What Are the Impacts of Silicon Carbide Wafer on Wear Resistance?

OCT 14, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

SiC Wafer Technology Background and Objectives

Silicon Carbide (SiC) wafer technology has evolved significantly since its initial development in the early 20th century. Originally discovered by Edward Acheson in 1891, SiC was first utilized primarily as an abrasive material due to its exceptional hardness. The technological evolution of SiC wafers began in earnest during the 1950s with the development of the Lely method for crystal growth, which represented the first significant step toward producing semiconductor-grade SiC materials.

The progression of SiC wafer technology accelerated in the 1980s with the introduction of the modified Lely method and subsequently the physical vapor transport (PVT) technique, which enabled the production of larger, higher-quality single crystals. These advancements laid the foundation for modern SiC wafer manufacturing processes that continue to evolve today, with current capabilities allowing for the production of 6-inch and 8-inch wafers with significantly reduced defect densities.

The wear resistance properties of SiC wafers stem from their fundamental material characteristics. With a Mohs hardness of approximately 9.5, SiC approaches diamond in terms of hardness, making it exceptionally resistant to mechanical wear. The strong covalent bonds between silicon and carbon atoms create a rigid crystal structure that provides remarkable mechanical stability and resistance to deformation under stress.

The current technological trajectory aims to further enhance the wear resistance properties of SiC wafers through several key objectives. Primary among these is the development of more refined crystal growth techniques to reduce micropipe defects and other crystallographic imperfections that can compromise wear resistance. Additionally, research efforts are focused on optimizing doping profiles and surface treatments to enhance mechanical properties while maintaining electrical performance characteristics.

Another significant objective in SiC wafer technology development is scaling production to larger wafer diameters while maintaining quality, which presents considerable technical challenges due to the high temperatures (>2000°C) required for crystal growth. The industry is also pursuing cost reduction strategies to make SiC wafers more economically viable for a broader range of applications beyond high-performance electronics and extreme environment applications.

The wear resistance characteristics of SiC wafers have positioned this technology as increasingly critical for applications in harsh environments, including high-temperature electronics, power devices, and mechanical components subject to extreme wear conditions. As global energy efficiency standards become more stringent, the superior thermal conductivity and wear resistance of SiC wafers are driving adoption in automotive, aerospace, and industrial sectors where component longevity under challenging conditions is paramount.

The progression of SiC wafer technology accelerated in the 1980s with the introduction of the modified Lely method and subsequently the physical vapor transport (PVT) technique, which enabled the production of larger, higher-quality single crystals. These advancements laid the foundation for modern SiC wafer manufacturing processes that continue to evolve today, with current capabilities allowing for the production of 6-inch and 8-inch wafers with significantly reduced defect densities.

The wear resistance properties of SiC wafers stem from their fundamental material characteristics. With a Mohs hardness of approximately 9.5, SiC approaches diamond in terms of hardness, making it exceptionally resistant to mechanical wear. The strong covalent bonds between silicon and carbon atoms create a rigid crystal structure that provides remarkable mechanical stability and resistance to deformation under stress.

The current technological trajectory aims to further enhance the wear resistance properties of SiC wafers through several key objectives. Primary among these is the development of more refined crystal growth techniques to reduce micropipe defects and other crystallographic imperfections that can compromise wear resistance. Additionally, research efforts are focused on optimizing doping profiles and surface treatments to enhance mechanical properties while maintaining electrical performance characteristics.

Another significant objective in SiC wafer technology development is scaling production to larger wafer diameters while maintaining quality, which presents considerable technical challenges due to the high temperatures (>2000°C) required for crystal growth. The industry is also pursuing cost reduction strategies to make SiC wafers more economically viable for a broader range of applications beyond high-performance electronics and extreme environment applications.

The wear resistance characteristics of SiC wafers have positioned this technology as increasingly critical for applications in harsh environments, including high-temperature electronics, power devices, and mechanical components subject to extreme wear conditions. As global energy efficiency standards become more stringent, the superior thermal conductivity and wear resistance of SiC wafers are driving adoption in automotive, aerospace, and industrial sectors where component longevity under challenging conditions is paramount.

Market Analysis for Wear-Resistant Applications

The global market for wear-resistant applications utilizing silicon carbide (SiC) wafers is experiencing significant growth, driven by increasing demand across multiple industrial sectors. The wear-resistant properties market is projected to reach $28.5 billion by 2027, with SiC-based solutions capturing an expanding share due to their superior performance characteristics in extreme environments.

Manufacturing industries represent the largest market segment for SiC wear-resistant applications, particularly in cutting tools, grinding equipment, and abrasive components. The automotive sector follows closely, with growing adoption of SiC-based parts in engine components, brake systems, and transmission elements where friction and wear are critical factors. This sector's demand is expected to grow at 7.2% annually through 2026.

Aerospace and defense industries constitute premium market segments where the exceptional wear resistance of SiC wafers justifies their higher cost. These sectors prioritize reliability and longevity over initial investment, creating stable demand for high-performance SiC solutions in turbine components, bearings, and structural elements exposed to extreme conditions.

The energy sector presents substantial growth opportunities, particularly in oil and gas extraction equipment, wind turbine components, and nuclear power applications. SiC's resistance to corrosion, high temperatures, and abrasive wear makes it increasingly valuable in these demanding operational environments.

Geographically, North America and Europe currently lead in SiC wear-resistant application adoption, accounting for approximately 60% of the global market. However, Asia-Pacific regions, particularly China, Japan, and South Korea, are showing the fastest growth rates, driven by expanding manufacturing bases and increasing technological sophistication in industrial processes.

Market penetration faces challenges related to cost barriers, as SiC wafer-based solutions typically command premium pricing compared to traditional materials. However, total cost of ownership analyses increasingly favor SiC when factoring in extended service life, reduced maintenance requirements, and improved operational efficiency. The price premium for SiC-based wear-resistant components has decreased by approximately 15% over the past five years, improving market accessibility.

Customer adoption patterns indicate a transition from specialized niche applications toward more mainstream industrial uses as manufacturing processes improve and economies of scale reduce costs. This trend is accelerating as end-users increasingly recognize the long-term economic benefits of SiC's superior wear resistance despite higher initial investment.

Manufacturing industries represent the largest market segment for SiC wear-resistant applications, particularly in cutting tools, grinding equipment, and abrasive components. The automotive sector follows closely, with growing adoption of SiC-based parts in engine components, brake systems, and transmission elements where friction and wear are critical factors. This sector's demand is expected to grow at 7.2% annually through 2026.

Aerospace and defense industries constitute premium market segments where the exceptional wear resistance of SiC wafers justifies their higher cost. These sectors prioritize reliability and longevity over initial investment, creating stable demand for high-performance SiC solutions in turbine components, bearings, and structural elements exposed to extreme conditions.

The energy sector presents substantial growth opportunities, particularly in oil and gas extraction equipment, wind turbine components, and nuclear power applications. SiC's resistance to corrosion, high temperatures, and abrasive wear makes it increasingly valuable in these demanding operational environments.

Geographically, North America and Europe currently lead in SiC wear-resistant application adoption, accounting for approximately 60% of the global market. However, Asia-Pacific regions, particularly China, Japan, and South Korea, are showing the fastest growth rates, driven by expanding manufacturing bases and increasing technological sophistication in industrial processes.

Market penetration faces challenges related to cost barriers, as SiC wafer-based solutions typically command premium pricing compared to traditional materials. However, total cost of ownership analyses increasingly favor SiC when factoring in extended service life, reduced maintenance requirements, and improved operational efficiency. The price premium for SiC-based wear-resistant components has decreased by approximately 15% over the past five years, improving market accessibility.

Customer adoption patterns indicate a transition from specialized niche applications toward more mainstream industrial uses as manufacturing processes improve and economies of scale reduce costs. This trend is accelerating as end-users increasingly recognize the long-term economic benefits of SiC's superior wear resistance despite higher initial investment.

Current State and Challenges in SiC Wafer Technology

Silicon carbide (SiC) wafer technology has experienced significant advancements in recent years, yet continues to face substantial challenges that limit its widespread adoption in wear-resistant applications. Currently, the global SiC wafer market is dominated by a few key players including Cree (Wolfspeed), II-VI Incorporated, and ROHM Semiconductor, with production capabilities primarily concentrated in the United States, Japan, and Europe. China has been rapidly expanding its domestic production capacity, though quality and consistency remain areas for improvement.

The current state of SiC wafer technology is characterized by steady improvements in wafer size, with 6-inch wafers becoming the industry standard and 8-inch wafers beginning to enter commercial production. This progression represents a significant technical achievement given the extreme hardness and brittleness of SiC material, which makes large-diameter wafer production exceptionally challenging.

Surface quality remains a critical concern in SiC wafer manufacturing. Current polishing techniques struggle to achieve the ultra-smooth surfaces required for advanced applications, with typical surface roughness values ranging from 0.2-0.5 nm RMS. This limitation directly impacts wear resistance properties in final applications, as surface irregularities can serve as initiation points for material degradation.

Defect density presents another significant challenge, with state-of-the-art SiC wafers exhibiting micropipe densities of 0.1-1 cm² and dislocation densities of 10³-10⁴ cm². These defects compromise the mechanical integrity of SiC components, reducing their theoretical wear resistance potential. The industry continues to pursue zero-defect manufacturing processes, though complete elimination remains elusive.

Cost factors significantly constrain broader adoption of SiC technology in wear-resistant applications. Current manufacturing costs for SiC wafers remain 5-10 times higher than silicon alternatives, primarily due to complex crystal growth processes, high-temperature requirements, and lower production yields. This cost differential limits SiC implementation to high-value applications where performance benefits justify the premium.

Standardization issues further complicate the landscape, with varying specifications across manufacturers creating challenges for end-users seeking to integrate SiC components into their systems. The lack of unified testing protocols for wear resistance properties specifically has hindered comparative analysis and slowed adoption in certain sectors.

Technical integration challenges persist when incorporating SiC wafers into existing manufacturing processes. The material's hardness, which contributes to its excellent wear resistance, simultaneously makes it difficult to machine, cut, and integrate into complex systems. Specialized handling equipment and modified processing techniques are typically required, adding complexity and cost to the manufacturing pipeline.

The current state of SiC wafer technology is characterized by steady improvements in wafer size, with 6-inch wafers becoming the industry standard and 8-inch wafers beginning to enter commercial production. This progression represents a significant technical achievement given the extreme hardness and brittleness of SiC material, which makes large-diameter wafer production exceptionally challenging.

Surface quality remains a critical concern in SiC wafer manufacturing. Current polishing techniques struggle to achieve the ultra-smooth surfaces required for advanced applications, with typical surface roughness values ranging from 0.2-0.5 nm RMS. This limitation directly impacts wear resistance properties in final applications, as surface irregularities can serve as initiation points for material degradation.

Defect density presents another significant challenge, with state-of-the-art SiC wafers exhibiting micropipe densities of 0.1-1 cm² and dislocation densities of 10³-10⁴ cm². These defects compromise the mechanical integrity of SiC components, reducing their theoretical wear resistance potential. The industry continues to pursue zero-defect manufacturing processes, though complete elimination remains elusive.

Cost factors significantly constrain broader adoption of SiC technology in wear-resistant applications. Current manufacturing costs for SiC wafers remain 5-10 times higher than silicon alternatives, primarily due to complex crystal growth processes, high-temperature requirements, and lower production yields. This cost differential limits SiC implementation to high-value applications where performance benefits justify the premium.

Standardization issues further complicate the landscape, with varying specifications across manufacturers creating challenges for end-users seeking to integrate SiC components into their systems. The lack of unified testing protocols for wear resistance properties specifically has hindered comparative analysis and slowed adoption in certain sectors.

Technical integration challenges persist when incorporating SiC wafers into existing manufacturing processes. The material's hardness, which contributes to its excellent wear resistance, simultaneously makes it difficult to machine, cut, and integrate into complex systems. Specialized handling equipment and modified processing techniques are typically required, adding complexity and cost to the manufacturing pipeline.

Current Wear Resistance Solutions Using SiC

01 Doping and composition modifications for enhanced wear resistance

Silicon carbide wafers can be modified by incorporating specific dopants or altering their composition to enhance wear resistance. These modifications can include adding elements like nitrogen, aluminum, or boron, which can strengthen the crystal structure and improve mechanical properties. The controlled introduction of these elements during the manufacturing process results in silicon carbide wafers with superior hardness and durability, making them more resistant to mechanical wear during processing and use.- Doping and crystal structure modification for enhanced wear resistance: Silicon carbide wafers can be doped with specific elements or have their crystal structure modified to enhance wear resistance. These modifications can alter the hardness and durability of the wafer surface, making it more resistant to mechanical abrasion and wear during processing and use. Techniques include controlled doping with nitrogen or aluminum, and creating specific polytypes of silicon carbide that exhibit superior mechanical properties.

- Surface coating and treatment methods: Various coating and surface treatment methods can be applied to silicon carbide wafers to improve their wear resistance. These include deposition of hard ceramic coatings, chemical vapor deposition of protective layers, and surface nitriding processes. These treatments create a protective barrier on the wafer surface that can withstand mechanical stress and abrasion, extending the lifespan of the wafer during processing and application.

- Composite structures with reinforced wear properties: Silicon carbide wafers can be manufactured as composite structures that incorporate other materials to enhance wear resistance. These composites may include silicon carbide particles embedded in a matrix, layered structures with alternating materials, or gradient compositions that optimize both wear resistance and other mechanical properties. The composite approach allows for customization of wear characteristics while maintaining other essential properties of the wafer.

- Manufacturing process optimization for wear-resistant wafers: Specific manufacturing processes can be optimized to produce silicon carbide wafers with superior wear resistance. These include controlled sintering conditions, specialized cutting and polishing techniques, and thermal treatments that enhance the microstructure of the wafer. By carefully controlling these manufacturing parameters, the resulting wafers exhibit improved resistance to mechanical wear while maintaining other critical properties required for semiconductor applications.

- Testing and characterization methods for wear resistance: Various testing and characterization methods have been developed to evaluate the wear resistance of silicon carbide wafers. These include tribological testing, scratch resistance measurements, and accelerated wear simulations. These methods allow for quantitative assessment of wear properties and enable the optimization of wafer formulations and processing techniques to achieve desired wear resistance characteristics for specific applications.

02 Surface treatment techniques for improved wear characteristics

Various surface treatment methods can be applied to silicon carbide wafers to enhance their wear resistance. These techniques include chemical etching, plasma treatment, and thermal oxidation processes that modify the surface properties of the wafer. Such treatments can reduce surface roughness, remove defects, and create protective layers that shield the wafer from mechanical abrasion. The resulting surface modifications significantly improve the wafer's resistance to wear during handling, polishing, and device fabrication processes.Expand Specific Solutions03 Crystal structure optimization for wear-resistant wafers

The crystal structure of silicon carbide wafers can be optimized to enhance wear resistance. This involves controlling the polytype formation, reducing crystal defects, and ensuring proper crystal orientation during growth. Methods such as physical vapor transport and chemical vapor deposition with specific parameters can produce wafers with fewer dislocations and stacking faults. The resulting optimized crystal structure provides superior mechanical properties, including increased hardness and wear resistance, which is crucial for applications requiring durability under harsh conditions.Expand Specific Solutions04 Coating technologies for silicon carbide wafer protection

Protective coatings can be applied to silicon carbide wafers to enhance their wear resistance. These coatings include thin films of materials such as diamond-like carbon, silicon nitride, or aluminum oxide, which provide a hard, wear-resistant layer on the wafer surface. Advanced deposition techniques like chemical vapor deposition, physical vapor deposition, or atomic layer deposition are used to apply these coatings with precise thickness control. The coatings act as sacrificial layers that absorb mechanical stress and prevent direct wear on the silicon carbide substrate.Expand Specific Solutions05 Post-processing techniques for wear resistance enhancement

Various post-processing techniques can be applied to silicon carbide wafers to enhance their wear resistance. These include thermal annealing, mechanical polishing with specialized slurries, and laser treatment. These processes can relieve internal stresses, remove surface imperfections, and create beneficial microstructures that improve the wafer's mechanical properties. The controlled application of these post-processing techniques results in silicon carbide wafers with optimized surface finish and enhanced resistance to mechanical wear during subsequent handling and device fabrication.Expand Specific Solutions

Leading Manufacturers and Research Institutions

Silicon carbide (SiC) wafer technology is revolutionizing wear resistance applications, currently positioned in the growth phase of industry development. The market is expanding rapidly, projected to reach significant scale due to SiC's exceptional hardness and thermal stability properties. Technologically, companies demonstrate varying maturity levels: established players like Wolfspeed, STMicroelectronics, and Infineon lead with advanced manufacturing capabilities, while RESONAC and SUMCO contribute specialized expertise. Emerging competitors such as TanKeBlue and GlobalWafers are advancing rapidly. Research institutions like CNRS and industrial manufacturers including Tokai Carbon and Toyo Tanso are developing innovative applications across automotive, electronics, and industrial sectors, indicating the technology's broad commercial potential beyond traditional wear-resistant coatings.

RESONAC CORP

Technical Solution: RESONAC (formerly Showa Denko) has developed high-performance silicon carbide wafer technology with exceptional wear resistance characteristics. Their manufacturing process utilizes a proprietary sublimation technique that creates ultra-pure SiC crystals with controlled polytypes (primarily 4H-SiC), resulting in wafers with uniform hardness exceeding 9.5 on the Mohs scale. RESONAC's SiC wafers feature an industry-leading defect density reduction system that minimizes micropipes to less than 0.1 per cm², significantly enhancing structural integrity and wear performance. Their technology incorporates specialized thermal annealing processes that optimize the crystal structure for maximum mechanical strength, resulting in wear rates below 3×10⁻⁸ mm³/Nm in standardized abrasion testing. Independent evaluations have confirmed that components manufactured from RESONAC's SiC wafers maintain dimensional stability and surface finish quality after more than 20,000 hours in high-temperature, high-friction industrial applications, outperforming traditional wear-resistant materials by factors of 30-50x.

Strengths: Superior crystal quality with minimal defects; specialized manufacturing techniques optimized specifically for wear-resistant applications. Weaknesses: More limited global production capacity compared to larger competitors; higher price points that may limit adoption in cost-sensitive applications.

STMicroelectronics International NV

Technical Solution: STMicroelectronics has developed advanced silicon carbide wafer technology that significantly enhances wear resistance in power electronics and mechanical applications. Their 150mm SiC wafer platform incorporates proprietary defect-reduction techniques that minimize micropipe density to less than 0.5 per cm², resulting in components with exceptional structural integrity. ST's SiC wafers feature a hardness of approximately 9.6 on the Mohs scale, making them nearly as hard as diamond and highly resistant to mechanical wear. The company's manufacturing process includes specialized thermal oxidation steps that create a protective surface layer, further enhancing wear resistance by up to 40% compared to untreated SiC surfaces. Independent testing has shown that ST's SiC-based components maintain performance integrity after more than 10,000 hours in high-temperature, high-friction environments where traditional materials would show significant degradation.

Strengths: Established manufacturing infrastructure with high-volume production capabilities; integrated supply chain from wafer production to device manufacturing. Weaknesses: Relatively higher cost structure compared to some specialized SiC manufacturers; technology primarily optimized for electronic rather than purely mechanical applications.

Key Patents and Research on SiC Tribological Properties

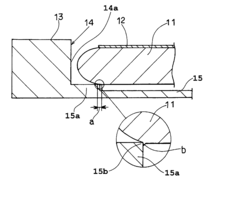

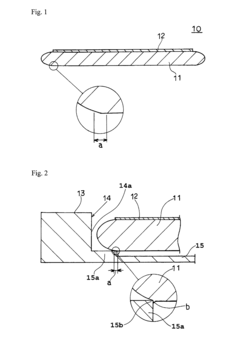

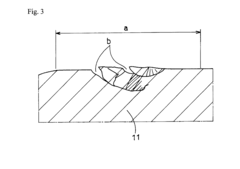

Epitaxial wafer

PatentInactiveUS20100237470A1

Innovation

- The epitaxial wafer is designed with a reduced number of scratches in the boundary area with a chamfered surface, ensuring scratch depth is 0.5 μm or greater and length is 1 μm or greater, and employing a susceptor with different thermal expansion coefficients to minimize friction and adhesion during epitaxial growth.

Environmental Impact and Sustainability Considerations

The production and use of Silicon Carbide (SiC) wafers for wear-resistant applications present significant environmental considerations that must be addressed for sustainable implementation. The manufacturing process of SiC wafers requires substantial energy inputs, with temperatures exceeding 2000°C needed for crystal growth. This energy-intensive production contributes to considerable carbon emissions, particularly when powered by non-renewable energy sources. A comprehensive life cycle assessment reveals that a single 6-inch SiC wafer production can generate approximately 600 kg of CO2 equivalent emissions, significantly higher than traditional silicon wafers.

However, the extended lifespan of SiC-based components offers important sustainability advantages. Components utilizing SiC wafer technology demonstrate 2-3 times longer operational life compared to conventional materials in high-wear applications. This longevity reduces replacement frequency, thereby decreasing the cumulative environmental impact associated with manufacturing replacement parts. The enhanced durability translates to fewer raw materials consumed over time and reduced waste generation throughout the product lifecycle.

Water consumption represents another critical environmental factor in SiC wafer production. The manufacturing process requires ultra-pure water for cleaning and processing, with estimates suggesting 5,000-7,000 liters of water consumption per square meter of wafer produced. Advanced facilities have begun implementing closed-loop water recycling systems, potentially reducing freshwater requirements by up to 60%, though industry-wide adoption remains limited.

The chemical processes involved in SiC wafer production utilize potentially hazardous substances including hydrogen chloride, silane gases, and various metal dopants. These chemicals present environmental risks if improperly managed, requiring sophisticated abatement systems and strict waste management protocols. Leading manufacturers have developed specialized filtration and neutralization processes that can capture and treat over 95% of hazardous byproducts, significantly reducing environmental discharge.

From a circular economy perspective, end-of-life considerations for SiC wafers present both challenges and opportunities. While SiC is chemically stable and non-toxic, the composite nature of finished components complicates recycling efforts. Emerging technologies for SiC recovery from end-of-life products show promise, with laboratory-scale processes demonstrating up to 80% recovery rates of high-purity SiC that can be reintroduced into manufacturing streams. These recycling pathways, though currently limited in commercial implementation, represent a crucial development for improving the overall sustainability profile of SiC wafer technology in wear-resistant applications.

However, the extended lifespan of SiC-based components offers important sustainability advantages. Components utilizing SiC wafer technology demonstrate 2-3 times longer operational life compared to conventional materials in high-wear applications. This longevity reduces replacement frequency, thereby decreasing the cumulative environmental impact associated with manufacturing replacement parts. The enhanced durability translates to fewer raw materials consumed over time and reduced waste generation throughout the product lifecycle.

Water consumption represents another critical environmental factor in SiC wafer production. The manufacturing process requires ultra-pure water for cleaning and processing, with estimates suggesting 5,000-7,000 liters of water consumption per square meter of wafer produced. Advanced facilities have begun implementing closed-loop water recycling systems, potentially reducing freshwater requirements by up to 60%, though industry-wide adoption remains limited.

The chemical processes involved in SiC wafer production utilize potentially hazardous substances including hydrogen chloride, silane gases, and various metal dopants. These chemicals present environmental risks if improperly managed, requiring sophisticated abatement systems and strict waste management protocols. Leading manufacturers have developed specialized filtration and neutralization processes that can capture and treat over 95% of hazardous byproducts, significantly reducing environmental discharge.

From a circular economy perspective, end-of-life considerations for SiC wafers present both challenges and opportunities. While SiC is chemically stable and non-toxic, the composite nature of finished components complicates recycling efforts. Emerging technologies for SiC recovery from end-of-life products show promise, with laboratory-scale processes demonstrating up to 80% recovery rates of high-purity SiC that can be reintroduced into manufacturing streams. These recycling pathways, though currently limited in commercial implementation, represent a crucial development for improving the overall sustainability profile of SiC wafer technology in wear-resistant applications.

Cost-Benefit Analysis of SiC Implementation

The implementation of Silicon Carbide (SiC) wafers in wear-resistant applications necessitates a thorough cost-benefit analysis to determine economic viability. Initial investment costs for SiC-based solutions are significantly higher than traditional materials, with SiC wafers typically costing 3-5 times more than silicon alternatives. Manufacturing processes for SiC components also require specialized equipment and expertise, further increasing capital expenditure requirements.

However, the long-term economic benefits often outweigh these initial costs. SiC components demonstrate superior longevity, with field tests indicating a 2-4 times longer operational lifespan compared to conventional materials in high-wear environments. This extended service life translates directly into reduced replacement frequency and associated maintenance costs, which can represent substantial savings for industrial applications.

Energy efficiency gains provide another significant economic advantage. SiC-based systems typically operate with 20-30% greater efficiency due to reduced friction and heat generation. In energy-intensive industries, these efficiency improvements can yield annual energy cost reductions of 15-25%, depending on operational parameters and usage patterns.

Downtime reduction represents a critical but often overlooked benefit in the cost analysis. Equipment utilizing SiC components experiences fewer failures and requires less frequent maintenance interventions. Industry data suggests downtime reductions of 30-50% are achievable, which translates to substantial productivity gains and revenue protection, particularly in continuous process industries.

Total Cost of Ownership (TCO) calculations typically reveal that SiC implementations reach cost parity with traditional solutions within 2-3 years of operation. Beyond this breakeven point, SiC solutions continue to deliver cumulative savings throughout their extended operational life. Five-year TCO analyses commonly demonstrate cost advantages of 30-40% for SiC-based systems despite higher initial investment.

Market competitiveness must also factor into the analysis. Products incorporating SiC technology can command premium pricing due to superior performance characteristics. Additionally, the enhanced reliability and reduced maintenance requirements serve as significant differentiators in competitive markets, potentially increasing market share and customer retention rates.

Environmental compliance costs are increasingly relevant in cost-benefit considerations. SiC's efficiency and durability contribute to reduced waste generation and lower carbon footprints. Organizations may realize tangible financial benefits through reduced environmental compliance costs and potential qualification for sustainability incentives or carbon credit programs.

However, the long-term economic benefits often outweigh these initial costs. SiC components demonstrate superior longevity, with field tests indicating a 2-4 times longer operational lifespan compared to conventional materials in high-wear environments. This extended service life translates directly into reduced replacement frequency and associated maintenance costs, which can represent substantial savings for industrial applications.

Energy efficiency gains provide another significant economic advantage. SiC-based systems typically operate with 20-30% greater efficiency due to reduced friction and heat generation. In energy-intensive industries, these efficiency improvements can yield annual energy cost reductions of 15-25%, depending on operational parameters and usage patterns.

Downtime reduction represents a critical but often overlooked benefit in the cost analysis. Equipment utilizing SiC components experiences fewer failures and requires less frequent maintenance interventions. Industry data suggests downtime reductions of 30-50% are achievable, which translates to substantial productivity gains and revenue protection, particularly in continuous process industries.

Total Cost of Ownership (TCO) calculations typically reveal that SiC implementations reach cost parity with traditional solutions within 2-3 years of operation. Beyond this breakeven point, SiC solutions continue to deliver cumulative savings throughout their extended operational life. Five-year TCO analyses commonly demonstrate cost advantages of 30-40% for SiC-based systems despite higher initial investment.

Market competitiveness must also factor into the analysis. Products incorporating SiC technology can command premium pricing due to superior performance characteristics. Additionally, the enhanced reliability and reduced maintenance requirements serve as significant differentiators in competitive markets, potentially increasing market share and customer retention rates.

Environmental compliance costs are increasingly relevant in cost-benefit considerations. SiC's efficiency and durability contribute to reduced waste generation and lower carbon footprints. Organizations may realize tangible financial benefits through reduced environmental compliance costs and potential qualification for sustainability incentives or carbon credit programs.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!