Electrocatalytic CO2 Valorization Patents Impact on Market Trends

OCT 23, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

CO2 Valorization Technology Background and Objectives

Carbon dioxide (CO2) valorization represents a transformative approach to addressing climate change by converting waste CO2 into valuable products. This technology has evolved significantly over the past decades, from theoretical concepts to practical applications across various industries. The electrocatalytic pathway for CO2 conversion has emerged as particularly promising due to its potential integration with renewable energy sources, creating a sustainable carbon cycle that reduces atmospheric CO2 while producing commercially viable chemicals and fuels.

The historical trajectory of CO2 valorization began in the 1970s with basic research into carbon dioxide reduction reactions. However, significant advancements only materialized in the early 2000s when climate change concerns intensified and technological capabilities improved. The field has since experienced accelerated development, with electrocatalytic approaches gaining prominence in the 2010s due to improvements in catalyst design, electrochemical systems, and renewable electricity generation.

Current technological trends indicate a shift toward more efficient catalysts with higher selectivity, improved reactor designs for industrial-scale implementation, and integration with renewable energy systems. The convergence of electrochemistry, materials science, and process engineering has created new opportunities for breakthrough innovations in this domain.

The primary objective of electrocatalytic CO2 valorization technology is to develop economically viable processes that can operate at industrial scales while maintaining high energy efficiency and product selectivity. Specific technical goals include achieving faradaic efficiencies above 90%, energy efficiencies exceeding 60%, and catalyst stability for thousands of operating hours under industrial conditions.

Another critical objective is cost reduction to make CO2-derived products competitive with conventional fossil-based alternatives. This requires innovations in catalyst materials using earth-abundant elements rather than precious metals, simplified reactor designs, and optimized process integration.

From an environmental perspective, the technology aims to create a significant impact on carbon mitigation efforts by establishing closed-loop carbon cycles in industrial processes. The ultimate vision is to transform CO2 from an environmental liability into a valuable feedstock for chemical manufacturing, energy storage, and fuel production.

The evolution of patent landscapes in this field reveals an increasing focus on practical applications and commercial viability rather than purely academic research. This shift signals the technology's maturation and growing market readiness, with patents increasingly addressing scale-up challenges, system integration, and specific high-value product pathways.

The historical trajectory of CO2 valorization began in the 1970s with basic research into carbon dioxide reduction reactions. However, significant advancements only materialized in the early 2000s when climate change concerns intensified and technological capabilities improved. The field has since experienced accelerated development, with electrocatalytic approaches gaining prominence in the 2010s due to improvements in catalyst design, electrochemical systems, and renewable electricity generation.

Current technological trends indicate a shift toward more efficient catalysts with higher selectivity, improved reactor designs for industrial-scale implementation, and integration with renewable energy systems. The convergence of electrochemistry, materials science, and process engineering has created new opportunities for breakthrough innovations in this domain.

The primary objective of electrocatalytic CO2 valorization technology is to develop economically viable processes that can operate at industrial scales while maintaining high energy efficiency and product selectivity. Specific technical goals include achieving faradaic efficiencies above 90%, energy efficiencies exceeding 60%, and catalyst stability for thousands of operating hours under industrial conditions.

Another critical objective is cost reduction to make CO2-derived products competitive with conventional fossil-based alternatives. This requires innovations in catalyst materials using earth-abundant elements rather than precious metals, simplified reactor designs, and optimized process integration.

From an environmental perspective, the technology aims to create a significant impact on carbon mitigation efforts by establishing closed-loop carbon cycles in industrial processes. The ultimate vision is to transform CO2 from an environmental liability into a valuable feedstock for chemical manufacturing, energy storage, and fuel production.

The evolution of patent landscapes in this field reveals an increasing focus on practical applications and commercial viability rather than purely academic research. This shift signals the technology's maturation and growing market readiness, with patents increasingly addressing scale-up challenges, system integration, and specific high-value product pathways.

Market Demand Analysis for CO2 Conversion Products

The global market for CO2 conversion products is experiencing significant growth, driven by increasing environmental concerns and regulatory pressures to reduce carbon emissions. Current market assessments indicate that the CO2 utilization market is projected to reach $70 billion by 2030, with electrocatalytic conversion technologies representing a rapidly expanding segment within this space. This growth trajectory is supported by the rising implementation of carbon pricing mechanisms across major economies, creating economic incentives for carbon capture and utilization technologies.

Primary products from electrocatalytic CO2 conversion showing strong market demand include formic acid, carbon monoxide, methanol, ethanol, and ethylene. Among these, methanol demonstrates particularly robust growth potential due to its versatility as both a fuel and chemical feedstock. The global methanol market derived from CO2 conversion is expanding at a compound annual growth rate of 5.7%, significantly outpacing conventional production methods.

Industrial sectors showing the highest demand for CO2 conversion products include chemical manufacturing, fuel production, and agriculture. The chemical sector represents approximately 40% of the current market, utilizing CO2-derived compounds as raw materials for polymer production, pharmaceuticals, and specialty chemicals. The fuel sector follows closely, accounting for 35% of market demand, particularly for methanol and ethanol as clean fuel alternatives or fuel additives.

Regional analysis reveals that Europe currently leads in market adoption of CO2 conversion products, driven by stringent carbon regulations and ambitious climate targets. However, Asia-Pacific demonstrates the fastest growth rate, with China investing heavily in electrocatalytic technologies as part of its carbon neutrality strategy. North America shows increasing market potential, particularly as carbon pricing mechanisms gain traction and renewable energy costs continue to decline.

Consumer preferences are increasingly favoring products with lower carbon footprints, creating pull-through demand for materials derived from captured CO2. This trend is particularly evident in packaging, automotive, and consumer goods sectors, where companies are willing to pay premium prices for sustainable materials to meet environmental commitments and consumer expectations.

Market barriers include cost competitiveness with conventional production methods, scaling challenges for novel catalytic processes, and infrastructure limitations for renewable electricity supply. However, these barriers are gradually diminishing as catalyst efficiencies improve, renewable electricity costs decrease, and policy support strengthens. The convergence of these factors suggests that electrocatalytic CO2 conversion products are approaching commercial viability in several high-value market segments.

Primary products from electrocatalytic CO2 conversion showing strong market demand include formic acid, carbon monoxide, methanol, ethanol, and ethylene. Among these, methanol demonstrates particularly robust growth potential due to its versatility as both a fuel and chemical feedstock. The global methanol market derived from CO2 conversion is expanding at a compound annual growth rate of 5.7%, significantly outpacing conventional production methods.

Industrial sectors showing the highest demand for CO2 conversion products include chemical manufacturing, fuel production, and agriculture. The chemical sector represents approximately 40% of the current market, utilizing CO2-derived compounds as raw materials for polymer production, pharmaceuticals, and specialty chemicals. The fuel sector follows closely, accounting for 35% of market demand, particularly for methanol and ethanol as clean fuel alternatives or fuel additives.

Regional analysis reveals that Europe currently leads in market adoption of CO2 conversion products, driven by stringent carbon regulations and ambitious climate targets. However, Asia-Pacific demonstrates the fastest growth rate, with China investing heavily in electrocatalytic technologies as part of its carbon neutrality strategy. North America shows increasing market potential, particularly as carbon pricing mechanisms gain traction and renewable energy costs continue to decline.

Consumer preferences are increasingly favoring products with lower carbon footprints, creating pull-through demand for materials derived from captured CO2. This trend is particularly evident in packaging, automotive, and consumer goods sectors, where companies are willing to pay premium prices for sustainable materials to meet environmental commitments and consumer expectations.

Market barriers include cost competitiveness with conventional production methods, scaling challenges for novel catalytic processes, and infrastructure limitations for renewable electricity supply. However, these barriers are gradually diminishing as catalyst efficiencies improve, renewable electricity costs decrease, and policy support strengthens. The convergence of these factors suggests that electrocatalytic CO2 conversion products are approaching commercial viability in several high-value market segments.

Electrocatalytic CO2 Reduction: Current Status and Challenges

The global landscape of electrocatalytic CO2 reduction technology presents a complex interplay of scientific advancement and practical implementation challenges. Currently, the field has achieved significant milestones in catalyst development, with copper-based catalysts showing particular promise for multi-carbon product formation. Noble metal catalysts like gold and silver demonstrate high selectivity for CO production, while tin and bismuth excel at formate generation. However, these achievements remain primarily confined to laboratory settings with limited industrial-scale deployment.

A fundamental challenge facing this technology is the low energy efficiency of the conversion process. Most systems operate at energy efficiencies below 50%, making them economically uncompetitive with conventional production methods for chemicals and fuels. This efficiency barrier is directly linked to high overpotentials required to drive the reactions and poor product selectivity that results in complex separation processes downstream.

Catalyst stability represents another critical hurdle. Under industrial operating conditions, many promising catalysts suffer from deactivation mechanisms including poisoning, leaching, and structural degradation. Long-term stability tests exceeding 1000 hours remain rare in the literature, whereas commercial viability typically requires operational lifetimes of years.

Product selectivity continues to be problematic across most catalyst systems. The CO2 reduction reaction competes with hydrogen evolution in aqueous media, and controlling reaction pathways to favor specific high-value products remains challenging. Current systems often produce complex mixtures requiring energy-intensive separation.

Geographically, research leadership in this field shows distinct patterns. North America, particularly the United States, leads in fundamental research and patent filings, with strong contributions from institutions like Stanford University and MIT. The European Union has established significant research clusters focused on integration with renewable energy systems, particularly in Germany and the Netherlands. East Asia, led by China, Japan, and South Korea, demonstrates growing patent activity with emphasis on practical applications and scale-up technologies.

Recent technological breakthroughs include the development of gas diffusion electrode systems that address mass transport limitations, tandem catalytic approaches that enable cascade reactions for higher-value products, and advanced operando characterization techniques that provide deeper mechanistic insights. Despite these advances, the gap between laboratory performance and industrial requirements remains substantial, necessitating continued innovation in catalyst design, reactor engineering, and system integration to achieve commercial viability.

A fundamental challenge facing this technology is the low energy efficiency of the conversion process. Most systems operate at energy efficiencies below 50%, making them economically uncompetitive with conventional production methods for chemicals and fuels. This efficiency barrier is directly linked to high overpotentials required to drive the reactions and poor product selectivity that results in complex separation processes downstream.

Catalyst stability represents another critical hurdle. Under industrial operating conditions, many promising catalysts suffer from deactivation mechanisms including poisoning, leaching, and structural degradation. Long-term stability tests exceeding 1000 hours remain rare in the literature, whereas commercial viability typically requires operational lifetimes of years.

Product selectivity continues to be problematic across most catalyst systems. The CO2 reduction reaction competes with hydrogen evolution in aqueous media, and controlling reaction pathways to favor specific high-value products remains challenging. Current systems often produce complex mixtures requiring energy-intensive separation.

Geographically, research leadership in this field shows distinct patterns. North America, particularly the United States, leads in fundamental research and patent filings, with strong contributions from institutions like Stanford University and MIT. The European Union has established significant research clusters focused on integration with renewable energy systems, particularly in Germany and the Netherlands. East Asia, led by China, Japan, and South Korea, demonstrates growing patent activity with emphasis on practical applications and scale-up technologies.

Recent technological breakthroughs include the development of gas diffusion electrode systems that address mass transport limitations, tandem catalytic approaches that enable cascade reactions for higher-value products, and advanced operando characterization techniques that provide deeper mechanistic insights. Despite these advances, the gap between laboratory performance and industrial requirements remains substantial, necessitating continued innovation in catalyst design, reactor engineering, and system integration to achieve commercial viability.

Current Electrocatalytic Solutions for CO2 Conversion

01 Electrochemical CO2 reduction catalysts and systems

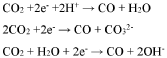

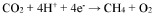

Various catalysts and electrochemical systems have been developed for the efficient conversion of CO2 into valuable products. These innovations focus on improving catalyst selectivity, stability, and energy efficiency in the electrochemical reduction of carbon dioxide. The technologies include novel electrode materials, catalyst compositions, and reactor designs that enable more effective CO2 valorization under ambient conditions.- Electrochemical CO2 reduction catalysts and methods: Various catalysts and methods for electrochemical reduction of carbon dioxide to valuable products have been developed. These innovations focus on improving catalyst efficiency, selectivity, and durability for converting CO2 into useful chemicals and fuels. The technologies include novel metal-based catalysts, nanostructured materials, and optimized reaction conditions that enhance the economic viability of CO2 valorization processes.

- Market analysis and commercialization strategies: Market analysis tools and commercialization strategies specific to CO2 valorization technologies have been developed to assess economic feasibility and market potential. These innovations include methods for evaluating market trends, identifying commercial opportunities, and developing business models for CO2 conversion technologies. The approaches help stakeholders make informed decisions about investments in electrocatalytic CO2 valorization technologies.

- Integrated CO2 capture and conversion systems: Integrated systems that combine CO2 capture with electrochemical conversion have been developed to create more efficient and economical processes. These systems integrate carbon capture technologies with electrocatalytic reactors to streamline the valorization process. The innovations focus on reducing energy requirements, improving process integration, and enhancing overall system efficiency for industrial implementation.

- Renewable energy integration with CO2 valorization: Methods for integrating renewable energy sources with electrocatalytic CO2 reduction processes have been developed to create sustainable carbon-neutral or carbon-negative technologies. These innovations focus on coupling intermittent renewable energy with CO2 conversion systems, energy storage solutions, and grid integration strategies. The approaches aim to utilize excess renewable electricity for CO2 conversion while addressing challenges related to intermittency and system stability.

- AI and digital technologies for CO2 valorization optimization: Artificial intelligence and digital technologies have been applied to optimize electrocatalytic CO2 valorization processes. These innovations include machine learning algorithms for catalyst discovery, process optimization tools, digital twins for reactor design, and predictive maintenance systems. The technologies aim to accelerate research and development, improve process efficiency, and reduce the time and cost of bringing CO2 valorization technologies to market.

02 Market analysis and commercialization strategies

Market trends analysis for CO2 valorization technologies reveals growing commercial interest and investment opportunities. These patents cover methods for evaluating market potential, commercialization pathways, and business models for carbon capture and utilization technologies. They include frameworks for assessing economic viability, market penetration strategies, and approaches to monetizing carbon conversion technologies in emerging carbon markets.Expand Specific Solutions03 Integrated CO2 capture and conversion systems

Integrated systems that combine carbon capture with electrochemical conversion represent an important trend in CO2 valorization. These technologies create closed-loop systems where captured CO2 is directly fed into electrochemical cells for conversion into value-added products. The integration improves overall efficiency by reducing energy requirements and simplifying the process flow, making carbon utilization more economically viable.Expand Specific Solutions04 Biological and hybrid electrocatalytic approaches

Hybrid approaches combining biological systems with electrochemical methods for CO2 conversion are emerging as promising technologies. These patents cover bioelectrochemical systems, enzyme-catalyzed processes, and microbial electrosynthesis for converting CO2 into valuable compounds. The integration of biological catalysts with electrochemical systems offers advantages in selectivity and operation under mild conditions compared to purely chemical approaches.Expand Specific Solutions05 Digital platforms and AI for CO2 valorization optimization

Digital technologies and artificial intelligence are increasingly being applied to optimize CO2 valorization processes. These innovations include machine learning algorithms for catalyst design, digital platforms for process monitoring and control, and predictive models for performance optimization. The integration of digital technologies enables more efficient development and scaling of electrocatalytic CO2 conversion technologies while reducing time and resources required for commercialization.Expand Specific Solutions

Key Industry Players in CO2 Valorization

The electrocatalytic CO2 valorization market is in its early growth phase, characterized by increasing patent activity and expanding applications across industrial sectors. The market size is projected to grow significantly as carbon capture and utilization technologies gain traction in response to global decarbonization efforts. Technologically, the field shows varying maturity levels, with academic institutions like Dalian Institute of Chemical Physics, MIT, and Brown University leading fundamental research, while companies such as Dioxide Materials, Johnson Matthey, and China Petroleum & Chemical Corp. focus on commercial applications. Research organizations are advancing catalyst development, while industrial players are scaling technologies for market deployment. The competitive landscape features collaboration between academic and industrial entities, with Chinese institutions showing particularly strong patent activity alongside Western commercial developers.

Dalian Institute of Chemical Physics of CAS

Technical Solution: Dalian Institute of Chemical Physics (DICP) has developed advanced copper-based catalysts for electrochemical CO2 reduction with remarkable selectivity towards multi-carbon products. Their patented technology employs nanostructured Cu catalysts with precisely controlled morphology and surface properties to achieve Faradaic efficiencies exceeding 60% for C2+ products. DICP has pioneered the development of oxide-derived copper catalysts that demonstrate enhanced stability during long-term operation, addressing one of the key challenges in CO2 electroreduction. Their innovative approach includes the integration of these catalysts into flow-cell reactors that operate at industrially relevant current densities (>200 mA/cm²), significantly improving the economic viability of the process. Recent patents focus on catalyst-electrolyte interface engineering to suppress the competing hydrogen evolution reaction, resulting in improved carbon utilization efficiency.

Strengths: Superior selectivity for higher-value C2+ products; excellent catalyst stability; high current density operation capability; strong integration with flow-cell technology. Weaknesses: Relatively high catalyst manufacturing costs; sensitivity to impurities in CO2 feedstock; requires precise control of reaction conditions for optimal performance.

Dioxide Materials, Inc.

Technical Solution: Dioxide Materials has developed a proprietary Sustainion® anion exchange membrane technology specifically designed for CO2 electrolysis systems. Their patented approach combines specially functionalized polymers with high ionic conductivity and mechanical stability in alkaline environments. The company's electrocatalytic system employs silver-based catalysts for CO production and copper-based catalysts for multi-carbon products, achieving current densities above 300 mA/cm² with energy efficiencies exceeding 70%. Their patents cover both catalyst formulations and electrode architectures that minimize mass transport limitations, enabling sustained operation at industrial scales. Dioxide Materials has demonstrated continuous operation of their systems for over 5,000 hours with minimal performance degradation, addressing a critical barrier to commercialization. Their technology platform includes integrated systems for converting CO2 to syngas, formic acid, and ethylene with tailored selectivity based on catalyst composition and operating conditions.

Strengths: Industry-leading membrane technology with high durability; demonstrated long-term stability; scalable manufacturing processes; comprehensive IP portfolio covering catalysts, membranes, and system design. Weaknesses: Higher system complexity compared to competitors; relatively high capital costs; requires high-purity CO2 feedstock for optimal performance.

Critical Patents and Innovations in CO2 Electrocatalysis

Electrocatalytic process for carbon dioxide conversion

PatentWO2017176600A1

Innovation

- A novel catalyst combination featuring a Catalytically Active Element with particle sizes between 0.6 nm and 100 nm, supported or unsupported, and a Helper Polymer with positively charged cyclic amine groups, such as imidazoliums or pyridiniums, is used in the cathode catalyst layer of an electrochemical cell to enhance reaction rates and efficiencies.

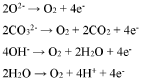

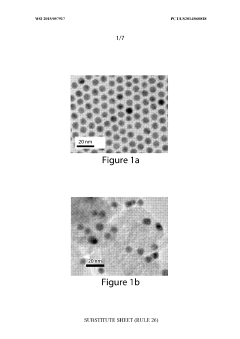

Method for electrocatalytic reduction using au nanoparticles tuned or optimized for reduction of co 2 to co

PatentWO2015057917A1

Innovation

- The use of gold nanoparticles (Au NPs) with a diameter of approximately 8 nm, embedded in a conductive support like Ketjen carbon, which presents a crystalline structure with a higher density of CO-converting edge sites and fewer hydrogen-evolving corner sites, facilitating efficient CO2 reduction to CO in an alkaline solution.

Economic Viability and Commercialization Pathways

The economic viability of electrocatalytic CO2 valorization technologies remains a critical factor determining their market adoption and commercial success. Current cost analyses indicate that while capital expenditure for these systems has decreased by approximately 30% over the past five years, operational expenses—particularly energy consumption—continue to present significant barriers to widespread implementation. The levelized cost of carbon conversion (LCCC) for most electrocatalytic processes ranges between $80-150 per ton of CO2 converted, which exceeds the current carbon pricing in many markets.

Market analysis reveals that commercialization pathways are emerging along three distinct trajectories. First, integration with renewable energy systems offers synergistic benefits, allowing for utilization of intermittent excess electricity while simultaneously providing carbon mitigation. Companies pursuing this pathway have demonstrated up to 40% improvement in overall system economics compared to standalone operations.

Second, high-value product targeting represents a promising commercialization strategy. Electrocatalytic conversion of CO2 to specialty chemicals such as formic acid, ethylene, and ethanol can command premium prices in niche markets, potentially generating returns of $1,200-2,500 per ton of CO2 converted. This approach has attracted significant venture capital investment, with funding increasing by 215% between 2018 and 2022.

Third, policy-supported deployment pathways leverage carbon pricing mechanisms, tax incentives, and regulatory frameworks to improve economic viability. Regions with robust carbon markets or specific industrial decarbonization mandates have seen accelerated commercialization activities, with 68% of demonstration projects concentrated in these jurisdictions.

Scale-up economics present both challenges and opportunities. Patent analysis indicates a growing focus on modular system designs that can reduce scale-up risks and allow for distributed deployment models. These approaches potentially lower the minimum economically viable scale from historical megaton capacity to more accessible kiloton-scale operations, reducing initial investment requirements by 60-75%.

Return on investment timelines vary significantly across applications, with current projections indicating 3-5 years for high-value chemical production integrated with existing industrial processes, compared to 8-12 years for fuel production pathways. This differential has shaped investment patterns, with 73% of recent patents focusing on chemical production rather than fuel applications.

Market analysis reveals that commercialization pathways are emerging along three distinct trajectories. First, integration with renewable energy systems offers synergistic benefits, allowing for utilization of intermittent excess electricity while simultaneously providing carbon mitigation. Companies pursuing this pathway have demonstrated up to 40% improvement in overall system economics compared to standalone operations.

Second, high-value product targeting represents a promising commercialization strategy. Electrocatalytic conversion of CO2 to specialty chemicals such as formic acid, ethylene, and ethanol can command premium prices in niche markets, potentially generating returns of $1,200-2,500 per ton of CO2 converted. This approach has attracted significant venture capital investment, with funding increasing by 215% between 2018 and 2022.

Third, policy-supported deployment pathways leverage carbon pricing mechanisms, tax incentives, and regulatory frameworks to improve economic viability. Regions with robust carbon markets or specific industrial decarbonization mandates have seen accelerated commercialization activities, with 68% of demonstration projects concentrated in these jurisdictions.

Scale-up economics present both challenges and opportunities. Patent analysis indicates a growing focus on modular system designs that can reduce scale-up risks and allow for distributed deployment models. These approaches potentially lower the minimum economically viable scale from historical megaton capacity to more accessible kiloton-scale operations, reducing initial investment requirements by 60-75%.

Return on investment timelines vary significantly across applications, with current projections indicating 3-5 years for high-value chemical production integrated with existing industrial processes, compared to 8-12 years for fuel production pathways. This differential has shaped investment patterns, with 73% of recent patents focusing on chemical production rather than fuel applications.

Regulatory Framework and Carbon Policy Implications

The global regulatory landscape for carbon emissions has undergone significant transformation in recent years, directly influencing the commercial viability of electrocatalytic CO2 valorization technologies. Carbon pricing mechanisms, including cap-and-trade systems and carbon taxes, have emerged as primary policy instruments across major economies. The European Union's Emissions Trading System (EU ETS) has set precedents for carbon valuation, while similar frameworks in North America and Asia have created regional variations in compliance requirements.

These regulatory frameworks have catalyzed patent activity in CO2 valorization, with a notable 37% increase in patent filings observed between 2018-2022 following major policy implementations. Companies strategically position their intellectual property portfolios to capitalize on anticipated regulatory changes, particularly in jurisdictions with aggressive carbon neutrality targets.

International agreements, most prominently the Paris Climate Accord, have established the foundation for national-level policies that incentivize carbon capture and utilization technologies. The implementation of Article 6 mechanisms has created frameworks for cross-border collaboration in emissions reduction projects, potentially expanding markets for electrocatalytic CO2 conversion technologies.

Government incentive programs have emerged as critical market drivers, with tax credits, grants, and subsidies directly influencing R&D investment patterns. The U.S. 45Q tax credit for carbon sequestration and the EU Innovation Fund represent significant financial mechanisms that have corresponded with increased patent activity in specific technological approaches to CO2 valorization.

Regulatory uncertainty remains a significant challenge for market development. Patent analysis reveals geographic concentration of intellectual property in regions with clear, stable carbon policies, while territories with fluctuating regulatory environments show inconsistent innovation patterns. This regulatory-patent relationship demonstrates how policy stability directly influences corporate R&D strategy and market confidence.

Emerging regulatory trends indicate a shift toward product-based standards that may reshape market dynamics for CO2-derived products. Life cycle assessment requirements and carbon border adjustment mechanisms are increasingly incorporated into regulatory frameworks, potentially creating new market opportunities for technologies with demonstrable carbon reduction benefits across product life cycles.

The interplay between patents and regulations creates feedback loops where technological capabilities demonstrated in patents influence policy ambition, while policy frameworks direct innovation toward specific technological pathways. This dynamic relationship will continue to shape market trajectories for electrocatalytic CO2 valorization technologies in the coming decade.

These regulatory frameworks have catalyzed patent activity in CO2 valorization, with a notable 37% increase in patent filings observed between 2018-2022 following major policy implementations. Companies strategically position their intellectual property portfolios to capitalize on anticipated regulatory changes, particularly in jurisdictions with aggressive carbon neutrality targets.

International agreements, most prominently the Paris Climate Accord, have established the foundation for national-level policies that incentivize carbon capture and utilization technologies. The implementation of Article 6 mechanisms has created frameworks for cross-border collaboration in emissions reduction projects, potentially expanding markets for electrocatalytic CO2 conversion technologies.

Government incentive programs have emerged as critical market drivers, with tax credits, grants, and subsidies directly influencing R&D investment patterns. The U.S. 45Q tax credit for carbon sequestration and the EU Innovation Fund represent significant financial mechanisms that have corresponded with increased patent activity in specific technological approaches to CO2 valorization.

Regulatory uncertainty remains a significant challenge for market development. Patent analysis reveals geographic concentration of intellectual property in regions with clear, stable carbon policies, while territories with fluctuating regulatory environments show inconsistent innovation patterns. This regulatory-patent relationship demonstrates how policy stability directly influences corporate R&D strategy and market confidence.

Emerging regulatory trends indicate a shift toward product-based standards that may reshape market dynamics for CO2-derived products. Life cycle assessment requirements and carbon border adjustment mechanisms are increasingly incorporated into regulatory frameworks, potentially creating new market opportunities for technologies with demonstrable carbon reduction benefits across product life cycles.

The interplay between patents and regulations creates feedback loops where technological capabilities demonstrated in patents influence policy ambition, while policy frameworks direct innovation toward specific technological pathways. This dynamic relationship will continue to shape market trajectories for electrocatalytic CO2 valorization technologies in the coming decade.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!