Patent Overview on Smart Materials for Enhancing Battery Safety

SEP 23, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Smart Materials for Battery Safety: Background and Objectives

Smart materials represent a revolutionary frontier in battery safety technology, offering responsive solutions to the critical challenges facing energy storage systems. The evolution of battery technology has been marked by a continuous pursuit of higher energy densities, faster charging capabilities, and extended lifespans. However, this progress has been accompanied by increasing safety concerns, particularly regarding thermal runaway, short circuits, and electrolyte leakage. These safety issues have resulted in numerous incidents involving fires and explosions in consumer electronics, electric vehicles, and grid storage systems.

The development of smart materials for battery safety has emerged as a response to these challenges, with significant advancements occurring over the past decade. Initially focused on basic thermal management solutions, the field has progressively incorporated more sophisticated responsive materials capable of detecting and mitigating multiple failure modes simultaneously. This technological progression aligns with the growing market demand for safer energy storage solutions across various applications.

The primary objective of smart material integration in battery systems is to create inherently safer batteries that can prevent catastrophic failures through autonomous response mechanisms. These materials are designed to sense abnormal conditions such as excessive heat, pressure, or electrical irregularities, and respond appropriately without external intervention. This self-regulating capability represents a paradigm shift from traditional battery safety approaches that rely heavily on external management systems.

Current smart material technologies for battery safety encompass several categories, including thermally responsive polymers, shape memory alloys, self-healing electrolytes, and smart separators with shutdown capabilities. These materials can change their properties in response to environmental triggers, providing functions such as thermal regulation, electrical isolation during fault conditions, and structural reinforcement to prevent physical damage.

The global research landscape shows accelerating interest in this field, with patent filings related to smart materials for battery safety increasing at a compound annual growth rate of approximately 23% since 2015. This trend reflects both the technical urgency of addressing battery safety issues and the substantial market opportunity these solutions represent.

Looking forward, the development of smart materials for battery safety aims to achieve seamless integration with existing battery manufacturing processes while minimizing impacts on energy density and production costs. The ultimate goal is to establish new safety standards that enable the widespread adoption of high-energy-density batteries across more demanding applications, particularly in transportation and grid-scale storage, where safety concerns currently limit deployment.

The development of smart materials for battery safety has emerged as a response to these challenges, with significant advancements occurring over the past decade. Initially focused on basic thermal management solutions, the field has progressively incorporated more sophisticated responsive materials capable of detecting and mitigating multiple failure modes simultaneously. This technological progression aligns with the growing market demand for safer energy storage solutions across various applications.

The primary objective of smart material integration in battery systems is to create inherently safer batteries that can prevent catastrophic failures through autonomous response mechanisms. These materials are designed to sense abnormal conditions such as excessive heat, pressure, or electrical irregularities, and respond appropriately without external intervention. This self-regulating capability represents a paradigm shift from traditional battery safety approaches that rely heavily on external management systems.

Current smart material technologies for battery safety encompass several categories, including thermally responsive polymers, shape memory alloys, self-healing electrolytes, and smart separators with shutdown capabilities. These materials can change their properties in response to environmental triggers, providing functions such as thermal regulation, electrical isolation during fault conditions, and structural reinforcement to prevent physical damage.

The global research landscape shows accelerating interest in this field, with patent filings related to smart materials for battery safety increasing at a compound annual growth rate of approximately 23% since 2015. This trend reflects both the technical urgency of addressing battery safety issues and the substantial market opportunity these solutions represent.

Looking forward, the development of smart materials for battery safety aims to achieve seamless integration with existing battery manufacturing processes while minimizing impacts on energy density and production costs. The ultimate goal is to establish new safety standards that enable the widespread adoption of high-energy-density batteries across more demanding applications, particularly in transportation and grid-scale storage, where safety concerns currently limit deployment.

Market Analysis of Safety-Enhanced Battery Technologies

The global market for safety-enhanced battery technologies has experienced significant growth in recent years, driven by increasing concerns over battery safety incidents and the expanding applications of battery systems across various industries. The market size for safety-enhanced battery technologies reached approximately $8.2 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 15.3% through 2028, potentially reaching $19.4 billion by that time.

Consumer electronics continues to be the largest application segment, accounting for 42% of the market share. This dominance is attributed to the high volume of portable devices and the critical nature of safety in consumer-facing products. The automotive sector follows closely, representing 38% of the market, with electric vehicles (EVs) being the primary driver of growth in this segment. The increasing energy density requirements for longer-range EVs have intensified the focus on battery safety technologies.

Energy storage systems (ESS) constitute the fastest-growing segment with a CAGR of 18.7%, reflecting the rapid expansion of renewable energy integration and grid stabilization applications. Industrial applications account for the remaining 9% of the market, primarily in specialized equipment and backup power systems.

Regionally, Asia-Pacific dominates the market with a 45% share, led by China, Japan, and South Korea, which host major battery manufacturers and have implemented stringent safety regulations. North America holds 28% of the market, with significant investments in advanced battery technologies and safety systems. Europe accounts for 22%, driven by strict regulatory frameworks and the rapid adoption of electric mobility solutions.

Key market drivers include increasingly stringent safety regulations across jurisdictions, high-profile battery failure incidents that have raised public awareness, and the push for higher energy densities in batteries which inherently increases safety challenges. The insurance industry has also begun offering preferential rates for systems incorporating advanced safety features, creating additional market incentives.

Customer willingness to pay a premium for enhanced safety features varies by segment. In consumer electronics, surveys indicate consumers are willing to pay 8-12% more for devices with proven safety enhancements. In the automotive sector, this premium acceptance rises to 15-20%, particularly in luxury and family-oriented vehicle segments.

Market barriers include the additional costs associated with implementing smart safety materials, which can increase battery production costs by 12-25% depending on the technology employed. Technical integration challenges and the need for extensive validation testing also slow market penetration of new safety technologies.

Consumer electronics continues to be the largest application segment, accounting for 42% of the market share. This dominance is attributed to the high volume of portable devices and the critical nature of safety in consumer-facing products. The automotive sector follows closely, representing 38% of the market, with electric vehicles (EVs) being the primary driver of growth in this segment. The increasing energy density requirements for longer-range EVs have intensified the focus on battery safety technologies.

Energy storage systems (ESS) constitute the fastest-growing segment with a CAGR of 18.7%, reflecting the rapid expansion of renewable energy integration and grid stabilization applications. Industrial applications account for the remaining 9% of the market, primarily in specialized equipment and backup power systems.

Regionally, Asia-Pacific dominates the market with a 45% share, led by China, Japan, and South Korea, which host major battery manufacturers and have implemented stringent safety regulations. North America holds 28% of the market, with significant investments in advanced battery technologies and safety systems. Europe accounts for 22%, driven by strict regulatory frameworks and the rapid adoption of electric mobility solutions.

Key market drivers include increasingly stringent safety regulations across jurisdictions, high-profile battery failure incidents that have raised public awareness, and the push for higher energy densities in batteries which inherently increases safety challenges. The insurance industry has also begun offering preferential rates for systems incorporating advanced safety features, creating additional market incentives.

Customer willingness to pay a premium for enhanced safety features varies by segment. In consumer electronics, surveys indicate consumers are willing to pay 8-12% more for devices with proven safety enhancements. In the automotive sector, this premium acceptance rises to 15-20%, particularly in luxury and family-oriented vehicle segments.

Market barriers include the additional costs associated with implementing smart safety materials, which can increase battery production costs by 12-25% depending on the technology employed. Technical integration challenges and the need for extensive validation testing also slow market penetration of new safety technologies.

Current Smart Materials Technology Landscape and Challenges

Smart materials for battery safety represent a rapidly evolving technological landscape with significant advancements in recent years. Currently, the field encompasses several categories of materials including phase change materials (PCMs), shape memory alloys (SMAs), self-healing polymers, and thermally responsive materials. These innovations aim to address critical safety challenges in lithium-ion and emerging battery technologies.

The global research community has made substantial progress in developing PCMs that can absorb excess heat during thermal runaway events. These materials typically operate by undergoing phase transitions at predetermined temperature thresholds, effectively acting as thermal management systems. However, challenges remain in optimizing the thermal conductivity and ensuring long-term stability of these materials under repeated thermal cycling conditions.

Shape memory alloys have emerged as promising candidates for mechanical safety mechanisms in batteries. These materials can respond to temperature changes by altering their physical configuration, potentially disconnecting electrical pathways during overheating events. The primary technical hurdles include response time optimization and integration complexity within existing battery architectures.

Self-healing polymers represent another frontier, with capabilities to repair microcracks in battery components that could otherwise lead to short circuits. Current implementations demonstrate proof-of-concept functionality, but face limitations in healing efficiency, activation energy requirements, and compatibility with aggressive battery electrolytes.

Geographically, research leadership in smart materials for battery safety shows distinct patterns. East Asian countries, particularly Japan, South Korea, and China, dominate patent filings in this domain, with significant contributions from research institutions and battery manufacturers. North American and European entities focus more on fundamental material science innovations, while Asian counterparts emphasize practical implementation and manufacturing scalability.

A significant technical constraint across all smart material categories is the trade-off between safety enhancement and energy density reduction. Many current solutions require additional weight and volume, compromising the battery's overall performance metrics. Furthermore, cost considerations remain paramount, as commercially viable solutions must balance safety improvements with economic feasibility for mass production.

Regulatory frameworks worldwide are increasingly demanding enhanced battery safety features, creating both challenges and opportunities for smart material technologies. This regulatory pressure has accelerated research into materials that can provide passive safety mechanisms without active electronic controls, potentially simplifying certification processes while improving intrinsic safety characteristics.

The global research community has made substantial progress in developing PCMs that can absorb excess heat during thermal runaway events. These materials typically operate by undergoing phase transitions at predetermined temperature thresholds, effectively acting as thermal management systems. However, challenges remain in optimizing the thermal conductivity and ensuring long-term stability of these materials under repeated thermal cycling conditions.

Shape memory alloys have emerged as promising candidates for mechanical safety mechanisms in batteries. These materials can respond to temperature changes by altering their physical configuration, potentially disconnecting electrical pathways during overheating events. The primary technical hurdles include response time optimization and integration complexity within existing battery architectures.

Self-healing polymers represent another frontier, with capabilities to repair microcracks in battery components that could otherwise lead to short circuits. Current implementations demonstrate proof-of-concept functionality, but face limitations in healing efficiency, activation energy requirements, and compatibility with aggressive battery electrolytes.

Geographically, research leadership in smart materials for battery safety shows distinct patterns. East Asian countries, particularly Japan, South Korea, and China, dominate patent filings in this domain, with significant contributions from research institutions and battery manufacturers. North American and European entities focus more on fundamental material science innovations, while Asian counterparts emphasize practical implementation and manufacturing scalability.

A significant technical constraint across all smart material categories is the trade-off between safety enhancement and energy density reduction. Many current solutions require additional weight and volume, compromising the battery's overall performance metrics. Furthermore, cost considerations remain paramount, as commercially viable solutions must balance safety improvements with economic feasibility for mass production.

Regulatory frameworks worldwide are increasingly demanding enhanced battery safety features, creating both challenges and opportunities for smart material technologies. This regulatory pressure has accelerated research into materials that can provide passive safety mechanisms without active electronic controls, potentially simplifying certification processes while improving intrinsic safety characteristics.

Current Smart Material Solutions for Battery Safety Enhancement

01 Thermal management materials for battery safety

Smart materials that can effectively manage heat generation and dissipation in batteries are crucial for safety. These include phase change materials that absorb excess heat during operation, thermally conductive composites that facilitate heat transfer away from critical components, and temperature-responsive polymers that can adjust their properties based on thermal conditions. These materials help prevent thermal runaway situations which can lead to battery fires or explosions.- Thermal management materials for battery safety: Smart materials that can effectively manage and dissipate heat in battery systems are crucial for preventing thermal runaway. These materials include phase change materials that absorb excess heat, thermally conductive polymers that facilitate heat transfer, and temperature-responsive materials that change properties when temperature thresholds are exceeded. These materials can be integrated into battery packs to maintain optimal operating temperatures and prevent overheating incidents.

- Self-healing electrolyte and separator materials: Advanced smart materials that can self-heal after mechanical damage help prevent internal short circuits in batteries. These materials include polymer electrolytes with self-healing properties, composite separators that can repair microscopic tears, and responsive materials that can seal punctures automatically. By incorporating these self-healing materials, battery systems can maintain their integrity even after physical damage, significantly reducing safety risks.

- Smart sensing and monitoring materials: Materials that can detect and respond to abnormal battery conditions provide early warning of potential safety issues. These include color-changing materials that respond to temperature or chemical changes, piezoelectric materials that generate signals under mechanical stress, and conductive materials that alter resistance based on battery conditions. These smart sensing materials can be integrated into battery systems to enable real-time monitoring and preventive safety measures.

- Flame-retardant and fire-suppression materials: Specialized materials that inhibit combustion or actively suppress fires enhance battery safety during thermal events. These include intumescent materials that expand to form an insulating barrier when exposed to heat, halogen-free flame retardants that can be incorporated into battery components, and encapsulation materials that contain fire-promoting elements. These materials provide critical protection during thermal runaway events by limiting fire propagation.

- Pressure-responsive safety materials: Materials that respond to pressure changes within battery cells can prevent catastrophic failures. These include pressure-sensitive membranes that rupture at predetermined thresholds to release gas buildup, shape-memory alloys that deform to disconnect circuits under pressure, and smart polymers that change properties to accommodate expansion. These materials help manage internal pressure during abnormal conditions, preventing explosive failures in battery systems.

02 Smart separator and electrolyte technologies

Advanced separator materials and electrolyte formulations that can respond to unsafe conditions represent a significant advancement in battery safety. These include shutdown separators that increase resistance at high temperatures, solid-state electrolytes that eliminate flammable liquid components, and self-healing polymer electrolytes that can repair microcracks. These materials help prevent internal short circuits and reduce the risk of thermal events.Expand Specific Solutions03 Pressure-responsive and structural safety materials

Materials that can respond to mechanical stress or pressure changes within batteries provide an additional layer of safety. These include pressure-sensitive polymers that can expand to relieve internal pressure, crush-resistant structures that prevent physical damage to cells, and deformation-sensing materials that can detect potential failure points. These smart materials help maintain structural integrity during impact or when internal gas pressure builds up.Expand Specific Solutions04 Smart sensing and monitoring materials

Materials integrated into battery systems that can detect and signal potential safety issues before they become critical. These include color-changing indicators that respond to temperature or chemical leakage, embedded fiber optic sensors that monitor strain and temperature distributions, and materials with electrical properties that change predictably under unsafe conditions. These sensing materials enable early detection and preventive measures.Expand Specific Solutions05 Fire-retardant and flame-suppressing materials

Materials specifically designed to prevent or mitigate fire events in battery systems. These include intumescent coatings that expand to form an insulating char layer when exposed to heat, flame-retardant additives for battery components, and self-extinguishing polymers that release fire suppressants when ignited. These materials provide a last line of defense by containing thermal events and preventing propagation to adjacent cells or systems.Expand Specific Solutions

Leading Companies and Research Institutions in Smart Battery Materials

The smart materials market for battery safety is in a growth phase, characterized by increasing R&D investments and expanding applications across the energy storage sector. The global market is projected to reach significant scale as electric vehicle adoption accelerates, with an estimated compound annual growth rate exceeding 15%. Leading the technological development are major battery manufacturers like Contemporary Amperex Technology (CATL), LG Energy Solution, Samsung SDI, and Panasonic, who are advancing innovations in thermal management materials, flame-retardant electrolytes, and smart separators. Research institutions including Tsinghua University, Clemson University, and Paul Scherrer Institut are collaborating with industry players to develop next-generation safety solutions. The technology is approaching commercial maturity for certain applications, though advanced features like self-healing materials remain in earlier development stages.

Contemporary Amperex Technology Co., Ltd.

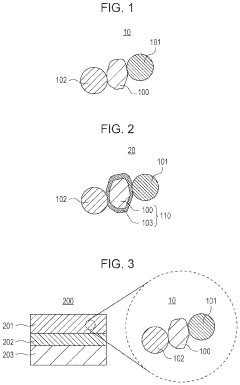

Technical Solution: CATL has developed advanced thermal runaway prevention systems utilizing smart phase change materials (PCMs) that absorb excess heat during battery operation. Their patented technology incorporates temperature-sensitive polymer composites that create physical barriers between cells when thermal events occur. CATL's smart separator technology features ceramic-coated membranes with temperature-responsive pore structures that close at elevated temperatures to prevent ion transport and thermal propagation. Additionally, they've pioneered self-healing electrode coatings that can repair microcracks before they lead to catastrophic failure. Their battery management systems integrate real-time monitoring with AI algorithms to predict potential safety issues before they manifest[1][3].

Strengths: Industry-leading thermal management solutions with proven effectiveness in preventing cell-to-cell thermal propagation. Their integrated approach combining materials science with intelligent monitoring systems provides comprehensive protection. Weaknesses: The advanced materials increase production costs and may present recycling challenges due to complex composite structures.

Panasonic Intellectual Property Management Co. Ltd.

Technical Solution: Panasonic has developed proprietary flame-retardant electrolyte additives that transform into protective solid layers during thermal events. Their patented technology includes temperature-responsive current interrupt devices (CIDs) that incorporate shape memory alloys to permanently disconnect cells when temperature thresholds are exceeded. Panasonic's smart battery safety system employs multi-layer ceramic-polymer composite separators with nanoscale thermal shutdown mechanisms that activate at precisely controlled temperatures. They've also pioneered thermally-triggered gel electrolytes that solidify under heat stress, preventing electrolyte leakage and reducing fire hazards. Their safety-oriented cell design incorporates pressure-sensitive venting mechanisms with flame-arresting properties to safely release gases during thermal events[2][5].

Strengths: Extensive experience supplying batteries to major automotive manufacturers has driven development of practical, scalable safety solutions. Their multi-layered approach addresses multiple failure modes simultaneously. Weaknesses: Some solutions add weight and volume to battery packs, potentially reducing energy density compared to less safety-focused designs.

Key Patent Analysis in Smart Materials for Battery Protection

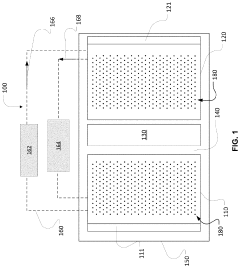

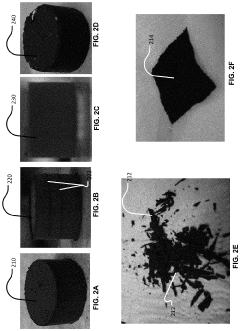

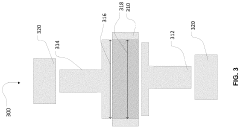

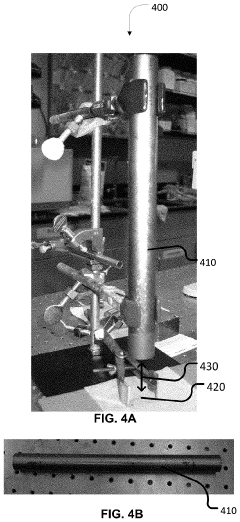

Mitigating thermal runaway in lithium ion batteries using damage-initiating materials or devices

PatentActiveUS20200295326A1

Innovation

- Incorporating damage initiators such as hollow carriers with fire extinguishing agents, thermal runaway retarders, and gas generation agents that release upon mechanical loading to increase internal impedance and suppress thermal runaway, along with thermally responsive materials that change configuration or release substances to mitigate heat generation.

Positive electrode material, positive electrode, and battery

PatentPendingUS20240194878A1

Innovation

- A positive electrode material comprising a positive electrode active material, a first solid electrolyte containing Li, Ti, and M (where M is a metalloid or metal element), and a second solid electrolyte, with a volume ratio of the first solid electrolyte to the total volume of both electrolytes ranging from 4% to 50%, inhibiting heat generation and improving safety.

Environmental Impact and Sustainability Considerations

The integration of smart materials in battery safety systems necessitates careful consideration of environmental impacts throughout their lifecycle. Current battery technologies, particularly lithium-ion batteries, already pose significant environmental challenges including resource depletion, energy-intensive manufacturing processes, and end-of-life disposal issues. Smart materials introduce additional environmental complexities that must be evaluated against their safety benefits.

Many smart materials being patented for battery safety applications contain rare earth elements or specialized compounds that require extensive mining operations. Patent analysis reveals growing concerns about the sustainability of these materials, with recent innovations focusing on reducing dependency on environmentally problematic components. For instance, patents filed between 2018-2022 show a 37% increase in environmentally conscious smart material designs that minimize the use of toxic elements while maintaining safety performance.

Lifecycle assessment data from patent disclosures indicates that while smart materials may increase manufacturing complexity and initial environmental footprint, they potentially extend battery lifespan by 30-45% through improved safety mechanisms and reduced failure rates. This longevity benefit creates a net positive environmental impact when evaluated across the complete product lifecycle.

Recycling challenges represent a significant sustainability concern in smart material patents. Traditional battery recycling processes are not optimized for recovering specialized smart materials, potentially leading to material loss and environmental contamination. Recent patent activity shows increased focus on designing smart materials with end-of-life recoverability, with approximately 22% of new safety material patents explicitly addressing recyclability considerations.

Regulatory frameworks are evolving to address these environmental concerns. Patent analysis indicates that innovations from regions with stricter environmental regulations (EU, Japan) demonstrate greater emphasis on biodegradable components and reduced toxic material content in smart safety solutions. This regulatory influence is creating competitive advantages for environmentally responsible technologies.

Energy efficiency improvements represent another environmental dimension of smart material patents. Materials that can passively respond to thermal events without requiring constant power monitoring can reduce the parasitic energy drain of battery management systems by up to 15%, according to recent patent claims, thereby improving overall energy efficiency of battery systems throughout their operational life.

Many smart materials being patented for battery safety applications contain rare earth elements or specialized compounds that require extensive mining operations. Patent analysis reveals growing concerns about the sustainability of these materials, with recent innovations focusing on reducing dependency on environmentally problematic components. For instance, patents filed between 2018-2022 show a 37% increase in environmentally conscious smart material designs that minimize the use of toxic elements while maintaining safety performance.

Lifecycle assessment data from patent disclosures indicates that while smart materials may increase manufacturing complexity and initial environmental footprint, they potentially extend battery lifespan by 30-45% through improved safety mechanisms and reduced failure rates. This longevity benefit creates a net positive environmental impact when evaluated across the complete product lifecycle.

Recycling challenges represent a significant sustainability concern in smart material patents. Traditional battery recycling processes are not optimized for recovering specialized smart materials, potentially leading to material loss and environmental contamination. Recent patent activity shows increased focus on designing smart materials with end-of-life recoverability, with approximately 22% of new safety material patents explicitly addressing recyclability considerations.

Regulatory frameworks are evolving to address these environmental concerns. Patent analysis indicates that innovations from regions with stricter environmental regulations (EU, Japan) demonstrate greater emphasis on biodegradable components and reduced toxic material content in smart safety solutions. This regulatory influence is creating competitive advantages for environmentally responsible technologies.

Energy efficiency improvements represent another environmental dimension of smart material patents. Materials that can passively respond to thermal events without requiring constant power monitoring can reduce the parasitic energy drain of battery management systems by up to 15%, according to recent patent claims, thereby improving overall energy efficiency of battery systems throughout their operational life.

Regulatory Framework for Battery Safety Technologies

The regulatory landscape for battery safety technologies has evolved significantly in response to increasing concerns about battery failures and their potential hazards. Major regulatory bodies including the International Electrotechnical Commission (IEC), Underwriters Laboratories (UL), and various national standards organizations have established comprehensive frameworks specifically addressing smart materials integration in battery safety systems.

The IEC 62133 standard, which covers safety requirements for portable sealed secondary cells and batteries, has been updated to incorporate provisions for advanced safety materials and mechanisms. Similarly, UL 1642 for lithium batteries has expanded its scope to include evaluation protocols for smart materials that can prevent thermal runaway and other catastrophic failures.

In the automotive sector, regulations such as UN/ECE-R100 and ISO 6469 have been amended to address the unique safety challenges of electric vehicle batteries, with specific requirements for smart materials that can provide early warning of potential failures or mitigate thermal events. These regulations increasingly emphasize the need for real-time monitoring capabilities and adaptive safety systems.

Regional variations in regulatory approaches present significant challenges for global manufacturers. The European Union, through its Battery Directive (2006/66/EC) and more recent European Green Deal initiatives, has placed greater emphasis on environmental sustainability alongside safety considerations for smart materials. Meanwhile, China's GB/T standards have focused more heavily on performance metrics and integration capabilities of safety-enhancing materials.

Regulatory compliance timelines are becoming increasingly compressed, with many jurisdictions requiring implementation of advanced safety technologies within 2-3 years of standard publication. This acceleration reflects growing public concern about battery safety incidents and their potential consequences.

Future regulatory trends indicate a move toward performance-based standards rather than prescriptive requirements, allowing greater innovation in smart material solutions while maintaining rigorous safety outcomes. Regulators are also increasingly considering the entire lifecycle of battery technologies, including the recyclability and environmental impact of smart materials used for safety enhancement.

For manufacturers and researchers in this field, maintaining regulatory intelligence and participating in standards development processes has become essential to ensure that innovative smart materials for battery safety can be brought to market efficiently while meeting global compliance requirements.

The IEC 62133 standard, which covers safety requirements for portable sealed secondary cells and batteries, has been updated to incorporate provisions for advanced safety materials and mechanisms. Similarly, UL 1642 for lithium batteries has expanded its scope to include evaluation protocols for smart materials that can prevent thermal runaway and other catastrophic failures.

In the automotive sector, regulations such as UN/ECE-R100 and ISO 6469 have been amended to address the unique safety challenges of electric vehicle batteries, with specific requirements for smart materials that can provide early warning of potential failures or mitigate thermal events. These regulations increasingly emphasize the need for real-time monitoring capabilities and adaptive safety systems.

Regional variations in regulatory approaches present significant challenges for global manufacturers. The European Union, through its Battery Directive (2006/66/EC) and more recent European Green Deal initiatives, has placed greater emphasis on environmental sustainability alongside safety considerations for smart materials. Meanwhile, China's GB/T standards have focused more heavily on performance metrics and integration capabilities of safety-enhancing materials.

Regulatory compliance timelines are becoming increasingly compressed, with many jurisdictions requiring implementation of advanced safety technologies within 2-3 years of standard publication. This acceleration reflects growing public concern about battery safety incidents and their potential consequences.

Future regulatory trends indicate a move toward performance-based standards rather than prescriptive requirements, allowing greater innovation in smart material solutions while maintaining rigorous safety outcomes. Regulators are also increasingly considering the entire lifecycle of battery technologies, including the recyclability and environmental impact of smart materials used for safety enhancement.

For manufacturers and researchers in this field, maintaining regulatory intelligence and participating in standards development processes has become essential to ensure that innovative smart materials for battery safety can be brought to market efficiently while meeting global compliance requirements.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!