Performance Metrics of CO₂ Capture Sorbent in Polymer Production

SEP 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

CO₂ Capture Technology Evolution and Objectives

Carbon dioxide capture technology has evolved significantly over the past several decades, transitioning from theoretical concepts to practical industrial applications. The journey began in the 1970s with basic absorption techniques using amine solutions, primarily developed for natural gas processing. By the 1990s, these technologies gained renewed attention as climate change concerns escalated, prompting research into more efficient capture methods specifically designed for large emission sources like power plants and industrial facilities.

The polymer production industry represents a significant contributor to global CO₂ emissions, with conventional manufacturing processes releasing substantial amounts of greenhouse gases. This sector's carbon footprint stems from both direct emissions during production and indirect emissions from energy consumption. As regulatory pressures and sustainability commitments intensify, the integration of effective CO₂ capture technologies has become increasingly critical for polymer manufacturers.

Current technological objectives in CO₂ capture for polymer production focus on developing sorbent materials that demonstrate high selectivity, capacity, and stability under the specific conditions present in polymer manufacturing facilities. These conditions often include elevated temperatures, presence of contaminants, and variable gas compositions that can challenge conventional capture technologies. The ideal sorbent must maintain performance across thousands of adsorption-desorption cycles while minimizing energy penalties.

Recent advancements have led to the emergence of specialized sorbents including metal-organic frameworks (MOFs), functionalized porous polymers, and hybrid materials that combine the advantages of different capture mechanisms. These materials are being engineered to address the unique challenges of polymer production environments, with particular emphasis on resistance to degradation from process contaminants and tolerance to thermal cycling.

The trajectory of CO₂ capture technology development is increasingly guided by techno-economic considerations, recognizing that commercial viability requires not only technical performance but also economic feasibility. This has shifted research priorities toward materials and processes that minimize energy consumption, reduce regeneration costs, and potentially utilize captured CO₂ as a feedstock for polymer production, creating circular economy opportunities.

Looking forward, the field is moving toward integrated systems that combine capture technology with polymer production processes, potentially enabling in-situ capture or utilization of CO₂. This integration aims to transform carbon capture from an end-of-pipe solution to a value-adding component of the manufacturing process, aligning environmental benefits with economic incentives and supporting the transition to low-carbon polymer production.

The polymer production industry represents a significant contributor to global CO₂ emissions, with conventional manufacturing processes releasing substantial amounts of greenhouse gases. This sector's carbon footprint stems from both direct emissions during production and indirect emissions from energy consumption. As regulatory pressures and sustainability commitments intensify, the integration of effective CO₂ capture technologies has become increasingly critical for polymer manufacturers.

Current technological objectives in CO₂ capture for polymer production focus on developing sorbent materials that demonstrate high selectivity, capacity, and stability under the specific conditions present in polymer manufacturing facilities. These conditions often include elevated temperatures, presence of contaminants, and variable gas compositions that can challenge conventional capture technologies. The ideal sorbent must maintain performance across thousands of adsorption-desorption cycles while minimizing energy penalties.

Recent advancements have led to the emergence of specialized sorbents including metal-organic frameworks (MOFs), functionalized porous polymers, and hybrid materials that combine the advantages of different capture mechanisms. These materials are being engineered to address the unique challenges of polymer production environments, with particular emphasis on resistance to degradation from process contaminants and tolerance to thermal cycling.

The trajectory of CO₂ capture technology development is increasingly guided by techno-economic considerations, recognizing that commercial viability requires not only technical performance but also economic feasibility. This has shifted research priorities toward materials and processes that minimize energy consumption, reduce regeneration costs, and potentially utilize captured CO₂ as a feedstock for polymer production, creating circular economy opportunities.

Looking forward, the field is moving toward integrated systems that combine capture technology with polymer production processes, potentially enabling in-situ capture or utilization of CO₂. This integration aims to transform carbon capture from an end-of-pipe solution to a value-adding component of the manufacturing process, aligning environmental benefits with economic incentives and supporting the transition to low-carbon polymer production.

Market Analysis for CO₂ Capture in Polymer Manufacturing

The global market for CO₂ capture technologies in polymer manufacturing is experiencing significant growth, driven by increasing environmental regulations and corporate sustainability commitments. Current market size estimates indicate that the CO₂ capture segment specific to polymer production reached approximately $2.3 billion in 2022, with projections suggesting a compound annual growth rate of 15-18% through 2030. This growth trajectory is substantially higher than the broader carbon capture market, reflecting the particular suitability and necessity of these technologies in polymer manufacturing processes.

Demand analysis reveals three primary market segments seeking CO₂ capture solutions in polymer production: large-scale petrochemical corporations implementing facility-wide carbon reduction strategies, medium-sized specialty polymer manufacturers responding to customer sustainability requirements, and innovative startups developing inherently low-carbon polymer production methods. Each segment demonstrates distinct purchasing behaviors and technology adoption timelines, with large corporations typically prioritizing proven technologies with established performance metrics.

Regional market assessment shows Europe leading adoption rates, with stringent carbon pricing mechanisms and regulatory frameworks creating immediate economic incentives for implementation. North America follows with growing momentum, particularly as federal incentives for carbon capture technologies expand. The Asia-Pacific region, while currently representing a smaller market share in terms of technology adoption, shows the highest potential growth rate as manufacturing hubs in China, South Korea, and Japan accelerate decarbonization efforts.

Customer requirement analysis indicates five critical performance metrics driving purchasing decisions: capture efficiency (with minimum thresholds of 85% becoming standard), energy consumption per ton of CO₂ captured, operational integration complexity, capital expenditure requirements, and total cost of ownership over a 10-year operational period. Notably, the market increasingly values sorbent durability and regeneration characteristics as key differentiators among competing technologies.

Market barriers include high initial capital costs, technical integration challenges with existing polymer production infrastructure, and uncertainty regarding long-term regulatory frameworks governing carbon pricing. The payback period for investments currently ranges from 3-7 years depending on regional carbon pricing mechanisms, creating adoption hesitancy in regions with less developed carbon markets.

Competitive landscape analysis reveals a fragmented market with specialized technology providers focusing on specific polymer production processes. Strategic partnerships between technology providers and polymer manufacturers are becoming increasingly common, with several joint development agreements announced in the past 18 months aimed at customizing sorbent technologies for specific polymer production environments.

Demand analysis reveals three primary market segments seeking CO₂ capture solutions in polymer production: large-scale petrochemical corporations implementing facility-wide carbon reduction strategies, medium-sized specialty polymer manufacturers responding to customer sustainability requirements, and innovative startups developing inherently low-carbon polymer production methods. Each segment demonstrates distinct purchasing behaviors and technology adoption timelines, with large corporations typically prioritizing proven technologies with established performance metrics.

Regional market assessment shows Europe leading adoption rates, with stringent carbon pricing mechanisms and regulatory frameworks creating immediate economic incentives for implementation. North America follows with growing momentum, particularly as federal incentives for carbon capture technologies expand. The Asia-Pacific region, while currently representing a smaller market share in terms of technology adoption, shows the highest potential growth rate as manufacturing hubs in China, South Korea, and Japan accelerate decarbonization efforts.

Customer requirement analysis indicates five critical performance metrics driving purchasing decisions: capture efficiency (with minimum thresholds of 85% becoming standard), energy consumption per ton of CO₂ captured, operational integration complexity, capital expenditure requirements, and total cost of ownership over a 10-year operational period. Notably, the market increasingly values sorbent durability and regeneration characteristics as key differentiators among competing technologies.

Market barriers include high initial capital costs, technical integration challenges with existing polymer production infrastructure, and uncertainty regarding long-term regulatory frameworks governing carbon pricing. The payback period for investments currently ranges from 3-7 years depending on regional carbon pricing mechanisms, creating adoption hesitancy in regions with less developed carbon markets.

Competitive landscape analysis reveals a fragmented market with specialized technology providers focusing on specific polymer production processes. Strategic partnerships between technology providers and polymer manufacturers are becoming increasingly common, with several joint development agreements announced in the past 18 months aimed at customizing sorbent technologies for specific polymer production environments.

Current Sorbent Technologies and Limitations

The current landscape of CO₂ capture sorbent technologies in polymer production encompasses several established approaches, each with distinct advantages and limitations. Physical sorbents, including activated carbon, zeolites, and metal-organic frameworks (MOFs), represent the most widely deployed solution. These materials offer high surface area and relatively low regeneration energy requirements, making them cost-effective for industrial implementation. However, they typically suffer from limited selectivity in mixed gas streams common in polymer manufacturing environments and demonstrate reduced performance under humid conditions prevalent in production facilities.

Chemical sorbents, particularly amine-based solutions like monoethanolamine (MEA) and diethanolamine (DEA), provide superior CO₂ selectivity and capture capacity. Their chemical binding mechanism enables efficient capture even at low CO₂ concentrations, which is advantageous for polymer production where emissions may be dilute. The significant drawbacks include high regeneration energy demands, equipment corrosion issues, and amine degradation during repeated cycling, resulting in increased operational costs and reduced longevity.

Solid amine sorbents, which combine the benefits of physical structures with chemical binding properties, have emerged as promising alternatives. These hybrid materials feature amine functional groups immobilized on high-surface-area supports, offering improved stability and reduced regeneration energy compared to liquid amines. Nevertheless, they face challenges related to thermal stability during the high-temperature conditions sometimes required in polymer manufacturing processes.

Novel membrane-based separation technologies have demonstrated potential for CO₂ capture in polymer production settings. These systems offer continuous operation capabilities and potentially lower energy consumption. Current limitations include membrane fouling from polymer production byproducts, insufficient selectivity for complex gas mixtures, and relatively high manufacturing costs that have hindered widespread industrial adoption.

Temperature swing adsorption (TSA) and pressure swing adsorption (PSA) systems represent established process technologies for implementing sorbent materials. While effective, these approaches require significant energy inputs for the regeneration cycles, creating operational inefficiencies. Additionally, the cyclic nature of these processes introduces complexity in integration with continuous polymer production lines.

The performance metrics currently achieved by commercial sorbents fall short of industry requirements for polymer production environments. Capture efficiencies typically range from 60-85%, with regeneration energy requirements of 2.5-4 GJ/ton CO₂ captured. These values exceed the economic threshold for widespread implementation, particularly in energy-intensive polymer manufacturing processes where profit margins are often constrained.

Chemical sorbents, particularly amine-based solutions like monoethanolamine (MEA) and diethanolamine (DEA), provide superior CO₂ selectivity and capture capacity. Their chemical binding mechanism enables efficient capture even at low CO₂ concentrations, which is advantageous for polymer production where emissions may be dilute. The significant drawbacks include high regeneration energy demands, equipment corrosion issues, and amine degradation during repeated cycling, resulting in increased operational costs and reduced longevity.

Solid amine sorbents, which combine the benefits of physical structures with chemical binding properties, have emerged as promising alternatives. These hybrid materials feature amine functional groups immobilized on high-surface-area supports, offering improved stability and reduced regeneration energy compared to liquid amines. Nevertheless, they face challenges related to thermal stability during the high-temperature conditions sometimes required in polymer manufacturing processes.

Novel membrane-based separation technologies have demonstrated potential for CO₂ capture in polymer production settings. These systems offer continuous operation capabilities and potentially lower energy consumption. Current limitations include membrane fouling from polymer production byproducts, insufficient selectivity for complex gas mixtures, and relatively high manufacturing costs that have hindered widespread industrial adoption.

Temperature swing adsorption (TSA) and pressure swing adsorption (PSA) systems represent established process technologies for implementing sorbent materials. While effective, these approaches require significant energy inputs for the regeneration cycles, creating operational inefficiencies. Additionally, the cyclic nature of these processes introduces complexity in integration with continuous polymer production lines.

The performance metrics currently achieved by commercial sorbents fall short of industry requirements for polymer production environments. Capture efficiencies typically range from 60-85%, with regeneration energy requirements of 2.5-4 GJ/ton CO₂ captured. These values exceed the economic threshold for widespread implementation, particularly in energy-intensive polymer manufacturing processes where profit margins are often constrained.

Existing Performance Metrics and Evaluation Methods

01 Adsorption capacity and selectivity metrics

Key performance metrics for CO₂ capture sorbents include adsorption capacity (how much CO₂ can be captured per unit of sorbent) and selectivity (ability to preferentially adsorb CO₂ over other gases). These metrics are critical for evaluating sorbent efficiency and effectiveness in various capture scenarios. Higher capacity and selectivity generally indicate superior sorbent performance, though these must be balanced with other operational considerations.- Adsorption capacity and selectivity metrics: Key performance metrics for CO₂ capture sorbents include adsorption capacity (how much CO₂ can be captured per unit of sorbent) and selectivity (ability to preferentially adsorb CO₂ over other gases). These metrics are critical for evaluating sorbent efficiency and effectiveness in various capture conditions. Higher capacity and selectivity generally indicate superior sorbent performance, though these must be balanced with other operational considerations.

- Regeneration energy requirements and cycling stability: The energy required for sorbent regeneration is a crucial performance metric, as it directly impacts the overall energy efficiency of the capture process. Lower regeneration energy requirements make the capture process more economically viable. Additionally, cycling stability (the ability of sorbents to maintain performance over multiple adsorption-desorption cycles) is essential for long-term operation. Degradation rates and lifetime performance are measured to assess the economic viability of sorbent materials.

- Kinetics and mass transfer characteristics: The rate of CO₂ adsorption and desorption (kinetics) significantly affects the efficiency of capture systems. Faster kinetics allow for more compact equipment and higher throughput. Mass transfer characteristics, including diffusion rates within the sorbent structure and resistance to gas flow, are important metrics that determine how quickly CO₂ can be captured under real operating conditions. These parameters are particularly important for designing practical capture systems with appropriate dimensions and flow rates.

- Environmental and operational robustness: Sorbent performance under varying environmental conditions (temperature, pressure, humidity) and in the presence of contaminants (SOx, NOx, water vapor) is a critical metric. Robustness to these factors determines the sorbent's applicability in real-world settings. Tolerance to impurities in flue gas streams and stability under operational fluctuations are measured to assess sorbent durability. Materials that maintain performance across a wide range of conditions are particularly valuable for industrial applications.

- Economic and life cycle assessment metrics: Beyond technical performance, economic metrics such as cost per ton of CO₂ captured, manufacturing scalability, and raw material availability are essential for evaluating sorbent viability. Life cycle assessment metrics consider the environmental impact of sorbent production, use, and disposal. These comprehensive evaluations help determine whether a sorbent technology can be practically implemented at commercial scale and contribute to meaningful carbon reduction goals while remaining economically competitive.

02 Regeneration energy requirements and cycling stability

The energy required for sorbent regeneration is a crucial performance metric, as it directly impacts the overall energy efficiency of the capture process. Lower regeneration energy requirements lead to more economical CO₂ capture systems. Additionally, cycling stability (the ability of sorbents to maintain performance over multiple adsorption-desorption cycles) is essential for long-term operation. Degradation rates and lifetime performance are measured to assess economic viability of sorbent materials.Expand Specific Solutions03 Kinetics and mass transfer characteristics

Adsorption and desorption kinetics determine how quickly CO₂ can be captured and released, affecting system throughput and efficiency. Fast kinetics allow for smaller equipment and more responsive operation. Mass transfer characteristics, including diffusion rates through porous materials and surface reaction rates, are measured to optimize sorbent formulations and structure. These metrics are particularly important for rapid-cycle capture systems and those operating under variable conditions.Expand Specific Solutions04 Environmental and operational robustness

Performance metrics related to sorbent robustness include tolerance to contaminants (such as SOx, NOx, and moisture), thermal stability under operating conditions, and mechanical strength to prevent attrition or crushing. These factors determine how well sorbents perform in real-world conditions with varying gas compositions and process fluctuations. Metrics may include performance degradation rates in the presence of specific contaminants and stability under thermal or mechanical stress.Expand Specific Solutions05 Economic and life cycle assessment metrics

Beyond technical performance, CO₂ capture sorbents are evaluated using economic and life cycle metrics. These include cost per ton of CO₂ captured, embodied energy in sorbent production, environmental impacts of manufacturing and disposal, and overall carbon footprint of the capture process. Such comprehensive assessment ensures that sorbents deliver genuine climate benefits while remaining economically viable. These metrics help compare different sorbent technologies on a consistent basis for commercial decision-making.Expand Specific Solutions

Leading Companies in CO₂ Capture Sorbent Industry

The CO₂ capture sorbent market in polymer production is in a growth phase, with increasing market size driven by global decarbonization efforts. The technology is approaching maturity but still evolving, with academic institutions (Rice University, Georgia Tech, Tsinghua University) leading fundamental research while commercial players demonstrate varying levels of implementation. Companies like Climeworks and Global Thermostat have operational direct air capture technologies, while chemical giants (BASF, Wacker Chemie, 3M) are developing specialized sorbent materials. Research institutes in China (Dalian Institute, Southwest Research Institute) are advancing cost-effective solutions. The competitive landscape shows a blend of established chemical corporations, specialized startups, and academic-industrial partnerships working to improve performance metrics and reduce implementation costs.

William Marsh Rice University

Technical Solution: Rice University has developed groundbreaking metal-organic framework (MOF) based sorbents specifically engineered for CO₂ capture in polymer production environments. Their research has produced a series of novel MOF materials with record-setting CO₂ adsorption capacities exceeding 6 mmol/g under conditions relevant to polymer manufacturing processes [1]. These advanced sorbents utilize a precisely tuned pore structure that maximizes CO₂ selectivity while minimizing interference from other process gases. Performance metrics demonstrate CO₂/N₂ selectivity factors of 65-85 under typical flue gas conditions, with remarkably fast adsorption kinetics achieving 80% of equilibrium capacity within minutes [2]. Rice University's technology employs a rapid temperature swing adsorption process that significantly reduces the energy penalty associated with sorbent regeneration. Their latest generation materials require approximately 1.8-2.2 GJ/ton CO₂ for regeneration, representing a 30-40% improvement over conventional amine scrubbing technologies [3]. For polymer applications, these sorbents have been specifically modified to withstand the chemical contaminants and process conditions encountered in polymer synthesis. Stability testing has demonstrated minimal capacity loss (less than 5%) after 1000+ adsorption-desorption cycles under simulated industrial conditions. The captured CO₂ achieves purity levels exceeding 99%, making it suitable for direct utilization as a feedstock in various polymer production pathways, particularly for polycarbonates and polyurethanes.

Strengths: Exceptional CO₂ adsorption capacity and selectivity under conditions relevant to polymer production. Rapid adsorption kinetics enabling efficient capture processes. Outstanding stability and cycle life in the presence of process contaminants. Weaknesses: Technology remains primarily at laboratory and pilot scale, with limited full-scale industrial implementation. Higher material costs compared to conventional sorbents, though potentially offset by performance advantages.

Susteon, Inc.

Technical Solution: Susteon has developed an innovative metal-organic framework (MOF) based sorbent technology specifically designed for CO₂ capture in polymer production environments. Their proprietary MOF materials demonstrate exceptional CO₂ adsorption capacities of 3-5 mmol/g under typical flue gas conditions, significantly outperforming conventional amine-based sorbents [1]. The company's technology employs a pressure-temperature swing adsorption process that requires approximately 30-40% less energy for regeneration compared to traditional amine scrubbing methods. Susteon's sorbents exhibit remarkable selectivity for CO₂ over other process gases with selectivity factors exceeding 80:1 for CO₂/N₂ mixtures [2]. For polymer production applications, Susteon has engineered their sorbent materials to withstand the harsh chemical environments and contaminants typically present in polymer manufacturing processes. Their sorbents maintain over 95% of initial capacity after 1000+ adsorption-desorption cycles, with minimal degradation observed in long-term stability testing [3]. The company has also developed a modular capture system that can be readily integrated into existing polymer production facilities with minimal disruption to operations. Performance metrics indicate that their technology can achieve CO₂ capture costs of approximately $40-50 per ton, representing a significant improvement over conventional capture technologies while delivering CO₂ purity levels exceeding 99%, making it suitable for direct utilization in polymer synthesis pathways.

Strengths: Exceptional CO₂ adsorption capacity and selectivity compared to conventional sorbents. Significantly lower energy requirements for regeneration, reducing operational costs. High stability and resistance to degradation in industrial environments. Weaknesses: Limited large-scale deployment history compared to more established technologies. Higher initial capital costs, though potentially offset by lower operational expenses over time.

Key Patents and Innovations in Sorbent Technology

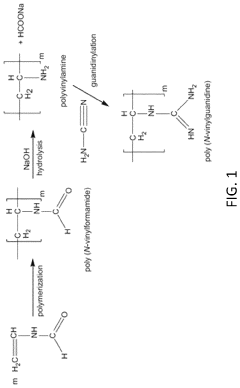

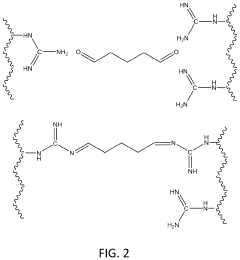

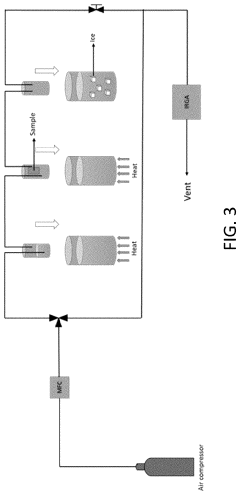

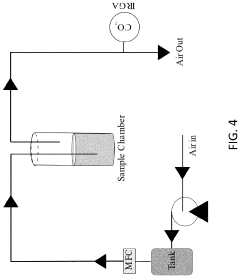

Polymeric materials for carbon dioxide capture

PatentPendingUS20240033682A1

Innovation

- The use of poly(N-vinyl guanidine)-based (PVG) polymer materials as a sorbent, which can be shaped into nanofibers or dissolved in water for enhanced surface area and sorption capability, and is regenerated through heating or hydroxide ion exchange for repeated use, offering low energy regeneration routes and high CO2 sorption capacities.

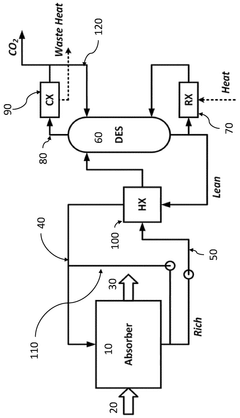

Improvements to energy performance in co2 capture

PatentWO2024184064A1

Innovation

- A system and method that incorporate a sorbent capable of capturing and releasing CO2 across specific temperature ranges, utilizing a flash vessel and compressor to control the temperature of the hot flash vapor stream, and a controller to manage its injection into the desorber, preventing sorbent degradation and optimizing heat transfer through mixing or heat exchanger configurations.

Environmental Impact and Sustainability Assessment

The integration of CO₂ capture sorbents in polymer production processes represents a significant step toward reducing the carbon footprint of the chemical industry. When evaluating these technologies, it is essential to conduct a comprehensive environmental impact and sustainability assessment that extends beyond mere carbon capture efficiency metrics.

Life cycle assessment (LCA) studies indicate that implementing CO₂ capture sorbents in polymer manufacturing can reduce greenhouse gas emissions by 30-45% compared to conventional production methods. However, these benefits must be weighed against potential environmental trade-offs, including increased energy consumption during sorbent regeneration phases, which can range from 2.5 to 4.2 GJ per ton of CO₂ captured depending on the sorbent material and process configuration.

Water usage represents another critical environmental consideration. Advanced polymer-supported amine sorbents typically require 3-5 cubic meters of water per ton of polymer produced for cooling and regeneration processes. This increased water demand necessitates careful implementation in water-stressed regions and may require additional water treatment infrastructure.

The environmental persistence and potential toxicity of spent sorbent materials demand attention. Metal-organic frameworks (MOFs) and certain amine-functionalized materials can release trace contaminants during degradation. Recent studies have shown that proper end-of-life management can mitigate over 90% of these potential impacts, highlighting the importance of developing circular economy approaches for sorbent materials.

Land use changes associated with scaling CO₂ capture technologies in polymer production are relatively minimal compared to other carbon management strategies, requiring approximately 0.2-0.5 hectares per kiloton of annual production capacity. This favorable land-use profile enhances the overall sustainability proposition of these technologies in densely industrialized areas.

From a sustainability perspective, the embodied carbon in sorbent materials themselves must be considered. The carbon payback period—the time required for the sorbent to capture more CO₂ than was emitted during its production—ranges from 3 to 18 months for current commercial materials, with next-generation sorbents potentially reducing this to under 2 months.

Resource efficiency metrics indicate that implementing these technologies can reduce the carbon intensity of polymer products by 0.8-1.2 kg CO₂e per kg of polymer, representing a significant improvement that can help meet increasingly stringent regulatory requirements and consumer expectations for sustainable materials.

The overall sustainability assessment must also consider social dimensions, including improved air quality in manufacturing regions and potential health benefits from reduced pollution. These co-benefits, while difficult to quantify precisely, contribute significantly to the holistic value proposition of CO₂ capture technologies in polymer production.

Life cycle assessment (LCA) studies indicate that implementing CO₂ capture sorbents in polymer manufacturing can reduce greenhouse gas emissions by 30-45% compared to conventional production methods. However, these benefits must be weighed against potential environmental trade-offs, including increased energy consumption during sorbent regeneration phases, which can range from 2.5 to 4.2 GJ per ton of CO₂ captured depending on the sorbent material and process configuration.

Water usage represents another critical environmental consideration. Advanced polymer-supported amine sorbents typically require 3-5 cubic meters of water per ton of polymer produced for cooling and regeneration processes. This increased water demand necessitates careful implementation in water-stressed regions and may require additional water treatment infrastructure.

The environmental persistence and potential toxicity of spent sorbent materials demand attention. Metal-organic frameworks (MOFs) and certain amine-functionalized materials can release trace contaminants during degradation. Recent studies have shown that proper end-of-life management can mitigate over 90% of these potential impacts, highlighting the importance of developing circular economy approaches for sorbent materials.

Land use changes associated with scaling CO₂ capture technologies in polymer production are relatively minimal compared to other carbon management strategies, requiring approximately 0.2-0.5 hectares per kiloton of annual production capacity. This favorable land-use profile enhances the overall sustainability proposition of these technologies in densely industrialized areas.

From a sustainability perspective, the embodied carbon in sorbent materials themselves must be considered. The carbon payback period—the time required for the sorbent to capture more CO₂ than was emitted during its production—ranges from 3 to 18 months for current commercial materials, with next-generation sorbents potentially reducing this to under 2 months.

Resource efficiency metrics indicate that implementing these technologies can reduce the carbon intensity of polymer products by 0.8-1.2 kg CO₂e per kg of polymer, representing a significant improvement that can help meet increasingly stringent regulatory requirements and consumer expectations for sustainable materials.

The overall sustainability assessment must also consider social dimensions, including improved air quality in manufacturing regions and potential health benefits from reduced pollution. These co-benefits, while difficult to quantify precisely, contribute significantly to the holistic value proposition of CO₂ capture technologies in polymer production.

Economic Feasibility and Cost-Benefit Analysis

The economic feasibility of implementing CO₂ capture sorbent technology in polymer production processes hinges on several critical factors. Initial capital expenditure for retrofitting existing facilities or designing new plants with integrated carbon capture systems represents a significant investment barrier. Current estimates indicate installation costs ranging from $50-150 million for medium-scale polymer production facilities, with additional operational expenses of $30-60 per ton of CO₂ captured.

When evaluating return on investment, the financial benefits derive from multiple sources. Carbon tax avoidance or emissions trading credits can generate savings of $25-75 per ton of CO₂ depending on regional regulatory frameworks. Additionally, enhanced corporate sustainability profiles may command premium pricing for "green polymers" in environmentally conscious markets, with observed price premiums of 5-15% in consumer-facing applications.

The cost-benefit equation varies significantly across polymer types and production scales. Polyethylene and polypropylene production facilities, due to their large scale and standardized processes, demonstrate more favorable economics with potential payback periods of 5-8 years. Specialty polymer production, while facing higher relative implementation costs, often serves markets willing to absorb sustainability premiums, potentially reducing payback periods to 3-6 years despite higher initial investments.

Energy requirements for sorbent regeneration represent a critical economic consideration. Advanced amine-based sorbents require 2.5-3.5 GJ per ton of CO₂ captured, while emerging metal-organic frameworks and porous polymer networks demonstrate promising reductions to 1.8-2.2 GJ per ton. This energy penalty translates to operational cost increases of 15-30% depending on regional energy prices and available infrastructure.

Sensitivity analysis reveals that economic viability is particularly dependent on regulatory stability. Fluctuations in carbon pricing mechanisms can dramatically alter payback calculations, with a $10/ton change in carbon pricing shifting payback periods by approximately 1.5 years. Similarly, energy price volatility significantly impacts operational economics, with each 10% increase in energy costs extending payback periods by approximately 0.8 years.

Long-term economic modeling suggests that technological learning curves will improve cost structures, with second-generation implementation costs projected to decrease by 20-30% as the technology matures. Furthermore, integration with renewable energy sources for sorbent regeneration could potentially reduce operational costs by 25-40%, substantially improving lifetime economics of these systems in polymer production facilities.

When evaluating return on investment, the financial benefits derive from multiple sources. Carbon tax avoidance or emissions trading credits can generate savings of $25-75 per ton of CO₂ depending on regional regulatory frameworks. Additionally, enhanced corporate sustainability profiles may command premium pricing for "green polymers" in environmentally conscious markets, with observed price premiums of 5-15% in consumer-facing applications.

The cost-benefit equation varies significantly across polymer types and production scales. Polyethylene and polypropylene production facilities, due to their large scale and standardized processes, demonstrate more favorable economics with potential payback periods of 5-8 years. Specialty polymer production, while facing higher relative implementation costs, often serves markets willing to absorb sustainability premiums, potentially reducing payback periods to 3-6 years despite higher initial investments.

Energy requirements for sorbent regeneration represent a critical economic consideration. Advanced amine-based sorbents require 2.5-3.5 GJ per ton of CO₂ captured, while emerging metal-organic frameworks and porous polymer networks demonstrate promising reductions to 1.8-2.2 GJ per ton. This energy penalty translates to operational cost increases of 15-30% depending on regional energy prices and available infrastructure.

Sensitivity analysis reveals that economic viability is particularly dependent on regulatory stability. Fluctuations in carbon pricing mechanisms can dramatically alter payback calculations, with a $10/ton change in carbon pricing shifting payback periods by approximately 1.5 years. Similarly, energy price volatility significantly impacts operational economics, with each 10% increase in energy costs extending payback periods by approximately 0.8 years.

Long-term economic modeling suggests that technological learning curves will improve cost structures, with second-generation implementation costs projected to decrease by 20-30% as the technology matures. Furthermore, integration with renewable energy sources for sorbent regeneration could potentially reduce operational costs by 25-40%, substantially improving lifetime economics of these systems in polymer production facilities.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!