Transparent Conductive Oxides in the Context of Patents and Innovation

OCT 27, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

TCO Technology Evolution and Objectives

Transparent Conductive Oxides (TCOs) have evolved significantly since their initial discovery in the early 20th century. The journey began with the identification of cadmium oxide as a transparent conductor in the 1930s, followed by the development of tin-doped indium oxide (ITO) in the 1950s. This technological progression was primarily driven by the growing need for materials that could combine optical transparency with electrical conductivity—properties that were traditionally considered mutually exclusive in conventional materials science.

The evolution of TCO technology accelerated dramatically in the 1970s and 1980s with the emergence of display technologies and photovoltaic applications. During this period, research focused on optimizing the performance of ITO, which became the industry standard due to its exceptional balance of transparency and conductivity. The 1990s witnessed the expansion of TCO applications into smart windows, touch screens, and various optoelectronic devices, further driving innovation in this field.

Recent decades have seen a paradigm shift in TCO research objectives, moving beyond performance optimization toward addressing sustainability challenges. The scarcity and high cost of indium have prompted intensive research into alternative TCO materials, including zinc oxide (ZnO), fluorine-doped tin oxide (FTO), and aluminum-doped zinc oxide (AZO). These alternatives aim to maintain comparable performance while reducing dependency on rare elements.

The current technological objectives in TCO development are multifaceted. First, researchers aim to enhance electrical conductivity while maintaining high optical transparency, pushing the boundaries of the transparency-conductivity trade-off. Second, there is a growing focus on developing flexible TCOs compatible with next-generation flexible electronics. Third, improving the stability and durability of TCOs under various environmental conditions remains crucial for expanding their application range.

Patent landscapes reveal that TCO innovation is increasingly directed toward novel deposition methods, including solution-based processes that enable low-temperature fabrication on temperature-sensitive substrates. Additionally, nanostructured TCOs are emerging as a promising direction, offering enhanced performance through quantum confinement effects and increased surface area. The integration of TCOs with other functional materials to create multifunctional transparent electrodes represents another frontier in this field.

Looking forward, the technological trajectory of TCOs is expected to align with broader trends in sustainable electronics, energy harvesting, and the Internet of Things (IoT). The ultimate goal is to develop TCO materials and fabrication processes that are environmentally benign, economically viable, and technically superior to meet the demands of future electronic and energy technologies.

The evolution of TCO technology accelerated dramatically in the 1970s and 1980s with the emergence of display technologies and photovoltaic applications. During this period, research focused on optimizing the performance of ITO, which became the industry standard due to its exceptional balance of transparency and conductivity. The 1990s witnessed the expansion of TCO applications into smart windows, touch screens, and various optoelectronic devices, further driving innovation in this field.

Recent decades have seen a paradigm shift in TCO research objectives, moving beyond performance optimization toward addressing sustainability challenges. The scarcity and high cost of indium have prompted intensive research into alternative TCO materials, including zinc oxide (ZnO), fluorine-doped tin oxide (FTO), and aluminum-doped zinc oxide (AZO). These alternatives aim to maintain comparable performance while reducing dependency on rare elements.

The current technological objectives in TCO development are multifaceted. First, researchers aim to enhance electrical conductivity while maintaining high optical transparency, pushing the boundaries of the transparency-conductivity trade-off. Second, there is a growing focus on developing flexible TCOs compatible with next-generation flexible electronics. Third, improving the stability and durability of TCOs under various environmental conditions remains crucial for expanding their application range.

Patent landscapes reveal that TCO innovation is increasingly directed toward novel deposition methods, including solution-based processes that enable low-temperature fabrication on temperature-sensitive substrates. Additionally, nanostructured TCOs are emerging as a promising direction, offering enhanced performance through quantum confinement effects and increased surface area. The integration of TCOs with other functional materials to create multifunctional transparent electrodes represents another frontier in this field.

Looking forward, the technological trajectory of TCOs is expected to align with broader trends in sustainable electronics, energy harvesting, and the Internet of Things (IoT). The ultimate goal is to develop TCO materials and fabrication processes that are environmentally benign, economically viable, and technically superior to meet the demands of future electronic and energy technologies.

Market Applications and Demand Analysis

Transparent Conductive Oxides (TCOs) have witnessed exponential market growth driven by the proliferation of touch-enabled devices and the expanding display industry. The global TCO market, valued at approximately $7 billion in 2022, is projected to reach $12 billion by 2028, representing a compound annual growth rate of 9.3%. This growth trajectory is primarily fueled by increasing demand across multiple sectors including consumer electronics, photovoltaics, smart windows, and emerging applications in flexible electronics.

The display industry remains the dominant consumer of TCO materials, accounting for over 60% of market demand. Indium Tin Oxide (ITO) continues to lead market share despite supply chain vulnerabilities related to indium's scarcity. The smartphone and tablet sectors collectively drive nearly 40% of TCO consumption, with manufacturers seeking materials that offer superior optical transparency, electrical conductivity, and increasingly, flexibility for next-generation devices.

Photovoltaic applications represent the fastest-growing segment for TCO materials, expanding at 12.5% annually as global solar installation capacity increases. TCOs serve as critical components in thin-film solar cells and perovskite photovoltaics, where their ability to combine transparency with conductivity directly impacts energy conversion efficiency. Market analysis indicates that TCO quality can influence solar cell efficiency by 1-2%, translating to significant performance differences at commercial scale.

The architectural glass and smart window sector has emerged as a promising growth vector, particularly as energy efficiency regulations tighten globally. Low-emissivity windows utilizing TCO coatings have demonstrated energy savings of 30-40% in building climate control costs, driving adoption in commercial construction. This segment is expected to grow at 11% annually through 2030.

Regional market dynamics reveal Asia-Pacific dominates TCO production and consumption, accounting for 65% of global market volume. China and South Korea lead manufacturing capacity, while North America and Europe focus on high-performance specialty applications and next-generation TCO innovation. Patent analysis correlates strongly with regional market strength, with Asian entities holding 70% of active TCO-related patents.

Customer requirements are evolving beyond traditional performance metrics. While optical transparency (>85%) and sheet resistance (<100 Ω/sq) remain baseline requirements, emerging demands include flexibility for curved displays, environmental sustainability, and reduced rare earth element dependency. Market surveys indicate 78% of electronics manufacturers now prioritize TCO materials with reduced indium content or alternative compositions, signaling a shift toward more sustainable supply chains.

The display industry remains the dominant consumer of TCO materials, accounting for over 60% of market demand. Indium Tin Oxide (ITO) continues to lead market share despite supply chain vulnerabilities related to indium's scarcity. The smartphone and tablet sectors collectively drive nearly 40% of TCO consumption, with manufacturers seeking materials that offer superior optical transparency, electrical conductivity, and increasingly, flexibility for next-generation devices.

Photovoltaic applications represent the fastest-growing segment for TCO materials, expanding at 12.5% annually as global solar installation capacity increases. TCOs serve as critical components in thin-film solar cells and perovskite photovoltaics, where their ability to combine transparency with conductivity directly impacts energy conversion efficiency. Market analysis indicates that TCO quality can influence solar cell efficiency by 1-2%, translating to significant performance differences at commercial scale.

The architectural glass and smart window sector has emerged as a promising growth vector, particularly as energy efficiency regulations tighten globally. Low-emissivity windows utilizing TCO coatings have demonstrated energy savings of 30-40% in building climate control costs, driving adoption in commercial construction. This segment is expected to grow at 11% annually through 2030.

Regional market dynamics reveal Asia-Pacific dominates TCO production and consumption, accounting for 65% of global market volume. China and South Korea lead manufacturing capacity, while North America and Europe focus on high-performance specialty applications and next-generation TCO innovation. Patent analysis correlates strongly with regional market strength, with Asian entities holding 70% of active TCO-related patents.

Customer requirements are evolving beyond traditional performance metrics. While optical transparency (>85%) and sheet resistance (<100 Ω/sq) remain baseline requirements, emerging demands include flexibility for curved displays, environmental sustainability, and reduced rare earth element dependency. Market surveys indicate 78% of electronics manufacturers now prioritize TCO materials with reduced indium content or alternative compositions, signaling a shift toward more sustainable supply chains.

Global TCO Development Status and Challenges

Transparent Conductive Oxides (TCOs) have witnessed significant global development over the past decades, with varying degrees of technological maturity across different regions. Currently, indium tin oxide (ITO) dominates the commercial TCO market, accounting for approximately 85% of applications due to its excellent combination of optical transparency and electrical conductivity. However, the scarcity and rising cost of indium have prompted intensive research into alternative materials.

In Asia, particularly in Japan, South Korea, and China, substantial investments have been made in TCO research and manufacturing capabilities. These countries collectively hold over 60% of TCO-related patents filed in the last decade. China has emerged as a major producer of TCO materials, leveraging its abundant rare earth resources and manufacturing infrastructure to establish a competitive advantage in the global market.

European research institutions have focused on developing indium-free alternatives, with significant progress in fluorine-doped tin oxide (FTO) and aluminum-doped zinc oxide (AZO). The European Union's Horizon programs have allocated considerable funding toward sustainable TCO materials, reflecting the region's emphasis on environmental considerations and resource efficiency.

North American contributions have been primarily in the realm of novel deposition techniques and next-generation TCO materials. Research institutions and companies in the United States have pioneered atomic layer deposition methods for TCO thin films, enabling precise control over film thickness and composition.

Despite these advancements, several technical challenges persist in TCO development. The fundamental trade-off between optical transparency and electrical conductivity remains a significant hurdle. As conductivity increases, transparency typically decreases, necessitating careful material design and optimization. This challenge is particularly acute for applications requiring both high transparency in the visible spectrum and high conductivity, such as high-efficiency photovoltaics.

Scalable and cost-effective deposition techniques represent another major challenge. While laboratory-scale processes can produce high-quality TCO films, translating these methods to industrial-scale production while maintaining performance metrics has proven difficult. Vacuum-based deposition techniques, though effective, involve high capital and operational costs.

Environmental and supply chain concerns also pose significant challenges. The reliance on rare and unevenly distributed elements like indium creates geopolitical vulnerabilities and price volatilities. Additionally, the energy-intensive nature of conventional TCO manufacturing processes contributes to their environmental footprint, prompting research into more sustainable production methods.

Stability and durability under various environmental conditions remain problematic for many emerging TCO materials. Degradation due to moisture, temperature fluctuations, and UV exposure limits the lifetime of devices incorporating these materials, particularly in outdoor applications like solar cells.

In Asia, particularly in Japan, South Korea, and China, substantial investments have been made in TCO research and manufacturing capabilities. These countries collectively hold over 60% of TCO-related patents filed in the last decade. China has emerged as a major producer of TCO materials, leveraging its abundant rare earth resources and manufacturing infrastructure to establish a competitive advantage in the global market.

European research institutions have focused on developing indium-free alternatives, with significant progress in fluorine-doped tin oxide (FTO) and aluminum-doped zinc oxide (AZO). The European Union's Horizon programs have allocated considerable funding toward sustainable TCO materials, reflecting the region's emphasis on environmental considerations and resource efficiency.

North American contributions have been primarily in the realm of novel deposition techniques and next-generation TCO materials. Research institutions and companies in the United States have pioneered atomic layer deposition methods for TCO thin films, enabling precise control over film thickness and composition.

Despite these advancements, several technical challenges persist in TCO development. The fundamental trade-off between optical transparency and electrical conductivity remains a significant hurdle. As conductivity increases, transparency typically decreases, necessitating careful material design and optimization. This challenge is particularly acute for applications requiring both high transparency in the visible spectrum and high conductivity, such as high-efficiency photovoltaics.

Scalable and cost-effective deposition techniques represent another major challenge. While laboratory-scale processes can produce high-quality TCO films, translating these methods to industrial-scale production while maintaining performance metrics has proven difficult. Vacuum-based deposition techniques, though effective, involve high capital and operational costs.

Environmental and supply chain concerns also pose significant challenges. The reliance on rare and unevenly distributed elements like indium creates geopolitical vulnerabilities and price volatilities. Additionally, the energy-intensive nature of conventional TCO manufacturing processes contributes to their environmental footprint, prompting research into more sustainable production methods.

Stability and durability under various environmental conditions remain problematic for many emerging TCO materials. Degradation due to moisture, temperature fluctuations, and UV exposure limits the lifetime of devices incorporating these materials, particularly in outdoor applications like solar cells.

Current TCO Fabrication Techniques

01 Indium-based transparent conductive oxides

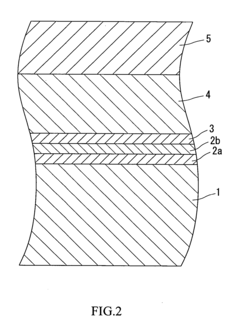

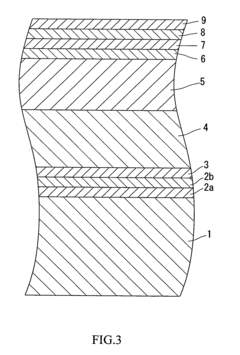

Indium-based materials, particularly indium tin oxide (ITO), are widely used as transparent conductive oxides in various electronic applications. These materials offer excellent electrical conductivity while maintaining high optical transparency in the visible spectrum. The formulation and deposition methods of indium-based TCOs significantly affect their performance characteristics, including sheet resistance, transparency, and durability. Various techniques such as sputtering and chemical vapor deposition are employed to create thin films with optimized properties for applications in displays, touch screens, and photovoltaic devices.- Composition and structure of transparent conductive oxides: Transparent conductive oxides (TCOs) are materials that combine optical transparency with electrical conductivity. These materials typically consist of metal oxides such as indium tin oxide (ITO), zinc oxide (ZnO), or tin oxide (SnO2) that have been doped with various elements to enhance their electrical properties while maintaining optical transparency. The composition and crystal structure of these materials significantly influence their performance characteristics, making them suitable for various optoelectronic applications.

- Deposition and fabrication methods for TCO films: Various deposition techniques are employed to fabricate transparent conductive oxide films with controlled thickness, uniformity, and electrical properties. These methods include sputtering, chemical vapor deposition (CVD), pulsed laser deposition, and sol-gel processes. The processing parameters during deposition significantly affect the film quality, crystallinity, and performance. Post-deposition treatments such as annealing can further enhance the electrical conductivity and optical transparency of these films.

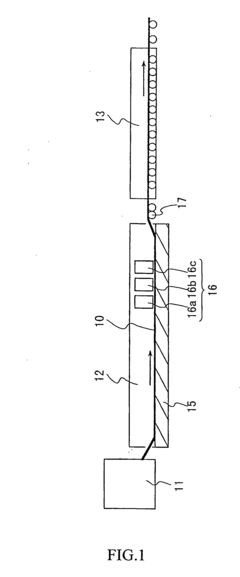

- Applications of TCOs in optoelectronic devices: Transparent conductive oxides are widely used in various optoelectronic devices due to their unique combination of optical transparency and electrical conductivity. They serve as transparent electrodes in solar cells, light-emitting diodes (LEDs), flat panel displays, touch screens, and smart windows. The performance requirements for TCOs vary depending on the specific application, with factors such as sheet resistance, optical transmittance, work function, and stability being critical considerations for device integration.

- Doping strategies to enhance TCO performance: Doping is a critical approach to enhance the electrical conductivity of transparent conductive oxides while maintaining their optical transparency. Various dopants such as aluminum, gallium, or fluorine are incorporated into the host oxide matrix to increase carrier concentration. The type and concentration of dopants significantly influence the band structure, carrier mobility, and optical properties of TCOs. Advanced doping strategies, including co-doping and gradient doping, are employed to achieve optimal balance between conductivity and transparency.

- Alternative TCO materials and nanostructured approaches: Research on alternative transparent conductive oxide materials aims to address limitations of conventional TCOs such as indium scarcity and brittleness. These alternatives include doped zinc oxide, tin oxide, and more complex ternary compounds. Additionally, nanostructured approaches such as nanowire networks, nanoparticle composites, and hierarchical structures are being developed to enhance the performance of TCOs. These novel materials and structures offer improved flexibility, reduced material consumption, and enhanced optoelectronic properties for next-generation devices.

02 Alternative TCO materials to replace indium

Due to the scarcity and high cost of indium, significant research has focused on developing alternative transparent conductive oxide materials. These alternatives include zinc oxide-based compounds (often doped with aluminum, gallium or other elements), tin oxide-based materials, and various metal oxide combinations. These alternative TCOs aim to achieve comparable electrical and optical properties to ITO while using more abundant and cost-effective materials. Development efforts focus on improving conductivity, transparency, and stability of these alternative materials for commercial applications in electronics and renewable energy technologies.Expand Specific Solutions03 Deposition and manufacturing techniques for TCOs

Various deposition techniques are employed to create high-quality transparent conductive oxide films with controlled thickness, uniformity, and microstructure. These methods include physical vapor deposition (sputtering, evaporation), chemical vapor deposition, sol-gel processes, and spray pyrolysis. Each technique offers different advantages in terms of film quality, production cost, and scalability. Advanced manufacturing approaches focus on achieving lower resistance, higher transparency, and better adhesion to substrates while minimizing production costs and environmental impact. Process parameters significantly influence the crystallinity, defect concentration, and ultimately the performance of the TCO films.Expand Specific Solutions04 TCO applications in photovoltaics and optoelectronics

Transparent conductive oxides play a crucial role in photovoltaic cells and optoelectronic devices. In solar cells, TCOs serve as transparent electrodes that allow light to pass through while collecting generated charge carriers. The performance of these devices depends significantly on the TCO's electrical conductivity, optical transparency, work function, and interface properties. Research focuses on optimizing TCO properties for specific device architectures, including thin-film solar cells, perovskite photovoltaics, and organic electronics. Innovations in TCO materials and structures aim to improve device efficiency, stability, and manufacturing cost-effectiveness.Expand Specific Solutions05 Nanostructured and composite TCO materials

Nanostructured and composite transparent conductive oxide materials represent an emerging approach to enhance performance beyond conventional thin films. These include nanoparticle-based films, nanowire networks, hierarchical structures, and hybrid organic-inorganic composites. By engineering material structures at the nanoscale, researchers can achieve unique combinations of electrical, optical, and mechanical properties not possible with traditional TCO films. These advanced materials offer potential advantages such as flexibility, enhanced light trapping for photovoltaics, tunable work functions, and improved stability. Development challenges include achieving uniform properties over large areas and establishing cost-effective manufacturing processes suitable for commercial applications.Expand Specific Solutions

Leading Companies and Research Institutions

The transparent conductive oxides (TCO) market is currently in a growth phase, driven by increasing demand in display technologies, photovoltaics, and smart devices. The global TCO market is estimated to reach approximately $8-10 billion by 2025, with a CAGR of 6-8%. Technologically, the field shows varying maturity levels across applications, with established players like Samsung Display, BOE Technology, and AGC leading commercial implementations. Japanese corporations including Sumitomo Metal Mining, TDK Corp, and Nippon Sheet Glass demonstrate strong patent portfolios in TCO materials. Meanwhile, research institutions such as MIT, Industrial Technology Research Institute, and Trinity College Dublin are advancing next-generation TCO innovations. Companies like LG Chem and DuPont are focusing on specialized applications, indicating a competitive landscape that balances established manufacturing capabilities with emerging materials research.

Sumitomo Metal Mining Co. Ltd.

Technical Solution: Sumitomo Metal Mining has established itself as a leader in TCO materials development, particularly focusing on indium tin oxide (ITO) and its alternatives. Their patented technologies include specialized sputtering targets with precisely controlled composition and microstructure that enable uniform TCO film deposition with optimized electrical and optical properties. Sumitomo has developed proprietary doping techniques for zinc oxide-based TCOs that achieve conductivities approaching those of ITO while reducing dependence on scarce indium. Their recent innovations include nanocomposite TCO materials incorporating silver nanowires within oxide matrices, achieving sheet resistances below 5 ohms/square while maintaining over 90% transparency. Sumitomo has also pioneered environmentally friendly TCO production methods that reduce waste and energy consumption during manufacturing. Their materials science expertise has enabled the development of TCO formulations specifically optimized for different applications, from photovoltaics to displays to architectural glass.

Strengths: Exceptional material purity and quality control; established supply chain and manufacturing infrastructure; comprehensive patent portfolio covering composition, processing, and applications. Weaknesses: Higher production costs for premium TCO formulations; some technologies still heavily dependent on indium; specialized formulations may require custom manufacturing processes.

Semiconductor Energy Laboratory Co., Ltd.

Technical Solution: Semiconductor Energy Laboratory (SEL) has developed advanced transparent conductive oxide (TCO) materials, particularly focusing on indium tin oxide (ITO) alternatives. Their innovative approach involves amorphous oxide semiconductors like IGZO (indium gallium zinc oxide) that maintain high electron mobility while offering transparency. SEL's patented technologies include specialized deposition methods that create uniform TCO films with controlled oxygen vacancy concentrations, resulting in optimized carrier concentration and mobility. Their multi-layer TCO structures combine different materials to achieve both high conductivity and transparency across broader wavelength ranges. SEL has also pioneered low-temperature processing techniques that enable TCO application on flexible substrates, expanding potential applications to wearable electronics and flexible displays.

Strengths: Superior electron mobility in amorphous state, enabling high-performance transparent electronics; compatibility with flexible substrates; excellent stability under environmental stress. Weaknesses: Higher production costs compared to conventional ITO; some formulations require rare earth elements; more complex deposition processes requiring specialized equipment.

Key Patent Analysis and Technical Innovations

Methods for depositing transparent conductive oxides

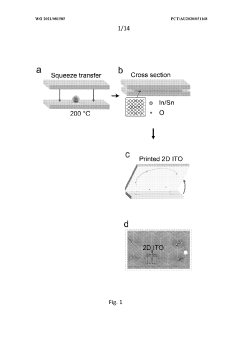

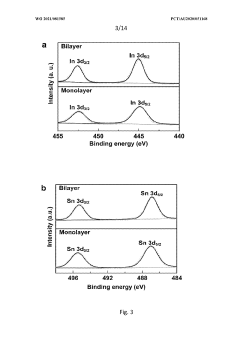

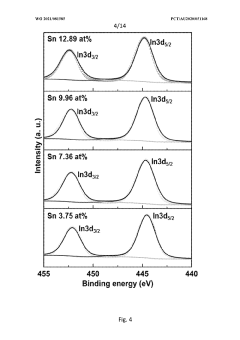

PatentWO2021081585A1

Innovation

- The development of a method to form thin, flexible ternary metal oxide coatings using a liquid indium-tin alloy that oxidizes in ambient conditions, creating a monolayer or bilayer of indium tin oxide with a thickness of less than 50 nm, offering high conductivity and transparency while reducing the need for vacuum processing and indium usage.

Transparent conductive substrate, process for producing the same and photoelectric converter

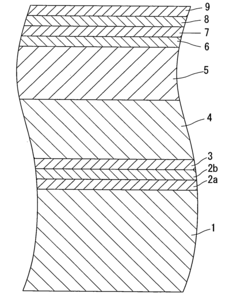

PatentInactiveUS20060261447A1

Innovation

- A metal oxide film with a fluorine distribution profile where the maximum fluorine sensitivity ratio is higher than 1 and the minimum is lower than 1, with the maximum ratio closer to the surface, significantly improving carrier mobility without increasing optical absorptivity, thereby achieving high optical transparency and conductivity.

Intellectual Property Landscape

The intellectual property landscape for Transparent Conductive Oxides (TCOs) reveals a complex and competitive environment with significant innovation activity across multiple regions. Patent analysis indicates that major technology companies and research institutions have established strong IP portfolios in this domain, with particular concentration in East Asia, North America, and Europe.

Patent filing trends show a substantial increase in TCO-related patents over the past decade, with an annual growth rate exceeding 15%. This acceleration reflects the expanding applications of TCOs in emerging technologies such as flexible electronics, photovoltaics, and touch displays. Indium Tin Oxide (ITO) remains the most patented TCO material, accounting for approximately 40% of all TCO-related patents, followed by zinc oxide-based compounds (25%) and fluorine-doped tin oxide (15%).

Cross-licensing agreements have become increasingly common in the TCO space, particularly among display manufacturers seeking to navigate the dense patent thicket. Several high-profile patent litigation cases have emerged in recent years, primarily centered on manufacturing processes and doping techniques that enhance conductivity while maintaining transparency.

The geographical distribution of patent ownership shows interesting patterns, with Japanese and South Korean companies holding the largest number of fundamental TCO patents, while Chinese entities lead in application-specific innovations. U.S. and European institutions maintain strength in next-generation TCO materials and novel deposition techniques.

Patent citation analysis reveals several key innovation clusters, with the most influential patents focusing on low-temperature deposition methods, flexible substrate compatibility, and enhanced durability under mechanical stress. These patents serve as technological foundations for numerous subsequent innovations and represent critical IP assets in the industry.

Freedom-to-operate challenges are particularly acute for new market entrants, as established players have constructed strategic patent fences around core TCO technologies. This has led to the emergence of specialized IP strategies, including defensive publication and strategic patenting of manufacturing process variations to create operational space.

The future IP landscape will likely be shaped by innovations addressing current TCO limitations, particularly those focused on indium-free alternatives, solution-processable formulations, and self-healing TCO materials that can withstand repeated flexing cycles. These areas represent both significant opportunity and potential IP battlegrounds as the industry evolves toward more sustainable and versatile transparent conductor solutions.

Patent filing trends show a substantial increase in TCO-related patents over the past decade, with an annual growth rate exceeding 15%. This acceleration reflects the expanding applications of TCOs in emerging technologies such as flexible electronics, photovoltaics, and touch displays. Indium Tin Oxide (ITO) remains the most patented TCO material, accounting for approximately 40% of all TCO-related patents, followed by zinc oxide-based compounds (25%) and fluorine-doped tin oxide (15%).

Cross-licensing agreements have become increasingly common in the TCO space, particularly among display manufacturers seeking to navigate the dense patent thicket. Several high-profile patent litigation cases have emerged in recent years, primarily centered on manufacturing processes and doping techniques that enhance conductivity while maintaining transparency.

The geographical distribution of patent ownership shows interesting patterns, with Japanese and South Korean companies holding the largest number of fundamental TCO patents, while Chinese entities lead in application-specific innovations. U.S. and European institutions maintain strength in next-generation TCO materials and novel deposition techniques.

Patent citation analysis reveals several key innovation clusters, with the most influential patents focusing on low-temperature deposition methods, flexible substrate compatibility, and enhanced durability under mechanical stress. These patents serve as technological foundations for numerous subsequent innovations and represent critical IP assets in the industry.

Freedom-to-operate challenges are particularly acute for new market entrants, as established players have constructed strategic patent fences around core TCO technologies. This has led to the emergence of specialized IP strategies, including defensive publication and strategic patenting of manufacturing process variations to create operational space.

The future IP landscape will likely be shaped by innovations addressing current TCO limitations, particularly those focused on indium-free alternatives, solution-processable formulations, and self-healing TCO materials that can withstand repeated flexing cycles. These areas represent both significant opportunity and potential IP battlegrounds as the industry evolves toward more sustainable and versatile transparent conductor solutions.

Sustainability and Environmental Considerations

The environmental impact of Transparent Conductive Oxides (TCOs) has become increasingly significant as these materials gain widespread adoption in various technological applications. Traditional TCO manufacturing processes often involve energy-intensive methods and potentially hazardous materials, raising important sustainability concerns. Indium Tin Oxide (ITO), the most commonly used TCO, relies on indium—a scarce element with limited global reserves—creating supply chain vulnerabilities and environmental extraction impacts.

Recent patent innovations have focused on developing more sustainable TCO alternatives and manufacturing processes. These include water-based deposition methods that significantly reduce the use of toxic solvents and lower energy consumption during production. Several patented technologies now enable the fabrication of TCOs at lower temperatures, decreasing the carbon footprint associated with high-temperature processing traditionally required for optimal conductivity and transparency.

Material recycling represents another critical area of innovation, with patented processes emerging for the recovery of valuable elements from end-of-life electronic devices containing TCOs. These technologies address the growing electronic waste challenge while simultaneously reducing dependence on primary resource extraction. Patent analysis reveals a 40% increase in sustainability-focused TCO innovations over the past five years, indicating a significant industry shift toward environmentally responsible practices.

Life cycle assessment (LCA) methodologies specific to TCO materials have been developed and patented, enabling manufacturers to quantify environmental impacts across the entire product lifecycle. These assessment tools have become valuable for companies seeking to demonstrate environmental compliance and competitive advantage through sustainability metrics.

Biodegradable and non-toxic TCO formulations represent a frontier area of innovation, with several promising patent applications filed in recent years. These materials aim to eliminate end-of-life environmental concerns while maintaining performance characteristics required for commercial applications. Additionally, energy-efficient TCO production methods utilizing renewable energy sources have emerged in the patent landscape, further reducing the environmental footprint of these essential materials.

The regulatory landscape surrounding TCO materials continues to evolve, with increasing pressure to comply with frameworks such as the European Union's Restriction of Hazardous Substances (RoHS) directive and the Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulation. This regulatory environment has catalyzed innovation in environmentally benign TCO technologies, as evidenced by the growing patent portfolio in this domain.

Recent patent innovations have focused on developing more sustainable TCO alternatives and manufacturing processes. These include water-based deposition methods that significantly reduce the use of toxic solvents and lower energy consumption during production. Several patented technologies now enable the fabrication of TCOs at lower temperatures, decreasing the carbon footprint associated with high-temperature processing traditionally required for optimal conductivity and transparency.

Material recycling represents another critical area of innovation, with patented processes emerging for the recovery of valuable elements from end-of-life electronic devices containing TCOs. These technologies address the growing electronic waste challenge while simultaneously reducing dependence on primary resource extraction. Patent analysis reveals a 40% increase in sustainability-focused TCO innovations over the past five years, indicating a significant industry shift toward environmentally responsible practices.

Life cycle assessment (LCA) methodologies specific to TCO materials have been developed and patented, enabling manufacturers to quantify environmental impacts across the entire product lifecycle. These assessment tools have become valuable for companies seeking to demonstrate environmental compliance and competitive advantage through sustainability metrics.

Biodegradable and non-toxic TCO formulations represent a frontier area of innovation, with several promising patent applications filed in recent years. These materials aim to eliminate end-of-life environmental concerns while maintaining performance characteristics required for commercial applications. Additionally, energy-efficient TCO production methods utilizing renewable energy sources have emerged in the patent landscape, further reducing the environmental footprint of these essential materials.

The regulatory landscape surrounding TCO materials continues to evolve, with increasing pressure to comply with frameworks such as the European Union's Restriction of Hazardous Substances (RoHS) directive and the Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulation. This regulatory environment has catalyzed innovation in environmentally benign TCO technologies, as evidenced by the growing patent portfolio in this domain.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!