Technological Patents in Electrocatalytic CO2 Valorization

OCT 23, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Electrocatalytic CO2 Valorization Background and Objectives

Carbon dioxide (CO2) valorization represents a critical technological frontier in addressing climate change while simultaneously creating economic value. Electrocatalytic CO2 conversion has emerged as a particularly promising approach, evolving from early theoretical concepts in the 1980s to increasingly practical applications in recent decades. This technology leverages renewable electricity to transform CO2 waste into valuable chemicals and fuels, offering a dual benefit of carbon utilization and renewable energy storage.

The historical trajectory of electrocatalytic CO2 valorization shows significant acceleration since 2010, with breakthrough developments in catalyst design, reactor engineering, and process integration. Early research focused primarily on fundamental electrochemical mechanisms, while contemporary work has expanded to include industrial scalability and economic viability considerations. Patent activity in this field has grown exponentially, with annual filings increasing by approximately 300% between 2015 and 2022.

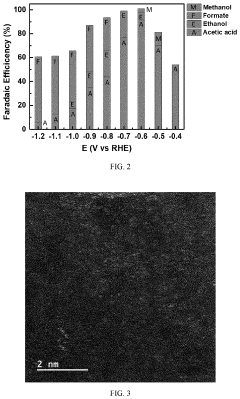

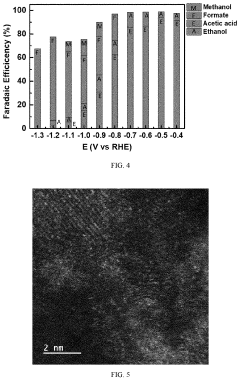

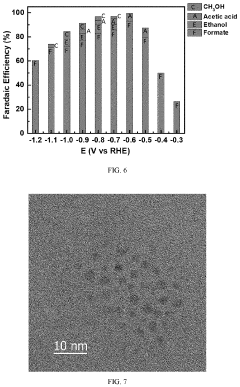

Current technological objectives center on addressing several critical challenges. First, improving catalyst selectivity to achieve product specificity above 90% for target molecules such as ethylene, ethanol, and formic acid. Second, enhancing energy efficiency to reduce the electrical input required per unit of product, with targets of exceeding 50% Faradaic efficiency for multi-carbon products. Third, extending catalyst stability from hours to thousands of hours to enable commercial viability.

The technology evolution pathway indicates a shift from copper-based catalysts toward more complex bimetallic and metal-organic framework catalysts. Concurrently, reactor designs have progressed from simple H-cells to more sophisticated flow cells and gas diffusion electrode systems that significantly improve mass transport limitations.

Patent landscapes reveal concentrated activity in three main application areas: conversion to formic acid and formates (primarily for chemical feedstocks), conversion to carbon monoxide (for syngas applications), and direct conversion to multi-carbon products (for fuels and high-value chemicals). Geographic distribution of patent activity shows leadership from the United States, China, Japan, and Germany, with emerging contributions from South Korea and Canada.

The ultimate technological goal is to develop integrated systems capable of converting CO2 at industrial scales with minimal energy input, high selectivity, and long-term stability. Success would enable circular carbon economy models where CO2 emissions become valuable feedstocks rather than waste products, potentially revolutionizing both energy systems and chemical manufacturing industries.

The historical trajectory of electrocatalytic CO2 valorization shows significant acceleration since 2010, with breakthrough developments in catalyst design, reactor engineering, and process integration. Early research focused primarily on fundamental electrochemical mechanisms, while contemporary work has expanded to include industrial scalability and economic viability considerations. Patent activity in this field has grown exponentially, with annual filings increasing by approximately 300% between 2015 and 2022.

Current technological objectives center on addressing several critical challenges. First, improving catalyst selectivity to achieve product specificity above 90% for target molecules such as ethylene, ethanol, and formic acid. Second, enhancing energy efficiency to reduce the electrical input required per unit of product, with targets of exceeding 50% Faradaic efficiency for multi-carbon products. Third, extending catalyst stability from hours to thousands of hours to enable commercial viability.

The technology evolution pathway indicates a shift from copper-based catalysts toward more complex bimetallic and metal-organic framework catalysts. Concurrently, reactor designs have progressed from simple H-cells to more sophisticated flow cells and gas diffusion electrode systems that significantly improve mass transport limitations.

Patent landscapes reveal concentrated activity in three main application areas: conversion to formic acid and formates (primarily for chemical feedstocks), conversion to carbon monoxide (for syngas applications), and direct conversion to multi-carbon products (for fuels and high-value chemicals). Geographic distribution of patent activity shows leadership from the United States, China, Japan, and Germany, with emerging contributions from South Korea and Canada.

The ultimate technological goal is to develop integrated systems capable of converting CO2 at industrial scales with minimal energy input, high selectivity, and long-term stability. Success would enable circular carbon economy models where CO2 emissions become valuable feedstocks rather than waste products, potentially revolutionizing both energy systems and chemical manufacturing industries.

Market Analysis for CO2 Conversion Technologies

The global market for CO2 conversion technologies is experiencing significant growth, driven by increasing environmental concerns and regulatory pressures to reduce carbon emissions. The market size for CO2 utilization technologies was valued at approximately $2.5 billion in 2022 and is projected to reach $8.6 billion by 2030, growing at a CAGR of 16.8% during the forecast period. This growth trajectory is supported by substantial investments from both public and private sectors, with government funding for carbon capture and utilization projects exceeding $4.7 billion globally in 2022.

Electrocatalytic CO2 valorization represents a particularly promising segment within this market, with an estimated market share of 23% among all CO2 conversion technologies. The technology enables the transformation of carbon dioxide into value-added products such as carbon monoxide, formic acid, methanol, ethylene, and other hydrocarbons, creating economic incentives for carbon capture while simultaneously addressing environmental concerns.

Key market drivers include increasingly stringent carbon emission regulations across major economies, rising carbon pricing mechanisms, and growing corporate commitments to carbon neutrality. The European Union's Carbon Border Adjustment Mechanism and similar policies in North America and Asia are creating favorable market conditions for CO2 conversion technologies by internalizing the cost of carbon emissions.

Market segmentation reveals distinct application sectors for electrocatalytic CO2 valorization products. The chemical industry represents the largest market segment (42%), followed by fuel production (27%), pharmaceuticals (18%), and other applications (13%). Geographically, North America currently leads the market with 38% share, followed by Europe (32%), Asia-Pacific (24%), and rest of the world (6%). However, the Asia-Pacific region is expected to witness the fastest growth rate of 19.2% during the forecast period, primarily driven by China's aggressive decarbonization targets.

Consumer demand patterns indicate increasing preference for products with lower carbon footprints, with 67% of global consumers expressing willingness to pay premium prices for environmentally sustainable products. This trend is particularly pronounced in developed economies, creating market pull for CO2-derived materials and fuels.

The competitive landscape features both established chemical companies and innovative startups. Major chemical corporations are integrating CO2 conversion technologies into their sustainability strategies, while venture capital funding for startups in this space reached $1.8 billion in 2022, a 35% increase from the previous year. This influx of capital is accelerating commercialization efforts and technological advancement in the field of electrocatalytic CO2 valorization.

Electrocatalytic CO2 valorization represents a particularly promising segment within this market, with an estimated market share of 23% among all CO2 conversion technologies. The technology enables the transformation of carbon dioxide into value-added products such as carbon monoxide, formic acid, methanol, ethylene, and other hydrocarbons, creating economic incentives for carbon capture while simultaneously addressing environmental concerns.

Key market drivers include increasingly stringent carbon emission regulations across major economies, rising carbon pricing mechanisms, and growing corporate commitments to carbon neutrality. The European Union's Carbon Border Adjustment Mechanism and similar policies in North America and Asia are creating favorable market conditions for CO2 conversion technologies by internalizing the cost of carbon emissions.

Market segmentation reveals distinct application sectors for electrocatalytic CO2 valorization products. The chemical industry represents the largest market segment (42%), followed by fuel production (27%), pharmaceuticals (18%), and other applications (13%). Geographically, North America currently leads the market with 38% share, followed by Europe (32%), Asia-Pacific (24%), and rest of the world (6%). However, the Asia-Pacific region is expected to witness the fastest growth rate of 19.2% during the forecast period, primarily driven by China's aggressive decarbonization targets.

Consumer demand patterns indicate increasing preference for products with lower carbon footprints, with 67% of global consumers expressing willingness to pay premium prices for environmentally sustainable products. This trend is particularly pronounced in developed economies, creating market pull for CO2-derived materials and fuels.

The competitive landscape features both established chemical companies and innovative startups. Major chemical corporations are integrating CO2 conversion technologies into their sustainability strategies, while venture capital funding for startups in this space reached $1.8 billion in 2022, a 35% increase from the previous year. This influx of capital is accelerating commercialization efforts and technological advancement in the field of electrocatalytic CO2 valorization.

Global Landscape of CO2 Electrocatalysis Patents

The global landscape of CO2 electrocatalysis patents has evolved significantly over the past decade, reflecting the growing importance of carbon dioxide utilization technologies in addressing climate change. Patent activity in this field has shown exponential growth since 2010, with a particularly sharp increase observed between 2015-2020, indicating accelerated research and development efforts worldwide.

Geographically, patent filings demonstrate distinct regional concentrations. China has emerged as the dominant player, accounting for approximately 45% of global patents in CO2 electrocatalysis, followed by the United States (22%), Japan (12%), South Korea (8%), and the European Union (10%). This distribution highlights Asia's significant investment in carbon utilization technologies, potentially positioning the region as the future manufacturing hub for related products.

The institutional landscape reveals a balanced mix of academic and industrial patent holders. Leading universities such as MIT, Stanford, Tsinghua University, and the University of Tokyo contribute significantly to fundamental catalyst innovations. Meanwhile, industrial giants including Siemens, BASF, Mitsubishi, and emerging startups like Carbon Clean Solutions and Dioxide Materials focus on system integration and scalability aspects.

Patent content analysis shows several technological clusters. Catalyst development represents the largest segment (38%), with particular emphasis on novel materials including metal-organic frameworks, doped carbon structures, and bimetallic catalysts. Reactor design patents constitute approximately 25% of filings, focusing on flow cell configurations, membrane electrode assemblies, and gas diffusion electrodes. System integration patents (20%) address scale-up challenges, while process optimization patents (17%) focus on enhancing selectivity and efficiency.

Temporal analysis of patent filings reveals evolving technological priorities. Early patents (2010-2015) primarily focused on fundamental catalyst discovery, while more recent filings (2016-present) demonstrate increased attention to practical implementation challenges such as stability, selectivity, and economic viability. This shift indicates the technology's progression toward commercial readiness.

Cross-licensing patterns and collaborative patents have increased by 35% since 2018, suggesting growing industry recognition of the need for complementary expertise in bringing CO2 electrocatalysis technologies to market. Notable collaborations include partnerships between catalyst developers and engineering firms specializing in electrochemical systems.

The patent landscape also reveals emerging geographical specializations, with Chinese patents showing strength in catalyst materials, German patents focusing on system engineering, and U.S. patents emphasizing novel reactor designs and control systems. This specialization pattern may influence future supply chain development and technology transfer pathways in the industry.

Geographically, patent filings demonstrate distinct regional concentrations. China has emerged as the dominant player, accounting for approximately 45% of global patents in CO2 electrocatalysis, followed by the United States (22%), Japan (12%), South Korea (8%), and the European Union (10%). This distribution highlights Asia's significant investment in carbon utilization technologies, potentially positioning the region as the future manufacturing hub for related products.

The institutional landscape reveals a balanced mix of academic and industrial patent holders. Leading universities such as MIT, Stanford, Tsinghua University, and the University of Tokyo contribute significantly to fundamental catalyst innovations. Meanwhile, industrial giants including Siemens, BASF, Mitsubishi, and emerging startups like Carbon Clean Solutions and Dioxide Materials focus on system integration and scalability aspects.

Patent content analysis shows several technological clusters. Catalyst development represents the largest segment (38%), with particular emphasis on novel materials including metal-organic frameworks, doped carbon structures, and bimetallic catalysts. Reactor design patents constitute approximately 25% of filings, focusing on flow cell configurations, membrane electrode assemblies, and gas diffusion electrodes. System integration patents (20%) address scale-up challenges, while process optimization patents (17%) focus on enhancing selectivity and efficiency.

Temporal analysis of patent filings reveals evolving technological priorities. Early patents (2010-2015) primarily focused on fundamental catalyst discovery, while more recent filings (2016-present) demonstrate increased attention to practical implementation challenges such as stability, selectivity, and economic viability. This shift indicates the technology's progression toward commercial readiness.

Cross-licensing patterns and collaborative patents have increased by 35% since 2018, suggesting growing industry recognition of the need for complementary expertise in bringing CO2 electrocatalysis technologies to market. Notable collaborations include partnerships between catalyst developers and engineering firms specializing in electrochemical systems.

The patent landscape also reveals emerging geographical specializations, with Chinese patents showing strength in catalyst materials, German patents focusing on system engineering, and U.S. patents emphasizing novel reactor designs and control systems. This specialization pattern may influence future supply chain development and technology transfer pathways in the industry.

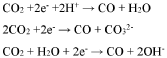

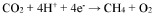

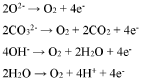

Current Electrocatalytic Approaches for CO2 Reduction

01 Metal-based catalysts for CO2 electroreduction

Metal-based catalysts play a crucial role in the electrochemical reduction of CO2 to valuable products. Various metals such as copper, silver, gold, and their alloys exhibit different selectivity toward specific products like carbon monoxide, formic acid, methanol, or hydrocarbons. The catalytic performance can be enhanced by controlling the morphology, particle size, and surface structure of these metal catalysts, leading to improved efficiency and selectivity in CO2 valorization processes.- Metal-based catalysts for CO2 electroreduction: Metal-based catalysts play a crucial role in the electrochemical reduction of CO2 to valuable products. Various metals such as copper, silver, gold, and their alloys exhibit different selectivity and efficiency for converting CO2 into specific products like carbon monoxide, formic acid, methanol, or hydrocarbons. These catalysts can be optimized through nanostructuring, alloying, or surface modification to enhance their catalytic performance, stability, and product selectivity in the electrocatalytic valorization of CO2.

- Carbon-based electrocatalysts for CO2 conversion: Carbon-based materials serve as effective electrocatalysts or catalyst supports for CO2 reduction reactions. These include graphene, carbon nanotubes, nitrogen-doped carbon, and carbon quantum dots. The advantages of carbon-based catalysts include high surface area, excellent electrical conductivity, tunable surface chemistry, and cost-effectiveness. Functionalization of carbon materials with heteroatoms or metal particles can significantly enhance their catalytic activity and selectivity toward specific CO2 reduction products.

- Reactor design and system integration for CO2 electroreduction: The design of electrochemical reactors and their integration into complete systems is critical for efficient CO2 valorization. Advanced reactor configurations include flow cells, gas diffusion electrodes, and membrane electrode assemblies that address mass transport limitations and improve energy efficiency. System integration involves coupling CO2 capture with electroreduction, managing heat and product separation, and optimizing operating conditions such as temperature, pressure, and electrolyte composition to maximize conversion efficiency and product yield.

- Electrolyte engineering for enhanced CO2 reduction: The composition and properties of electrolytes significantly influence the performance of CO2 electroreduction processes. Innovations in electrolyte engineering include the development of ionic liquids, deep eutectic solvents, and modified aqueous solutions with specific additives. These advanced electrolytes can enhance CO2 solubility, stabilize reaction intermediates, suppress competing hydrogen evolution reactions, and direct selectivity toward desired products, thereby improving the overall efficiency of the electrocatalytic CO2 valorization process.

- Process intensification and scale-up strategies: Process intensification and scale-up are essential for transitioning CO2 electroreduction technologies from laboratory to industrial applications. This involves developing high-throughput electrode materials, optimizing current density and energy consumption, and designing modular and scalable electrochemical cells. Strategies include continuous flow processes, cascade reaction systems, and integration with renewable energy sources to ensure economic viability and sustainability of the CO2 valorization process at commercial scale.

02 Carbon-based electrocatalysts for CO2 conversion

Carbon-based materials serve as effective electrocatalysts for CO2 reduction reactions. These include carbon nanotubes, graphene, carbon quantum dots, and nitrogen-doped carbon materials. The high surface area, excellent electrical conductivity, and tunable surface chemistry of these carbon-based catalysts make them promising candidates for CO2 valorization. Functionalization with heteroatoms or metal nanoparticles can further enhance their catalytic activity and selectivity toward specific value-added products.Expand Specific Solutions03 Reactor design and system optimization for CO2 electroreduction

The design of electrochemical reactors and optimization of operating conditions significantly impact the efficiency of CO2 valorization processes. Advanced reactor configurations, including flow cells, gas diffusion electrodes, and membrane electrode assemblies, can enhance mass transfer and reaction kinetics. System parameters such as electrolyte composition, pH, temperature, pressure, and applied potential need to be carefully optimized to achieve high conversion rates, energy efficiency, and product selectivity in electrocatalytic CO2 reduction.Expand Specific Solutions04 Novel electrolyte systems for enhanced CO2 reduction

Innovative electrolyte systems play a vital role in improving the performance of CO2 electroreduction processes. These include ionic liquids, deep eutectic solvents, and modified aqueous solutions with specific additives. Advanced electrolytes can enhance CO2 solubility, stabilize reaction intermediates, suppress competing hydrogen evolution reactions, and facilitate product separation. The development of electrolyte systems with high conductivity and appropriate pH buffering capacity contributes significantly to the efficiency and selectivity of electrocatalytic CO2 valorization.Expand Specific Solutions05 Integration of renewable energy with CO2 electroreduction systems

Coupling CO2 electroreduction processes with renewable energy sources represents a sustainable approach to carbon dioxide valorization. These integrated systems utilize intermittent renewable electricity from solar or wind power to drive the electrochemical conversion of CO2 into valuable chemicals and fuels. Advanced power management strategies, energy storage solutions, and smart control systems enable efficient operation under fluctuating power input. This integration not only provides a pathway for renewable energy storage but also contributes to carbon neutrality by recycling CO2 into useful products.Expand Specific Solutions

Leading Companies and Research Institutions in CO2 Valorization

Electrocatalytic CO2 valorization technology is currently in an early growth phase, characterized by increasing research intensity and emerging commercial applications. The market is projected to expand significantly as carbon reduction initiatives gain momentum globally, though exact size estimates vary due to the nascent nature of the field. Technologically, academic institutions like Dalian Institute of Chemical Physics, University of California, and Tianjin University are leading fundamental research, while companies including Dioxide Materials, Shell, and Siemens are advancing practical applications. Honda and Calera represent industrial players developing proprietary systems for CO2 conversion. The technology shows promising maturity in laboratory settings but requires further development for widespread commercial deployment, with key challenges remaining in catalyst efficiency, selectivity, and system scalability.

Dalian Institute of Chemical Physics of CAS

Technical Solution: Dalian Institute of Chemical Physics (DICP) has developed advanced electrocatalysts for CO2 reduction, focusing on copper-based materials with precisely controlled structures. Their technology employs atomically dispersed metal sites on nitrogen-doped carbon supports to achieve high selectivity for valuable C2+ products like ethylene and ethanol. DICP's approach involves innovative synthesis methods including high-temperature pyrolysis and electrochemical activation to create catalysts with optimized coordination environments. Their patents cover novel electrode designs that incorporate gas diffusion layers to enhance CO2 mass transfer and local pH control mechanisms to suppress competing hydrogen evolution reactions. Recent developments include bimetallic catalysts that leverage synergistic effects between copper and secondary metals (Ag, Zn) to improve Faradaic efficiency above 60% for C2+ products at industrially relevant current densities (>200 mA/cm²)[1][3]. Their technology also addresses stability issues through encapsulation strategies that prevent catalyst leaching during extended operation.

Strengths: Superior selectivity for higher-value C2+ products compared to conventional catalysts; excellent stability under industrial conditions; innovative electrode designs that address mass transfer limitations. Weaknesses: Higher manufacturing costs compared to traditional catalysts; complex synthesis procedures that may challenge large-scale production; potential sensitivity to impurities in industrial CO2 streams.

Dioxide Materials, Inc.

Technical Solution: Dioxide Materials has pioneered proprietary Sustainion® anion exchange membranes and ionomers specifically engineered for electrochemical CO2 reduction. Their patented technology focuses on alkaline-stable polymers that facilitate selective CO2 conversion to carbon monoxide, formic acid, and other value-added products. The company's electrocatalytic systems employ silver-based catalysts for CO production with Faradaic efficiencies exceeding 95% and energy efficiencies above 70% at industrially relevant current densities (>200 mA/cm²)[2]. Their patents cover complete electrolyzer designs that incorporate advanced flow field architectures to optimize reactant distribution and product separation. Dioxide Materials has developed specialized electrode treatments that enhance the three-phase boundary, critical for efficient gas-phase CO2 reduction. Their technology platform includes proprietary catalyst deposition methods that achieve high metal utilization and minimize precious metal loading while maintaining performance. Recent patents describe integrated systems for direct coupling of CO2 electrolysis with downstream chemical synthesis to produce higher-value chemicals like ethanol and acetic acid through C-C coupling reactions[4].

Strengths: Industry-leading membrane technology specifically designed for CO2 electrolysis; complete system integration from catalyst to final product; demonstrated scale-up capability with commercial-sized electrodes. Weaknesses: Higher capital costs compared to thermochemical conversion routes; dependence on low-carbon electricity sources to achieve net carbon reduction; current focus primarily on C1 products rather than higher-value C2+ chemicals.

Key Patent Analysis in CO2 Electrocatalysis

Electrocatalytic process for carbon dioxide conversion

PatentWO2017176600A1

Innovation

- A novel catalyst combination featuring a Catalytically Active Element with particle sizes between 0.6 nm and 100 nm, supported or unsupported, and a Helper Polymer with positively charged cyclic amine groups, such as imidazoliums or pyridiniums, is used in the cathode catalyst layer of an electrochemical cell to enhance reaction rates and efficiencies.

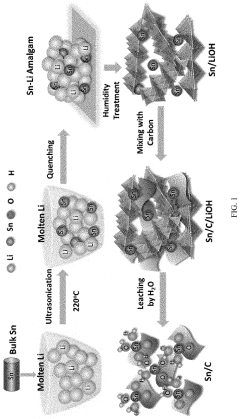

Method of preparing electrocatalysts for converting carbon dioxide to chemicals

PatentActiveUS20220062864A1

Innovation

- Development of high surface area carbonaceous nano-electrocatalysts using a lithium-melt method to create single atom to size-controlled metal clusters, allowing for efficient and selective CO2 conversion to chemicals and fuels at low onset voltage.

Carbon Policy Frameworks and Incentives

Carbon policy frameworks and incentives play a crucial role in accelerating the development and deployment of electrocatalytic CO2 valorization technologies. The global landscape of carbon policies has evolved significantly over the past decade, with various mechanisms being implemented to reduce carbon emissions and promote sustainable technologies.

Carbon pricing mechanisms, including carbon taxes and emissions trading systems (ETS), have emerged as primary policy instruments across different jurisdictions. The European Union's ETS, established in 2005, has been particularly influential in creating economic incentives for CO2 reduction technologies. Similarly, carbon taxes in countries like Sweden, Switzerland, and Canada have created financial pressures that drive investment in carbon capture and utilization technologies.

Research and development tax credits specifically targeting carbon reduction technologies have been implemented in several countries. The United States' 45Q tax credit provides up to $50 per metric ton of CO2 permanently sequestered and $35 per metric ton for CO2 utilized in enhanced oil recovery or converted into products. This has significantly stimulated patent applications in electrocatalytic CO2 conversion technologies since its enhancement in 2018.

Green procurement policies are increasingly incorporating carbon footprint considerations, creating market pull for products derived from captured CO2. The EU's Innovation Fund and similar programs in Japan, South Korea, and China provide substantial funding for demonstration projects in CO2 valorization, bridging the gap between laboratory research and commercial deployment.

Regulatory frameworks are also evolving to accommodate novel CO2 utilization pathways. Standards and certification schemes for carbon-derived products are being developed to verify emissions reduction claims and ensure market acceptance. The International Organization for Standardization (ISO) is working on standards for quantifying and reporting CO2 utilization in products.

Regional differences in policy approaches significantly impact patent filing strategies. Asian markets, particularly China and Japan, have implemented targeted industrial policies to dominate specific segments of the CO2 valorization value chain, resulting in concentrated patent portfolios in catalysts and reactor designs. European policies tend to favor system integration approaches, while North American frameworks often emphasize market-based mechanisms.

The interaction between intellectual property protection and carbon policy incentives creates complex dynamics in technology diffusion. Some jurisdictions are exploring mechanisms to balance IP protection with the need for rapid deployment of climate solutions, including patent pools and compulsory licensing provisions for critical climate technologies.

Carbon pricing mechanisms, including carbon taxes and emissions trading systems (ETS), have emerged as primary policy instruments across different jurisdictions. The European Union's ETS, established in 2005, has been particularly influential in creating economic incentives for CO2 reduction technologies. Similarly, carbon taxes in countries like Sweden, Switzerland, and Canada have created financial pressures that drive investment in carbon capture and utilization technologies.

Research and development tax credits specifically targeting carbon reduction technologies have been implemented in several countries. The United States' 45Q tax credit provides up to $50 per metric ton of CO2 permanently sequestered and $35 per metric ton for CO2 utilized in enhanced oil recovery or converted into products. This has significantly stimulated patent applications in electrocatalytic CO2 conversion technologies since its enhancement in 2018.

Green procurement policies are increasingly incorporating carbon footprint considerations, creating market pull for products derived from captured CO2. The EU's Innovation Fund and similar programs in Japan, South Korea, and China provide substantial funding for demonstration projects in CO2 valorization, bridging the gap between laboratory research and commercial deployment.

Regulatory frameworks are also evolving to accommodate novel CO2 utilization pathways. Standards and certification schemes for carbon-derived products are being developed to verify emissions reduction claims and ensure market acceptance. The International Organization for Standardization (ISO) is working on standards for quantifying and reporting CO2 utilization in products.

Regional differences in policy approaches significantly impact patent filing strategies. Asian markets, particularly China and Japan, have implemented targeted industrial policies to dominate specific segments of the CO2 valorization value chain, resulting in concentrated patent portfolios in catalysts and reactor designs. European policies tend to favor system integration approaches, while North American frameworks often emphasize market-based mechanisms.

The interaction between intellectual property protection and carbon policy incentives creates complex dynamics in technology diffusion. Some jurisdictions are exploring mechanisms to balance IP protection with the need for rapid deployment of climate solutions, including patent pools and compulsory licensing provisions for critical climate technologies.

Techno-economic Assessment of CO2 Valorization Processes

The techno-economic assessment of CO2 valorization processes reveals significant potential for electrocatalytic approaches to transform carbon dioxide into valuable products. Current economic analyses indicate that the levelized cost of production for CO2-derived chemicals ranges from $50-200 per ton for basic commodities like methanol to $500-2,000 per ton for specialty chemicals. These figures highlight the economic viability gap that must be bridged for widespread commercial adoption.

Energy efficiency remains a critical economic factor, with most electrocatalytic CO2 conversion processes currently operating at 30-60% Faradaic efficiency. Analysis of industrial-scale implementations suggests that achieving at least 70% efficiency would be necessary to reach economic parity with conventional production methods. The capital expenditure for electrocatalytic facilities is estimated at $500-1,500 per kilowatt of installed capacity, with catalyst costs contributing 15-25% of this total.

Market projections indicate that CO2 valorization could capture 5-10% of the chemical manufacturing market by 2030, representing a potential value of $50-100 billion annually. However, sensitivity analyses demonstrate that process economics remain highly dependent on electricity prices, with renewable electricity costs below $0.04/kWh typically required for cost-competitive operation without additional policy incentives.

Life cycle assessments of various CO2 valorization pathways show net carbon reduction potential ranging from 0.5 to 2.5 tons of CO2 equivalent per ton of product, depending on electricity sources and process configurations. The most economically promising applications currently appear in regions with low-cost renewable electricity and existing carbon capture infrastructure.

Policy mechanisms significantly impact economic viability, with carbon pricing thresholds of $40-80 per ton of CO2 typically needed to incentivize investment in these technologies. Tax credits, such as the 45Q in the United States, have demonstrated effectiveness in improving project economics, reducing payback periods from 15+ years to 7-10 years for early commercial deployments.

Integration with existing industrial infrastructure presents opportunities for cost reduction, with co-located facilities potentially reducing capital costs by 20-30% through shared utilities and infrastructure. The economic assessment also highlights the value of product selectivity, with processes capable of targeting higher-value products showing significantly improved return on investment despite higher technical complexity.

Energy efficiency remains a critical economic factor, with most electrocatalytic CO2 conversion processes currently operating at 30-60% Faradaic efficiency. Analysis of industrial-scale implementations suggests that achieving at least 70% efficiency would be necessary to reach economic parity with conventional production methods. The capital expenditure for electrocatalytic facilities is estimated at $500-1,500 per kilowatt of installed capacity, with catalyst costs contributing 15-25% of this total.

Market projections indicate that CO2 valorization could capture 5-10% of the chemical manufacturing market by 2030, representing a potential value of $50-100 billion annually. However, sensitivity analyses demonstrate that process economics remain highly dependent on electricity prices, with renewable electricity costs below $0.04/kWh typically required for cost-competitive operation without additional policy incentives.

Life cycle assessments of various CO2 valorization pathways show net carbon reduction potential ranging from 0.5 to 2.5 tons of CO2 equivalent per ton of product, depending on electricity sources and process configurations. The most economically promising applications currently appear in regions with low-cost renewable electricity and existing carbon capture infrastructure.

Policy mechanisms significantly impact economic viability, with carbon pricing thresholds of $40-80 per ton of CO2 typically needed to incentivize investment in these technologies. Tax credits, such as the 45Q in the United States, have demonstrated effectiveness in improving project economics, reducing payback periods from 15+ years to 7-10 years for early commercial deployments.

Integration with existing industrial infrastructure presents opportunities for cost reduction, with co-located facilities potentially reducing capital costs by 20-30% through shared utilities and infrastructure. The economic assessment also highlights the value of product selectivity, with processes capable of targeting higher-value products showing significantly improved return on investment despite higher technical complexity.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!