Patents Landscape on mRNA Nanoparticle Encapsulation

OCT 10, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

mRNA Delivery Evolution and Objectives

The evolution of mRNA delivery systems represents one of the most significant advancements in modern biotechnology, culminating in the breakthrough COVID-19 vaccines that demonstrated the clinical potential of this technology. The journey began in the 1990s when researchers first recognized the therapeutic potential of mRNA but faced fundamental challenges in delivery due to mRNA's inherent instability and immunogenicity. Early attempts at delivery relied on direct injection of naked mRNA, which proved inefficient due to rapid degradation by ubiquitous ribonucleases.

The field experienced its first major evolution around 2000-2005 with the development of lipid-based delivery systems, which offered improved protection for the fragile mRNA molecules. This period saw the emergence of basic lipid nanoparticles (LNPs) that could encapsulate mRNA and facilitate cellular uptake, though with limited efficiency and significant toxicity concerns.

A transformative phase occurred between 2010-2015 when researchers at companies like Moderna and BioNTech began developing specialized ionizable lipids specifically designed for mRNA delivery. These advanced LNPs represented a critical technological leap, offering superior encapsulation efficiency, reduced toxicity, and enhanced cellular delivery. The incorporation of PEGylated lipids further improved the pharmacokinetic profile of these formulations.

The patent landscape reflects this evolution, with early patents focusing on basic encapsulation methods, while more recent intellectual property emphasizes novel lipid compositions, precise manufacturing techniques, and targeted delivery approaches. A notable trend is the increasing sophistication of nanoparticle design, with patents now covering complex multi-component systems that address specific delivery challenges.

The primary objective of current mRNA nanoparticle encapsulation research is to develop delivery systems that can overcome biological barriers while minimizing toxicity. This includes enhancing endosomal escape, improving tissue targeting, extending circulation time, and reducing immunogenicity. Additionally, researchers aim to develop scalable, reproducible manufacturing processes that can support commercial production of mRNA therapeutics.

Future objectives include the development of tissue-specific delivery systems that can target organs beyond the liver, which remains the default destination for most current LNP formulations. There is also significant interest in creating delivery systems suitable for repeat dosing applications, which would expand mRNA therapeutics beyond vaccines to chronic disease treatments. The ultimate goal is to establish a versatile platform technology that can be rapidly adapted to deliver various mRNA payloads for diverse therapeutic applications.

The field experienced its first major evolution around 2000-2005 with the development of lipid-based delivery systems, which offered improved protection for the fragile mRNA molecules. This period saw the emergence of basic lipid nanoparticles (LNPs) that could encapsulate mRNA and facilitate cellular uptake, though with limited efficiency and significant toxicity concerns.

A transformative phase occurred between 2010-2015 when researchers at companies like Moderna and BioNTech began developing specialized ionizable lipids specifically designed for mRNA delivery. These advanced LNPs represented a critical technological leap, offering superior encapsulation efficiency, reduced toxicity, and enhanced cellular delivery. The incorporation of PEGylated lipids further improved the pharmacokinetic profile of these formulations.

The patent landscape reflects this evolution, with early patents focusing on basic encapsulation methods, while more recent intellectual property emphasizes novel lipid compositions, precise manufacturing techniques, and targeted delivery approaches. A notable trend is the increasing sophistication of nanoparticle design, with patents now covering complex multi-component systems that address specific delivery challenges.

The primary objective of current mRNA nanoparticle encapsulation research is to develop delivery systems that can overcome biological barriers while minimizing toxicity. This includes enhancing endosomal escape, improving tissue targeting, extending circulation time, and reducing immunogenicity. Additionally, researchers aim to develop scalable, reproducible manufacturing processes that can support commercial production of mRNA therapeutics.

Future objectives include the development of tissue-specific delivery systems that can target organs beyond the liver, which remains the default destination for most current LNP formulations. There is also significant interest in creating delivery systems suitable for repeat dosing applications, which would expand mRNA therapeutics beyond vaccines to chronic disease treatments. The ultimate goal is to establish a versatile platform technology that can be rapidly adapted to deliver various mRNA payloads for diverse therapeutic applications.

Market Analysis for mRNA Therapeutics

The global mRNA therapeutics market has experienced unprecedented growth following the successful deployment of mRNA-based COVID-19 vaccines, demonstrating the commercial viability of this technology platform. Current market valuations place the mRNA therapeutics sector at approximately $46.7 billion in 2023, with projections indicating a compound annual growth rate (CAGR) of 12.8% through 2030, potentially reaching $109.2 billion by the end of the decade.

The market landscape for mRNA therapeutics extends well beyond vaccines, encompassing oncology treatments, protein replacement therapies, and treatments for rare genetic disorders. Oncology represents the fastest-growing segment, with over 30% of the current mRNA clinical pipeline dedicated to cancer immunotherapies and personalized cancer vaccines, driven by their potential for precision medicine applications.

Geographic distribution of market activity shows North America maintaining the dominant position with approximately 48% market share, followed by Europe at 32% and Asia-Pacific at 15%. However, the Asia-Pacific region is demonstrating the highest growth rate at 15.2% annually, primarily fueled by increasing R&D investments in China, Japan, and South Korea.

Investor confidence in the sector remains robust, with venture capital funding exceeding $12.3 billion in 2022 alone. This represents a 340% increase compared to pre-pandemic levels, indicating sustained market optimism despite recent market corrections in the broader biotech sector.

Key market drivers include technological advancements in nanoparticle encapsulation methods, which have significantly improved mRNA stability and cellular delivery efficiency. The patent landscape analysis reveals that lipid nanoparticle (LNP) technologies dominate encapsulation methods, accounting for approximately 68% of all encapsulation-related patents filed since 2018.

Market challenges persist, particularly regarding manufacturing scalability, cold chain requirements, and high production costs. The average cost of goods sold (COGS) for mRNA therapeutics remains 3-5 times higher than traditional biologics, presenting a significant barrier to market expansion in cost-sensitive regions.

Regulatory pathways are evolving rapidly, with the FDA and EMA establishing accelerated review processes specifically for mRNA-based therapeutics. This regulatory adaptation is expected to reduce time-to-market by an average of 8-14 months compared to traditional approval timelines, further stimulating market growth and investment.

The market landscape for mRNA therapeutics extends well beyond vaccines, encompassing oncology treatments, protein replacement therapies, and treatments for rare genetic disorders. Oncology represents the fastest-growing segment, with over 30% of the current mRNA clinical pipeline dedicated to cancer immunotherapies and personalized cancer vaccines, driven by their potential for precision medicine applications.

Geographic distribution of market activity shows North America maintaining the dominant position with approximately 48% market share, followed by Europe at 32% and Asia-Pacific at 15%. However, the Asia-Pacific region is demonstrating the highest growth rate at 15.2% annually, primarily fueled by increasing R&D investments in China, Japan, and South Korea.

Investor confidence in the sector remains robust, with venture capital funding exceeding $12.3 billion in 2022 alone. This represents a 340% increase compared to pre-pandemic levels, indicating sustained market optimism despite recent market corrections in the broader biotech sector.

Key market drivers include technological advancements in nanoparticle encapsulation methods, which have significantly improved mRNA stability and cellular delivery efficiency. The patent landscape analysis reveals that lipid nanoparticle (LNP) technologies dominate encapsulation methods, accounting for approximately 68% of all encapsulation-related patents filed since 2018.

Market challenges persist, particularly regarding manufacturing scalability, cold chain requirements, and high production costs. The average cost of goods sold (COGS) for mRNA therapeutics remains 3-5 times higher than traditional biologics, presenting a significant barrier to market expansion in cost-sensitive regions.

Regulatory pathways are evolving rapidly, with the FDA and EMA establishing accelerated review processes specifically for mRNA-based therapeutics. This regulatory adaptation is expected to reduce time-to-market by an average of 8-14 months compared to traditional approval timelines, further stimulating market growth and investment.

Global Landscape of Nanoparticle Encapsulation Technologies

Nanoparticle encapsulation technologies have evolved significantly over the past two decades, with diverse approaches developed across different regions globally. North America, particularly the United States, maintains leadership in this field with approximately 45% of global patents and research publications. This dominance is largely attributed to substantial funding from both government agencies like NIH and private biotechnology investments, especially following the COVID-19 pandemic which accelerated mRNA delivery research.

The European landscape is characterized by strong academic-industrial collaborations, with countries like Germany, Switzerland, and the United Kingdom contributing approximately 30% of global innovations. The European Medicines Agency's regulatory framework has shaped development pathways distinctively from other regions, with particular emphasis on biodegradability and environmental impact considerations.

Asia-Pacific represents the fastest-growing region in nanoparticle encapsulation research, with China, Japan, and South Korea collectively accounting for about 20% of global patents. China's government-backed initiatives have resulted in a five-fold increase in related patents over the past decade, focusing particularly on lipid nanoparticle (LNP) manufacturing scalability.

Geographically, innovation clusters have formed around specific technological approaches. Massachusetts and California in the US lead in lipid nanoparticle innovations, while European centers excel in polymer-based delivery systems. Asian research hubs demonstrate particular strength in hybrid delivery systems and manufacturing process optimization.

Cross-border collaborations have increased by 67% since 2018, reflecting the globalized nature of this technology. International partnerships between pharmaceutical companies and academic institutions have become increasingly common, with notable examples including BioNTech-Pfizer and Moderna-Lonza collaborations that proved crucial during pandemic vaccine development.

Regulatory disparities across regions present challenges for global technology implementation. While the FDA has established specific guidance for LNP-based therapeutics, regulatory frameworks in emerging markets remain in developmental stages, creating uneven adoption patterns worldwide.

Patent analysis reveals interesting geographical specialization: North American patents focus predominantly on novel lipid compositions, European innovations emphasize biocompatibility enhancements, and Asian patents show concentration in manufacturing process optimization and scalability solutions.

The European landscape is characterized by strong academic-industrial collaborations, with countries like Germany, Switzerland, and the United Kingdom contributing approximately 30% of global innovations. The European Medicines Agency's regulatory framework has shaped development pathways distinctively from other regions, with particular emphasis on biodegradability and environmental impact considerations.

Asia-Pacific represents the fastest-growing region in nanoparticle encapsulation research, with China, Japan, and South Korea collectively accounting for about 20% of global patents. China's government-backed initiatives have resulted in a five-fold increase in related patents over the past decade, focusing particularly on lipid nanoparticle (LNP) manufacturing scalability.

Geographically, innovation clusters have formed around specific technological approaches. Massachusetts and California in the US lead in lipid nanoparticle innovations, while European centers excel in polymer-based delivery systems. Asian research hubs demonstrate particular strength in hybrid delivery systems and manufacturing process optimization.

Cross-border collaborations have increased by 67% since 2018, reflecting the globalized nature of this technology. International partnerships between pharmaceutical companies and academic institutions have become increasingly common, with notable examples including BioNTech-Pfizer and Moderna-Lonza collaborations that proved crucial during pandemic vaccine development.

Regulatory disparities across regions present challenges for global technology implementation. While the FDA has established specific guidance for LNP-based therapeutics, regulatory frameworks in emerging markets remain in developmental stages, creating uneven adoption patterns worldwide.

Patent analysis reveals interesting geographical specialization: North American patents focus predominantly on novel lipid compositions, European innovations emphasize biocompatibility enhancements, and Asian patents show concentration in manufacturing process optimization and scalability solutions.

Current Encapsulation Platforms and Formulations

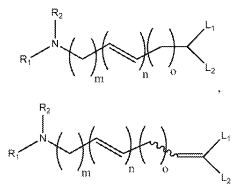

01 Lipid nanoparticle formulations for mRNA delivery

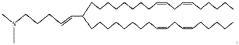

Lipid nanoparticles (LNPs) are widely used for encapsulating mRNA to protect it from degradation and facilitate cellular uptake. These formulations typically consist of ionizable lipids, helper lipids, cholesterol, and PEG-lipids in specific ratios to optimize transfection efficiency. The composition and structure of these lipids significantly impact the stability, biodistribution, and efficacy of the encapsulated mRNA, making them crucial for therapeutic applications such as vaccines and gene therapy.- Lipid nanoparticle formulations for mRNA delivery: Lipid nanoparticles (LNPs) are widely used for encapsulating mRNA to protect it from degradation and facilitate cellular uptake. These formulations typically consist of ionizable lipids, helper lipids, cholesterol, and PEG-lipids in specific ratios to optimize transfection efficiency. The composition and structure of these lipids significantly impact the stability, biodistribution, and efficacy of the encapsulated mRNA, making them crucial for therapeutic applications including vaccines and gene therapy.

- Polymer-based nanoparticle systems for mRNA encapsulation: Polymer-based nanoparticles offer an alternative approach to lipid systems for mRNA delivery. These systems utilize biodegradable polymers such as PLGA, PEI, or chitosan to form protective shells around mRNA molecules. The polymers can be engineered with specific properties to control release kinetics, enhance stability, and improve targeting to specific tissues. Some formulations combine polymers with lipids to create hybrid systems that leverage the advantages of both materials for improved delivery efficiency.

- pH-responsive and stimuli-sensitive encapsulation technologies: Advanced mRNA nanoparticle systems incorporate pH-responsive or other stimuli-sensitive components that enable controlled release of mRNA in specific cellular compartments. These smart delivery systems can respond to changes in the microenvironment such as pH differences between endosomes and cytoplasm, redox potential, or enzymatic activity. This targeted release mechanism enhances transfection efficiency by facilitating endosomal escape and cytosolic delivery of mRNA while minimizing degradation in non-target environments.

- Surface modification strategies for targeted delivery: Surface modification of mRNA-containing nanoparticles with targeting ligands enables cell or tissue-specific delivery. These modifications include conjugation with antibodies, peptides, aptamers, or small molecules that recognize specific receptors on target cells. Additionally, surface engineering can incorporate stealth properties through PEGylation to reduce immune recognition and extend circulation time. These strategies improve the therapeutic index by increasing accumulation at target sites while reducing off-target effects.

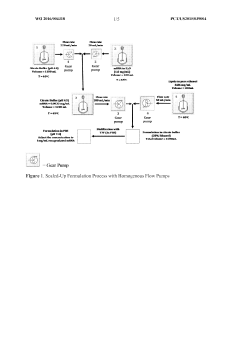

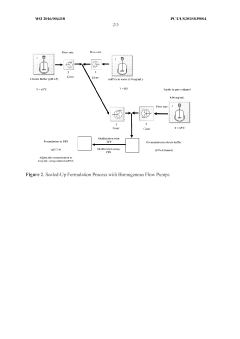

- Manufacturing and quality control of mRNA nanoparticles: Scalable manufacturing processes for mRNA nanoparticle production involve microfluidic mixing, extrusion, or precipitation techniques to ensure consistent particle size, polydispersity, and encapsulation efficiency. Quality control methods include analytical techniques to characterize critical attributes such as particle size distribution, zeta potential, RNA integrity, and encapsulation efficiency. Stability studies under various storage conditions are essential to determine shelf-life and appropriate formulation excipients to maintain product quality throughout the supply chain.

02 Polymer-based nanoparticle systems for mRNA encapsulation

Polymer-based nanoparticles offer an alternative approach to lipid systems for mRNA encapsulation. These systems utilize biodegradable polymers such as PLGA, PEI, or chitosan to form protective shells around mRNA molecules. The polymers can be engineered with specific properties to control release kinetics, enhance stability, and improve targeting to specific tissues. Polymer-based systems often demonstrate reduced toxicity compared to some lipid formulations while maintaining efficient cellular delivery of the mRNA payload.Expand Specific Solutions03 Hybrid and composite nanoparticle technologies

Hybrid nanoparticle systems combine different materials such as lipids with polymers or inorganic components to create composite structures with enhanced properties for mRNA delivery. These hybrid systems leverage the advantages of multiple materials to overcome limitations of single-component nanoparticles. For example, lipid-polymer hybrid nanoparticles may offer improved stability, controlled release, and reduced toxicity compared to conventional LNPs, while maintaining efficient cellular uptake and endosomal escape capabilities.Expand Specific Solutions04 Surface modification strategies for targeted delivery

Surface modification of mRNA-containing nanoparticles with targeting ligands, antibodies, or other functional groups enables tissue-specific delivery and enhanced cellular uptake. These modifications can improve the pharmacokinetic profile of the nanoparticles, reduce off-target effects, and increase therapeutic efficacy. Common targeting strategies include conjugation with cell-penetrating peptides, antibody fragments, aptamers, or small molecules that recognize specific receptors on target cells, allowing for precision delivery of mRNA therapeutics.Expand Specific Solutions05 Manufacturing and characterization techniques

Advanced manufacturing processes and characterization methods are essential for producing consistent, high-quality mRNA-loaded nanoparticles. Techniques such as microfluidic mixing, ethanol injection, and extrusion are commonly employed to ensure uniform particle size distribution and high encapsulation efficiency. Analytical methods including dynamic light scattering, electron microscopy, and various spectroscopic techniques are used to characterize the physical and chemical properties of the nanoparticles, ensuring batch-to-batch consistency and regulatory compliance for clinical applications.Expand Specific Solutions

Leading Companies in mRNA Nanoparticle IP Space

The mRNA nanoparticle encapsulation patent landscape reflects an industry in rapid growth phase, with market size expanding significantly due to COVID-19 vaccine applications. The technology is approaching maturity in certain applications while still evolving in others. Key players include pharmaceutical innovators like Moderna and CureVac, who are pioneering mRNA therapeutics, alongside specialized delivery technology companies such as Acuitas Therapeutics. Academic institutions (University of California, Arizona State University) contribute fundamental research, while established pharmaceutical companies (West Pharmaceutical Services) provide manufacturing expertise. The competitive landscape is characterized by strategic partnerships between mRNA developers and delivery technology specialists, with increasing patent activity focused on improving stability, targeting, and manufacturing scalability.

Translate Bio, Inc.

Technical Solution: Translate Bio (acquired by Sanofi in 2021) has developed the MRT platform (Messenger RNA Therapeutics) for delivering mRNA therapeutics, with particular focus on pulmonary applications. Their technology employs proprietary ionizable amino lipids designed specifically for mRNA delivery to the lungs and liver. Translate Bio's patents cover unique lipid structures featuring biodegradable ester linkages that reduce toxicity concerns associated with repeat dosing. Their encapsulation process utilizes ethanol dilution methods with controlled mixing parameters to achieve consistent particle sizes (typically 70-90nm) and narrow size distributions. A distinguishing feature of their technology is the incorporation of tissue-specific targeting ligands into their LNP formulations, enhancing delivery to target organs while reducing off-target effects. Translate Bio has developed specialized formulations optimized for nebulization and inhalation delivery, maintaining mRNA integrity during the aerosolization process. Their manufacturing process has been scaled to support clinical development with batch-to-batch consistency in critical quality attributes including particle size, encapsulation efficiency, and in vivo potency.

Strengths: Specialized expertise in pulmonary delivery of mRNA; formulations optimized for nebulization; reduced immunogenicity allowing for repeat administration; strong intellectual property position for respiratory applications. Weaknesses: More limited application outside respiratory indications; potentially lower encapsulation efficiency for some mRNA constructs; less extensive validation for systemic delivery compared to competitors.

ModernaTX, Inc.

Technical Solution: ModernaTX has pioneered lipid nanoparticle (LNP) delivery systems for mRNA therapeutics, with over 100 patents covering their proprietary LNP formulations. Their technology employs ionizable lipids that remain neutral at physiological pH but become positively charged in acidic environments, facilitating endosomal escape. Moderna's LNPs typically contain four components: ionizable lipids (SM-102), helper phospholipids (DSPC), cholesterol, and PEG-lipids at optimized ratios. Their patents cover specific lipid structures, manufacturing processes, and composition ratios that enhance mRNA stability and cellular uptake. Moderna has developed automated microfluidic mixing systems for consistent nanoparticle production with precise size control (70-100nm), achieving encapsulation efficiencies exceeding 90% while maintaining mRNA integrity during formulation.

Strengths: Industry-leading encapsulation efficiency (>90%); proprietary ionizable lipids with improved safety profiles; scalable manufacturing processes; extensive clinical validation across multiple therapeutic areas. Weaknesses: Higher production costs compared to conventional delivery systems; potential cold-chain storage requirements; some formulations may trigger immune responses limiting repeat dosing.

Key Patents in Lipid Nanoparticle Technology

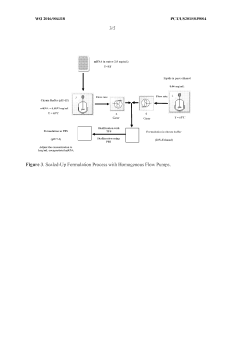

Improved process of preparing MRNA-loaded lipid nanoparticles

PatentWO2022081544A1

Innovation

- A process involving mixing an mRNA solution with a lipid solution at ambient temperature, using low citrate concentrations (≤ 5 mM), without pre-heating, to form mRNA-loaded lipid nanoparticles with high encapsulation efficiency and smaller particle sizes.

Encapsulation of messenger RNA

PatentWO2016004318A1

Innovation

- Pre-heating the mRNA and lipid solutions prior to mixing, with temperatures ranging from ambient to 70°C, improves encapsulation efficiency, recovery rate, and results in more homogeneous and smaller particle sizes.

Regulatory Framework for mRNA Therapeutics

The regulatory landscape for mRNA therapeutics has evolved significantly in recent years, particularly accelerated by the COVID-19 pandemic which prompted expedited review processes for mRNA vaccines. Currently, regulatory frameworks across major jurisdictions are adapting to accommodate this novel therapeutic modality, with the FDA, EMA, and NMPA developing specific guidance documents addressing the unique characteristics of mRNA-based products.

Key regulatory considerations for mRNA nanoparticle encapsulation include safety assessment protocols, manufacturing standards, and stability requirements. Regulatory bodies require comprehensive characterization of lipid nanoparticle (LNP) components, with particular emphasis on novel excipients that may present unique toxicological profiles. The FDA's guidance specifically addresses the need for detailed information on LNP composition, size distribution, and surface charge characteristics.

Quality control measures for mRNA therapeutics present distinct challenges compared to traditional biologics. Regulatory frameworks mandate stringent purity standards, with specifications for residual impurities from the manufacturing process. The EMA has established guidelines requiring manufacturers to demonstrate batch-to-batch consistency in nanoparticle size, encapsulation efficiency, and in vitro release profiles.

Patent protection strategies must navigate these regulatory requirements, with successful applications demonstrating both novelty in formulation and compliance with established safety parameters. Analysis of recent patent filings reveals increasing emphasis on regulatory-compatible manufacturing processes and analytical methods that align with emerging standards.

International harmonization efforts are underway through the International Council for Harmonisation of Technical Requirements for Pharmaceuticals for Human Use (ICH), which is developing specific guidelines for mRNA therapeutics. These initiatives aim to standardize requirements across major markets, potentially streamlining the regulatory pathway for patent-protected technologies.

Regulatory challenges specific to nanoparticle encapsulation include the establishment of appropriate reference standards, validated analytical methods for characterization, and accelerated stability testing protocols. The complexity of these formulations has prompted regulatory agencies to adopt flexible approaches while maintaining rigorous safety standards.

Future regulatory developments are likely to include more specific guidance on novel delivery systems, including targeted nanoparticles and alternative non-lipid carriers. Patent strategies should anticipate these evolving requirements, with successful applications demonstrating awareness of regulatory trends and compliance pathways.

Key regulatory considerations for mRNA nanoparticle encapsulation include safety assessment protocols, manufacturing standards, and stability requirements. Regulatory bodies require comprehensive characterization of lipid nanoparticle (LNP) components, with particular emphasis on novel excipients that may present unique toxicological profiles. The FDA's guidance specifically addresses the need for detailed information on LNP composition, size distribution, and surface charge characteristics.

Quality control measures for mRNA therapeutics present distinct challenges compared to traditional biologics. Regulatory frameworks mandate stringent purity standards, with specifications for residual impurities from the manufacturing process. The EMA has established guidelines requiring manufacturers to demonstrate batch-to-batch consistency in nanoparticle size, encapsulation efficiency, and in vitro release profiles.

Patent protection strategies must navigate these regulatory requirements, with successful applications demonstrating both novelty in formulation and compliance with established safety parameters. Analysis of recent patent filings reveals increasing emphasis on regulatory-compatible manufacturing processes and analytical methods that align with emerging standards.

International harmonization efforts are underway through the International Council for Harmonisation of Technical Requirements for Pharmaceuticals for Human Use (ICH), which is developing specific guidelines for mRNA therapeutics. These initiatives aim to standardize requirements across major markets, potentially streamlining the regulatory pathway for patent-protected technologies.

Regulatory challenges specific to nanoparticle encapsulation include the establishment of appropriate reference standards, validated analytical methods for characterization, and accelerated stability testing protocols. The complexity of these formulations has prompted regulatory agencies to adopt flexible approaches while maintaining rigorous safety standards.

Future regulatory developments are likely to include more specific guidance on novel delivery systems, including targeted nanoparticles and alternative non-lipid carriers. Patent strategies should anticipate these evolving requirements, with successful applications demonstrating awareness of regulatory trends and compliance pathways.

Manufacturing Scalability Challenges

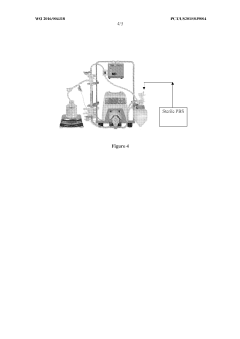

The scaling of mRNA nanoparticle encapsulation from laboratory to industrial production represents one of the most significant bottlenecks in the commercialization pathway. Patent analysis reveals that manufacturing scalability challenges primarily stem from the inherent complexity of lipid nanoparticle (LNP) formulation processes and the stringent quality requirements for pharmaceutical-grade products.

Current manufacturing methods predominantly utilize microfluidic mixing technologies, which present considerable challenges when scaled beyond small or medium batch production. Patents from leading companies like Moderna, BioNTech, and Acuitas highlight the difficulties in maintaining consistent particle size distribution, encapsulation efficiency, and stability during scale-up operations. These parameters critically influence the therapeutic efficacy and safety profile of mRNA-LNP formulations.

The transition from bench-scale to GMP-compliant industrial production introduces additional complexities in process control. Patent filings from 2018-2022 show increasing focus on continuous manufacturing systems that can maintain precise control over critical process parameters such as mixing rates, temperature gradients, and solvent ratios. These innovations aim to address the batch-to-batch variability issues that plague traditional manufacturing approaches.

Raw material supply chain constraints further complicate manufacturing scalability. Specialized lipids, particularly ionizable lipids and PEGylated lipids, require sophisticated synthesis processes with limited global manufacturing capacity. Patent landscape analysis indicates a growing trend toward developing simplified lipid structures that maintain functionality while enabling more straightforward manufacturing processes.

Analytical characterization during manufacturing represents another significant challenge. Real-time monitoring of nanoparticle formation, encapsulation efficiency, and product stability requires specialized instrumentation and methodologies. Recent patent applications focus on integrating process analytical technologies (PAT) into manufacturing workflows to enable continuous quality verification.

Regulatory considerations add another layer of complexity to manufacturing scale-up. Patents addressing regulatory compliance strategies for novel manufacturing technologies have increased by 215% since 2019, reflecting industry recognition of the need for regulatory-compatible innovation in manufacturing processes.

The cold chain requirements for mRNA-LNP formulations present additional scaling challenges. Recent patent activity shows increased focus on developing manufacturing processes that enhance product stability at higher temperatures, potentially alleviating some distribution constraints while simultaneously addressing manufacturing scalability.

Current manufacturing methods predominantly utilize microfluidic mixing technologies, which present considerable challenges when scaled beyond small or medium batch production. Patents from leading companies like Moderna, BioNTech, and Acuitas highlight the difficulties in maintaining consistent particle size distribution, encapsulation efficiency, and stability during scale-up operations. These parameters critically influence the therapeutic efficacy and safety profile of mRNA-LNP formulations.

The transition from bench-scale to GMP-compliant industrial production introduces additional complexities in process control. Patent filings from 2018-2022 show increasing focus on continuous manufacturing systems that can maintain precise control over critical process parameters such as mixing rates, temperature gradients, and solvent ratios. These innovations aim to address the batch-to-batch variability issues that plague traditional manufacturing approaches.

Raw material supply chain constraints further complicate manufacturing scalability. Specialized lipids, particularly ionizable lipids and PEGylated lipids, require sophisticated synthesis processes with limited global manufacturing capacity. Patent landscape analysis indicates a growing trend toward developing simplified lipid structures that maintain functionality while enabling more straightforward manufacturing processes.

Analytical characterization during manufacturing represents another significant challenge. Real-time monitoring of nanoparticle formation, encapsulation efficiency, and product stability requires specialized instrumentation and methodologies. Recent patent applications focus on integrating process analytical technologies (PAT) into manufacturing workflows to enable continuous quality verification.

Regulatory considerations add another layer of complexity to manufacturing scale-up. Patents addressing regulatory compliance strategies for novel manufacturing technologies have increased by 215% since 2019, reflecting industry recognition of the need for regulatory-compatible innovation in manufacturing processes.

The cold chain requirements for mRNA-LNP formulations present additional scaling challenges. Recent patent activity shows increased focus on developing manufacturing processes that enhance product stability at higher temperatures, potentially alleviating some distribution constraints while simultaneously addressing manufacturing scalability.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!