How Do Coatings Affect the Efficiency of Microfluidic Chips?

OCT 10, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Microfluidic Coating Technology Background and Objectives

Microfluidic technology has evolved significantly since its inception in the early 1990s, transforming from simple channel designs to sophisticated lab-on-a-chip systems capable of performing complex analytical procedures. The development trajectory has been characterized by continuous innovation in materials science, fabrication techniques, and surface chemistry, with coating technologies emerging as a critical factor in optimizing microfluidic chip performance.

Surface coatings represent a pivotal advancement in microfluidic technology, addressing fundamental challenges related to fluid dynamics, biomolecule interactions, and analytical sensitivity. The evolution of coating methodologies has progressed from basic hydrophobic/hydrophilic treatments to highly specialized functional coatings that can be tailored for specific applications in diagnostics, drug discovery, and biological research.

The primary objective of microfluidic coating technology is to modify surface properties to enhance fluid flow characteristics, reduce non-specific binding, prevent fouling, and improve overall system efficiency. These modifications directly impact critical performance parameters including flow rate consistency, detection sensitivity, sample recovery, and device longevity – all of which contribute to the overall efficiency of microfluidic operations.

Current technological trends indicate a shift toward multifunctional coatings that can simultaneously address multiple performance requirements. These include stimuli-responsive coatings that can change properties in response to environmental conditions, gradient coatings that enable spatial control of surface properties, and biocompatible coatings that maintain cell viability while preventing protein adsorption.

The integration of nanotechnology with microfluidic coating approaches has opened new possibilities for precise surface engineering at the nanoscale. Techniques such as layer-by-layer assembly, plasma polymerization, and atomic layer deposition are enabling unprecedented control over coating thickness, composition, and functionality, driving innovation in high-performance microfluidic devices.

Looking forward, the field is moving toward sustainable coating technologies that minimize environmental impact while maintaining performance standards. This includes the development of bio-based coatings, solvent-free deposition methods, and recyclable coating materials that align with growing sustainability imperatives in scientific and industrial applications.

The convergence of coating technology with other emerging fields such as artificial intelligence and materials informatics is expected to accelerate innovation, enabling predictive design of coating formulations optimized for specific microfluidic applications and operating conditions. This represents a significant opportunity for transformative advances in microfluidic efficiency and functionality.

Surface coatings represent a pivotal advancement in microfluidic technology, addressing fundamental challenges related to fluid dynamics, biomolecule interactions, and analytical sensitivity. The evolution of coating methodologies has progressed from basic hydrophobic/hydrophilic treatments to highly specialized functional coatings that can be tailored for specific applications in diagnostics, drug discovery, and biological research.

The primary objective of microfluidic coating technology is to modify surface properties to enhance fluid flow characteristics, reduce non-specific binding, prevent fouling, and improve overall system efficiency. These modifications directly impact critical performance parameters including flow rate consistency, detection sensitivity, sample recovery, and device longevity – all of which contribute to the overall efficiency of microfluidic operations.

Current technological trends indicate a shift toward multifunctional coatings that can simultaneously address multiple performance requirements. These include stimuli-responsive coatings that can change properties in response to environmental conditions, gradient coatings that enable spatial control of surface properties, and biocompatible coatings that maintain cell viability while preventing protein adsorption.

The integration of nanotechnology with microfluidic coating approaches has opened new possibilities for precise surface engineering at the nanoscale. Techniques such as layer-by-layer assembly, plasma polymerization, and atomic layer deposition are enabling unprecedented control over coating thickness, composition, and functionality, driving innovation in high-performance microfluidic devices.

Looking forward, the field is moving toward sustainable coating technologies that minimize environmental impact while maintaining performance standards. This includes the development of bio-based coatings, solvent-free deposition methods, and recyclable coating materials that align with growing sustainability imperatives in scientific and industrial applications.

The convergence of coating technology with other emerging fields such as artificial intelligence and materials informatics is expected to accelerate innovation, enabling predictive design of coating formulations optimized for specific microfluidic applications and operating conditions. This represents a significant opportunity for transformative advances in microfluidic efficiency and functionality.

Market Applications and Demand Analysis for Coated Microfluidics

The global microfluidics market has experienced significant growth, reaching approximately $23 billion in 2022 and projected to expand at a CAGR of 11.5% through 2030. Within this expanding market, coated microfluidic chips represent a rapidly growing segment due to their enhanced performance characteristics and broader application potential.

Healthcare applications currently dominate the market demand for coated microfluidics, accounting for nearly 60% of total market share. Point-of-care diagnostics particularly benefits from surface-modified chips that offer improved sensitivity and specificity in detecting biomarkers. The COVID-19 pandemic accelerated adoption, with coated microfluidic platforms enabling rapid, sensitive viral detection protocols that require minimal sample volumes.

Pharmaceutical research and drug discovery represent another substantial market segment, valued at approximately $4.2 billion in 2022. Companies increasingly utilize coated microfluidic platforms for high-throughput screening and organ-on-chip applications. The demand for hydrophilic and hydrophobic coatings that enable precise fluid control has grown by 15% annually in this sector, driven by requirements for more physiologically relevant drug testing environments.

The academic research sector continues to drive innovation in coating technologies, though commercial applications are expanding more rapidly. Market analysis indicates that industrial applications of coated microfluidics, particularly in chemical synthesis and material science, grew by 18% in 2022-2023, outpacing other segments.

Regionally, North America leads the market with approximately 40% share, followed by Europe (30%) and Asia-Pacific (25%). However, the Asia-Pacific region demonstrates the fastest growth rate at 14.2% annually, driven by increasing investment in biotechnology infrastructure and manufacturing capabilities in China, Japan, and South Korea.

Consumer demand increasingly focuses on disposable, pre-coated microfluidic chips that eliminate the need for complex surface preparation protocols. This trend has created a $1.8 billion sub-market for ready-to-use devices with specialized coatings that maintain stability during storage and transport.

Environmental monitoring applications represent an emerging market segment growing at 16% annually, with particular demand for coated microfluidic platforms capable of detecting contaminants in water and soil samples. The food and beverage industry has also begun adopting these technologies for quality control and safety testing, creating a new market estimated at $780 million in 2023.

Industry surveys indicate that end-users prioritize coating durability, batch-to-batch consistency, and compatibility with automated manufacturing processes when selecting microfluidic products. This has driven manufacturers to develop standardized coating protocols and quality control measures that ensure reliable performance across production lots.

Healthcare applications currently dominate the market demand for coated microfluidics, accounting for nearly 60% of total market share. Point-of-care diagnostics particularly benefits from surface-modified chips that offer improved sensitivity and specificity in detecting biomarkers. The COVID-19 pandemic accelerated adoption, with coated microfluidic platforms enabling rapid, sensitive viral detection protocols that require minimal sample volumes.

Pharmaceutical research and drug discovery represent another substantial market segment, valued at approximately $4.2 billion in 2022. Companies increasingly utilize coated microfluidic platforms for high-throughput screening and organ-on-chip applications. The demand for hydrophilic and hydrophobic coatings that enable precise fluid control has grown by 15% annually in this sector, driven by requirements for more physiologically relevant drug testing environments.

The academic research sector continues to drive innovation in coating technologies, though commercial applications are expanding more rapidly. Market analysis indicates that industrial applications of coated microfluidics, particularly in chemical synthesis and material science, grew by 18% in 2022-2023, outpacing other segments.

Regionally, North America leads the market with approximately 40% share, followed by Europe (30%) and Asia-Pacific (25%). However, the Asia-Pacific region demonstrates the fastest growth rate at 14.2% annually, driven by increasing investment in biotechnology infrastructure and manufacturing capabilities in China, Japan, and South Korea.

Consumer demand increasingly focuses on disposable, pre-coated microfluidic chips that eliminate the need for complex surface preparation protocols. This trend has created a $1.8 billion sub-market for ready-to-use devices with specialized coatings that maintain stability during storage and transport.

Environmental monitoring applications represent an emerging market segment growing at 16% annually, with particular demand for coated microfluidic platforms capable of detecting contaminants in water and soil samples. The food and beverage industry has also begun adopting these technologies for quality control and safety testing, creating a new market estimated at $780 million in 2023.

Industry surveys indicate that end-users prioritize coating durability, batch-to-batch consistency, and compatibility with automated manufacturing processes when selecting microfluidic products. This has driven manufacturers to develop standardized coating protocols and quality control measures that ensure reliable performance across production lots.

Current Coating Technologies and Implementation Challenges

Microfluidic chip coating technologies have evolved significantly over the past decade, with several approaches now established as industry standards. Surface modification through hydrophilic and hydrophobic coatings represents the most widely adopted technique, where materials such as polyethylene glycol (PEG), polyvinyl alcohol (PVA), and various silanes are applied to channel surfaces. These coatings effectively alter surface energy properties, enabling precise control of fluid flow dynamics and reducing non-specific adsorption of biomolecules that can compromise analytical performance.

Dynamic coating methods have gained prominence for applications requiring temporary surface modifications. These involve adding surfactants or blocking agents directly to sample solutions, creating an in-situ coating during operation. While offering operational flexibility, these approaches often suffer from coating instability during extended operations, necessitating continuous replenishment of coating agents.

Plasma treatment technologies have emerged as powerful tools for surface activation and modification, allowing for highly controlled alterations to surface chemistry without dimensional changes to microchannels. Oxygen plasma treatments increase hydrophilicity, while fluorocarbon plasma treatments enhance hydrophobicity. However, the specialized equipment requirements and the often temporary nature of plasma-induced modifications present significant implementation challenges.

Anti-fouling coatings based on zwitterionic polymers represent the cutting edge in preventing protein adsorption and biofilm formation. These materials present balanced positive and negative charges, creating a strong hydration layer that resists biomolecule attachment. Despite their impressive performance, the complex synthesis procedures and challenges in achieving uniform coverage in high-aspect-ratio microchannels limit widespread adoption.

Implementation challenges span multiple dimensions across these coating technologies. Coating uniformity remains problematic, particularly in complex channel geometries with varying dimensions and sharp corners. Many coating protocols developed in laboratory settings fail to translate effectively to mass production environments, creating a significant barrier to commercialization. Coating stability under various operational conditions—including exposure to different pH levels, temperatures, and organic solvents—often falls short of application requirements.

Compatibility issues between coating materials and detection methods present another significant challenge. Fluorescent coatings may interfere with optical detection systems, while certain conductive coatings can disrupt electrochemical sensing. Additionally, the biocompatibility of coating materials becomes critical for medical and biological applications, requiring extensive validation studies that increase development timelines and costs.

Dynamic coating methods have gained prominence for applications requiring temporary surface modifications. These involve adding surfactants or blocking agents directly to sample solutions, creating an in-situ coating during operation. While offering operational flexibility, these approaches often suffer from coating instability during extended operations, necessitating continuous replenishment of coating agents.

Plasma treatment technologies have emerged as powerful tools for surface activation and modification, allowing for highly controlled alterations to surface chemistry without dimensional changes to microchannels. Oxygen plasma treatments increase hydrophilicity, while fluorocarbon plasma treatments enhance hydrophobicity. However, the specialized equipment requirements and the often temporary nature of plasma-induced modifications present significant implementation challenges.

Anti-fouling coatings based on zwitterionic polymers represent the cutting edge in preventing protein adsorption and biofilm formation. These materials present balanced positive and negative charges, creating a strong hydration layer that resists biomolecule attachment. Despite their impressive performance, the complex synthesis procedures and challenges in achieving uniform coverage in high-aspect-ratio microchannels limit widespread adoption.

Implementation challenges span multiple dimensions across these coating technologies. Coating uniformity remains problematic, particularly in complex channel geometries with varying dimensions and sharp corners. Many coating protocols developed in laboratory settings fail to translate effectively to mass production environments, creating a significant barrier to commercialization. Coating stability under various operational conditions—including exposure to different pH levels, temperatures, and organic solvents—often falls short of application requirements.

Compatibility issues between coating materials and detection methods present another significant challenge. Fluorescent coatings may interfere with optical detection systems, while certain conductive coatings can disrupt electrochemical sensing. Additionally, the biocompatibility of coating materials becomes critical for medical and biological applications, requiring extensive validation studies that increase development timelines and costs.

Mainstream Coating Solutions for Efficiency Enhancement

01 Surface modification techniques for microfluidic chips

Various surface modification techniques can be applied to microfluidic chips to enhance their efficiency. These techniques include chemical vapor deposition, plasma treatment, and self-assembled monolayers that modify the surface properties of the microchannels. Such modifications can improve wettability, reduce fouling, and enhance flow characteristics, leading to better overall performance of the microfluidic devices.- Surface modification techniques for microfluidic chips: Various surface modification techniques can be applied to microfluidic chips to enhance their efficiency. These techniques include chemical vapor deposition, plasma treatment, and chemical grafting to modify the surface properties of the microchannels. Such modifications can reduce adsorption of biomolecules, prevent fouling, and improve flow characteristics, ultimately leading to better performance and higher efficiency of microfluidic devices.

- Hydrophilic and hydrophobic coatings for flow control: Microfluidic chip efficiency can be significantly improved by applying selective hydrophilic or hydrophobic coatings. These coatings control fluid flow within the microchannels by altering surface energy and wettability. Hydrophilic coatings facilitate capillary-driven flow while hydrophobic coatings can create barriers or droplet formation regions. Strategic application of these coatings enables precise fluid manipulation, reduced sample volumes, and enhanced mixing efficiency.

- Anti-fouling and biocompatible coatings: Anti-fouling and biocompatible coatings are essential for microfluidic chips used in biological applications. These coatings prevent protein adsorption, cell adhesion, and biofilm formation that can compromise chip performance. Materials such as polyethylene glycol (PEG), zwitterionic polymers, and other biocompatible materials create surfaces that resist non-specific binding while maintaining compatibility with biological samples. These coatings extend chip lifetime, improve reproducibility, and enhance overall efficiency in bioanalytical applications.

- Functional coatings for analytical performance: Functional coatings can be applied to microfluidic chips to enhance their analytical capabilities. These include enzyme-immobilized surfaces, antibody-coated regions, and catalyst-containing layers that facilitate specific chemical reactions or detection methods. Such coatings transform passive microchannels into active analytical platforms, enabling on-chip sample preparation, separation, and detection. The integration of these functional elements improves sensitivity, selectivity, and overall analytical efficiency of microfluidic devices.

- Advanced manufacturing techniques for coating application: Advanced manufacturing techniques have been developed to apply precise and uniform coatings to microfluidic chips. These include layer-by-layer deposition, atomic layer deposition, microcontact printing, and controlled polymerization methods. These techniques enable the creation of complex coating patterns with nanometer-scale precision, gradient properties, and multi-functional characteristics. The precision of these manufacturing approaches ensures consistent coating performance, which directly impacts the efficiency and reliability of microfluidic operations.

02 Hydrophobic and hydrophilic coatings for flow control

Specialized coatings with hydrophobic or hydrophilic properties can be applied to microfluidic chips to control fluid flow and improve efficiency. Hydrophobic coatings repel water and can be used to create barriers or direct flow, while hydrophilic coatings attract water and facilitate smooth flow in channels. These coatings can be selectively applied to different regions of the chip to create complex flow patterns and improve mixing efficiency.Expand Specific Solutions03 Anti-fouling and biocompatible coatings

Anti-fouling and biocompatible coatings are essential for microfluidic chips used in biological applications. These coatings prevent protein adsorption, cell adhesion, and biofilm formation, which can otherwise clog channels and reduce device efficiency. Materials such as polyethylene glycol (PEG), zwitterionic polymers, and certain metal oxides can be used to create surfaces that maintain performance over extended periods of operation with biological samples.Expand Specific Solutions04 Functional coatings for analytical performance

Functional coatings can be applied to microfluidic chips to enhance their analytical performance. These include catalytic coatings that facilitate chemical reactions, sensing layers that enable detection of specific analytes, and electrode materials that improve electrochemical measurements. Such coatings can significantly increase the sensitivity, selectivity, and overall efficiency of microfluidic analytical devices.Expand Specific Solutions05 Advanced manufacturing methods for coating application

Advanced manufacturing methods for applying coatings to microfluidic chips can significantly improve coating uniformity and efficiency. Techniques such as atomic layer deposition, layer-by-layer assembly, and microcontact printing allow for precise control over coating thickness and properties. Additionally, novel approaches like in-situ polymerization and gradient coatings enable the creation of spatially varied surface properties within a single microfluidic device.Expand Specific Solutions

Leading Companies and Research Institutions in Microfluidic Coatings

The microfluidic chip coating market is in a growth phase, with increasing adoption across pharmaceutical, diagnostic, and research sectors. The global market size is expanding rapidly due to rising demand for point-of-care testing and lab-on-a-chip technologies. Technologically, surface coatings significantly impact microfluidic efficiency by modifying wettability, preventing fouling, and enhancing flow dynamics. Leading players include established companies like Bio-Rad Laboratories and TOPPAN, alongside specialized firms such as Fluxergy and Klearia SAS. Academic institutions like Korea Advanced Institute of Science & Technology and Zhejiang University are driving innovation through fundamental research. The competitive landscape features collaboration between industrial manufacturers and research institutions, with emerging players focusing on novel coating materials that improve biocompatibility and reduce non-specific adsorption for enhanced microfluidic performance.

Fluxergy LLC

Technical Solution: Fluxergy has developed an innovative approach to microfluidic chip coatings focused on multiplex diagnostic applications. Their technology utilizes a multi-layer coating strategy that combines hydrophobic and hydrophilic regions to precisely control fluid movement through complex channel networks. The company's proprietary "FluxCoat" technology incorporates nanoscale surface texturing before applying functional coatings, which enhances coating adhesion and stability. This approach creates defined surface energy gradients that drive passive fluid transport without external pumping mechanisms. Fluxergy's coatings also incorporate antimicrobial properties that extend shelf life and prevent microbial contamination during storage. Their most recent innovation involves reagent-specific coatings that can selectively bind target molecules while repelling interferents, significantly improving diagnostic sensitivity. This technology has enabled their microfluidic platforms to achieve detection limits in the femtomolar range for nucleic acid targets.

Strengths: Excellent fluid control through surface energy patterning; enhanced shelf stability through antimicrobial properties; selective binding capabilities improving diagnostic accuracy. Weaknesses: Complex manufacturing process requiring precise control of multiple coating layers; potential for increased production costs; some specialized coatings may have limited compatibility with certain sample types.

Zhejiang University

Technical Solution: Zhejiang University has developed several innovative microfluidic coating technologies through their Micro/Nano Fluidics Research Center. Their approach focuses on biomimetic surface modifications that replicate natural biological interfaces. Their researchers have pioneered "ZJU-BioCoat" technology that utilizes zwitterionic polymer brushes grown directly on channel surfaces via controlled radical polymerization. These coatings create a strongly hydrated layer that effectively prevents protein adsorption and cell adhesion, reducing biofouling by up to 98% compared to unmodified surfaces. The university has also developed gradient coating techniques that create continuous variations in surface properties along microchannels, enabling novel separation applications. Their most recent innovation involves stimuli-responsive coatings that can switch between hydrophilic and hydrophobic states in response to temperature, pH, or light exposure. This technology has enabled the development of microfluidic valves and flow controllers that operate without moving parts, significantly simplifying chip design and operation.

Strengths: Excellent anti-biofouling properties improving performance with biological samples; innovative stimuli-responsive capabilities enabling advanced flow control; gradient coating capabilities enabling novel separation applications. Weaknesses: Some advanced coatings require complex synthesis procedures limiting scalability; potential challenges in technology transfer to industrial manufacturing; some coatings may have limited long-term stability under storage conditions.

Key Patents and Scientific Advances in Microfluidic Surface Chemistry

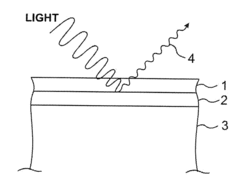

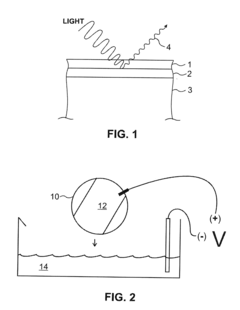

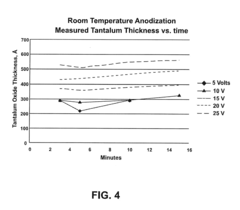

Anti-reflective coatings for micro-fluid applications

PatentActiveUS20120026234A1

Innovation

- The use of anodized tantalum or titanium oxide layers with controlled thickness and refractive index on micro-fluid ejection chips to minimize stray light reflections during photo imaging, achieved through specific processing conditions such as voltage, timing, and bathing solutions, facilitating destructive interference of light.

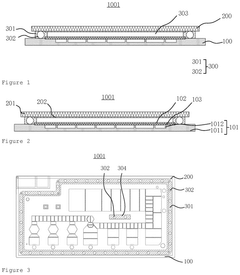

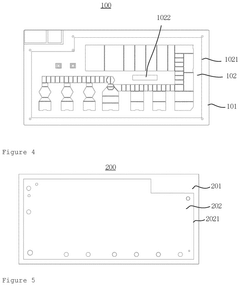

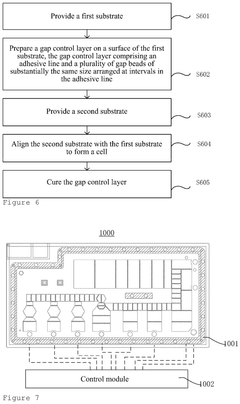

Microfluidic chip, preparation method therefor, and microfluidic system

PatentPendingEP4582184A1

Innovation

- A microfluidic chip design with a gap control layer featuring uniformly sized gap beads and adhesive lines, along with a hydrophobic dielectric functional layer, ensures accurate gap control and droplet movement, enhancing manufacturing precision and stability.

Manufacturing Processes and Scalability Considerations

The manufacturing processes for microfluidic chips with specialized coatings present unique challenges that directly impact both production efficiency and final device performance. Traditional fabrication methods such as photolithography, soft lithography, and etching must be adapted to accommodate coating application without compromising the precise microstructures essential for fluid dynamics. The integration of coating steps into manufacturing workflows requires careful consideration of compatibility with existing processes, as certain coating materials may require specific curing conditions that could affect substrate integrity.

Surface modification techniques vary significantly in their scalability potential. While some methods like plasma treatment can be readily implemented in high-throughput production lines, others such as layer-by-layer deposition or chemical vapor deposition may require specialized equipment and longer processing times. The uniformity of coating application across large substrate areas remains a critical challenge, particularly as manufacturers seek to increase chip size or implement multi-chip arrays for higher throughput applications.

Material selection for coatings must balance performance requirements with manufacturing practicality. Hydrophilic coatings based on polyethylene glycol derivatives offer excellent biocompatibility but may present challenges in terms of shelf stability and application consistency. Conversely, fluoropolymer-based hydrophobic coatings provide exceptional chemical resistance but often require specialized application equipment and handling protocols that increase production complexity.

Quality control processes represent another significant consideration in coating manufacturing. Techniques such as contact angle measurement, atomic force microscopy, and spectroscopic analysis must be integrated into production lines to ensure coating uniformity and functionality. The development of inline measurement systems capable of rapid assessment without disrupting production flow remains an active area of research and development.

Cost considerations ultimately determine commercial viability. While laboratory-scale coating processes may achieve excellent performance, their translation to industrial scale often requires significant optimization to maintain economic feasibility. Materials that require expensive precursors or complex application equipment may prove prohibitive for mass production, driving research toward simpler alternatives that maintain adequate performance characteristics while reducing manufacturing complexity.

Environmental and regulatory factors also influence manufacturing approaches. The transition away from perfluorinated compounds in certain applications has necessitated the development of alternative coating chemistries that maintain performance while meeting increasingly stringent environmental standards. Similarly, biomedical applications require manufacturing processes that ensure consistent biocompatibility and meet regulatory requirements for medical devices.

Surface modification techniques vary significantly in their scalability potential. While some methods like plasma treatment can be readily implemented in high-throughput production lines, others such as layer-by-layer deposition or chemical vapor deposition may require specialized equipment and longer processing times. The uniformity of coating application across large substrate areas remains a critical challenge, particularly as manufacturers seek to increase chip size or implement multi-chip arrays for higher throughput applications.

Material selection for coatings must balance performance requirements with manufacturing practicality. Hydrophilic coatings based on polyethylene glycol derivatives offer excellent biocompatibility but may present challenges in terms of shelf stability and application consistency. Conversely, fluoropolymer-based hydrophobic coatings provide exceptional chemical resistance but often require specialized application equipment and handling protocols that increase production complexity.

Quality control processes represent another significant consideration in coating manufacturing. Techniques such as contact angle measurement, atomic force microscopy, and spectroscopic analysis must be integrated into production lines to ensure coating uniformity and functionality. The development of inline measurement systems capable of rapid assessment without disrupting production flow remains an active area of research and development.

Cost considerations ultimately determine commercial viability. While laboratory-scale coating processes may achieve excellent performance, their translation to industrial scale often requires significant optimization to maintain economic feasibility. Materials that require expensive precursors or complex application equipment may prove prohibitive for mass production, driving research toward simpler alternatives that maintain adequate performance characteristics while reducing manufacturing complexity.

Environmental and regulatory factors also influence manufacturing approaches. The transition away from perfluorinated compounds in certain applications has necessitated the development of alternative coating chemistries that maintain performance while meeting increasingly stringent environmental standards. Similarly, biomedical applications require manufacturing processes that ensure consistent biocompatibility and meet regulatory requirements for medical devices.

Biocompatibility and Regulatory Compliance of Coating Materials

Biocompatibility is a critical consideration when selecting coating materials for microfluidic chips, particularly for applications in healthcare, diagnostics, and biological research. Materials that come into contact with biological samples must not elicit adverse reactions, such as inflammation, toxicity, or immune responses. The most commonly used biocompatible coating materials include polyethylene glycol (PEG), phospholipid bilayers, and certain hydrogels that mimic natural biological environments.

Regulatory frameworks governing the use of coating materials vary significantly across different regions and applications. In the United States, the FDA regulates microfluidic devices used for clinical diagnostics under the Medical Device Regulations, with specific requirements for biocompatibility testing according to ISO 10993 standards. The European Union employs the Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR), which mandate comprehensive biocompatibility assessments for materials contacting biological specimens.

Compliance testing typically involves cytotoxicity assays, sensitization tests, and hemocompatibility evaluations for blood-contacting applications. These tests assess whether coating materials release harmful substances or trigger adverse biological responses. For microfluidic chips intended for point-of-care diagnostics, additional considerations include shelf-life stability and performance consistency under various environmental conditions.

Recent advancements in biomimetic coatings have introduced materials that not only meet regulatory requirements but also enhance biological functionality. For instance, zwitterionic polymer coatings demonstrate excellent resistance to nonspecific protein adsorption while maintaining high biocompatibility. These innovations are particularly valuable for microfluidic devices designed for rare cell isolation or protein analysis.

The regulatory landscape continues to evolve as new coating technologies emerge. Manufacturers must navigate an increasingly complex approval process, especially for novel coating materials without established safety profiles. Documentation requirements include detailed chemical characterization, manufacturing process validation, and comprehensive biocompatibility testing data.

Cost implications of regulatory compliance are significant, with biocompatibility testing potentially adding substantial development expenses. This economic factor often influences coating material selection, particularly for startups and smaller companies developing microfluidic technologies. Consequently, many developers opt for materials with established regulatory precedents, potentially limiting innovation in coating technologies.

Sustainable and environmentally friendly coating materials represent an emerging consideration in regulatory frameworks. As global sustainability initiatives gain momentum, regulatory bodies are beginning to incorporate environmental impact assessments into approval processes, adding another dimension to compliance requirements for microfluidic chip coatings.

Regulatory frameworks governing the use of coating materials vary significantly across different regions and applications. In the United States, the FDA regulates microfluidic devices used for clinical diagnostics under the Medical Device Regulations, with specific requirements for biocompatibility testing according to ISO 10993 standards. The European Union employs the Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR), which mandate comprehensive biocompatibility assessments for materials contacting biological specimens.

Compliance testing typically involves cytotoxicity assays, sensitization tests, and hemocompatibility evaluations for blood-contacting applications. These tests assess whether coating materials release harmful substances or trigger adverse biological responses. For microfluidic chips intended for point-of-care diagnostics, additional considerations include shelf-life stability and performance consistency under various environmental conditions.

Recent advancements in biomimetic coatings have introduced materials that not only meet regulatory requirements but also enhance biological functionality. For instance, zwitterionic polymer coatings demonstrate excellent resistance to nonspecific protein adsorption while maintaining high biocompatibility. These innovations are particularly valuable for microfluidic devices designed for rare cell isolation or protein analysis.

The regulatory landscape continues to evolve as new coating technologies emerge. Manufacturers must navigate an increasingly complex approval process, especially for novel coating materials without established safety profiles. Documentation requirements include detailed chemical characterization, manufacturing process validation, and comprehensive biocompatibility testing data.

Cost implications of regulatory compliance are significant, with biocompatibility testing potentially adding substantial development expenses. This economic factor often influences coating material selection, particularly for startups and smaller companies developing microfluidic technologies. Consequently, many developers opt for materials with established regulatory precedents, potentially limiting innovation in coating technologies.

Sustainable and environmentally friendly coating materials represent an emerging consideration in regulatory frameworks. As global sustainability initiatives gain momentum, regulatory bodies are beginning to incorporate environmental impact assessments into approval processes, adding another dimension to compliance requirements for microfluidic chip coatings.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!