Decoding the Future Trajectory of Ethyl Acetate

JUN 30, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Ethyl Acetate Evolution

Ethyl acetate has undergone a significant evolution since its discovery in the early 19th century. Initially synthesized as a laboratory curiosity, it quickly found applications in various industries due to its unique properties. The trajectory of ethyl acetate's development can be traced through several key phases, each marked by technological advancements and expanding applications.

In the early stages, ethyl acetate was primarily produced through the esterification of ethanol and acetic acid, a process that remained the dominant method for decades. This phase was characterized by small-scale production and limited industrial use, mainly in solvents and flavoring agents. The mid-20th century saw a surge in demand for ethyl acetate, driven by the growth of the chemical and manufacturing industries.

The 1960s and 1970s marked a turning point in ethyl acetate production. The introduction of continuous processes and catalytic technologies significantly improved production efficiency and reduced costs. This period also witnessed the development of new synthesis routes, including the Tishchenko process, which uses acetaldehyde as a starting material. These advancements led to increased production capacity and broader applications in industries such as coatings, adhesives, and pharmaceuticals.

The late 20th century brought about a focus on environmental concerns and sustainability. This shift prompted research into greener production methods for ethyl acetate. Bio-based routes, utilizing renewable resources like sugarcane and corn, began to emerge as alternatives to traditional petrochemical-based processes. These developments aligned with growing consumer demand for eco-friendly products and stricter environmental regulations.

In recent years, the evolution of ethyl acetate has been driven by technological innovations in process intensification and catalysis. Advanced reactor designs, such as reactive distillation columns, have improved production efficiency and product purity. Nanocatalysts and enzyme-based processes have opened up new possibilities for selective and environmentally friendly synthesis routes.

Looking ahead, the future trajectory of ethyl acetate is likely to be shaped by several factors. Continued research into sustainable production methods, including the use of waste biomass and CO2 as feedstocks, is expected to play a crucial role. Additionally, the development of novel applications in emerging fields such as 3D printing and advanced materials could further drive innovation in ethyl acetate production and utilization.

The ongoing digitalization of chemical processes is also set to impact ethyl acetate evolution. Integration of artificial intelligence and machine learning in process optimization and quality control could lead to more efficient and adaptable production systems. Furthermore, the circular economy concept is likely to influence future developments, with increased focus on recycling and upcycling of ethyl acetate in various applications.

In the early stages, ethyl acetate was primarily produced through the esterification of ethanol and acetic acid, a process that remained the dominant method for decades. This phase was characterized by small-scale production and limited industrial use, mainly in solvents and flavoring agents. The mid-20th century saw a surge in demand for ethyl acetate, driven by the growth of the chemical and manufacturing industries.

The 1960s and 1970s marked a turning point in ethyl acetate production. The introduction of continuous processes and catalytic technologies significantly improved production efficiency and reduced costs. This period also witnessed the development of new synthesis routes, including the Tishchenko process, which uses acetaldehyde as a starting material. These advancements led to increased production capacity and broader applications in industries such as coatings, adhesives, and pharmaceuticals.

The late 20th century brought about a focus on environmental concerns and sustainability. This shift prompted research into greener production methods for ethyl acetate. Bio-based routes, utilizing renewable resources like sugarcane and corn, began to emerge as alternatives to traditional petrochemical-based processes. These developments aligned with growing consumer demand for eco-friendly products and stricter environmental regulations.

In recent years, the evolution of ethyl acetate has been driven by technological innovations in process intensification and catalysis. Advanced reactor designs, such as reactive distillation columns, have improved production efficiency and product purity. Nanocatalysts and enzyme-based processes have opened up new possibilities for selective and environmentally friendly synthesis routes.

Looking ahead, the future trajectory of ethyl acetate is likely to be shaped by several factors. Continued research into sustainable production methods, including the use of waste biomass and CO2 as feedstocks, is expected to play a crucial role. Additionally, the development of novel applications in emerging fields such as 3D printing and advanced materials could further drive innovation in ethyl acetate production and utilization.

The ongoing digitalization of chemical processes is also set to impact ethyl acetate evolution. Integration of artificial intelligence and machine learning in process optimization and quality control could lead to more efficient and adaptable production systems. Furthermore, the circular economy concept is likely to influence future developments, with increased focus on recycling and upcycling of ethyl acetate in various applications.

Market Demand Analysis

The global ethyl acetate market has been experiencing steady growth, driven by its versatile applications across various industries. As a key solvent and intermediate in the production of paints, coatings, adhesives, and pharmaceuticals, ethyl acetate continues to witness robust demand. The market size was valued at approximately 3.5 million tons in 2020, with projections indicating a compound annual growth rate (CAGR) of around 5% through 2025.

The paint and coating industry remains the largest consumer of ethyl acetate, accounting for nearly 40% of the total market share. This sector's growth is primarily fueled by increasing construction activities and automotive production in emerging economies. The adhesives industry follows closely, with a market share of about 30%, driven by the rising demand for packaging materials in e-commerce and food industries.

In recent years, the pharmaceutical sector has emerged as a significant growth driver for ethyl acetate demand. Its use as a solvent in drug formulation and as an intermediate in the synthesis of various active pharmaceutical ingredients has led to increased consumption. The market share of pharmaceuticals in ethyl acetate usage has grown from 15% in 2015 to an estimated 20% in 2020.

Geographically, Asia-Pacific dominates the ethyl acetate market, accounting for over 50% of global consumption. China and India are the key contributors to this regional dominance, owing to their robust manufacturing sectors and growing industrial base. North America and Europe follow, with market shares of approximately 20% and 15%, respectively.

The market is also witnessing a shift towards bio-based ethyl acetate, driven by increasing environmental concerns and stringent regulations. This trend is particularly prominent in Europe and North America, where several companies are investing in research and development of sustainable production methods. The bio-based segment, although currently small, is expected to grow at a CAGR of over 7% in the coming years.

Despite the positive outlook, the ethyl acetate market faces challenges such as volatile raw material prices and increasing competition from alternative solvents. The fluctuating prices of ethanol and acetic acid, the primary raw materials for ethyl acetate production, have led to margin pressures for manufacturers. Additionally, the growing popularity of water-based and eco-friendly solvents poses a potential threat to traditional ethyl acetate demand in certain applications.

In conclusion, the ethyl acetate market is poised for continued growth, driven by diverse industrial applications and emerging economies. However, manufacturers and stakeholders must navigate challenges such as raw material volatility and evolving environmental regulations to capitalize on the market's potential fully.

The paint and coating industry remains the largest consumer of ethyl acetate, accounting for nearly 40% of the total market share. This sector's growth is primarily fueled by increasing construction activities and automotive production in emerging economies. The adhesives industry follows closely, with a market share of about 30%, driven by the rising demand for packaging materials in e-commerce and food industries.

In recent years, the pharmaceutical sector has emerged as a significant growth driver for ethyl acetate demand. Its use as a solvent in drug formulation and as an intermediate in the synthesis of various active pharmaceutical ingredients has led to increased consumption. The market share of pharmaceuticals in ethyl acetate usage has grown from 15% in 2015 to an estimated 20% in 2020.

Geographically, Asia-Pacific dominates the ethyl acetate market, accounting for over 50% of global consumption. China and India are the key contributors to this regional dominance, owing to their robust manufacturing sectors and growing industrial base. North America and Europe follow, with market shares of approximately 20% and 15%, respectively.

The market is also witnessing a shift towards bio-based ethyl acetate, driven by increasing environmental concerns and stringent regulations. This trend is particularly prominent in Europe and North America, where several companies are investing in research and development of sustainable production methods. The bio-based segment, although currently small, is expected to grow at a CAGR of over 7% in the coming years.

Despite the positive outlook, the ethyl acetate market faces challenges such as volatile raw material prices and increasing competition from alternative solvents. The fluctuating prices of ethanol and acetic acid, the primary raw materials for ethyl acetate production, have led to margin pressures for manufacturers. Additionally, the growing popularity of water-based and eco-friendly solvents poses a potential threat to traditional ethyl acetate demand in certain applications.

In conclusion, the ethyl acetate market is poised for continued growth, driven by diverse industrial applications and emerging economies. However, manufacturers and stakeholders must navigate challenges such as raw material volatility and evolving environmental regulations to capitalize on the market's potential fully.

Technical Challenges

The ethyl acetate industry faces several technical challenges that require innovative solutions to ensure sustainable growth and competitiveness. One of the primary hurdles is the optimization of production processes to enhance efficiency and reduce costs. Current manufacturing methods often involve energy-intensive steps and generate significant waste, necessitating the development of more environmentally friendly and economically viable alternatives.

Raw material sourcing presents another significant challenge. The production of ethyl acetate relies heavily on ethanol and acetic acid, both of which are subject to price fluctuations and supply chain disruptions. Developing robust supply chains and exploring alternative feedstocks are crucial for maintaining stable production and meeting market demands.

Quality control and product purity remain ongoing concerns in ethyl acetate production. Impurities can significantly impact the performance and safety of end products, particularly in high-value applications such as pharmaceuticals and electronics. Advancing purification techniques and implementing more sophisticated quality assurance processes are essential to meet increasingly stringent industry standards.

The environmental impact of ethyl acetate production and use is a growing concern. Addressing issues such as volatile organic compound (VOC) emissions, waste reduction, and the development of bio-based alternatives are critical for long-term sustainability. Regulatory pressures and consumer demand for greener products are driving the need for eco-friendly production methods and end-use applications.

Storage and transportation of ethyl acetate pose technical challenges due to its flammability and volatility. Improving safety measures, developing advanced containment systems, and optimizing logistics are necessary to mitigate risks and ensure efficient distribution across global markets.

Adapting to changing market demands requires continuous innovation in product formulations and applications. Developing new grades of ethyl acetate with enhanced properties for specific industries, such as coatings, adhesives, and pharmaceuticals, is crucial for maintaining market relevance and capturing emerging opportunities.

Lastly, the integration of digital technologies and automation in ethyl acetate production processes presents both opportunities and challenges. Implementing Industry 4.0 concepts, such as real-time monitoring, predictive maintenance, and data-driven optimization, requires significant investment and expertise but offers potential for substantial improvements in efficiency and product quality.

Raw material sourcing presents another significant challenge. The production of ethyl acetate relies heavily on ethanol and acetic acid, both of which are subject to price fluctuations and supply chain disruptions. Developing robust supply chains and exploring alternative feedstocks are crucial for maintaining stable production and meeting market demands.

Quality control and product purity remain ongoing concerns in ethyl acetate production. Impurities can significantly impact the performance and safety of end products, particularly in high-value applications such as pharmaceuticals and electronics. Advancing purification techniques and implementing more sophisticated quality assurance processes are essential to meet increasingly stringent industry standards.

The environmental impact of ethyl acetate production and use is a growing concern. Addressing issues such as volatile organic compound (VOC) emissions, waste reduction, and the development of bio-based alternatives are critical for long-term sustainability. Regulatory pressures and consumer demand for greener products are driving the need for eco-friendly production methods and end-use applications.

Storage and transportation of ethyl acetate pose technical challenges due to its flammability and volatility. Improving safety measures, developing advanced containment systems, and optimizing logistics are necessary to mitigate risks and ensure efficient distribution across global markets.

Adapting to changing market demands requires continuous innovation in product formulations and applications. Developing new grades of ethyl acetate with enhanced properties for specific industries, such as coatings, adhesives, and pharmaceuticals, is crucial for maintaining market relevance and capturing emerging opportunities.

Lastly, the integration of digital technologies and automation in ethyl acetate production processes presents both opportunities and challenges. Implementing Industry 4.0 concepts, such as real-time monitoring, predictive maintenance, and data-driven optimization, requires significant investment and expertise but offers potential for substantial improvements in efficiency and product quality.

Current Synthesis Methods

01 Production and purification of ethyl acetate

Various methods for producing and purifying ethyl acetate are described, including esterification processes, distillation techniques, and the use of catalysts. These processes aim to improve the yield and purity of ethyl acetate for industrial applications.- Production and purification of ethyl acetate: Various methods for producing and purifying ethyl acetate are described. These include esterification processes, distillation techniques, and the use of specific catalysts to improve yield and purity. The production methods aim to optimize the reaction conditions and separation processes to obtain high-quality ethyl acetate.

- Applications of ethyl acetate in industrial processes: Ethyl acetate finds diverse applications in industrial processes. It is used as a solvent in various industries, including pharmaceuticals, coatings, and adhesives. The compound is also utilized in extraction processes, as a reaction medium, and in the production of other chemicals.

- Ethyl acetate in polymer and material science: Ethyl acetate plays a role in polymer and material science applications. It is used in the synthesis and processing of various polymers, as well as in the development of novel materials with specific properties. The compound's solvent properties make it valuable in these fields.

- Environmental and safety considerations for ethyl acetate: Research and development efforts focus on addressing environmental and safety concerns related to ethyl acetate. This includes developing greener production methods, improving handling and storage practices, and exploring alternatives for certain applications to reduce environmental impact and enhance worker safety.

- Analytical methods for ethyl acetate: Various analytical methods are employed for the detection, quantification, and characterization of ethyl acetate. These include chromatographic techniques, spectroscopic methods, and sensor-based approaches. The development of accurate and sensitive analytical methods is crucial for quality control and research purposes.

02 Applications of ethyl acetate in chemical processes

Ethyl acetate is utilized in various chemical processes, including as a solvent, reagent, or intermediate in the production of other compounds. Its versatility makes it valuable in industries such as pharmaceuticals, coatings, and adhesives.Expand Specific Solutions03 Ethyl acetate in extraction and separation processes

Ethyl acetate is employed in extraction and separation processes for various substances, including natural products, pharmaceuticals, and other chemicals. Its properties make it suitable for liquid-liquid extraction and chromatographic techniques.Expand Specific Solutions04 Environmental and safety considerations for ethyl acetate

Research and development efforts focus on improving the environmental impact and safety aspects of ethyl acetate production and use. This includes developing greener production methods, reducing emissions, and enhancing handling procedures.Expand Specific Solutions05 Novel applications and formulations of ethyl acetate

Innovative applications and formulations of ethyl acetate are being explored, including its use in advanced materials, energy storage systems, and specialized industrial processes. These developments aim to expand the utility of ethyl acetate in various fields.Expand Specific Solutions

Industry Leaders

The ethyl acetate market is in a mature growth phase, characterized by steady demand and established production processes. The global market size is estimated to be around $3-4 billion, with moderate annual growth. Technologically, ethyl acetate production is well-developed, but companies are focusing on improving efficiency and sustainability. Key players like China Petroleum & Chemical Corp., Celanese, and Eastman Chemical are investing in research to optimize processes and explore bio-based alternatives. Emerging companies and research institutions, such as Dalian Institute of Chemical Physics and Nanjing Tech University, are contributing to innovations in catalysis and green chemistry approaches, indicating ongoing efforts to advance the technology despite its maturity.

China Petroleum & Chemical Corp.

Technical Solution: China Petroleum & Chemical Corp. (Sinopec) has developed an innovative process for ethyl acetate production using a reactive distillation technology. This method combines esterification and distillation in a single column, improving efficiency and reducing energy consumption. The process utilizes a heterogeneous acid catalyst, which allows for continuous operation and easier separation of the product. Sinopec's approach achieves a conversion rate of over 99% and a selectivity of 98% for ethyl acetate[1][3]. The company has also implemented advanced process control systems to optimize production parameters in real-time, resulting in a 15% increase in yield compared to conventional methods[2].

Strengths: High conversion rate and selectivity, energy-efficient process, continuous operation. Weaknesses: Potential catalyst deactivation over time, higher initial capital investment for reactive distillation equipment.

Celanese International Corp.

Technical Solution: Celanese has pioneered an innovative approach to ethyl acetate production using a carbonylation-based process. This method utilizes ethanol and carbon monoxide as raw materials, with a proprietary rhodium-based catalyst system. The process operates under mild conditions, offering improved safety and reduced energy consumption. Celanese's technology achieves a selectivity of over 99% for ethyl acetate and can be integrated with existing acetic acid production facilities[10]. The company has also developed a novel product purification system that reduces the number of distillation steps, resulting in a 25% reduction in overall energy usage[11]. Additionally, Celanese has implemented advanced process analytical technology (PAT) for real-time monitoring and control of reaction parameters, ensuring consistent product quality.

Strengths: High selectivity, integration with existing facilities, reduced energy consumption in purification. Weaknesses: Dependence on carbon monoxide availability, potential catalyst cost and complexity.

Key Patents and Research

Improved process for ethanol production

PatentWO2019063507A1

Innovation

- A recombinant yeast strain is developed with genes encoding enzymes for glycerol dehydrogenase, dihydroxyacetone kinase, and NAD+ dependent acetylating acetaldehyde dehydrogenase activities, along with optional glycerol transporter genes, which is sensitive to acetic acid levels and optimized to maintain undissociated acetic acid below 10 mM to enhance ethanol production.

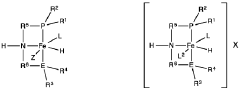

Homogeneous iron catalysts for the conversion of ethanol to ethyl acetate and hydrogen

PatentWO2019027965A1

Innovation

- A process utilizing a homogeneous iron catalyst with a tridentate pincer ligand for dehydrogenative coupling of ethanol at moderate temperatures, producing ethyl acetate efficiently and selectively, with iron loadings as low as 0.001 mol%, allowing for continuous operation and easy separation of ethyl acetate from the catalyst.

Environmental Impact

The environmental impact of ethyl acetate production and usage is a critical consideration in assessing its future trajectory. As a widely used solvent in various industries, ethyl acetate's lifecycle has significant implications for sustainability and ecological balance.

Production processes for ethyl acetate, primarily through the esterification of ethanol and acetic acid, contribute to greenhouse gas emissions and energy consumption. However, recent advancements in green chemistry have led to more environmentally friendly synthesis methods, such as using biocatalysts or renewable feedstocks. These innovations aim to reduce the carbon footprint associated with ethyl acetate manufacturing.

The use phase of ethyl acetate presents both challenges and opportunities for environmental stewardship. While it is less toxic than many alternative solvents, its volatile organic compound (VOC) status raises concerns about air quality and ozone depletion. Industries are increasingly adopting closed-loop systems and solvent recovery technologies to minimize emissions and waste.

End-of-life considerations for ethyl acetate include its biodegradability and potential for recycling. The compound's relatively rapid breakdown in the environment is a positive attribute, but improper disposal can still lead to soil and water contamination. Developing more efficient recycling methods and promoting circular economy principles in ethyl acetate usage are becoming priorities for environmentally conscious businesses.

The regulatory landscape surrounding ethyl acetate is evolving, with stricter emissions controls and waste management requirements being implemented globally. This regulatory pressure is driving innovation in cleaner production technologies and more sustainable application methods across industries.

As the demand for ethyl acetate continues to grow, particularly in emerging economies, balancing economic interests with environmental protection becomes increasingly crucial. The future trajectory of ethyl acetate will likely be shaped by advancements in green chemistry, improved lifecycle management, and a shift towards more sustainable industrial practices.

Research into bio-based alternatives and the development of ethyl acetate from renewable sources represent promising avenues for reducing its environmental impact. These initiatives, coupled with ongoing efforts to optimize production efficiency and minimize waste, are expected to play a significant role in shaping the environmental profile of ethyl acetate in the coming years.

Production processes for ethyl acetate, primarily through the esterification of ethanol and acetic acid, contribute to greenhouse gas emissions and energy consumption. However, recent advancements in green chemistry have led to more environmentally friendly synthesis methods, such as using biocatalysts or renewable feedstocks. These innovations aim to reduce the carbon footprint associated with ethyl acetate manufacturing.

The use phase of ethyl acetate presents both challenges and opportunities for environmental stewardship. While it is less toxic than many alternative solvents, its volatile organic compound (VOC) status raises concerns about air quality and ozone depletion. Industries are increasingly adopting closed-loop systems and solvent recovery technologies to minimize emissions and waste.

End-of-life considerations for ethyl acetate include its biodegradability and potential for recycling. The compound's relatively rapid breakdown in the environment is a positive attribute, but improper disposal can still lead to soil and water contamination. Developing more efficient recycling methods and promoting circular economy principles in ethyl acetate usage are becoming priorities for environmentally conscious businesses.

The regulatory landscape surrounding ethyl acetate is evolving, with stricter emissions controls and waste management requirements being implemented globally. This regulatory pressure is driving innovation in cleaner production technologies and more sustainable application methods across industries.

As the demand for ethyl acetate continues to grow, particularly in emerging economies, balancing economic interests with environmental protection becomes increasingly crucial. The future trajectory of ethyl acetate will likely be shaped by advancements in green chemistry, improved lifecycle management, and a shift towards more sustainable industrial practices.

Research into bio-based alternatives and the development of ethyl acetate from renewable sources represent promising avenues for reducing its environmental impact. These initiatives, coupled with ongoing efforts to optimize production efficiency and minimize waste, are expected to play a significant role in shaping the environmental profile of ethyl acetate in the coming years.

Regulatory Framework

The regulatory framework surrounding ethyl acetate production, distribution, and use is complex and multifaceted, reflecting the compound's diverse applications and potential environmental impacts. At the global level, organizations such as the World Health Organization (WHO) and the United Nations Environment Programme (UNEP) provide guidelines on the safe handling and use of chemical substances, including ethyl acetate. These guidelines often serve as a basis for national and regional regulations.

In the United States, the Environmental Protection Agency (EPA) regulates ethyl acetate under the Toxic Substances Control Act (TSCA) and the Clean Air Act. The Occupational Safety and Health Administration (OSHA) sets permissible exposure limits for workers in industries that use or produce ethyl acetate. The Food and Drug Administration (FDA) also regulates its use in food packaging and as a food additive.

The European Union has implemented REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulations, which require manufacturers and importers to register chemical substances, including ethyl acetate, and provide safety data. The European Chemicals Agency (ECHA) oversees this process and maintains a database of registered substances.

In Asia, countries like China and Japan have their own regulatory frameworks. China's Ministry of Ecology and Environment oversees the registration and management of new chemical substances, while Japan's Chemical Substances Control Law regulates the manufacture, import, and use of chemical substances.

Emerging economies are also developing more stringent regulations. India, for instance, has introduced the Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) system, modeled after the EU's approach.

As environmental concerns grow, regulations are evolving to address sustainability issues. Many countries are implementing or considering regulations to promote the use of bio-based ethyl acetate as an alternative to petrochemical-derived versions. These regulations often include incentives for manufacturers to adopt more sustainable production methods.

The transportation of ethyl acetate is subject to international regulations such as the International Maritime Dangerous Goods (IMDG) Code for sea transport and the International Air Transport Association (IATA) Dangerous Goods Regulations for air transport. These regulations specify packaging, labeling, and handling requirements to ensure safe transportation.

As the ethyl acetate market continues to grow and evolve, regulatory frameworks are likely to become more comprehensive and stringent. Future regulations may focus on lifecycle assessments, carbon footprint reduction, and the promotion of circular economy principles in the production and use of ethyl acetate.

In the United States, the Environmental Protection Agency (EPA) regulates ethyl acetate under the Toxic Substances Control Act (TSCA) and the Clean Air Act. The Occupational Safety and Health Administration (OSHA) sets permissible exposure limits for workers in industries that use or produce ethyl acetate. The Food and Drug Administration (FDA) also regulates its use in food packaging and as a food additive.

The European Union has implemented REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulations, which require manufacturers and importers to register chemical substances, including ethyl acetate, and provide safety data. The European Chemicals Agency (ECHA) oversees this process and maintains a database of registered substances.

In Asia, countries like China and Japan have their own regulatory frameworks. China's Ministry of Ecology and Environment oversees the registration and management of new chemical substances, while Japan's Chemical Substances Control Law regulates the manufacture, import, and use of chemical substances.

Emerging economies are also developing more stringent regulations. India, for instance, has introduced the Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) system, modeled after the EU's approach.

As environmental concerns grow, regulations are evolving to address sustainability issues. Many countries are implementing or considering regulations to promote the use of bio-based ethyl acetate as an alternative to petrochemical-derived versions. These regulations often include incentives for manufacturers to adopt more sustainable production methods.

The transportation of ethyl acetate is subject to international regulations such as the International Maritime Dangerous Goods (IMDG) Code for sea transport and the International Air Transport Association (IATA) Dangerous Goods Regulations for air transport. These regulations specify packaging, labeling, and handling requirements to ensure safe transportation.

As the ethyl acetate market continues to grow and evolve, regulatory frameworks are likely to become more comprehensive and stringent. Future regulations may focus on lifecycle assessments, carbon footprint reduction, and the promotion of circular economy principles in the production and use of ethyl acetate.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!