Market Analysis of mRNA Lipid Nanoparticle Applications

OCT 10, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

mRNA-LNP Technology Background and Objectives

Messenger RNA (mRNA) technology has experienced a remarkable evolution over the past four decades, transforming from a theoretical concept to a revolutionary therapeutic platform. The journey began in the 1980s with fundamental research on mRNA structure and function, followed by critical breakthroughs in the 1990s addressing key challenges such as mRNA instability and immunogenicity. The field gained significant momentum in the early 2000s with the development of modified nucleosides that enhanced mRNA stability and reduced inflammatory responses.

Lipid nanoparticles (LNPs) emerged as the critical delivery vehicle for mRNA therapeutics, overcoming the inherent challenges of delivering large, negatively charged mRNA molecules into cells. The convergence of mRNA and LNP technologies created a synergistic platform that has revolutionized vaccine development and opened new frontiers in protein replacement therapies, gene editing, and immunomodulation.

The COVID-19 pandemic served as a watershed moment for mRNA-LNP technology, demonstrating its unprecedented speed of development and remarkable efficacy. The successful deployment of mRNA vaccines against SARS-CoV-2 validated decades of research and established mRNA-LNP as a versatile and powerful therapeutic modality with applications extending far beyond infectious diseases.

Current technological trends indicate a focus on optimizing LNP formulations for targeted delivery to specific tissues beyond the liver, enhancing mRNA stability and translation efficiency, and developing self-amplifying mRNA platforms that could reduce dosing requirements. Researchers are also exploring novel lipid compositions and surface modifications to improve biodistribution profiles and reduce potential toxicity concerns.

The primary objectives of mRNA-LNP technology development include expanding therapeutic applications beyond vaccines to address genetic disorders, cancer, and autoimmune diseases; improving manufacturing scalability and cost-effectiveness; enhancing storage stability to overcome cold chain requirements; and developing personalized mRNA therapeutics tailored to individual patient needs.

Looking forward, the field aims to achieve tissue-specific delivery capabilities, develop combination therapies leveraging multiple mRNA payloads, establish repeat dosing protocols for chronic conditions, and create orally administered mRNA formulations. These advancements would significantly broaden the therapeutic potential of mRNA-LNP technology and potentially revolutionize treatment paradigms across numerous disease areas, representing a fundamental shift in how we approach medicine development and delivery.

Lipid nanoparticles (LNPs) emerged as the critical delivery vehicle for mRNA therapeutics, overcoming the inherent challenges of delivering large, negatively charged mRNA molecules into cells. The convergence of mRNA and LNP technologies created a synergistic platform that has revolutionized vaccine development and opened new frontiers in protein replacement therapies, gene editing, and immunomodulation.

The COVID-19 pandemic served as a watershed moment for mRNA-LNP technology, demonstrating its unprecedented speed of development and remarkable efficacy. The successful deployment of mRNA vaccines against SARS-CoV-2 validated decades of research and established mRNA-LNP as a versatile and powerful therapeutic modality with applications extending far beyond infectious diseases.

Current technological trends indicate a focus on optimizing LNP formulations for targeted delivery to specific tissues beyond the liver, enhancing mRNA stability and translation efficiency, and developing self-amplifying mRNA platforms that could reduce dosing requirements. Researchers are also exploring novel lipid compositions and surface modifications to improve biodistribution profiles and reduce potential toxicity concerns.

The primary objectives of mRNA-LNP technology development include expanding therapeutic applications beyond vaccines to address genetic disorders, cancer, and autoimmune diseases; improving manufacturing scalability and cost-effectiveness; enhancing storage stability to overcome cold chain requirements; and developing personalized mRNA therapeutics tailored to individual patient needs.

Looking forward, the field aims to achieve tissue-specific delivery capabilities, develop combination therapies leveraging multiple mRNA payloads, establish repeat dosing protocols for chronic conditions, and create orally administered mRNA formulations. These advancements would significantly broaden the therapeutic potential of mRNA-LNP technology and potentially revolutionize treatment paradigms across numerous disease areas, representing a fundamental shift in how we approach medicine development and delivery.

Market Demand Analysis for mRNA-LNP Applications

The mRNA-LNP (messenger RNA-Lipid Nanoparticle) market has experienced unprecedented growth following the successful deployment of COVID-19 vaccines, with the global market value reaching $5.4 billion in 2022. Industry analysts project this market to expand at a compound annual growth rate (CAGR) of 28.4% through 2030, potentially reaching $37.8 billion. This remarkable trajectory reflects the transformative potential of mRNA-LNP technology across multiple therapeutic areas.

The primary market demand currently centers on infectious disease prevention, with COVID-19 vaccines representing the first widespread commercial application. However, significant market expansion is occurring in oncology, where mRNA-LNPs offer personalized cancer vaccine approaches. Clinical trials by companies like BioNTech and Moderna demonstrate promising results in melanoma and other solid tumors, with market projections indicating oncology applications could reach $12.3 billion by 2028.

Rare genetic disorders represent another high-growth segment, with over 7,000 identified rare diseases affecting approximately 400 million people globally. The ability of mRNA-LNPs to deliver therapeutic proteins for conditions like cystic fibrosis and hemophilia addresses substantial unmet medical needs. This segment is expected to grow at 32.1% CAGR through 2030.

Autoimmune disease treatment represents an emerging application with significant market potential. Companies like Moderna and CureVac are developing mRNA therapies for conditions including multiple sclerosis and rheumatoid arthritis, targeting a market currently valued at $110 billion globally with substantial growth potential for mRNA-LNP solutions.

Regional market analysis reveals North America dominating with 42% market share, followed by Europe at 31%. However, Asia-Pacific markets, particularly China, Japan, and South Korea, are experiencing the fastest growth rates, exceeding 35% annually as regulatory frameworks evolve and manufacturing capabilities expand.

Healthcare payers and insurance systems are increasingly recognizing the value proposition of mRNA-LNP therapies. Despite high initial costs, their potential for durable efficacy with fewer administrations presents favorable pharmacoeconomic profiles. Market research indicates 68% of healthcare payers are developing specific reimbursement pathways for these advanced therapeutics.

Manufacturing capacity represents a critical market constraint, with current global capacity estimated at 12 billion doses annually. Significant investments in manufacturing infrastructure are underway, with over $7.2 billion committed to new facilities since 2021. This expansion addresses a key bottleneck in meeting projected market demand across therapeutic applications.

The primary market demand currently centers on infectious disease prevention, with COVID-19 vaccines representing the first widespread commercial application. However, significant market expansion is occurring in oncology, where mRNA-LNPs offer personalized cancer vaccine approaches. Clinical trials by companies like BioNTech and Moderna demonstrate promising results in melanoma and other solid tumors, with market projections indicating oncology applications could reach $12.3 billion by 2028.

Rare genetic disorders represent another high-growth segment, with over 7,000 identified rare diseases affecting approximately 400 million people globally. The ability of mRNA-LNPs to deliver therapeutic proteins for conditions like cystic fibrosis and hemophilia addresses substantial unmet medical needs. This segment is expected to grow at 32.1% CAGR through 2030.

Autoimmune disease treatment represents an emerging application with significant market potential. Companies like Moderna and CureVac are developing mRNA therapies for conditions including multiple sclerosis and rheumatoid arthritis, targeting a market currently valued at $110 billion globally with substantial growth potential for mRNA-LNP solutions.

Regional market analysis reveals North America dominating with 42% market share, followed by Europe at 31%. However, Asia-Pacific markets, particularly China, Japan, and South Korea, are experiencing the fastest growth rates, exceeding 35% annually as regulatory frameworks evolve and manufacturing capabilities expand.

Healthcare payers and insurance systems are increasingly recognizing the value proposition of mRNA-LNP therapies. Despite high initial costs, their potential for durable efficacy with fewer administrations presents favorable pharmacoeconomic profiles. Market research indicates 68% of healthcare payers are developing specific reimbursement pathways for these advanced therapeutics.

Manufacturing capacity represents a critical market constraint, with current global capacity estimated at 12 billion doses annually. Significant investments in manufacturing infrastructure are underway, with over $7.2 billion committed to new facilities since 2021. This expansion addresses a key bottleneck in meeting projected market demand across therapeutic applications.

Global mRNA-LNP Development Status and Challenges

The mRNA-LNP technology landscape has experienced remarkable growth globally, with significant advancements occurring primarily in North America, Europe, and parts of Asia. The United States leads development with companies like Moderna and Pfizer-BioNTech demonstrating unprecedented success in COVID-19 vaccine commercialization. Europe follows closely with BioNTech in Germany and CureVac establishing strong research foundations, while the UK's academic institutions contribute substantially to fundamental research.

In Asia, Japan has established expertise in lipid chemistry, with companies like Daiichi Sankyo making notable progress. China has rapidly expanded its mRNA capabilities through companies such as CanSino Biologics and Walvax Biotechnology, supported by substantial government investment in biotechnology infrastructure.

Despite these advancements, the global mRNA-LNP field faces several critical challenges. Stability remains a primary concern, as current formulations require ultra-cold storage conditions (-70°C for some products), creating significant logistical barriers for global distribution, particularly in regions with limited cold chain infrastructure.

Manufacturing scalability presents another major hurdle. The production of clinical-grade lipid nanoparticles requires specialized equipment and expertise, creating bottlenecks in global supply chains. This was evident during the COVID-19 pandemic when limited manufacturing capacity restricted vaccine availability in many regions.

Regulatory frameworks for mRNA-LNP technologies vary significantly across jurisdictions, creating a complex approval landscape. While emergency use authorizations accelerated COVID-19 vaccine approvals, the pathway for non-pandemic applications remains less defined in many countries, particularly for novel therapeutic applications beyond vaccines.

Intellectual property considerations further complicate the landscape, with key patents concentrated among a small number of companies and institutions. This concentration has created potential barriers to entry for new market participants, especially in emerging economies seeking to develop domestic mRNA capabilities.

The technology transfer gap between high-income and low/middle-income countries represents a significant challenge for global equity in mRNA-LNP access. Limited local manufacturing capabilities, technical expertise, and regulatory experience in many regions have resulted in uneven global distribution of these advanced therapeutics.

Addressing these challenges will require coordinated international efforts, including public-private partnerships, technology transfer initiatives, and harmonized regulatory approaches to ensure that mRNA-LNP technologies can achieve their full potential as a transformative platform for global healthcare.

In Asia, Japan has established expertise in lipid chemistry, with companies like Daiichi Sankyo making notable progress. China has rapidly expanded its mRNA capabilities through companies such as CanSino Biologics and Walvax Biotechnology, supported by substantial government investment in biotechnology infrastructure.

Despite these advancements, the global mRNA-LNP field faces several critical challenges. Stability remains a primary concern, as current formulations require ultra-cold storage conditions (-70°C for some products), creating significant logistical barriers for global distribution, particularly in regions with limited cold chain infrastructure.

Manufacturing scalability presents another major hurdle. The production of clinical-grade lipid nanoparticles requires specialized equipment and expertise, creating bottlenecks in global supply chains. This was evident during the COVID-19 pandemic when limited manufacturing capacity restricted vaccine availability in many regions.

Regulatory frameworks for mRNA-LNP technologies vary significantly across jurisdictions, creating a complex approval landscape. While emergency use authorizations accelerated COVID-19 vaccine approvals, the pathway for non-pandemic applications remains less defined in many countries, particularly for novel therapeutic applications beyond vaccines.

Intellectual property considerations further complicate the landscape, with key patents concentrated among a small number of companies and institutions. This concentration has created potential barriers to entry for new market participants, especially in emerging economies seeking to develop domestic mRNA capabilities.

The technology transfer gap between high-income and low/middle-income countries represents a significant challenge for global equity in mRNA-LNP access. Limited local manufacturing capabilities, technical expertise, and regulatory experience in many regions have resulted in uneven global distribution of these advanced therapeutics.

Addressing these challenges will require coordinated international efforts, including public-private partnerships, technology transfer initiatives, and harmonized regulatory approaches to ensure that mRNA-LNP technologies can achieve their full potential as a transformative platform for global healthcare.

Current mRNA-LNP Delivery Solutions

01 Lipid nanoparticle composition for mRNA delivery

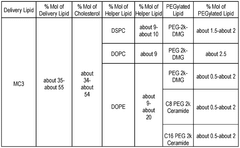

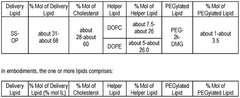

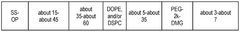

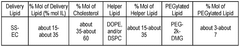

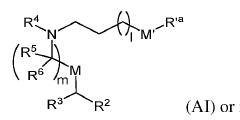

Lipid nanoparticles (LNPs) can be formulated with specific lipid compositions to effectively encapsulate and deliver mRNA to target cells. These compositions typically include ionizable lipids, helper lipids, cholesterol, and PEG-lipids in optimized ratios. The ionizable lipids facilitate endosomal escape, while the helper lipids and cholesterol provide structural stability. The PEG-lipids help prevent aggregation and extend circulation time in the bloodstream, enhancing the overall delivery efficiency of the mRNA payload.- Lipid nanoparticle composition for mRNA delivery: Lipid nanoparticles (LNPs) can be formulated with specific lipid compositions to effectively encapsulate and deliver mRNA to target cells. These formulations typically include ionizable lipids, helper lipids, cholesterol, and PEG-lipids in optimized ratios to enhance stability, cellular uptake, and endosomal escape of the mRNA payload. The composition of these LNPs significantly impacts their efficacy in delivering therapeutic mRNA for various applications including vaccines and gene therapy.

- mRNA-LNP manufacturing and production methods: Various manufacturing processes have been developed for the production of mRNA-loaded lipid nanoparticles. These methods include microfluidic mixing, T-junction mixing, and controlled ethanol dilution techniques that allow for reproducible and scalable production of LNPs with consistent size distribution and mRNA encapsulation efficiency. Advanced manufacturing approaches focus on maintaining the integrity of the mRNA during encapsulation while achieving high loading capacity and batch-to-batch consistency.

- Modified lipids for improved mRNA delivery and reduced toxicity: Novel lipid structures have been designed to enhance the delivery efficiency of mRNA while reducing potential toxicity. These include biodegradable ionizable lipids with optimized pKa values, lipids with branched or cyclic structures, and lipids containing cleavable bonds that facilitate release of mRNA in the cytoplasm. These modified lipids can improve the therapeutic index of mRNA-LNP formulations by enhancing cellular uptake and endosomal escape while minimizing cytotoxicity and inflammatory responses.

- Targeted delivery of mRNA-LNPs to specific tissues: Strategies for targeting mRNA-LNPs to specific tissues or cell types have been developed to improve therapeutic efficacy and reduce off-target effects. These approaches include surface modification of LNPs with targeting ligands such as antibodies, peptides, or aptamers that bind to receptors expressed on target cells. Additionally, the lipid composition can be tailored to preferentially accumulate in certain tissues, such as liver, lung, or tumor tissues, enabling more precise delivery of therapeutic mRNA.

- Stability enhancement and storage of mRNA-LNPs: Methods to improve the stability and shelf-life of mRNA-LNPs have been developed to address challenges in storage and distribution. These include lyophilization techniques, cryopreservation methods, and the addition of stabilizing excipients that prevent aggregation and protect the mRNA from degradation. Formulation strategies focus on maintaining the structural integrity of the lipid nanoparticles and preserving the functionality of the encapsulated mRNA during storage at various temperatures, enabling practical deployment of mRNA therapeutics in diverse settings.

02 mRNA-LNP formulation for therapeutic applications

mRNA-loaded lipid nanoparticles can be specifically formulated for various therapeutic applications, including vaccines, cancer immunotherapy, and protein replacement therapies. These formulations are designed to protect the mRNA from degradation, facilitate cellular uptake, and ensure efficient translation of the encoded protein. By adjusting the lipid composition, particle size, and surface properties, the biodistribution and targeting of mRNA-LNPs can be optimized for specific therapeutic purposes, enhancing their efficacy and safety profile.Expand Specific Solutions03 Manufacturing processes for mRNA lipid nanoparticles

Various manufacturing processes can be employed to produce mRNA lipid nanoparticles with consistent quality and scalability. These include microfluidic mixing, T-junction mixing, and ethanol injection methods. The manufacturing process parameters, such as flow rate, mixing speed, and temperature, significantly impact the physicochemical properties of the resulting nanoparticles, including size, polydispersity, encapsulation efficiency, and stability. Advanced manufacturing techniques enable the production of mRNA-LNPs with reproducible characteristics suitable for clinical applications.Expand Specific Solutions04 Stability enhancement of mRNA lipid nanoparticles

The stability of mRNA lipid nanoparticles can be enhanced through various formulation strategies and storage conditions. These include lyophilization with appropriate cryoprotectants, addition of antioxidants, pH optimization, and selection of suitable buffer systems. Modified lipid components with improved resistance to oxidation and hydrolysis can also contribute to extended shelf-life. Additionally, the incorporation of stabilizing excipients and development of specialized storage containers can protect mRNA-LNPs from degradation during long-term storage and transportation.Expand Specific Solutions05 Targeted delivery systems for mRNA lipid nanoparticles

Targeted delivery systems can be developed for mRNA lipid nanoparticles to enhance their specificity for certain tissues or cell types. These systems involve the modification of the nanoparticle surface with targeting ligands, such as antibodies, peptides, aptamers, or small molecules that recognize specific receptors on target cells. Additionally, the incorporation of stimuli-responsive elements that respond to environmental cues like pH, temperature, or enzymatic activity can enable site-specific release of the mRNA payload, improving therapeutic efficacy while reducing off-target effects.Expand Specific Solutions

Key Industry Players in mRNA-LNP Market

The mRNA Lipid Nanoparticle (LNP) market is currently in a growth phase, transitioning from early development to commercial applications, with an estimated market value exceeding $5 billion and projected annual growth of 15-20%. The COVID-19 pandemic significantly accelerated technology adoption, with companies like Moderna, CureVac, and Acuitas Therapeutics leading commercial applications. Technical maturity varies across applications: vaccine delivery systems are relatively mature, while targeted therapeutics remain in early development stages. Key players including BioNTech/Pfizer, Moderna, and AstraZeneca have established strong market positions, while emerging companies like eTheRNA, SalioGen, and NanoVation Therapeutics are advancing specialized LNP technologies for tissue-specific delivery and novel therapeutic applications beyond vaccines.

ModernaTX, Inc.

Technical Solution: Moderna has pioneered mRNA lipid nanoparticle (LNP) technology for vaccine delivery, most notably with their COVID-19 vaccine. Their proprietary LNP formulation consists of four lipid components: ionizable lipids, helper phospholipids, cholesterol, and PEG-lipids. The ionizable lipids facilitate RNA encapsulation at acidic pH while becoming neutral at physiological pH, enabling efficient cellular uptake. Moderna's SM-102 ionizable lipid specifically enhances mRNA delivery efficiency while reducing inflammatory responses. Their manufacturing process employs microfluidic mixing technology that allows precise control of particle size (typically 80-100 nm) and narrow size distribution, critical for biodistribution and cellular uptake[1][3]. Moderna has expanded their platform beyond vaccines to therapeutics, including treatments for rare diseases and cancer immunotherapies, demonstrating versatility of their LNP technology[2].

Strengths: Industry-leading mRNA encapsulation efficiency (>90%); proven clinical safety profile with billions of doses administered; scalable manufacturing process. Weaknesses: Temperature stability challenges requiring cold chain logistics; potential for reactogenicity in some patients; higher production costs compared to traditional vaccine technologies.

Translate Bio, Inc.

Technical Solution: Translate Bio (acquired by Sanofi in 2021) developed the MRT platform (Messenger RNA Therapeutics) utilizing lipid nanoparticles for mRNA delivery. Their LNP technology employs proprietary ionizable amino lipids designed to enhance endosomal escape, a critical barrier in mRNA delivery. The company's LUNAR® delivery system incorporates biodegradable lipids that reduce potential toxicity concerns associated with repeated dosing. Translate Bio's LNPs are formulated using a controlled ethanol dilution process that produces particles with consistent size distribution (70-100 nm) and high encapsulation efficiency[4]. Their technology initially focused on pulmonary delivery for cystic fibrosis treatment, demonstrating effective mRNA delivery to lung epithelial cells. This specialized tissue targeting represents a significant advancement in directing LNPs to specific organs beyond liver accumulation, which has been a limitation for many LNP formulations[5].

Strengths: Advanced tissue-specific targeting capabilities, particularly for pulmonary applications; reduced immunogenicity compared to some competitor formulations; biodegradable lipid components for improved safety profile. Weaknesses: Limited commercial-scale manufacturing experience compared to industry leaders; narrower clinical pipeline than some competitors; integration challenges following Sanofi acquisition.

Critical Patents and Innovations in LNP Formulation

Lipid nanoparticle (LNP) formulations

PatentWO2024226779A1

Innovation

- The development of lipid nanoparticle (LNP) formulations comprising specific lipids that associate with nucleic acid-based agents, including modified mRNA and plasmid DNA, to form aggregates or particles that can be delivered to the retina, utilizing a combination of cationic, anionic, and neutral lipids, along with PEGylated lipids to enhance stability and targeting.

RNA formulations for high volume distribution, and methods of using the same for treating covid-19

PatentWO2021231963A1

Innovation

- Development of liquid pharmaceutical compositions comprising RNA formulated in lipid carriers, such as lipid nanoparticles, that maintain integrity and potency over three months at refrigerated temperatures, ensuring a minimum effective dose is delivered, even in high-volume distribution scenarios, by accounting for degradation rates and manufacturing complexities.

Regulatory Framework for mRNA-LNP Therapeutics

The regulatory landscape for mRNA-LNP therapeutics has evolved rapidly following the unprecedented emergency use authorizations granted to COVID-19 vaccines. Currently, regulatory frameworks across major jurisdictions are being adapted to address the unique characteristics of this emerging therapeutic modality. The FDA has established a specialized pathway for mRNA-LNP products under its Center for Biologics Evaluation and Research (CBER), requiring comprehensive characterization of both the mRNA component and the lipid nanoparticle delivery system.

In Europe, the European Medicines Agency (EMA) has developed specific guidelines for advanced therapy medicinal products (ATMPs) that encompass mRNA-LNP therapeutics. These guidelines emphasize quality control measures for lipid components, encapsulation efficiency, and stability assessments. The EMA's approach includes accelerated assessment provisions for therapeutics addressing unmet medical needs, which has benefited several mRNA-LNP candidates in the pipeline.

Regulatory requirements typically include extensive characterization of lipid components, particle size distribution, polydispersity index, zeta potential, and encapsulation efficiency. Safety assessments focus particularly on potential immunogenicity, cytokine release, and biodistribution profiles. The novelty of LNP formulations has prompted regulators to request additional long-term safety monitoring protocols beyond traditional requirements.

Manufacturing considerations present significant regulatory challenges, with authorities requiring robust chemistry, manufacturing, and controls (CMC) documentation. Process analytical technology (PAT) implementation is increasingly expected to ensure batch-to-batch consistency. Cold chain requirements for mRNA-LNP products have also necessitated specialized validation protocols for distribution and storage.

Harmonization efforts are underway through the International Council for Harmonisation of Technical Requirements for Pharmaceuticals for Human Use (ICH), which is developing specific guidance for nucleic acid-based therapeutics including mRNA-LNP products. These initiatives aim to standardize regulatory approaches across major markets and facilitate global development programs.

Emerging markets are developing their regulatory frameworks at varying paces. China's National Medical Products Administration (NMPA) has established an expedited pathway for innovative therapeutics that includes provisions for mRNA-LNP products. Similarly, Japan's Pharmaceuticals and Medical Devices Agency (PMDA) has implemented a sakigake designation system that can accelerate approval for breakthrough therapies.

The regulatory environment continues to evolve as real-world data accumulates from authorized mRNA-LNP products. Regulatory agencies are increasingly adopting flexible approaches that balance rigorous safety standards with the need to facilitate innovation in this rapidly advancing field. This adaptive regulatory landscape will significantly influence market entry strategies and commercialization timelines for companies developing mRNA-LNP applications.

In Europe, the European Medicines Agency (EMA) has developed specific guidelines for advanced therapy medicinal products (ATMPs) that encompass mRNA-LNP therapeutics. These guidelines emphasize quality control measures for lipid components, encapsulation efficiency, and stability assessments. The EMA's approach includes accelerated assessment provisions for therapeutics addressing unmet medical needs, which has benefited several mRNA-LNP candidates in the pipeline.

Regulatory requirements typically include extensive characterization of lipid components, particle size distribution, polydispersity index, zeta potential, and encapsulation efficiency. Safety assessments focus particularly on potential immunogenicity, cytokine release, and biodistribution profiles. The novelty of LNP formulations has prompted regulators to request additional long-term safety monitoring protocols beyond traditional requirements.

Manufacturing considerations present significant regulatory challenges, with authorities requiring robust chemistry, manufacturing, and controls (CMC) documentation. Process analytical technology (PAT) implementation is increasingly expected to ensure batch-to-batch consistency. Cold chain requirements for mRNA-LNP products have also necessitated specialized validation protocols for distribution and storage.

Harmonization efforts are underway through the International Council for Harmonisation of Technical Requirements for Pharmaceuticals for Human Use (ICH), which is developing specific guidance for nucleic acid-based therapeutics including mRNA-LNP products. These initiatives aim to standardize regulatory approaches across major markets and facilitate global development programs.

Emerging markets are developing their regulatory frameworks at varying paces. China's National Medical Products Administration (NMPA) has established an expedited pathway for innovative therapeutics that includes provisions for mRNA-LNP products. Similarly, Japan's Pharmaceuticals and Medical Devices Agency (PMDA) has implemented a sakigake designation system that can accelerate approval for breakthrough therapies.

The regulatory environment continues to evolve as real-world data accumulates from authorized mRNA-LNP products. Regulatory agencies are increasingly adopting flexible approaches that balance rigorous safety standards with the need to facilitate innovation in this rapidly advancing field. This adaptive regulatory landscape will significantly influence market entry strategies and commercialization timelines for companies developing mRNA-LNP applications.

Manufacturing Scalability and Cost Analysis

The scalability of mRNA lipid nanoparticle (LNP) manufacturing represents a critical factor in the widespread adoption of this technology across various therapeutic applications. Current manufacturing processes face significant challenges when transitioning from laboratory-scale production to commercial manufacturing volumes, particularly in maintaining consistent quality parameters and nanoparticle characteristics.

Production scale-up challenges primarily stem from the complex multi-step processes involved in LNP formulation, including microfluidic mixing, purification, and fill-finish operations. The precision required in controlling particle size distribution, encapsulation efficiency, and lipid composition becomes increasingly difficult at larger scales. Industry data indicates that batch-to-batch variability increases approximately 15-20% when scaling from 1-liter to 100-liter production volumes without corresponding process modifications.

Cost analysis reveals that raw materials constitute 60-70% of total manufacturing expenses for mRNA-LNP products. Specifically, specialized lipids (particularly ionizable and PEG-lipids) account for approximately 40% of material costs, while GMP-grade mRNA synthesis represents another 30%. Equipment and facility requirements for aseptic processing add substantial capital expenditure, estimated at $50-100 million for a mid-sized commercial facility.

Recent technological innovations are gradually addressing these challenges. Continuous manufacturing systems have demonstrated potential to reduce batch size requirements while maintaining output volumes, potentially decreasing production costs by 25-30% compared to traditional batch processes. Additionally, advances in microfluidic mixing technologies have improved scalability, with newer systems capable of processing up to 12 liters per hour while maintaining critical quality attributes.

Economic modeling suggests that manufacturing costs could decrease significantly with increased scale and process optimization. Current estimates place the cost of goods sold (COGS) for mRNA-LNP products at $50-200 per dose, depending on mRNA payload size and formulation complexity. Industry projections indicate potential for 40-60% cost reduction over the next five years as manufacturing technologies mature and supply chains for specialized lipids expand.

Regulatory considerations also impact manufacturing scalability, with stringent requirements for process validation and characterization at each scale-up stage. Companies must demonstrate consistent product quality across multiple production scales, necessitating substantial investment in analytical technologies and quality systems. This regulatory burden adds approximately 15-20% to overall development costs but remains essential for ensuring product safety and efficacy.

Production scale-up challenges primarily stem from the complex multi-step processes involved in LNP formulation, including microfluidic mixing, purification, and fill-finish operations. The precision required in controlling particle size distribution, encapsulation efficiency, and lipid composition becomes increasingly difficult at larger scales. Industry data indicates that batch-to-batch variability increases approximately 15-20% when scaling from 1-liter to 100-liter production volumes without corresponding process modifications.

Cost analysis reveals that raw materials constitute 60-70% of total manufacturing expenses for mRNA-LNP products. Specifically, specialized lipids (particularly ionizable and PEG-lipids) account for approximately 40% of material costs, while GMP-grade mRNA synthesis represents another 30%. Equipment and facility requirements for aseptic processing add substantial capital expenditure, estimated at $50-100 million for a mid-sized commercial facility.

Recent technological innovations are gradually addressing these challenges. Continuous manufacturing systems have demonstrated potential to reduce batch size requirements while maintaining output volumes, potentially decreasing production costs by 25-30% compared to traditional batch processes. Additionally, advances in microfluidic mixing technologies have improved scalability, with newer systems capable of processing up to 12 liters per hour while maintaining critical quality attributes.

Economic modeling suggests that manufacturing costs could decrease significantly with increased scale and process optimization. Current estimates place the cost of goods sold (COGS) for mRNA-LNP products at $50-200 per dose, depending on mRNA payload size and formulation complexity. Industry projections indicate potential for 40-60% cost reduction over the next five years as manufacturing technologies mature and supply chains for specialized lipids expand.

Regulatory considerations also impact manufacturing scalability, with stringent requirements for process validation and characterization at each scale-up stage. Companies must demonstrate consistent product quality across multiple production scales, necessitating substantial investment in analytical technologies and quality systems. This regulatory burden adds approximately 15-20% to overall development costs but remains essential for ensuring product safety and efficacy.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!