Transparent Conductive Oxides and Conductive Polymer Interactions

OCT 27, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

TCO and Conductive Polymer Evolution and Objectives

Transparent Conductive Oxides (TCOs) and conductive polymers have evolved significantly over the past several decades, transforming from laboratory curiosities to essential components in modern optoelectronic devices. The journey of TCOs began in the early 20th century with the discovery of tin-doped indium oxide (ITO), which remains the industry standard despite ongoing challenges. The evolution accelerated in the 1970s with the development of alternative TCOs such as fluorine-doped tin oxide (FTO) and aluminum-doped zinc oxide (AZO), driven by the need for more cost-effective and sustainable materials.

Conductive polymers emerged as a parallel technological path in the late 1970s when Alan Heeger, Alan MacDiarmid, and Hideki Shirakawa discovered that polyacetylene could be made conductive through halogen doping, earning them the Nobel Prize in Chemistry in 2000. This breakthrough catalyzed research into various conductive polymers including PEDOT:PSS, polyaniline, and polypyrrole, which offered flexibility and processability advantages over traditional inorganic conductors.

The intersection of TCOs and conductive polymers represents a particularly promising frontier, with hybrid systems potentially combining the high conductivity and transparency of TCOs with the flexibility and solution processability of conductive polymers. Recent years have witnessed significant advancements in understanding the interface physics and chemistry between these material classes, enabling more effective integration in devices such as organic photovoltaics, flexible displays, and touch screens.

The primary technical objectives in this field include enhancing the electrical conductivity of polymer systems to approach that of traditional TCOs while maintaining optical transparency, improving the mechanical compatibility between rigid TCOs and flexible polymers, and developing scalable manufacturing processes for hybrid systems. Additionally, there is a growing emphasis on reducing dependence on scarce elements like indium and developing environmentally sustainable alternatives.

Future evolution paths are likely to focus on nanoscale engineering of interfaces, development of self-healing composite materials, and exploration of novel deposition techniques that enable precise control over material properties. The ultimate goal is to create next-generation transparent conductors that combine high performance with sustainability, flexibility, and cost-effectiveness, thereby enabling new applications in wearable electronics, building-integrated photovoltaics, and transparent electronics.

Understanding the fundamental mechanisms of charge transfer and optical interactions between TCOs and conductive polymers remains a critical research objective, as these insights will guide the rational design of improved materials and interfaces for specific applications.

Conductive polymers emerged as a parallel technological path in the late 1970s when Alan Heeger, Alan MacDiarmid, and Hideki Shirakawa discovered that polyacetylene could be made conductive through halogen doping, earning them the Nobel Prize in Chemistry in 2000. This breakthrough catalyzed research into various conductive polymers including PEDOT:PSS, polyaniline, and polypyrrole, which offered flexibility and processability advantages over traditional inorganic conductors.

The intersection of TCOs and conductive polymers represents a particularly promising frontier, with hybrid systems potentially combining the high conductivity and transparency of TCOs with the flexibility and solution processability of conductive polymers. Recent years have witnessed significant advancements in understanding the interface physics and chemistry between these material classes, enabling more effective integration in devices such as organic photovoltaics, flexible displays, and touch screens.

The primary technical objectives in this field include enhancing the electrical conductivity of polymer systems to approach that of traditional TCOs while maintaining optical transparency, improving the mechanical compatibility between rigid TCOs and flexible polymers, and developing scalable manufacturing processes for hybrid systems. Additionally, there is a growing emphasis on reducing dependence on scarce elements like indium and developing environmentally sustainable alternatives.

Future evolution paths are likely to focus on nanoscale engineering of interfaces, development of self-healing composite materials, and exploration of novel deposition techniques that enable precise control over material properties. The ultimate goal is to create next-generation transparent conductors that combine high performance with sustainability, flexibility, and cost-effectiveness, thereby enabling new applications in wearable electronics, building-integrated photovoltaics, and transparent electronics.

Understanding the fundamental mechanisms of charge transfer and optical interactions between TCOs and conductive polymers remains a critical research objective, as these insights will guide the rational design of improved materials and interfaces for specific applications.

Market Applications and Demand Analysis

The transparent conductive oxides (TCOs) and conductive polymers market has experienced significant growth driven by the expanding electronics industry, particularly in display technologies. The global TCO market was valued at approximately $7.5 billion in 2022 and is projected to reach $12.3 billion by 2028, growing at a CAGR of 8.6%. This growth is primarily fueled by increasing demand for touchscreens, smart devices, and OLED displays across consumer electronics, automotive, and healthcare sectors.

The interaction between TCOs and conductive polymers represents a particularly promising market segment, as these hybrid materials offer enhanced performance characteristics that address limitations of individual components. The touchscreen panel market, a major application area for these materials, exceeded $80 billion in 2022 and continues to expand as consumer electronics manufacturers seek more durable, flexible, and responsive display solutions.

Photovoltaic applications constitute another significant market driver, with the global solar PV market projected to reach $200 billion by 2026. TCO-polymer composites are increasingly utilized in next-generation solar cells, offering improved efficiency and reduced manufacturing costs compared to traditional silicon-based technologies. The building-integrated photovoltaics (BIPV) segment specifically demands transparent conductive materials that can be incorporated into windows and building facades.

The automotive industry represents an emerging high-value market for TCO-polymer interactions, particularly in smart glass applications, heads-up displays, and integrated touch controls. This sector is expected to grow at 12% annually through 2028, driven by increasing vehicle electrification and autonomous driving technologies that require sophisticated display and sensing capabilities.

Flexible electronics represents perhaps the most promising growth area, with market projections exceeding $40 billion by 2027. The unique properties achieved through TCO-polymer interactions enable truly flexible, foldable displays and wearable technology applications that were previously unattainable with rigid TCO materials alone.

Regional market analysis indicates Asia-Pacific dominates manufacturing capacity, with China, South Korea, and Japan accounting for over 65% of global production. However, significant R&D investments in North America and Europe are focused on developing next-generation TCO-polymer composites with enhanced performance characteristics and sustainability profiles.

Customer demand increasingly emphasizes environmental considerations alongside performance metrics. The industry faces pressure to develop indium-free TCO alternatives and environmentally friendly processing methods, creating market opportunities for novel TCO-polymer solutions that reduce reliance on scarce materials while maintaining or improving performance characteristics.

The interaction between TCOs and conductive polymers represents a particularly promising market segment, as these hybrid materials offer enhanced performance characteristics that address limitations of individual components. The touchscreen panel market, a major application area for these materials, exceeded $80 billion in 2022 and continues to expand as consumer electronics manufacturers seek more durable, flexible, and responsive display solutions.

Photovoltaic applications constitute another significant market driver, with the global solar PV market projected to reach $200 billion by 2026. TCO-polymer composites are increasingly utilized in next-generation solar cells, offering improved efficiency and reduced manufacturing costs compared to traditional silicon-based technologies. The building-integrated photovoltaics (BIPV) segment specifically demands transparent conductive materials that can be incorporated into windows and building facades.

The automotive industry represents an emerging high-value market for TCO-polymer interactions, particularly in smart glass applications, heads-up displays, and integrated touch controls. This sector is expected to grow at 12% annually through 2028, driven by increasing vehicle electrification and autonomous driving technologies that require sophisticated display and sensing capabilities.

Flexible electronics represents perhaps the most promising growth area, with market projections exceeding $40 billion by 2027. The unique properties achieved through TCO-polymer interactions enable truly flexible, foldable displays and wearable technology applications that were previously unattainable with rigid TCO materials alone.

Regional market analysis indicates Asia-Pacific dominates manufacturing capacity, with China, South Korea, and Japan accounting for over 65% of global production. However, significant R&D investments in North America and Europe are focused on developing next-generation TCO-polymer composites with enhanced performance characteristics and sustainability profiles.

Customer demand increasingly emphasizes environmental considerations alongside performance metrics. The industry faces pressure to develop indium-free TCO alternatives and environmentally friendly processing methods, creating market opportunities for novel TCO-polymer solutions that reduce reliance on scarce materials while maintaining or improving performance characteristics.

Current Technological Landscape and Barriers

The global landscape of Transparent Conductive Oxides (TCOs) and conductive polymers has evolved significantly over the past decade, with both materials playing crucial roles in optoelectronic applications. Currently, indium tin oxide (ITO) dominates the TCO market with approximately 90% market share due to its excellent combination of optical transparency (>90%) and electrical conductivity (<10 Ω/sq). However, the industry faces critical challenges including indium scarcity, with reserves projected to deplete within 20 years at current consumption rates.

Alternative TCOs such as aluminum-doped zinc oxide (AZO), fluorine-doped tin oxide (FTO), and gallium-doped zinc oxide (GZO) have emerged as potential replacements, but still struggle to match ITO's performance-to-cost ratio in commercial applications. These materials typically achieve 80-85% transparency with sheet resistances of 15-50 Ω/sq, falling short of ITO's benchmark properties.

Conductive polymers, particularly PEDOT:PSS, have gained significant traction with annual market growth of approximately 15%. These materials offer advantages in flexibility and solution processability but face limitations in conductivity (typically 100-1000 Ω/sq) and long-term stability, with performance degradation of 20-30% observed under ambient conditions over 1000 hours.

The interface between TCOs and conductive polymers represents a particularly challenging research area. Current understanding of charge transfer mechanisms across these interfaces remains incomplete, with inconsistent models explaining the observed phenomena. Work function mismatches between TCOs (4.7-5.0 eV) and most conductive polymers (4.9-5.3 eV) create energy barriers that impede efficient charge transport.

Geographically, TCO research and production remain concentrated in East Asia, with Japan, South Korea, and China accounting for approximately 70% of patents filed in the last five years. Conductive polymer research shows a more distributed pattern, with significant contributions from European research institutions and North American startups.

Manufacturing scalability presents another significant barrier, particularly for novel TCO-polymer composite systems. While roll-to-roll processing has advanced for individual components, integrated manufacturing of hybrid systems faces yield issues below 60% at commercial scales. Additionally, environmental stability of these interfaces under operating conditions remains problematic, with accelerated degradation observed at the material boundaries.

Recent technological advances in atomic layer deposition and interface engineering have shown promise in addressing some of these challenges, but commercial implementation remains limited by cost considerations, with current solutions increasing production expenses by 30-40% compared to traditional ITO-based systems.

Alternative TCOs such as aluminum-doped zinc oxide (AZO), fluorine-doped tin oxide (FTO), and gallium-doped zinc oxide (GZO) have emerged as potential replacements, but still struggle to match ITO's performance-to-cost ratio in commercial applications. These materials typically achieve 80-85% transparency with sheet resistances of 15-50 Ω/sq, falling short of ITO's benchmark properties.

Conductive polymers, particularly PEDOT:PSS, have gained significant traction with annual market growth of approximately 15%. These materials offer advantages in flexibility and solution processability but face limitations in conductivity (typically 100-1000 Ω/sq) and long-term stability, with performance degradation of 20-30% observed under ambient conditions over 1000 hours.

The interface between TCOs and conductive polymers represents a particularly challenging research area. Current understanding of charge transfer mechanisms across these interfaces remains incomplete, with inconsistent models explaining the observed phenomena. Work function mismatches between TCOs (4.7-5.0 eV) and most conductive polymers (4.9-5.3 eV) create energy barriers that impede efficient charge transport.

Geographically, TCO research and production remain concentrated in East Asia, with Japan, South Korea, and China accounting for approximately 70% of patents filed in the last five years. Conductive polymer research shows a more distributed pattern, with significant contributions from European research institutions and North American startups.

Manufacturing scalability presents another significant barrier, particularly for novel TCO-polymer composite systems. While roll-to-roll processing has advanced for individual components, integrated manufacturing of hybrid systems faces yield issues below 60% at commercial scales. Additionally, environmental stability of these interfaces under operating conditions remains problematic, with accelerated degradation observed at the material boundaries.

Recent technological advances in atomic layer deposition and interface engineering have shown promise in addressing some of these challenges, but commercial implementation remains limited by cost considerations, with current solutions increasing production expenses by 30-40% compared to traditional ITO-based systems.

Existing Interface Engineering Solutions

01 Transparent conductive oxide compositions and fabrication methods

Transparent conductive oxides (TCOs) are materials that combine optical transparency with electrical conductivity. These materials are typically metal oxides such as indium tin oxide (ITO), zinc oxide, and tin oxide. Various fabrication methods including sputtering, chemical vapor deposition, and sol-gel processes can be used to create thin films of these materials. The composition and processing conditions significantly affect the transparency and conductivity properties of the resulting films.- Transparent Conductive Oxide (TCO) Compositions: Various compositions of transparent conductive oxides are used in electronic and optoelectronic devices. These materials combine optical transparency with electrical conductivity, making them suitable for applications such as displays, touch screens, and solar cells. Common TCO materials include indium tin oxide (ITO), zinc oxide (ZnO), and their doped variants. These materials can be optimized for specific properties such as conductivity, transparency, and stability through careful control of composition and processing conditions.

- Conductive Polymer Formulations: Conductive polymers offer an alternative to traditional metal oxides for transparent conductive applications. These materials include polyaniline (PANI), polythiophene derivatives such as PEDOT:PSS, and other conjugated polymers. Conductive polymers can be formulated with various additives to enhance their electrical conductivity, optical transparency, and mechanical flexibility. They are particularly valuable in applications requiring flexibility, such as wearable electronics and flexible displays.

- Hybrid TCO-Polymer Composite Materials: Hybrid materials combining transparent conductive oxides with conductive polymers can leverage the advantages of both material classes. These composites often exhibit enhanced performance characteristics including improved conductivity, better mechanical properties, and increased stability compared to either component alone. Fabrication methods for these hybrid materials include solution processing, layer-by-layer deposition, and in-situ polymerization techniques. Applications include flexible electronics, photovoltaics, and electrochromic devices.

- Fabrication Methods for Transparent Conductive Films: Various fabrication techniques are employed to create transparent conductive films from both oxides and polymers. These methods include physical vapor deposition (sputtering, evaporation), chemical vapor deposition, solution processing (spin coating, spray coating), and printing techniques (inkjet, screen printing). Each method offers different advantages in terms of film quality, scalability, and compatibility with various substrates. Post-deposition treatments such as annealing and plasma treatment can further enhance the performance of these films.

- Applications in Optoelectronic Devices: Transparent conductive oxides and polymers are crucial components in various optoelectronic devices. They serve as electrodes in organic light-emitting diodes (OLEDs), solar cells, touch screens, and electrochromic windows. The specific requirements for these materials vary by application, with some prioritizing conductivity while others emphasize transparency or flexibility. Recent developments focus on improving the performance and durability of these materials while reducing costs and environmental impact, particularly by developing alternatives to rare elements like indium.

02 Conductive polymer formulations and applications

Conductive polymers offer an alternative to traditional metal-based conductors, providing flexibility and processability advantages. These materials include polyaniline, polypyrrole, and poly(3,4-ethylenedioxythiophene) (PEDOT). The conductivity of these polymers can be enhanced through doping processes. Applications include flexible electronics, organic light-emitting diodes (OLEDs), and touch screens. The formulation often includes additives to improve stability, adhesion, and other performance characteristics.Expand Specific Solutions03 Hybrid materials combining TCOs and conductive polymers

Hybrid materials that combine transparent conductive oxides with conductive polymers can leverage the advantages of both material classes. These composites often exhibit enhanced conductivity, flexibility, and stability compared to either component alone. Various methods for creating these hybrid materials include layer-by-layer deposition, co-deposition, and nanocomposite formation. The interface between the inorganic oxide and organic polymer components plays a crucial role in determining the overall performance of the hybrid material.Expand Specific Solutions04 Display and optoelectronic device applications

Transparent conductive materials are essential components in various display and optoelectronic devices. They serve as electrodes in liquid crystal displays (LCDs), touchscreens, and organic light-emitting diodes (OLEDs). The requirements for these applications include high transparency in the visible spectrum, low sheet resistance, and compatibility with device fabrication processes. Patterning techniques for these materials include photolithography, laser ablation, and printing methods to create the desired electrode configurations.Expand Specific Solutions05 Novel deposition and patterning techniques

Advanced deposition and patterning techniques have been developed to create transparent conductive films with improved properties and reduced manufacturing costs. These include solution-based processes such as inkjet printing, spray coating, and roll-to-roll manufacturing. Nanomaterial approaches using nanowires, nanoparticles, and nanocomposites offer pathways to materials with enhanced performance. Post-deposition treatments including thermal annealing, plasma treatment, and chemical modification can further optimize the electrical and optical properties of the films.Expand Specific Solutions

Leading Research Institutions and Industrial Manufacturers

The transparent conductive oxides (TCO) and conductive polymer interactions market is currently in a growth phase, with increasing applications in optoelectronic devices, displays, and renewable energy technologies. The global market size is expanding rapidly, projected to reach significant value due to rising demand for flexible electronics and photovoltaics. Technologically, this field shows varying maturity levels across applications, with companies demonstrating different specialization areas. Industry leaders like Eastman Kodak, TDK, and DuPont bring established expertise in materials science, while BOE Technology and LG Chem focus on display applications. Research institutions including Naval Research Laboratory and Oregon State University contribute fundamental innovations. Emerging players like Intenanomat are developing specialized nanoparticle solutions. The competitive landscape features both traditional chemical companies (Henkel, Solvay) and electronics manufacturers (Samsung Electro-Mechanics), indicating cross-industry convergence in this technology domain.

Merck Patent GmbH

Technical Solution: Merck Patent GmbH has developed sophisticated TCO/conductive polymer systems through their "OPTIXTM" platform technology. Their approach focuses on molecular engineering of the TCO/polymer interface using proprietary surface functionalization agents that create covalent bonds between the inorganic and organic components. Merck's research has yielded transparent electrodes with tunable work functions (ranging from 4.0 to 5.7 eV) by controlling the composition and processing of their hybrid materials. Their technology employs solution-processable indium-free TCOs (primarily FTO and AZO) combined with specially designed conductive polymers containing functional groups that enhance adhesion and charge transfer at interfaces. Merck has demonstrated that their hybrid electrodes achieve transparency >88% across the visible spectrum while maintaining conductivity comparable to standard ITO (sheet resistance ~40-60 Ω/sq). Their materials show exceptional stability, with less than 5% performance degradation after 1000 hours of environmental stress testing at elevated temperature and humidity conditions.

Strengths: Highly tunable work function for optimized device integration; excellent environmental stability; proprietary surface chemistry for enhanced interfaces; indium-free compositions reducing dependency on rare elements. Weaknesses: Complex manufacturing processes requiring precise control; higher initial material costs; intellectual property restrictions limiting widespread adoption.

BOE Technology Group Co., Ltd.

Technical Solution: BOE Technology has developed advanced transparent conductive oxide (TCO) and conductive polymer composite materials for display applications. Their research focuses on indium tin oxide (ITO) alternatives using metal oxide/conductive polymer hybrids that maintain high transparency (>90% in visible range) while achieving sheet resistance below 100 Ω/sq. BOE's proprietary PEDOT:PSS formulations modified with specific dopants enhance conductivity at the TCO interface. Their technology implements a multi-layer structure where the conductive polymer serves as a buffer layer between the TCO and active organic layers, significantly improving charge injection and reducing interfacial resistance. BOE has demonstrated that controlling the work function alignment between TCO and conductive polymers through surface treatments can enhance device efficiency by up to 25% compared to conventional structures.

Strengths: Superior optical transparency while maintaining electrical conductivity; excellent interface engineering between inorganic and organic materials; scalable manufacturing processes compatible with existing production lines. Weaknesses: Higher production costs compared to standard ITO; potential long-term stability issues in high-humidity environments; limited flexibility compared to pure polymer solutions.

Key Patents and Scientific Breakthroughs

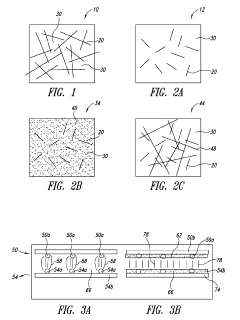

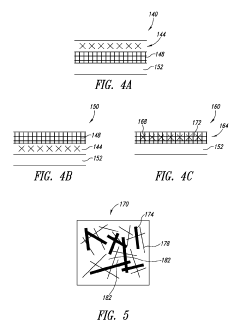

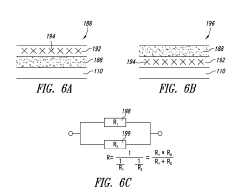

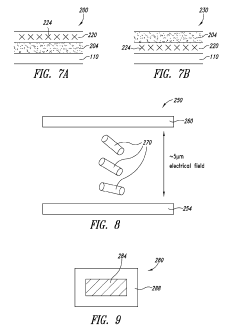

Composite transparent conductors and methods of forming the same

PatentActiveUS20190191569A1

Innovation

- A composite transparent conductor is formed by combining a primary conductive medium of metal nanowires or metal nanotubes with a secondary conductive medium, such as carbon nanotubes or conductive films, to enhance conductivity, durability, and optical properties, while reducing fabrication costs.

Conductive polymer composition and transparent electrode and/or antistatic layer made therefrom

PatentInactiveTW201420720A

Innovation

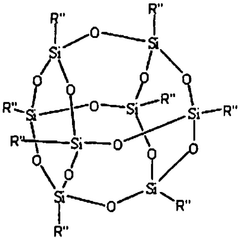

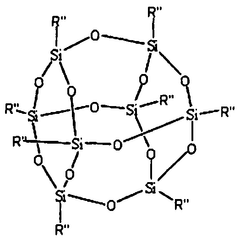

- A conductive polymer composition comprising PEDOT polymers, polysilsesquioxane or polysilazane binders, and solvents, which provide high stability, moisture/air resistance, and uniformity, enabling the formation of transparent electrodes and antistatic layers with improved adhesion and hardness.

Sustainability and Environmental Impact Assessment

The environmental impact of transparent conductive oxides (TCOs) and conductive polymers has become increasingly important as these materials find widespread applications in optoelectronic devices. Traditional TCOs like indium tin oxide (ITO) rely on rare earth metals, particularly indium, which faces significant sustainability challenges due to limited global reserves and geopolitical supply constraints. Mining and processing these materials generate substantial carbon emissions and environmental degradation, raising concerns about long-term viability.

Conductive polymers offer a potentially more sustainable alternative, being primarily carbon-based and derived from more abundant resources. However, their production often involves toxic solvents and energy-intensive synthesis processes. Life cycle assessments reveal that while conductive polymers may reduce dependency on scarce metals, their overall environmental footprint can sometimes exceed that of inorganic alternatives when considering manufacturing energy requirements and chemical waste generation.

The interaction between TCOs and conductive polymers presents unique opportunities for sustainability improvements. Hybrid systems that combine minimal amounts of TCOs with conductive polymers can significantly reduce rare metal usage while maintaining performance standards. Research indicates that such composite materials can achieve up to 70% reduction in indium content without compromising conductivity or transparency properties.

Recycling and end-of-life considerations represent another critical dimension of environmental impact. Current recovery rates for indium from discarded electronics remain below 1%, highlighting a substantial opportunity for improvement. Conductive polymers present their own recycling challenges due to complex formulations and integration with other device components, often resulting in downcycling rather than true material recovery.

Water usage and contamination constitute additional environmental concerns. TCO production processes typically require significant quantities of ultrapure water, while polymer synthesis and processing can generate wastewater containing persistent organic pollutants. Recent innovations in water-based processing methods for conductive polymers show promise for reducing both water consumption and hazardous waste generation by up to 40% compared to conventional methods.

Energy efficiency during device operation represents a positive environmental aspect of these materials. The superior conductivity and transparency properties of TCO-polymer hybrid systems contribute to more efficient solar cells and displays, potentially offsetting manufacturing impacts through reduced energy consumption during product lifetimes. Calculations suggest that energy payback periods for solar applications using these materials can be reduced by 15-20% compared to conventional technologies.

Conductive polymers offer a potentially more sustainable alternative, being primarily carbon-based and derived from more abundant resources. However, their production often involves toxic solvents and energy-intensive synthesis processes. Life cycle assessments reveal that while conductive polymers may reduce dependency on scarce metals, their overall environmental footprint can sometimes exceed that of inorganic alternatives when considering manufacturing energy requirements and chemical waste generation.

The interaction between TCOs and conductive polymers presents unique opportunities for sustainability improvements. Hybrid systems that combine minimal amounts of TCOs with conductive polymers can significantly reduce rare metal usage while maintaining performance standards. Research indicates that such composite materials can achieve up to 70% reduction in indium content without compromising conductivity or transparency properties.

Recycling and end-of-life considerations represent another critical dimension of environmental impact. Current recovery rates for indium from discarded electronics remain below 1%, highlighting a substantial opportunity for improvement. Conductive polymers present their own recycling challenges due to complex formulations and integration with other device components, often resulting in downcycling rather than true material recovery.

Water usage and contamination constitute additional environmental concerns. TCO production processes typically require significant quantities of ultrapure water, while polymer synthesis and processing can generate wastewater containing persistent organic pollutants. Recent innovations in water-based processing methods for conductive polymers show promise for reducing both water consumption and hazardous waste generation by up to 40% compared to conventional methods.

Energy efficiency during device operation represents a positive environmental aspect of these materials. The superior conductivity and transparency properties of TCO-polymer hybrid systems contribute to more efficient solar cells and displays, potentially offsetting manufacturing impacts through reduced energy consumption during product lifetimes. Calculations suggest that energy payback periods for solar applications using these materials can be reduced by 15-20% compared to conventional technologies.

Manufacturing Scalability and Cost Analysis

The manufacturing scalability of transparent conductive oxides (TCOs) and conductive polymers represents a critical factor in their commercial viability. Current industrial production of TCOs, particularly indium tin oxide (ITO), relies on established vacuum-based deposition techniques including sputtering, chemical vapor deposition, and thermal evaporation. These methods offer excellent film quality and uniformity but require significant capital investment and energy consumption. The high-temperature processing requirements of TCOs (typically 300-500°C) further limit substrate compatibility and increase production costs.

Conductive polymers present an alternative manufacturing paradigm with solution-based processing capabilities. PEDOT:PSS and other conductive polymers can be deposited via roll-to-roll printing, spray coating, and inkjet printing at near-ambient temperatures. This processing advantage translates to theoretical production cost reductions of 40-60% compared to vacuum-based TCO deposition, particularly for large-area applications.

Cost analysis reveals that material expenses constitute 30-45% of total production costs for TCO-based transparent conductors. Indium scarcity remains a significant concern, with prices fluctuating between $500-900/kg in recent years. Alternative TCOs utilizing more abundant elements (AZO, FTO) offer material cost reductions of 50-70% but often with performance trade-offs. Conductive polymers present lower material costs initially, but stability issues may necessitate additional encapsulation or protective measures, offsetting some cost advantages.

Scale-up challenges differ significantly between these technologies. TCO manufacturing faces bottlenecks in equipment throughput and energy consumption, while conductive polymers struggle with batch-to-batch consistency and long-term stability at industrial scales. Hybrid systems combining TCOs with conductive polymers introduce additional interface engineering challenges but may optimize cost-performance ratios through reduced TCO thickness requirements.

Economic modeling suggests that the crossover point where conductive polymers become more cost-effective than TCOs occurs at production volumes exceeding 10,000 m² for flexible electronics applications. However, for applications requiring high conductivity and optical transparency exceeding 90%, TCOs maintain economic advantages despite higher initial capital costs due to their superior performance consistency and established quality control protocols.

Recent innovations in atmospheric pressure deposition techniques for TCOs and advanced polymer stabilization methods are gradually narrowing the manufacturing cost gap between these technologies, potentially enabling more cost-effective hybrid systems that leverage the advantages of both material classes.

Conductive polymers present an alternative manufacturing paradigm with solution-based processing capabilities. PEDOT:PSS and other conductive polymers can be deposited via roll-to-roll printing, spray coating, and inkjet printing at near-ambient temperatures. This processing advantage translates to theoretical production cost reductions of 40-60% compared to vacuum-based TCO deposition, particularly for large-area applications.

Cost analysis reveals that material expenses constitute 30-45% of total production costs for TCO-based transparent conductors. Indium scarcity remains a significant concern, with prices fluctuating between $500-900/kg in recent years. Alternative TCOs utilizing more abundant elements (AZO, FTO) offer material cost reductions of 50-70% but often with performance trade-offs. Conductive polymers present lower material costs initially, but stability issues may necessitate additional encapsulation or protective measures, offsetting some cost advantages.

Scale-up challenges differ significantly between these technologies. TCO manufacturing faces bottlenecks in equipment throughput and energy consumption, while conductive polymers struggle with batch-to-batch consistency and long-term stability at industrial scales. Hybrid systems combining TCOs with conductive polymers introduce additional interface engineering challenges but may optimize cost-performance ratios through reduced TCO thickness requirements.

Economic modeling suggests that the crossover point where conductive polymers become more cost-effective than TCOs occurs at production volumes exceeding 10,000 m² for flexible electronics applications. However, for applications requiring high conductivity and optical transparency exceeding 90%, TCOs maintain economic advantages despite higher initial capital costs due to their superior performance consistency and established quality control protocols.

Recent innovations in atmospheric pressure deposition techniques for TCOs and advanced polymer stabilization methods are gradually narrowing the manufacturing cost gap between these technologies, potentially enabling more cost-effective hybrid systems that leverage the advantages of both material classes.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!