Patents Overview in Electrocatalytic CO2 Valorization

OCT 23, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Electrocatalytic CO2 Valorization Background and Objectives

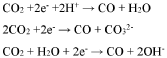

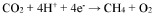

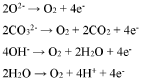

Electrocatalytic CO2 valorization has emerged as a promising approach to address the dual challenges of climate change and sustainable energy production. The technology has evolved significantly since the 1980s when initial research focused on basic electrochemical reduction of CO2 in aqueous solutions. Early work by pioneers such as Hori and colleagues established fundamental principles for CO2 reduction to various products including carbon monoxide, formic acid, and hydrocarbons.

The technological evolution accelerated in the 2000s with advances in nanotechnology enabling more precise catalyst design. This period saw the development of nanostructured catalysts with enhanced selectivity and efficiency, marking a significant milestone in the field. Recent years have witnessed exponential growth in research publications and patent filings, indicating the increasing commercial and scientific interest in this technology.

The primary objective of electrocatalytic CO2 valorization is to transform carbon dioxide, a greenhouse gas, into value-added chemicals and fuels using renewable electricity. This approach offers a sustainable pathway to close the carbon cycle while potentially creating economic value from waste CO2. Specific technical goals include developing catalysts with high selectivity toward desired products, achieving energy efficiency exceeding 50%, and demonstrating long-term stability under industrial conditions.

Current research trends focus on several key areas: novel catalyst materials including transition metals, metal oxides, and carbon-based materials; advanced reactor designs to overcome mass transport limitations; and integrated systems combining CO2 capture with electrochemical conversion. The integration with renewable energy sources represents another critical trend, as it enables truly carbon-neutral or even carbon-negative processes.

The technology trajectory suggests a shift from laboratory-scale demonstrations toward pilot and commercial applications. Several startups and established companies have begun scaling up these technologies, though significant challenges remain in catalyst durability, product separation, and overall system economics.

Patent activity in this field has grown at a compound annual growth rate of approximately 25% over the past decade, with notable concentration in regions including the United States, China, Japan, and the European Union. This patent landscape reflects both the global interest in the technology and the competitive race to secure intellectual property rights for commercially viable applications.

The convergence of climate policy drivers, renewable energy growth, and advances in materials science suggests that electrocatalytic CO2 valorization is positioned at an inflection point, with potential for significant technological breakthroughs in the coming decade.

The technological evolution accelerated in the 2000s with advances in nanotechnology enabling more precise catalyst design. This period saw the development of nanostructured catalysts with enhanced selectivity and efficiency, marking a significant milestone in the field. Recent years have witnessed exponential growth in research publications and patent filings, indicating the increasing commercial and scientific interest in this technology.

The primary objective of electrocatalytic CO2 valorization is to transform carbon dioxide, a greenhouse gas, into value-added chemicals and fuels using renewable electricity. This approach offers a sustainable pathway to close the carbon cycle while potentially creating economic value from waste CO2. Specific technical goals include developing catalysts with high selectivity toward desired products, achieving energy efficiency exceeding 50%, and demonstrating long-term stability under industrial conditions.

Current research trends focus on several key areas: novel catalyst materials including transition metals, metal oxides, and carbon-based materials; advanced reactor designs to overcome mass transport limitations; and integrated systems combining CO2 capture with electrochemical conversion. The integration with renewable energy sources represents another critical trend, as it enables truly carbon-neutral or even carbon-negative processes.

The technology trajectory suggests a shift from laboratory-scale demonstrations toward pilot and commercial applications. Several startups and established companies have begun scaling up these technologies, though significant challenges remain in catalyst durability, product separation, and overall system economics.

Patent activity in this field has grown at a compound annual growth rate of approximately 25% over the past decade, with notable concentration in regions including the United States, China, Japan, and the European Union. This patent landscape reflects both the global interest in the technology and the competitive race to secure intellectual property rights for commercially viable applications.

The convergence of climate policy drivers, renewable energy growth, and advances in materials science suggests that electrocatalytic CO2 valorization is positioned at an inflection point, with potential for significant technological breakthroughs in the coming decade.

Market Analysis for CO2 Conversion Technologies

The global market for CO2 conversion technologies has witnessed significant growth in recent years, driven by increasing environmental concerns and regulatory pressures to reduce carbon emissions. The market size for CO2 conversion technologies was valued at approximately $1.8 billion in 2022 and is projected to reach $4.2 billion by 2030, growing at a CAGR of 11.2% during the forecast period.

Electrocatalytic CO2 valorization represents one of the most promising segments within this market, accounting for roughly 23% of the total market share. This technology offers dual benefits of reducing greenhouse gas emissions while simultaneously producing value-added chemicals and fuels, creating a compelling economic case for adoption across various industries.

Regional analysis reveals that North America currently leads the market with approximately 35% share, followed by Europe (30%) and Asia-Pacific (25%). However, the Asia-Pacific region is expected to witness the highest growth rate in the coming years due to aggressive carbon neutrality targets set by countries like China and Japan, coupled with substantial investments in renewable energy infrastructure.

Industry-wise, the chemical manufacturing sector remains the largest end-user of CO2 conversion technologies, accounting for 42% of market applications. Other significant sectors include energy production (28%), transportation fuels (15%), and pharmaceuticals (8%). The remaining 7% is distributed across various niche applications including food processing and agriculture.

Key market drivers include stringent carbon emission regulations, increasing carbon pricing mechanisms, growing corporate sustainability commitments, and technological advancements reducing the cost of CO2 conversion. The European Union's Carbon Border Adjustment Mechanism and similar policies worldwide are creating strong financial incentives for industries to adopt carbon capture and utilization technologies.

Market challenges primarily revolve around high capital costs, energy intensity of conversion processes, and competition from established fossil-based production routes. The average payback period for industrial-scale CO2 conversion facilities currently ranges from 5-8 years, which remains a significant barrier to widespread adoption.

Consumer demand for green products is also influencing market dynamics, with 68% of global consumers expressing willingness to pay premium prices for products manufactured using carbon-neutral or carbon-negative processes. This trend is particularly pronounced in developed economies and among younger demographic segments.

Electrocatalytic CO2 valorization represents one of the most promising segments within this market, accounting for roughly 23% of the total market share. This technology offers dual benefits of reducing greenhouse gas emissions while simultaneously producing value-added chemicals and fuels, creating a compelling economic case for adoption across various industries.

Regional analysis reveals that North America currently leads the market with approximately 35% share, followed by Europe (30%) and Asia-Pacific (25%). However, the Asia-Pacific region is expected to witness the highest growth rate in the coming years due to aggressive carbon neutrality targets set by countries like China and Japan, coupled with substantial investments in renewable energy infrastructure.

Industry-wise, the chemical manufacturing sector remains the largest end-user of CO2 conversion technologies, accounting for 42% of market applications. Other significant sectors include energy production (28%), transportation fuels (15%), and pharmaceuticals (8%). The remaining 7% is distributed across various niche applications including food processing and agriculture.

Key market drivers include stringent carbon emission regulations, increasing carbon pricing mechanisms, growing corporate sustainability commitments, and technological advancements reducing the cost of CO2 conversion. The European Union's Carbon Border Adjustment Mechanism and similar policies worldwide are creating strong financial incentives for industries to adopt carbon capture and utilization technologies.

Market challenges primarily revolve around high capital costs, energy intensity of conversion processes, and competition from established fossil-based production routes. The average payback period for industrial-scale CO2 conversion facilities currently ranges from 5-8 years, which remains a significant barrier to widespread adoption.

Consumer demand for green products is also influencing market dynamics, with 68% of global consumers expressing willingness to pay premium prices for products manufactured using carbon-neutral or carbon-negative processes. This trend is particularly pronounced in developed economies and among younger demographic segments.

Global Patent Landscape and Technical Barriers

The global patent landscape for electrocatalytic CO2 valorization has witnessed exponential growth over the past decade, reflecting the increasing importance of carbon capture and utilization technologies in addressing climate change. Patent filings have surged particularly in the United States, China, Japan, and the European Union, with China demonstrating the most aggressive growth trajectory since 2015. This geographical distribution aligns with regions investing heavily in renewable energy infrastructure and carbon neutrality commitments.

Analysis of patent ownership reveals a diverse ecosystem of stakeholders. Academic institutions and national laboratories account for approximately 40% of patent filings, particularly in fundamental catalyst design and reaction mechanisms. Multinational corporations, especially those in the chemical, energy, and materials sectors, hold about 35% of patents, focusing on scalable systems and integration with existing industrial processes. The remaining 25% is distributed among startups and SMEs, often specializing in niche applications or novel reactor designs.

Technical barriers identified through patent analysis highlight several persistent challenges. Catalyst selectivity remains a primary obstacle, with patents revealing ongoing struggles to achieve high faradaic efficiency for specific value-added products while minimizing unwanted side reactions. Most commercial catalysts still demonstrate selectivity below 80% for target products, significantly impacting economic viability. Patent trends show increasing focus on bimetallic and multi-component catalyst systems to address this limitation.

Energy efficiency represents another major barrier, with current systems requiring excessive electrical input relative to the value of products generated. Patents in this domain increasingly incorporate renewable energy integration strategies and advanced electrode designs to reduce overall energy consumption. Recent innovations focus on lowering overpotentials through precise nanostructuring and interface engineering of catalytic surfaces.

Stability and durability of catalytic systems emerge as critical challenges in industrial implementation. Patent data indicates that most laboratory-scale catalysts demonstrate significant performance degradation after 100-200 hours of operation. Recent patent applications increasingly address this through protective coatings, self-healing mechanisms, and regeneration protocols for extended catalyst lifetimes.

Scale-up and system integration patents have seen the most substantial growth in the past three years, indicating a shift from fundamental catalyst discovery toward practical implementation. These patents frequently address reactor design, mass transport limitations, and integration with existing industrial infrastructure, suggesting the technology is progressing toward commercial readiness despite remaining technical barriers.

Analysis of patent ownership reveals a diverse ecosystem of stakeholders. Academic institutions and national laboratories account for approximately 40% of patent filings, particularly in fundamental catalyst design and reaction mechanisms. Multinational corporations, especially those in the chemical, energy, and materials sectors, hold about 35% of patents, focusing on scalable systems and integration with existing industrial processes. The remaining 25% is distributed among startups and SMEs, often specializing in niche applications or novel reactor designs.

Technical barriers identified through patent analysis highlight several persistent challenges. Catalyst selectivity remains a primary obstacle, with patents revealing ongoing struggles to achieve high faradaic efficiency for specific value-added products while minimizing unwanted side reactions. Most commercial catalysts still demonstrate selectivity below 80% for target products, significantly impacting economic viability. Patent trends show increasing focus on bimetallic and multi-component catalyst systems to address this limitation.

Energy efficiency represents another major barrier, with current systems requiring excessive electrical input relative to the value of products generated. Patents in this domain increasingly incorporate renewable energy integration strategies and advanced electrode designs to reduce overall energy consumption. Recent innovations focus on lowering overpotentials through precise nanostructuring and interface engineering of catalytic surfaces.

Stability and durability of catalytic systems emerge as critical challenges in industrial implementation. Patent data indicates that most laboratory-scale catalysts demonstrate significant performance degradation after 100-200 hours of operation. Recent patent applications increasingly address this through protective coatings, self-healing mechanisms, and regeneration protocols for extended catalyst lifetimes.

Scale-up and system integration patents have seen the most substantial growth in the past three years, indicating a shift from fundamental catalyst discovery toward practical implementation. These patents frequently address reactor design, mass transport limitations, and integration with existing industrial infrastructure, suggesting the technology is progressing toward commercial readiness despite remaining technical barriers.

Current Patented Electrocatalytic Solutions

01 Metal-based catalysts for CO2 electroreduction

Metal-based catalysts play a crucial role in the electrochemical reduction of CO2 to valuable products. Various metals such as copper, silver, gold, and their alloys exhibit different selectivity toward specific products like carbon monoxide, formic acid, methanol, and hydrocarbons. The catalytic performance can be enhanced by controlling the morphology, particle size, and surface structure of these metal catalysts, leading to improved efficiency and selectivity in CO2 valorization processes.- Metal-based catalysts for CO2 electroreduction: Various metal-based catalysts can be employed for the electrochemical reduction of CO2 to valuable products. These catalysts include transition metals, metal alloys, and metal oxides that facilitate the conversion of CO2 to compounds such as carbon monoxide, formic acid, methanol, and hydrocarbons. The catalytic performance can be enhanced by controlling the morphology, particle size, and surface structure of the metal catalysts to improve selectivity and efficiency in CO2 valorization processes.

- Carbon-based electrocatalysts for CO2 conversion: Carbon-based materials serve as effective electrocatalysts for CO2 reduction reactions. These include carbon nanotubes, graphene, carbon quantum dots, and nitrogen-doped carbon materials. The high surface area, excellent electrical conductivity, and tunable surface properties of carbon-based catalysts make them promising candidates for CO2 valorization. Functionalization of carbon materials with heteroatoms or metal nanoparticles can further enhance their catalytic activity and selectivity toward specific CO2 reduction products.

- Reactor design and system optimization for CO2 electroreduction: The design of electrochemical reactors and system optimization play crucial roles in enhancing the efficiency of CO2 valorization processes. Factors such as electrode configuration, electrolyte composition, membrane selection, and operating conditions (temperature, pressure, pH) significantly impact the performance of CO2 electroreduction systems. Advanced reactor designs, including flow cells, gas diffusion electrodes, and microfluidic systems, can improve mass transfer, reduce energy consumption, and increase product yield and selectivity.

- Hybrid and composite catalysts for enhanced CO2 conversion: Hybrid and composite catalysts combine different materials to achieve synergistic effects in CO2 electroreduction. These may include metal-organic frameworks (MOFs), metal-carbon composites, bimetallic catalysts, and oxide-supported metal catalysts. The integration of multiple components can enhance catalytic activity, stability, and selectivity by providing complementary functionalities. These hybrid systems often demonstrate improved performance in terms of conversion efficiency, product selectivity, and catalyst durability compared to single-component catalysts.

- Process integration and sustainable approaches for CO2 valorization: Integrating CO2 electroreduction with other processes can enhance overall efficiency and sustainability. This includes coupling with renewable energy sources, combining electrochemical and biological systems, and developing closed-loop processes for carbon utilization. Sustainable approaches focus on using earth-abundant materials, minimizing waste generation, and reducing energy consumption. Life cycle assessment and techno-economic analysis are employed to evaluate the environmental impact and economic viability of different CO2 valorization strategies.

02 Carbon-based electrocatalysts for CO2 conversion

Carbon-based materials serve as effective electrocatalysts for CO2 reduction due to their high surface area, excellent conductivity, and tunable surface chemistry. These include carbon nanotubes, graphene, carbon quantum dots, and nitrogen-doped carbon materials. The incorporation of heteroatoms like nitrogen, sulfur, or phosphorus into carbon frameworks creates active sites that facilitate CO2 adsorption and activation, enhancing the catalytic performance for converting CO2 into value-added chemicals and fuels.Expand Specific Solutions03 Reactor design and system integration for CO2 electroreduction

Advanced reactor designs and integrated systems are essential for scaling up electrocatalytic CO2 valorization processes. These include flow cells, gas diffusion electrodes, and membrane electrode assemblies that enhance mass transport and reaction kinetics. System integration focuses on optimizing electrolyte composition, electrode configuration, and operating conditions such as temperature, pressure, and applied potential to maximize conversion efficiency and product selectivity while minimizing energy consumption.Expand Specific Solutions04 Bimetallic and multi-component catalysts for selective CO2 reduction

Bimetallic and multi-component catalysts offer enhanced performance in CO2 electroreduction through synergistic effects between different metals or components. These catalysts can be designed with core-shell structures, alloys, or supported configurations to optimize the binding energies of reaction intermediates. The combination of metals with complementary properties allows for tuning the selectivity toward specific high-value products while improving stability and reducing overpotential requirements.Expand Specific Solutions05 Process intensification and product separation techniques

Process intensification strategies and efficient product separation techniques are critical for practical implementation of CO2 electroreduction technologies. These include continuous flow processes, in-situ product separation, and integrated capture-conversion systems that reduce energy consumption and improve overall process economics. Advanced separation methods such as membrane technology, pressure swing adsorption, and cryogenic distillation enable the recovery of high-purity products from complex reaction mixtures, facilitating the commercial viability of CO2 valorization processes.Expand Specific Solutions

Leading Patent Holders and Industry Competitors

Electrocatalytic CO2 valorization is currently in an early growth phase, with the market expected to expand significantly due to increasing focus on carbon neutrality technologies. The competitive landscape features a mix of academic institutions (MIT, University of Toronto, Zhejiang University), established industrial players (Siemens AG, TotalEnergies, Honda Motor), and emerging specialized companies (Dioxide Materials, Prometheus Fuels, Sublime Systems). Technical maturity varies considerably across applications, with most technologies at TRL 3-6. Leading research institutions like MIT and Dalian Institute of Chemical Physics are advancing fundamental catalysis science, while companies like Siemens and China Petroleum & Chemical Corp are focusing on scaling up promising technologies for industrial implementation. The field is characterized by intense patent activity as organizations position themselves in this strategically important clean energy domain.

Dioxide Materials, Inc.

Technical Solution: Dioxide Materials has developed advanced electrocatalysts specifically designed for CO2 reduction to valuable products like carbon monoxide and formic acid. Their patented technology utilizes ionic liquid-based systems with silver and bismuth-based catalysts that operate at low overpotentials. The company has pioneered the development of anion exchange membranes (AEMs) that enable efficient CO2 electrolysis at industrial scales. Their electrolyzer designs incorporate novel electrode architectures that maximize the three-phase boundary where CO2, catalyst, and electrolyte interact, significantly improving conversion efficiency. Dioxide Materials' systems can achieve Faradaic efficiencies exceeding 95% for CO production and operate at current densities above 150 mA/cm², making them commercially viable for industrial applications.

Strengths: Highly specialized in CO2 electrocatalysis with proprietary membrane technology that reduces energy requirements; demonstrated scalability potential for industrial applications. Weaknesses: Limited product portfolio compared to larger competitors; higher capital costs for initial system deployment compared to conventional carbon capture technologies.

China Petroleum & Chemical Corp.

Technical Solution: China Petroleum & Chemical Corp. (Sinopec) has developed proprietary electrocatalytic systems for CO2 conversion that integrate with their existing petrochemical infrastructure. Their technology focuses on copper-based catalysts modified with nitrogen-doped carbon supports to enhance selectivity toward multi-carbon products like ethylene and ethanol. Sinopec's approach combines traditional heterogeneous catalysis expertise with electrochemical methods, creating hybrid systems that can operate at industrial scales. Their patents cover novel reactor designs that address mass transport limitations in CO2 reduction reactions, including pressurized systems that increase CO2 solubility in the electrolyte. Sinopec has also developed integrated processes that couple CO2 capture from their refinery operations directly with electrochemical conversion units, creating a closed carbon cycle within their facilities.

Strengths: Extensive industrial infrastructure that facilitates rapid scaling and implementation; significant financial resources for R&D; ability to integrate CO2 valorization directly into existing petrochemical value chains. Weaknesses: Primary focus remains on traditional fossil fuel business; electrocatalytic technologies still secondary to core operations; less specialized in advanced materials compared to research-focused organizations.

Key Patent Innovations and Technical Breakthroughs

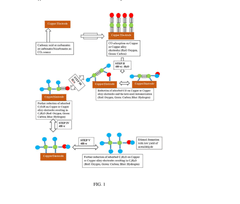

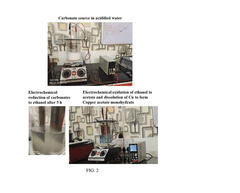

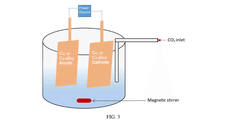

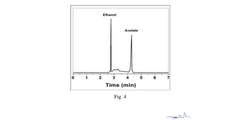

Electrochemical conversion of carbon dioxide into value-added products

PatentActiveIN202442017597A

Innovation

- The method employs an electrochemical reactor with metallic Copper (Cu) or Cu-alloy symmetric electrodes and acidified water as electrolyte, achieving high FE and EE through asymmetric C-C coupling on the cathode surface, forming short-lived cation radical intermediates that react to produce ethanol and other value-added products.

Electrocatalytic process for carbon dioxide conversion

PatentWO2017176600A1

Innovation

- A novel catalyst combination featuring a Catalytically Active Element with particle sizes between 0.6 nm and 100 nm, supported or unsupported, and a Helper Polymer with positively charged cyclic amine groups, such as imidazoliums or pyridiniums, is used in the cathode catalyst layer of an electrochemical cell to enhance reaction rates and efficiencies.

Intellectual Property Strategy and Protection

In the rapidly evolving field of electrocatalytic CO2 valorization, intellectual property protection has become a critical strategic consideration for both academic institutions and industrial players. Patent activity in this domain has seen exponential growth over the past decade, with major innovation hubs emerging in North America, Europe, and East Asia. The patent landscape reveals concentrated efforts around novel catalyst materials, particularly transition metal-based catalysts and carbon-supported structures that demonstrate enhanced selectivity and efficiency.

Strategic patent filing approaches in this field typically follow two distinct patterns: broad foundational patents covering basic technological principles and more specific patents addressing particular catalyst formulations or process optimizations. Leading companies like Siemens, BASF, and Shell have established robust patent portfolios that create significant barriers to entry for newcomers, while simultaneously securing their freedom to operate in this promising green technology space.

Patent analysis reveals several key technology clusters where IP protection is particularly dense: copper-based catalyst systems, metal-organic frameworks for CO2 reduction, and integrated reactor designs that combine capture and conversion processes. These clusters represent areas where licensing opportunities may be limited due to strong protection, suggesting that new entrants should consider alternative technological approaches or seek strategic partnerships with patent holders.

For organizations pursuing research in electrocatalytic CO2 valorization, a comprehensive IP strategy should include regular freedom-to-operate analyses, strategic patent mapping to identify white space opportunities, and defensive publication strategies for non-core innovations. Additionally, cross-licensing agreements have emerged as an effective mechanism for technology exchange in this field, particularly between catalyst developers and system integrators.

Geographic patterns in patent protection show interesting trends, with broader protection sought in industrialized nations with established carbon reduction policies, while emerging economies are often considered secondary markets. This creates potential opportunities for technology deployment in regions with less restrictive IP landscapes, particularly for pilot-scale implementations and market testing.

The time-limited nature of patent protection also creates a dynamic landscape where older foundational patents for CO2 electroreduction are beginning to expire, potentially opening new commercialization pathways for technologies that were previously restricted. Organizations should carefully monitor these expirations as they may significantly alter the competitive landscape in the coming years.

Strategic patent filing approaches in this field typically follow two distinct patterns: broad foundational patents covering basic technological principles and more specific patents addressing particular catalyst formulations or process optimizations. Leading companies like Siemens, BASF, and Shell have established robust patent portfolios that create significant barriers to entry for newcomers, while simultaneously securing their freedom to operate in this promising green technology space.

Patent analysis reveals several key technology clusters where IP protection is particularly dense: copper-based catalyst systems, metal-organic frameworks for CO2 reduction, and integrated reactor designs that combine capture and conversion processes. These clusters represent areas where licensing opportunities may be limited due to strong protection, suggesting that new entrants should consider alternative technological approaches or seek strategic partnerships with patent holders.

For organizations pursuing research in electrocatalytic CO2 valorization, a comprehensive IP strategy should include regular freedom-to-operate analyses, strategic patent mapping to identify white space opportunities, and defensive publication strategies for non-core innovations. Additionally, cross-licensing agreements have emerged as an effective mechanism for technology exchange in this field, particularly between catalyst developers and system integrators.

Geographic patterns in patent protection show interesting trends, with broader protection sought in industrialized nations with established carbon reduction policies, while emerging economies are often considered secondary markets. This creates potential opportunities for technology deployment in regions with less restrictive IP landscapes, particularly for pilot-scale implementations and market testing.

The time-limited nature of patent protection also creates a dynamic landscape where older foundational patents for CO2 electroreduction are beginning to expire, potentially opening new commercialization pathways for technologies that were previously restricted. Organizations should carefully monitor these expirations as they may significantly alter the competitive landscape in the coming years.

Regulatory Framework for Carbon Utilization Technologies

The regulatory landscape for carbon utilization technologies, particularly in electrocatalytic CO2 valorization, has evolved significantly in recent years as governments worldwide recognize the urgent need to address climate change. The Paris Agreement serves as the foundational international framework, establishing commitments to limit global warming and encouraging the development of carbon capture and utilization technologies. Within this context, electrocatalytic CO2 conversion has gained regulatory attention as a promising pathway for carbon neutrality.

In the United States, the 45Q tax credit provides substantial financial incentives for carbon capture, utilization, and storage (CCUS) projects, offering up to $50 per metric ton of CO2 utilized in industrial processes. The Inflation Reduction Act of 2022 further expanded these incentives, increasing credit values and lowering capture thresholds, thereby making electrocatalytic CO2 valorization projects more economically viable. The Department of Energy also maintains regulatory oversight through its Carbon Utilization Program, which establishes technical standards for conversion efficiency and product purity.

The European Union has implemented the Innovation Fund, allocating substantial resources to innovative low-carbon technologies including electrocatalytic processes. The EU Emissions Trading System (ETS) provides a market-based approach to carbon pricing, creating economic incentives for CO2 utilization. Additionally, the European Commission's Circular Economy Action Plan explicitly recognizes CO2 as a valuable feedstock, establishing a regulatory pathway for products derived from carbon conversion technologies.

In Asia, China has incorporated carbon utilization into its 14th Five-Year Plan, with specific provisions for electrocatalytic technologies in its national carbon trading scheme. Japan's Green Innovation Fund allocates significant resources to carbon recycling technologies, with regulatory frameworks that facilitate the commercialization of CO2-derived products. South Korea has established the K-ETS (Korean Emissions Trading Scheme) with provisions specifically addressing carbon utilization technologies.

Patent protection for electrocatalytic CO2 valorization technologies faces unique regulatory challenges. Many jurisdictions are adapting intellectual property frameworks to address the novelty requirements for catalysts and processes. The European Patent Office has issued specific examination guidelines for climate change mitigation technologies, while the USPTO has established the Climate Change Mitigation Pilot Program to expedite examination of patent applications related to carbon utilization technologies.

Standardization efforts are emerging through organizations like ISO and ASTM International, which are developing technical standards for measuring and verifying CO2 conversion efficiency and product quality. These standards are increasingly referenced in regulatory frameworks, creating a harmonized approach to technology assessment and compliance verification across different jurisdictions.

In the United States, the 45Q tax credit provides substantial financial incentives for carbon capture, utilization, and storage (CCUS) projects, offering up to $50 per metric ton of CO2 utilized in industrial processes. The Inflation Reduction Act of 2022 further expanded these incentives, increasing credit values and lowering capture thresholds, thereby making electrocatalytic CO2 valorization projects more economically viable. The Department of Energy also maintains regulatory oversight through its Carbon Utilization Program, which establishes technical standards for conversion efficiency and product purity.

The European Union has implemented the Innovation Fund, allocating substantial resources to innovative low-carbon technologies including electrocatalytic processes. The EU Emissions Trading System (ETS) provides a market-based approach to carbon pricing, creating economic incentives for CO2 utilization. Additionally, the European Commission's Circular Economy Action Plan explicitly recognizes CO2 as a valuable feedstock, establishing a regulatory pathway for products derived from carbon conversion technologies.

In Asia, China has incorporated carbon utilization into its 14th Five-Year Plan, with specific provisions for electrocatalytic technologies in its national carbon trading scheme. Japan's Green Innovation Fund allocates significant resources to carbon recycling technologies, with regulatory frameworks that facilitate the commercialization of CO2-derived products. South Korea has established the K-ETS (Korean Emissions Trading Scheme) with provisions specifically addressing carbon utilization technologies.

Patent protection for electrocatalytic CO2 valorization technologies faces unique regulatory challenges. Many jurisdictions are adapting intellectual property frameworks to address the novelty requirements for catalysts and processes. The European Patent Office has issued specific examination guidelines for climate change mitigation technologies, while the USPTO has established the Climate Change Mitigation Pilot Program to expedite examination of patent applications related to carbon utilization technologies.

Standardization efforts are emerging through organizations like ISO and ASTM International, which are developing technical standards for measuring and verifying CO2 conversion efficiency and product quality. These standards are increasingly referenced in regulatory frameworks, creating a harmonized approach to technology assessment and compliance verification across different jurisdictions.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!