Battery Pack Innovations within Regulatory Compliance Frameworks

SEP 23, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Battery Technology Evolution and Innovation Goals

Battery technology has undergone significant evolution since the introduction of the first practical battery by Alessandro Volta in 1800. The lead-acid battery, invented in 1859, marked the beginning of commercially viable energy storage solutions. Subsequent innovations included nickel-cadmium (1899), nickel-metal hydride (1970s), and lithium-ion batteries (1991), with each generation offering improved energy density, cycle life, and safety characteristics.

The lithium-ion battery revolution, pioneered by John Goodenough, Stanley Whittingham, and Akira Yoshino, transformed portable electronics and later enabled the modern electric vehicle industry. Since their commercial introduction by Sony in 1991, lithium-ion batteries have seen continuous improvements in energy density from approximately 200 Wh/L to over 700 Wh/L in advanced formulations today.

Recent technological developments have focused on addressing key challenges in battery pack design, including thermal management, structural integration, and regulatory compliance. The industry has witnessed a shift from modular designs to cell-to-pack and emerging cell-to-chassis architectures, reducing weight and maximizing energy density at the system level.

Regulatory frameworks have significantly shaped battery technology evolution, with standards like UN 38.3, IEC 62133, UL 1642, and regional regulations such as the EU Battery Directive establishing increasingly stringent safety requirements. These regulations have driven innovations in battery management systems (BMS), thermal runaway prevention, and fire suppression technologies.

The current innovation goals in battery pack technology center around five key objectives: increasing energy density beyond 350 Wh/kg at pack level; extending cycle life to over 2,000 cycles; improving fast-charging capabilities to achieve 80% charge in under 15 minutes; enhancing safety through advanced thermal management and fire prevention; and reducing environmental impact through sustainable materials and improved recyclability.

Emerging technologies poised to transform battery packs include solid-state electrolytes, silicon and lithium-metal anodes, high-nickel cathodes, and advanced structural battery designs. These innovations aim to simultaneously address energy density, safety, and regulatory compliance challenges.

The industry's long-term vision encompasses the development of battery packs that achieve energy densities approaching 500 Wh/kg, operate safely across extreme temperature ranges (-40°C to 60°C), and incorporate self-healing materials to extend operational lifetimes. Additionally, there is growing emphasis on designing battery systems that facilitate end-of-life disassembly and material recovery, aligning with circular economy principles and evolving regulatory requirements for producer responsibility.

The lithium-ion battery revolution, pioneered by John Goodenough, Stanley Whittingham, and Akira Yoshino, transformed portable electronics and later enabled the modern electric vehicle industry. Since their commercial introduction by Sony in 1991, lithium-ion batteries have seen continuous improvements in energy density from approximately 200 Wh/L to over 700 Wh/L in advanced formulations today.

Recent technological developments have focused on addressing key challenges in battery pack design, including thermal management, structural integration, and regulatory compliance. The industry has witnessed a shift from modular designs to cell-to-pack and emerging cell-to-chassis architectures, reducing weight and maximizing energy density at the system level.

Regulatory frameworks have significantly shaped battery technology evolution, with standards like UN 38.3, IEC 62133, UL 1642, and regional regulations such as the EU Battery Directive establishing increasingly stringent safety requirements. These regulations have driven innovations in battery management systems (BMS), thermal runaway prevention, and fire suppression technologies.

The current innovation goals in battery pack technology center around five key objectives: increasing energy density beyond 350 Wh/kg at pack level; extending cycle life to over 2,000 cycles; improving fast-charging capabilities to achieve 80% charge in under 15 minutes; enhancing safety through advanced thermal management and fire prevention; and reducing environmental impact through sustainable materials and improved recyclability.

Emerging technologies poised to transform battery packs include solid-state electrolytes, silicon and lithium-metal anodes, high-nickel cathodes, and advanced structural battery designs. These innovations aim to simultaneously address energy density, safety, and regulatory compliance challenges.

The industry's long-term vision encompasses the development of battery packs that achieve energy densities approaching 500 Wh/kg, operate safely across extreme temperature ranges (-40°C to 60°C), and incorporate self-healing materials to extend operational lifetimes. Additionally, there is growing emphasis on designing battery systems that facilitate end-of-life disassembly and material recovery, aligning with circular economy principles and evolving regulatory requirements for producer responsibility.

Market Demand Analysis for Advanced Battery Packs

The global market for advanced battery packs is experiencing unprecedented growth, driven primarily by the rapid expansion of electric vehicles (EVs), renewable energy storage systems, and portable electronic devices. Current market valuations indicate that the global advanced battery market reached approximately 90 billion USD in 2022, with projections suggesting a compound annual growth rate (CAGR) of 18-20% through 2030, potentially reaching 380 billion USD by the end of the decade.

Electric vehicle adoption represents the most significant demand driver, with major automotive markets including China, Europe, and North America implementing increasingly stringent emissions regulations that favor electrification. Industry forecasts suggest that EVs will constitute over 30% of new vehicle sales globally by 2030, creating substantial demand for high-performance battery packs that balance energy density, safety, and regulatory compliance.

Energy storage systems (ESS) form another rapidly expanding market segment, with grid-scale installations growing at approximately 25% annually. This growth is fueled by the increasing integration of intermittent renewable energy sources into power grids worldwide, necessitating advanced battery solutions that can provide frequency regulation, peak shaving, and backup power capabilities while adhering to evolving safety standards.

Consumer electronics continue to drive innovation in compact, high-density battery packs, with particular emphasis on fast-charging capabilities and extended cycle life. This segment values miniaturization and safety features that comply with international transportation regulations, especially following high-profile incidents involving lithium-ion batteries in consumer products.

Regional analysis reveals China dominating battery production capacity, accounting for approximately 75% of global lithium-ion manufacturing. However, significant investments in North America and Europe aim to reduce dependency on Asian supply chains, with new gigafactories under construction that will reshape market dynamics by 2025.

Customer requirements are evolving rapidly across all segments, with increasing emphasis on sustainability metrics including carbon footprint, recyclability, and ethical material sourcing. This shift is reflected in regulatory frameworks worldwide, with the EU Battery Directive and similar initiatives in other regions mandating minimum recycled content and maximum carbon intensity for battery products.

Price sensitivity varies significantly by application, with automotive customers particularly focused on achieving cost parity with internal combustion vehicles. Current industry benchmarks target battery pack costs below 100 USD/kWh to enable mass-market EV adoption, representing a critical threshold for manufacturers to achieve through economies of scale and technological innovation while maintaining compliance with increasingly complex regulatory requirements.

Electric vehicle adoption represents the most significant demand driver, with major automotive markets including China, Europe, and North America implementing increasingly stringent emissions regulations that favor electrification. Industry forecasts suggest that EVs will constitute over 30% of new vehicle sales globally by 2030, creating substantial demand for high-performance battery packs that balance energy density, safety, and regulatory compliance.

Energy storage systems (ESS) form another rapidly expanding market segment, with grid-scale installations growing at approximately 25% annually. This growth is fueled by the increasing integration of intermittent renewable energy sources into power grids worldwide, necessitating advanced battery solutions that can provide frequency regulation, peak shaving, and backup power capabilities while adhering to evolving safety standards.

Consumer electronics continue to drive innovation in compact, high-density battery packs, with particular emphasis on fast-charging capabilities and extended cycle life. This segment values miniaturization and safety features that comply with international transportation regulations, especially following high-profile incidents involving lithium-ion batteries in consumer products.

Regional analysis reveals China dominating battery production capacity, accounting for approximately 75% of global lithium-ion manufacturing. However, significant investments in North America and Europe aim to reduce dependency on Asian supply chains, with new gigafactories under construction that will reshape market dynamics by 2025.

Customer requirements are evolving rapidly across all segments, with increasing emphasis on sustainability metrics including carbon footprint, recyclability, and ethical material sourcing. This shift is reflected in regulatory frameworks worldwide, with the EU Battery Directive and similar initiatives in other regions mandating minimum recycled content and maximum carbon intensity for battery products.

Price sensitivity varies significantly by application, with automotive customers particularly focused on achieving cost parity with internal combustion vehicles. Current industry benchmarks target battery pack costs below 100 USD/kWh to enable mass-market EV adoption, representing a critical threshold for manufacturers to achieve through economies of scale and technological innovation while maintaining compliance with increasingly complex regulatory requirements.

Current Battery Pack Technologies and Regulatory Challenges

The battery pack landscape is currently dominated by lithium-ion technology, which has become the standard for electric vehicles, consumer electronics, and energy storage systems. Contemporary battery pack designs typically incorporate multiple cells arranged in series and parallel configurations to achieve desired voltage and capacity specifications. These packs feature sophisticated battery management systems (BMS) that monitor cell voltage, temperature, and state of charge to ensure safe operation and optimal performance.

Advanced thermal management systems represent a critical component in modern battery packs, utilizing liquid cooling, phase-change materials, or air cooling to maintain optimal operating temperatures. Cell-to-pack technologies are gaining prominence, eliminating traditional module structures to increase energy density by up to 15-20% while reducing weight and manufacturing complexity.

The regulatory environment surrounding battery packs has become increasingly stringent and complex. UN 38.3 testing requirements mandate rigorous safety testing including altitude simulation, thermal cycling, vibration, shock, external short circuit, impact, overcharge, and forced discharge tests. Regional variations in regulations present significant challenges for global manufacturers, with the EU Battery Directive, China's GB/T standards, and the US DOT regulations each imposing unique requirements.

Safety standards such as IEC 62133 for portable batteries and UL 1642 for lithium cells establish baseline safety requirements, while transportation regulations under UN 38.3 and IATA Dangerous Goods Regulations impose strict packaging, labeling, and documentation requirements. Environmental regulations including the EU's REACH and RoHS directives restrict the use of hazardous substances and mandate recycling programs.

Current technical challenges include balancing energy density improvements with safety requirements, as higher energy densities often correlate with increased thermal runaway risks. Manufacturers struggle with regulatory compliance costs, which can represent 5-10% of total development expenses and extend time-to-market by 3-6 months due to certification processes.

Interoperability issues arise from divergent regional standards, forcing manufacturers to develop market-specific variants. The rapid evolution of battery technology frequently outpaces regulatory frameworks, creating uncertainty in compliance requirements for novel technologies like solid-state batteries. Additionally, end-of-life management presents growing challenges as regulations increasingly emphasize circular economy principles, requiring manufacturers to implement take-back programs and design for recyclability.

Advanced thermal management systems represent a critical component in modern battery packs, utilizing liquid cooling, phase-change materials, or air cooling to maintain optimal operating temperatures. Cell-to-pack technologies are gaining prominence, eliminating traditional module structures to increase energy density by up to 15-20% while reducing weight and manufacturing complexity.

The regulatory environment surrounding battery packs has become increasingly stringent and complex. UN 38.3 testing requirements mandate rigorous safety testing including altitude simulation, thermal cycling, vibration, shock, external short circuit, impact, overcharge, and forced discharge tests. Regional variations in regulations present significant challenges for global manufacturers, with the EU Battery Directive, China's GB/T standards, and the US DOT regulations each imposing unique requirements.

Safety standards such as IEC 62133 for portable batteries and UL 1642 for lithium cells establish baseline safety requirements, while transportation regulations under UN 38.3 and IATA Dangerous Goods Regulations impose strict packaging, labeling, and documentation requirements. Environmental regulations including the EU's REACH and RoHS directives restrict the use of hazardous substances and mandate recycling programs.

Current technical challenges include balancing energy density improvements with safety requirements, as higher energy densities often correlate with increased thermal runaway risks. Manufacturers struggle with regulatory compliance costs, which can represent 5-10% of total development expenses and extend time-to-market by 3-6 months due to certification processes.

Interoperability issues arise from divergent regional standards, forcing manufacturers to develop market-specific variants. The rapid evolution of battery technology frequently outpaces regulatory frameworks, creating uncertainty in compliance requirements for novel technologies like solid-state batteries. Additionally, end-of-life management presents growing challenges as regulations increasingly emphasize circular economy principles, requiring manufacturers to implement take-back programs and design for recyclability.

Compliant Battery Pack Design Solutions

01 Battery Management Systems

Advanced battery management systems (BMS) that monitor and control battery parameters such as voltage, current, temperature, and state of charge. These systems optimize battery performance, extend battery life, and enhance safety by preventing overcharging, over-discharging, and overheating. Modern BMS innovations include predictive analytics for battery health monitoring and adaptive control algorithms that adjust charging parameters based on battery conditions.- Battery Management Systems: Advanced battery management systems (BMS) that monitor and control battery performance, temperature, and charging/discharging cycles. These systems optimize battery life, prevent overcharging and overheating, and ensure safe operation through intelligent control algorithms and sensors that continuously monitor battery conditions.

- Thermal Management Solutions: Innovative thermal management technologies for battery packs that regulate temperature and prevent overheating. These solutions include cooling systems, heat dissipation structures, and thermal interface materials that maintain optimal operating temperatures, extending battery life and improving safety during high-power operations.

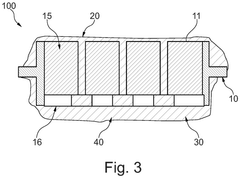

- Structural Design Improvements: Novel structural designs for battery packs that enhance mechanical integrity, space utilization, and ease of assembly. These innovations include modular configurations, lightweight materials, shock-absorbing structures, and compact arrangements that improve energy density while maintaining structural strength and safety.

- Cell Connection and Integration Technologies: Advanced methods for connecting and integrating battery cells into packs, including bus bar designs, cell-to-cell connections, and pack assembly techniques. These innovations improve electrical conductivity, reduce resistance, enhance current distribution, and simplify manufacturing while maintaining reliability under various operating conditions.

- Safety Enhancement Features: Safety mechanisms and features designed to prevent battery failures and mitigate risks. These include isolation systems, pressure relief mechanisms, fire-resistant materials, short-circuit prevention designs, and fault detection systems that improve overall battery pack safety and reliability in various applications and environments.

02 Thermal Management Solutions

Innovative thermal management solutions for battery packs that regulate temperature and prevent thermal runaway. These include active cooling systems using liquid or air circulation, phase change materials for heat absorption, and thermally conductive materials for efficient heat dissipation. Advanced thermal management designs ensure uniform temperature distribution across battery cells, which is crucial for maintaining consistent performance and extending the operational life of battery packs.Expand Specific Solutions03 Modular Battery Pack Architectures

Modular battery pack designs that allow for flexible configuration, easier maintenance, and scalability. These architectures enable the replacement of individual modules rather than entire battery packs, reducing maintenance costs and environmental impact. Modular designs also facilitate customization of battery capacity and voltage to meet specific application requirements, and support hot-swapping capabilities for continuous operation in critical applications.Expand Specific Solutions04 Advanced Cell Connection Technologies

Innovative cell connection methods that improve electrical conductivity, mechanical stability, and thermal performance of battery packs. These include busbar designs that minimize resistance, cell-to-cell connection techniques that reduce weight and volume, and vibration-resistant connections for applications in harsh environments. Advanced connection technologies also incorporate features for cell balancing and fault isolation to enhance overall battery pack reliability and safety.Expand Specific Solutions05 Smart Battery Integration Systems

Integration systems that enable batteries to communicate with devices, charging infrastructure, and energy management systems. These smart systems include wireless connectivity for remote monitoring and diagnostics, data analytics for performance optimization, and adaptive charging protocols that extend battery life. Smart battery integration also supports vehicle-to-grid (V2G) functionality, enabling bidirectional power flow for grid stabilization and energy arbitrage in electric vehicle applications.Expand Specific Solutions

Key Industry Players in Battery Pack Manufacturing

The battery pack innovation landscape is evolving rapidly within a maturing yet still dynamic market estimated at $25-30 billion annually, with projected growth exceeding 20% through 2030. Major players like CATL, BYD, and LG Energy Solution dominate with approximately 65% market share, leveraging vertical integration and economies of scale. Technological competition centers on energy density improvements, thermal management systems, and regulatory compliance integration. Established automotive manufacturers (Toyota, Ford) are partnering with battery specialists, while tech companies (Apple) are exploring proprietary solutions. The regulatory environment is driving innovation in safety protocols, recycling capabilities, and standardization, with companies like Samsung SDI, Panasonic, and Rimac developing advanced battery management systems that balance performance with compliance requirements.

LG Energy Solution Ltd.

Technical Solution: LG Energy Solution has developed the NCMA (Nickel, Cobalt, Manganese, Aluminum) cathode technology that reduces cobalt content while maintaining performance, addressing both regulatory concerns about critical materials and safety requirements. Their battery packs feature a patented "Safety Reinforced Separator" technology that provides mechanical and thermal stability even under extreme conditions. LG's regulatory compliance framework includes a comprehensive Battery Management System with advanced diagnostic capabilities that can detect potential issues before they become safety hazards, meeting requirements of standards like ISO 26262 for functional safety. Their manufacturing facilities implement a "Zero Defect" quality system with in-line inspection technologies that identify potential non-compliance issues during production. LG has pioneered the development of "Design for Recycling" battery architectures that facilitate end-of-life processing in accordance with emerging circular economy regulations. Their compliance management system includes continuous monitoring of regulatory developments across 30+ countries with market-specific adaptation strategies for each region.

Strengths: Extensive experience with large-scale EV deployments across multiple regulatory environments; advanced quality control systems that minimize field incidents; flexible manufacturing capabilities that can adapt to changing requirements. Weaknesses: Previous recalls have increased regulatory scrutiny requiring more extensive validation; complex global manufacturing footprint creates compliance consistency challenges; higher costs associated with premium safety features.

Samsung SDI Co., Ltd.

Technical Solution: Samsung SDI has developed the PRiMX (Premium, Reliable, Innovative, Maximum) battery platform that integrates regulatory compliance throughout the design process. Their Gen5 battery technology utilizes high-nickel cathodes (over 88% nickel content) while implementing a comprehensive safety verification system that includes more than 500 tests exceeding international standards. Samsung's "Safety by Design" approach incorporates multi-layered protection systems including a new separator technology with ceramic coating that prevents internal short circuits even at high temperatures. Their regulatory compliance framework addresses the entire battery lifecycle, from raw material procurement (conforming to OECD due diligence guidelines) through manufacturing (ISO 14001/45001/9001 certified) to end-of-life management. Samsung has pioneered the implementation of digital battery passports that track regulatory compliance data throughout the supply chain, anticipating requirements in the EU Battery Regulation and similar frameworks globally. Their modular battery pack design allows for market-specific configurations to address varying regulatory requirements across regions.

Strengths: Advanced materials science capabilities enabling high-performance while maintaining safety margins; comprehensive testing infrastructure that can rapidly adapt to new regulatory requirements; strong intellectual property portfolio covering safety innovations. Weaknesses: High-nickel chemistry faces more stringent thermal management requirements; complex supply chain with multiple tiers requiring extensive compliance monitoring; higher production costs compared to some competitors.

Critical Patents and Research in Battery Safety Technologies

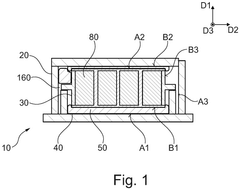

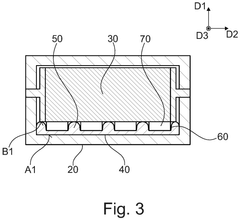

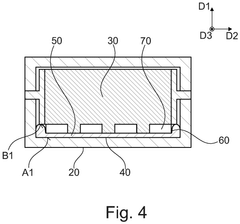

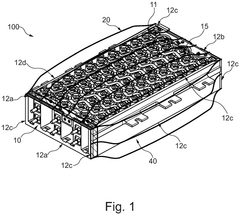

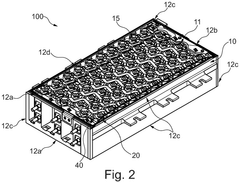

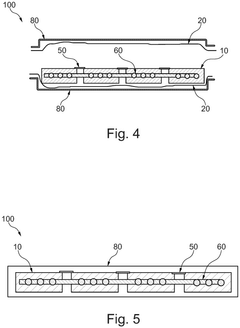

Battery pack with containing member comprising a self-expendable filler material

PatentPendingEP4597713A1

Innovation

- A battery pack design incorporating a self-expandable filler material within a containing member that provides stability and support to battery systems, using a chemical transformation to expand and harden, offering thermal and fire insulation, shock absorption, and ease of replacement without additional fixing, while maintaining structural integrity and reducing noise, vibration, and harshness.

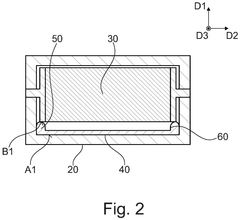

Battery pack, electric system comprising the battery pack, and manufacturing method for a battery pack

PatentPendingEP4597706A1

Innovation

- A battery pack design incorporating a boundary member and a filler, where the boundary member covers the battery system and a liquid filler is injected between the boundary member and the system, which hardens to provide structural stability and rigidity, allowing for adaptable and efficient manufacturing.

Regulatory Framework Analysis for Battery Pack Certification

The regulatory landscape for battery pack certification presents a complex matrix of standards that manufacturers must navigate to ensure market access and consumer safety. At the international level, UN 38.3 testing requirements establish baseline safety parameters for lithium battery transportation, while IEC 62133 provides comprehensive safety specifications for rechargeable cells and batteries containing alkaline or non-acid electrolytes. These foundational frameworks are complemented by region-specific regulations that often incorporate additional requirements.

In North America, UL 2054 and UL 1642 standards govern rechargeable batteries and lithium cells respectively, with the former focusing on battery pack assemblies and the latter on individual cell safety. The United States Department of Transportation (DOT) and Transport Canada enforce strict compliance with hazardous materials regulations for battery shipment, requiring extensive documentation and specific packaging protocols.

The European Union implements some of the most stringent regulatory frameworks through directives such as the Battery Directive (2006/66/EC) and its recent update (2023/1591), which address environmental concerns including recycling requirements and restrictions on hazardous substances. Additionally, the CE marking process necessitates conformity with multiple directives including EMC (2014/30/EU) and RoHS (2011/65/EU).

Asia presents varying regulatory approaches, with China implementing GB standards (GB/T 18287-2013) for portable electronic devices and Japan enforcing PSE certification requirements. South Korea's KC certification and Taiwan's BSMI standards further fragment the Asian regulatory landscape, creating challenges for global manufacturers seeking market access across the region.

Emerging markets are increasingly developing their own certification frameworks, often adapting elements from established international standards while incorporating unique local requirements. This regulatory evolution creates additional complexity for manufacturers operating in multiple jurisdictions.

The certification process typically involves multiple phases including design review, sample testing, factory inspection, and documentation verification. Third-party testing laboratories such as UL, TÜV, and SGS play crucial roles in this ecosystem, providing independent verification of compliance with applicable standards. The testing protocols evaluate factors including electrical safety, thermal performance, mechanical integrity, and environmental resilience.

Recent regulatory trends indicate increasing harmonization efforts alongside more stringent safety requirements, particularly regarding thermal runaway prevention and battery management systems. Sustainability considerations are also gaining prominence, with emerging regulations addressing battery lifecycle management, recycling infrastructure, and carbon footprint reduction throughout the supply chain.

In North America, UL 2054 and UL 1642 standards govern rechargeable batteries and lithium cells respectively, with the former focusing on battery pack assemblies and the latter on individual cell safety. The United States Department of Transportation (DOT) and Transport Canada enforce strict compliance with hazardous materials regulations for battery shipment, requiring extensive documentation and specific packaging protocols.

The European Union implements some of the most stringent regulatory frameworks through directives such as the Battery Directive (2006/66/EC) and its recent update (2023/1591), which address environmental concerns including recycling requirements and restrictions on hazardous substances. Additionally, the CE marking process necessitates conformity with multiple directives including EMC (2014/30/EU) and RoHS (2011/65/EU).

Asia presents varying regulatory approaches, with China implementing GB standards (GB/T 18287-2013) for portable electronic devices and Japan enforcing PSE certification requirements. South Korea's KC certification and Taiwan's BSMI standards further fragment the Asian regulatory landscape, creating challenges for global manufacturers seeking market access across the region.

Emerging markets are increasingly developing their own certification frameworks, often adapting elements from established international standards while incorporating unique local requirements. This regulatory evolution creates additional complexity for manufacturers operating in multiple jurisdictions.

The certification process typically involves multiple phases including design review, sample testing, factory inspection, and documentation verification. Third-party testing laboratories such as UL, TÜV, and SGS play crucial roles in this ecosystem, providing independent verification of compliance with applicable standards. The testing protocols evaluate factors including electrical safety, thermal performance, mechanical integrity, and environmental resilience.

Recent regulatory trends indicate increasing harmonization efforts alongside more stringent safety requirements, particularly regarding thermal runaway prevention and battery management systems. Sustainability considerations are also gaining prominence, with emerging regulations addressing battery lifecycle management, recycling infrastructure, and carbon footprint reduction throughout the supply chain.

Environmental Impact and Sustainability Considerations

The environmental footprint of battery pack manufacturing and disposal represents a critical consideration in the evolving landscape of energy storage technologies. Life cycle assessments reveal that battery production processes contribute significantly to greenhouse gas emissions, with lithium-ion battery manufacturing generating between 61-106 kg CO2-equivalent per kWh of battery capacity. This environmental burden necessitates innovative approaches to minimize ecological impact throughout the battery lifecycle.

Regulatory frameworks worldwide are increasingly incorporating sustainability metrics into compliance requirements. The European Union's Battery Directive and the forthcoming Battery Regulation establish comprehensive sustainability criteria, mandating carbon footprint declarations, recycled content thresholds, and extended producer responsibility. Similarly, California's advanced battery regulations set precedents for environmental performance standards that may influence national policies in the United States.

Material sourcing presents substantial environmental challenges, particularly regarding critical minerals like lithium, cobalt, and nickel. Extraction processes for these materials often result in habitat disruption, water pollution, and energy-intensive operations. Innovations in sustainable sourcing include blockchain-verified supply chains that ensure ethical and environmentally responsible material acquisition, while reducing the carbon intensity of battery production.

End-of-life management represents both an environmental imperative and an economic opportunity. Current recycling rates for lithium-ion batteries remain suboptimal at approximately 5% globally, resulting in valuable material loss and potential environmental contamination. Advanced recycling technologies, including hydrometallurgical and direct recycling processes, demonstrate promising recovery rates exceeding 95% for critical materials, substantially reducing the need for virgin resource extraction.

Design for sustainability has emerged as a fundamental principle in battery pack innovation. Modular architectures facilitate easier disassembly and component replacement, extending useful life while simplifying eventual recycling. Second-life applications represent another sustainability frontier, with degraded electric vehicle batteries finding new utility in stationary storage applications, potentially doubling the effective lifecycle of battery materials before recycling becomes necessary.

Carbon neutrality commitments from major battery manufacturers signal a paradigm shift in production approaches. Companies including CATL, LG Energy Solution, and Tesla have announced ambitious decarbonization targets, implementing renewable energy in manufacturing facilities and optimizing production processes to minimize environmental impact. These initiatives align with regulatory trends requiring carbon footprint declarations and establishing maximum emissions thresholds for battery products entering various markets.

Regulatory frameworks worldwide are increasingly incorporating sustainability metrics into compliance requirements. The European Union's Battery Directive and the forthcoming Battery Regulation establish comprehensive sustainability criteria, mandating carbon footprint declarations, recycled content thresholds, and extended producer responsibility. Similarly, California's advanced battery regulations set precedents for environmental performance standards that may influence national policies in the United States.

Material sourcing presents substantial environmental challenges, particularly regarding critical minerals like lithium, cobalt, and nickel. Extraction processes for these materials often result in habitat disruption, water pollution, and energy-intensive operations. Innovations in sustainable sourcing include blockchain-verified supply chains that ensure ethical and environmentally responsible material acquisition, while reducing the carbon intensity of battery production.

End-of-life management represents both an environmental imperative and an economic opportunity. Current recycling rates for lithium-ion batteries remain suboptimal at approximately 5% globally, resulting in valuable material loss and potential environmental contamination. Advanced recycling technologies, including hydrometallurgical and direct recycling processes, demonstrate promising recovery rates exceeding 95% for critical materials, substantially reducing the need for virgin resource extraction.

Design for sustainability has emerged as a fundamental principle in battery pack innovation. Modular architectures facilitate easier disassembly and component replacement, extending useful life while simplifying eventual recycling. Second-life applications represent another sustainability frontier, with degraded electric vehicle batteries finding new utility in stationary storage applications, potentially doubling the effective lifecycle of battery materials before recycling becomes necessary.

Carbon neutrality commitments from major battery manufacturers signal a paradigm shift in production approaches. Companies including CATL, LG Energy Solution, and Tesla have announced ambitious decarbonization targets, implementing renewable energy in manufacturing facilities and optimizing production processes to minimize environmental impact. These initiatives align with regulatory trends requiring carbon footprint declarations and establishing maximum emissions thresholds for battery products entering various markets.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!