Comparing GDI and Diesel Engine Emissions: Insights

AUG 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

GDI and Diesel Emission Technology Background

Internal combustion engines have undergone significant evolution since their inception, with Gasoline Direct Injection (GDI) and Diesel engines representing two major technological pathways in modern automotive propulsion systems. The development of these technologies has been driven by increasingly stringent emission regulations, fuel efficiency demands, and performance expectations from consumers and regulatory bodies worldwide.

GDI technology emerged in the 1990s as an advancement over traditional port fuel injection systems, offering improved fuel economy and power output through precise fuel delivery directly into the combustion chamber. This technology allows for stratified charge combustion, enabling leaner air-fuel mixtures and reduced throttling losses. The commercial adoption of GDI systems accelerated in the early 2000s, with manufacturers like Mitsubishi, Volkswagen, and Toyota implementing various iterations of direct injection technology in their gasoline engines.

Diesel engines, conversely, have a longer history in automotive applications, with their compression ignition principle offering inherently higher thermal efficiency compared to spark ignition engines. Modern diesel technology has evolved from rudimentary mechanical injection systems to sophisticated common-rail direct injection architectures capable of multiple injection events per combustion cycle at extremely high pressures exceeding 2,000 bar.

The emission profiles of these two engine types differ significantly due to their fundamental combustion characteristics. Diesel engines traditionally produce higher levels of nitrogen oxides (NOx) and particulate matter (PM), while GDI engines generate comparatively higher carbon monoxide (CO) and hydrocarbon (HC) emissions. However, GDI engines have increasingly faced scrutiny for their particulate emissions, particularly ultrafine particles that pose significant health concerns.

The regulatory landscape has shaped the technological trajectory of both engine types. The implementation of Euro standards in Europe, Tier regulations in the United States, and equivalent frameworks in other markets has progressively tightened emission limits, necessitating advanced aftertreatment systems for both engine types. For diesel engines, this typically includes diesel oxidation catalysts (DOC), diesel particulate filters (DPF), and selective catalytic reduction (SCR) systems. GDI engines increasingly employ gasoline particulate filters (GPF) alongside traditional three-way catalysts.

Recent technological developments have focused on hybridization strategies, with both GDI and diesel engines being integrated into various hybrid architectures to further reduce emissions and improve efficiency. Additionally, low-temperature combustion modes such as Homogeneous Charge Compression Ignition (HCCI) and Reactivity Controlled Compression Ignition (RCCI) represent potential pathways for future development, potentially blurring the traditional boundaries between gasoline and diesel combustion concepts.

GDI technology emerged in the 1990s as an advancement over traditional port fuel injection systems, offering improved fuel economy and power output through precise fuel delivery directly into the combustion chamber. This technology allows for stratified charge combustion, enabling leaner air-fuel mixtures and reduced throttling losses. The commercial adoption of GDI systems accelerated in the early 2000s, with manufacturers like Mitsubishi, Volkswagen, and Toyota implementing various iterations of direct injection technology in their gasoline engines.

Diesel engines, conversely, have a longer history in automotive applications, with their compression ignition principle offering inherently higher thermal efficiency compared to spark ignition engines. Modern diesel technology has evolved from rudimentary mechanical injection systems to sophisticated common-rail direct injection architectures capable of multiple injection events per combustion cycle at extremely high pressures exceeding 2,000 bar.

The emission profiles of these two engine types differ significantly due to their fundamental combustion characteristics. Diesel engines traditionally produce higher levels of nitrogen oxides (NOx) and particulate matter (PM), while GDI engines generate comparatively higher carbon monoxide (CO) and hydrocarbon (HC) emissions. However, GDI engines have increasingly faced scrutiny for their particulate emissions, particularly ultrafine particles that pose significant health concerns.

The regulatory landscape has shaped the technological trajectory of both engine types. The implementation of Euro standards in Europe, Tier regulations in the United States, and equivalent frameworks in other markets has progressively tightened emission limits, necessitating advanced aftertreatment systems for both engine types. For diesel engines, this typically includes diesel oxidation catalysts (DOC), diesel particulate filters (DPF), and selective catalytic reduction (SCR) systems. GDI engines increasingly employ gasoline particulate filters (GPF) alongside traditional three-way catalysts.

Recent technological developments have focused on hybridization strategies, with both GDI and diesel engines being integrated into various hybrid architectures to further reduce emissions and improve efficiency. Additionally, low-temperature combustion modes such as Homogeneous Charge Compression Ignition (HCCI) and Reactivity Controlled Compression Ignition (RCCI) represent potential pathways for future development, potentially blurring the traditional boundaries between gasoline and diesel combustion concepts.

Market Demand Analysis for Low-Emission Engines

The global market for low-emission engines has experienced significant growth in recent years, driven primarily by stringent environmental regulations and increasing consumer awareness about carbon footprints. The comparison between Gasoline Direct Injection (GDI) and Diesel engines represents a critical aspect of this market evolution, as both technologies compete to meet increasingly demanding emission standards worldwide.

Market research indicates that the automotive industry is witnessing a paradigm shift toward cleaner propulsion systems. The global market for low-emission internal combustion engines was valued at approximately $38.2 billion in 2022 and is projected to reach $59.7 billion by 2028, growing at a CAGR of 7.7%. This growth trajectory underscores the substantial demand for technologies that can reduce harmful emissions while maintaining performance standards.

Consumer preferences have notably shifted toward vehicles with lower environmental impact. A recent survey across major automotive markets revealed that 68% of potential car buyers now consider emission levels as a significant factor in their purchasing decisions, compared to just 42% five years ago. This trend is particularly pronounced in Europe and parts of Asia, where urban air quality concerns have heightened public awareness.

Regulatory frameworks continue to be the primary market driver for low-emission engines. The European Union's Euro 7 standards, China's China 6 regulations, and the United States' Tier 3 standards have all established progressively stricter limits on particulate matter, nitrogen oxides, and carbon dioxide emissions. These regulations have created substantial market pressure for both GDI and diesel technologies to evolve rapidly.

Regional market analysis shows varying adoption patterns for GDI and diesel technologies. Western Europe has traditionally favored diesel engines, though this preference has begun to shift following emissions scandals and the introduction of low-emission zones in major cities. North America maintains a stronger preference for gasoline engines, with GDI technology gaining significant market share. Meanwhile, emerging markets in Asia-Pacific show growing demand for both technologies, with particular emphasis on cost-effective solutions that meet newer emission standards.

Fleet operators represent another significant market segment, with commercial vehicles and logistics companies increasingly seeking fuel-efficient, low-emission alternatives. The total cost of ownership calculations now routinely incorporate emission-related factors such as carbon taxes, urban access restrictions, and potential resale value impacts of higher-emission vehicles.

Market forecasts suggest that while both GDI and diesel technologies will continue to see demand in specific applications, hybrid systems incorporating these technologies alongside electrification components will experience the fastest growth rate in the coming decade, reflecting the industry's transitional approach toward eventual decarbonization.

Market research indicates that the automotive industry is witnessing a paradigm shift toward cleaner propulsion systems. The global market for low-emission internal combustion engines was valued at approximately $38.2 billion in 2022 and is projected to reach $59.7 billion by 2028, growing at a CAGR of 7.7%. This growth trajectory underscores the substantial demand for technologies that can reduce harmful emissions while maintaining performance standards.

Consumer preferences have notably shifted toward vehicles with lower environmental impact. A recent survey across major automotive markets revealed that 68% of potential car buyers now consider emission levels as a significant factor in their purchasing decisions, compared to just 42% five years ago. This trend is particularly pronounced in Europe and parts of Asia, where urban air quality concerns have heightened public awareness.

Regulatory frameworks continue to be the primary market driver for low-emission engines. The European Union's Euro 7 standards, China's China 6 regulations, and the United States' Tier 3 standards have all established progressively stricter limits on particulate matter, nitrogen oxides, and carbon dioxide emissions. These regulations have created substantial market pressure for both GDI and diesel technologies to evolve rapidly.

Regional market analysis shows varying adoption patterns for GDI and diesel technologies. Western Europe has traditionally favored diesel engines, though this preference has begun to shift following emissions scandals and the introduction of low-emission zones in major cities. North America maintains a stronger preference for gasoline engines, with GDI technology gaining significant market share. Meanwhile, emerging markets in Asia-Pacific show growing demand for both technologies, with particular emphasis on cost-effective solutions that meet newer emission standards.

Fleet operators represent another significant market segment, with commercial vehicles and logistics companies increasingly seeking fuel-efficient, low-emission alternatives. The total cost of ownership calculations now routinely incorporate emission-related factors such as carbon taxes, urban access restrictions, and potential resale value impacts of higher-emission vehicles.

Market forecasts suggest that while both GDI and diesel technologies will continue to see demand in specific applications, hybrid systems incorporating these technologies alongside electrification components will experience the fastest growth rate in the coming decade, reflecting the industry's transitional approach toward eventual decarbonization.

Current Emission Control Challenges

Despite significant advancements in emission control technologies, both Gasoline Direct Injection (GDI) and diesel engines continue to face substantial challenges in meeting increasingly stringent global emission standards. The primary challenge for GDI engines lies in controlling particulate matter (PM) emissions, which have increased compared to traditional port fuel injection systems. The direct injection process creates fuel-rich zones that promote soot formation, requiring sophisticated particulate filters that add cost and complexity to the emission control system.

Diesel engines, while more fuel-efficient than their gasoline counterparts, struggle with the simultaneous reduction of nitrogen oxides (NOx) and particulate matter. This fundamental trade-off, known as the NOx-PM trade-off, represents a significant technical hurdle. Advanced after-treatment systems including Selective Catalytic Reduction (SCR), Diesel Particulate Filters (DPF), and Lean NOx Traps (LNT) have been developed but add substantial cost and complexity to diesel powertrains.

Cold-start emissions remain problematic for both engine types, with catalytic converters requiring time to reach operational temperatures. During this warm-up period, both GDI and diesel engines produce significantly higher emissions. This challenge is particularly acute in regions with cold climates and for vehicles used primarily for short trips.

Real-world driving emissions (RDE) present another major challenge, as laboratory testing cycles often fail to accurately represent actual driving conditions. The gap between certified and real-world emissions has led to regulatory shifts toward on-road testing protocols, requiring more robust emission control strategies that function effectively across a wider range of operating conditions.

The durability and long-term performance of emission control systems pose additional challenges. Catalytic converters and particulate filters can degrade over time, particularly when exposed to fuel contaminants or extreme operating conditions. Ensuring these systems maintain their effectiveness throughout the vehicle's lifespan requires sophisticated on-board diagnostics and potentially more frequent maintenance.

Cost constraints further complicate emission control efforts. The additional components required to meet current standards add significant expense to vehicle production. This cost pressure is particularly challenging for smaller, more affordable vehicle segments where profit margins are already thin.

Emerging markets present unique challenges due to variations in fuel quality, maintenance practices, and regulatory frameworks. Sulfur content in fuels remains high in many developing regions, which can poison catalytic converters and reduce the effectiveness of advanced emission control technologies, requiring region-specific engineering solutions.

Diesel engines, while more fuel-efficient than their gasoline counterparts, struggle with the simultaneous reduction of nitrogen oxides (NOx) and particulate matter. This fundamental trade-off, known as the NOx-PM trade-off, represents a significant technical hurdle. Advanced after-treatment systems including Selective Catalytic Reduction (SCR), Diesel Particulate Filters (DPF), and Lean NOx Traps (LNT) have been developed but add substantial cost and complexity to diesel powertrains.

Cold-start emissions remain problematic for both engine types, with catalytic converters requiring time to reach operational temperatures. During this warm-up period, both GDI and diesel engines produce significantly higher emissions. This challenge is particularly acute in regions with cold climates and for vehicles used primarily for short trips.

Real-world driving emissions (RDE) present another major challenge, as laboratory testing cycles often fail to accurately represent actual driving conditions. The gap between certified and real-world emissions has led to regulatory shifts toward on-road testing protocols, requiring more robust emission control strategies that function effectively across a wider range of operating conditions.

The durability and long-term performance of emission control systems pose additional challenges. Catalytic converters and particulate filters can degrade over time, particularly when exposed to fuel contaminants or extreme operating conditions. Ensuring these systems maintain their effectiveness throughout the vehicle's lifespan requires sophisticated on-board diagnostics and potentially more frequent maintenance.

Cost constraints further complicate emission control efforts. The additional components required to meet current standards add significant expense to vehicle production. This cost pressure is particularly challenging for smaller, more affordable vehicle segments where profit margins are already thin.

Emerging markets present unique challenges due to variations in fuel quality, maintenance practices, and regulatory frameworks. Sulfur content in fuels remains high in many developing regions, which can poison catalytic converters and reduce the effectiveness of advanced emission control technologies, requiring region-specific engineering solutions.

Current Emission Reduction Solutions

01 Emission reduction technologies for GDI engines

Various technologies have been developed to reduce emissions from Gasoline Direct Injection (GDI) engines. These include advanced fuel injection systems, combustion optimization techniques, and catalytic converters specifically designed for GDI engines. These technologies aim to reduce particulate matter, nitrogen oxides (NOx), and hydrocarbon emissions while maintaining or improving engine performance and fuel efficiency.- Emission reduction technologies for GDI engines: Various technologies have been developed to reduce emissions from Gasoline Direct Injection (GDI) engines. These include advanced fuel injection systems, combustion optimization techniques, and catalytic converters specifically designed for GDI engines. These technologies aim to reduce particulate matter, nitrogen oxides, and hydrocarbon emissions while maintaining or improving engine performance and fuel efficiency.

- Diesel exhaust aftertreatment systems: Aftertreatment systems for diesel engines include technologies such as Diesel Particulate Filters (DPF), Selective Catalytic Reduction (SCR), and Diesel Oxidation Catalysts (DOC). These systems are designed to capture and convert harmful emissions from diesel engines, including particulate matter and nitrogen oxides, into less harmful substances before they are released into the atmosphere.

- Fuel formulations for emission reduction: Specialized fuel formulations and additives can significantly reduce emissions from both GDI and diesel engines. These formulations may include detergents, cetane improvers, oxygenates, and other compounds that enhance combustion efficiency, reduce deposit formation, and lower emissions of particulate matter, nitrogen oxides, and unburned hydrocarbons.

- Exhaust gas recirculation systems: Exhaust Gas Recirculation (EGR) systems reduce nitrogen oxide emissions by recirculating a portion of an engine's exhaust gas back to the engine cylinders. This lowers combustion temperatures and reduces the formation of nitrogen oxides. Advanced EGR systems for both GDI and diesel engines may include cooling components, precise control mechanisms, and integration with other emission control technologies.

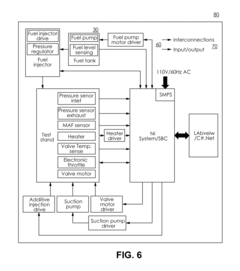

- Emission monitoring and control systems: Advanced electronic control systems monitor and manage emissions from GDI and diesel engines in real-time. These systems use sensors to measure various parameters such as oxygen levels, temperature, and pressure in the exhaust stream. The collected data is used to optimize engine operation, fuel injection timing, and aftertreatment system performance to minimize emissions under various operating conditions.

02 Diesel exhaust aftertreatment systems

Aftertreatment systems for diesel engines include technologies such as Diesel Particulate Filters (DPF), Selective Catalytic Reduction (SCR), and Diesel Oxidation Catalysts (DOC). These systems are designed to capture and convert harmful emissions from diesel engines, including particulate matter, nitrogen oxides, and carbon monoxide, into less harmful substances before they are released into the atmosphere.Expand Specific Solutions03 Fuel formulations for emission reduction

Specialized fuel formulations and additives can significantly reduce emissions from both GDI and diesel engines. These formulations may include detergents to prevent injector fouling, cetane improvers for diesel fuels, and oxygenates to promote more complete combustion. By optimizing fuel composition, these formulations help reduce particulate matter, nitrogen oxides, and unburned hydrocarbon emissions.Expand Specific Solutions04 Engine design modifications for emission control

Modifications to engine design can significantly impact emissions from both GDI and diesel engines. These modifications include changes to combustion chamber geometry, piston design, valve timing, and exhaust gas recirculation systems. Such design changes aim to optimize the combustion process, reduce the formation of pollutants, and improve overall engine efficiency while meeting increasingly stringent emission standards.Expand Specific Solutions05 Hybrid and alternative powertrain solutions

Hybrid powertrains and alternative solutions that combine conventional GDI or diesel engines with electric motors can significantly reduce overall emissions. These systems often incorporate start-stop technology, regenerative braking, and electric-only operation modes for low-speed driving. By optimizing the use of the internal combustion engine and supplementing it with electric power, these solutions can achieve substantial reductions in both greenhouse gas emissions and criteria pollutants.Expand Specific Solutions

Key Industry Players in Emission Control

The GDI and Diesel Engine Emissions landscape is currently in a mature development phase, with the market valued at approximately $30 billion globally. Major automotive manufacturers including Ford, GM, Hyundai, and Geely are competing to optimize emission reduction technologies as regulatory pressures intensify. The technical maturity varies significantly between solutions, with diesel particulate filters reaching high maturity while GDI particulate control remains in active development. Key technology players like Lubrizol, BASF, and ExxonMobil are advancing fuel additive solutions, while Corning and Cummins Filtration lead in filtration technologies. Research institutions such as Southwest Research Institute and Tianjin University are driving fundamental innovations, creating a competitive ecosystem balancing immediate compliance needs with long-term sustainability goals.

Ford Global Technologies LLC

Technical Solution: Ford has developed advanced EcoBoost GDI engine technology that combines direct fuel injection with turbocharging to reduce emissions while maintaining performance. Their system utilizes high-pressure fuel injection (up to 2150 bar) for precise fuel atomization and mixing, coupled with advanced exhaust gas recirculation (EGR) systems. Ford's emissions control strategy integrates close-coupled catalysts with gasoline particulate filters (GPFs) to address particulate matter concerns in GDI engines. Their research shows that optimized spray patterns and multiple injection events per cycle can reduce particulate emissions by up to 90% compared to earlier GDI implementations. Ford has also pioneered cylinder deactivation technology in their EcoBoost engines to further reduce fuel consumption and CO2 emissions during partial load conditions.

Strengths: Excellent balance between performance and emissions reduction; integrated approach combining multiple technologies; proven real-world implementation across global markets. Weaknesses: Higher system complexity increases manufacturing costs; potential reliability concerns with high-pressure components; particulate emissions from GDI still higher than port fuel injection under certain operating conditions.

Hyundai Motor Co., Ltd.

Technical Solution: Hyundai has developed a dual-approach strategy for emissions control across both GDI and diesel platforms. For GDI engines, their Smartstream technology incorporates continuously variable valve duration (CVVD) that adjusts valve timing based on driving conditions, reducing emissions by up to 12% while improving fuel efficiency by 5%. Their diesel emissions technology centers on their proprietary Lean NOx Trap (LNT) combined with Selective Catalytic Reduction (SCR) in a dual-dosing configuration. This system features two separate urea injection points at different temperature zones in the exhaust stream, optimizing NOx conversion efficiency across a wider operating range. Hyundai's research indicates this approach achieves over 90% NOx reduction even in low-temperature urban driving conditions where traditional SCR systems struggle. Their integrated controller manages both engine parameters and aftertreatment systems using predictive algorithms based on real-time driving conditions.

Strengths: Innovative valve control technology reduces emissions at the source; dual-dosing SCR system provides superior low-temperature NOx reduction; integrated control approach optimizes overall system efficiency. Weaknesses: Complex valve control mechanisms add cost and potential reliability concerns; dual-dosing SCR requires additional urea consumption; system optimization requires sophisticated control algorithms.

Core Emission Control Technologies

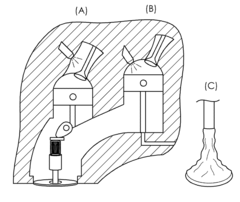

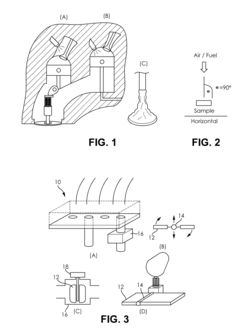

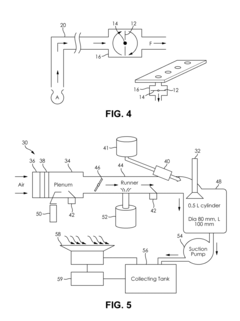

Evaluation of the delivery and effectiveness of engine performance chemicals and products

PatentActiveUS20170114716A1

Innovation

- A method and system for evaluating the delivery and effectiveness of engine performance chemicals and products for reducing intake valve deposits, utilizing a controlled environment with simulated engine conditions to quantify improvements, including adjustable parameters like air-fuel ratio, temperature, and oscillation frequency, and employing three approaches to introduce cleaners: airstream addition, suction-based distribution, and fuel additive application.

Method for maximizing the formation of deposits in injector nozzles of GDI engines

PatentWO2018002610A1

Innovation

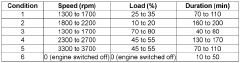

- A method to maximize deposit formation in GDI engine injector nozzles by simulating severe conditions through controlled engine speed and load variations, high nozzle temperatures, and moderate fuel flow rates, allowing for automated and unsupervised testing to quickly assess fuel's deposit-forming tendencies.

Environmental Impact Assessment

The environmental impact of vehicle emissions represents a critical concern in the automotive industry, with significant implications for public health, climate change, and regulatory compliance. When comparing Gasoline Direct Injection (GDI) and diesel engines, their distinct emission profiles reveal important differences in environmental footprint and potential mitigation strategies.

GDI engines typically produce lower carbon dioxide (CO2) emissions compared to traditional port fuel injection systems, offering a 15-20% reduction in greenhouse gas contributions. However, they generate significantly higher levels of particulate matter (PM), particularly ultrafine particles smaller than 2.5 micrometers (PM2.5) that can penetrate deep into lung tissue. Recent studies indicate GDI vehicles emit 5-10 times more particulate number (PN) emissions than their port fuel injection counterparts under certain operating conditions.

Diesel engines, while historically known for their higher nitrogen oxide (NOx) and particulate matter emissions, have seen substantial improvements through advanced aftertreatment systems. Modern diesel vehicles equipped with selective catalytic reduction (SCR) technology can reduce NOx emissions by up to 90%, while diesel particulate filters (DPFs) capture more than 99% of particulate matter. However, these systems introduce additional complexity, maintenance requirements, and potential for malfunction.

Climate impact assessments reveal that diesel engines typically emit 15-20% less CO2 per kilometer driven compared to equivalent gasoline engines due to their higher thermal efficiency. This advantage must be weighed against their higher emissions of black carbon, a short-lived climate pollutant with significant warming potential. Recent atmospheric modeling suggests that black carbon from diesel exhaust may contribute disproportionately to regional warming effects, particularly in urban areas with high traffic density.

Water and soil contamination risks also differ between these technologies. Diesel fuel spills pose greater environmental persistence challenges due to slower biodegradation rates compared to gasoline. Additionally, nitrogen compounds from vehicle emissions contribute to acid rain formation and nitrogen deposition in sensitive ecosystems, with diesel NOx emissions playing a particularly significant role in this process.

Life cycle assessment (LCA) studies comparing these technologies indicate that while diesel engines may offer advantages in operational emissions, the environmental impacts of fuel production and vehicle manufacturing must also be considered. The energy-intensive refining process for diesel fuel partially offsets its operational efficiency advantages. Furthermore, the additional materials and manufacturing complexity of modern diesel aftertreatment systems increase their production-phase environmental footprint by approximately 5-8% compared to equivalent GDI systems.

GDI engines typically produce lower carbon dioxide (CO2) emissions compared to traditional port fuel injection systems, offering a 15-20% reduction in greenhouse gas contributions. However, they generate significantly higher levels of particulate matter (PM), particularly ultrafine particles smaller than 2.5 micrometers (PM2.5) that can penetrate deep into lung tissue. Recent studies indicate GDI vehicles emit 5-10 times more particulate number (PN) emissions than their port fuel injection counterparts under certain operating conditions.

Diesel engines, while historically known for their higher nitrogen oxide (NOx) and particulate matter emissions, have seen substantial improvements through advanced aftertreatment systems. Modern diesel vehicles equipped with selective catalytic reduction (SCR) technology can reduce NOx emissions by up to 90%, while diesel particulate filters (DPFs) capture more than 99% of particulate matter. However, these systems introduce additional complexity, maintenance requirements, and potential for malfunction.

Climate impact assessments reveal that diesel engines typically emit 15-20% less CO2 per kilometer driven compared to equivalent gasoline engines due to their higher thermal efficiency. This advantage must be weighed against their higher emissions of black carbon, a short-lived climate pollutant with significant warming potential. Recent atmospheric modeling suggests that black carbon from diesel exhaust may contribute disproportionately to regional warming effects, particularly in urban areas with high traffic density.

Water and soil contamination risks also differ between these technologies. Diesel fuel spills pose greater environmental persistence challenges due to slower biodegradation rates compared to gasoline. Additionally, nitrogen compounds from vehicle emissions contribute to acid rain formation and nitrogen deposition in sensitive ecosystems, with diesel NOx emissions playing a particularly significant role in this process.

Life cycle assessment (LCA) studies comparing these technologies indicate that while diesel engines may offer advantages in operational emissions, the environmental impacts of fuel production and vehicle manufacturing must also be considered. The energy-intensive refining process for diesel fuel partially offsets its operational efficiency advantages. Furthermore, the additional materials and manufacturing complexity of modern diesel aftertreatment systems increase their production-phase environmental footprint by approximately 5-8% compared to equivalent GDI systems.

Regulatory Compliance Framework

The global regulatory landscape for vehicle emissions has evolved significantly over the past decades, creating a complex framework that manufacturers must navigate when developing GDI (Gasoline Direct Injection) and diesel engines. These regulations vary by region but share common goals of reducing harmful emissions and improving air quality.

In the European Union, the Euro standards (currently Euro 6d) establish strict limits for both diesel and gasoline engines, with particular focus on nitrogen oxides (NOx), particulate matter (PM), carbon monoxide (CO), and hydrocarbons (HC). The Euro standards have progressively tightened, with diesel engines facing increasingly stringent NOx limits and GDI engines subject to particulate number (PN) restrictions similar to those applied to diesel vehicles.

The United States implements a different approach through the Environmental Protection Agency's Tier 3 standards and California Air Resources Board's (CARB) LEV III regulations. These frameworks employ a technology-neutral stance, setting identical emission limits regardless of fuel type. This regulatory philosophy has pushed manufacturers to develop advanced aftertreatment systems for both engine technologies.

Asian markets present varying regulatory landscapes. China has implemented China 6 standards, closely aligned with Euro 6 but with some unique testing procedures. Japan's post-new long-term regulations focus heavily on real-world driving emissions, while India has accelerated its regulatory timeline with Bharat Stage VI standards, leapfrogging intermediate stages to address severe air quality concerns.

Real Driving Emissions (RDE) testing has become a cornerstone of modern compliance frameworks globally, requiring vehicles to meet emission standards not only in laboratory conditions but also during on-road operation. This approach has significantly impacted both GDI and diesel technologies, with diesel facing greater challenges in meeting NOx limits under real-world conditions.

The regulatory timeline for future standards indicates continued tightening of emission limits. Euro 7 proposals suggest further reductions in pollutant limits and expanded testing conditions. Similarly, the EPA has signaled intentions to implement more stringent standards by 2027. These upcoming regulations will likely accelerate the convergence of emission control technologies between GDI and diesel platforms.

Compliance costs have become a critical factor in engine development strategies. The increasing complexity of aftertreatment systems—particularly for diesel engines—has shifted the economic equation for manufacturers, influencing technology choices and market positioning. For GDI engines, the addition of particulate filters represents a significant cost increase, though still generally lower than comprehensive diesel aftertreatment systems.

In the European Union, the Euro standards (currently Euro 6d) establish strict limits for both diesel and gasoline engines, with particular focus on nitrogen oxides (NOx), particulate matter (PM), carbon monoxide (CO), and hydrocarbons (HC). The Euro standards have progressively tightened, with diesel engines facing increasingly stringent NOx limits and GDI engines subject to particulate number (PN) restrictions similar to those applied to diesel vehicles.

The United States implements a different approach through the Environmental Protection Agency's Tier 3 standards and California Air Resources Board's (CARB) LEV III regulations. These frameworks employ a technology-neutral stance, setting identical emission limits regardless of fuel type. This regulatory philosophy has pushed manufacturers to develop advanced aftertreatment systems for both engine technologies.

Asian markets present varying regulatory landscapes. China has implemented China 6 standards, closely aligned with Euro 6 but with some unique testing procedures. Japan's post-new long-term regulations focus heavily on real-world driving emissions, while India has accelerated its regulatory timeline with Bharat Stage VI standards, leapfrogging intermediate stages to address severe air quality concerns.

Real Driving Emissions (RDE) testing has become a cornerstone of modern compliance frameworks globally, requiring vehicles to meet emission standards not only in laboratory conditions but also during on-road operation. This approach has significantly impacted both GDI and diesel technologies, with diesel facing greater challenges in meeting NOx limits under real-world conditions.

The regulatory timeline for future standards indicates continued tightening of emission limits. Euro 7 proposals suggest further reductions in pollutant limits and expanded testing conditions. Similarly, the EPA has signaled intentions to implement more stringent standards by 2027. These upcoming regulations will likely accelerate the convergence of emission control technologies between GDI and diesel platforms.

Compliance costs have become a critical factor in engine development strategies. The increasing complexity of aftertreatment systems—particularly for diesel engines—has shifted the economic equation for manufacturers, influencing technology choices and market positioning. For GDI engines, the addition of particulate filters represents a significant cost increase, though still generally lower than comprehensive diesel aftertreatment systems.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!