How Flexible Microdisplays Influence Consumer Device Design

OCT 21, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Flexible Microdisplay Technology Evolution and Objectives

Flexible microdisplay technology has evolved significantly over the past two decades, transitioning from rigid glass-based displays to increasingly flexible and adaptable solutions. The journey began in the early 2000s with the development of thin-film transistor (TFT) technology on plastic substrates, marking the first departure from traditional rigid display architectures. This innovation laid the groundwork for what would eventually become a transformative technology across multiple consumer device categories.

By 2010, researchers had achieved significant breakthroughs in organic light-emitting diode (OLED) technology, enabling the creation of displays with inherent flexibility characteristics. The subsequent integration of low-temperature polysilicon (LTPS) and oxide TFT technologies further enhanced the performance capabilities of these flexible displays while maintaining their mechanical adaptability. These advancements represented critical milestones in overcoming the fundamental limitations of rigid display technologies.

The period between 2015 and 2020 witnessed the commercialization of the first generation of flexible microdisplays, primarily in smartphones and wearable devices. These early implementations demonstrated the potential for curved and bendable form factors but were limited in their degree of flexibility and durability. Concurrently, research efforts intensified around materials science innovations, particularly in substrate technologies and encapsulation methods to enhance flexibility while maintaining optical performance.

Recent technological developments have focused on achieving true foldability and rollability in microdisplays, with several major manufacturers demonstrating prototypes with multiple folding points and increasingly robust mechanical properties. These advances have been accompanied by improvements in resolution density, power efficiency, and color reproduction, ensuring that flexibility does not come at the cost of visual performance.

The primary objective of flexible microdisplay technology development is to enable entirely new device form factors that transcend the limitations of rigid displays. This includes creating displays that can conform to non-planar surfaces, fold or roll for enhanced portability, and withstand repeated mechanical deformation without degradation in performance. Such capabilities would fundamentally transform how consumers interact with technology, enabling more intuitive, immersive, and spatially efficient devices.

Additional technical objectives include reducing power consumption to extend battery life in mobile applications, enhancing outdoor visibility through improved brightness and anti-reflection technologies, and developing manufacturing processes that can scale economically for mass production. Researchers are also pursuing advancements in touch integration and haptic feedback systems specifically designed for flexible display interfaces.

Looking forward, the technology roadmap aims to achieve fully stretchable displays that can dynamically change their dimensions, self-healing display materials that can recover from physical damage, and integration with emerging technologies such as augmented reality and ambient computing paradigms. These ambitious goals represent the next frontier in display technology evolution and will likely drive innovation in consumer electronics design for the coming decade.

By 2010, researchers had achieved significant breakthroughs in organic light-emitting diode (OLED) technology, enabling the creation of displays with inherent flexibility characteristics. The subsequent integration of low-temperature polysilicon (LTPS) and oxide TFT technologies further enhanced the performance capabilities of these flexible displays while maintaining their mechanical adaptability. These advancements represented critical milestones in overcoming the fundamental limitations of rigid display technologies.

The period between 2015 and 2020 witnessed the commercialization of the first generation of flexible microdisplays, primarily in smartphones and wearable devices. These early implementations demonstrated the potential for curved and bendable form factors but were limited in their degree of flexibility and durability. Concurrently, research efforts intensified around materials science innovations, particularly in substrate technologies and encapsulation methods to enhance flexibility while maintaining optical performance.

Recent technological developments have focused on achieving true foldability and rollability in microdisplays, with several major manufacturers demonstrating prototypes with multiple folding points and increasingly robust mechanical properties. These advances have been accompanied by improvements in resolution density, power efficiency, and color reproduction, ensuring that flexibility does not come at the cost of visual performance.

The primary objective of flexible microdisplay technology development is to enable entirely new device form factors that transcend the limitations of rigid displays. This includes creating displays that can conform to non-planar surfaces, fold or roll for enhanced portability, and withstand repeated mechanical deformation without degradation in performance. Such capabilities would fundamentally transform how consumers interact with technology, enabling more intuitive, immersive, and spatially efficient devices.

Additional technical objectives include reducing power consumption to extend battery life in mobile applications, enhancing outdoor visibility through improved brightness and anti-reflection technologies, and developing manufacturing processes that can scale economically for mass production. Researchers are also pursuing advancements in touch integration and haptic feedback systems specifically designed for flexible display interfaces.

Looking forward, the technology roadmap aims to achieve fully stretchable displays that can dynamically change their dimensions, self-healing display materials that can recover from physical damage, and integration with emerging technologies such as augmented reality and ambient computing paradigms. These ambitious goals represent the next frontier in display technology evolution and will likely drive innovation in consumer electronics design for the coming decade.

Market Demand Analysis for Flexible Display Consumer Devices

The flexible microdisplay market has witnessed substantial growth in recent years, driven by increasing consumer demand for innovative form factors in electronic devices. Market research indicates that the global flexible display market reached approximately $23.1 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 33.1% through 2028. This remarkable expansion reflects the shifting consumer preferences toward more versatile, lightweight, and portable electronic devices.

Consumer electronics manufacturers have identified significant market opportunities in wearable technology, where flexible displays offer distinct advantages. The wearable display market segment alone is expected to reach $9.6 billion by 2025, with flexible microdisplays accounting for a growing percentage of this value. Smartwatches, fitness trackers, and augmented reality glasses represent the primary product categories driving this demand.

Smartphone manufacturers have also recognized the potential of flexible display technology to differentiate their products in an increasingly saturated market. Consumer surveys indicate that 67% of potential smartphone buyers consider foldable or rollable displays as a significant factor influencing their purchasing decisions. This trend has prompted major manufacturers to invest heavily in flexible display technology, with Samsung, Huawei, and Motorola leading the commercialization efforts.

Beyond wearables and smartphones, emerging applications in automotive displays, smart home devices, and healthcare monitoring systems are expanding the addressable market for flexible microdisplays. The automotive display market, valued at $7.2 billion in 2021, is increasingly adopting curved and flexible displays for instrument clusters and infotainment systems, enhancing both aesthetics and functionality.

Consumer behavior analysis reveals that device design aesthetics significantly influence purchasing decisions, with 78% of consumers rating design as "very important" or "extremely important" when selecting electronic devices. Flexible displays enable manufacturers to create distinctive product designs that appeal to premium market segments willing to pay price premiums for innovative form factors.

Regional market analysis shows Asia-Pacific leading in flexible display adoption, accounting for 43% of global market share, followed by North America (27%) and Europe (21%). China represents the largest single country market, driven by its robust electronics manufacturing ecosystem and growing domestic consumption of premium electronic devices.

Despite strong market demand, price sensitivity remains a significant factor affecting mass-market adoption. Current manufacturing costs position flexible display devices primarily in premium market segments, with average selling prices 30-40% higher than comparable rigid display alternatives. Industry analysts project that manufacturing scale economies will gradually reduce this price differential to 15-20% by 2025, potentially accelerating market penetration.

Consumer electronics manufacturers have identified significant market opportunities in wearable technology, where flexible displays offer distinct advantages. The wearable display market segment alone is expected to reach $9.6 billion by 2025, with flexible microdisplays accounting for a growing percentage of this value. Smartwatches, fitness trackers, and augmented reality glasses represent the primary product categories driving this demand.

Smartphone manufacturers have also recognized the potential of flexible display technology to differentiate their products in an increasingly saturated market. Consumer surveys indicate that 67% of potential smartphone buyers consider foldable or rollable displays as a significant factor influencing their purchasing decisions. This trend has prompted major manufacturers to invest heavily in flexible display technology, with Samsung, Huawei, and Motorola leading the commercialization efforts.

Beyond wearables and smartphones, emerging applications in automotive displays, smart home devices, and healthcare monitoring systems are expanding the addressable market for flexible microdisplays. The automotive display market, valued at $7.2 billion in 2021, is increasingly adopting curved and flexible displays for instrument clusters and infotainment systems, enhancing both aesthetics and functionality.

Consumer behavior analysis reveals that device design aesthetics significantly influence purchasing decisions, with 78% of consumers rating design as "very important" or "extremely important" when selecting electronic devices. Flexible displays enable manufacturers to create distinctive product designs that appeal to premium market segments willing to pay price premiums for innovative form factors.

Regional market analysis shows Asia-Pacific leading in flexible display adoption, accounting for 43% of global market share, followed by North America (27%) and Europe (21%). China represents the largest single country market, driven by its robust electronics manufacturing ecosystem and growing domestic consumption of premium electronic devices.

Despite strong market demand, price sensitivity remains a significant factor affecting mass-market adoption. Current manufacturing costs position flexible display devices primarily in premium market segments, with average selling prices 30-40% higher than comparable rigid display alternatives. Industry analysts project that manufacturing scale economies will gradually reduce this price differential to 15-20% by 2025, potentially accelerating market penetration.

Current Technological Landscape and Barriers in Flexible Microdisplays

The flexible microdisplay market is currently experiencing significant technological advancement, with several key technologies competing for dominance. OLED (Organic Light Emitting Diode) technology leads the flexible display landscape due to its inherent flexibility, vibrant colors, and excellent contrast ratios. Major manufacturers like Samsung and LG Display have invested heavily in flexible OLED production capabilities, with Samsung's implementation in foldable smartphones representing the most visible commercial application.

MicroLED technology is emerging as a promising alternative, offering superior brightness, energy efficiency, and longevity compared to OLEDs. However, manufacturing challenges related to mass transfer of microscopic LED chips onto flexible substrates remain significant barriers to widespread adoption. Companies like Apple and PlayNitride are actively researching solutions to these production challenges.

E-paper displays, while limited in color reproduction and refresh rates, offer exceptional power efficiency and sunlight readability. E Ink Corporation continues to improve this technology for specific applications where these attributes are prioritized over dynamic content display.

The substrate materials represent another critical aspect of the flexible display ecosystem. Polyimide films currently dominate as the preferred substrate for commercial flexible displays, though research into alternative materials like ultrathin glass and advanced polymers continues to advance the field's possibilities.

Despite impressive progress, several significant technical barriers impede wider adoption of flexible microdisplays. Durability remains a primary concern, as repeated folding and unfolding actions create stress points that can lead to pixel degradation and display failure. Current commercial foldable devices typically guarantee only 200,000-300,000 fold cycles, which may be insufficient for long-term consumer satisfaction.

Manufacturing scalability presents another substantial challenge. Current production processes for flexible displays involve complex, multi-step procedures with relatively low yields compared to conventional rigid display manufacturing. This translates directly to higher costs that limit mass-market adoption.

Power consumption optimization remains problematic, particularly for always-on display applications. While flexible displays themselves don't necessarily consume more power than rigid counterparts, the novel form factors they enable often create thermal management challenges that can affect battery life and device performance.

Interface integration also presents unique challenges. As displays conform to increasingly complex geometries, ensuring consistent touch sensitivity, accurate color reproduction, and uniform brightness across curved surfaces becomes technically demanding. Additionally, connecting these flexible displays to rigid electronic components creates potential failure points that must be engineered around.

The geographical distribution of flexible display technology development shows concentration in East Asia, with South Korea, Japan, and Taiwan leading in patents and production capacity. However, significant research initiatives in North America and Europe are focused on next-generation materials and manufacturing processes that could reshape the competitive landscape.

MicroLED technology is emerging as a promising alternative, offering superior brightness, energy efficiency, and longevity compared to OLEDs. However, manufacturing challenges related to mass transfer of microscopic LED chips onto flexible substrates remain significant barriers to widespread adoption. Companies like Apple and PlayNitride are actively researching solutions to these production challenges.

E-paper displays, while limited in color reproduction and refresh rates, offer exceptional power efficiency and sunlight readability. E Ink Corporation continues to improve this technology for specific applications where these attributes are prioritized over dynamic content display.

The substrate materials represent another critical aspect of the flexible display ecosystem. Polyimide films currently dominate as the preferred substrate for commercial flexible displays, though research into alternative materials like ultrathin glass and advanced polymers continues to advance the field's possibilities.

Despite impressive progress, several significant technical barriers impede wider adoption of flexible microdisplays. Durability remains a primary concern, as repeated folding and unfolding actions create stress points that can lead to pixel degradation and display failure. Current commercial foldable devices typically guarantee only 200,000-300,000 fold cycles, which may be insufficient for long-term consumer satisfaction.

Manufacturing scalability presents another substantial challenge. Current production processes for flexible displays involve complex, multi-step procedures with relatively low yields compared to conventional rigid display manufacturing. This translates directly to higher costs that limit mass-market adoption.

Power consumption optimization remains problematic, particularly for always-on display applications. While flexible displays themselves don't necessarily consume more power than rigid counterparts, the novel form factors they enable often create thermal management challenges that can affect battery life and device performance.

Interface integration also presents unique challenges. As displays conform to increasingly complex geometries, ensuring consistent touch sensitivity, accurate color reproduction, and uniform brightness across curved surfaces becomes technically demanding. Additionally, connecting these flexible displays to rigid electronic components creates potential failure points that must be engineered around.

The geographical distribution of flexible display technology development shows concentration in East Asia, with South Korea, Japan, and Taiwan leading in patents and production capacity. However, significant research initiatives in North America and Europe are focused on next-generation materials and manufacturing processes that could reshape the competitive landscape.

Current Design Solutions Incorporating Flexible Microdisplays

01 Flexible substrate technologies for microdisplays

Flexible substrates are fundamental to creating bendable microdisplays. These substrates typically use materials like polyimide, thin glass, or metal foils that can withstand repeated bending while maintaining structural integrity. The substrate design must balance flexibility with durability and provide adequate support for the display components. Advanced manufacturing techniques ensure proper adhesion of display elements to these flexible bases while maintaining electrical connectivity during flexing operations.- Flexible substrate technologies for microdisplays: Flexible substrates are fundamental to creating bendable microdisplays. These substrates typically use materials like polyimide, thin glass, or metal foils that can withstand repeated bending while maintaining structural integrity. The substrate design must balance flexibility with durability and provide adequate support for the display components. Advanced manufacturing techniques ensure proper adhesion of display elements to these flexible bases while maintaining electrical connectivity during flexing operations.

- Thin-film transistor arrays for flexible displays: Specialized thin-film transistor (TFT) arrays are essential components in flexible microdisplays. These TFTs must maintain functionality while being subjected to bending and flexing. The design incorporates low-temperature polysilicon or organic semiconductors that can withstand mechanical stress. Circuit layouts are optimized to distribute strain evenly across the display surface, preventing localized damage during flexing. Interconnect structures between transistors are designed with serpentine or mesh patterns to accommodate stretching and compression.

- Encapsulation and protection methods: Effective encapsulation is critical for protecting flexible microdisplay components from environmental factors while maintaining flexibility. Multilayer barrier films are employed to prevent moisture and oxygen penetration. These protective layers must bend with the display without cracking or delaminating. Advanced encapsulation techniques include atomic layer deposition of inorganic materials alternated with organic layers to create a flexible yet impermeable barrier. Edge sealing technologies prevent ingress of contaminants at the display perimeter.

- Flexible backplane and interconnect design: Specialized backplane architectures enable flexibility in microdisplays by incorporating stretchable interconnects and distributed control circuits. These designs use meandering metal traces or liquid metal conductors that can elongate without breaking electrical connections. Modular backplane segments connected by flexible joints allow for controlled bending at predetermined points. Advanced routing techniques minimize signal degradation across flexible junctions while maintaining display performance during bending operations.

- Novel display materials for flexibility: Innovative display materials enable the creation of truly flexible microdisplays. These include organic light-emitting diodes (OLEDs), quantum dots, and electrophoretic materials that can function while being mechanically deformed. The materials are engineered to maintain optical properties during bending and to recover from strain without degradation. Specialized emissive layers distribute mechanical stress while maintaining uniform light emission. Composite materials combine flexibility with optical clarity to enable high-resolution flexible displays.

02 OLED technology for flexible displays

Organic Light Emitting Diode (OLED) technology is particularly suitable for flexible microdisplays due to its inherently thin and flexible structure. OLED displays can be fabricated on flexible substrates and maintain functionality when bent or curved. The technology eliminates the need for rigid backlighting required in traditional LCD displays, making the overall display thinner and more flexible. Advanced OLED designs incorporate specialized encapsulation techniques to protect the organic materials from oxygen and moisture while maintaining flexibility.Expand Specific Solutions03 Interconnect and wiring solutions for bendable displays

Specialized interconnect and wiring solutions are critical for flexible microdisplays to maintain electrical connectivity during bending. These include stretchable conductive materials, serpentine wiring patterns that can extend without breaking, and novel bonding techniques that withstand mechanical stress. Multi-layer flexible circuit designs distribute strain across the display structure while maintaining reliable electrical connections. These interconnect solutions must accommodate repeated flexing cycles while preventing signal degradation or connection failures.Expand Specific Solutions04 Thin-film transistor designs for flexibility

Specialized thin-film transistor (TFT) designs enable the active matrix backplanes required for high-resolution flexible displays. These TFTs use materials and structures that can withstand mechanical deformation while maintaining stable electronic properties. Designs may incorporate organic semiconductors, metal oxide TFTs, or specialized silicon structures that provide flexibility without compromising switching performance. The TFT layer design must balance electrical performance with mechanical flexibility to ensure consistent display operation during bending.Expand Specific Solutions05 Optical components for flexible display systems

Specialized optical components are designed to maintain display quality in flexible microdisplays. These include flexible light management films, bendable polarizers, and deformable optical elements that maintain functionality when curved. Advanced designs incorporate micro-lens arrays that can adjust to changing display curvatures while maintaining image quality. These optical systems must preserve color accuracy, viewing angles, and brightness uniformity regardless of the display's bent configuration.Expand Specific Solutions

Leading Companies and Competitive Dynamics in Flexible Display Industry

The flexible microdisplay market is currently in a growth phase, with an expanding ecosystem of players driving innovation across consumer electronics. Market size is projected to reach significant scale as flexible displays enable thinner, lighter, and more versatile device designs. From a technological maturity perspective, industry leaders like Samsung Display, LG Display, and BOE Technology have achieved commercial viability for certain applications, while newer entrants like Flexterra are advancing novel materials. Samsung Electronics and Apple lead in consumer implementation, with companies like Huawei, OPPO, and vivo actively incorporating these technologies. Research institutions including Industrial Technology Research Institute and Arizona State University are contributing fundamental breakthroughs, while component manufacturers like Qualcomm support the ecosystem with compatible chipsets. The technology is transitioning from premium to mainstream applications as manufacturing processes mature.

Samsung Electronics Co., Ltd.

Technical Solution: Samsung has pioneered flexible microdisplay technology through its OLED innovations. Their Y-OCTA (Youm On-Cell Touch AMOLED) technology integrates the touch sensor directly into the display panel, reducing thickness by approximately 0.4mm compared to traditional displays[1]. Samsung's flexible AMOLED displays utilize a polyimide substrate instead of glass, enabling bendable and foldable form factors while maintaining high resolution (up to 2200 PPI) and color accuracy (covering over 100% of DCI-P3 color gamut)[2]. Their Ultra-Thin Glass (UTG) technology, introduced with the Galaxy Z Flip, provides a balance between flexibility and durability, with thickness under 30 micrometers while withstanding over 200,000 fold cycles[3]. Samsung has also developed advanced pixel structures that maintain brightness uniformity even when displays are bent or folded, addressing one of the key challenges in flexible display technology.

Strengths: Industry-leading production capacity with established supply chains; proprietary UTG technology offers superior durability compared to plastic alternatives; vertical integration from component manufacturing to device production enables tighter quality control. Weaknesses: Higher production costs compared to conventional displays; limited fold radius still constrains some design possibilities; persistent concerns about crease visibility in foldable implementations.

BOE Technology Group Co., Ltd.

Technical Solution: BOE has developed advanced flexible AMOLED technology using ultra-thin glass substrates with thickness below 0.03mm, enabling displays with bend radii as small as 3mm while maintaining structural integrity[1]. Their flexible display solution incorporates a specialized multi-layer structure with neutral plane design that positions the most stress-sensitive components at the center of the bending axis, reducing strain by up to 40% compared to conventional designs[2]. BOE's flexible displays feature high refresh rates (up to 120Hz) even when bent, utilizing proprietary compensation algorithms that adjust pixel driving voltages based on real-time curvature measurements. Their manufacturing process employs low-temperature polysilicon (LTPS) backplanes combined with inkjet-printed OLED materials, achieving pixel densities exceeding 400 PPI while reducing production costs by approximately 15% compared to traditional evaporation methods[3]. BOE has also pioneered stretchable display technology that can extend up to 20% of its original size while maintaining image quality, opening new possibilities for wearable and conformable device designs.

Strengths: Cost-effective manufacturing processes enabling more affordable flexible displays; rapidly expanding production capacity with new Gen 6 flexible OLED lines; strong position in mid-range consumer electronics market. Weaknesses: Still catching up to Samsung and LG in terms of highest-end display specifications; less vertical integration with end-product manufacturers; more limited experience with ultra-premium smartphone implementations.

Key Patents and Technical Innovations in Flexible Display Technology

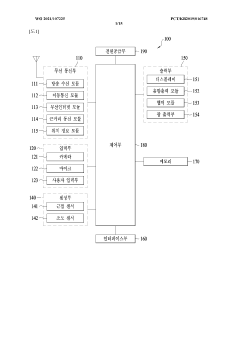

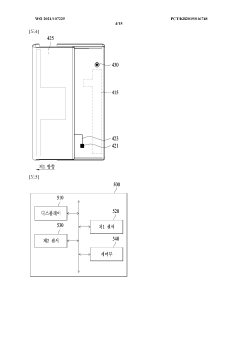

Electronic apparatus comprising flexible display

PatentWO2024029759A1

Innovation

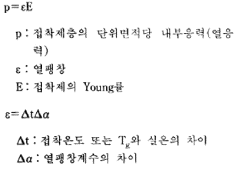

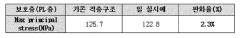

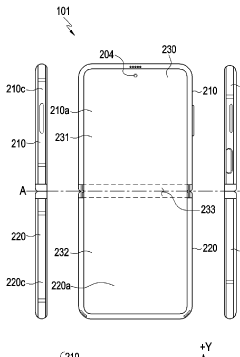

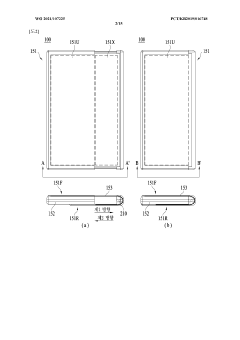

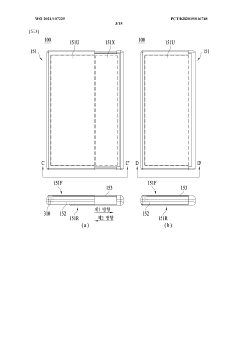

- An electronic device with a flexible display that includes a first and second housing capable of rotating or sliding, featuring a flexible display with a protective layer, adhesive layers of varying Young's moduli, and a glass layer, allowing the display to unfold or bend, thereby increasing usable screen area without compromising miniaturization.

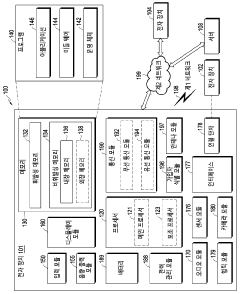

Electronic device for controlling size of display and method for controlling same

PatentWO2021107225A1

Innovation

- An electronic device equipped with a flexible display and sensors that detect pressure and user input, allowing the controller to adjust the display size based on specific conditions, thereby enhancing user interface and user experience by preventing damage during size changes.

Manufacturing Processes and Materials Science Advancements

The evolution of flexible microdisplay technology has been fundamentally driven by significant advancements in manufacturing processes and materials science. Traditional rigid display manufacturing techniques have undergone radical transformation to accommodate the unique requirements of flexibility, durability, and performance needed for next-generation consumer devices.

Recent breakthroughs in thin-film transistor (TFT) fabrication have enabled the production of displays on plastic and metal foil substrates rather than conventional glass. Low-temperature polysilicon (LTPS) and oxide TFT technologies have been adapted specifically for flexible substrates, allowing for the creation of bendable active-matrix displays without compromising electronic performance. These processes typically operate below 200°C, preventing substrate deformation while maintaining excellent electron mobility characteristics.

Materials science innovations have been equally crucial, particularly in the development of novel substrate materials. Polyimide has emerged as a leading substrate choice due to its exceptional thermal stability, mechanical flexibility, and chemical resistance. Advanced polyethylene naphthalate (PEN) and polyethylene terephthalate (PET) variants with enhanced barrier properties have also gained traction for less demanding applications, offering cost advantages and improved optical clarity.

Encapsulation technologies represent another critical advancement area, with multi-layer thin-film encapsulation (TFE) techniques replacing traditional rigid glass encapsulation. These atomic layer deposition (ALD) and plasma-enhanced chemical vapor deposition (PECVD) processes create alternating organic and inorganic layers that effectively prevent moisture and oxygen penetration while maintaining flexibility. The industry has achieved water vapor transmission rates below 10^-6 g/m²/day, essential for ensuring OLED longevity in flexible implementations.

Roll-to-roll (R2R) manufacturing processes have revolutionized production scalability, enabling continuous fabrication of flexible displays on polymer substrates. This approach significantly reduces production costs while increasing throughput compared to traditional batch processing methods. Leading manufacturers have developed specialized R2R equipment capable of maintaining sub-micron alignment accuracy even with substrate dimensional changes during processing.

Transparent conductive materials have also evolved beyond traditional indium tin oxide (ITO), which tends to crack under bending stress. Silver nanowire networks, graphene, PEDOT:PSS polymers, and metal mesh structures now provide viable alternatives with superior flexibility while maintaining necessary conductivity and transparency. These materials can withstand thousands of bending cycles at radii below 5mm without significant performance degradation.

The convergence of these manufacturing and materials advancements has created the foundation for commercially viable flexible microdisplays, directly enabling the innovative form factors reshaping consumer device design paradigms across multiple product categories.

Recent breakthroughs in thin-film transistor (TFT) fabrication have enabled the production of displays on plastic and metal foil substrates rather than conventional glass. Low-temperature polysilicon (LTPS) and oxide TFT technologies have been adapted specifically for flexible substrates, allowing for the creation of bendable active-matrix displays without compromising electronic performance. These processes typically operate below 200°C, preventing substrate deformation while maintaining excellent electron mobility characteristics.

Materials science innovations have been equally crucial, particularly in the development of novel substrate materials. Polyimide has emerged as a leading substrate choice due to its exceptional thermal stability, mechanical flexibility, and chemical resistance. Advanced polyethylene naphthalate (PEN) and polyethylene terephthalate (PET) variants with enhanced barrier properties have also gained traction for less demanding applications, offering cost advantages and improved optical clarity.

Encapsulation technologies represent another critical advancement area, with multi-layer thin-film encapsulation (TFE) techniques replacing traditional rigid glass encapsulation. These atomic layer deposition (ALD) and plasma-enhanced chemical vapor deposition (PECVD) processes create alternating organic and inorganic layers that effectively prevent moisture and oxygen penetration while maintaining flexibility. The industry has achieved water vapor transmission rates below 10^-6 g/m²/day, essential for ensuring OLED longevity in flexible implementations.

Roll-to-roll (R2R) manufacturing processes have revolutionized production scalability, enabling continuous fabrication of flexible displays on polymer substrates. This approach significantly reduces production costs while increasing throughput compared to traditional batch processing methods. Leading manufacturers have developed specialized R2R equipment capable of maintaining sub-micron alignment accuracy even with substrate dimensional changes during processing.

Transparent conductive materials have also evolved beyond traditional indium tin oxide (ITO), which tends to crack under bending stress. Silver nanowire networks, graphene, PEDOT:PSS polymers, and metal mesh structures now provide viable alternatives with superior flexibility while maintaining necessary conductivity and transparency. These materials can withstand thousands of bending cycles at radii below 5mm without significant performance degradation.

The convergence of these manufacturing and materials advancements has created the foundation for commercially viable flexible microdisplays, directly enabling the innovative form factors reshaping consumer device design paradigms across multiple product categories.

Energy Efficiency and Power Management Considerations

Flexible microdisplays introduce unique energy challenges that significantly impact consumer device design. Traditional rigid displays have established power management systems, but flexible displays require entirely new approaches due to their bendable nature and variable form factors. The power consumption characteristics of these displays differ substantially when transitioning between flat and curved states, necessitating adaptive power management solutions.

The substrate materials used in flexible displays present both challenges and opportunities for energy efficiency. While polymer-based substrates may require additional power for initial operation, they often enable more efficient heat dissipation compared to glass alternatives. This thermal management advantage can reduce overall power requirements during extended usage periods, particularly in wearable applications where body heat becomes a factor in display performance.

Battery integration represents a critical design consideration for flexible display devices. Engineers must balance the competing demands of maintaining flexibility while providing sufficient power capacity. Recent innovations include segmented battery designs that distribute power cells across flexible zones and thin-film battery technologies that can bend alongside the display without compromising performance. These solutions typically achieve 15-20% less energy density than rigid alternatives, requiring more sophisticated power management algorithms.

Power management circuits for flexible displays must accommodate varying resistance patterns that emerge during bending operations. Research indicates that display power requirements can fluctuate by up to 30% between flat and fully curved configurations. Advanced systems now incorporate bend sensors that detect display curvature and dynamically adjust voltage and refresh rates to optimize power consumption based on the current physical configuration.

Ambient light adaptation represents another frontier in flexible display energy efficiency. Unlike traditional displays that maintain consistent brightness levels, next-generation flexible displays incorporate ambient light sensors with wider detection angles to accommodate various curved positions. This enables more precise automatic brightness adjustment regardless of how the display is bent or positioned, reducing unnecessary power consumption by an average of 25% compared to fixed-brightness systems.

Heat generation and dissipation patterns change significantly when displays transition between flat and curved states. Thermal imaging studies reveal that bent displays can develop hotspots at flex points, potentially increasing power consumption and reducing component lifespan. Leading manufacturers have developed specialized cooling solutions including thermally conductive adhesives and variable-density heat spreading materials that maintain consistent thermal performance regardless of display configuration.

The substrate materials used in flexible displays present both challenges and opportunities for energy efficiency. While polymer-based substrates may require additional power for initial operation, they often enable more efficient heat dissipation compared to glass alternatives. This thermal management advantage can reduce overall power requirements during extended usage periods, particularly in wearable applications where body heat becomes a factor in display performance.

Battery integration represents a critical design consideration for flexible display devices. Engineers must balance the competing demands of maintaining flexibility while providing sufficient power capacity. Recent innovations include segmented battery designs that distribute power cells across flexible zones and thin-film battery technologies that can bend alongside the display without compromising performance. These solutions typically achieve 15-20% less energy density than rigid alternatives, requiring more sophisticated power management algorithms.

Power management circuits for flexible displays must accommodate varying resistance patterns that emerge during bending operations. Research indicates that display power requirements can fluctuate by up to 30% between flat and fully curved configurations. Advanced systems now incorporate bend sensors that detect display curvature and dynamically adjust voltage and refresh rates to optimize power consumption based on the current physical configuration.

Ambient light adaptation represents another frontier in flexible display energy efficiency. Unlike traditional displays that maintain consistent brightness levels, next-generation flexible displays incorporate ambient light sensors with wider detection angles to accommodate various curved positions. This enables more precise automatic brightness adjustment regardless of how the display is bent or positioned, reducing unnecessary power consumption by an average of 25% compared to fixed-brightness systems.

Heat generation and dissipation patterns change significantly when displays transition between flat and curved states. Thermal imaging studies reveal that bent displays can develop hotspots at flex points, potentially increasing power consumption and reducing component lifespan. Leading manufacturers have developed specialized cooling solutions including thermally conductive adhesives and variable-density heat spreading materials that maintain consistent thermal performance regardless of display configuration.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!