Comparative Studies on Sulfur Cathodes and Silicon Anodes

SEP 23, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Battery Technology Evolution and Research Objectives

Battery technology has undergone significant evolution since the introduction of the first practical battery by Alessandro Volta in 1800. The progression from lead-acid batteries to lithium-ion technologies represents a remarkable journey of innovation driven by increasing energy demands across various sectors. In recent decades, lithium-ion batteries have dominated the market due to their high energy density, longer cycle life, and decreasing costs. However, as we approach the theoretical limits of conventional lithium-ion chemistry, research has intensified toward next-generation battery technologies.

The comparative study of sulfur cathodes and silicon anodes emerges as a critical research area in this evolutionary context. These materials represent promising pathways to overcome current energy density limitations. Lithium-sulfur batteries offer theoretical energy densities up to 2,600 Wh/kg, significantly higher than conventional lithium-ion batteries (250-300 Wh/kg). Similarly, silicon anodes possess a theoretical capacity approximately ten times greater than traditional graphite anodes, potentially enabling dramatic improvements in overall battery performance.

Historical data indicates that battery energy density has improved at approximately 5-8% annually over the past two decades. This incremental progress, while substantial, may be insufficient to meet the projected demands of electric vehicles, renewable energy storage, and portable electronics. The integration of sulfur cathodes and silicon anodes could potentially accelerate this improvement curve, enabling step-change advancements rather than incremental gains.

The primary research objectives in this comparative study include addressing the fundamental challenges associated with both materials. For sulfur cathodes, these challenges encompass the polysulfide shuttle effect, poor electrical conductivity, and substantial volume expansion during cycling. For silicon anodes, the focus remains on mitigating the extreme volume changes (up to 300%) during lithiation/delithiation processes and enhancing cycling stability.

Additionally, this research aims to develop comprehensive understanding of the electrochemical interfaces in both systems, optimize electrolyte compositions for each material, and explore synergistic effects when these materials are combined in full-cell configurations. The ultimate goal is to establish whether these materials represent viable pathways toward commercially feasible high-energy batteries that can meet the demands of next-generation applications.

The timeline for potential commercialization remains uncertain, with most industry analysts projecting 5-10 years for meaningful market penetration. This research seeks to accelerate this timeline through systematic investigation of fundamental mechanisms and innovative engineering approaches to material design and battery architecture.

The comparative study of sulfur cathodes and silicon anodes emerges as a critical research area in this evolutionary context. These materials represent promising pathways to overcome current energy density limitations. Lithium-sulfur batteries offer theoretical energy densities up to 2,600 Wh/kg, significantly higher than conventional lithium-ion batteries (250-300 Wh/kg). Similarly, silicon anodes possess a theoretical capacity approximately ten times greater than traditional graphite anodes, potentially enabling dramatic improvements in overall battery performance.

Historical data indicates that battery energy density has improved at approximately 5-8% annually over the past two decades. This incremental progress, while substantial, may be insufficient to meet the projected demands of electric vehicles, renewable energy storage, and portable electronics. The integration of sulfur cathodes and silicon anodes could potentially accelerate this improvement curve, enabling step-change advancements rather than incremental gains.

The primary research objectives in this comparative study include addressing the fundamental challenges associated with both materials. For sulfur cathodes, these challenges encompass the polysulfide shuttle effect, poor electrical conductivity, and substantial volume expansion during cycling. For silicon anodes, the focus remains on mitigating the extreme volume changes (up to 300%) during lithiation/delithiation processes and enhancing cycling stability.

Additionally, this research aims to develop comprehensive understanding of the electrochemical interfaces in both systems, optimize electrolyte compositions for each material, and explore synergistic effects when these materials are combined in full-cell configurations. The ultimate goal is to establish whether these materials represent viable pathways toward commercially feasible high-energy batteries that can meet the demands of next-generation applications.

The timeline for potential commercialization remains uncertain, with most industry analysts projecting 5-10 years for meaningful market penetration. This research seeks to accelerate this timeline through systematic investigation of fundamental mechanisms and innovative engineering approaches to material design and battery architecture.

Market Analysis for Next-Generation Battery Materials

The global battery market is experiencing unprecedented growth, driven primarily by the rapid expansion of electric vehicles (EVs), renewable energy storage systems, and portable electronics. Current projections indicate the battery market will reach approximately $310 billion by 2030, with a compound annual growth rate exceeding 12%. Within this expanding landscape, next-generation battery materials, particularly sulfur cathodes and silicon anodes, are positioned to capture significant market share due to their superior theoretical performance characteristics.

Lithium-sulfur batteries featuring sulfur cathodes represent a promising market segment with theoretical energy densities up to 2,600 Wh/kg, substantially higher than conventional lithium-ion batteries (250-300 Wh/kg). Market analysis indicates that sulfur's abundance and low cost ($0.10-0.20 per kg compared to cobalt at $30-35 per kg) make it particularly attractive for large-scale energy storage applications where cost sensitivity is paramount.

Silicon anodes similarly demonstrate strong market potential, offering theoretical capacity nearly ten times that of traditional graphite anodes (4,200 mAh/g versus 372 mAh/g). The silicon anode market segment is projected to grow at 22% CAGR through 2028, outpacing the broader battery materials market. This growth is supported by silicon's abundance as the second most common element in Earth's crust and its established processing infrastructure from the semiconductor industry.

Regional market analysis reveals differentiated adoption patterns. Asia-Pacific, particularly China, South Korea, and Japan, dominates manufacturing capacity for next-generation battery materials, controlling approximately 75% of the global production. North America and Europe are rapidly expanding research initiatives and production capabilities, with significant government funding supporting domestic supply chain development for these strategic materials.

End-user market segmentation shows electric vehicles as the primary demand driver, accounting for approximately 60% of advanced battery material consumption. Grid storage applications represent the fastest-growing segment at 28% annual growth, while consumer electronics maintains steady demand growth at 8-10% annually.

Pricing trends indicate decreasing costs for both technologies, with silicon anode materials experiencing more rapid cost reduction (18% annually) compared to sulfur cathode materials (12% annually). This cost trajectory is critical for market penetration as both technologies must achieve price parity with conventional materials to enable mass adoption beyond premium applications.

Market barriers include technical challenges related to cycle life, manufacturing scalability, and integration with existing battery production infrastructure. Industry analysts project commercial viability for silicon anodes in hybrid configurations within 2-3 years, while sulfur cathodes may require 4-6 years for mainstream commercial deployment beyond niche applications.

Lithium-sulfur batteries featuring sulfur cathodes represent a promising market segment with theoretical energy densities up to 2,600 Wh/kg, substantially higher than conventional lithium-ion batteries (250-300 Wh/kg). Market analysis indicates that sulfur's abundance and low cost ($0.10-0.20 per kg compared to cobalt at $30-35 per kg) make it particularly attractive for large-scale energy storage applications where cost sensitivity is paramount.

Silicon anodes similarly demonstrate strong market potential, offering theoretical capacity nearly ten times that of traditional graphite anodes (4,200 mAh/g versus 372 mAh/g). The silicon anode market segment is projected to grow at 22% CAGR through 2028, outpacing the broader battery materials market. This growth is supported by silicon's abundance as the second most common element in Earth's crust and its established processing infrastructure from the semiconductor industry.

Regional market analysis reveals differentiated adoption patterns. Asia-Pacific, particularly China, South Korea, and Japan, dominates manufacturing capacity for next-generation battery materials, controlling approximately 75% of the global production. North America and Europe are rapidly expanding research initiatives and production capabilities, with significant government funding supporting domestic supply chain development for these strategic materials.

End-user market segmentation shows electric vehicles as the primary demand driver, accounting for approximately 60% of advanced battery material consumption. Grid storage applications represent the fastest-growing segment at 28% annual growth, while consumer electronics maintains steady demand growth at 8-10% annually.

Pricing trends indicate decreasing costs for both technologies, with silicon anode materials experiencing more rapid cost reduction (18% annually) compared to sulfur cathode materials (12% annually). This cost trajectory is critical for market penetration as both technologies must achieve price parity with conventional materials to enable mass adoption beyond premium applications.

Market barriers include technical challenges related to cycle life, manufacturing scalability, and integration with existing battery production infrastructure. Industry analysts project commercial viability for silicon anodes in hybrid configurations within 2-3 years, while sulfur cathodes may require 4-6 years for mainstream commercial deployment beyond niche applications.

Current Challenges in Sulfur Cathodes and Silicon Anodes

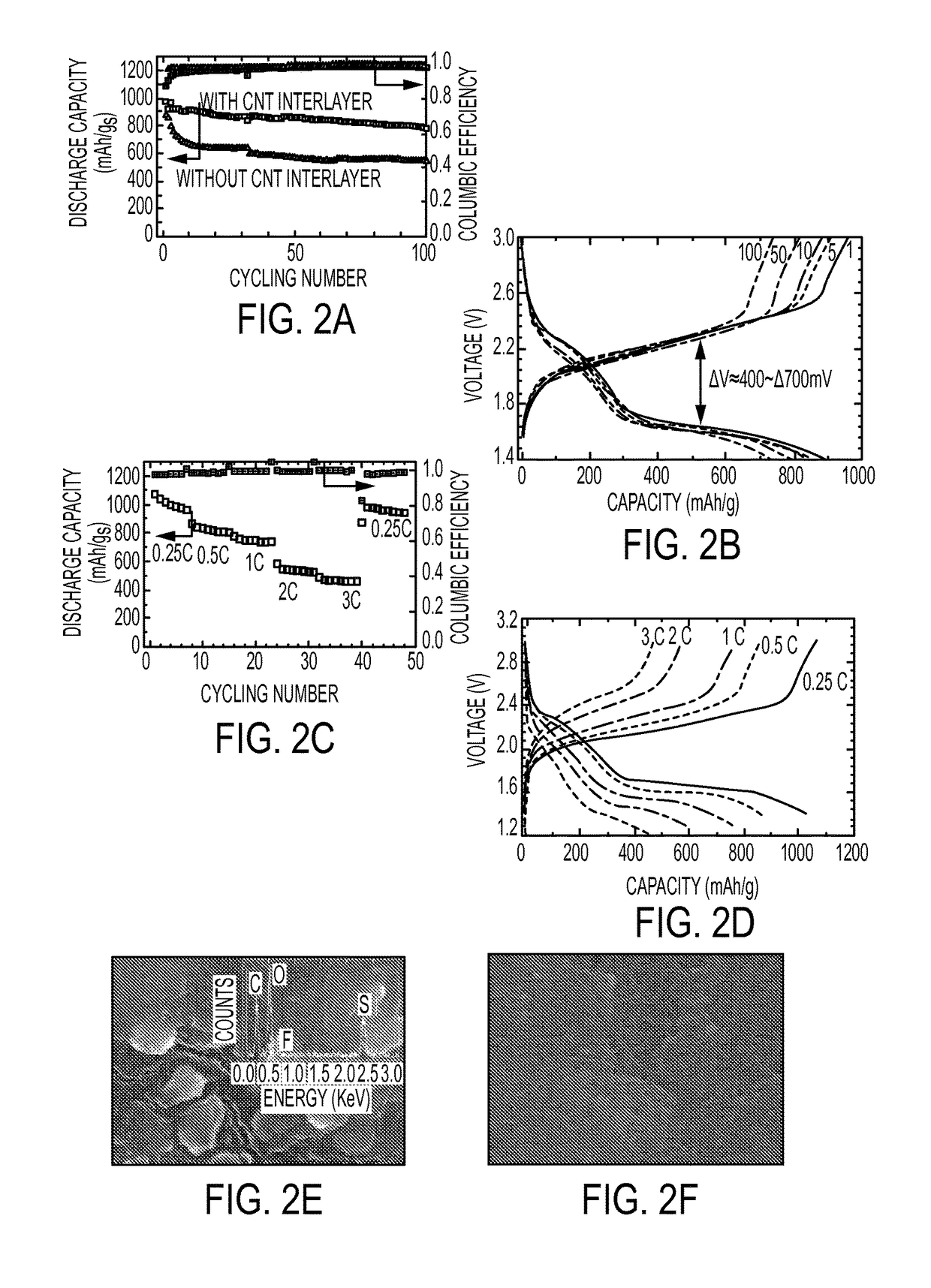

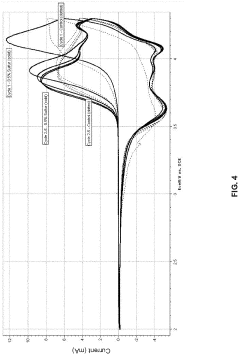

Despite significant advancements in lithium-ion battery technology, sulfur cathodes and silicon anodes face persistent challenges that hinder their widespread commercial adoption. For sulfur cathodes, the primary obstacle remains the "shuttle effect," where soluble polysulfide intermediates dissolve in the electrolyte during cycling, causing active material loss, parasitic reactions with the lithium anode, and rapid capacity fading. This phenomenon fundamentally limits cycle life and coulombic efficiency of sulfur-based batteries.

The insulating nature of sulfur presents another significant barrier, with its electrical conductivity approximately 5×10^-30 S/cm at room temperature. This poor conductivity necessitates large amounts of conductive additives, reducing the overall energy density advantage that sulfur theoretically offers. Additionally, sulfur undergoes substantial volume expansion (approximately 80%) during lithiation, leading to mechanical stress and electrode degradation over multiple cycles.

Silicon anodes face equally challenging issues, with volume expansion being the most critical. During lithiation, silicon expands by approximately 300-400%, causing particle pulverization, electrode delamination, and continuous solid-electrolyte interphase (SEI) formation. This expansion-contraction cycle consumes electrolyte, increases internal resistance, and ultimately leads to rapid capacity decay.

The unstable SEI layer on silicon surfaces represents another major hurdle. Unlike graphite anodes that form a stable passivation layer, silicon's dramatic volume changes continuously expose fresh surfaces to the electrolyte, resulting in perpetual SEI growth. This parasitic process consumes lithium ions and electrolyte components, reducing coulombic efficiency and battery lifespan.

Both materials also face manufacturing challenges that impede industrial scale-up. Sulfur cathodes require specialized synthesis techniques to achieve intimate contact with conductive hosts, while silicon anodes demand novel binder systems and electrode architectures to accommodate volume changes. These requirements often conflict with established manufacturing processes optimized for conventional materials.

Electrolyte compatibility represents a cross-cutting challenge for both materials. Sulfur requires electrolytes that minimize polysulfide solubility while maintaining ionic conductivity, whereas silicon demands formulations that form flexible yet stable SEI layers. Finding electrolyte systems that simultaneously address these divergent requirements while maintaining safety standards remains elusive.

Recent research has demonstrated that these challenges are interconnected and must be addressed holistically rather than in isolation. For instance, advances in nanostructured carbon hosts for sulfur have partially mitigated both the shuttle effect and conductivity issues, while engineered void spaces in silicon structures have shown promise in accommodating volume expansion without catastrophic mechanical failure.

The insulating nature of sulfur presents another significant barrier, with its electrical conductivity approximately 5×10^-30 S/cm at room temperature. This poor conductivity necessitates large amounts of conductive additives, reducing the overall energy density advantage that sulfur theoretically offers. Additionally, sulfur undergoes substantial volume expansion (approximately 80%) during lithiation, leading to mechanical stress and electrode degradation over multiple cycles.

Silicon anodes face equally challenging issues, with volume expansion being the most critical. During lithiation, silicon expands by approximately 300-400%, causing particle pulverization, electrode delamination, and continuous solid-electrolyte interphase (SEI) formation. This expansion-contraction cycle consumes electrolyte, increases internal resistance, and ultimately leads to rapid capacity decay.

The unstable SEI layer on silicon surfaces represents another major hurdle. Unlike graphite anodes that form a stable passivation layer, silicon's dramatic volume changes continuously expose fresh surfaces to the electrolyte, resulting in perpetual SEI growth. This parasitic process consumes lithium ions and electrolyte components, reducing coulombic efficiency and battery lifespan.

Both materials also face manufacturing challenges that impede industrial scale-up. Sulfur cathodes require specialized synthesis techniques to achieve intimate contact with conductive hosts, while silicon anodes demand novel binder systems and electrode architectures to accommodate volume changes. These requirements often conflict with established manufacturing processes optimized for conventional materials.

Electrolyte compatibility represents a cross-cutting challenge for both materials. Sulfur requires electrolytes that minimize polysulfide solubility while maintaining ionic conductivity, whereas silicon demands formulations that form flexible yet stable SEI layers. Finding electrolyte systems that simultaneously address these divergent requirements while maintaining safety standards remains elusive.

Recent research has demonstrated that these challenges are interconnected and must be addressed holistically rather than in isolation. For instance, advances in nanostructured carbon hosts for sulfur have partially mitigated both the shuttle effect and conductivity issues, while engineered void spaces in silicon structures have shown promise in accommodating volume expansion without catastrophic mechanical failure.

Technical Solutions for Sulfur and Silicon Electrode Implementation

01 Lithium-sulfur battery cathode compositions

Lithium-sulfur batteries utilize sulfur-based cathodes to achieve high energy density. These cathodes typically incorporate sulfur as the active material, often combined with carbon materials to improve conductivity and cycle stability. Various compositions and structures have been developed to address challenges such as polysulfide dissolution and volume expansion during cycling, including sulfur-carbon composites and polymer-sulfur combinations.- Lithium-sulfur battery cathode compositions: Lithium-sulfur batteries utilize sulfur-based cathode materials to achieve high energy density. These cathodes typically incorporate sulfur with conductive additives and binders to improve electrical conductivity and structural stability. Various approaches include sulfur-carbon composites, polymer-sulfur composites, and sulfur infiltrated into porous carbon structures to address challenges such as polysulfide dissolution and volume expansion during cycling.

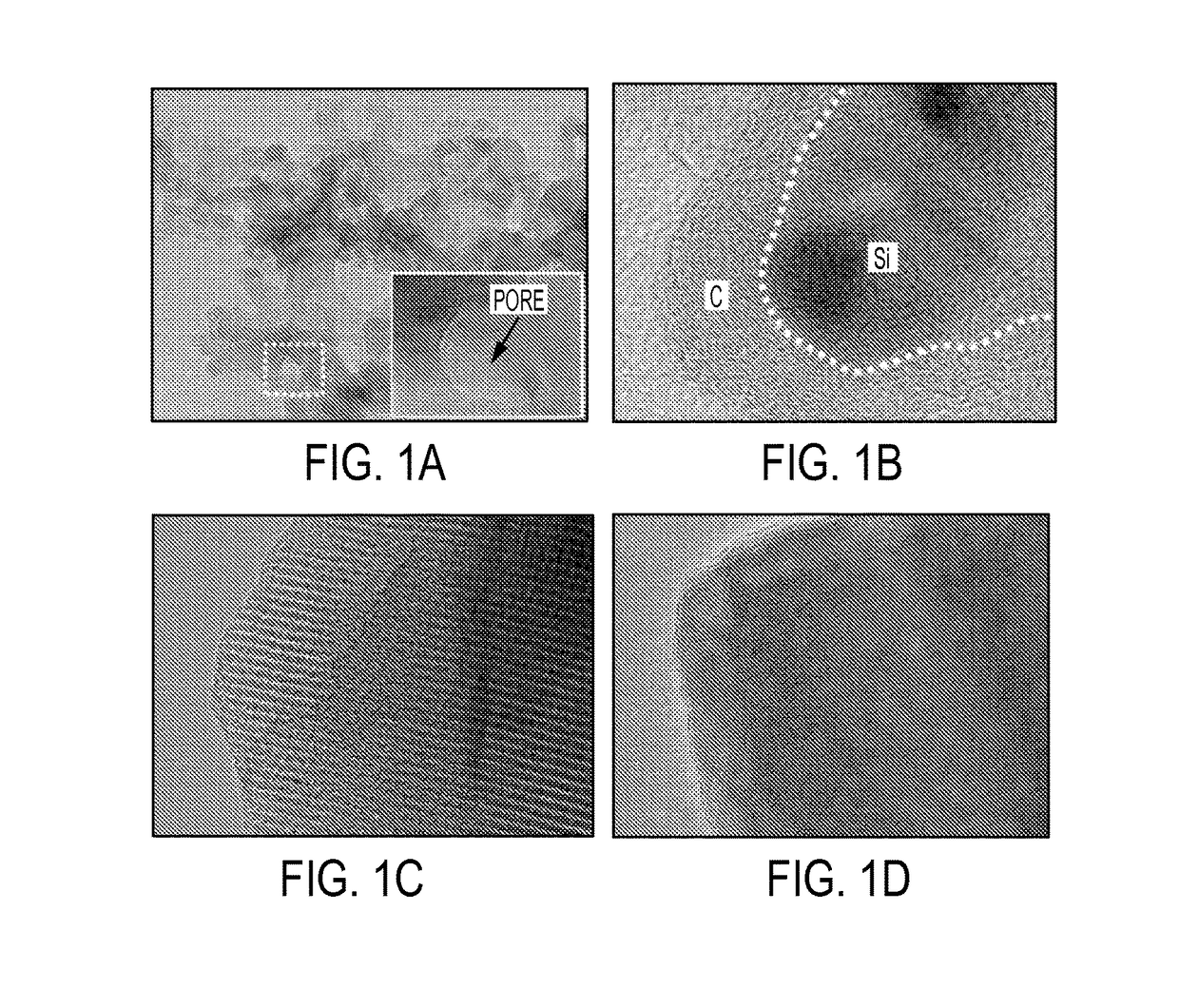

- Silicon anode materials and structures: Silicon anodes offer significantly higher theoretical capacity compared to traditional graphite anodes. However, they face challenges related to volume expansion during lithiation. Advanced silicon anode designs incorporate nanostructured silicon, silicon-carbon composites, and silicon alloys to accommodate volume changes while maintaining electrical contact. Protective coatings and specialized binders are also employed to enhance cycling stability and prevent capacity fade.

- Electrolyte formulations for sulfur cathodes and silicon anodes: Specialized electrolyte formulations are critical for batteries combining sulfur cathodes and silicon anodes. These electrolytes typically contain lithium salts in organic solvents with additives designed to form stable solid-electrolyte interphase layers on silicon and suppress polysulfide shuttle effects at the sulfur cathode. Fluorinated compounds, ionic liquids, and solid-state electrolytes are being explored to enhance compatibility with both electrode materials.

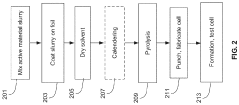

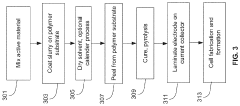

- Manufacturing processes for battery electrodes: Advanced manufacturing techniques are employed to produce high-performance sulfur cathodes and silicon anodes. These include specialized coating methods, particle engineering approaches, and thermal treatments to optimize electrode structure and performance. Techniques such as electrospinning, chemical vapor deposition, and solution-based processing are used to create nanostructured electrodes with controlled morphology and composition, enhancing capacity and cycle life.

- Battery system integration and performance optimization: Integrating sulfur cathodes and silicon anodes into practical battery systems requires careful cell design and optimization. This includes considerations for electrode thickness, electrolyte volume, separator selection, and current collector materials. Advanced battery management systems are employed to control charging protocols and temperature management, extending cycle life and ensuring safety. Various cell formats including pouch, cylindrical, and prismatic designs are being explored for different applications.

02 Silicon anode materials and structures

Silicon anodes offer significantly higher theoretical capacity compared to traditional graphite anodes. However, they face challenges related to volume expansion during lithiation. Advanced silicon anode designs incorporate nanostructured silicon, silicon-carbon composites, and silicon alloys to mitigate these issues. These structures aim to accommodate volume changes while maintaining electrical connectivity and mechanical integrity throughout charge-discharge cycles.Expand Specific Solutions03 Electrolyte formulations for sulfur cathodes and silicon anodes

Specialized electrolyte formulations are crucial for batteries combining sulfur cathodes and silicon anodes. These electrolytes typically contain additives that form stable solid-electrolyte interphase layers on silicon surfaces while also suppressing polysulfide shuttle effects at the sulfur cathode. Functional additives, ionic liquids, and fluorinated solvents are commonly employed to enhance the electrochemical performance and cycling stability of these advanced battery systems.Expand Specific Solutions04 Manufacturing processes for battery electrodes

Manufacturing techniques for sulfur cathodes and silicon anodes involve specialized processes to ensure optimal performance. These include methods for uniform material distribution, controlled porosity, and strong adhesion to current collectors. Advanced techniques such as slurry optimization, coating processes, calendering parameters, and heat treatment protocols are developed to address the unique challenges of these electrode materials while enabling scalable production.Expand Specific Solutions05 Battery system integration and performance optimization

Integration of sulfur cathodes and silicon anodes into complete battery systems requires careful engineering to balance their different electrochemical behaviors. This includes optimizing electrode loading ratios, current collector selection, and cell design parameters. Advanced battery management systems are employed to control charging protocols, temperature management, and safety features, ensuring optimal performance while extending cycle life and preventing degradation mechanisms specific to these electrode materials.Expand Specific Solutions

Leading Companies and Research Institutions in Battery Innovation

The lithium-sulfur and silicon anode battery technology market is currently in a growth phase, with an estimated market size of $2-3 billion and projected to reach $10-15 billion by 2030. The competitive landscape features established players like Toyota Motor Corp. and BYD alongside innovative startups such as Sila Nanotechnologies and Enevate Corp. Academic institutions including Chinese Academy of Sciences and Cornell University are driving fundamental research, while companies like Honeycomb Battery and Solid New Material Technology are commercializing advanced materials. The technology maturity varies significantly - silicon anodes are approaching commercial viability with companies like Enevate demonstrating 5-minute fast charging capabilities, while sulfur cathodes remain predominantly in research phases due to cycle life limitations, with Johnson Matthey and Indian Oil Corp making notable progress toward practical applications.

Sila Nanotechnologies, Inc.

Technical Solution: Sila Nanotechnologies has pioneered silicon-dominant anode materials using a proprietary nano-composite architecture that enables silicon to expand within a carefully engineered matrix without degrading the electrode structure. Their silicon anodes deliver up to 20% higher energy density compared to conventional graphite anodes[3]. The company's core innovation involves silicon nanoparticles embedded within a robust scaffold that maintains electrical connectivity throughout cycling. This architecture creates void spaces that accommodate silicon's volume expansion while preventing electrode pulverization. Sila's technology also incorporates advanced surface coatings that stabilize the solid-electrolyte interphase (SEI) layer, addressing a key degradation mechanism in silicon anodes. Their materials have demonstrated over 1000 cycles with minimal capacity fade in commercial-format cells[4]. While primarily focused on silicon anodes, Sila has also conducted research on compatible cathode materials, including advanced sulfur cathodes, to create full-cell systems that maximize the benefits of their silicon technology.

Strengths: Sila's technology offers drop-in compatibility with existing lithium-ion manufacturing processes, enabling faster commercialization. Their silicon anodes provide significantly higher energy density without requiring radical changes to battery design. Weaknesses: The proprietary nano-composite materials likely involve complex synthesis processes that may impact production costs. The technology may also require specially formulated electrolytes to achieve optimal performance, potentially limiting flexibility in battery system design.

Toyota Motor Corp.

Technical Solution: Toyota has developed a proprietary sulfur-based cathode technology that utilizes a unique carbon-sulfur composite structure to address the "shuttle effect" problem in lithium-sulfur batteries. Their approach involves encapsulating sulfur within porous carbon matrices and applying functional polymer coatings to prevent polysulfide dissolution. Toyota's research has demonstrated batteries with initial capacities exceeding 1200 mAh/g and capacity retention of over 80% after 200 cycles[1]. For silicon anodes, Toyota employs a nano-structured silicon-carbon composite that accommodates volume expansion during lithiation. Their silicon anodes incorporate elastic binder systems and artificial SEI (Solid Electrolyte Interphase) layers to maintain structural integrity during cycling. Toyota has reported silicon-based anodes with capacities approaching 1500 mAh/g while maintaining 70% capacity after 500 cycles[2].

Strengths: Toyota's extensive manufacturing infrastructure allows for potential mass production of these advanced battery technologies. Their integrated approach addressing both cathode and anode materials simultaneously provides system-level optimization. Weaknesses: The complex carbon-sulfur composites may face scalability challenges for mass production, and the silicon anode technology still shows capacity fade over extended cycling that needs further improvement.

Critical Patents and Scientific Breakthroughs in Electrode Materials

Large energy density batteries

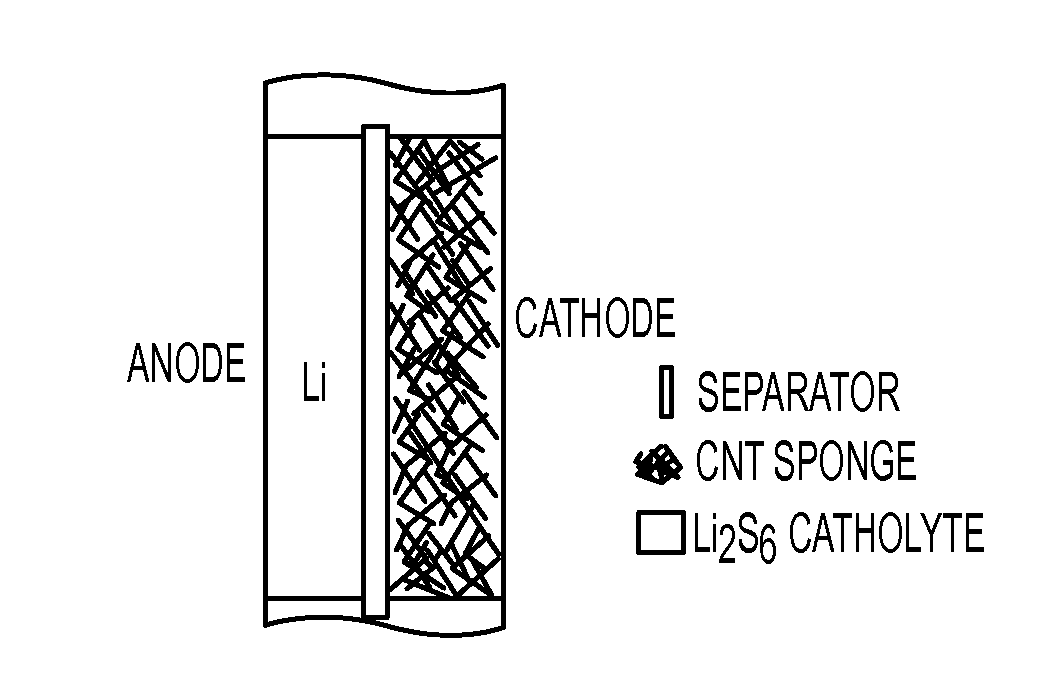

PatentActiveUS20170170511A1

Innovation

- The use of a lithiated silicon anode and a sulfur-based cathode with mesoporous structures, along with a semi-liquid polysulfide catholyte housed in a carbon nanotube sponge, to enhance charge transfer and suppress polysulfide shuttle, thereby improving cycling performance and safety.

Method and system for sulfur and sulfur-containing chemicals as cathode additives for silicon anode-based lithium ion batteries

PatentPendingUS20210175504A1

Innovation

- Incorporating sulfur-containing chemicals as cathode additives, such as elemental sulfur, lithium polysulfides, or sulfur-based polymers, into the cathode active material slurry or as electrolyte additives to enhance structural stability and ionic conductivity, reducing interfacial impedance and improving cycle performance of silicon-based lithium-ion batteries.

Environmental Impact and Sustainability Assessment

The environmental footprint of battery technologies has become a critical consideration in the transition towards sustainable energy systems. When comparing sulfur cathodes and silicon anodes, their environmental impacts differ significantly across the entire lifecycle. Sulfur cathodes offer remarkable environmental advantages as sulfur is an abundant by-product of petroleum refining processes, effectively repurposing industrial waste. This utilization pathway reduces the environmental burden associated with sulfur disposal while simultaneously decreasing the material extraction demands for battery production.

Silicon anodes similarly present environmental benefits through the use of silicon, the second most abundant element in Earth's crust. The widespread availability of silicon reduces dependence on geographically concentrated resources like graphite or cobalt, potentially decreasing transportation-related emissions and geopolitical supply risks. However, the energy-intensive purification processes required for battery-grade silicon currently offset some of these advantages.

Manufacturing processes for both technologies demonstrate varying environmental profiles. Sulfur cathode production generally requires lower processing temperatures compared to conventional cathode materials, resulting in reduced energy consumption and associated greenhouse gas emissions. Conversely, silicon anode manufacturing often involves energy-intensive processes, particularly in the production of nanostructured silicon materials designed to address volume expansion issues.

Water usage patterns also differ between these technologies. Silicon processing typically demands significant water resources for purification and cooling, raising concerns in water-stressed regions. Sulfur cathode production generally exhibits lower water intensity, though specific manufacturing approaches can influence this metric considerably.

End-of-life considerations reveal additional sustainability dimensions. Lithium-sulfur batteries present recycling challenges due to the complex dissolution-precipitation mechanisms during operation, which can alter material structures. However, the inherent value of lithium and the relative simplicity of sulfur separation offer economic incentives for recycling development. Silicon anodes face different recycling hurdles, primarily related to the separation of silicon from other battery components and the management of silicon oxide formation.

Life cycle assessments indicate that both technologies could potentially reduce the carbon footprint of energy storage systems compared to conventional lithium-ion batteries, though this advantage depends heavily on manufacturing efficiency improvements and the implementation of effective recycling systems. The environmental competitiveness of these technologies will ultimately be determined by advances in production methods, material efficiency, and circular economy integration.

Silicon anodes similarly present environmental benefits through the use of silicon, the second most abundant element in Earth's crust. The widespread availability of silicon reduces dependence on geographically concentrated resources like graphite or cobalt, potentially decreasing transportation-related emissions and geopolitical supply risks. However, the energy-intensive purification processes required for battery-grade silicon currently offset some of these advantages.

Manufacturing processes for both technologies demonstrate varying environmental profiles. Sulfur cathode production generally requires lower processing temperatures compared to conventional cathode materials, resulting in reduced energy consumption and associated greenhouse gas emissions. Conversely, silicon anode manufacturing often involves energy-intensive processes, particularly in the production of nanostructured silicon materials designed to address volume expansion issues.

Water usage patterns also differ between these technologies. Silicon processing typically demands significant water resources for purification and cooling, raising concerns in water-stressed regions. Sulfur cathode production generally exhibits lower water intensity, though specific manufacturing approaches can influence this metric considerably.

End-of-life considerations reveal additional sustainability dimensions. Lithium-sulfur batteries present recycling challenges due to the complex dissolution-precipitation mechanisms during operation, which can alter material structures. However, the inherent value of lithium and the relative simplicity of sulfur separation offer economic incentives for recycling development. Silicon anodes face different recycling hurdles, primarily related to the separation of silicon from other battery components and the management of silicon oxide formation.

Life cycle assessments indicate that both technologies could potentially reduce the carbon footprint of energy storage systems compared to conventional lithium-ion batteries, though this advantage depends heavily on manufacturing efficiency improvements and the implementation of effective recycling systems. The environmental competitiveness of these technologies will ultimately be determined by advances in production methods, material efficiency, and circular economy integration.

Manufacturing Scalability and Cost Analysis

The manufacturing scalability of sulfur cathodes and silicon anodes presents significant challenges that directly impact their commercial viability in next-generation battery technologies. For sulfur cathodes, current production methods face limitations in achieving consistent quality at scale. The conventional melt-diffusion process, while effective in laboratory settings, exhibits considerable batch-to-batch variations when scaled to industrial levels. This inconsistency primarily stems from non-uniform sulfur distribution within the carbon host, leading to performance disparities across manufactured cells.

Silicon anode manufacturing encounters different but equally challenging scalability issues. The production of nano-structured silicon materials, essential for mitigating volume expansion problems, requires sophisticated equipment and precise process control. Current industrial capacity for high-quality nano-silicon production remains limited, creating a bottleneck in the supply chain. Additionally, the handling of nano-silicon materials demands specialized environments to prevent oxidation and contamination, further complicating large-scale manufacturing.

From a cost perspective, sulfur cathodes offer compelling advantages, with raw sulfur being abundant and inexpensive (approximately $0.10-0.15/kg). However, the total cathode cost increases substantially when accounting for conductive additives, binders, and the complex processing required to achieve optimal sulfur-carbon composites. Current estimates place sulfur cathode production costs at $15-25/kWh, which, while lower than conventional cathodes, still exceeds theoretical minimums due to manufacturing inefficiencies.

Silicon anodes present a more complex cost structure. While silicon itself is abundant, the processing required to create battery-grade materials is energy-intensive and expensive. Current production costs for silicon anodes range from $25-40/kWh, significantly higher than graphite alternatives ($10-15/kWh). The cost premium primarily stems from specialized nano-structuring processes and the additional materials required to stabilize silicon during cycling.

Economic modeling suggests that achieving cost parity with conventional lithium-ion batteries requires manufacturing breakthroughs in both materials. For sulfur cathodes, developing continuous production methods could reduce costs by 30-40%. For silicon anodes, innovations in precursor materials and simplified nano-structuring approaches could potentially halve current production costs. Recent pilot-scale demonstrations by companies like Sila Nanotechnologies and Amprius indicate progress toward more cost-effective silicon anode manufacturing, though full commercial-scale implementation remains forthcoming.

The environmental footprint of manufacturing processes also warrants consideration in scalability assessments. Sulfur cathode production generally involves fewer toxic materials but requires energy-intensive thermal treatments. Silicon processing typically involves hazardous chemicals and significant water usage, presenting additional scaling challenges related to environmental compliance and sustainability.

Silicon anode manufacturing encounters different but equally challenging scalability issues. The production of nano-structured silicon materials, essential for mitigating volume expansion problems, requires sophisticated equipment and precise process control. Current industrial capacity for high-quality nano-silicon production remains limited, creating a bottleneck in the supply chain. Additionally, the handling of nano-silicon materials demands specialized environments to prevent oxidation and contamination, further complicating large-scale manufacturing.

From a cost perspective, sulfur cathodes offer compelling advantages, with raw sulfur being abundant and inexpensive (approximately $0.10-0.15/kg). However, the total cathode cost increases substantially when accounting for conductive additives, binders, and the complex processing required to achieve optimal sulfur-carbon composites. Current estimates place sulfur cathode production costs at $15-25/kWh, which, while lower than conventional cathodes, still exceeds theoretical minimums due to manufacturing inefficiencies.

Silicon anodes present a more complex cost structure. While silicon itself is abundant, the processing required to create battery-grade materials is energy-intensive and expensive. Current production costs for silicon anodes range from $25-40/kWh, significantly higher than graphite alternatives ($10-15/kWh). The cost premium primarily stems from specialized nano-structuring processes and the additional materials required to stabilize silicon during cycling.

Economic modeling suggests that achieving cost parity with conventional lithium-ion batteries requires manufacturing breakthroughs in both materials. For sulfur cathodes, developing continuous production methods could reduce costs by 30-40%. For silicon anodes, innovations in precursor materials and simplified nano-structuring approaches could potentially halve current production costs. Recent pilot-scale demonstrations by companies like Sila Nanotechnologies and Amprius indicate progress toward more cost-effective silicon anode manufacturing, though full commercial-scale implementation remains forthcoming.

The environmental footprint of manufacturing processes also warrants consideration in scalability assessments. Sulfur cathode production generally involves fewer toxic materials but requires energy-intensive thermal treatments. Silicon processing typically involves hazardous chemicals and significant water usage, presenting additional scaling challenges related to environmental compliance and sustainability.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!