What Makes Silicon Carbide Wafer Ideal for Microwave Applications?

OCT 14, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

SiC Wafer Evolution and Microwave Application Goals

Silicon Carbide (SiC) has emerged as a revolutionary material in semiconductor technology, with its development trajectory spanning over a century since its first synthesis in 1891. The evolution of SiC wafer technology has been characterized by persistent efforts to overcome manufacturing challenges, particularly in producing large-diameter, defect-free crystals. From initial small-diameter wafers with high defect densities, the industry has progressed to 6-inch and now 8-inch wafers with significantly improved quality, marking critical milestones in commercial viability.

The technological evolution of SiC wafers has been driven by their exceptional material properties that make them particularly suitable for microwave applications. With a bandgap nearly three times wider than silicon (3.2 eV vs 1.1 eV), SiC demonstrates superior performance in high-temperature environments, reaching operational capabilities up to 600°C compared to silicon's 150°C limit. This thermal stability is complemented by SiC's outstanding thermal conductivity of 3-5 W/cm·K, approximately three times higher than silicon, enabling efficient heat dissipation in high-power microwave devices.

The historical progression of SiC wafer development reveals a consistent trend toward higher quality and larger diameters, with significant breakthroughs occurring in the early 2000s when 4-inch wafers became commercially viable. Recent advancements have focused on reducing micropipe defects—a critical impediment to device performance—from hundreds per square centimeter to near-zero levels in modern wafers, dramatically enhancing yield rates for microwave device manufacturing.

In the context of microwave applications, the primary technical goals for SiC wafer development include achieving higher frequency operation capabilities, improved power handling, enhanced thermal management, and increased reliability under extreme conditions. The material's high breakdown electric field strength (approximately 10 times that of silicon) enables the design of smaller, more efficient microwave components that can operate at higher voltages and power densities without compromising performance.

Current research trajectories are focused on further refining crystal growth techniques to produce ultra-high-purity SiC wafers with precisely controlled doping profiles, essential for next-generation microwave devices operating in millimeter-wave frequencies. Additionally, efforts are underway to develop more cost-effective manufacturing processes to bridge the significant price gap between SiC and conventional silicon wafers, which remains a primary barrier to widespread adoption despite SiC's superior technical characteristics.

The convergence of these technological advancements positions SiC wafers as the foundation for next-generation microwave systems in telecommunications, radar, satellite communications, and defense applications, where performance under extreme conditions is paramount and conventional silicon-based solutions reach their fundamental limitations.

The technological evolution of SiC wafers has been driven by their exceptional material properties that make them particularly suitable for microwave applications. With a bandgap nearly three times wider than silicon (3.2 eV vs 1.1 eV), SiC demonstrates superior performance in high-temperature environments, reaching operational capabilities up to 600°C compared to silicon's 150°C limit. This thermal stability is complemented by SiC's outstanding thermal conductivity of 3-5 W/cm·K, approximately three times higher than silicon, enabling efficient heat dissipation in high-power microwave devices.

The historical progression of SiC wafer development reveals a consistent trend toward higher quality and larger diameters, with significant breakthroughs occurring in the early 2000s when 4-inch wafers became commercially viable. Recent advancements have focused on reducing micropipe defects—a critical impediment to device performance—from hundreds per square centimeter to near-zero levels in modern wafers, dramatically enhancing yield rates for microwave device manufacturing.

In the context of microwave applications, the primary technical goals for SiC wafer development include achieving higher frequency operation capabilities, improved power handling, enhanced thermal management, and increased reliability under extreme conditions. The material's high breakdown electric field strength (approximately 10 times that of silicon) enables the design of smaller, more efficient microwave components that can operate at higher voltages and power densities without compromising performance.

Current research trajectories are focused on further refining crystal growth techniques to produce ultra-high-purity SiC wafers with precisely controlled doping profiles, essential for next-generation microwave devices operating in millimeter-wave frequencies. Additionally, efforts are underway to develop more cost-effective manufacturing processes to bridge the significant price gap between SiC and conventional silicon wafers, which remains a primary barrier to widespread adoption despite SiC's superior technical characteristics.

The convergence of these technological advancements positions SiC wafers as the foundation for next-generation microwave systems in telecommunications, radar, satellite communications, and defense applications, where performance under extreme conditions is paramount and conventional silicon-based solutions reach their fundamental limitations.

Market Analysis for SiC in RF/Microwave Industry

The Silicon Carbide (SiC) RF/microwave market is experiencing robust growth, driven by the material's superior properties that enable high-power, high-frequency applications. Current market valuations place the global SiC RF/microwave segment at approximately $400 million, with projections indicating a compound annual growth rate (CAGR) of 18-22% through 2028. This accelerated growth significantly outpaces traditional semiconductor materials in the RF sector.

Defense and aerospace applications currently dominate the SiC RF/microwave market, accounting for nearly 45% of total demand. These sectors value SiC's radiation hardness, thermal stability, and high-power handling capabilities for radar systems, electronic warfare equipment, and satellite communications. The telecommunications industry represents the second-largest market segment at 30%, particularly as 5G infrastructure deployment accelerates globally.

Market penetration analysis reveals significant regional variations. North America leads with approximately 40% market share, driven by substantial defense spending and the presence of major SiC manufacturers like Wolfspeed, II-VI, and MACOM Technology Solutions. Asia-Pacific follows at 35%, with rapid growth fueled by China's strategic investments in semiconductor self-sufficiency and Japan's established expertise in wide-bandgap semiconductors.

Customer demand patterns indicate a growing preference for larger diameter SiC wafers (6-inch and above) to improve economies of scale and reduce per-device costs. This transition from 4-inch wafers represents a critical market inflection point, as manufacturing yields and quality consistency at larger diameters continue to improve.

Price sensitivity analysis shows that while SiC components command a premium of 2.5-4x over silicon alternatives, the total system cost benefits often justify this premium in high-performance applications. The price-performance ratio continues to improve as manufacturing processes mature and production volumes increase.

Supply chain assessment reveals potential vulnerabilities, with raw material sourcing and specialized manufacturing equipment representing key bottlenecks. The limited number of qualified SiC substrate suppliers creates competitive dynamics that influence pricing and availability. Recent investments in manufacturing capacity by major players suggest anticipation of continued strong demand growth.

Emerging market opportunities include automotive radar systems, industrial IoT infrastructure, and medical imaging equipment. These applications are increasingly adopting SiC technology as performance requirements intensify and cost barriers diminish. The market is also witnessing growing interest in SiC-based GaN-on-SiC devices, which combine the benefits of both materials for next-generation RF applications.

Defense and aerospace applications currently dominate the SiC RF/microwave market, accounting for nearly 45% of total demand. These sectors value SiC's radiation hardness, thermal stability, and high-power handling capabilities for radar systems, electronic warfare equipment, and satellite communications. The telecommunications industry represents the second-largest market segment at 30%, particularly as 5G infrastructure deployment accelerates globally.

Market penetration analysis reveals significant regional variations. North America leads with approximately 40% market share, driven by substantial defense spending and the presence of major SiC manufacturers like Wolfspeed, II-VI, and MACOM Technology Solutions. Asia-Pacific follows at 35%, with rapid growth fueled by China's strategic investments in semiconductor self-sufficiency and Japan's established expertise in wide-bandgap semiconductors.

Customer demand patterns indicate a growing preference for larger diameter SiC wafers (6-inch and above) to improve economies of scale and reduce per-device costs. This transition from 4-inch wafers represents a critical market inflection point, as manufacturing yields and quality consistency at larger diameters continue to improve.

Price sensitivity analysis shows that while SiC components command a premium of 2.5-4x over silicon alternatives, the total system cost benefits often justify this premium in high-performance applications. The price-performance ratio continues to improve as manufacturing processes mature and production volumes increase.

Supply chain assessment reveals potential vulnerabilities, with raw material sourcing and specialized manufacturing equipment representing key bottlenecks. The limited number of qualified SiC substrate suppliers creates competitive dynamics that influence pricing and availability. Recent investments in manufacturing capacity by major players suggest anticipation of continued strong demand growth.

Emerging market opportunities include automotive radar systems, industrial IoT infrastructure, and medical imaging equipment. These applications are increasingly adopting SiC technology as performance requirements intensify and cost barriers diminish. The market is also witnessing growing interest in SiC-based GaN-on-SiC devices, which combine the benefits of both materials for next-generation RF applications.

Current Status and Challenges in SiC Wafer Technology

Silicon carbide (SiC) wafer technology has made significant strides globally, yet continues to face several critical challenges that impede its widespread adoption in microwave applications. Currently, the global SiC wafer market is experiencing robust growth, with a compound annual growth rate exceeding 10% since 2018, primarily driven by power electronics and now increasingly by microwave device applications.

The production of high-quality SiC wafers has advanced considerably, with commercial availability now extending to 6-inch diameter wafers, while 8-inch wafers remain in development stages. Leading manufacturers have achieved defect densities below 1 per cm² for micropipe defects, representing substantial progress from earlier generations. However, this remains significantly higher than silicon wafer standards, where defect densities are typically orders of magnitude lower.

One persistent technical challenge is the presence of crystallographic defects including basal plane dislocations, threading screw dislocations, and stacking faults that adversely affect device performance in microwave applications. These defects create electron traps and recombination centers that degrade high-frequency performance and reliability under thermal stress conditions common in high-power microwave operations.

Surface roughness presents another significant hurdle, as SiC wafers typically exhibit RMS roughness values of 0.2-0.5 nm after chemical-mechanical polishing, which still exceeds ideal requirements for certain advanced microwave devices. This surface imperfection contributes to interface scattering that diminishes electron mobility in the critical device channels.

Wafer bow and warp remain problematic, with typical values ranging from 10-30 μm across a 6-inch wafer. This dimensional instability complicates photolithography processes and creates challenges in achieving precise device geometries essential for microwave circuit performance.

Geographically, SiC wafer production is concentrated in the United States, Japan, and Europe, with emerging capacity in China. Cree/Wolfspeed and II-VI in the US, ROHM and Showa Denko in Japan, and STMicroelectronics in Europe maintain technological leadership, while Chinese manufacturers are rapidly expanding production capacity despite quality gaps.

Cost remains perhaps the most significant barrier to widespread adoption, with SiC wafers commanding prices 5-10 times higher than comparable silicon wafers. This cost differential stems from complex manufacturing processes, lower yields, and smaller economies of scale. For microwave applications specifically, the additional requirements for ultra-high purity and precise doping profiles further increase production costs.

The integration of SiC with other semiconductor materials and packaging technologies presents additional challenges, particularly in managing thermal interfaces and ensuring reliable electrical connections that can withstand the high-temperature operation that makes SiC attractive for microwave applications in the first place.

The production of high-quality SiC wafers has advanced considerably, with commercial availability now extending to 6-inch diameter wafers, while 8-inch wafers remain in development stages. Leading manufacturers have achieved defect densities below 1 per cm² for micropipe defects, representing substantial progress from earlier generations. However, this remains significantly higher than silicon wafer standards, where defect densities are typically orders of magnitude lower.

One persistent technical challenge is the presence of crystallographic defects including basal plane dislocations, threading screw dislocations, and stacking faults that adversely affect device performance in microwave applications. These defects create electron traps and recombination centers that degrade high-frequency performance and reliability under thermal stress conditions common in high-power microwave operations.

Surface roughness presents another significant hurdle, as SiC wafers typically exhibit RMS roughness values of 0.2-0.5 nm after chemical-mechanical polishing, which still exceeds ideal requirements for certain advanced microwave devices. This surface imperfection contributes to interface scattering that diminishes electron mobility in the critical device channels.

Wafer bow and warp remain problematic, with typical values ranging from 10-30 μm across a 6-inch wafer. This dimensional instability complicates photolithography processes and creates challenges in achieving precise device geometries essential for microwave circuit performance.

Geographically, SiC wafer production is concentrated in the United States, Japan, and Europe, with emerging capacity in China. Cree/Wolfspeed and II-VI in the US, ROHM and Showa Denko in Japan, and STMicroelectronics in Europe maintain technological leadership, while Chinese manufacturers are rapidly expanding production capacity despite quality gaps.

Cost remains perhaps the most significant barrier to widespread adoption, with SiC wafers commanding prices 5-10 times higher than comparable silicon wafers. This cost differential stems from complex manufacturing processes, lower yields, and smaller economies of scale. For microwave applications specifically, the additional requirements for ultra-high purity and precise doping profiles further increase production costs.

The integration of SiC with other semiconductor materials and packaging technologies presents additional challenges, particularly in managing thermal interfaces and ensuring reliable electrical connections that can withstand the high-temperature operation that makes SiC attractive for microwave applications in the first place.

Technical Solutions for SiC Microwave Implementation

01 Silicon Carbide Wafer Manufacturing Methods

Various manufacturing techniques are employed to produce high-quality silicon carbide wafers for semiconductor applications. These methods include chemical vapor deposition (CVD), physical vapor transport (PVT), and modified Lely processes. The manufacturing processes focus on controlling crystal growth, reducing defects, and achieving uniform wafer properties. Advanced techniques allow for the production of larger diameter wafers with improved crystalline quality, which is essential for high-performance electronic devices.- Silicon Carbide Wafer Manufacturing Methods: Various methods for manufacturing silicon carbide wafers have been developed to improve quality and yield. These methods include specific crystal growth techniques, slicing processes, and surface treatments that enhance the wafer's properties. Advanced manufacturing processes focus on reducing defects and improving uniformity across the wafer surface, which is critical for semiconductor applications.

- Defect Reduction Techniques in SiC Wafers: Techniques for reducing defects in silicon carbide wafers are essential for improving device performance. These include methods to minimize micropipes, dislocations, and other crystallographic defects that can affect electrical properties. Processes such as high-temperature annealing, specialized polishing, and defect screening have been developed to enhance wafer quality and reliability for power electronics applications.

- Surface Treatment and Polishing of SiC Wafers: Surface treatment and polishing techniques are crucial for preparing silicon carbide wafers for device fabrication. These processes include chemical-mechanical polishing, etching, and cleaning methods that achieve atomically smooth surfaces with minimal subsurface damage. Advanced polishing techniques help to remove scratches and surface irregularities while maintaining precise thickness control and flatness.

- Epitaxial Growth on Silicon Carbide Substrates: Epitaxial growth processes on silicon carbide substrates are essential for creating device-quality layers for power electronics and RF applications. These techniques involve controlled deposition of silicon carbide or other semiconductor materials on SiC wafers to create specific electrical properties. Methods include chemical vapor deposition (CVD) and molecular beam epitaxy (MBE) that enable precise control of doping profiles and layer thickness.

- Large Diameter SiC Wafer Development: Development of large diameter silicon carbide wafers represents a significant advancement in the field, enabling more cost-effective device production. Techniques for growing larger crystals and processing them into wafers with diameters of 6 inches and beyond have been developed to meet increasing industry demands. These larger wafers present unique challenges in maintaining quality and uniformity across the increased surface area while offering economic advantages through higher device yields per wafer.

02 Defect Reduction in Silicon Carbide Wafers

Techniques for reducing defects in silicon carbide wafers are critical for improving device performance. These approaches include specialized annealing processes, surface treatment methods, and defect engineering strategies. Common defects addressed include micropipes, dislocations, and basal plane defects that can negatively impact electronic device performance. By minimizing these defects, manufacturers can produce higher quality wafers suitable for power electronics and high-frequency applications.Expand Specific Solutions03 Silicon Carbide Wafer Surface Processing

Surface processing techniques for silicon carbide wafers include polishing, etching, and planarization methods to achieve atomically smooth surfaces. Chemical mechanical polishing (CMP) and various wet and dry etching processes are employed to remove surface damage and prepare wafers for epitaxial growth or device fabrication. These processes are essential for reducing surface roughness and removing subsurface damage that can affect device performance and reliability.Expand Specific Solutions04 Epitaxial Growth on Silicon Carbide Substrates

Epitaxial layer growth on silicon carbide substrates is a critical process for device fabrication. Various epitaxial growth techniques, including chemical vapor deposition (CVD) and molecular beam epitaxy (MBE), are used to deposit controlled layers of silicon carbide or other materials on SiC wafers. The epitaxial process parameters, such as temperature, pressure, and gas flow rates, are carefully controlled to achieve desired layer thickness, doping concentration, and crystal quality for specific device applications.Expand Specific Solutions05 Silicon Carbide Wafer Applications in Power Electronics

Silicon carbide wafers are increasingly used in power electronic applications due to their superior properties compared to silicon. These applications include high-voltage power devices, electric vehicle components, renewable energy systems, and industrial motor drives. The wide bandgap, high thermal conductivity, and high breakdown field strength of silicon carbide enable the development of smaller, more efficient, and higher temperature-tolerant power devices that can operate at higher frequencies and voltages than traditional silicon-based components.Expand Specific Solutions

Leading SiC Wafer Manufacturers and Competitors

Silicon Carbide (SiC) wafer technology for microwave applications is currently in a growth phase, with the market expanding rapidly due to increasing demand in 5G communications, defense systems, and high-power RF applications. The global SiC microwave device market is projected to reach significant scale as industries transition from traditional semiconductor materials. Technologically, the field is maturing with key players demonstrating varying levels of expertise. Wolfspeed leads as a pioneer in wide bandgap semiconductors with advanced SiC wafer capabilities, while SICC and Coherent Corp. have established strong positions in substrate manufacturing. Research institutions like Nanjing University and Southeast University contribute valuable innovations. Companies such as NXP Semiconductors and Resonac are developing application-specific implementations, creating a competitive landscape that balances established manufacturers and emerging specialists.

Wolfspeed, Inc.

Technical Solution: Wolfspeed has pioneered silicon carbide (SiC) wafer technology specifically optimized for microwave applications. Their proprietary high-purity SiC substrate manufacturing process creates wafers with extremely low micropipe density (<1 cm²) and uniform electrical properties across the entire wafer surface. Wolfspeed's SiC wafers feature high thermal conductivity (3-4x that of silicon), enabling efficient heat dissipation in high-power microwave devices. Their semi-insulating SiC substrates achieve resistivity values exceeding 1×10⁹ ohm-cm, providing excellent isolation between active components in microwave integrated circuits. The company's advanced epitaxial growth techniques produce precise, uniform epitaxial layers with controlled doping profiles essential for consistent microwave device performance. Wolfspeed's SiC wafers demonstrate exceptional high-frequency performance with low signal loss even at frequencies above 100 GHz, making them ideal for next-generation 5G and radar applications.

Strengths: Industry-leading SiC wafer quality with lowest defect density; Vertically integrated production from substrate to device; Extensive IP portfolio in SiC technology. Weaknesses: Higher production costs compared to silicon alternatives; Limited wafer size options compared to mature silicon technology; Longer lead times for specialized microwave-optimized wafers.

SICC Co., Ltd.

Technical Solution: SICC Co., Ltd. has developed specialized silicon carbide wafer technology optimized for microwave applications. Their manufacturing process employs a modified physical vapor transport (PVT) technique that produces high-purity 4H and 6H SiC substrates with resistivity values exceeding 10⁹ ohm-cm, essential for minimizing signal loss in high-frequency applications. SICC's SiC wafers feature exceptional thermal conductivity (approximately 370-490 W/m·K), enabling efficient heat dissipation in high-power microwave devices. The company has achieved significant reductions in basal plane dislocations (BPDs) through proprietary post-growth processing techniques, resulting in wafers with defect densities below 10 cm⁻². Their SiC substrates demonstrate excellent high-frequency performance with minimal dielectric losses at frequencies up to 40 GHz, making them particularly suitable for radar and communication systems. SICC employs advanced chemical-mechanical polishing (CMP) processes to achieve surface roughness values below 0.5nm RMS, critical for building complex epitaxial structures required in modern microwave devices.

Strengths: Cost-effective manufacturing process compared to Western competitors; Strong capabilities in customizing wafer specifications for specific microwave applications; Rapidly expanding production capacity. Weaknesses: Less extensive track record in high-reliability aerospace and defense applications; More limited wafer diameter options compared to industry leaders; Less vertical integration across the full value chain.

Key Patents and Innovations in SiC Wafer Processing

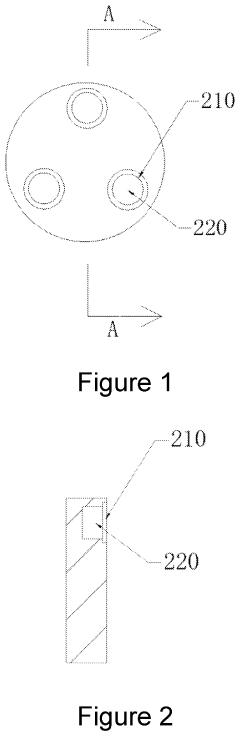

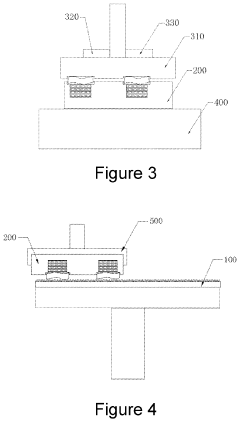

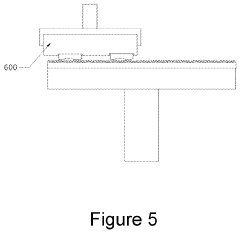

Wafer surface processing device

PatentInactiveUS20210305080A1

Innovation

- A wafer surface processing device comprising a grinding mechanism, a first fixing mechanism with a stepped structure and a connecting medium solution, and a second fixing mechanism, which allows for sequential polishing of both surfaces without deformation, using a grinding disc and vacuum chucks with pressure and distance sensors to maintain precise control and avoid extrusion.

Patent

Innovation

- Silicon Carbide (SiC) wafers offer superior thermal conductivity compared to traditional silicon wafers, enabling more efficient heat dissipation in high-power microwave applications.

- SiC wafers provide higher breakdown field strength (approximately 10 times that of silicon), allowing for higher voltage operation and power density in microwave devices.

- The wide bandgap properties of SiC enable operation at higher frequencies with lower parasitic losses, making it ideal for high-frequency microwave applications in telecommunications and radar systems.

Thermal Management Advantages of SiC in High-Power RF

Silicon Carbide (SiC) demonstrates exceptional thermal management capabilities that make it particularly valuable for high-power radio frequency (RF) applications. The material exhibits thermal conductivity approximately three times higher than silicon, reaching values of 3.3-4.9 W/cm·K compared to silicon's 1.3-1.5 W/cm·K. This superior thermal conductivity enables SiC-based devices to dissipate heat more efficiently, a critical factor in maintaining operational stability in high-power RF systems where thermal management presents significant challenges.

The wide bandgap properties of SiC further enhance its thermal performance. With a bandgap of 3.26 eV (compared to silicon's 1.12 eV), SiC maintains semiconductor properties at much higher temperatures, allowing devices to operate reliably at junction temperatures exceeding 200°C, while silicon-based devices typically become unstable above 150°C. This temperature tolerance translates directly to improved reliability in demanding RF environments.

SiC's thermal expansion coefficient closely matches that of GaN, another critical material in RF applications. This compatibility minimizes mechanical stress during thermal cycling, reducing the risk of delamination and cracking that often plague high-power RF devices. The resulting improvement in device longevity represents a significant advantage for applications requiring extended operational lifetimes.

The material's high thermal stability also contributes to consistent performance across varying temperature conditions. RF power amplifiers built on SiC substrates demonstrate minimal drift in key parameters such as gain, efficiency, and linearity when subjected to temperature fluctuations. This stability is particularly valuable in applications like radar systems and satellite communications where performance consistency is paramount.

From a system design perspective, SiC's thermal advantages enable more compact RF power amplifier designs. The enhanced heat dissipation capabilities allow for reduced heatsink dimensions and simplified cooling systems, resulting in smaller, lighter, and more cost-effective RF modules. Military and aerospace applications benefit significantly from this size and weight reduction without compromising performance.

Recent advancements in SiC wafer manufacturing have further improved thermal performance through defect reduction and increased wafer diameter uniformity. These improvements ensure more consistent thermal characteristics across the entire wafer, enhancing yield rates and reducing production costs for high-power RF devices. The combination of superior thermal management and manufacturing improvements positions SiC as the substrate of choice for next-generation high-power RF applications.

The wide bandgap properties of SiC further enhance its thermal performance. With a bandgap of 3.26 eV (compared to silicon's 1.12 eV), SiC maintains semiconductor properties at much higher temperatures, allowing devices to operate reliably at junction temperatures exceeding 200°C, while silicon-based devices typically become unstable above 150°C. This temperature tolerance translates directly to improved reliability in demanding RF environments.

SiC's thermal expansion coefficient closely matches that of GaN, another critical material in RF applications. This compatibility minimizes mechanical stress during thermal cycling, reducing the risk of delamination and cracking that often plague high-power RF devices. The resulting improvement in device longevity represents a significant advantage for applications requiring extended operational lifetimes.

The material's high thermal stability also contributes to consistent performance across varying temperature conditions. RF power amplifiers built on SiC substrates demonstrate minimal drift in key parameters such as gain, efficiency, and linearity when subjected to temperature fluctuations. This stability is particularly valuable in applications like radar systems and satellite communications where performance consistency is paramount.

From a system design perspective, SiC's thermal advantages enable more compact RF power amplifier designs. The enhanced heat dissipation capabilities allow for reduced heatsink dimensions and simplified cooling systems, resulting in smaller, lighter, and more cost-effective RF modules. Military and aerospace applications benefit significantly from this size and weight reduction without compromising performance.

Recent advancements in SiC wafer manufacturing have further improved thermal performance through defect reduction and increased wafer diameter uniformity. These improvements ensure more consistent thermal characteristics across the entire wafer, enhancing yield rates and reducing production costs for high-power RF devices. The combination of superior thermal management and manufacturing improvements positions SiC as the substrate of choice for next-generation high-power RF applications.

Environmental Impact and Sustainability of SiC Production

The production of Silicon Carbide (SiC) wafers, while offering significant advantages for microwave applications, presents notable environmental challenges that must be addressed for sustainable industry growth. Traditional SiC manufacturing processes are energy-intensive, requiring temperatures exceeding 2000°C for crystal growth, resulting in substantial carbon emissions. A single 6-inch SiC wafer production can consume approximately 1,000 kWh of electricity, significantly higher than silicon wafer manufacturing.

Water usage represents another critical environmental concern, with estimates suggesting that producing one SiC wafer requires 5,000-8,000 liters of ultra-pure water for cleaning and processing steps. This intensive water consumption places pressure on local resources, particularly in regions already experiencing water scarcity.

Chemical waste management poses additional challenges, as SiC production involves hazardous substances including hydrofluoric acid, hydrogen chloride, and various metallic contaminants. These chemicals require specialized handling and disposal protocols to prevent environmental contamination and protect worker safety.

However, the industry has begun implementing more sustainable practices. Several leading manufacturers have invested in closed-loop water recycling systems that can reduce freshwater consumption by up to 60%. Energy efficiency improvements through optimized furnace designs and process refinements have demonstrated potential to reduce energy requirements by 15-25% compared to conventional methods.

Renewable energy integration represents a promising approach to reducing the carbon footprint of SiC production. Companies like Wolfspeed and STMicroelectronics have committed to powering their manufacturing facilities with renewable energy sources, with some facilities already achieving 30-40% renewable energy utilization.

Material efficiency innovations are also emerging, with advanced manufacturing techniques reducing kerf loss during wafer slicing by up to 30%. This not only conserves raw materials but also decreases the environmental impact per wafer produced. Additionally, recycling programs for SiC manufacturing byproducts have been established, recovering valuable materials and reducing waste.

The long-term environmental benefits of SiC technology must also be considered. SiC-based devices in power electronics and microwave applications operate with significantly higher efficiency than traditional alternatives, potentially saving substantial energy throughout their operational lifetime. Life cycle assessments indicate that despite higher production impacts, SiC components in electric vehicles and renewable energy systems can offset their manufacturing footprint within 1-3 years of operation through improved system efficiency.

Water usage represents another critical environmental concern, with estimates suggesting that producing one SiC wafer requires 5,000-8,000 liters of ultra-pure water for cleaning and processing steps. This intensive water consumption places pressure on local resources, particularly in regions already experiencing water scarcity.

Chemical waste management poses additional challenges, as SiC production involves hazardous substances including hydrofluoric acid, hydrogen chloride, and various metallic contaminants. These chemicals require specialized handling and disposal protocols to prevent environmental contamination and protect worker safety.

However, the industry has begun implementing more sustainable practices. Several leading manufacturers have invested in closed-loop water recycling systems that can reduce freshwater consumption by up to 60%. Energy efficiency improvements through optimized furnace designs and process refinements have demonstrated potential to reduce energy requirements by 15-25% compared to conventional methods.

Renewable energy integration represents a promising approach to reducing the carbon footprint of SiC production. Companies like Wolfspeed and STMicroelectronics have committed to powering their manufacturing facilities with renewable energy sources, with some facilities already achieving 30-40% renewable energy utilization.

Material efficiency innovations are also emerging, with advanced manufacturing techniques reducing kerf loss during wafer slicing by up to 30%. This not only conserves raw materials but also decreases the environmental impact per wafer produced. Additionally, recycling programs for SiC manufacturing byproducts have been established, recovering valuable materials and reducing waste.

The long-term environmental benefits of SiC technology must also be considered. SiC-based devices in power electronics and microwave applications operate with significantly higher efficiency than traditional alternatives, potentially saving substantial energy throughout their operational lifetime. Life cycle assessments indicate that despite higher production impacts, SiC components in electric vehicles and renewable energy systems can offset their manufacturing footprint within 1-3 years of operation through improved system efficiency.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!