Research on Silicon Carbide Wafer Integration in Robotics

OCT 14, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

SiC Wafer Technology Background and Objectives

Silicon Carbide (SiC) wafer technology represents a significant advancement in semiconductor materials, evolving from its initial discovery in 1824 by Jöns Jacob Berzelius to becoming a critical component in modern high-performance electronics. The material's exceptional properties, including wide bandgap (3.2 eV), high thermal conductivity (3-4 W/cm·K), and superior electric breakdown field strength (2.8 MV/cm), position it as an ideal candidate for applications requiring operation under extreme conditions.

The historical trajectory of SiC wafer development has been marked by persistent challenges in crystal growth and defect reduction. Early commercialization efforts in the 1990s faced limitations in wafer size and quality, with initial products restricted to 2-inch diameters and high defect densities. Significant technological breakthroughs in the 2000s enabled the production of larger 4-inch and 6-inch wafers, while recent advancements have pushed boundaries to 8-inch wafers with substantially reduced defect rates.

In the context of robotics integration, SiC wafers offer transformative potential through enabling more efficient power electronics, enhanced sensor capabilities, and improved thermal management systems. These advantages directly address critical limitations in current robotic systems, particularly in environments requiring high temperature operation, radiation resistance, or extreme power efficiency.

The primary technical objectives for SiC wafer integration in robotics include developing more compact and efficient power conversion modules capable of operating at higher frequencies and temperatures, creating radiation-hardened control systems for hazardous environment deployment, and implementing advanced sensing capabilities leveraging SiC's unique electrical properties.

Current market trends indicate accelerating adoption of SiC technology across multiple industries, with compound annual growth rates exceeding 30% in power electronics applications. This growth trajectory is expected to continue as manufacturing processes mature and economies of scale reduce production costs, making SiC increasingly viable for mainstream robotic applications.

Looking forward, the technology roadmap for SiC in robotics aims to achieve several key milestones: reducing wafer costs by 40-50% through improved manufacturing yields and larger wafer sizes; enhancing device performance through novel epitaxial growth techniques and advanced doping profiles; and developing specialized packaging solutions that maximize SiC's thermal and electrical advantages in robotic form factors.

The convergence of SiC wafer technology with robotics represents a promising frontier for next-generation autonomous systems, particularly in extreme environment applications where traditional silicon-based electronics face fundamental limitations. This technological synergy has the potential to enable robotic capabilities previously considered impractical or impossible due to material constraints.

The historical trajectory of SiC wafer development has been marked by persistent challenges in crystal growth and defect reduction. Early commercialization efforts in the 1990s faced limitations in wafer size and quality, with initial products restricted to 2-inch diameters and high defect densities. Significant technological breakthroughs in the 2000s enabled the production of larger 4-inch and 6-inch wafers, while recent advancements have pushed boundaries to 8-inch wafers with substantially reduced defect rates.

In the context of robotics integration, SiC wafers offer transformative potential through enabling more efficient power electronics, enhanced sensor capabilities, and improved thermal management systems. These advantages directly address critical limitations in current robotic systems, particularly in environments requiring high temperature operation, radiation resistance, or extreme power efficiency.

The primary technical objectives for SiC wafer integration in robotics include developing more compact and efficient power conversion modules capable of operating at higher frequencies and temperatures, creating radiation-hardened control systems for hazardous environment deployment, and implementing advanced sensing capabilities leveraging SiC's unique electrical properties.

Current market trends indicate accelerating adoption of SiC technology across multiple industries, with compound annual growth rates exceeding 30% in power electronics applications. This growth trajectory is expected to continue as manufacturing processes mature and economies of scale reduce production costs, making SiC increasingly viable for mainstream robotic applications.

Looking forward, the technology roadmap for SiC in robotics aims to achieve several key milestones: reducing wafer costs by 40-50% through improved manufacturing yields and larger wafer sizes; enhancing device performance through novel epitaxial growth techniques and advanced doping profiles; and developing specialized packaging solutions that maximize SiC's thermal and electrical advantages in robotic form factors.

The convergence of SiC wafer technology with robotics represents a promising frontier for next-generation autonomous systems, particularly in extreme environment applications where traditional silicon-based electronics face fundamental limitations. This technological synergy has the potential to enable robotic capabilities previously considered impractical or impossible due to material constraints.

Market Demand Analysis for SiC in Robotics

The global market for Silicon Carbide (SiC) in robotics applications is experiencing significant growth, driven by the increasing demand for high-performance robots across various industries. Current market analysis indicates that the SiC semiconductor market is expanding at a compound annual growth rate of approximately 16% from 2023 to 2028, with robotics representing one of the fastest-growing application segments.

Industrial robotics constitutes the largest market segment for SiC integration, particularly in manufacturing environments where robots operate under harsh conditions requiring high temperature tolerance and power efficiency. The automotive industry's shift toward electric vehicles has created a parallel demand for advanced robotics in production lines, further accelerating the need for SiC-based components that can handle high-voltage operations with minimal energy loss.

Consumer robotics represents another rapidly expanding market segment, with household robots, personal assistants, and entertainment robots gaining popularity. These applications benefit from SiC's ability to enable smaller, more efficient power systems, extending battery life and improving overall performance. Market research indicates that consumer robotics incorporating advanced semiconductor materials like SiC could see market penetration increase by 25% over the next five years.

Healthcare robotics presents a particularly promising growth area for SiC technology. Surgical robots, rehabilitation devices, and care robots require exceptional precision, reliability, and safety—all attributes enhanced by SiC's superior electrical properties. The medical robotics market is projected to grow substantially, creating increased demand for high-performance semiconductor materials that can ensure consistent operation in critical applications.

Logistics and warehouse automation represents another significant market driver, with companies increasingly deploying autonomous mobile robots (AMRs) and automated guided vehicles (AGVs) to improve operational efficiency. These robots benefit from SiC's ability to enhance power conversion efficiency, enabling longer operational periods between charges and reducing downtime.

Regional analysis reveals that Asia-Pacific currently leads in SiC adoption for robotics, followed by North America and Europe. China, Japan, and South Korea are making substantial investments in both robotics development and semiconductor manufacturing capabilities, positioning the region as the primary growth market for SiC in robotics applications.

Market challenges include the relatively high cost of SiC wafers compared to traditional silicon, which remains a barrier to widespread adoption in cost-sensitive robotics applications. However, as manufacturing processes mature and economies of scale improve, industry analysts expect SiC wafer costs to decrease by 30-40% over the next decade, significantly expanding market opportunities across all robotics segments.

Industrial robotics constitutes the largest market segment for SiC integration, particularly in manufacturing environments where robots operate under harsh conditions requiring high temperature tolerance and power efficiency. The automotive industry's shift toward electric vehicles has created a parallel demand for advanced robotics in production lines, further accelerating the need for SiC-based components that can handle high-voltage operations with minimal energy loss.

Consumer robotics represents another rapidly expanding market segment, with household robots, personal assistants, and entertainment robots gaining popularity. These applications benefit from SiC's ability to enable smaller, more efficient power systems, extending battery life and improving overall performance. Market research indicates that consumer robotics incorporating advanced semiconductor materials like SiC could see market penetration increase by 25% over the next five years.

Healthcare robotics presents a particularly promising growth area for SiC technology. Surgical robots, rehabilitation devices, and care robots require exceptional precision, reliability, and safety—all attributes enhanced by SiC's superior electrical properties. The medical robotics market is projected to grow substantially, creating increased demand for high-performance semiconductor materials that can ensure consistent operation in critical applications.

Logistics and warehouse automation represents another significant market driver, with companies increasingly deploying autonomous mobile robots (AMRs) and automated guided vehicles (AGVs) to improve operational efficiency. These robots benefit from SiC's ability to enhance power conversion efficiency, enabling longer operational periods between charges and reducing downtime.

Regional analysis reveals that Asia-Pacific currently leads in SiC adoption for robotics, followed by North America and Europe. China, Japan, and South Korea are making substantial investments in both robotics development and semiconductor manufacturing capabilities, positioning the region as the primary growth market for SiC in robotics applications.

Market challenges include the relatively high cost of SiC wafers compared to traditional silicon, which remains a barrier to widespread adoption in cost-sensitive robotics applications. However, as manufacturing processes mature and economies of scale improve, industry analysts expect SiC wafer costs to decrease by 30-40% over the next decade, significantly expanding market opportunities across all robotics segments.

Current State and Challenges of SiC Integration

Silicon Carbide (SiC) wafer integration in robotics represents a significant technological advancement, yet its current implementation faces several challenges. Globally, SiC technology has reached commercial viability in power electronics applications, with 6-inch wafers becoming the industry standard and 8-inch wafers emerging in advanced research facilities. However, the integration of SiC specifically for robotics applications remains in early adoption phases, with limited deployment in high-performance industrial robots and experimental autonomous systems.

The primary technical challenges hindering widespread SiC adoption in robotics stem from manufacturing complexities. SiC crystal growth processes still suffer from higher defect densities compared to traditional silicon, with micropipe defects and basal plane dislocations affecting yield rates and performance consistency. These defects become particularly problematic in the high-stress operational environments typical of robotic applications, where thermal cycling and mechanical vibration are common.

Cost factors present another significant barrier, with SiC wafers commanding a 3-5x price premium over silicon alternatives. This cost differential makes integration economically viable only for high-end robotics applications where performance advantages clearly justify the increased expense. The specialized manufacturing equipment required for SiC processing further compounds this economic challenge, as many robotics manufacturers lack access to appropriate fabrication facilities.

Geographically, SiC technology development shows distinct regional characteristics. North America leads in fundamental research and patent generation, with companies like Wolfspeed (formerly Cree) and ON Semiconductor dominating intellectual property landscapes. Europe excels in industrial applications, particularly through companies like STMicroelectronics and Infineon Technologies. Meanwhile, Asia, especially Japan and China, has rapidly expanded manufacturing capacity, with companies like Rohm Semiconductor and SICC Materials establishing significant production capabilities.

Integration challenges specific to robotics applications include thermal management complexities, as SiC components operate optimally at higher temperatures than traditional silicon but require careful thermal design to protect surrounding components. Additionally, interface compatibility issues arise when incorporating SiC power modules with existing robot control systems, often necessitating redesigned driver circuits and control algorithms to fully leverage SiC's faster switching capabilities.

The reliability qualification framework for SiC in robotics remains underdeveloped, with insufficient long-term performance data in dynamic robotic operational environments. This creates uncertainty regarding maintenance schedules and lifetime performance predictions, particularly for robots operating in extreme conditions where SiC's advantages would be most beneficial.

The primary technical challenges hindering widespread SiC adoption in robotics stem from manufacturing complexities. SiC crystal growth processes still suffer from higher defect densities compared to traditional silicon, with micropipe defects and basal plane dislocations affecting yield rates and performance consistency. These defects become particularly problematic in the high-stress operational environments typical of robotic applications, where thermal cycling and mechanical vibration are common.

Cost factors present another significant barrier, with SiC wafers commanding a 3-5x price premium over silicon alternatives. This cost differential makes integration economically viable only for high-end robotics applications where performance advantages clearly justify the increased expense. The specialized manufacturing equipment required for SiC processing further compounds this economic challenge, as many robotics manufacturers lack access to appropriate fabrication facilities.

Geographically, SiC technology development shows distinct regional characteristics. North America leads in fundamental research and patent generation, with companies like Wolfspeed (formerly Cree) and ON Semiconductor dominating intellectual property landscapes. Europe excels in industrial applications, particularly through companies like STMicroelectronics and Infineon Technologies. Meanwhile, Asia, especially Japan and China, has rapidly expanded manufacturing capacity, with companies like Rohm Semiconductor and SICC Materials establishing significant production capabilities.

Integration challenges specific to robotics applications include thermal management complexities, as SiC components operate optimally at higher temperatures than traditional silicon but require careful thermal design to protect surrounding components. Additionally, interface compatibility issues arise when incorporating SiC power modules with existing robot control systems, often necessitating redesigned driver circuits and control algorithms to fully leverage SiC's faster switching capabilities.

The reliability qualification framework for SiC in robotics remains underdeveloped, with insufficient long-term performance data in dynamic robotic operational environments. This creates uncertainty regarding maintenance schedules and lifetime performance predictions, particularly for robots operating in extreme conditions where SiC's advantages would be most beneficial.

Current SiC Integration Solutions for Robotics

01 Silicon Carbide Wafer Manufacturing Methods

Various methods for manufacturing silicon carbide wafers have been developed to improve quality and yield. These methods include specific crystal growth techniques, wafer slicing processes, and surface preparation methods. Advanced manufacturing techniques help to reduce defects and improve the crystalline structure of the wafers, making them suitable for high-performance electronic applications.- Silicon Carbide Wafer Manufacturing Methods: Various manufacturing methods are employed to produce high-quality silicon carbide wafers for semiconductor applications. These methods include chemical vapor deposition (CVD), physical vapor transport (PVT), and modified Lely processes. The manufacturing techniques focus on controlling crystal growth, reducing defects, and achieving uniform wafer properties. Advanced processes have been developed to increase wafer diameter and improve surface quality, which are critical for high-performance electronic devices.

- Defect Reduction Techniques in SiC Wafers: Reducing defects in silicon carbide wafers is crucial for enhancing device performance and reliability. Techniques include thermal annealing processes, specialized polishing methods, and defect-selective etching. These approaches target common defects such as micropipes, dislocations, and stacking faults that can compromise the electrical properties of SiC-based devices. Advanced characterization methods are also employed to identify and mitigate defects during the manufacturing process.

- Surface Treatment and Polishing of SiC Wafers: Surface treatment and polishing techniques are essential for preparing silicon carbide wafers for device fabrication. Chemical-mechanical polishing (CMP), plasma etching, and high-temperature hydrogen etching are commonly used to achieve atomically smooth surfaces. These processes remove subsurface damage, reduce roughness, and create uniform surfaces necessary for epitaxial growth and device processing. Advanced polishing methods have been developed to address the extreme hardness of silicon carbide while maintaining precise dimensional control.

- Epitaxial Growth on SiC Substrates: Epitaxial growth on silicon carbide substrates is a critical process for creating functional semiconductor layers. Techniques include chemical vapor deposition (CVD), molecular beam epitaxy (MBE), and liquid phase epitaxy (LPE). These methods enable the controlled deposition of high-quality semiconductor films with specific electrical properties. The epitaxial process must account for the unique properties of SiC substrates, including polytype consistency, surface preparation, and thermal expansion characteristics.

- SiC Wafer Applications in Power Electronics: Silicon carbide wafers are increasingly used in power electronics applications due to their superior properties compared to traditional silicon. SiC-based devices offer higher breakdown voltage, better thermal conductivity, and improved efficiency in high-power and high-temperature environments. Applications include electric vehicle inverters, industrial motor drives, renewable energy systems, and high-voltage power transmission. The wide bandgap properties of SiC enable smaller, more efficient power electronic systems that can operate at higher frequencies and temperatures.

02 Defect Reduction in Silicon Carbide Wafers

Techniques for reducing defects in silicon carbide wafers are crucial for improving device performance. These include methods for minimizing micropipes, dislocations, and other crystallographic defects that can affect electrical properties. Post-growth treatments and specialized polishing techniques help to achieve wafers with lower defect densities, which is essential for high-power and high-frequency electronic applications.Expand Specific Solutions03 Surface Treatment and Polishing of Silicon Carbide Wafers

Surface treatment and polishing methods are essential for preparing silicon carbide wafers for device fabrication. These processes include chemical-mechanical polishing, etching techniques, and surface passivation methods to achieve atomically smooth surfaces with minimal subsurface damage. Proper surface preparation ensures better device performance and reliability in the final semiconductor products.Expand Specific Solutions04 Epitaxial Growth on Silicon Carbide Substrates

Epitaxial growth techniques on silicon carbide substrates are critical for creating device-quality layers for power electronics and RF applications. These methods include chemical vapor deposition (CVD) and other specialized growth techniques to create precisely controlled semiconductor layers. The quality of the epitaxial layers directly impacts device performance characteristics such as breakdown voltage and on-resistance.Expand Specific Solutions05 Silicon Carbide Wafer Applications in Power Electronics

Silicon carbide wafers are increasingly used in power electronics applications due to their superior properties compared to silicon. These applications include high-voltage power devices, electric vehicle components, renewable energy systems, and industrial motor drives. The wide bandgap properties of silicon carbide enable devices that can operate at higher temperatures, higher frequencies, and higher voltages with improved efficiency.Expand Specific Solutions

Key Industry Players in SiC Wafer Production

The silicon carbide (SiC) wafer integration in robotics market is in its early growth phase, characterized by increasing adoption but still evolving technological maturity. The global market is expanding rapidly, driven by robotics applications requiring high-temperature operation, power efficiency, and miniaturization capabilities that SiC provides. Key players form a competitive landscape with established semiconductor manufacturers like Wolfspeed, Infineon Technologies, and STMicroelectronics leading commercial development, while research institutions such as Dalian University of Technology and University of Warwick advance fundamental innovations. Companies including GlobalWafers, RESONAC, and SUMCO bring materials expertise, while specialized firms like CoorsTek and Element Six focus on technical ceramics and synthetic materials. This ecosystem demonstrates a technology transition period where manufacturing scalability and cost reduction remain critical challenges for widespread robotics adoption.

Wolfspeed, Inc.

Technical Solution: Wolfspeed has pioneered the integration of silicon carbide (SiC) wafers in robotics applications through their advanced manufacturing processes that produce high-quality 150mm and 200mm SiC wafers. Their technology enables the development of more efficient power modules specifically designed for robotic systems. Wolfspeed's SiC-based power solutions deliver higher power density and switching frequencies compared to traditional silicon, allowing for more compact and lightweight robotic designs. Their vertical integration approach—from substrate production to device manufacturing—ensures quality control throughout the supply chain. Wolfspeed has developed specialized SiC MOSFETs and diodes that operate efficiently at higher temperatures (up to 200°C), making them ideal for robotics applications where thermal management is critical. Their materials also demonstrate superior mechanical properties that enhance durability in dynamic robotic environments.

Strengths: Superior thermal conductivity (3-4x better than silicon) enabling better heat dissipation in compact robotic designs; higher breakdown electric field strength allowing for higher voltage operation; excellent mechanical properties providing durability in high-vibration environments. Weaknesses: Higher manufacturing costs compared to traditional silicon; limited wafer size options compared to mature silicon technology; requires specialized packaging solutions to fully leverage SiC benefits.

Infineon Technologies AG

Technical Solution: Infineon has developed a comprehensive SiC integration strategy for robotics, focusing on their CoolSiC™ technology platform. Their approach combines SiC wafer processing with specialized packaging techniques to create power modules optimized for robotic applications. Infineon's SiC MOSFETs and diodes are designed to operate at switching frequencies up to 100kHz, significantly higher than silicon alternatives, enabling more responsive motor control systems in robots. Their technology incorporates advanced gate driver designs specifically optimized for SiC characteristics, addressing switching behavior challenges unique to SiC devices. Infineon has also developed specialized thermal management solutions to maximize the temperature advantages of SiC in confined robotic spaces. Their integration approach includes comprehensive EMI mitigation strategies, critical for sensitive sensor systems in robotics. Infineon's robotics-focused SiC solutions have demonstrated up to 30% reduction in power losses compared to silicon alternatives, directly translating to extended battery life in mobile robots.

Strengths: Comprehensive ecosystem approach including drivers and control ICs specifically designed for SiC; established manufacturing capacity ensuring supply chain stability; extensive application expertise in motor drives and power conversion for robotics. Weaknesses: Higher initial component costs compared to silicon alternatives; requires redesign of existing power systems to fully leverage SiC benefits; more complex gate driving requirements necessitating additional engineering expertise.

Core Patents and Technical Literature Analysis

Sic p-type, and low resistivity, crystals, boules, wafers and devices, and methods of making the same

PatentWO2023283474A1

Innovation

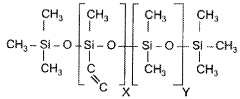

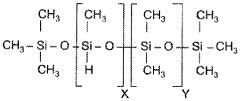

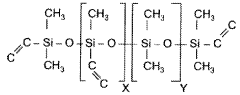

- The development of methods and materials for producing p-type SiC crystals, ingots, boules, and wafers with controlled dopant distribution using polysilocarb precursor materials and physical vapor transport (PVT) processes, enabling the growth of p-type SiC materials with low resistivity and uniform electrical properties.

Silicon carbide composite wafer and manufacturing method thereof

PatentActiveJP2022181154A

Innovation

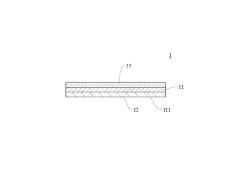

- A silicon carbide composite wafer is manufactured by directly bonding a silicon carbide material to a ceramic or glass wafer substrate through surface modification, utilizing methods such as hydrogen bonding, electrostatic bonding, or physical bonding, without an intermediate thin film, and optionally including a crystal layer.

Supply Chain Resilience and Manufacturing Considerations

The integration of Silicon Carbide (SiC) wafers in robotics manufacturing faces significant supply chain challenges that require strategic planning and resilience-building measures. The global SiC supply chain remains relatively concentrated, with key production capabilities centered in the United States, Japan, and Europe. This geographic concentration creates inherent vulnerabilities, particularly when considering geopolitical tensions and trade restrictions that have affected semiconductor industries in recent years.

Manufacturing considerations for SiC wafers are substantially more complex than traditional silicon, requiring specialized equipment and expertise. The high-temperature processes necessary for SiC crystal growth and wafer production demand specialized furnaces capable of operating at temperatures exceeding 2000°C. These manufacturing requirements create significant barriers to entry and limit the number of qualified suppliers, further concentrating the supply chain.

Raw material sourcing represents another critical vulnerability point. High-purity silicon carbide powder and other precursor materials are essential for wafer production but are subject to availability constraints and price volatility. Companies integrating SiC technology into robotics applications must develop multi-sourcing strategies and consider vertical integration options to mitigate these risks.

Lead times for SiC wafer production typically range from 3-6 months, significantly longer than conventional silicon wafers. This extended production timeline necessitates more sophisticated inventory management and forecasting systems for robotics manufacturers. Just-in-time manufacturing approaches that work well with mature silicon supply chains prove inadequate for SiC components, requiring adaptation of production planning methodologies.

Quality control presents additional manufacturing challenges, as defect rates in SiC wafers remain higher than in traditional silicon. The crystalline structure of SiC is more prone to micropipe defects and other imperfections that can affect device performance. Robotics applications, particularly those in safety-critical environments, require stringent quality assurance protocols and potentially redundant design approaches to compensate for these material limitations.

Capacity expansion in the SiC wafer industry has accelerated in recent years but continues to lag behind growing demand from automotive, industrial, and now robotics sectors. This capacity constraint creates competitive procurement challenges, with larger industries potentially crowding out robotics manufacturers. Strategic partnerships and long-term supply agreements have become essential tools for securing reliable access to SiC components for robotics applications.

Manufacturing considerations for SiC wafers are substantially more complex than traditional silicon, requiring specialized equipment and expertise. The high-temperature processes necessary for SiC crystal growth and wafer production demand specialized furnaces capable of operating at temperatures exceeding 2000°C. These manufacturing requirements create significant barriers to entry and limit the number of qualified suppliers, further concentrating the supply chain.

Raw material sourcing represents another critical vulnerability point. High-purity silicon carbide powder and other precursor materials are essential for wafer production but are subject to availability constraints and price volatility. Companies integrating SiC technology into robotics applications must develop multi-sourcing strategies and consider vertical integration options to mitigate these risks.

Lead times for SiC wafer production typically range from 3-6 months, significantly longer than conventional silicon wafers. This extended production timeline necessitates more sophisticated inventory management and forecasting systems for robotics manufacturers. Just-in-time manufacturing approaches that work well with mature silicon supply chains prove inadequate for SiC components, requiring adaptation of production planning methodologies.

Quality control presents additional manufacturing challenges, as defect rates in SiC wafers remain higher than in traditional silicon. The crystalline structure of SiC is more prone to micropipe defects and other imperfections that can affect device performance. Robotics applications, particularly those in safety-critical environments, require stringent quality assurance protocols and potentially redundant design approaches to compensate for these material limitations.

Capacity expansion in the SiC wafer industry has accelerated in recent years but continues to lag behind growing demand from automotive, industrial, and now robotics sectors. This capacity constraint creates competitive procurement challenges, with larger industries potentially crowding out robotics manufacturers. Strategic partnerships and long-term supply agreements have become essential tools for securing reliable access to SiC components for robotics applications.

Thermal Management and Power Efficiency Improvements

Silicon Carbide (SiC) wafers offer exceptional thermal management capabilities that are revolutionizing robotics applications. The wide bandgap semiconductor material demonstrates superior thermal conductivity of approximately 370 W/mK, nearly three times that of silicon, enabling significantly improved heat dissipation in high-power robotic systems. This property becomes crucial as robots increasingly operate in extreme environments and perform computation-intensive tasks that generate substantial heat.

The integration of SiC power modules in robotic drive systems has demonstrated temperature reductions of 15-30% compared to traditional silicon-based solutions under identical operating conditions. This thermal advantage translates directly to enhanced reliability, with studies indicating up to 40% reduction in thermal-related failures in industrial robots utilizing SiC components. The material's ability to function efficiently at temperatures exceeding 200°C makes it particularly valuable for robots operating in high-temperature environments such as foundries, firefighting scenarios, or space exploration.

Power efficiency improvements represent another significant benefit of SiC integration in robotics. SiC-based power electronics demonstrate switching losses reduced by 75-80% compared to silicon alternatives, dramatically improving overall system efficiency. Field tests with SiC-equipped robotic arms show energy consumption reductions of 20-35% during typical operation cycles, extending battery life in mobile robots and reducing operational costs in industrial applications.

The implementation of SiC wafers in motor drive inverters for humanoid robots has yielded power density improvements of up to 300%, enabling more compact designs without compromising performance. This miniaturization potential addresses one of robotics' fundamental challenges: the size-to-power ratio constraint that limits mobility and application scope. Companies pioneering these implementations report weight reductions of 40-60% in power management components, directly enhancing robot agility and operational range.

Recent advancements in SiC wafer cooling technologies have introduced innovative solutions like microfluidic channels etched directly into wafer substrates, providing localized cooling precisely where heat generation is most concentrated. These techniques have demonstrated the ability to maintain junction temperatures below critical thresholds even during peak processing loads, preventing thermal throttling that would otherwise compromise computational performance in AI-driven robots.

The economic impact of these thermal and power improvements extends beyond technical specifications. Analysis indicates that despite the higher initial cost of SiC components (typically 2-3 times that of silicon equivalents), the total cost of ownership over a five-year operational period shows net savings of 15-25% due to reduced energy consumption, lower cooling requirements, and extended maintenance intervals. This favorable economic equation is accelerating SiC adoption across the robotics industry, particularly in high-value applications where performance and reliability justify premium component selection.

The integration of SiC power modules in robotic drive systems has demonstrated temperature reductions of 15-30% compared to traditional silicon-based solutions under identical operating conditions. This thermal advantage translates directly to enhanced reliability, with studies indicating up to 40% reduction in thermal-related failures in industrial robots utilizing SiC components. The material's ability to function efficiently at temperatures exceeding 200°C makes it particularly valuable for robots operating in high-temperature environments such as foundries, firefighting scenarios, or space exploration.

Power efficiency improvements represent another significant benefit of SiC integration in robotics. SiC-based power electronics demonstrate switching losses reduced by 75-80% compared to silicon alternatives, dramatically improving overall system efficiency. Field tests with SiC-equipped robotic arms show energy consumption reductions of 20-35% during typical operation cycles, extending battery life in mobile robots and reducing operational costs in industrial applications.

The implementation of SiC wafers in motor drive inverters for humanoid robots has yielded power density improvements of up to 300%, enabling more compact designs without compromising performance. This miniaturization potential addresses one of robotics' fundamental challenges: the size-to-power ratio constraint that limits mobility and application scope. Companies pioneering these implementations report weight reductions of 40-60% in power management components, directly enhancing robot agility and operational range.

Recent advancements in SiC wafer cooling technologies have introduced innovative solutions like microfluidic channels etched directly into wafer substrates, providing localized cooling precisely where heat generation is most concentrated. These techniques have demonstrated the ability to maintain junction temperatures below critical thresholds even during peak processing loads, preventing thermal throttling that would otherwise compromise computational performance in AI-driven robots.

The economic impact of these thermal and power improvements extends beyond technical specifications. Analysis indicates that despite the higher initial cost of SiC components (typically 2-3 times that of silicon equivalents), the total cost of ownership over a five-year operational period shows net savings of 15-25% due to reduced energy consumption, lower cooling requirements, and extended maintenance intervals. This favorable economic equation is accelerating SiC adoption across the robotics industry, particularly in high-value applications where performance and reliability justify premium component selection.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!