Research on Silicon Carbide Wafer Influence in 5G Networks

OCT 14, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

SiC Wafer Technology Background and Objectives

Silicon Carbide (SiC) wafer technology represents a significant advancement in semiconductor materials, evolving from its initial applications in power electronics to becoming increasingly relevant in telecommunications infrastructure, particularly for 5G networks. The historical development of SiC began in the early 1900s with its synthesis, but commercial viability only emerged in the late 20th century as manufacturing processes matured. The material's exceptional properties—wide bandgap, high thermal conductivity, and superior electron mobility—position it as an ideal candidate for high-frequency, high-power applications essential to 5G deployment.

The technological evolution of SiC wafers has accelerated dramatically over the past decade, with significant improvements in crystal quality, wafer diameter expansion from 2-inch to 6-inch (with 8-inch in development), and substantial reductions in defect density. These advancements have been driven by increasing demands for more efficient power management solutions in telecommunications infrastructure, where energy efficiency and thermal management represent critical challenges.

Current 5G network architectures require unprecedented levels of performance from their semiconductor components, particularly in base stations and transmission equipment. The millimeter-wave frequencies utilized in 5G networks necessitate semiconductors capable of operating efficiently at higher frequencies while managing increased power densities. SiC wafers offer a compelling solution to these challenges, potentially enabling more compact, energy-efficient, and reliable 5G infrastructure components.

The primary technical objectives for SiC wafer development in 5G applications include further reducing defect densities below 1/cm², improving wafer uniformity to enhance yield rates, scaling production to 8-inch wafers to align with standard semiconductor manufacturing equipment, and reducing production costs to enable broader commercial adoption. Additionally, research aims to optimize SiC epitaxial growth processes specifically for RF applications relevant to 5G infrastructure.

Industry projections indicate that the SiC wafer market for telecommunications applications could grow at a CAGR exceeding 25% through 2026, driven primarily by 5G infrastructure deployment. This growth trajectory is supported by increasing investment from major semiconductor manufacturers and telecommunications equipment providers seeking competitive advantages through material innovation.

The convergence of SiC wafer technology with 5G network requirements represents a critical intersection of materials science and telecommunications engineering. Success in this domain could significantly influence the cost structure, energy efficiency, and performance capabilities of next-generation wireless networks, while simultaneously accelerating the broader adoption of wide-bandgap semiconductors across multiple industries.

The technological evolution of SiC wafers has accelerated dramatically over the past decade, with significant improvements in crystal quality, wafer diameter expansion from 2-inch to 6-inch (with 8-inch in development), and substantial reductions in defect density. These advancements have been driven by increasing demands for more efficient power management solutions in telecommunications infrastructure, where energy efficiency and thermal management represent critical challenges.

Current 5G network architectures require unprecedented levels of performance from their semiconductor components, particularly in base stations and transmission equipment. The millimeter-wave frequencies utilized in 5G networks necessitate semiconductors capable of operating efficiently at higher frequencies while managing increased power densities. SiC wafers offer a compelling solution to these challenges, potentially enabling more compact, energy-efficient, and reliable 5G infrastructure components.

The primary technical objectives for SiC wafer development in 5G applications include further reducing defect densities below 1/cm², improving wafer uniformity to enhance yield rates, scaling production to 8-inch wafers to align with standard semiconductor manufacturing equipment, and reducing production costs to enable broader commercial adoption. Additionally, research aims to optimize SiC epitaxial growth processes specifically for RF applications relevant to 5G infrastructure.

Industry projections indicate that the SiC wafer market for telecommunications applications could grow at a CAGR exceeding 25% through 2026, driven primarily by 5G infrastructure deployment. This growth trajectory is supported by increasing investment from major semiconductor manufacturers and telecommunications equipment providers seeking competitive advantages through material innovation.

The convergence of SiC wafer technology with 5G network requirements represents a critical intersection of materials science and telecommunications engineering. Success in this domain could significantly influence the cost structure, energy efficiency, and performance capabilities of next-generation wireless networks, while simultaneously accelerating the broader adoption of wide-bandgap semiconductors across multiple industries.

5G Market Demand Analysis for SiC Components

The global 5G market is experiencing unprecedented growth, creating substantial demand for Silicon Carbide (SiC) components that can support the advanced requirements of next-generation networks. Current market projections indicate that the 5G infrastructure market will reach approximately $47.8 billion by 2027, with a compound annual growth rate of 67.1% from 2019 to 2027. Within this expanding ecosystem, SiC-based components are becoming increasingly critical due to their superior performance characteristics in high-frequency, high-power applications.

The demand for SiC components in 5G networks is primarily driven by the need for higher bandwidth, lower latency, and increased power efficiency. As 5G networks operate at significantly higher frequencies (up to 39 GHz in mmWave bands) compared to previous generations, traditional silicon-based semiconductors face limitations in terms of power handling capabilities and thermal management. SiC components address these challenges effectively, offering up to 10 times higher breakdown electric field strength and 3 times better thermal conductivity than silicon.

Telecommunications equipment manufacturers represent the largest market segment for SiC components, with companies investing heavily in SiC-based power amplifiers, switches, and other RF components for base stations. Market research indicates that SiC power devices in 5G base stations can reduce energy consumption by 15-20% compared to traditional silicon alternatives, resulting in significant operational cost savings for network operators.

The automotive sector presents another substantial growth opportunity for SiC in 5G applications, particularly for vehicle-to-everything (V2X) communication systems. The market for automotive 5G connectivity solutions is projected to grow at a CAGR of 26.3% through 2028, with SiC components playing a crucial role in enabling reliable, high-speed communications in challenging automotive environments.

Regional analysis reveals that Asia-Pacific currently dominates the market for SiC components in 5G applications, accounting for approximately 45% of global demand. This is largely attributed to aggressive 5G deployment strategies in China, South Korea, and Japan. North America follows with roughly 30% market share, while Europe represents about 20% of the global market.

Supply chain constraints present significant challenges to meeting this growing demand. The complex manufacturing process for SiC wafers, requiring specialized equipment and expertise, has created production bottlenecks. Current global production capacity for SiC wafers suitable for 5G applications falls short of projected demand by approximately 25%, indicating substantial growth opportunities for manufacturers who can scale production effectively.

The demand for SiC components in 5G networks is primarily driven by the need for higher bandwidth, lower latency, and increased power efficiency. As 5G networks operate at significantly higher frequencies (up to 39 GHz in mmWave bands) compared to previous generations, traditional silicon-based semiconductors face limitations in terms of power handling capabilities and thermal management. SiC components address these challenges effectively, offering up to 10 times higher breakdown electric field strength and 3 times better thermal conductivity than silicon.

Telecommunications equipment manufacturers represent the largest market segment for SiC components, with companies investing heavily in SiC-based power amplifiers, switches, and other RF components for base stations. Market research indicates that SiC power devices in 5G base stations can reduce energy consumption by 15-20% compared to traditional silicon alternatives, resulting in significant operational cost savings for network operators.

The automotive sector presents another substantial growth opportunity for SiC in 5G applications, particularly for vehicle-to-everything (V2X) communication systems. The market for automotive 5G connectivity solutions is projected to grow at a CAGR of 26.3% through 2028, with SiC components playing a crucial role in enabling reliable, high-speed communications in challenging automotive environments.

Regional analysis reveals that Asia-Pacific currently dominates the market for SiC components in 5G applications, accounting for approximately 45% of global demand. This is largely attributed to aggressive 5G deployment strategies in China, South Korea, and Japan. North America follows with roughly 30% market share, while Europe represents about 20% of the global market.

Supply chain constraints present significant challenges to meeting this growing demand. The complex manufacturing process for SiC wafers, requiring specialized equipment and expertise, has created production bottlenecks. Current global production capacity for SiC wafers suitable for 5G applications falls short of projected demand by approximately 25%, indicating substantial growth opportunities for manufacturers who can scale production effectively.

Current Status and Challenges in SiC Wafer Technology

Silicon carbide (SiC) wafer technology has emerged as a critical component in the advancement of 5G network infrastructure, yet its global development remains uneven. Currently, the United States, Japan, and Europe lead in SiC wafer production technology, with companies like Cree/Wolfspeed, II-VI, and ROHM dominating the high-quality wafer market. China has made significant investments in recent years but still lags in producing the highest quality 6-inch and 8-inch wafers necessary for advanced 5G applications.

The primary technical challenge in SiC wafer production remains the reduction of defect density. Current state-of-the-art wafers still exhibit micropipe defects at rates of 0.1-0.5 cm², which can significantly impact device performance in high-frequency 5G applications. These defects become particularly problematic when implementing millimeter-wave technology required for ultra-high-speed 5G communications.

Wafer size scaling represents another significant hurdle. While silicon wafers have reached 12-inch diameter standard production, SiC wafer manufacturing is predominantly limited to 4-inch and 6-inch diameters, with 8-inch wafers only beginning to enter commercial production. This size limitation directly impacts economies of scale and integration capabilities with existing semiconductor manufacturing infrastructure optimized for larger wafers.

Production costs remain prohibitively high, with SiC wafers costing approximately 10-20 times more than their silicon counterparts. This cost differential stems from complex manufacturing processes including crystal growth challenges, where temperatures exceeding 2000°C are required, and subsequent wafer processing steps that demand specialized equipment and expertise.

Surface quality and uniformity issues continue to plague SiC wafer technology. The extreme hardness of SiC (9.5 on the Mohs scale) makes traditional polishing techniques less effective, resulting in surface roughness that can compromise device performance in high-frequency applications critical to 5G networks.

The integration of SiC technology into existing semiconductor manufacturing processes presents compatibility challenges. Different thermal expansion coefficients and material properties require significant modifications to standard equipment and processes, creating barriers to widespread adoption in 5G infrastructure components.

Supply chain constraints have become increasingly evident, with demand for high-quality SiC wafers outpacing production capacity. This imbalance has been exacerbated by the accelerated global rollout of 5G networks, creating bottlenecks in the production of critical RF components and power amplifiers that rely on SiC technology.

Standardization issues further complicate the landscape, as varying specifications across manufacturers create integration challenges for device designers. The lack of unified standards for SiC wafer quality, particularly regarding defect classification and acceptable performance parameters for 5G applications, impedes broader industry adoption.

The primary technical challenge in SiC wafer production remains the reduction of defect density. Current state-of-the-art wafers still exhibit micropipe defects at rates of 0.1-0.5 cm², which can significantly impact device performance in high-frequency 5G applications. These defects become particularly problematic when implementing millimeter-wave technology required for ultra-high-speed 5G communications.

Wafer size scaling represents another significant hurdle. While silicon wafers have reached 12-inch diameter standard production, SiC wafer manufacturing is predominantly limited to 4-inch and 6-inch diameters, with 8-inch wafers only beginning to enter commercial production. This size limitation directly impacts economies of scale and integration capabilities with existing semiconductor manufacturing infrastructure optimized for larger wafers.

Production costs remain prohibitively high, with SiC wafers costing approximately 10-20 times more than their silicon counterparts. This cost differential stems from complex manufacturing processes including crystal growth challenges, where temperatures exceeding 2000°C are required, and subsequent wafer processing steps that demand specialized equipment and expertise.

Surface quality and uniformity issues continue to plague SiC wafer technology. The extreme hardness of SiC (9.5 on the Mohs scale) makes traditional polishing techniques less effective, resulting in surface roughness that can compromise device performance in high-frequency applications critical to 5G networks.

The integration of SiC technology into existing semiconductor manufacturing processes presents compatibility challenges. Different thermal expansion coefficients and material properties require significant modifications to standard equipment and processes, creating barriers to widespread adoption in 5G infrastructure components.

Supply chain constraints have become increasingly evident, with demand for high-quality SiC wafers outpacing production capacity. This imbalance has been exacerbated by the accelerated global rollout of 5G networks, creating bottlenecks in the production of critical RF components and power amplifiers that rely on SiC technology.

Standardization issues further complicate the landscape, as varying specifications across manufacturers create integration challenges for device designers. The lack of unified standards for SiC wafer quality, particularly regarding defect classification and acceptable performance parameters for 5G applications, impedes broader industry adoption.

Current SiC Solutions for 5G Infrastructure

01 Silicon Carbide Wafer Manufacturing Methods

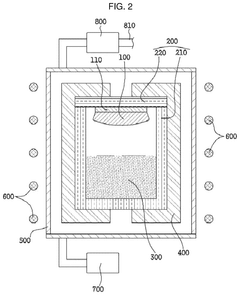

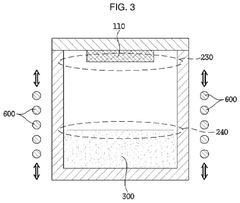

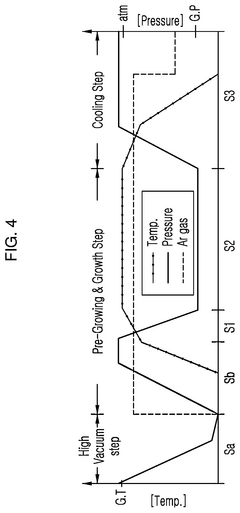

Various methods for manufacturing silicon carbide wafers have been developed to improve quality and yield. These methods include specific crystal growth techniques, cutting processes, and surface treatments to produce wafers with desired properties. Advanced manufacturing techniques help reduce defects and improve the overall quality of silicon carbide wafers for semiconductor applications.- Silicon Carbide Wafer Manufacturing Methods: Various methods for manufacturing silicon carbide wafers have been developed to improve quality and yield. These methods include specific crystal growth techniques, wafer slicing processes, and surface treatment procedures. Advanced manufacturing techniques help to reduce defects and improve the crystalline structure of the wafers, making them suitable for high-performance electronic applications.

- Defect Reduction in Silicon Carbide Wafers: Techniques for reducing defects in silicon carbide wafers are crucial for improving device performance. These include methods to minimize micropipes, dislocations, and other crystallographic defects that can affect electrical properties. Processes such as high-temperature annealing, specialized polishing techniques, and defect-selective etching help to produce wafers with lower defect densities suitable for power electronics and other demanding applications.

- Surface Treatment and Polishing of Silicon Carbide Wafers: Surface treatment and polishing techniques are essential for preparing silicon carbide wafers for device fabrication. These processes include chemical-mechanical polishing, plasma etching, and thermal oxidation to achieve atomically smooth surfaces with minimal subsurface damage. Advanced surface treatments help to improve wafer flatness, reduce roughness, and remove contaminants, resulting in better device performance and reliability.

- Epitaxial Growth on Silicon Carbide Substrates: Epitaxial growth processes on silicon carbide substrates are used to create high-quality semiconductor layers for device fabrication. These techniques include chemical vapor deposition (CVD) and molecular beam epitaxy (MBE) to grow controlled layers of silicon carbide or other materials like gallium nitride. The epitaxial layers can be precisely doped and structured to create specific electrical properties needed for power devices, RF components, and optoelectronic applications.

- Silicon Carbide Wafer Applications in Power Electronics: Silicon carbide wafers are increasingly used in power electronics due to their superior properties compared to silicon. These applications include high-voltage power devices, electric vehicle components, renewable energy systems, and industrial motor drives. The wide bandgap, high thermal conductivity, and high breakdown field strength of silicon carbide enable devices that can operate at higher temperatures, frequencies, and voltages with improved efficiency and reliability.

02 Surface Treatment and Polishing Techniques

Surface treatment and polishing techniques are crucial for preparing silicon carbide wafers for device fabrication. These processes involve mechanical polishing, chemical-mechanical planarization, and other surface finishing methods to achieve atomically smooth surfaces with minimal subsurface damage. Proper surface preparation enhances the electrical performance and reliability of devices fabricated on silicon carbide wafers.Expand Specific Solutions03 Defect Reduction and Quality Control

Methods for reducing defects and improving quality control in silicon carbide wafers focus on minimizing crystallographic defects such as micropipes, dislocations, and stacking faults. These approaches include specialized growth conditions, post-growth treatments, and inspection techniques to identify and eliminate defects that can adversely affect device performance and reliability.Expand Specific Solutions04 Wafer Bonding and Substrate Engineering

Techniques for silicon carbide wafer bonding and substrate engineering involve creating composite substrates, heteroepitaxial structures, and engineered wafer stacks. These methods allow for the integration of silicon carbide with other materials to enhance functionality, improve thermal management, or reduce costs in semiconductor device manufacturing.Expand Specific Solutions05 Large Diameter Wafer Production

Advancements in large diameter silicon carbide wafer production address the challenges of scaling up wafer size while maintaining quality. These developments include modified crystal growth techniques, specialized handling equipment, and process adaptations to accommodate larger wafers. Larger diameter wafers enable more efficient device manufacturing and reduced production costs for silicon carbide-based electronics.Expand Specific Solutions

Key Industry Players in SiC Wafer Manufacturing

The Silicon Carbide (SiC) wafer market for 5G networks is currently in a growth phase, with increasing adoption driven by SiC's superior thermal conductivity and power efficiency properties critical for 5G infrastructure. The global market is expanding rapidly, projected to reach significant scale as 5G deployment accelerates worldwide. Leading players include established semiconductor manufacturers like Wolfspeed, which specializes in wide bandgap semiconductors, and SICC Co., focusing specifically on SiC substrates for 5G communications. Other key competitors include diversified technology giants such as STMicroelectronics and Infineon Technologies, who are integrating SiC solutions into their telecommunications portfolios. Asian manufacturers, particularly Chinese companies like Hunan Sanan Semiconductor, are rapidly advancing their technological capabilities, challenging traditional Western market dominance in this emerging field.

Wolfspeed, Inc.

Technical Solution: Wolfspeed has pioneered silicon carbide (SiC) technology specifically optimized for 5G infrastructure applications. Their 150mm SiC wafers serve as the foundation for high-frequency, high-power RF devices essential in 5G base stations. Wolfspeed's proprietary high-purity SiC crystal growth process achieves defect densities below 1 per cm², significantly outperforming silicon alternatives. Their 5G-focused SiC solutions include GaN-on-SiC HEMT (High Electron Mobility Transistor) technology that operates efficiently at frequencies up to 80 GHz with power densities exceeding 7W/mm. These components demonstrate thermal conductivity of approximately 3.7 W/cm·K, more than twice that of silicon, enabling sustained operation at junction temperatures up to 225°C without performance degradation. This thermal advantage translates to 5G systems with 30-40% smaller form factors and reduced cooling requirements compared to conventional silicon-based solutions.

Strengths: Industry-leading SiC substrate quality with minimal defects; superior thermal management capabilities; established manufacturing scale with dedicated 5G product lines. Weaknesses: Higher initial component costs compared to silicon alternatives; limited wafer diameter options compared to mature silicon technology; requires specialized packaging solutions to fully leverage thermal benefits.

STMicroelectronics International NV

Technical Solution: STMicroelectronics has developed advanced silicon carbide (SiC) technology specifically tailored for 5G network applications. Their proprietary SiC wafer manufacturing process achieves crystal quality with defect densities below 2 per cm², enabling high-reliability RF components essential for 5G infrastructure. ST's SiC-based power devices feature blocking voltages up to 1700V with on-resistance values as low as 2.5 mΩ·cm², representing a 40% improvement over silicon alternatives. For 5G applications, ST has engineered SiC solutions that maintain efficiency above 97% even at the elevated switching frequencies (>100kHz) required by modern network equipment. Their SiC technology enables power density improvements of approximately 300% in 5G base station power supplies, directly addressing the space constraints of urban small cell deployments. ST's integrated SiC modules incorporate advanced thermal management techniques that maintain junction temperatures below critical thresholds even under the variable load conditions typical of 5G traffic patterns, with thermal resistance values as low as 0.15°C/W.

Strengths: Vertically integrated manufacturing from SiC substrates to finished devices; extensive automotive qualification experience transferable to 5G reliability requirements; strong ecosystem of development tools and reference designs. Weaknesses: Production capacity constraints during industry-wide SiC demand surges; higher cost structure compared to some specialized competitors; relatively recent entry into RF-specific SiC applications compared to power applications.

Critical Patents and Innovations in SiC Wafer Technology

Silicon carbide wafer and semiconductor device

PatentActiveUS12270122B2

Innovation

- A silicon carbide wafer with specific surface roughness characteristics, including an average Rmax roughness of 2.0 nm or less and an average Ra roughness of 0.1 nm or less, is developed. The wafer is designed to maintain a uniform quality across its surface, with a controlled difference in roughness between the edge and central regions, and optimized optical properties such as total light transmittance and haze.

Patent

Innovation

- Integration of Silicon Carbide (SiC) wafers in 5G base station power amplifiers, significantly reducing power consumption and heat generation while improving signal integrity.

- Development of specialized SiC substrate configurations that enhance thermal conductivity in high-frequency 5G applications, enabling more efficient heat dissipation in compact network equipment.

- Implementation of novel doping profiles in SiC wafers that maintain performance integrity under the high-power density conditions typical in 5G millimeter wave applications.

Thermal Management Advancements with SiC in 5G Systems

The thermal management challenges in 5G networks have become increasingly critical as system densities and power requirements escalate. Silicon Carbide (SiC) wafers represent a significant advancement in addressing these thermal issues, offering superior thermal conductivity of approximately 370 W/mK compared to silicon's 150 W/mK. This property enables more efficient heat dissipation in high-power RF components and base station equipment, which is essential for maintaining optimal operating temperatures in 5G infrastructure.

Recent developments in SiC-based thermal management solutions have focused on integrating these materials into heat spreaders, substrates, and packaging for power amplifiers and other heat-generating components. The implementation of SiC in these applications has demonstrated temperature reductions of 15-30% compared to traditional materials, significantly extending component lifespan and improving reliability in demanding 5G environments.

Advanced thermal interface materials (TIMs) incorporating SiC particles have shown enhanced performance in creating efficient thermal pathways between components and heat sinks. These composite materials leverage SiC's thermal properties while addressing challenges related to mechanical stress and integration with existing manufacturing processes. Studies indicate that SiC-enhanced TIMs can reduce thermal resistance by up to 40% compared to conventional solutions.

Liquid cooling systems utilizing SiC components have emerged as another promising approach for managing thermal loads in high-density 5G equipment. SiC's chemical stability and resistance to corrosion make it suitable for direct liquid cooling applications, where it can withstand aggressive coolants while maintaining excellent thermal performance. These systems have demonstrated the ability to handle power densities exceeding 100 W/cm², which is increasingly common in advanced 5G equipment.

The miniaturization trend in 5G technology has further emphasized the importance of SiC in thermal management. As component sizes decrease and integration increases, thermal densities rise dramatically. SiC-based microchannel coolers and 3D-stacked thermal management solutions are being developed to address these challenges, offering promising results in laboratory testing with thermal management efficiencies improving by 25-35% over conventional approaches.

Energy efficiency improvements resulting from better thermal management with SiC materials translate directly to operational cost savings for network operators. Analysis suggests that implementing SiC-based thermal solutions can reduce cooling-related energy consumption by 10-20% in typical 5G base stations, contributing significantly to sustainability goals while improving network performance and reliability.

Recent developments in SiC-based thermal management solutions have focused on integrating these materials into heat spreaders, substrates, and packaging for power amplifiers and other heat-generating components. The implementation of SiC in these applications has demonstrated temperature reductions of 15-30% compared to traditional materials, significantly extending component lifespan and improving reliability in demanding 5G environments.

Advanced thermal interface materials (TIMs) incorporating SiC particles have shown enhanced performance in creating efficient thermal pathways between components and heat sinks. These composite materials leverage SiC's thermal properties while addressing challenges related to mechanical stress and integration with existing manufacturing processes. Studies indicate that SiC-enhanced TIMs can reduce thermal resistance by up to 40% compared to conventional solutions.

Liquid cooling systems utilizing SiC components have emerged as another promising approach for managing thermal loads in high-density 5G equipment. SiC's chemical stability and resistance to corrosion make it suitable for direct liquid cooling applications, where it can withstand aggressive coolants while maintaining excellent thermal performance. These systems have demonstrated the ability to handle power densities exceeding 100 W/cm², which is increasingly common in advanced 5G equipment.

The miniaturization trend in 5G technology has further emphasized the importance of SiC in thermal management. As component sizes decrease and integration increases, thermal densities rise dramatically. SiC-based microchannel coolers and 3D-stacked thermal management solutions are being developed to address these challenges, offering promising results in laboratory testing with thermal management efficiencies improving by 25-35% over conventional approaches.

Energy efficiency improvements resulting from better thermal management with SiC materials translate directly to operational cost savings for network operators. Analysis suggests that implementing SiC-based thermal solutions can reduce cooling-related energy consumption by 10-20% in typical 5G base stations, contributing significantly to sustainability goals while improving network performance and reliability.

Environmental Impact and Sustainability of SiC Production

The production of Silicon Carbide (SiC) wafers, while offering significant benefits for 5G network infrastructure, presents considerable environmental challenges that must be addressed for sustainable implementation. The manufacturing process of SiC wafers requires extremely high temperatures, typically exceeding 2000°C, resulting in substantial energy consumption. Current production methods consume approximately 300-500 kWh per kilogram of SiC produced, significantly higher than traditional silicon wafer manufacturing.

Carbon emissions associated with SiC production represent another critical environmental concern. Depending on the energy source utilized, the carbon footprint can range from 30 to 60 kg CO2 equivalent per kilogram of SiC produced. This environmental impact is particularly relevant as 5G networks expand globally, potentially increasing the demand for SiC components by 25-30% annually over the next five years.

Water usage in SiC wafer production also presents sustainability challenges. The manufacturing process requires ultra-pure water for cleaning and processing, consuming approximately 5-7 cubic meters per square meter of wafer produced. Additionally, the chemical processes involved generate wastewater containing various compounds that require specialized treatment before discharge.

Raw material extraction for SiC production impacts local ecosystems, particularly in regions where mining operations for silicon and carbon sources occur. These activities can lead to habitat disruption, soil erosion, and potential contamination of local water sources if not properly managed. The geographical concentration of raw material sources also raises concerns about supply chain resilience and environmental justice.

Several sustainability initiatives are emerging within the industry to address these challenges. Leading manufacturers have begun implementing closed-loop water systems that reduce freshwater consumption by 40-60%. Energy efficiency improvements through process optimization and equipment upgrades have demonstrated potential reductions in energy consumption by 15-25% in pilot programs.

Renewable energy integration represents another promising approach, with several major SiC manufacturers committing to powering their facilities with 50-100% renewable energy by 2030. This transition could significantly reduce the carbon footprint of SiC production. Additionally, research into alternative synthesis methods, including lower-temperature processes and recycling of manufacturing waste, shows potential for further environmental impact reduction.

Life cycle assessment studies indicate that despite the environmental costs of production, SiC components in 5G networks may offer net environmental benefits through improved energy efficiency during operation. The extended lifespan and superior performance of SiC components can offset initial production impacts over the full product lifecycle, particularly when combined with responsible end-of-life management strategies.

Carbon emissions associated with SiC production represent another critical environmental concern. Depending on the energy source utilized, the carbon footprint can range from 30 to 60 kg CO2 equivalent per kilogram of SiC produced. This environmental impact is particularly relevant as 5G networks expand globally, potentially increasing the demand for SiC components by 25-30% annually over the next five years.

Water usage in SiC wafer production also presents sustainability challenges. The manufacturing process requires ultra-pure water for cleaning and processing, consuming approximately 5-7 cubic meters per square meter of wafer produced. Additionally, the chemical processes involved generate wastewater containing various compounds that require specialized treatment before discharge.

Raw material extraction for SiC production impacts local ecosystems, particularly in regions where mining operations for silicon and carbon sources occur. These activities can lead to habitat disruption, soil erosion, and potential contamination of local water sources if not properly managed. The geographical concentration of raw material sources also raises concerns about supply chain resilience and environmental justice.

Several sustainability initiatives are emerging within the industry to address these challenges. Leading manufacturers have begun implementing closed-loop water systems that reduce freshwater consumption by 40-60%. Energy efficiency improvements through process optimization and equipment upgrades have demonstrated potential reductions in energy consumption by 15-25% in pilot programs.

Renewable energy integration represents another promising approach, with several major SiC manufacturers committing to powering their facilities with 50-100% renewable energy by 2030. This transition could significantly reduce the carbon footprint of SiC production. Additionally, research into alternative synthesis methods, including lower-temperature processes and recycling of manufacturing waste, shows potential for further environmental impact reduction.

Life cycle assessment studies indicate that despite the environmental costs of production, SiC components in 5G networks may offer net environmental benefits through improved energy efficiency during operation. The extended lifespan and superior performance of SiC components can offset initial production impacts over the full product lifecycle, particularly when combined with responsible end-of-life management strategies.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!