized to enhance cellular uptake, endosomal escape, and overall transfection efficiency. Advanced LNP formulations enable targeted delivery to specific tissues and improved stability of the encapsulated mRNA.

- Polymer-based nanoparticle systems for mRNA delivery: Polymer-based nanoparticles represent an alternative approach to mRNA delivery. These systems utilize biodegradable polymers such as poly(lactic-co-glycolic acid) (PLGA), polyethylenimine (PEI), or chitosan to form complexes with mRNA. The polymer composition can be tailored to control release kinetics and improve cellular uptake. These nanoparticles offer advantages including reduced toxicity, enhanced stability, and the ability to co-deliver multiple therapeutic agents alongside mRNA.

- Hybrid and composite nanoparticle systems for mRNA delivery: Hybrid nanoparticle systems combine different materials to leverage their complementary properties for improved mRNA delivery. These may include lipid-polymer hybrid nanoparticles, inorganic-organic composites, or multi-layered structures. Such hybrid systems can overcome limitations of single-component carriers by enhancing stability, reducing toxicity, improving cellular uptake, and allowing for controlled release of mRNA. The synergistic effects of combined materials result in superior transfection efficiency and therapeutic outcomes.

- Surface modification strategies for targeted mRNA delivery: Surface modification of mRNA nanoparticles with targeting ligands enables cell or tissue-specific delivery. These modifications include conjugation with antibodies, peptides, aptamers, or small molecules that recognize specific receptors on target cells. Additionally, surface engineering can improve the circulation time of nanoparticles by reducing opsonization and clearance by the reticuloendothelial system. These strategies enhance therapeutic efficacy while minimizing off-target effects and toxicity.

- Manufacturing and quality control of mRNA nanoparticle systems: Advanced manufacturing techniques for mRNA nanoparticle systems include microfluidic mixing, extrusion, and controlled precipitation methods that ensure reproducible particle size, narrow size distribution, and high encapsulation efficiency. Quality control measures involve characterization of physical properties (size, zeta potential), chemical composition, and biological activity. Stability studies and lyophilization strategies are developed to extend shelf-life and maintain efficacy during storage and transportation, which is crucial for clinical translation of mRNA therapeutics.

02 Polymer-based nanoparticle systems for mRNA delivery

Polymer-based nanoparticles represent an alternative approach to mRNA delivery. These systems utilize biodegradable polymers such as PLGA, PEI, or chitosan to form complexes with mRNA. The polymer composition can be engineered to control release kinetics and improve cellular internalization. These nanoparticles offer advantages including reduced immunogenicity, enhanced stability, and the ability to incorporate targeting moieties for tissue-specific delivery of mRNA therapeutics.Expand Specific Solutions03 Hybrid and composite nanoparticle systems for mRNA delivery

Hybrid nanoparticle systems combine multiple materials to leverage their complementary properties for improved mRNA delivery. These include lipid-polymer hybrid nanoparticles, inorganic-organic composites, and multi-layered structures. By integrating different components, these systems can overcome individual limitations of conventional delivery platforms, offering enhanced stability, reduced toxicity, controlled release profiles, and improved transfection efficiency for mRNA therapeutics.Expand Specific Solutions04 Surface modification strategies for targeted mRNA delivery

Surface modification of mRNA nanoparticles with targeting ligands enables tissue-specific delivery. These modifications include conjugation with antibodies, peptides, aptamers, or small molecules that recognize specific cell surface receptors. Additionally, surface engineering can improve the pharmacokinetic profile, reduce clearance by the reticuloendothelial system, and enhance cellular uptake. These strategies are crucial for developing precision therapeutics that minimize off-target effects while maximizing therapeutic efficacy.Expand Specific Solutions05 Manufacturing and characterization techniques for mRNA nanoparticles

Advanced manufacturing processes and characterization methods are essential for developing clinically viable mRNA nanoparticle systems. These include microfluidic-based production techniques, scalable manufacturing processes, and quality control methods. Analytical techniques such as dynamic light scattering, electron microscopy, and various spectroscopic methods are employed to characterize particle size, polydispersity, encapsulation efficiency, and stability. These approaches ensure batch-to-batch consistency and regulatory compliance for mRNA nanoparticle therapeutics.Expand Specific Solutions

Key Industry Players and Patent Portfolios

The mRNA nanoparticle system development landscape is currently in a growth phase, with the market expanding rapidly following COVID-19 vaccine breakthroughs. The global market size for mRNA therapeutics is projected to reach $15-20 billion by 2026, driven by applications beyond vaccines. Patent contributions reveal a competitive ecosystem dominated by pioneering companies like BioNTech, Moderna, and CureVac, who hold foundational intellectual property. Delivery system patents from Acuitas Therapeutics have proven critical for commercial applications. Academic institutions (University of Pennsylvania, Northwestern University) contribute significant basic research patents, while pharmaceutical giants (Janssen, Seqirus) are increasingly acquiring strategic patent portfolios. Technical maturity varies across application areas, with vaccine technology more advanced than therapeutic applications for cancer and rare diseases.

ModernaTX, Inc.

Technical Solution: ModernaTX has developed a proprietary lipid nanoparticle (LNP) delivery system for mRNA therapeutics and vaccines. Their LNP technology incorporates ionizable lipids that facilitate efficient cellular uptake and endosomal escape of mRNA molecules. The company has patented several key innovations including SM-102, a novel ionizable lipid used in their COVID-19 vaccine, which enables efficient mRNA delivery while maintaining a favorable safety profile. Their patents also cover specific LNP formulations with optimized ratios of ionizable lipids, cholesterol, phospholipids, and PEG-lipids that enhance stability and delivery efficiency. ModernaTX has further patented manufacturing processes for consistent LNP production at scale, including microfluidic mixing techniques that ensure uniform particle size distribution and high encapsulation efficiency of mRNA cargo[1][3]. Their patent portfolio extends to sequence modifications that improve mRNA stability and translation efficiency.

Strengths: Extensive patent portfolio covering both delivery systems and mRNA modifications; proven clinical efficacy with authorized COVID-19 vaccine; established manufacturing infrastructure for large-scale production. Weaknesses: High cost of proprietary LNP components may limit accessibility; some patent disputes with other companies in the field; potential cold chain requirements for some formulations limit distribution in resource-limited settings.

Trustees of the University of Pennsylvania

Technical Solution: The University of Pennsylvania has made foundational contributions to mRNA nanoparticle technology through pioneering research and an extensive patent portfolio. Their patents cover fundamental aspects of mRNA delivery using lipid nanoparticles (LNPs), including the development of ionizable lipid structures that facilitate efficient cellular uptake and endosomal escape. UPenn researchers, notably Dr. Drew Weissman and Dr. Katalin Karikó, hold critical patents on nucleoside-modified mRNA that reduces immunogenicity while enhancing translation efficiency - a breakthrough that enabled practical mRNA therapeutics. These modifications, particularly the incorporation of pseudouridine and 1-methylpseudouridine in place of uridine, are now utilized in approved COVID-19 vaccines[9][11]. The university's patents also cover specific LNP formulation techniques, including precise ratios of lipid components and manufacturing processes that ensure consistent nanoparticle production. Additionally, UPenn holds patents on sequence engineering approaches that optimize codon usage and UTR elements to enhance mRNA stability and translation efficiency in vivo.

Strengths: Foundational patents covering nucleoside modifications that are essential for most clinical mRNA applications; strong licensing position with multiple commercial partners; continued innovation through academic research programs. Weaknesses: As an academic institution, limited internal manufacturing or commercialization capabilities; dependency on licensing agreements for revenue generation; potential challenges in patent enforcement across global markets.

Critical Patent Innovations in LNP Technology

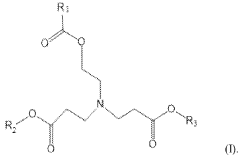

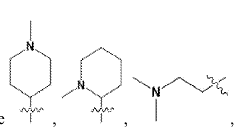

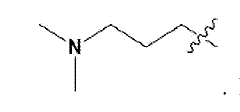

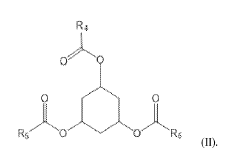

Methods of making ionizable lipids and lipid nanoparticles for mRNA delivery

PatentWO2024019770A1

Innovation

- Development of novel ionizable lipid compounds and lipid nanoparticles, specifically formulated with structures (I), (II), and (III), which include specific alkyl groups and combinations with phospholipids, PEG-lipids, and structural lipids, to create a stable mRNA delivery system.

RNA formulations

PatentWO2018232357A1

Innovation

- Lipid nanoparticles with specific distributions of components like ionizable lipids, PEG lipids, and mRNA, where a majority of mRNA is inaccessible and PEG lipid is surface-accessible, enhancing stability and reducing immunogenicity, are designed to achieve efficient intracellular delivery and high protein expression.

Regulatory Framework for mRNA Patent Protection

The regulatory landscape for mRNA patent protection has evolved significantly over the past decade, reflecting the rapid advancement of this technology. Patent protection for mRNA nanoparticle systems spans multiple jurisdictional frameworks, with varying approaches across the United States, European Union, and Asia. The U.S. Patent and Trademark Office (USPTO) has established specific examination guidelines for nucleic acid-based therapeutics, while the European Patent Office (EPO) maintains stringent requirements for demonstrating inventive step in mRNA delivery systems.

Key regulatory challenges in mRNA patent protection include the determination of subject matter eligibility, particularly following landmark cases such as Mayo Collaborative Services v. Prometheus Laboratories and Association for Molecular Pathology v. Myriad Genetics. These decisions have significantly impacted how mRNA-related inventions are evaluated, requiring patent applications to demonstrate substantial transformation beyond naturally occurring sequences.

Patent term extensions provide critical protection for mRNA technologies, considering the lengthy clinical development and regulatory approval processes. The Hatch-Waxman Act in the U.S. and Supplementary Protection Certificates in Europe offer mechanisms to compensate for regulatory delays, though their application to mRNA technologies presents unique considerations due to the novel nature of these therapeutics.

International harmonization efforts through TRIPS (Trade-Related Aspects of Intellectual Property Rights) and the Patent Cooperation Treaty have facilitated cross-border protection strategies for mRNA innovations. However, significant disparities remain in how different jurisdictions handle second medical use claims and process patents related to mRNA manufacturing and formulation.

Regulatory exclusivity provisions complement patent protection, with biologics exclusivity periods offering additional market protection independent of patent status. The interplay between these regulatory exclusivities and patent rights creates complex strategic considerations for mRNA technology developers seeking to maximize their protection periods.

Recent regulatory developments include specialized accelerated review pathways for breakthrough therapies, which have benefited several mRNA-based products. These expedited reviews must be carefully balanced with comprehensive patent strategies to ensure adequate protection throughout the product lifecycle, from initial research through commercialization phases.

Key regulatory challenges in mRNA patent protection include the determination of subject matter eligibility, particularly following landmark cases such as Mayo Collaborative Services v. Prometheus Laboratories and Association for Molecular Pathology v. Myriad Genetics. These decisions have significantly impacted how mRNA-related inventions are evaluated, requiring patent applications to demonstrate substantial transformation beyond naturally occurring sequences.

Patent term extensions provide critical protection for mRNA technologies, considering the lengthy clinical development and regulatory approval processes. The Hatch-Waxman Act in the U.S. and Supplementary Protection Certificates in Europe offer mechanisms to compensate for regulatory delays, though their application to mRNA technologies presents unique considerations due to the novel nature of these therapeutics.

International harmonization efforts through TRIPS (Trade-Related Aspects of Intellectual Property Rights) and the Patent Cooperation Treaty have facilitated cross-border protection strategies for mRNA innovations. However, significant disparities remain in how different jurisdictions handle second medical use claims and process patents related to mRNA manufacturing and formulation.

Regulatory exclusivity provisions complement patent protection, with biologics exclusivity periods offering additional market protection independent of patent status. The interplay between these regulatory exclusivities and patent rights creates complex strategic considerations for mRNA technology developers seeking to maximize their protection periods.

Recent regulatory developments include specialized accelerated review pathways for breakthrough therapies, which have benefited several mRNA-based products. These expedited reviews must be carefully balanced with comprehensive patent strategies to ensure adequate protection throughout the product lifecycle, from initial research through commercialization phases.

Cross-Licensing Strategies and Collaboration Models

Cross-licensing has emerged as a pivotal strategy in the mRNA nanoparticle system development landscape, enabling companies to navigate the complex patent ecosystem while fostering innovation. The fragmented nature of intellectual property in this field necessitates strategic collaborations, as no single entity holds all the patents required for comprehensive mRNA delivery systems. Major pharmaceutical companies like Moderna, BioNTech, and Pfizer have established extensive cross-licensing agreements to access complementary technologies, particularly for lipid nanoparticle formulations and mRNA modification techniques.

These cross-licensing arrangements typically follow several models, each with distinct advantages. The bilateral licensing model involves direct agreements between two companies, allowing for targeted technology exchange while maintaining competitive positions. This approach has been particularly effective between mRNA platform companies and delivery technology specialists, creating synergistic partnerships that accelerate development timelines.

Consortium-based licensing represents another significant collaboration model, wherein multiple stakeholders contribute patents to a common pool, enabling broader access to fundamental technologies. The COVID-19 pandemic catalyzed the formation of several such consortia, demonstrating how crisis-driven collaboration can overcome traditional competitive barriers. These arrangements have proven especially valuable for addressing global health challenges while respecting intellectual property rights.

Patent pools have also gained traction as structured frameworks for managing cross-licensing in the mRNA field. These pools consolidate related patents from multiple owners, offering streamlined licensing options for third parties while ensuring fair compensation to patent holders. The efficiency of this model has attracted smaller biotech companies seeking to enter the mRNA space without navigating numerous individual licensing negotiations.

Academic-industry partnerships constitute another crucial collaboration model, bridging fundamental research with commercial application. Universities holding foundational mRNA patents have established licensing programs that balance revenue generation with broad technology access, often including provisions for humanitarian applications in developing regions.

The evolution of these cross-licensing strategies reflects the maturing mRNA technology landscape, with agreements increasingly incorporating milestone-based royalty structures, field-of-use limitations, and geographic exclusivity provisions. These sophisticated arrangements enable companies to maintain competitive differentiation while accessing essential technologies, ultimately accelerating innovation in mRNA nanoparticle systems for diverse therapeutic applications beyond vaccines.

These cross-licensing arrangements typically follow several models, each with distinct advantages. The bilateral licensing model involves direct agreements between two companies, allowing for targeted technology exchange while maintaining competitive positions. This approach has been particularly effective between mRNA platform companies and delivery technology specialists, creating synergistic partnerships that accelerate development timelines.

Consortium-based licensing represents another significant collaboration model, wherein multiple stakeholders contribute patents to a common pool, enabling broader access to fundamental technologies. The COVID-19 pandemic catalyzed the formation of several such consortia, demonstrating how crisis-driven collaboration can overcome traditional competitive barriers. These arrangements have proven especially valuable for addressing global health challenges while respecting intellectual property rights.

Patent pools have also gained traction as structured frameworks for managing cross-licensing in the mRNA field. These pools consolidate related patents from multiple owners, offering streamlined licensing options for third parties while ensuring fair compensation to patent holders. The efficiency of this model has attracted smaller biotech companies seeking to enter the mRNA space without navigating numerous individual licensing negotiations.

Academic-industry partnerships constitute another crucial collaboration model, bridging fundamental research with commercial application. Universities holding foundational mRNA patents have established licensing programs that balance revenue generation with broad technology access, often including provisions for humanitarian applications in developing regions.

The evolution of these cross-licensing strategies reflects the maturing mRNA technology landscape, with agreements increasingly incorporating milestone-based royalty structures, field-of-use limitations, and geographic exclusivity provisions. These sophisticated arrangements enable companies to maintain competitive differentiation while accessing essential technologies, ultimately accelerating innovation in mRNA nanoparticle systems for diverse therapeutic applications beyond vaccines.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!