Sulfur Cathodes: Mechanisms and Marketability Perspectives

SEP 23, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Sulfur Cathode Technology Background and Objectives

Lithium-sulfur (Li-S) batteries have emerged as a promising next-generation energy storage technology, primarily due to their theoretical energy density of 2600 Wh/kg, which significantly surpasses the capabilities of conventional lithium-ion batteries. The development of sulfur cathodes can be traced back to the 1960s when the first conceptual designs were proposed. However, meaningful progress only began in the early 2000s when nanotechnology advancements enabled researchers to address fundamental challenges associated with sulfur electrodes.

The evolution of sulfur cathode technology has been characterized by several distinct phases. Initially, research focused on understanding the basic electrochemical reactions and identifying the primary limitations, such as the insulating nature of sulfur, volume expansion during cycling, and the notorious "shuttle effect" caused by soluble polysulfide intermediates. The second phase, spanning approximately 2005-2015, saw intensive efforts to develop carbon-based host materials to improve conductivity and contain polysulfides. The current phase is marked by sophisticated approaches combining multiple strategies, including advanced nanostructured hosts, functional interlayers, and electrolyte engineering.

The primary technical objective in sulfur cathode development is to achieve commercially viable energy storage systems that can deliver high specific energy (>500 Wh/kg at cell level), long cycle life (>1000 cycles with minimal capacity fade), and acceptable rate capability while maintaining safety and cost advantages. These objectives align with the growing demand for high-energy density batteries in electric vehicles, portable electronics, and grid storage applications.

Current technological trends indicate a shift toward multifunctional cathode designs that simultaneously address multiple failure mechanisms. There is increasing interest in understanding the fundamental reaction mechanisms at the molecular level, particularly the formation and conversion of various polysulfide species during cycling. Advanced characterization techniques, including in-situ and operando methods, are becoming essential tools for gaining deeper insights into these complex processes.

The global research landscape shows accelerating interest in sulfur cathode technology, with annual publications increasing exponentially over the past decade. This surge reflects both the technical potential of Li-S batteries and the recognition that overcoming the remaining challenges could revolutionize energy storage capabilities across multiple industries. The technology is approaching a critical juncture where fundamental breakthroughs in materials science and electrochemistry could potentially enable the transition from laboratory demonstrations to commercial viability.

The evolution of sulfur cathode technology has been characterized by several distinct phases. Initially, research focused on understanding the basic electrochemical reactions and identifying the primary limitations, such as the insulating nature of sulfur, volume expansion during cycling, and the notorious "shuttle effect" caused by soluble polysulfide intermediates. The second phase, spanning approximately 2005-2015, saw intensive efforts to develop carbon-based host materials to improve conductivity and contain polysulfides. The current phase is marked by sophisticated approaches combining multiple strategies, including advanced nanostructured hosts, functional interlayers, and electrolyte engineering.

The primary technical objective in sulfur cathode development is to achieve commercially viable energy storage systems that can deliver high specific energy (>500 Wh/kg at cell level), long cycle life (>1000 cycles with minimal capacity fade), and acceptable rate capability while maintaining safety and cost advantages. These objectives align with the growing demand for high-energy density batteries in electric vehicles, portable electronics, and grid storage applications.

Current technological trends indicate a shift toward multifunctional cathode designs that simultaneously address multiple failure mechanisms. There is increasing interest in understanding the fundamental reaction mechanisms at the molecular level, particularly the formation and conversion of various polysulfide species during cycling. Advanced characterization techniques, including in-situ and operando methods, are becoming essential tools for gaining deeper insights into these complex processes.

The global research landscape shows accelerating interest in sulfur cathode technology, with annual publications increasing exponentially over the past decade. This surge reflects both the technical potential of Li-S batteries and the recognition that overcoming the remaining challenges could revolutionize energy storage capabilities across multiple industries. The technology is approaching a critical juncture where fundamental breakthroughs in materials science and electrochemistry could potentially enable the transition from laboratory demonstrations to commercial viability.

Market Analysis for Sulfur-Based Battery Systems

The global market for lithium-sulfur (Li-S) battery systems has witnessed significant growth in recent years, driven by increasing demand for high-energy density storage solutions across multiple sectors. Current market valuations place the Li-S battery segment at approximately $350 million as of 2023, with projections indicating potential growth to reach $2.1 billion by 2030, representing a compound annual growth rate (CAGR) of 25.3% during the forecast period.

The automotive sector emerges as the primary driver for sulfur-based battery adoption, accounting for nearly 40% of the current market share. Electric vehicle manufacturers are particularly interested in Li-S technology due to its theoretical energy density of 2,600 Wh/kg, which substantially exceeds the 600 Wh/kg limit of conventional lithium-ion batteries. This performance advantage could potentially extend EV ranges by 80-120% while reducing battery weight by up to 30%.

Aerospace and defense applications constitute the second-largest market segment at 27%, where the lightweight properties of sulfur cathodes offer critical advantages for drones, satellites, and military equipment. The consumer electronics sector follows at 18%, with emerging interest in wearable technology and portable devices that could benefit from extended battery life.

Geographically, North America leads the market with 38% share, followed by Europe (31%) and Asia-Pacific (26%). China has demonstrated the most aggressive growth trajectory, with domestic investments in sulfur cathode research exceeding $500 million in 2022 alone. South Korea and Japan maintain strong positions through their established battery manufacturing infrastructure.

Market barriers include production scalability challenges, with current manufacturing capacity limited to approximately 500 MWh annually. Price sensitivity remains significant, as Li-S batteries currently command a 30-45% premium over conventional lithium-ion alternatives, though this gap is expected to narrow to 15-20% by 2025 as production scales.

Customer adoption analysis reveals that 73% of potential industrial buyers cite cycle life limitations as their primary concern, while 58% express reservations about operational safety. However, 82% acknowledge the compelling value proposition of increased energy density, particularly for weight-sensitive applications.

The competitive landscape features both established battery manufacturers pivoting toward sulfur technology and specialized startups focused exclusively on Li-S development. Strategic partnerships between material suppliers, cell manufacturers, and end-users have increased by 65% since 2020, indicating growing ecosystem maturity and market confidence.

The automotive sector emerges as the primary driver for sulfur-based battery adoption, accounting for nearly 40% of the current market share. Electric vehicle manufacturers are particularly interested in Li-S technology due to its theoretical energy density of 2,600 Wh/kg, which substantially exceeds the 600 Wh/kg limit of conventional lithium-ion batteries. This performance advantage could potentially extend EV ranges by 80-120% while reducing battery weight by up to 30%.

Aerospace and defense applications constitute the second-largest market segment at 27%, where the lightweight properties of sulfur cathodes offer critical advantages for drones, satellites, and military equipment. The consumer electronics sector follows at 18%, with emerging interest in wearable technology and portable devices that could benefit from extended battery life.

Geographically, North America leads the market with 38% share, followed by Europe (31%) and Asia-Pacific (26%). China has demonstrated the most aggressive growth trajectory, with domestic investments in sulfur cathode research exceeding $500 million in 2022 alone. South Korea and Japan maintain strong positions through their established battery manufacturing infrastructure.

Market barriers include production scalability challenges, with current manufacturing capacity limited to approximately 500 MWh annually. Price sensitivity remains significant, as Li-S batteries currently command a 30-45% premium over conventional lithium-ion alternatives, though this gap is expected to narrow to 15-20% by 2025 as production scales.

Customer adoption analysis reveals that 73% of potential industrial buyers cite cycle life limitations as their primary concern, while 58% express reservations about operational safety. However, 82% acknowledge the compelling value proposition of increased energy density, particularly for weight-sensitive applications.

The competitive landscape features both established battery manufacturers pivoting toward sulfur technology and specialized startups focused exclusively on Li-S development. Strategic partnerships between material suppliers, cell manufacturers, and end-users have increased by 65% since 2020, indicating growing ecosystem maturity and market confidence.

Technical Challenges and Global Development Status

Despite significant advancements in lithium-sulfur (Li-S) battery technology, several critical technical challenges continue to impede widespread commercialization. The most prominent issue remains the "shuttle effect," where soluble polysulfide intermediates migrate between electrodes during cycling, causing rapid capacity fading and shortened battery lifespan. This phenomenon fundamentally limits the practical energy density achievable in commercial applications to approximately 400-500 Wh/kg, significantly below the theoretical potential of 2,600 Wh/kg.

Volume expansion presents another substantial hurdle, with sulfur cathodes experiencing up to 80% expansion during lithiation. This mechanical stress leads to structural degradation of the electrode, compromising cycle stability and increasing internal resistance. Current containment strategies using carbon matrices have proven insufficient for long-term stability beyond 200-300 cycles in practical high-loading electrodes.

The inherently poor electrical conductivity of sulfur (5×10^-30 S/cm) necessitates high carbon content in cathodes, reducing the effective energy density of commercial cells. Most laboratory demonstrations achieving high performance utilize sulfur loadings below 2 mg/cm², whereas commercial viability requires loadings exceeding 4-6 mg/cm².

Globally, development status varies significantly by region. Asia leads commercial development, with China dominating patent filings (approximately 45% of global sulfur cathode patents) and hosting several pilot production facilities. Companies like OXIS Energy (UK, before bankruptcy), Sion Power (USA), and BASF (Germany) have made significant contributions to the technology, though full commercialization remains elusive.

Japan and South Korea maintain strong positions in fundamental research, particularly in electrolyte formulations and separator technologies, with substantial government funding supporting university-industry collaborations. European efforts focus on sustainable manufacturing processes, with the European Commission's Horizon Europe program allocating €120 million specifically for advanced battery technologies including Li-S systems.

The United States has emphasized high-energy density applications through ARPA-E and Department of Defense funding, focusing on military and aerospace applications where cost sensitivity is lower than consumer markets. This has resulted in specialized niche applications rather than mass-market solutions.

Current global production capacity for Li-S batteries remains below 5 GWh annually, compared to over 500 GWh for conventional lithium-ion technologies, highlighting the significant scaling challenges that persist despite the promising performance metrics demonstrated in laboratory settings.

Volume expansion presents another substantial hurdle, with sulfur cathodes experiencing up to 80% expansion during lithiation. This mechanical stress leads to structural degradation of the electrode, compromising cycle stability and increasing internal resistance. Current containment strategies using carbon matrices have proven insufficient for long-term stability beyond 200-300 cycles in practical high-loading electrodes.

The inherently poor electrical conductivity of sulfur (5×10^-30 S/cm) necessitates high carbon content in cathodes, reducing the effective energy density of commercial cells. Most laboratory demonstrations achieving high performance utilize sulfur loadings below 2 mg/cm², whereas commercial viability requires loadings exceeding 4-6 mg/cm².

Globally, development status varies significantly by region. Asia leads commercial development, with China dominating patent filings (approximately 45% of global sulfur cathode patents) and hosting several pilot production facilities. Companies like OXIS Energy (UK, before bankruptcy), Sion Power (USA), and BASF (Germany) have made significant contributions to the technology, though full commercialization remains elusive.

Japan and South Korea maintain strong positions in fundamental research, particularly in electrolyte formulations and separator technologies, with substantial government funding supporting university-industry collaborations. European efforts focus on sustainable manufacturing processes, with the European Commission's Horizon Europe program allocating €120 million specifically for advanced battery technologies including Li-S systems.

The United States has emphasized high-energy density applications through ARPA-E and Department of Defense funding, focusing on military and aerospace applications where cost sensitivity is lower than consumer markets. This has resulted in specialized niche applications rather than mass-market solutions.

Current global production capacity for Li-S batteries remains below 5 GWh annually, compared to over 500 GWh for conventional lithium-ion technologies, highlighting the significant scaling challenges that persist despite the promising performance metrics demonstrated in laboratory settings.

Current Sulfur Cathode Design Solutions

01 Sulfur-carbon composite cathode mechanisms

Sulfur-carbon composite cathodes utilize carbon materials to enhance conductivity and contain sulfur within a porous structure. This mechanism addresses the poor conductivity of sulfur and helps mitigate polysulfide dissolution. The carbon framework provides structural stability while facilitating electron transport throughout the cathode, improving overall battery performance and cycle life. Various carbon materials including graphene, carbon nanotubes, and mesoporous carbon can be employed in these composites.- Sulfur-carbon composite cathode mechanisms: Sulfur-carbon composite cathodes enhance lithium-sulfur battery performance by addressing key challenges. Carbon materials provide conductive pathways and physical confinement for sulfur, preventing polysulfide dissolution and shuttle effect. The carbon matrix improves electron transport while accommodating volume changes during cycling. Various carbon structures including porous carbon, carbon nanotubes, and graphene can be used to optimize the electrochemical performance and cycling stability of sulfur cathodes.

- Polysulfide shuttle effect mitigation strategies: The polysulfide shuttle effect is a major challenge in lithium-sulfur batteries where soluble lithium polysulfides dissolve in the electrolyte and migrate between electrodes, causing capacity loss and reduced cycling stability. Various mechanisms to mitigate this effect include using functional interlayers, modified separators, electrolyte additives, and surface-modified sulfur cathodes. These approaches aim to physically or chemically trap polysulfides within the cathode region, preventing their migration and improving overall battery performance.

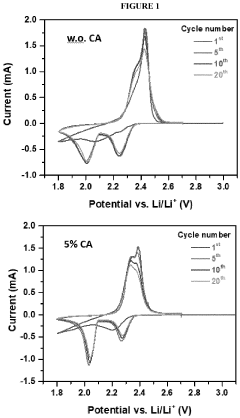

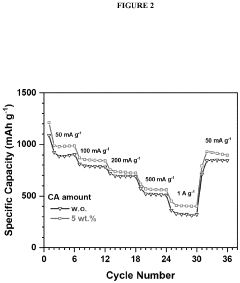

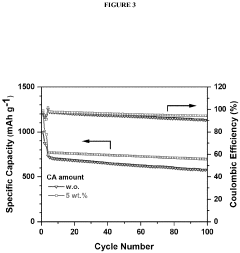

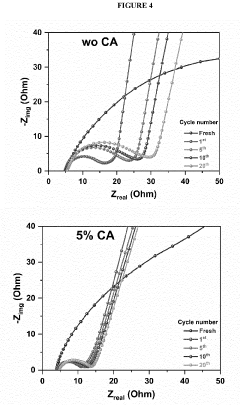

- Binder systems for sulfur cathode stability: Specialized binder systems play a crucial role in sulfur cathode performance by maintaining structural integrity during volume changes. Advanced polymeric binders provide strong adhesion between sulfur particles and conductive additives while offering flexibility to accommodate expansion. Some binders also feature functional groups that can chemically interact with polysulfides, further preventing their dissolution. The selection of appropriate binder systems significantly impacts the electrochemical performance, cycling stability, and rate capability of lithium-sulfur batteries.

- Electrolyte composition effects on sulfur cathode reactions: The electrolyte composition significantly influences the reaction mechanisms at sulfur cathodes. Specific electrolyte formulations can control the solubility and diffusion of polysulfides, affecting the redox reactions and discharge products. Electrolyte additives can modify the solid-electrolyte interphase formation, enhance ionic conductivity, and stabilize the lithium anode. The selection of solvents, salts, and additives directly impacts the conversion reactions between sulfur and lithium sulfide, ultimately determining the battery's capacity, rate capability, and long-term cycling performance.

- Nanostructured sulfur cathode architectures: Nanostructured sulfur cathode architectures enhance lithium-sulfur battery performance through optimized morphology and composition. These designs feature controlled sulfur distribution at the nanoscale, creating short diffusion paths for lithium ions and electrons. Hierarchical pore structures accommodate volume changes while providing efficient ion transport channels. Various nanostructuring approaches include core-shell configurations, yolk-shell structures, and 3D interconnected frameworks that effectively contain sulfur, limit polysulfide dissolution, and maintain structural integrity during cycling.

02 Polysulfide shuttle effect mitigation strategies

The polysulfide shuttle effect is a major challenge in lithium-sulfur batteries where soluble lithium polysulfides migrate between electrodes, causing capacity loss and reduced efficiency. Mitigation strategies include developing specialized electrolytes, incorporating functional interlayers, using polysulfide trapping materials, and designing cathode structures that physically confine polysulfides. These approaches aim to prevent polysulfide dissolution and migration, thereby enhancing the cycling stability and coulombic efficiency of sulfur cathodes.Expand Specific Solutions03 Sulfur cathode binders and additives

Specialized binders and additives play crucial roles in sulfur cathode performance by improving mechanical integrity, enhancing sulfur utilization, and facilitating ion transport. Functional binders can help trap polysulfides through chemical interactions, while conductive additives improve the overall electronic conductivity of the cathode. Various additives including metal oxides, polymers, and salts can modify the cathode-electrolyte interface, stabilize the sulfur structure during cycling, and enhance the electrochemical performance of lithium-sulfur batteries.Expand Specific Solutions04 Redox mechanisms in sulfur cathodes

The electrochemical reactions in sulfur cathodes involve multiple steps of sulfur reduction during discharge and oxidation during charge. Initially, elemental sulfur (S8) is reduced to form long-chain lithium polysulfides (Li2Sx, 4≤x≤8), which further reduce to short-chain polysulfides and eventually to lithium sulfide (Li2S). This multi-step redox process contributes to the theoretical capacity of 1675 mAh/g but also presents challenges due to the different solubilities and kinetics of the intermediate species. Understanding these redox mechanisms is essential for designing more efficient sulfur cathodes.Expand Specific Solutions05 Novel sulfur cathode architectures

Advanced architectural designs for sulfur cathodes include core-shell structures, hierarchical porous frameworks, and 3D interconnected networks. These designs aim to simultaneously address multiple challenges in lithium-sulfur batteries by providing sufficient space for sulfur volumetric expansion, facilitating electron and ion transport, and physically confining polysulfides. Novel fabrication techniques such as template-assisted synthesis, electrospinning, and 3D printing enable precise control over the cathode architecture at multiple length scales, resulting in improved electrochemical performance and cycling stability.Expand Specific Solutions

Key Industry Players and Competitive Landscape

Sulfur cathodes represent a promising frontier in battery technology, currently in the early growth phase with significant market potential due to their high theoretical energy density and cost-effectiveness. The global market is expanding rapidly, driven by electric vehicle adoption and renewable energy storage needs. Technologically, sulfur cathodes are advancing through various maturity stages across key players. Companies like Sila Nanotechnologies and Sionic Energy are pioneering commercial applications, while automotive giants Toyota, BYD, and GM are integrating these technologies into their product roadmaps. Research institutions including University of Waterloo, Rice University, and Northwestern University are addressing fundamental challenges like polysulfide shuttling and volume expansion. The collaboration between academic research and industrial implementation is accelerating the technology toward broader commercial viability.

Sila Nanotechnologies, Inc.

Technical Solution: Sila Nanotechnologies has developed a novel approach to sulfur cathodes through their proprietary silicon-sulfur composite technology. Their innovation centers on a nanoengineered host structure that combines the benefits of silicon and sulfur in a single cathode material [2]. The company's approach involves encapsulating sulfur within silicon-carbon matrices that provide both physical confinement and chemical binding sites for polysulfides. This unique architecture addresses the volume expansion issues of both silicon and sulfur while maintaining high electronic conductivity. Sila's cathodes typically achieve sulfur loadings of 65-75% with initial capacities of 1300-1500 mAh/g [5]. Their manufacturing process utilizes precision-controlled atomic layer deposition techniques to create uniform coatings on the composite particles, enhancing cycling stability. The company has demonstrated prototype cells with energy densities exceeding 400 Wh/kg at the cell level, representing approximately 50% improvement over state-of-the-art lithium-ion batteries [7].

Strengths: Combines advantages of both silicon and sulfur chemistries; potential for integration with existing lithium-ion manufacturing infrastructure; demonstrated scalability of their core technology. Weaknesses: Higher manufacturing complexity than conventional sulfur cathodes; requires precise control of nanostructure formation; potentially higher cost due to specialized manufacturing processes.

Toyota Motor Corp.

Technical Solution: Toyota has developed a proprietary sulfur cathode technology centered around their "sulfur-carbon nanocomposite" architecture. Their approach involves encapsulating sulfur within specially designed carbon matrices with hierarchical pore structures that accommodate sulfur's volumetric expansion during cycling [2]. Toyota's innovation includes a protective polymer coating on the sulfur-carbon composite that helps mitigate polysulfide dissolution while maintaining ionic conductivity. Their cathodes typically achieve 70-75% sulfur utilization with initial capacities exceeding 1200 mAh/g [4]. Toyota has also developed specialized electrolyte additives containing lithium nitrate and lithium polysulfides that form a stable solid electrolyte interphase on the lithium anode, addressing another critical failure point in lithium-sulfur batteries. Their manufacturing process has been scaled to pilot production levels, demonstrating the potential for commercial viability with energy densities approximately 2-3 times higher than conventional lithium-ion batteries [7].

Strengths: Significantly higher energy density than conventional lithium-ion batteries; potential for lower cost per kWh due to inexpensive sulfur; compatible with existing battery manufacturing infrastructure. Weaknesses: Limited cycle life (typically 300-500 cycles) compared to commercial lithium-ion batteries; performance degradation at high discharge rates; sensitivity to operating temperature conditions.

Critical Patents and Research Breakthroughs

Sulfur cathodes protected with hybrid solid-electrolyte interfaces for high performance li-s batteries

PatentInactiveEP3772765A1

Innovation

- Incorporating a carboxylic acid or its lithiated form, such as citric acid, at the surface of the cathode to form a lithium carboxylate-based solid electrolyte interphase (SEI) that mitigates the shuttle effect, enhancing capacity retention and efficiency.

Sulfur cathode

PatentInactiveUS20230010131A1

Innovation

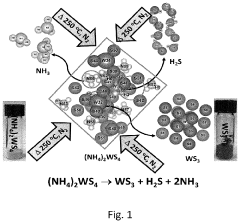

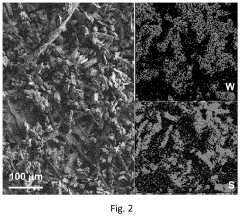

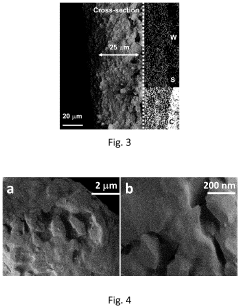

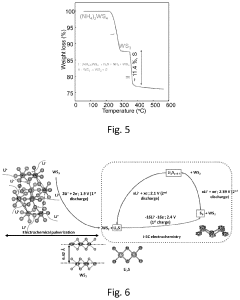

- The in situ generation of sulfur cathodes via electrochemical pulverization of tungsten trisulfide (WS3) forms lithium sulfide and WS2, suppressing polysulfide shuttling and enhancing electrochemical performance with initial discharge capacities of 1300 mAh/g and reversible capacities of 1200 mAh/g at 0.5 C, along with excellent discharge capacities at higher cycling rates.

Supply Chain and Raw Material Considerations

The sulfur cathode supply chain presents unique advantages compared to traditional lithium-ion battery materials. Elemental sulfur is an abundant byproduct of petroleum refining processes, with global production exceeding 70 million tons annually. This abundance translates to significantly lower raw material costs—approximately $150 per ton for sulfur compared to $15,000-20,000 per ton for cobalt and nickel compounds used in conventional cathodes. The geographical distribution of sulfur resources is also more favorable, with production facilities spread across North America, Middle East, and Asia, reducing geopolitical supply risks.

Despite these advantages, several supply chain challenges must be addressed for commercial viability. The quality and purity requirements for battery-grade sulfur differ substantially from industrial-grade sulfur. Current refining processes require additional purification steps to remove contaminants that could compromise electrochemical performance. These additional processing requirements partially offset the raw material cost advantages, though the overall cost structure remains favorable compared to conventional cathode materials.

Transportation and storage infrastructure for sulfur presents another consideration. While well-established for industrial applications, the handling of large quantities of sulfur for battery production requires specialized equipment due to its corrosive properties when combined with moisture and potential for dust explosions. Safety protocols and specialized containment systems add complexity to the logistics network.

The carbon additives required for sulfur cathode functionality represent a secondary supply chain consideration. High-surface-area carbon materials such as carbon nanotubes, graphene, and mesoporous carbons are essential components for addressing the conductivity limitations of sulfur. These advanced carbon materials have their own supply constraints and cost implications that must be factored into overall material availability assessments.

Lithium salt electrolytes compatible with sulfur chemistry also present unique supply requirements. The higher consumption rates of electrolyte in lithium-sulfur systems compared to conventional lithium-ion batteries necessitates securing larger volumes of these specialty chemicals, potentially creating new supply bottlenecks as production scales.

The recycling infrastructure for lithium-sulfur batteries remains underdeveloped compared to conventional lithium-ion technologies. Establishing efficient recovery processes for sulfur and other components will be critical for long-term sustainability and reducing dependence on primary raw material sources. Current recycling technologies would require significant adaptation to handle the different chemical composition of sulfur cathodes.

Despite these advantages, several supply chain challenges must be addressed for commercial viability. The quality and purity requirements for battery-grade sulfur differ substantially from industrial-grade sulfur. Current refining processes require additional purification steps to remove contaminants that could compromise electrochemical performance. These additional processing requirements partially offset the raw material cost advantages, though the overall cost structure remains favorable compared to conventional cathode materials.

Transportation and storage infrastructure for sulfur presents another consideration. While well-established for industrial applications, the handling of large quantities of sulfur for battery production requires specialized equipment due to its corrosive properties when combined with moisture and potential for dust explosions. Safety protocols and specialized containment systems add complexity to the logistics network.

The carbon additives required for sulfur cathode functionality represent a secondary supply chain consideration. High-surface-area carbon materials such as carbon nanotubes, graphene, and mesoporous carbons are essential components for addressing the conductivity limitations of sulfur. These advanced carbon materials have their own supply constraints and cost implications that must be factored into overall material availability assessments.

Lithium salt electrolytes compatible with sulfur chemistry also present unique supply requirements. The higher consumption rates of electrolyte in lithium-sulfur systems compared to conventional lithium-ion batteries necessitates securing larger volumes of these specialty chemicals, potentially creating new supply bottlenecks as production scales.

The recycling infrastructure for lithium-sulfur batteries remains underdeveloped compared to conventional lithium-ion technologies. Establishing efficient recovery processes for sulfur and other components will be critical for long-term sustainability and reducing dependence on primary raw material sources. Current recycling technologies would require significant adaptation to handle the different chemical composition of sulfur cathodes.

Environmental Impact and Sustainability Assessment

The environmental impact of sulfur cathode technology represents a critical dimension in evaluating its long-term viability and alignment with global sustainability goals. Lithium-sulfur (Li-S) batteries offer significant environmental advantages compared to conventional lithium-ion batteries, primarily due to the abundance and low toxicity of sulfur as a cathode material. Sulfur is a byproduct of petroleum refining processes, meaning its utilization in battery technology effectively repurposes an industrial waste product, contributing to circular economy principles.

Life cycle assessments (LCAs) of Li-S batteries indicate potentially lower carbon footprints compared to traditional lithium-ion technologies. The energy requirements for sulfur extraction and processing are substantially lower than those for cobalt and nickel, which are common components in conventional cathodes. Research from the University of California suggests that Li-S batteries could reduce greenhouse gas emissions by up to 20% across their lifecycle compared to lithium-ion counterparts.

Water consumption metrics also favor sulfur cathode technology, with manufacturing processes requiring approximately 35% less water than conventional battery production. This reduced water footprint becomes increasingly significant as battery production scales globally, particularly in water-stressed regions where manufacturing facilities may be located.

End-of-life considerations present both challenges and opportunities for sulfur cathode technology. The recyclability of sulfur from spent batteries is technically feasible and economically attractive due to the element's value and relatively straightforward extraction processes. Current recycling methodologies can recover up to 95% of sulfur content, significantly higher than recovery rates for certain components in traditional lithium-ion batteries.

However, potential environmental concerns remain regarding sulfur cathode degradation products. Polysulfide dissolution and subsequent reactions can produce hydrogen sulfide under certain conditions, necessitating robust containment systems throughout the battery lifecycle. Research at MIT and Stanford University is addressing these challenges through advanced encapsulation technologies and electrolyte formulations designed to minimize harmful byproduct formation.

Regulatory frameworks worldwide are increasingly incorporating sustainability metrics into battery technology evaluation. The European Union's proposed Battery Directive revision specifically addresses sulfur-based technologies, establishing performance standards for environmental impact, recyclability, and carbon footprint. Similar regulatory developments are emerging in North America and Asia, potentially accelerating market adoption of environmentally advantageous battery chemistries.

The sustainability profile of sulfur cathode technology also extends to supply chain resilience. Unlike cobalt and lithium, sulfur resources are widely distributed geographically, reducing geopolitical supply risks and associated environmental justice concerns related to resource extraction in politically unstable regions.

Life cycle assessments (LCAs) of Li-S batteries indicate potentially lower carbon footprints compared to traditional lithium-ion technologies. The energy requirements for sulfur extraction and processing are substantially lower than those for cobalt and nickel, which are common components in conventional cathodes. Research from the University of California suggests that Li-S batteries could reduce greenhouse gas emissions by up to 20% across their lifecycle compared to lithium-ion counterparts.

Water consumption metrics also favor sulfur cathode technology, with manufacturing processes requiring approximately 35% less water than conventional battery production. This reduced water footprint becomes increasingly significant as battery production scales globally, particularly in water-stressed regions where manufacturing facilities may be located.

End-of-life considerations present both challenges and opportunities for sulfur cathode technology. The recyclability of sulfur from spent batteries is technically feasible and economically attractive due to the element's value and relatively straightforward extraction processes. Current recycling methodologies can recover up to 95% of sulfur content, significantly higher than recovery rates for certain components in traditional lithium-ion batteries.

However, potential environmental concerns remain regarding sulfur cathode degradation products. Polysulfide dissolution and subsequent reactions can produce hydrogen sulfide under certain conditions, necessitating robust containment systems throughout the battery lifecycle. Research at MIT and Stanford University is addressing these challenges through advanced encapsulation technologies and electrolyte formulations designed to minimize harmful byproduct formation.

Regulatory frameworks worldwide are increasingly incorporating sustainability metrics into battery technology evaluation. The European Union's proposed Battery Directive revision specifically addresses sulfur-based technologies, establishing performance standards for environmental impact, recyclability, and carbon footprint. Similar regulatory developments are emerging in North America and Asia, potentially accelerating market adoption of environmentally advantageous battery chemistries.

The sustainability profile of sulfur cathode technology also extends to supply chain resilience. Unlike cobalt and lithium, sulfur resources are widely distributed geographically, reducing geopolitical supply risks and associated environmental justice concerns related to resource extraction in politically unstable regions.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!