Regulatory Considerations for Photonic Integrated Circuits

SEP 29, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

PIC Regulatory Landscape and Objectives

Photonic Integrated Circuits (PICs) have emerged as a transformative technology in the field of optoelectronics, offering significant advantages in size, power consumption, and performance compared to discrete optical components. The regulatory landscape surrounding PICs is complex and evolving, reflecting the technology's increasing adoption across multiple industries including telecommunications, data centers, sensing, and healthcare.

The historical development of PIC regulation has been characterized by a fragmented approach, with different regions and industries establishing their own standards and compliance frameworks. Initially, PICs were primarily regulated under broader semiconductor or electronic device frameworks, without specific consideration for their unique optical properties and applications.

As PIC technology has matured and found applications in critical infrastructure and sensitive domains, regulatory bodies worldwide have begun developing more tailored approaches. The European Union, through its Restriction of Hazardous Substances (RoHS) and Waste Electrical and Electronic Equipment (WEEE) directives, has established environmental compliance requirements that affect PIC manufacturing and disposal.

In the United States, the Federal Communications Commission (FCC) regulates PICs used in telecommunications, while the Food and Drug Administration (FDA) oversees medical applications. Meanwhile, China has incorporated PIC technology into its strategic technology initiatives, creating standards that align with its industrial policies.

The technical evolution of PICs has outpaced regulatory frameworks, creating challenges for manufacturers and end-users. Current regulatory gaps include insufficient standardization of testing methodologies, unclear certification processes for novel applications, and limited harmonization of international standards.

The primary objective of PIC regulation is to ensure safety, reliability, and interoperability while fostering innovation. This includes establishing clear performance metrics, ensuring electromagnetic compatibility, addressing thermal management concerns, and developing reliability standards for various operating environments.

Looking forward, regulatory trends indicate movement toward greater international harmonization, with organizations like the International Electrotechnical Commission (IEC) and the Institute of Electrical and Electronics Engineers (IEEE) working to develop global standards. These efforts aim to create a more unified regulatory environment that can accommodate the rapid pace of technological advancement in the PIC field.

A key challenge for regulators is balancing innovation with safety and security concerns, particularly as PICs find applications in quantum computing, secure communications, and defense systems. The dual-use nature of some PIC technologies necessitates thoughtful approaches to export controls and intellectual property protection.

The historical development of PIC regulation has been characterized by a fragmented approach, with different regions and industries establishing their own standards and compliance frameworks. Initially, PICs were primarily regulated under broader semiconductor or electronic device frameworks, without specific consideration for their unique optical properties and applications.

As PIC technology has matured and found applications in critical infrastructure and sensitive domains, regulatory bodies worldwide have begun developing more tailored approaches. The European Union, through its Restriction of Hazardous Substances (RoHS) and Waste Electrical and Electronic Equipment (WEEE) directives, has established environmental compliance requirements that affect PIC manufacturing and disposal.

In the United States, the Federal Communications Commission (FCC) regulates PICs used in telecommunications, while the Food and Drug Administration (FDA) oversees medical applications. Meanwhile, China has incorporated PIC technology into its strategic technology initiatives, creating standards that align with its industrial policies.

The technical evolution of PICs has outpaced regulatory frameworks, creating challenges for manufacturers and end-users. Current regulatory gaps include insufficient standardization of testing methodologies, unclear certification processes for novel applications, and limited harmonization of international standards.

The primary objective of PIC regulation is to ensure safety, reliability, and interoperability while fostering innovation. This includes establishing clear performance metrics, ensuring electromagnetic compatibility, addressing thermal management concerns, and developing reliability standards for various operating environments.

Looking forward, regulatory trends indicate movement toward greater international harmonization, with organizations like the International Electrotechnical Commission (IEC) and the Institute of Electrical and Electronics Engineers (IEEE) working to develop global standards. These efforts aim to create a more unified regulatory environment that can accommodate the rapid pace of technological advancement in the PIC field.

A key challenge for regulators is balancing innovation with safety and security concerns, particularly as PICs find applications in quantum computing, secure communications, and defense systems. The dual-use nature of some PIC technologies necessitates thoughtful approaches to export controls and intellectual property protection.

Market Demand Analysis for Regulated PICs

The global market for regulated Photonic Integrated Circuits (PICs) is experiencing significant growth driven by increasing demand for high-speed data transmission, telecommunications infrastructure, and advanced sensing applications. Current market projections indicate that the PIC market will reach approximately $3.5 billion by 2025, with a compound annual growth rate of 25% between 2020-2025, significantly outpacing traditional electronic integrated circuits.

Regulatory compliance has emerged as a critical market driver, particularly in sectors where PICs are deployed in safety-critical applications. The telecommunications sector represents the largest market segment, accounting for nearly 40% of regulated PIC applications, followed by data centers (25%), medical devices (15%), aerospace and defense (12%), and automotive applications (8%).

The demand for regulated PICs is particularly strong in regions with stringent regulatory frameworks. North America and Europe currently lead market consumption due to their established regulatory bodies and clear compliance guidelines for photonic technologies. However, the Asia-Pacific region is witnessing the fastest growth rate as countries like China, Japan, and South Korea develop their regulatory frameworks while simultaneously expanding their telecommunications and data infrastructure.

Industry surveys indicate that 78% of end-users consider regulatory compliance a "very important" or "critical" factor when selecting PIC solutions for their applications. This represents a significant shift from five years ago when only 45% of users prioritized regulatory aspects, demonstrating the increasing importance of regulatory considerations in purchasing decisions.

The medical device sector shows particularly strong demand growth for regulated PICs, with applications in diagnostic equipment, surgical tools, and patient monitoring systems. This sector demands PICs that comply with both photonic performance standards and medical device regulations such as FDA requirements in the US and MDR in Europe, creating a specialized market segment with premium pricing potential.

Energy efficiency regulations are also driving demand for PICs in data centers and telecommunications infrastructure. With data centers accounting for approximately 1% of global electricity consumption, regulations targeting energy efficiency are creating market pull for PIC solutions that can reduce power consumption while maintaining or improving performance metrics.

Customer feedback analysis reveals that 65% of enterprise clients are willing to pay a premium of 15-20% for PIC solutions with comprehensive regulatory certification and documentation. This price premium represents a significant market opportunity for manufacturers who can navigate the complex regulatory landscape effectively and provide turnkey compliant solutions.

Regulatory compliance has emerged as a critical market driver, particularly in sectors where PICs are deployed in safety-critical applications. The telecommunications sector represents the largest market segment, accounting for nearly 40% of regulated PIC applications, followed by data centers (25%), medical devices (15%), aerospace and defense (12%), and automotive applications (8%).

The demand for regulated PICs is particularly strong in regions with stringent regulatory frameworks. North America and Europe currently lead market consumption due to their established regulatory bodies and clear compliance guidelines for photonic technologies. However, the Asia-Pacific region is witnessing the fastest growth rate as countries like China, Japan, and South Korea develop their regulatory frameworks while simultaneously expanding their telecommunications and data infrastructure.

Industry surveys indicate that 78% of end-users consider regulatory compliance a "very important" or "critical" factor when selecting PIC solutions for their applications. This represents a significant shift from five years ago when only 45% of users prioritized regulatory aspects, demonstrating the increasing importance of regulatory considerations in purchasing decisions.

The medical device sector shows particularly strong demand growth for regulated PICs, with applications in diagnostic equipment, surgical tools, and patient monitoring systems. This sector demands PICs that comply with both photonic performance standards and medical device regulations such as FDA requirements in the US and MDR in Europe, creating a specialized market segment with premium pricing potential.

Energy efficiency regulations are also driving demand for PICs in data centers and telecommunications infrastructure. With data centers accounting for approximately 1% of global electricity consumption, regulations targeting energy efficiency are creating market pull for PIC solutions that can reduce power consumption while maintaining or improving performance metrics.

Customer feedback analysis reveals that 65% of enterprise clients are willing to pay a premium of 15-20% for PIC solutions with comprehensive regulatory certification and documentation. This price premium represents a significant market opportunity for manufacturers who can navigate the complex regulatory landscape effectively and provide turnkey compliant solutions.

Global PIC Regulatory Status and Challenges

Photonic Integrated Circuits (PICs) face a complex global regulatory landscape that varies significantly across regions, creating challenges for manufacturers and developers seeking international market access. The United States, through the FDA and FCC, has established regulatory frameworks primarily focused on medical applications and telecommunications aspects of PICs, with particular emphasis on safety standards and electromagnetic compatibility.

The European Union implements a more comprehensive approach through the CE marking system, requiring PIC manufacturers to comply with multiple directives including the Radio Equipment Directive (RED), Electromagnetic Compatibility Directive (EMC), and RoHS (Restriction of Hazardous Substances). The EU's regulatory framework is generally considered more stringent, particularly regarding environmental impact and material restrictions.

In Asia, regulatory approaches show considerable variation. Japan's regulatory body, the Ministry of Internal Affairs and Communications, has developed specific standards for optical components, while China has implemented its own certification system (CCC) with unique requirements that often necessitate in-country testing. South Korea follows a hybrid model incorporating elements from both US and EU frameworks.

A significant challenge in the global PIC regulatory landscape is the lack of harmonized standards specifically designed for integrated photonics. Most current regulations were developed for electronic integrated circuits or discrete optical components, creating regulatory gaps and inconsistencies when applied to PICs. This regulatory fragmentation increases compliance costs and extends time-to-market for PIC manufacturers operating globally.

Material compliance represents another major regulatory hurdle. Various jurisdictions impose different restrictions on materials used in PICs, particularly regarding rare earth elements and potentially hazardous substances. The EU's REACH regulation and RoHS directive are particularly impactful in this domain, requiring detailed documentation and sometimes necessitating material substitutions.

Safety certification processes also vary substantially across markets. While laser safety standards (such as IEC 60825) provide some consistency, their application to integrated photonic systems remains inconsistent across jurisdictions. Medical applications of PICs face additional regulatory scrutiny, with requirements for clinical validation that differ significantly between regions.

Emerging applications of PICs in quantum computing and sensing are creating new regulatory challenges, as existing frameworks struggle to address the unique characteristics and potential security implications of these technologies. Several jurisdictions are currently developing specialized regulatory approaches for quantum technologies, which will likely impact PIC development in these applications.

The European Union implements a more comprehensive approach through the CE marking system, requiring PIC manufacturers to comply with multiple directives including the Radio Equipment Directive (RED), Electromagnetic Compatibility Directive (EMC), and RoHS (Restriction of Hazardous Substances). The EU's regulatory framework is generally considered more stringent, particularly regarding environmental impact and material restrictions.

In Asia, regulatory approaches show considerable variation. Japan's regulatory body, the Ministry of Internal Affairs and Communications, has developed specific standards for optical components, while China has implemented its own certification system (CCC) with unique requirements that often necessitate in-country testing. South Korea follows a hybrid model incorporating elements from both US and EU frameworks.

A significant challenge in the global PIC regulatory landscape is the lack of harmonized standards specifically designed for integrated photonics. Most current regulations were developed for electronic integrated circuits or discrete optical components, creating regulatory gaps and inconsistencies when applied to PICs. This regulatory fragmentation increases compliance costs and extends time-to-market for PIC manufacturers operating globally.

Material compliance represents another major regulatory hurdle. Various jurisdictions impose different restrictions on materials used in PICs, particularly regarding rare earth elements and potentially hazardous substances. The EU's REACH regulation and RoHS directive are particularly impactful in this domain, requiring detailed documentation and sometimes necessitating material substitutions.

Safety certification processes also vary substantially across markets. While laser safety standards (such as IEC 60825) provide some consistency, their application to integrated photonic systems remains inconsistent across jurisdictions. Medical applications of PICs face additional regulatory scrutiny, with requirements for clinical validation that differ significantly between regions.

Emerging applications of PICs in quantum computing and sensing are creating new regulatory challenges, as existing frameworks struggle to address the unique characteristics and potential security implications of these technologies. Several jurisdictions are currently developing specialized regulatory approaches for quantum technologies, which will likely impact PIC development in these applications.

Current Compliance Frameworks for PICs

01 Integration of optical components on a single chip

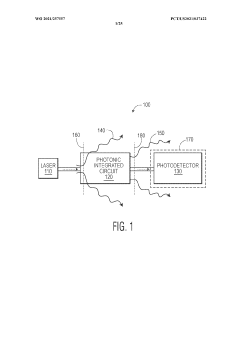

Photonic integrated circuits (PICs) involve the integration of multiple optical components such as waveguides, modulators, detectors, and light sources on a single chip. This integration enables compact, high-performance optical systems with reduced size, weight, and power consumption compared to discrete optical components. The integration technology allows for complex optical functionalities while maintaining signal integrity and minimizing coupling losses between components.- Integration of optical components on a single chip: Photonic integrated circuits (PICs) involve the integration of multiple optical components such as waveguides, modulators, detectors, and light sources on a single chip. This integration enables compact, high-performance optical systems with reduced size, weight, and power consumption compared to discrete optical components. The integration technology allows for complex optical functionalities while maintaining signal integrity across the chip.

- Silicon photonics technology for PICs: Silicon photonics technology leverages existing CMOS manufacturing infrastructure to create photonic integrated circuits. This approach uses silicon as the optical medium for waveguides and other photonic components, enabling cost-effective mass production of PICs. Silicon photonics facilitates the integration of electronic and photonic components on the same substrate, allowing for high-bandwidth data transmission and processing capabilities in telecommunications and data center applications.

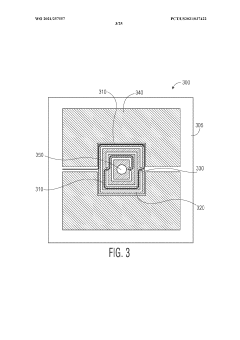

- Novel materials and structures for enhanced PIC performance: Advanced materials and innovative structures are being developed to enhance the performance of photonic integrated circuits. These include III-V semiconductor compounds, lithium niobate, polymers, and hybrid material platforms that offer improved light emission, modulation, and detection capabilities. Novel waveguide structures, resonators, and photonic crystals enable better light manipulation, reduced losses, and increased functionality in compact footprints.

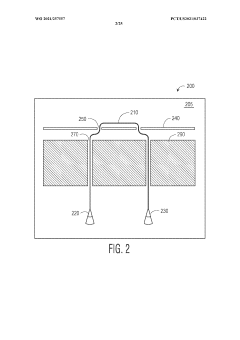

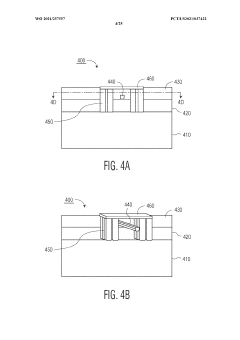

- Coupling and packaging technologies for PICs: Efficient coupling between photonic integrated circuits and external optical fibers or other components is crucial for system performance. Various coupling techniques including edge coupling, grating couplers, and mode converters are employed to minimize insertion losses. Advanced packaging technologies address thermal management, hermetic sealing, and electrical connections while maintaining optical alignment precision, enabling reliable operation in diverse environments and applications.

- Applications and specialized PIC designs: Photonic integrated circuits are designed for specific applications including optical communications, sensing, quantum computing, and biomedical devices. Specialized PIC designs incorporate application-specific components such as high-speed modulators for telecommunications, interferometers for sensing, quantum light sources for quantum information processing, or lab-on-chip functionalities for biomedical diagnostics. These tailored designs optimize performance parameters relevant to their intended use cases.

02 Silicon photonics manufacturing techniques

Silicon photonics leverages established semiconductor manufacturing processes to create photonic integrated circuits. These techniques include lithography, etching, deposition, and wafer bonding to fabricate optical structures on silicon substrates. The compatibility with CMOS processes enables cost-effective mass production of PICs and facilitates the integration of electronic and photonic components on the same chip, leading to enhanced functionality and performance for optical communication systems.Expand Specific Solutions03 Novel waveguide structures and materials

Advanced waveguide structures and materials are being developed to improve the performance of photonic integrated circuits. These include silicon nitride waveguides, polymer waveguides, and hybrid material platforms that combine different materials to leverage their respective advantages. Novel waveguide geometries such as slot waveguides, ridge waveguides, and photonic crystal waveguides enable enhanced light confinement, reduced propagation losses, and improved control over optical mode properties for various applications.Expand Specific Solutions04 Integration of lasers and light sources

Integrating efficient light sources into photonic integrated circuits remains a significant challenge. Various approaches include heterogeneous integration of III-V materials on silicon, monolithic integration of germanium-based light sources, and hybrid integration techniques. These methods aim to create reliable on-chip light sources with controlled wavelength, high output power, and efficient coupling to waveguides, which are essential for applications in optical communications, sensing, and computing.Expand Specific Solutions05 Optical signal processing and modulation

Photonic integrated circuits enable advanced optical signal processing and modulation capabilities. This includes high-speed electro-optic modulators, wavelength multiplexers/demultiplexers, optical switches, and filters integrated on a single chip. These components allow for complex signal manipulation such as wavelength conversion, signal routing, and data encoding/decoding at high speeds with low power consumption, making them crucial for next-generation optical communication networks and computing systems.Expand Specific Solutions

Key Regulatory Bodies and Industry Stakeholders

The photonic integrated circuits (PICs) regulatory landscape is evolving within a maturing but still developing industry. Market size is expanding rapidly, with projections indicating significant growth as applications diversify across telecommunications, data centers, sensing, and quantum computing. Technical maturity varies considerably among key players, with established semiconductor giants like Intel, TSMC, and Apple leveraging their manufacturing expertise to advance PIC development. Specialized photonics companies such as Infinera, Rockley Photonics, and EFFECT Photonics are driving innovation in specific applications, while research institutions like SRI International and the Institute of Semiconductors of Chinese Academy of Sciences contribute fundamental breakthroughs. Regulatory frameworks are still evolving, particularly regarding standards for performance, reliability, and safety, creating both challenges and opportunities for market participants as they navigate this complex landscape.

Intel Corp.

Technical Solution: Intel has developed a comprehensive regulatory compliance framework for their silicon photonics technology that addresses multiple jurisdictional requirements. Their approach includes built-in safety mechanisms that automatically adjust laser output power to comply with IEC 60825 laser safety standards. Intel's regulatory strategy involves early engagement with standards bodies like IEEE and IEC to influence photonic integrated circuit (PIC) standards development. They've implemented a "Design for Compliance" methodology that incorporates regulatory requirements into the initial design phase of PICs, reducing certification challenges later. Intel also maintains dedicated compliance teams that work with global regulatory bodies to ensure their photonic products meet electromagnetic compatibility (EMC) requirements, environmental standards (RoHS, REACH), and reliability specifications across different markets.

Strengths: Extensive experience navigating complex regulatory landscapes across multiple markets; established relationships with standards bodies; integrated compliance approach from design through manufacturing. Weaknesses: Regulatory overhead may slow time-to-market compared to smaller competitors; compliance costs potentially increase product pricing.

Infinera Corp.

Technical Solution: Infinera has pioneered a regulatory approach specifically tailored for telecommunications-grade photonic integrated circuits. Their Infinite Capacity Engine (ICE) platform incorporates regulatory compliance features directly into their large-scale PICs. Infinera's methodology includes developing specialized testing protocols that satisfy both FCC and international telecom regulatory requirements while demonstrating their PICs' performance capabilities. They've implemented an automated compliance verification system that continuously monitors their photonic circuits against evolving regulatory standards in different jurisdictions. Infinera has also developed specialized documentation packages for different regulatory bodies that streamline the approval process for their optical networking equipment. Their approach includes proactive engagement with regulatory agencies to establish appropriate testing methodologies for novel photonic integrated technologies that may not fit within existing regulatory frameworks.

Strengths: Deep expertise in telecom-specific regulatory requirements; established relationships with telecommunications regulatory bodies; automated compliance systems. Weaknesses: Regulatory focus primarily on telecom applications may limit flexibility for emerging PIC applications in other sectors; complex integration of multiple optical components creates additional regulatory challenges.

Critical Standards and Certification Pathways

Photonic integrated circuit

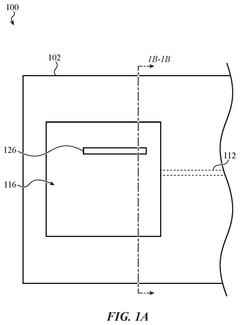

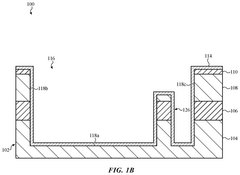

PatentWO2021257557A1

Innovation

- A monolithic photonic integrated circuit with optical and thermal isolation structures, fabricated using semiconductor processing techniques, to prevent background light and heat dissipation, enhancing the sensitivity and signal-to-noise ratio of photodetectors by isolating components using metal layers, vias, trenches, and reflective or absorptive materials.

Photonic integrated circuits with substrate noise coupling mitigation

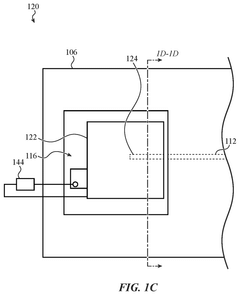

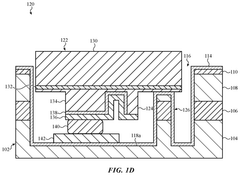

PatentPendingUS20250216599A1

Innovation

- Incorporation of a reference component and an electrically insulating layer between the substrate and electronic components, with the reference component connected to an electrical reference plane to shield from substrate noise.

International Trade Implications for PIC Technology

Photonic Integrated Circuits (PICs) have emerged as a critical technology in global telecommunications, data processing, and sensing applications. Their strategic importance has increasingly placed them at the center of international trade considerations and geopolitical tensions.

The global nature of PIC supply chains creates complex trade interdependencies. Key materials, manufacturing equipment, and intellectual property often cross multiple borders before a finished PIC product reaches market. This international distribution of resources has made the technology vulnerable to trade restrictions and export controls, particularly as nations recognize the strategic value of photonics technology in both commercial and defense applications.

Recent years have witnessed increasing trade barriers specifically targeting photonics technologies. The United States has implemented export controls on certain advanced PIC technologies to countries deemed strategic competitors, while the European Union has developed its own framework for protecting critical photonic technologies. Similarly, China has invested heavily in developing domestic PIC capabilities to reduce dependency on foreign suppliers, creating a fragmented global market.

Tariffs on semiconductor and photonic components have significantly impacted the PIC industry's cost structure. These trade measures have forced companies to reconsider their supply chain strategies, with some opting to relocate manufacturing facilities or establish redundant production capabilities across different jurisdictions to mitigate trade risks.

The concept of "technological sovereignty" has gained prominence in national policy discussions, with governments increasingly viewing PIC technology as essential to economic security and technological independence. This has led to substantial government investments in domestic PIC ecosystems, including research facilities, manufacturing capabilities, and workforce development programs.

International standards for PICs represent another dimension of trade implications. While technical standards organizations attempt to maintain global compatibility, competing standards frameworks have emerged that reflect regional interests and potentially create technical barriers to trade. Companies must navigate these divergent standards when designing products for global markets.

Intellectual property protection presents additional challenges in the international trade of PIC technology. Patent enforcement varies significantly across jurisdictions, creating uncertainty for companies investing in PIC innovation. Technology transfer requirements in certain markets may also compromise proprietary knowledge, influencing where companies choose to manufacture and sell their products.

Looking forward, the evolution of trade policies around PICs will likely reflect broader geopolitical tensions and technological competition. Companies operating in this space must develop sophisticated strategies to navigate an increasingly complex international trade environment while maintaining access to global markets and supply chains.

The global nature of PIC supply chains creates complex trade interdependencies. Key materials, manufacturing equipment, and intellectual property often cross multiple borders before a finished PIC product reaches market. This international distribution of resources has made the technology vulnerable to trade restrictions and export controls, particularly as nations recognize the strategic value of photonics technology in both commercial and defense applications.

Recent years have witnessed increasing trade barriers specifically targeting photonics technologies. The United States has implemented export controls on certain advanced PIC technologies to countries deemed strategic competitors, while the European Union has developed its own framework for protecting critical photonic technologies. Similarly, China has invested heavily in developing domestic PIC capabilities to reduce dependency on foreign suppliers, creating a fragmented global market.

Tariffs on semiconductor and photonic components have significantly impacted the PIC industry's cost structure. These trade measures have forced companies to reconsider their supply chain strategies, with some opting to relocate manufacturing facilities or establish redundant production capabilities across different jurisdictions to mitigate trade risks.

The concept of "technological sovereignty" has gained prominence in national policy discussions, with governments increasingly viewing PIC technology as essential to economic security and technological independence. This has led to substantial government investments in domestic PIC ecosystems, including research facilities, manufacturing capabilities, and workforce development programs.

International standards for PICs represent another dimension of trade implications. While technical standards organizations attempt to maintain global compatibility, competing standards frameworks have emerged that reflect regional interests and potentially create technical barriers to trade. Companies must navigate these divergent standards when designing products for global markets.

Intellectual property protection presents additional challenges in the international trade of PIC technology. Patent enforcement varies significantly across jurisdictions, creating uncertainty for companies investing in PIC innovation. Technology transfer requirements in certain markets may also compromise proprietary knowledge, influencing where companies choose to manufacture and sell their products.

Looking forward, the evolution of trade policies around PICs will likely reflect broader geopolitical tensions and technological competition. Companies operating in this space must develop sophisticated strategies to navigate an increasingly complex international trade environment while maintaining access to global markets and supply chains.

Environmental and Safety Compliance Requirements

Photonic Integrated Circuits (PICs) must adhere to stringent environmental and safety compliance requirements across their lifecycle. Manufacturing processes for PICs involve hazardous materials including heavy metals, acids, and specialized chemicals that require proper handling and disposal protocols. Facilities producing these components must implement comprehensive chemical management systems and adhere to regulations such as the Restriction of Hazardous Substances (RoHS) directive, which limits the use of lead, mercury, cadmium, and other harmful substances in electronic equipment.

Waste management presents significant challenges in PIC production, as fabrication generates substantial chemical waste. Manufacturers must comply with local and international waste disposal regulations, including the Basel Convention on hazardous waste and region-specific frameworks like the EU's Waste Electrical and Electronic Equipment (WEEE) directive. Advanced treatment systems for neutralizing chemical byproducts and recovering valuable materials are increasingly becoming standard industry practice.

Energy consumption during PIC manufacturing and operation necessitates compliance with energy efficiency standards. While PICs generally offer improved energy efficiency compared to electronic circuits, the fabrication processes remain energy-intensive. Regulatory frameworks such as the EU's Energy-related Products (ErP) directive and various international ISO standards establish benchmarks for energy management systems that PIC manufacturers must meet.

Radiation safety considerations are particularly relevant for PICs operating in high-power applications. These circuits must comply with laser safety standards including IEC 60825 and ANSI Z136, which classify lasers based on their potential hazards and specify corresponding safety measures. Manufacturers must implement appropriate engineering controls, warning labels, and user safety instructions to mitigate risks associated with optical radiation exposure.

End-of-life management for PICs presents unique challenges due to their composite nature, combining optical and electronic components. Extended Producer Responsibility (EPR) programs increasingly hold manufacturers accountable for the entire lifecycle of their products. This requires designing PICs with disassembly and recyclability in mind, as well as establishing take-back programs that comply with circular economy principles and regulations.

Certification processes for environmental and safety compliance involve rigorous testing and documentation. Third-party certification bodies verify adherence to standards through laboratory testing, facility audits, and documentation reviews. For global market access, manufacturers must navigate complex certification requirements across different jurisdictions, often necessitating multiple certifications to satisfy various regional regulatory frameworks.

Waste management presents significant challenges in PIC production, as fabrication generates substantial chemical waste. Manufacturers must comply with local and international waste disposal regulations, including the Basel Convention on hazardous waste and region-specific frameworks like the EU's Waste Electrical and Electronic Equipment (WEEE) directive. Advanced treatment systems for neutralizing chemical byproducts and recovering valuable materials are increasingly becoming standard industry practice.

Energy consumption during PIC manufacturing and operation necessitates compliance with energy efficiency standards. While PICs generally offer improved energy efficiency compared to electronic circuits, the fabrication processes remain energy-intensive. Regulatory frameworks such as the EU's Energy-related Products (ErP) directive and various international ISO standards establish benchmarks for energy management systems that PIC manufacturers must meet.

Radiation safety considerations are particularly relevant for PICs operating in high-power applications. These circuits must comply with laser safety standards including IEC 60825 and ANSI Z136, which classify lasers based on their potential hazards and specify corresponding safety measures. Manufacturers must implement appropriate engineering controls, warning labels, and user safety instructions to mitigate risks associated with optical radiation exposure.

End-of-life management for PICs presents unique challenges due to their composite nature, combining optical and electronic components. Extended Producer Responsibility (EPR) programs increasingly hold manufacturers accountable for the entire lifecycle of their products. This requires designing PICs with disassembly and recyclability in mind, as well as establishing take-back programs that comply with circular economy principles and regulations.

Certification processes for environmental and safety compliance involve rigorous testing and documentation. Third-party certification bodies verify adherence to standards through laboratory testing, facility audits, and documentation reviews. For global market access, manufacturers must navigate complex certification requirements across different jurisdictions, often necessitating multiple certifications to satisfy various regional regulatory frameworks.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!