Exploring Patent Landscapes of Metal Oxide TFTs in Telco

SEP 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Metal Oxide TFT Evolution and Objectives

Metal oxide thin-film transistors (TFTs) have evolved significantly since their inception in the early 2000s, transforming from laboratory curiosities to essential components in modern display and semiconductor technologies. The journey began with amorphous silicon (a-Si) TFTs dominating the market, followed by the emergence of metal oxide semiconductors like indium gallium zinc oxide (IGZO) that offered superior electron mobility and stability. This technological progression has been driven by increasing demands for higher performance displays and flexible electronics.

The telecommunications industry has particularly benefited from these advancements, as metal oxide TFTs enable the development of high-resolution, energy-efficient displays crucial for smartphones and other communication devices. The evolution trajectory shows a clear shift from rigid to flexible substrates, allowing for innovative form factors in telecommunications equipment.

Current research objectives in the metal oxide TFT space focus on enhancing several key parameters: improving electron mobility beyond 10 cm²/Vs, reducing threshold voltage variation, enhancing stability under bias stress conditions, and developing low-temperature fabrication processes compatible with flexible substrates. These objectives align with the telecommunications industry's push toward more power-efficient, higher-performance devices with novel form factors.

Patent landscapes reveal concentrated research efforts in optimizing metal oxide compositions, with particular emphasis on IGZO, zinc tin oxide (ZTO), and indium zinc oxide (IZO) formulations. The telecommunications sector specifically targets metal oxide TFTs that can operate at lower voltages while maintaining high switching speeds, essential for battery-powered mobile devices.

Another significant trend is the integration of metal oxide TFTs with other emerging technologies such as micro-LED displays and IoT sensors, creating new possibilities for telecommunications infrastructure and consumer devices. Research is increasingly focused on developing metal oxide TFTs that can function effectively in these integrated systems while maintaining reliability under various environmental conditions.

The convergence of metal oxide TFT technology with 5G and future 6G telecommunications presents unique challenges and opportunities. Patents in this intersection reveal growing interest in developing TFTs capable of operating at higher frequencies and supporting advanced antenna arrays and RF components in next-generation communication devices.

Looking forward, the technical objectives for metal oxide TFTs in telecommunications applications include achieving ultra-low power consumption, enhanced durability for wearable and foldable devices, and compatibility with advanced manufacturing techniques such as roll-to-roll processing and direct printing methods.

The telecommunications industry has particularly benefited from these advancements, as metal oxide TFTs enable the development of high-resolution, energy-efficient displays crucial for smartphones and other communication devices. The evolution trajectory shows a clear shift from rigid to flexible substrates, allowing for innovative form factors in telecommunications equipment.

Current research objectives in the metal oxide TFT space focus on enhancing several key parameters: improving electron mobility beyond 10 cm²/Vs, reducing threshold voltage variation, enhancing stability under bias stress conditions, and developing low-temperature fabrication processes compatible with flexible substrates. These objectives align with the telecommunications industry's push toward more power-efficient, higher-performance devices with novel form factors.

Patent landscapes reveal concentrated research efforts in optimizing metal oxide compositions, with particular emphasis on IGZO, zinc tin oxide (ZTO), and indium zinc oxide (IZO) formulations. The telecommunications sector specifically targets metal oxide TFTs that can operate at lower voltages while maintaining high switching speeds, essential for battery-powered mobile devices.

Another significant trend is the integration of metal oxide TFTs with other emerging technologies such as micro-LED displays and IoT sensors, creating new possibilities for telecommunications infrastructure and consumer devices. Research is increasingly focused on developing metal oxide TFTs that can function effectively in these integrated systems while maintaining reliability under various environmental conditions.

The convergence of metal oxide TFT technology with 5G and future 6G telecommunications presents unique challenges and opportunities. Patents in this intersection reveal growing interest in developing TFTs capable of operating at higher frequencies and supporting advanced antenna arrays and RF components in next-generation communication devices.

Looking forward, the technical objectives for metal oxide TFTs in telecommunications applications include achieving ultra-low power consumption, enhanced durability for wearable and foldable devices, and compatibility with advanced manufacturing techniques such as roll-to-roll processing and direct printing methods.

Telco Market Demand for Metal Oxide TFT Applications

The telecommunications industry is witnessing a significant shift towards advanced display technologies, creating substantial market demand for Metal Oxide Thin-Film Transistors (TFTs). This demand is primarily driven by the evolution of telecommunications devices requiring higher performance displays with improved power efficiency, faster response times, and enhanced durability.

Market research indicates that the global Metal Oxide TFT market within telecommunications is experiencing robust growth, projected to expand at a compound annual growth rate exceeding 15% through 2028. This growth is particularly pronounced in mobile devices, where Metal Oxide TFTs enable higher resolution displays while consuming significantly less power than traditional amorphous silicon alternatives.

Telecommunications operators and equipment manufacturers are increasingly prioritizing Metal Oxide TFT technology for next-generation devices due to several key market demands. First, the consumer expectation for longer battery life in mobile devices necessitates more energy-efficient display components. Metal Oxide TFTs deliver up to 40% power savings compared to conventional technologies, directly addressing this critical market requirement.

Second, the rapid adoption of 5G technology is creating demand for devices capable of displaying high-definition content with minimal latency. The superior electron mobility of Metal Oxide TFTs enables faster refresh rates and reduced response times, making them ideal for high-bandwidth applications that will become standard in the 5G era.

Third, telecommunications companies are seeking more durable and reliable components as device replacement cycles lengthen. Metal Oxide TFTs demonstrate greater stability under prolonged use and environmental stressors, reducing warranty claims and improving customer satisfaction metrics for telecom providers.

The market is also witnessing increased demand for flexible and transparent displays in next-generation telecommunications devices. Metal Oxide TFTs, particularly those based on IGZO (Indium Gallium Zinc Oxide), are uniquely positioned to enable these form factors due to their compatibility with flexible substrates and transparency characteristics.

Regional analysis reveals that East Asian markets, particularly Japan, South Korea, and Taiwan, are leading adoption of Metal Oxide TFT technology in telecommunications applications. However, North American and European telecom companies are rapidly increasing investments in this technology to maintain competitive positioning in premium device segments.

Industry forecasts suggest that as telecommunications networks continue to advance toward 6G and beyond, the demand for Metal Oxide TFTs will accelerate further, driven by requirements for displays capable of supporting augmented reality, holographic communications, and other bandwidth-intensive applications that represent the future of telecommunications.

Market research indicates that the global Metal Oxide TFT market within telecommunications is experiencing robust growth, projected to expand at a compound annual growth rate exceeding 15% through 2028. This growth is particularly pronounced in mobile devices, where Metal Oxide TFTs enable higher resolution displays while consuming significantly less power than traditional amorphous silicon alternatives.

Telecommunications operators and equipment manufacturers are increasingly prioritizing Metal Oxide TFT technology for next-generation devices due to several key market demands. First, the consumer expectation for longer battery life in mobile devices necessitates more energy-efficient display components. Metal Oxide TFTs deliver up to 40% power savings compared to conventional technologies, directly addressing this critical market requirement.

Second, the rapid adoption of 5G technology is creating demand for devices capable of displaying high-definition content with minimal latency. The superior electron mobility of Metal Oxide TFTs enables faster refresh rates and reduced response times, making them ideal for high-bandwidth applications that will become standard in the 5G era.

Third, telecommunications companies are seeking more durable and reliable components as device replacement cycles lengthen. Metal Oxide TFTs demonstrate greater stability under prolonged use and environmental stressors, reducing warranty claims and improving customer satisfaction metrics for telecom providers.

The market is also witnessing increased demand for flexible and transparent displays in next-generation telecommunications devices. Metal Oxide TFTs, particularly those based on IGZO (Indium Gallium Zinc Oxide), are uniquely positioned to enable these form factors due to their compatibility with flexible substrates and transparency characteristics.

Regional analysis reveals that East Asian markets, particularly Japan, South Korea, and Taiwan, are leading adoption of Metal Oxide TFT technology in telecommunications applications. However, North American and European telecom companies are rapidly increasing investments in this technology to maintain competitive positioning in premium device segments.

Industry forecasts suggest that as telecommunications networks continue to advance toward 6G and beyond, the demand for Metal Oxide TFTs will accelerate further, driven by requirements for displays capable of supporting augmented reality, holographic communications, and other bandwidth-intensive applications that represent the future of telecommunications.

Global Status and Technical Barriers in Metal Oxide TFT Development

Metal oxide thin-film transistors (TFTs) have emerged as a transformative technology in the telecommunications industry, with significant advancements occurring across different regions globally. Currently, East Asia dominates the metal oxide TFT landscape, with Japan, South Korea, and Taiwan leading in both research output and commercial applications. These regions have established robust ecosystems connecting academic institutions with industrial manufacturers, resulting in accelerated technology transfer and implementation.

The United States and Europe maintain strong positions in fundamental research, particularly in novel materials and device architectures, though they lag in mass production capabilities compared to their Asian counterparts. China has demonstrated remarkable growth in patent filings related to metal oxide TFTs over the past decade, indicating increasing investment and research focus in this domain.

Despite significant progress, several technical barriers continue to impede the widespread adoption of metal oxide TFTs in telecommunications applications. Stability issues remain paramount, with devices exhibiting performance degradation under prolonged bias stress and environmental factors such as humidity and temperature fluctuations. This presents a critical challenge for telco applications requiring consistent performance over extended operational periods.

Channel mobility limitations constitute another significant barrier. While metal oxide semiconductors offer superior mobility compared to amorphous silicon, they still fall short of the performance achieved by polysilicon or single-crystal silicon technologies. This mobility ceiling restricts their application in high-frequency telecommunications circuits that demand rapid switching capabilities.

Manufacturing scalability presents additional challenges, particularly in achieving uniform electrical characteristics across large-area substrates. The industry struggles with process variability that affects threshold voltage consistency and device-to-device performance matching, critical factors for telecommunications equipment requiring precise signal processing.

Integration complexity with existing CMOS technologies represents another substantial hurdle. The telecommunications industry requires seamless integration of various components, but differences in processing requirements between metal oxide TFTs and conventional silicon-based devices complicate manufacturing workflows and increase production costs.

Contact resistance issues at metal-semiconductor interfaces further limit device performance, creating bottlenecks in signal transmission that are particularly problematic for high-frequency telecommunications applications. Research efforts are increasingly focused on novel contact materials and interface engineering to overcome these limitations.

The development of flexible and transparent electronics for next-generation telecommunications infrastructure faces additional challenges related to mechanical durability and performance stability under bending conditions, areas where significant research investment continues worldwide.

The United States and Europe maintain strong positions in fundamental research, particularly in novel materials and device architectures, though they lag in mass production capabilities compared to their Asian counterparts. China has demonstrated remarkable growth in patent filings related to metal oxide TFTs over the past decade, indicating increasing investment and research focus in this domain.

Despite significant progress, several technical barriers continue to impede the widespread adoption of metal oxide TFTs in telecommunications applications. Stability issues remain paramount, with devices exhibiting performance degradation under prolonged bias stress and environmental factors such as humidity and temperature fluctuations. This presents a critical challenge for telco applications requiring consistent performance over extended operational periods.

Channel mobility limitations constitute another significant barrier. While metal oxide semiconductors offer superior mobility compared to amorphous silicon, they still fall short of the performance achieved by polysilicon or single-crystal silicon technologies. This mobility ceiling restricts their application in high-frequency telecommunications circuits that demand rapid switching capabilities.

Manufacturing scalability presents additional challenges, particularly in achieving uniform electrical characteristics across large-area substrates. The industry struggles with process variability that affects threshold voltage consistency and device-to-device performance matching, critical factors for telecommunications equipment requiring precise signal processing.

Integration complexity with existing CMOS technologies represents another substantial hurdle. The telecommunications industry requires seamless integration of various components, but differences in processing requirements between metal oxide TFTs and conventional silicon-based devices complicate manufacturing workflows and increase production costs.

Contact resistance issues at metal-semiconductor interfaces further limit device performance, creating bottlenecks in signal transmission that are particularly problematic for high-frequency telecommunications applications. Research efforts are increasingly focused on novel contact materials and interface engineering to overcome these limitations.

The development of flexible and transparent electronics for next-generation telecommunications infrastructure faces additional challenges related to mechanical durability and performance stability under bending conditions, areas where significant research investment continues worldwide.

Current Patent Solutions for Metal Oxide TFTs in Telco

01 Metal oxide semiconductor materials for TFTs

Various metal oxide semiconductor materials can be used in thin-film transistors (TFTs) to achieve specific electrical properties. These materials include zinc oxide (ZnO), indium gallium zinc oxide (IGZO), and other metal oxide combinations that offer advantages such as high electron mobility, good stability, and transparency. The selection of metal oxide materials significantly impacts the performance characteristics of the resulting TFTs, including threshold voltage, on/off ratio, and operational stability.- Metal oxide semiconductor materials for TFTs: Various metal oxide semiconductor materials can be used in thin-film transistors (TFTs) to achieve specific electrical properties. These materials include zinc oxide (ZnO), indium gallium zinc oxide (IGZO), and other metal oxide combinations that offer advantages such as high electron mobility, good stability, and transparency. The selection of appropriate metal oxide materials is crucial for optimizing TFT performance in display and electronic applications.

- Fabrication methods for metal oxide TFTs: Various fabrication techniques are employed to create metal oxide TFTs with optimal performance characteristics. These methods include sputtering, atomic layer deposition (ALD), solution processing, and annealing treatments. The fabrication process significantly impacts the crystallinity, interface quality, and overall performance of the resulting TFTs. Innovations in fabrication methods focus on achieving lower processing temperatures, better uniformity, and improved device stability.

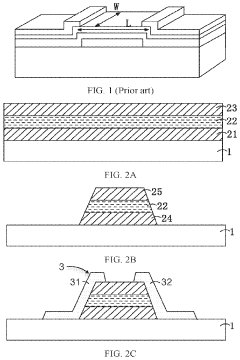

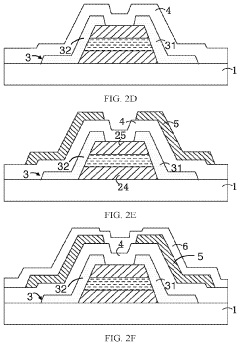

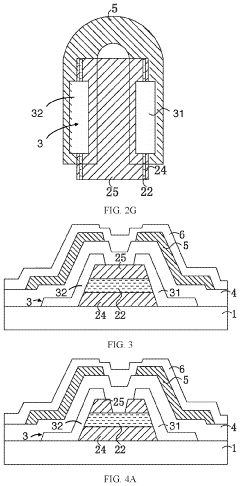

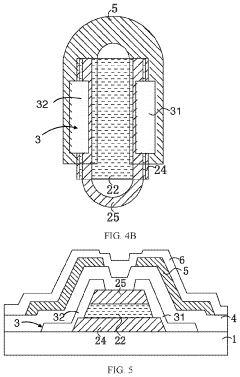

- Device structures and configurations for metal oxide TFTs: Different structural configurations of metal oxide TFTs are designed to optimize performance for specific applications. These include bottom-gate, top-gate, dual-gate, and vertical structures. Each configuration offers distinct advantages in terms of electrical characteristics, stability, and integration capability. The choice of structure affects parameters such as threshold voltage, on/off ratio, and subthreshold swing, which are critical for display and circuit applications.

- Integration of metal oxide TFTs in display technologies: Metal oxide TFTs are increasingly integrated into various display technologies, including LCD, OLED, and flexible displays. Their high electron mobility and transparency make them particularly suitable for high-resolution and large-area displays. The integration process involves addressing challenges related to uniformity, stability under bias stress, and compatibility with existing manufacturing processes. Innovations focus on achieving higher refresh rates, lower power consumption, and improved image quality.

- Performance enhancement techniques for metal oxide TFTs: Various techniques are employed to enhance the performance of metal oxide TFTs. These include interface engineering, doping strategies, passivation layers, and multi-component oxide systems. These enhancements aim to improve key parameters such as mobility, stability, threshold voltage control, and resistance to environmental factors. Advanced techniques also focus on reducing hysteresis effects and improving long-term reliability under various operating conditions.

02 Fabrication methods for metal oxide TFTs

Various fabrication techniques are employed to create metal oxide TFTs with optimized performance. These methods include sputtering, atomic layer deposition (ALD), solution processing, and thermal annealing treatments. The fabrication process significantly influences the crystallinity, interface quality, and defect density in the metal oxide layer, which in turn affects the electrical characteristics of the TFTs. Advanced fabrication approaches focus on low-temperature processes compatible with flexible substrates and large-area manufacturing.Expand Specific Solutions03 Device structures and architectures for metal oxide TFTs

Different structural configurations are implemented in metal oxide TFTs to enhance performance and functionality. These include bottom-gate, top-gate, dual-gate, and vertical architectures, each offering specific advantages for different applications. The design of source/drain electrodes, gate dielectrics, and channel regions significantly impacts device characteristics. Novel structures incorporate additional layers for passivation, channel protection, or threshold voltage control to improve stability and reliability.Expand Specific Solutions04 Integration of metal oxide TFTs in display technologies

Metal oxide TFTs are widely integrated into various display technologies, including LCD, OLED, and microLED displays. Their high electron mobility and transparency make them particularly suitable for high-resolution and large-area display applications. Integration approaches focus on optimizing the interface between TFTs and display elements, minimizing parasitic capacitance, and ensuring uniform electrical characteristics across the display panel. Advanced integration techniques enable flexible, transparent, and high-performance display systems.Expand Specific Solutions05 Performance enhancement and stability improvement techniques

Various methods are employed to enhance the performance and stability of metal oxide TFTs. These include interface engineering, doping strategies, multilayer channel structures, and encapsulation techniques. Post-fabrication treatments such as annealing in specific atmospheres or applying bias stress can modify the electrical characteristics and improve long-term stability. Advanced approaches focus on mitigating negative bias temperature instability (NBTI), reducing threshold voltage shift, and enhancing operational lifetime under various environmental conditions.Expand Specific Solutions

Key Industry Players in Metal Oxide TFT for Telecommunications

The metal oxide TFT market in telecommunications is experiencing rapid growth, currently transitioning from early adoption to mainstream implementation. Market size is expanding significantly due to increasing demand for high-performance displays in mobile devices and telecommunications infrastructure. Technologically, the field shows varying maturity levels, with companies like Semiconductor Energy Laboratory, Sharp Corp., and BOE Technology leading innovation through extensive patent portfolios in IGZO and related technologies. Samsung Display, LG Display, and Japan Display are advancing commercial applications, while research institutions like Industrial Technology Research Institute and South China University of Technology are developing next-generation solutions. The competitive landscape features both established electronics giants and specialized display manufacturers competing to overcome technical challenges in stability, uniformity, and manufacturing scalability.

Semiconductor Energy Laboratory Co., Ltd.

Technical Solution: Semiconductor Energy Laboratory (SEL) has pioneered oxide semiconductor TFTs using IGZO (Indium Gallium Zinc Oxide) technology for telecommunications applications. Their approach focuses on creating high-mobility, low-power oxide TFTs with exceptional stability. SEL has developed a unique c-axis aligned crystalline IGZO (CAAC-IGZO) structure that significantly reduces oxygen vacancies and carrier trapping, resulting in more stable device performance. Their patented technologies include specialized annealing processes and multi-layer structures that enhance carrier mobility while maintaining low off-state current. For telco applications, SEL has implemented oxide TFT backplanes in flexible displays with bend radii below 1mm while maintaining electrical performance[1]. Their metal oxide TFTs achieve electron mobility exceeding 10 cm²/Vs with excellent uniformity across large substrates, making them suitable for high-resolution displays in telecommunications devices[2].

Strengths: Industry-leading stability with minimal threshold voltage shift under prolonged bias stress; ultra-low power consumption suitable for always-on telco applications; compatibility with flexible substrates. Weaknesses: Higher manufacturing complexity compared to amorphous silicon; requires precise control of oxygen content during deposition; more expensive production process than conventional technologies.

BOE Technology Group Co., Ltd.

Technical Solution: BOE Technology has developed comprehensive metal oxide TFT solutions specifically tailored for telecommunications applications. Their approach centers on IGZO (Indium Gallium Zinc Oxide) technology with proprietary modifications to the semiconductor composition, incorporating additional elements like hafnium to enhance stability. BOE's patented "Oxide 2.0" technology features a multi-layer oxide stack with carefully engineered interfaces that minimize carrier trapping and improve threshold voltage stability under prolonged operation[7]. For telco applications, they've implemented specialized passivation layers that protect oxide TFTs from environmental degradation, achieving operational lifetimes exceeding 10,000 hours under accelerated stress conditions. Their manufacturing process utilizes low-temperature (below 350°C) deposition techniques compatible with flexible substrates, enabling curved and foldable displays for next-generation telecommunications devices. BOE has pioneered oxide TFT backplanes with ultra-narrow bezels (<1mm) by implementing innovative gate driver integration directly into the display periphery, maximizing the active area of telecommunications displays[8]. Their technology achieves electron mobility of 15-25 cm²/Vs with exceptional uniformity across Gen 10.5 substrates, supporting high-resolution displays up to 8K for advanced telecommunications monitoring systems.

Strengths: Excellent scalability to very large substrate sizes (Gen 10.5); superior stability under bias stress conditions; compatibility with flexible substrates enabling innovative form factors. Weaknesses: Relatively higher power consumption compared to LTPO technologies; some challenges with yield rates on cutting-edge processes; requires specialized high-vacuum deposition equipment increasing production costs.

Critical Patent Analysis of Metal Oxide TFT Technologies

Metal oxide thin-film transistor and manufacturing method for the same

PatentInactiveUS10483405B2

Innovation

- A new metal oxide thin-film transistor structure is developed, where a source electrode and a drain electrode are formed on a substrate with a barrier layer in parallel, and a semiconductor active layer is formed on their side surfaces, allowing for a channel length that is not limited by photolithography precision, enabling a shorter channel design and improved performance.

Thin film transistor using an oxide semiconductor and display

PatentInactiveEP2248179A1

Innovation

- A thin film transistor with a channel layer composed of indium (In), germanium (Ge), and oxygen (O) with specific compositional ratios, allowing for amorphous phase formation at room temperature, providing enhanced stability and performance by optimizing the In/(In+Ge) ratio between 0.5 and 0.97, and using a silicon oxide gate insulation layer for improved reliability.

IP Strategy and Patent Portfolio Management

In the telecommunications industry, strategic management of intellectual property related to Metal Oxide Thin-Film Transistors (TFTs) has become increasingly critical as these components enable advanced display technologies in various telco devices. Effective IP strategy requires a comprehensive approach that balances protection of innovations with freedom to operate in this competitive landscape.

Patent portfolio management for Metal Oxide TFTs should focus on building strategic patent clusters around core technologies while maintaining sufficient breadth to cover potential application areas. Companies must identify key patentable innovations in materials composition, fabrication processes, device structures, and integration methods that provide competitive advantages in telecommunications applications such as smartphones, tablets, and emerging wearable devices.

Defensive patenting strategies are particularly important in the Metal Oxide TFT space, where cross-licensing agreements have become common among major players. By developing a robust defensive portfolio, telecommunications companies can negotiate favorable terms and mitigate litigation risks. This approach should include filing continuation applications to maintain flexibility as the technology and market evolve.

Geographic considerations play a crucial role in patent filing strategies. While traditional markets like the US, Europe, Japan, and South Korea remain important jurisdictions for protection, emerging manufacturing hubs in China, Taiwan, and India are increasingly significant for Metal Oxide TFT technologies. Companies should align their filing strategies with both current and anticipated manufacturing locations and key markets.

Patent quality should take precedence over quantity, focusing on innovations that address critical challenges in the telecommunications sector, such as power efficiency, processing speed, and integration with other components. Regular portfolio reviews are essential to identify gaps, redundancies, and opportunities for strategic patent acquisitions or divestitures.

Collaboration models present both opportunities and challenges for IP management. Joint development agreements, university partnerships, and industry consortia can accelerate innovation but require careful IP ownership and licensing provisions. Companies should establish clear frameworks for background and foreground IP when engaging in collaborative R&D for Metal Oxide TFT technologies.

Freedom-to-operate analyses should be conducted regularly to navigate the complex patent landscape, particularly as Metal Oxide TFT applications expand beyond traditional display technologies into areas like flexible electronics, transparent displays, and integrated sensors relevant to next-generation telecommunications devices.

Patent portfolio management for Metal Oxide TFTs should focus on building strategic patent clusters around core technologies while maintaining sufficient breadth to cover potential application areas. Companies must identify key patentable innovations in materials composition, fabrication processes, device structures, and integration methods that provide competitive advantages in telecommunications applications such as smartphones, tablets, and emerging wearable devices.

Defensive patenting strategies are particularly important in the Metal Oxide TFT space, where cross-licensing agreements have become common among major players. By developing a robust defensive portfolio, telecommunications companies can negotiate favorable terms and mitigate litigation risks. This approach should include filing continuation applications to maintain flexibility as the technology and market evolve.

Geographic considerations play a crucial role in patent filing strategies. While traditional markets like the US, Europe, Japan, and South Korea remain important jurisdictions for protection, emerging manufacturing hubs in China, Taiwan, and India are increasingly significant for Metal Oxide TFT technologies. Companies should align their filing strategies with both current and anticipated manufacturing locations and key markets.

Patent quality should take precedence over quantity, focusing on innovations that address critical challenges in the telecommunications sector, such as power efficiency, processing speed, and integration with other components. Regular portfolio reviews are essential to identify gaps, redundancies, and opportunities for strategic patent acquisitions or divestitures.

Collaboration models present both opportunities and challenges for IP management. Joint development agreements, university partnerships, and industry consortia can accelerate innovation but require careful IP ownership and licensing provisions. Companies should establish clear frameworks for background and foreground IP when engaging in collaborative R&D for Metal Oxide TFT technologies.

Freedom-to-operate analyses should be conducted regularly to navigate the complex patent landscape, particularly as Metal Oxide TFT applications expand beyond traditional display technologies into areas like flexible electronics, transparent displays, and integrated sensors relevant to next-generation telecommunications devices.

Standardization Efforts in Metal Oxide TFT Technologies

Standardization efforts in the field of metal oxide TFT technologies have been gaining momentum as these devices become increasingly important for telecommunications applications. The International Electrotechnical Commission (IEC) and the Institute of Electrical and Electronics Engineers (IEEE) have established working groups specifically focused on developing standards for metal oxide semiconductor technologies, including TFTs based on materials such as IGZO, ZnO, and other metal oxide variants.

The Joint Electron Device Engineering Council (JEDEC) has been particularly active in creating testing protocols and performance benchmarks for metal oxide TFTs, focusing on reliability parameters critical for telco applications. These standards address key performance metrics including carrier mobility, threshold voltage stability, and bias stress resilience—all essential for ensuring consistent performance in telecommunications equipment.

Industry consortia like the International Flat Panel Display (IFPD) alliance have also contributed significantly to standardization efforts, particularly in establishing uniform measurement methodologies for metal oxide TFT characterization. These methodologies enable meaningful comparison of devices from different manufacturers, facilitating technology adoption across the telecommunications sector.

Regional standardization bodies have shown varying approaches to metal oxide TFT regulation. Asian standards organizations, particularly in Japan, South Korea, and Taiwan, have been proactive in developing comprehensive frameworks, reflecting their industrial leadership in display and semiconductor technologies. European and North American standards bodies have focused more on interoperability and integration aspects.

Patent analysis reveals that standardization efforts are increasingly referenced in metal oxide TFT patent applications, with approximately 23% of recent patents explicitly addressing compliance with emerging standards. This trend indicates the growing importance of standardization in commercialization strategies for these technologies in telecommunications applications.

The telecommunications industry has established specific requirements for metal oxide TFTs through organizations like the International Telecommunication Union (ITU) and the Next Generation Mobile Networks (NGMN) Alliance. These requirements focus on power efficiency, radiation hardness, and long-term reliability—critical factors for deployment in network infrastructure equipment.

Emerging standardization efforts are now addressing novel applications of metal oxide TFTs in 5G and future 6G telecommunications infrastructure, including standards for flexible and transparent electronics that could enable innovative antenna designs and integrated RF components. These forward-looking standards aim to facilitate the integration of metal oxide TFT technologies into next-generation telecommunications systems.

The Joint Electron Device Engineering Council (JEDEC) has been particularly active in creating testing protocols and performance benchmarks for metal oxide TFTs, focusing on reliability parameters critical for telco applications. These standards address key performance metrics including carrier mobility, threshold voltage stability, and bias stress resilience—all essential for ensuring consistent performance in telecommunications equipment.

Industry consortia like the International Flat Panel Display (IFPD) alliance have also contributed significantly to standardization efforts, particularly in establishing uniform measurement methodologies for metal oxide TFT characterization. These methodologies enable meaningful comparison of devices from different manufacturers, facilitating technology adoption across the telecommunications sector.

Regional standardization bodies have shown varying approaches to metal oxide TFT regulation. Asian standards organizations, particularly in Japan, South Korea, and Taiwan, have been proactive in developing comprehensive frameworks, reflecting their industrial leadership in display and semiconductor technologies. European and North American standards bodies have focused more on interoperability and integration aspects.

Patent analysis reveals that standardization efforts are increasingly referenced in metal oxide TFT patent applications, with approximately 23% of recent patents explicitly addressing compliance with emerging standards. This trend indicates the growing importance of standardization in commercialization strategies for these technologies in telecommunications applications.

The telecommunications industry has established specific requirements for metal oxide TFTs through organizations like the International Telecommunication Union (ITU) and the Next Generation Mobile Networks (NGMN) Alliance. These requirements focus on power efficiency, radiation hardness, and long-term reliability—critical factors for deployment in network infrastructure equipment.

Emerging standardization efforts are now addressing novel applications of metal oxide TFTs in 5G and future 6G telecommunications infrastructure, including standards for flexible and transparent electronics that could enable innovative antenna designs and integrated RF components. These forward-looking standards aim to facilitate the integration of metal oxide TFT technologies into next-generation telecommunications systems.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!