Regulations Influencing CO₂ Capture Sorbent in Industrial Sectors

SEP 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

CO₂ Capture Technology Background and Objectives

Carbon dioxide (CO₂) capture technology has evolved significantly over the past several decades, transitioning from theoretical concepts to practical applications across various industrial sectors. The development trajectory began in the 1970s with basic absorption techniques and has since expanded to include advanced sorbent materials, membrane technologies, and innovative hybrid systems. This evolution has been driven by the growing recognition of climate change impacts and the urgent need to reduce greenhouse gas emissions globally.

The current technological landscape for CO₂ capture encompasses three primary approaches: post-combustion capture, pre-combustion capture, and oxy-fuel combustion. Each methodology presents distinct advantages and challenges, with sorbent-based systems emerging as particularly promising due to their adaptability across different industrial environments and potentially lower energy penalties compared to traditional methods.

Regulatory frameworks have played a pivotal role in accelerating CO₂ capture technology development. The Paris Agreement of 2015 established international commitments to limit global warming, while regional policies such as the European Union's Emissions Trading System (EU ETS) and the United States' 45Q tax credits have created economic incentives for carbon capture implementation. These regulatory mechanisms have increasingly influenced the research direction and commercial viability of various sorbent technologies.

The primary objective of current CO₂ capture technology development is to significantly reduce the cost and energy requirements associated with carbon capture while maintaining or improving capture efficiency. Specifically, the U.S. Department of Energy has established targets to develop technologies capable of capturing CO₂ at less than $40 per metric ton by 2025, with further reductions anticipated in subsequent years.

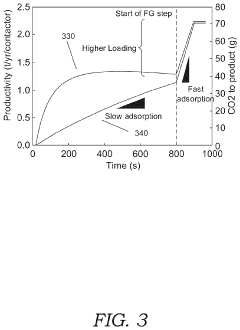

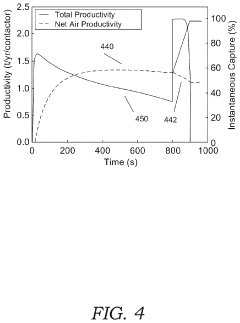

Technical goals focus on developing sorbent materials with enhanced CO₂ selectivity, improved stability under industrial conditions, faster kinetics, and reduced regeneration energy requirements. Additional objectives include scaling these technologies from laboratory demonstrations to commercial applications while addressing challenges related to sorbent degradation, process integration, and system optimization across diverse industrial environments.

The trajectory of CO₂ capture technology is increasingly influenced by the concept of circular carbon economy, where captured carbon is viewed not merely as waste but as a potential feedstock for various industrial processes. This paradigm shift is driving research toward technologies that not only capture carbon efficiently but also facilitate its conversion into valuable products, thereby creating economic incentives beyond regulatory compliance.

The current technological landscape for CO₂ capture encompasses three primary approaches: post-combustion capture, pre-combustion capture, and oxy-fuel combustion. Each methodology presents distinct advantages and challenges, with sorbent-based systems emerging as particularly promising due to their adaptability across different industrial environments and potentially lower energy penalties compared to traditional methods.

Regulatory frameworks have played a pivotal role in accelerating CO₂ capture technology development. The Paris Agreement of 2015 established international commitments to limit global warming, while regional policies such as the European Union's Emissions Trading System (EU ETS) and the United States' 45Q tax credits have created economic incentives for carbon capture implementation. These regulatory mechanisms have increasingly influenced the research direction and commercial viability of various sorbent technologies.

The primary objective of current CO₂ capture technology development is to significantly reduce the cost and energy requirements associated with carbon capture while maintaining or improving capture efficiency. Specifically, the U.S. Department of Energy has established targets to develop technologies capable of capturing CO₂ at less than $40 per metric ton by 2025, with further reductions anticipated in subsequent years.

Technical goals focus on developing sorbent materials with enhanced CO₂ selectivity, improved stability under industrial conditions, faster kinetics, and reduced regeneration energy requirements. Additional objectives include scaling these technologies from laboratory demonstrations to commercial applications while addressing challenges related to sorbent degradation, process integration, and system optimization across diverse industrial environments.

The trajectory of CO₂ capture technology is increasingly influenced by the concept of circular carbon economy, where captured carbon is viewed not merely as waste but as a potential feedstock for various industrial processes. This paradigm shift is driving research toward technologies that not only capture carbon efficiently but also facilitate its conversion into valuable products, thereby creating economic incentives beyond regulatory compliance.

Market Demand Analysis for Carbon Capture Solutions

The global market for carbon capture solutions has witnessed significant growth in recent years, driven primarily by increasing environmental regulations and corporate sustainability commitments. Current market assessments value the carbon capture, utilization, and storage (CCUS) sector at approximately $2.5 billion in 2022, with projections indicating growth to reach $7.0 billion by 2030, representing a compound annual growth rate of 13.8%.

Industrial sectors, particularly cement, steel, power generation, and chemical manufacturing, constitute the largest demand segment for CO₂ capture technologies. These industries collectively account for over 70% of global industrial carbon emissions, creating substantial market potential for sorbent-based capture solutions. The cement industry alone contributes roughly 8% of global CO₂ emissions, making it a prime target market for advanced capture technologies.

Regional analysis reveals varying levels of market maturity and demand. North America and Europe currently lead in technology adoption, driven by stringent regulatory frameworks and carbon pricing mechanisms. The European Union's Emissions Trading System (ETS) and the recent Inflation Reduction Act in the United States have significantly accelerated market demand by providing financial incentives for carbon capture implementation.

Asia-Pacific represents the fastest-growing market region, with China and India making substantial investments in carbon capture technologies as part of their climate commitments. China's 14th Five-Year Plan explicitly prioritizes CCUS development, creating a rapidly expanding market for sorbent technologies that can be deployed at scale in the country's extensive industrial base.

Customer segmentation within the carbon capture market reveals three primary buyer categories: large industrial emitters seeking compliance solutions, energy companies pursuing enhanced oil recovery applications, and forward-thinking corporations implementing voluntary carbon reduction initiatives as part of ESG commitments. Each segment presents distinct requirements for sorbent performance, cost parameters, and implementation timelines.

Market forecasts indicate particularly strong growth potential for solid sorbent technologies, which are projected to capture an increasing market share due to their lower energy penalties and operational flexibility compared to traditional amine-based solutions. Industry surveys suggest that customers are willing to pay premium prices for sorbents that demonstrate superior durability, selectivity, and regeneration characteristics under real-world industrial conditions.

The competitive landscape is evolving rapidly, with both established chemical companies and specialized startups vying for market position. Recent market entry by major industrial gas suppliers signals growing confidence in commercial viability, while venture capital funding for innovative sorbent technologies exceeded $800 million in 2022, reflecting strong investor confidence in market growth potential.

Industrial sectors, particularly cement, steel, power generation, and chemical manufacturing, constitute the largest demand segment for CO₂ capture technologies. These industries collectively account for over 70% of global industrial carbon emissions, creating substantial market potential for sorbent-based capture solutions. The cement industry alone contributes roughly 8% of global CO₂ emissions, making it a prime target market for advanced capture technologies.

Regional analysis reveals varying levels of market maturity and demand. North America and Europe currently lead in technology adoption, driven by stringent regulatory frameworks and carbon pricing mechanisms. The European Union's Emissions Trading System (ETS) and the recent Inflation Reduction Act in the United States have significantly accelerated market demand by providing financial incentives for carbon capture implementation.

Asia-Pacific represents the fastest-growing market region, with China and India making substantial investments in carbon capture technologies as part of their climate commitments. China's 14th Five-Year Plan explicitly prioritizes CCUS development, creating a rapidly expanding market for sorbent technologies that can be deployed at scale in the country's extensive industrial base.

Customer segmentation within the carbon capture market reveals three primary buyer categories: large industrial emitters seeking compliance solutions, energy companies pursuing enhanced oil recovery applications, and forward-thinking corporations implementing voluntary carbon reduction initiatives as part of ESG commitments. Each segment presents distinct requirements for sorbent performance, cost parameters, and implementation timelines.

Market forecasts indicate particularly strong growth potential for solid sorbent technologies, which are projected to capture an increasing market share due to their lower energy penalties and operational flexibility compared to traditional amine-based solutions. Industry surveys suggest that customers are willing to pay premium prices for sorbents that demonstrate superior durability, selectivity, and regeneration characteristics under real-world industrial conditions.

The competitive landscape is evolving rapidly, with both established chemical companies and specialized startups vying for market position. Recent market entry by major industrial gas suppliers signals growing confidence in commercial viability, while venture capital funding for innovative sorbent technologies exceeded $800 million in 2022, reflecting strong investor confidence in market growth potential.

Global Status and Challenges in CO₂ Sorbent Development

The global landscape of CO₂ capture sorbent development presents a complex interplay of technological advancement and regulatory challenges. Currently, the most mature CO₂ capture technologies include amine-based absorption, solid sorbents, membrane separation, and cryogenic processes, with varying levels of commercial deployment across different regions.

In North America, significant progress has been made in developing advanced solid sorbents, particularly metal-organic frameworks (MOFs) and amine-functionalized materials. The United States Department of Energy has invested substantially in research programs targeting cost reduction and efficiency improvements for carbon capture technologies, with several pilot projects demonstrating promising results in industrial settings.

European research institutions have pioneered innovations in porous materials and ionic liquids for CO₂ capture, with countries like Germany, the UK, and Norway leading collaborative research initiatives. The European Union's Horizon Europe program has allocated substantial funding specifically for carbon capture technology development, emphasizing integration with existing industrial infrastructure.

In Asia, China has rapidly expanded its research capabilities in this domain, focusing on low-cost, scalable sorbent materials suitable for its coal-dominated energy sector. Japan and South Korea have made notable advances in membrane technology and hybrid capture systems, particularly targeting applications in steel manufacturing and cement production.

Despite these advancements, several critical challenges persist in the global development of CO₂ capture sorbents. The primary technical hurdles include insufficient sorption capacity under realistic industrial conditions, degradation of sorbent materials during cycling, high regeneration energy requirements, and challenges in scaling laboratory successes to industrial implementation.

Economic barriers remain significant, with current capture costs ranging from $40-100 per ton of CO₂ for most technologies—still too high for widespread commercial adoption without regulatory incentives. The capital-intensive nature of carbon capture installations presents additional financial challenges, particularly for industries operating with thin profit margins.

Material science limitations constitute another major challenge, as researchers struggle to develop sorbents that maintain performance under the harsh conditions typical of industrial flue gases, including high temperatures, presence of contaminants, and variable gas compositions. The trade-off between selectivity, capacity, and regeneration energy continues to be a central focus of research efforts.

Infrastructure constraints further complicate deployment, with many industrial facilities lacking the physical space or system integration capabilities necessary for retrofitting carbon capture technologies. The absence of comprehensive CO₂ transport and storage networks in most regions creates additional downstream bottlenecks.

In North America, significant progress has been made in developing advanced solid sorbents, particularly metal-organic frameworks (MOFs) and amine-functionalized materials. The United States Department of Energy has invested substantially in research programs targeting cost reduction and efficiency improvements for carbon capture technologies, with several pilot projects demonstrating promising results in industrial settings.

European research institutions have pioneered innovations in porous materials and ionic liquids for CO₂ capture, with countries like Germany, the UK, and Norway leading collaborative research initiatives. The European Union's Horizon Europe program has allocated substantial funding specifically for carbon capture technology development, emphasizing integration with existing industrial infrastructure.

In Asia, China has rapidly expanded its research capabilities in this domain, focusing on low-cost, scalable sorbent materials suitable for its coal-dominated energy sector. Japan and South Korea have made notable advances in membrane technology and hybrid capture systems, particularly targeting applications in steel manufacturing and cement production.

Despite these advancements, several critical challenges persist in the global development of CO₂ capture sorbents. The primary technical hurdles include insufficient sorption capacity under realistic industrial conditions, degradation of sorbent materials during cycling, high regeneration energy requirements, and challenges in scaling laboratory successes to industrial implementation.

Economic barriers remain significant, with current capture costs ranging from $40-100 per ton of CO₂ for most technologies—still too high for widespread commercial adoption without regulatory incentives. The capital-intensive nature of carbon capture installations presents additional financial challenges, particularly for industries operating with thin profit margins.

Material science limitations constitute another major challenge, as researchers struggle to develop sorbents that maintain performance under the harsh conditions typical of industrial flue gases, including high temperatures, presence of contaminants, and variable gas compositions. The trade-off between selectivity, capacity, and regeneration energy continues to be a central focus of research efforts.

Infrastructure constraints further complicate deployment, with many industrial facilities lacking the physical space or system integration capabilities necessary for retrofitting carbon capture technologies. The absence of comprehensive CO₂ transport and storage networks in most regions creates additional downstream bottlenecks.

Current Sorbent Solutions for Industrial CO₂ Capture

01 Metal-organic frameworks (MOFs) for CO₂ capture

Metal-organic frameworks represent a class of porous materials with high surface area and tunable pore structures that are effective for CO₂ capture. These crystalline materials consist of metal ions or clusters coordinated with organic ligands, creating a framework with exceptional adsorption properties. MOFs can be designed with specific functional groups to enhance CO₂ selectivity and capacity, making them promising sorbents for carbon capture applications.- Metal-organic frameworks (MOFs) for CO₂ capture: Metal-organic frameworks are porous crystalline materials composed of metal ions or clusters coordinated with organic ligands. These materials have high surface areas and tunable pore sizes, making them effective for CO₂ adsorption. MOFs can be designed with specific functional groups to enhance CO₂ selectivity and capacity, and their structure can be modified to improve stability under various operating conditions. These materials show promise for post-combustion carbon capture applications due to their high adsorption capacity and potential for regeneration.

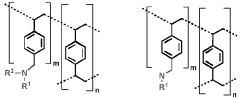

- Amine-functionalized sorbents: Amine-functionalized materials are widely used for CO₂ capture due to the strong chemical interaction between amine groups and CO₂ molecules. These sorbents can be prepared by incorporating amine compounds onto various supports such as silica, activated carbon, or polymeric materials. The amine groups react with CO₂ to form carbamates or bicarbonates, enabling selective capture even at low CO₂ concentrations. These materials can be regenerated through temperature or pressure swing processes, making them suitable for cyclic adsorption-desorption operations in carbon capture systems.

- Zeolite-based CO₂ capture materials: Zeolites are crystalline aluminosilicate materials with well-defined pore structures that can selectively adsorb CO₂. Their high thermal stability and mechanical strength make them suitable for industrial carbon capture applications. The adsorption properties of zeolites can be tuned by adjusting the silicon-to-aluminum ratio and introducing various cations into the framework. These materials work through physical adsorption mechanisms and can be regenerated multiple times without significant loss of capacity, making them cost-effective options for CO₂ capture from flue gas and other sources.

- Calcium-based CO₂ sorbents: Calcium-based materials, particularly calcium oxide (CaO), can capture CO₂ through carbonation reactions to form calcium carbonate (CaCO₃). These sorbents are attractive due to their high theoretical CO₂ uptake capacity, abundance, and low cost. The carbonation process occurs at high temperatures, and the material can be regenerated through calcination. To overcome issues like sintering and capacity degradation over multiple cycles, various approaches including doping with additives, structural modifications, and support materials are employed to enhance stability and maintain capture performance during repeated use.

- Novel composite and hybrid CO₂ sorbents: Composite and hybrid sorbents combine different materials to achieve enhanced CO₂ capture performance. These materials integrate the advantages of multiple components, such as the high capacity of one material with the selectivity or stability of another. Examples include polymer-inorganic composites, layered double hydroxides, and hybrid membranes. These advanced materials often feature hierarchical pore structures, multiple functional groups, or core-shell architectures designed to optimize both CO₂ adsorption kinetics and capacity. The synergistic effects between components can lead to superior performance compared to single-component sorbents, including faster adsorption rates, higher selectivity, and improved regenerability.

02 Amine-functionalized sorbents

Amine-functionalized materials are widely used as CO₂ capture sorbents due to their strong chemical affinity for CO₂. These sorbents typically consist of amines grafted onto porous supports such as silica, activated carbon, or polymers. The amine groups react with CO₂ to form carbamates or bicarbonates under ambient conditions, enabling efficient capture. These materials offer advantages including high selectivity, good capacity, and the ability to operate at relatively low temperatures compared to traditional solvent-based systems.Expand Specific Solutions03 Regenerable solid sorbents for cyclic CO₂ capture

Regenerable solid sorbents are designed for repeated CO₂ capture and release cycles in industrial applications. These materials can adsorb CO₂ under specific conditions and then release it when conditions change, typically through temperature or pressure swing processes. Key characteristics include high working capacity, good mechanical stability to withstand multiple cycles, fast kinetics, and low energy requirements for regeneration. This approach offers potential energy savings compared to liquid amine scrubbing technologies.Expand Specific Solutions04 Zeolite and molecular sieve-based CO₂ sorbents

Zeolites and molecular sieves are aluminosilicate materials with well-defined pore structures that can selectively adsorb CO₂. These materials function through physical adsorption mechanisms based on molecular size exclusion and electrostatic interactions. Their crystalline structure provides uniform pore sizes that can be tailored for optimal CO₂ separation from gas mixtures. Zeolites offer advantages including thermal stability, resistance to contaminants, and relatively low cost, making them suitable for industrial-scale carbon capture applications.Expand Specific Solutions05 Novel composite and hybrid CO₂ capture materials

Composite and hybrid materials combine different components to create CO₂ sorbents with enhanced properties. These materials typically integrate the advantages of multiple sorbent types, such as combining the high surface area of porous supports with the chemical reactivity of functional groups. Examples include polymer-inorganic composites, layered double hydroxides, and hybrid membranes. These innovative materials aim to overcome limitations of traditional sorbents by offering improved capacity, selectivity, stability, and regeneration efficiency for CO₂ capture applications.Expand Specific Solutions

Key Industry Players in CO₂ Capture Sorbent Market

The CO₂ capture sorbent market is in a growth phase, driven by increasing global regulations on carbon emissions across industrial sectors. The market is projected to expand significantly as industries seek compliance with stricter environmental policies. Technologically, the field shows varying maturity levels, with established players like Sinopec Group and BASF developing commercial-scale solutions, while newer entrants such as Mantel Capture and Aker Carbon Capture Norway focus on innovative approaches. Academic institutions including University of Nottingham, Dalian University of Technology, and Arizona State University are advancing fundamental research. The competitive landscape spans energy giants (Korea Electric Power subsidiaries), chemical manufacturers, and specialized carbon capture firms, indicating a diversifying market responding to regulatory pressures with both conventional and breakthrough sorbent technologies.

China Petroleum & Chemical Corp.

Technical Solution: China Petroleum & Chemical Corp. (Sinopec) has developed advanced amine-based CO₂ capture technologies specifically designed for industrial applications. Their proprietary solvent formulations demonstrate 30-40% lower regeneration energy requirements compared to conventional MEA solutions. Sinopec's integrated approach combines chemical absorption with membrane separation technologies, creating hybrid systems that optimize capture efficiency across different industrial processes. Their technology has been successfully deployed in large-scale demonstration projects across China's petrochemical sector, achieving capture rates exceeding 90% while maintaining operational stability. Sinopec has also pioneered regulatory-compliant monitoring systems that provide real-time emissions data to ensure compliance with China's increasingly stringent carbon regulations. Their sorbent technologies are specifically engineered to withstand the harsh conditions of industrial flue gases, including high SOx and NOx concentrations.

Strengths: Extensive industrial implementation experience across multiple sectors; proprietary sorbent formulations with demonstrated energy efficiency improvements; integrated systems approach that addresses multiple regulatory requirements simultaneously. Weaknesses: Technologies primarily optimized for China's regulatory environment; international deployment may require significant adaptation to meet varying regional standards.

BASF Corp.

Technical Solution: BASF has developed the OASE® blue technology, a proprietary amine-based CO₂ capture solution specifically designed to meet evolving regulatory requirements across industrial sectors. This technology utilizes advanced aqueous amine solvents that demonstrate 20-30% lower energy consumption compared to conventional capture methods. BASF's approach incorporates modular design principles that allow for scalable implementation across diverse industrial applications, from power generation to cement production. Their sorbent formulations have been engineered to maintain performance under varying flue gas compositions while minimizing degradation and emissions of volatile compounds - a critical factor for regulatory compliance in jurisdictions with strict air quality standards. BASF has conducted extensive testing at commercial-scale facilities in Europe and North America, demonstrating the technology's ability to achieve >90% capture rates while meeting stringent environmental regulations. The company has also developed comprehensive life cycle assessment methodologies to quantify the environmental impact of their sorbent technologies, providing valuable data for regulatory reporting requirements.

Strengths: Extensive commercial deployment experience across multiple regulatory environments; proprietary sorbent formulations with proven stability and efficiency; comprehensive technical support infrastructure for implementation and compliance. Weaknesses: Higher initial capital investment compared to some competing technologies; requires significant process integration expertise for optimal performance in specific industrial applications.

Critical Patents and Innovations in Sorbent Technology

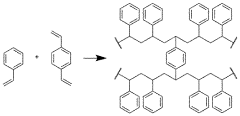

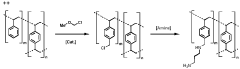

Sorbent materials for co2 capture, uses thereof and methods for making same

PatentWO2024002881A1

Innovation

- A sorbent material comprising primary, secondary, and tertiary amine moieties immobilized on a styrene-divinylbenzene support, functionalized with specific alkylamine groups, is used for cyclic adsorption/desorption, enhancing CO2 capture capacity and kinetic uptake, while maintaining stability through controlled temperature and steam injection.

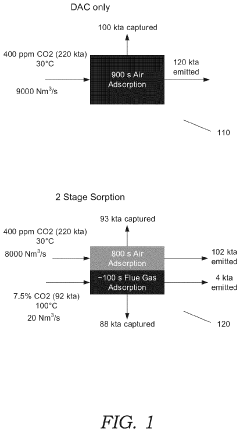

Direct capture of co2 from air and point sources

PatentPendingUS20240058743A1

Innovation

- A two-step sorption process where air is first captured at ambient conditions, followed by exposure to a CO2-rich flue gas stream for additional sorption, allowing for increased CO2 loading without prior heating and minimizing sorbent degradation, using amine sorbents and managing temperature and oxygen levels.

Regulatory Framework Impact on Sorbent Development

The regulatory landscape surrounding CO₂ capture technologies has evolved significantly over the past decade, creating both constraints and opportunities for sorbent development. International agreements such as the Paris Climate Accord have established ambitious carbon reduction targets, compelling industries to adopt more efficient carbon capture solutions. These regulatory frameworks have directly influenced research priorities and funding allocations in the sorbent development sector.

National and regional policies have implemented varying approaches to carbon regulation, from carbon taxation systems to cap-and-trade mechanisms. The European Union's Emissions Trading System (ETS) has been particularly influential, creating economic incentives for industries to invest in advanced sorbent technologies that can achieve higher capture rates at lower operational costs. Similarly, the United States has introduced tax credits through the 45Q provision, specifically targeting carbon capture initiatives.

Industry-specific regulations have further shaped sorbent development trajectories. Power generation facilities face stringent emission standards that have accelerated the development of specialized sorbents capable of operating efficiently within the unique conditions of flue gas streams. Meanwhile, cement and steel manufacturing sectors are subject to Best Available Techniques (BAT) requirements that increasingly incorporate carbon capture considerations, driving innovation in high-temperature sorbent applications.

Regulatory frameworks have also established performance benchmarks that directly influence sorbent design parameters. These include minimum capture efficiency requirements, environmental impact assessments for sorbent materials, and safety protocols for handling and disposal. The ISO 14000 series of environmental management standards has become increasingly relevant for sorbent developers, particularly regarding life cycle assessment methodologies.

Emerging regulatory trends indicate a shift toward more holistic approaches that consider the entire carbon value chain. This includes regulations addressing not only capture efficiency but also transportation infrastructure, utilization pathways, and long-term storage solutions. Such comprehensive frameworks are pushing sorbent developers to consider integration challenges beyond mere capture performance, including regeneration energy requirements and compatibility with downstream processes.

Financial regulations and reporting requirements have created additional dimensions of influence. The Task Force on Climate-related Financial Disclosures (TCFD) recommendations have prompted industries to evaluate carbon-related risks, indirectly stimulating investment in advanced sorbent technologies as risk mitigation strategies. Similarly, sustainable finance taxonomies are increasingly recognizing investments in carbon capture technologies as environmentally sustainable activities, improving access to capital for sorbent development initiatives.

National and regional policies have implemented varying approaches to carbon regulation, from carbon taxation systems to cap-and-trade mechanisms. The European Union's Emissions Trading System (ETS) has been particularly influential, creating economic incentives for industries to invest in advanced sorbent technologies that can achieve higher capture rates at lower operational costs. Similarly, the United States has introduced tax credits through the 45Q provision, specifically targeting carbon capture initiatives.

Industry-specific regulations have further shaped sorbent development trajectories. Power generation facilities face stringent emission standards that have accelerated the development of specialized sorbents capable of operating efficiently within the unique conditions of flue gas streams. Meanwhile, cement and steel manufacturing sectors are subject to Best Available Techniques (BAT) requirements that increasingly incorporate carbon capture considerations, driving innovation in high-temperature sorbent applications.

Regulatory frameworks have also established performance benchmarks that directly influence sorbent design parameters. These include minimum capture efficiency requirements, environmental impact assessments for sorbent materials, and safety protocols for handling and disposal. The ISO 14000 series of environmental management standards has become increasingly relevant for sorbent developers, particularly regarding life cycle assessment methodologies.

Emerging regulatory trends indicate a shift toward more holistic approaches that consider the entire carbon value chain. This includes regulations addressing not only capture efficiency but also transportation infrastructure, utilization pathways, and long-term storage solutions. Such comprehensive frameworks are pushing sorbent developers to consider integration challenges beyond mere capture performance, including regeneration energy requirements and compatibility with downstream processes.

Financial regulations and reporting requirements have created additional dimensions of influence. The Task Force on Climate-related Financial Disclosures (TCFD) recommendations have prompted industries to evaluate carbon-related risks, indirectly stimulating investment in advanced sorbent technologies as risk mitigation strategies. Similarly, sustainable finance taxonomies are increasingly recognizing investments in carbon capture technologies as environmentally sustainable activities, improving access to capital for sorbent development initiatives.

Economic Viability and Cost Analysis of Capture Solutions

The economic viability of CO₂ capture solutions represents a critical factor in their widespread adoption across industrial sectors. Current cost analyses indicate that carbon capture technologies typically add between $40-100 per ton of CO₂ captured, creating significant financial burdens for implementing companies. This cost structure varies substantially across different industrial applications, with power generation facing higher relative costs compared to cement or steel production due to lower CO₂ concentration in flue gases.

Capital expenditure (CAPEX) for sorbent-based capture systems encompasses equipment installation, infrastructure development, and initial sorbent loading. These upfront investments often constitute 60-70% of total lifetime costs, presenting a major barrier to adoption despite regulatory pressures. Operational expenditure (OPEX) includes sorbent regeneration energy requirements, replacement costs due to degradation, and maintenance expenses, which collectively determine long-term economic sustainability.

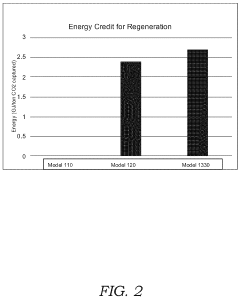

Energy penalties associated with sorbent regeneration significantly impact operational economics, with current technologies requiring 1.5-3.5 GJ per ton of CO₂ captured. This energy requirement translates to approximately 10-30% efficiency reduction in power generation applications. Advanced sorbent materials with lower regeneration energy requirements show promising potential to reduce this penalty by 20-40%, substantially improving economic viability.

Sorbent lifecycle considerations directly influence economic performance, with current materials demonstrating variable durability under industrial conditions. Leading amine-based sorbents typically require replacement after 500-2000 cycles, while emerging metal-organic frameworks and advanced solid sorbents potentially offer extended lifespans of 3000-5000 cycles, significantly reducing replacement costs over facility lifetimes.

Economic modeling under various regulatory scenarios reveals that carbon pricing thresholds of approximately $50-75 per ton CO₂ would make capture technologies economically viable for most high-emission industrial applications. Current carbon markets and regulatory mechanisms in Europe, parts of North America, and Asia are approaching these thresholds, suggesting imminent economic feasibility in regions with stringent emissions policies.

Cost reduction pathways primarily focus on sorbent material innovation, process optimization, and economies of scale. Industry projections suggest potential cost reductions of 30-50% within the next decade through these pathways, potentially bringing capture costs below $40 per ton in optimal applications. This trajectory aligns with regulatory timelines in major industrial economies, potentially creating synchronized economic and regulatory incentives for widespread adoption.

Capital expenditure (CAPEX) for sorbent-based capture systems encompasses equipment installation, infrastructure development, and initial sorbent loading. These upfront investments often constitute 60-70% of total lifetime costs, presenting a major barrier to adoption despite regulatory pressures. Operational expenditure (OPEX) includes sorbent regeneration energy requirements, replacement costs due to degradation, and maintenance expenses, which collectively determine long-term economic sustainability.

Energy penalties associated with sorbent regeneration significantly impact operational economics, with current technologies requiring 1.5-3.5 GJ per ton of CO₂ captured. This energy requirement translates to approximately 10-30% efficiency reduction in power generation applications. Advanced sorbent materials with lower regeneration energy requirements show promising potential to reduce this penalty by 20-40%, substantially improving economic viability.

Sorbent lifecycle considerations directly influence economic performance, with current materials demonstrating variable durability under industrial conditions. Leading amine-based sorbents typically require replacement after 500-2000 cycles, while emerging metal-organic frameworks and advanced solid sorbents potentially offer extended lifespans of 3000-5000 cycles, significantly reducing replacement costs over facility lifetimes.

Economic modeling under various regulatory scenarios reveals that carbon pricing thresholds of approximately $50-75 per ton CO₂ would make capture technologies economically viable for most high-emission industrial applications. Current carbon markets and regulatory mechanisms in Europe, parts of North America, and Asia are approaching these thresholds, suggesting imminent economic feasibility in regions with stringent emissions policies.

Cost reduction pathways primarily focus on sorbent material innovation, process optimization, and economies of scale. Industry projections suggest potential cost reductions of 30-50% within the next decade through these pathways, potentially bringing capture costs below $40 per ton in optimal applications. This trajectory aligns with regulatory timelines in major industrial economies, potentially creating synchronized economic and regulatory incentives for widespread adoption.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!