Transparent Conductive Oxides and Their Use in Power Electronics

OCT 27, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

TCO Development History and Objectives

Transparent Conductive Oxides (TCOs) emerged in the early 20th century with the discovery of cadmium oxide's conductive properties in 1907. However, significant development began in the 1940s with tin-doped indium oxide (ITO) research. The 1970s marked a pivotal era as the semiconductor industry's growth created substantial demand for transparent electrodes in display technologies, propelling TCO research forward.

The 1980s and 1990s witnessed diversification beyond ITO, with aluminum-doped zinc oxide (AZO) and fluorine-doped tin oxide (FTO) gaining prominence due to indium's increasing scarcity and cost. This period established TCOs as essential components in optoelectronic devices, particularly solar cells and flat-panel displays.

The early 2000s brought renewed interest in TCOs for power electronics applications, driven by wide-bandgap semiconductor technologies like GaN and SiC. Researchers recognized TCOs' potential to address critical challenges in power device performance, particularly in high-frequency and high-power applications where traditional metal contacts faced limitations.

The evolution of TCO technology has been guided by several key objectives. Primary among these is achieving the optimal balance between optical transparency and electrical conductivity—properties typically at odds with each other in most materials. For power electronics specifically, TCOs must maintain performance under high electric fields and elevated temperatures while offering compatibility with semiconductor fabrication processes.

Another crucial objective has been developing TCOs with tunable work functions to optimize contact resistance with various semiconductor materials. This adaptability is particularly valuable in wide-bandgap power devices where contact engineering significantly impacts overall device efficiency and reliability.

Environmental and economic sustainability has increasingly shaped TCO development, with research focusing on earth-abundant alternatives to indium-based compounds. This includes exploration of novel materials like graphene-TCO hybrids and conductive polymers that complement traditional oxide structures.

Recent objectives include enhancing TCO stability under extreme operating conditions typical in power electronics, with particular emphasis on thermal cycling resilience and resistance to environmental degradation. Additionally, researchers are pursuing scalable, cost-effective deposition techniques compatible with large-area manufacturing to facilitate commercial adoption in power device production.

The convergence of these development trajectories positions TCOs as transformative materials for next-generation power electronics, potentially enabling higher efficiency, greater power density, and improved thermal management in applications ranging from electric vehicles to renewable energy systems.

The 1980s and 1990s witnessed diversification beyond ITO, with aluminum-doped zinc oxide (AZO) and fluorine-doped tin oxide (FTO) gaining prominence due to indium's increasing scarcity and cost. This period established TCOs as essential components in optoelectronic devices, particularly solar cells and flat-panel displays.

The early 2000s brought renewed interest in TCOs for power electronics applications, driven by wide-bandgap semiconductor technologies like GaN and SiC. Researchers recognized TCOs' potential to address critical challenges in power device performance, particularly in high-frequency and high-power applications where traditional metal contacts faced limitations.

The evolution of TCO technology has been guided by several key objectives. Primary among these is achieving the optimal balance between optical transparency and electrical conductivity—properties typically at odds with each other in most materials. For power electronics specifically, TCOs must maintain performance under high electric fields and elevated temperatures while offering compatibility with semiconductor fabrication processes.

Another crucial objective has been developing TCOs with tunable work functions to optimize contact resistance with various semiconductor materials. This adaptability is particularly valuable in wide-bandgap power devices where contact engineering significantly impacts overall device efficiency and reliability.

Environmental and economic sustainability has increasingly shaped TCO development, with research focusing on earth-abundant alternatives to indium-based compounds. This includes exploration of novel materials like graphene-TCO hybrids and conductive polymers that complement traditional oxide structures.

Recent objectives include enhancing TCO stability under extreme operating conditions typical in power electronics, with particular emphasis on thermal cycling resilience and resistance to environmental degradation. Additionally, researchers are pursuing scalable, cost-effective deposition techniques compatible with large-area manufacturing to facilitate commercial adoption in power device production.

The convergence of these development trajectories positions TCOs as transformative materials for next-generation power electronics, potentially enabling higher efficiency, greater power density, and improved thermal management in applications ranging from electric vehicles to renewable energy systems.

Market Analysis for TCO in Power Electronics

The global market for Transparent Conductive Oxides (TCOs) in power electronics is experiencing robust growth, driven by increasing demand for high-performance electronic devices and renewable energy systems. Current market valuations indicate that the TCO segment within power electronics reached approximately 2.3 billion USD in 2022, with projections suggesting a compound annual growth rate (CAGR) of 8.7% through 2028.

The power electronics sector represents a significant growth opportunity for TCO materials, particularly in applications such as solar cells, LED displays, touch panels, and emerging wide bandgap semiconductor devices. Indium Tin Oxide (ITO) continues to dominate the market share at roughly 65%, though alternative materials like Aluminum-doped Zinc Oxide (AZO) and Fluorine-doped Tin Oxide (FTO) are gaining traction due to cost advantages and specific performance characteristics.

Regional analysis reveals Asia-Pacific as the largest market for TCOs in power electronics, accounting for approximately 58% of global consumption. This dominance is attributed to the concentration of electronics manufacturing facilities and solar panel production in countries like China, South Korea, and Taiwan. North America and Europe follow with market shares of 22% and 17% respectively, with particular growth in applications related to electric vehicles and renewable energy infrastructure.

Consumer electronics remains the largest application segment, representing about 42% of TCO usage in power electronics. However, the fastest growth is observed in the renewable energy sector, particularly in photovoltaic applications, which is expanding at nearly 12% annually as global solar installation capacity continues to increase.

Key market drivers include the transition toward more efficient power conversion systems, miniaturization of electronic components, and increasing adoption of transparent electronics in various industries. The push for higher power density in electronic devices is creating demand for TCO materials with improved thermal stability and conductivity properties.

Supply chain challenges present significant market constraints, particularly regarding indium availability and price volatility. This has accelerated research into alternative TCO formulations and manufacturing processes. Environmental regulations are also influencing market dynamics, with increasing pressure to develop lead-free and environmentally sustainable TCO materials.

The market is witnessing a shift toward customized TCO solutions for specific power electronic applications, moving away from one-size-fits-all approaches. This trend is creating opportunities for specialized material manufacturers who can deliver application-specific performance characteristics such as enhanced thermal stability for high-power applications or flexibility for wearable electronics.

The power electronics sector represents a significant growth opportunity for TCO materials, particularly in applications such as solar cells, LED displays, touch panels, and emerging wide bandgap semiconductor devices. Indium Tin Oxide (ITO) continues to dominate the market share at roughly 65%, though alternative materials like Aluminum-doped Zinc Oxide (AZO) and Fluorine-doped Tin Oxide (FTO) are gaining traction due to cost advantages and specific performance characteristics.

Regional analysis reveals Asia-Pacific as the largest market for TCOs in power electronics, accounting for approximately 58% of global consumption. This dominance is attributed to the concentration of electronics manufacturing facilities and solar panel production in countries like China, South Korea, and Taiwan. North America and Europe follow with market shares of 22% and 17% respectively, with particular growth in applications related to electric vehicles and renewable energy infrastructure.

Consumer electronics remains the largest application segment, representing about 42% of TCO usage in power electronics. However, the fastest growth is observed in the renewable energy sector, particularly in photovoltaic applications, which is expanding at nearly 12% annually as global solar installation capacity continues to increase.

Key market drivers include the transition toward more efficient power conversion systems, miniaturization of electronic components, and increasing adoption of transparent electronics in various industries. The push for higher power density in electronic devices is creating demand for TCO materials with improved thermal stability and conductivity properties.

Supply chain challenges present significant market constraints, particularly regarding indium availability and price volatility. This has accelerated research into alternative TCO formulations and manufacturing processes. Environmental regulations are also influencing market dynamics, with increasing pressure to develop lead-free and environmentally sustainable TCO materials.

The market is witnessing a shift toward customized TCO solutions for specific power electronic applications, moving away from one-size-fits-all approaches. This trend is creating opportunities for specialized material manufacturers who can deliver application-specific performance characteristics such as enhanced thermal stability for high-power applications or flexibility for wearable electronics.

Current TCO Technologies and Barriers

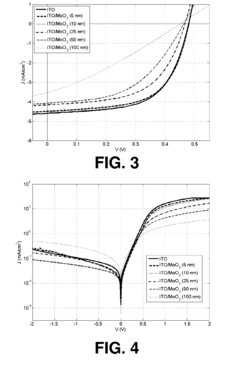

Transparent Conductive Oxides (TCOs) represent a critical class of materials in power electronics, with Indium Tin Oxide (ITO) currently dominating the market. ITO offers excellent optical transparency (>90%) combined with low electrical resistivity (~10^-4 Ω·cm), making it ideal for applications requiring both conductivity and transparency. However, ITO faces significant challenges including indium scarcity, rising costs, and brittleness that limits its application in flexible electronics.

Fluorine-doped Tin Oxide (FTO) has emerged as a viable alternative, offering superior thermal stability and chemical resistance compared to ITO. FTO demonstrates excellent performance in high-temperature applications, though its slightly higher resistivity (~3-5×10^-4 Ω·cm) remains a limitation for certain power electronic applications requiring minimal resistance.

Aluminum-doped Zinc Oxide (AZO) represents another promising TCO, gaining attention for its abundance of constituent materials and lower production costs. While AZO exhibits good optical and electrical properties, its performance degrades in humid environments, presenting challenges for long-term stability in power electronic devices exposed to varying environmental conditions.

A significant barrier to widespread TCO implementation in power electronics involves deposition techniques. Current methods such as sputtering, chemical vapor deposition, and sol-gel processes often require high temperatures or vacuum conditions, increasing manufacturing complexity and costs. The trade-off between optical transparency and electrical conductivity remains a fundamental challenge, as improving one property typically compromises the other.

Scalability presents another major hurdle, particularly for emerging TCO technologies. While laboratory-scale production demonstrates promising results, transitioning to industrial-scale manufacturing while maintaining consistent material properties proves difficult. Uniformity across large-area substrates remains problematic, affecting yield rates and increasing production costs.

For power electronics specifically, TCOs face additional challenges related to high-voltage and high-temperature operation. Current TCO materials often exhibit performance degradation under extreme operating conditions typical in power conversion systems. Interface issues between TCOs and other semiconductor materials in multilayer structures can lead to increased contact resistance and reliability concerns.

Recent research has focused on developing composite TCO materials and novel doping strategies to overcome these limitations. Multilayer TCO structures and hybrid organic-inorganic systems show promise in balancing optical and electrical properties while improving stability. However, these advanced materials often introduce additional complexity in manufacturing processes, presenting new challenges for commercial implementation in power electronic devices.

Fluorine-doped Tin Oxide (FTO) has emerged as a viable alternative, offering superior thermal stability and chemical resistance compared to ITO. FTO demonstrates excellent performance in high-temperature applications, though its slightly higher resistivity (~3-5×10^-4 Ω·cm) remains a limitation for certain power electronic applications requiring minimal resistance.

Aluminum-doped Zinc Oxide (AZO) represents another promising TCO, gaining attention for its abundance of constituent materials and lower production costs. While AZO exhibits good optical and electrical properties, its performance degrades in humid environments, presenting challenges for long-term stability in power electronic devices exposed to varying environmental conditions.

A significant barrier to widespread TCO implementation in power electronics involves deposition techniques. Current methods such as sputtering, chemical vapor deposition, and sol-gel processes often require high temperatures or vacuum conditions, increasing manufacturing complexity and costs. The trade-off between optical transparency and electrical conductivity remains a fundamental challenge, as improving one property typically compromises the other.

Scalability presents another major hurdle, particularly for emerging TCO technologies. While laboratory-scale production demonstrates promising results, transitioning to industrial-scale manufacturing while maintaining consistent material properties proves difficult. Uniformity across large-area substrates remains problematic, affecting yield rates and increasing production costs.

For power electronics specifically, TCOs face additional challenges related to high-voltage and high-temperature operation. Current TCO materials often exhibit performance degradation under extreme operating conditions typical in power conversion systems. Interface issues between TCOs and other semiconductor materials in multilayer structures can lead to increased contact resistance and reliability concerns.

Recent research has focused on developing composite TCO materials and novel doping strategies to overcome these limitations. Multilayer TCO structures and hybrid organic-inorganic systems show promise in balancing optical and electrical properties while improving stability. However, these advanced materials often introduce additional complexity in manufacturing processes, presenting new challenges for commercial implementation in power electronic devices.

Current TCO Implementation Solutions

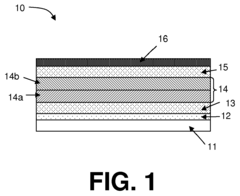

01 Composition and structure of transparent conductive oxides

Transparent conductive oxides (TCOs) are materials that combine optical transparency with electrical conductivity. These materials typically consist of metal oxides such as indium tin oxide (ITO), zinc oxide (ZnO), or tin oxide (SnO2). The composition and crystal structure of these oxides significantly influence their electrical and optical properties. Various dopants can be incorporated to enhance conductivity while maintaining transparency in the visible spectrum.- Indium-based transparent conductive oxides: Indium-based materials, particularly indium tin oxide (ITO), are widely used as transparent conductive oxides in various electronic applications. These materials offer excellent electrical conductivity while maintaining high optical transparency in the visible spectrum. Research focuses on improving deposition methods, reducing material costs, and enhancing performance characteristics such as conductivity and transparency for applications in displays, touch screens, and photovoltaic devices.

- Alternative TCO materials to replace indium: Due to the scarcity and high cost of indium, significant research efforts are directed toward developing alternative transparent conductive oxide materials. These alternatives include zinc oxide-based compounds (ZnO), aluminum-doped zinc oxide (AZO), gallium-doped zinc oxide (GZO), and tin oxide-based materials. These materials aim to provide comparable electrical and optical properties while offering cost advantages and improved sustainability compared to indium-based TCOs.

- Deposition and manufacturing techniques for TCOs: Various deposition techniques are employed to create high-quality transparent conductive oxide films with optimal properties. These methods include sputtering, chemical vapor deposition (CVD), atomic layer deposition (ALD), sol-gel processes, and pulsed laser deposition. Research focuses on developing processes that enable uniform film thickness, controlled doping levels, minimal defects, and compatibility with flexible substrates while maintaining cost-effectiveness for large-scale manufacturing.

- TCO applications in photovoltaics and optoelectronics: Transparent conductive oxides play a crucial role in photovoltaic cells and optoelectronic devices. In solar cells, TCOs serve as transparent electrodes that allow light to pass through while collecting generated charge carriers. Research focuses on optimizing TCO properties such as work function, band alignment, and surface morphology to enhance device efficiency. Applications include thin-film solar cells, light-emitting diodes, photodetectors, and smart windows with improved performance characteristics.

- Nanostructured and composite TCO materials: Advanced research explores nanostructured and composite transparent conductive oxide materials to achieve enhanced properties beyond conventional thin films. These include TCO nanoparticles, nanowires, nanotubes, and hierarchical structures that can provide improved electrical conductivity, optical transparency, and mechanical flexibility. Composite materials combining TCOs with other conductive materials like graphene or metal nanowires are also being developed to create hybrid systems with superior performance for next-generation flexible and wearable electronics.

02 Deposition methods for transparent conductive oxide films

Various deposition techniques are employed to create thin films of transparent conductive oxides on substrates. These methods include sputtering, chemical vapor deposition (CVD), pulsed laser deposition, and sol-gel processes. Each technique offers different advantages in terms of film quality, uniformity, and production efficiency. The deposition parameters such as temperature, pressure, and gas composition significantly affect the resulting film properties.Expand Specific Solutions03 Applications of transparent conductive oxides in electronic devices

Transparent conductive oxides are widely used in various electronic and optoelectronic devices. They serve as transparent electrodes in displays, touchscreens, solar cells, and light-emitting diodes. The combination of optical transparency and electrical conductivity makes these materials essential for modern electronic devices where visible light must pass through conductive layers. Recent developments focus on improving the performance of these materials for flexible electronics and high-efficiency photovoltaic applications.Expand Specific Solutions04 Novel transparent conductive oxide materials and composites

Research on new transparent conductive oxide materials aims to overcome limitations of traditional TCOs such as indium scarcity and brittleness. Novel materials include doped zinc oxide, aluminum-doped zinc oxide (AZO), fluorine-doped tin oxide (FTO), and various ternary compounds. Composite structures combining different TCO materials or TCOs with other materials like graphene or metal nanowires are being developed to achieve enhanced performance characteristics including better flexibility, conductivity, and transparency.Expand Specific Solutions05 Processing techniques to enhance TCO performance

Various post-deposition treatments and processing techniques are employed to enhance the performance of transparent conductive oxide films. These include thermal annealing, plasma treatment, laser processing, and chemical etching. Such processes can improve crystallinity, reduce defects, enhance carrier mobility, and optimize the trade-off between transparency and conductivity. Advanced patterning techniques allow for precise structuring of TCO layers for specific device architectures and applications.Expand Specific Solutions

Leading Companies in TCO Manufacturing

The transparent conductive oxides (TCO) market in power electronics is currently in a growth phase, with increasing adoption driven by the need for efficient, high-performance electronic devices. The global market is expanding steadily, projected to reach significant scale as power electronics applications diversify across renewable energy, automotive, and consumer electronics sectors. Technologically, TCOs are advancing from established materials toward novel compositions with enhanced properties. Leading players demonstrate varying levels of maturity: Samsung Electronics, TDK, and Micron Technology have established strong commercial positions, while research institutions like IMEC, ETRI, and NIMS are driving fundamental innovations. Academic players (Oregon State University, Peking University) collaborate with industrial partners (Sumitomo Metal Mining, DuPont) to bridge the gap between laboratory discoveries and commercial applications, creating a competitive landscape balanced between established manufacturers and emerging technology developers.

Samsung Electronics Co., Ltd.

Technical Solution: Samsung has developed advanced Transparent Conductive Oxide (TCO) materials, particularly focusing on indium tin oxide (ITO) and indium zinc oxide (IZO) for power electronic applications. Their technology integrates TCOs into wide-bandgap semiconductor devices, creating high-performance transparent electrodes with sheet resistance below 10 ohms/square while maintaining over 85% optical transparency. Samsung's approach involves atomic layer deposition (ALD) techniques to create ultra-thin, uniform TCO layers with precise thickness control down to nanometer scale. This enables integration with GaN and SiC power devices, improving thermal management and reducing parasitic capacitance. Their TCO-based power electronics demonstrate significantly reduced switching losses and higher operating frequencies (>1 MHz), making them suitable for high-efficiency power conversion systems in consumer electronics and automotive applications.

Strengths: Superior integration capabilities with existing semiconductor manufacturing processes; excellent balance of conductivity and transparency; proven scalability for mass production. Weaknesses: Reliance on indium, which faces supply constraints and price volatility; higher production costs compared to conventional electrode materials; limited high-temperature stability in certain power applications.

TDK Corp.

Technical Solution: TDK has pioneered innovative TCO materials specifically engineered for power electronic applications, focusing on aluminum-doped zinc oxide (AZO) and gallium-doped zinc oxide (GZO) as alternatives to traditional ITO. Their proprietary sputtering deposition technology creates TCO films with carrier concentrations exceeding 10^21 cm^-3 while maintaining mobility values above 40 cm²/Vs. TDK's TCO implementation in power devices features multi-layer structures with gradient doping profiles that optimize both electrical conductivity and optical transparency. These materials are integrated into their power semiconductor packages, particularly for high-voltage (>1200V) applications, where they serve as transparent electrodes and heat-spreading layers. TDK has demonstrated TCO-enhanced power modules with junction temperatures reduced by approximately 15°C compared to conventional designs, while maintaining electrical isolation properties critical for safety and reliability in power systems.

Strengths: Advanced materials expertise with indium-free TCO formulations; excellent thermal management properties; proven reliability in high-voltage applications. Weaknesses: Higher deposition temperatures required for optimal performance; slightly lower transparency compared to ITO-based solutions; more complex manufacturing process requiring specialized equipment.

Key TCO Patents and Technical Innovations

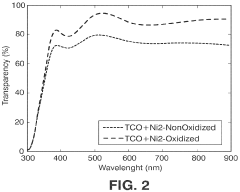

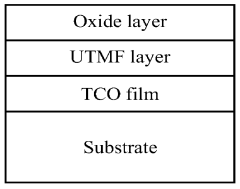

Transparent electrode based on combination of transparent conductive oxides, metals and oxides

PatentWO2011101338A2

Innovation

- A combination of transparent conductive oxides (TCOs) with an ultra-thin metal film (UTMF) and an oxide layer is proposed, where the UTMF is oxidized or covered by an oxide layer to enhance stability, compatibility, and reduce transparency loss, using materials like indium tin oxide, doped zinc oxide, and metals like Cu, Ni, and Cr, with a conductive mesh or nanowires for improved performance.

Method for fabricating organic optoelectronic devices and organic devices thereby obtained

PatentInactiveEP2256839A2

Innovation

- The use of doped metal oxide layers with enhanced electrical conductivity, formed through methods like thermal evaporation or electron beam evaporation, allows for thicker layers without increasing series resistance or reducing transparency, providing a buffer or optical spacer function while minimizing damage to underlying organic layers.

Material Sustainability and Supply Chain

The sustainability of transparent conductive oxide (TCO) materials represents a critical consideration for their long-term viability in power electronics applications. Indium tin oxide (ITO), the most widely used TCO, faces significant sustainability challenges due to the scarcity of indium, which is classified as a critical raw material by many governments. Global indium reserves are limited, with estimates suggesting potential supply constraints within the next few decades if consumption continues to increase at current rates. China currently dominates the indium supply chain, controlling approximately 60% of global production, creating geopolitical vulnerabilities for manufacturers in other regions.

Alternative TCO materials such as fluorine-doped tin oxide (FTO), aluminum-doped zinc oxide (AZO), and graphene-based composites offer more sustainable options with reduced supply chain risks. These alternatives utilize more abundant elements, potentially alleviating resource constraints while maintaining comparable performance characteristics for power electronics applications. The environmental impact of TCO production also warrants attention, as conventional manufacturing processes involve energy-intensive sputtering techniques and potentially hazardous chemicals.

Recent advancements in green synthesis methods for TCOs show promise for reducing environmental footprints. Solution-based processing techniques require lower temperatures and fewer toxic precursors than traditional vapor deposition methods. Additionally, circular economy approaches are emerging, with several companies developing recycling processes to recover indium and other valuable materials from end-of-life electronics. These recycling initiatives could significantly extend material availability while reducing primary extraction requirements.

Supply chain resilience for TCOs has become increasingly important following recent global disruptions. Diversification of material sources, development of regional manufacturing capabilities, and strategic stockpiling represent key strategies being adopted by forward-thinking companies in the power electronics sector. The European Union's Critical Raw Materials Act and similar initiatives in the United States aim to reduce dependency on imported materials through domestic production incentives and recycling programs.

Life cycle assessment studies indicate that while TCOs contribute to improved energy efficiency in power electronic devices during operation, their production phase can generate significant environmental impacts. Manufacturers are increasingly implementing responsible sourcing practices, including traceability systems and supplier certification programs, to ensure ethical and sustainable material acquisition. These efforts align with growing regulatory requirements and consumer expectations for environmentally responsible electronics.

The transition toward more sustainable TCO materials and supply chains will require coordinated efforts across the value chain, including continued research into alternative materials, investment in recycling infrastructure, and policy frameworks that incentivize sustainable practices. As power electronics applications continue to expand, particularly in renewable energy systems and electric vehicles, ensuring material sustainability will remain essential for long-term industry growth.

Alternative TCO materials such as fluorine-doped tin oxide (FTO), aluminum-doped zinc oxide (AZO), and graphene-based composites offer more sustainable options with reduced supply chain risks. These alternatives utilize more abundant elements, potentially alleviating resource constraints while maintaining comparable performance characteristics for power electronics applications. The environmental impact of TCO production also warrants attention, as conventional manufacturing processes involve energy-intensive sputtering techniques and potentially hazardous chemicals.

Recent advancements in green synthesis methods for TCOs show promise for reducing environmental footprints. Solution-based processing techniques require lower temperatures and fewer toxic precursors than traditional vapor deposition methods. Additionally, circular economy approaches are emerging, with several companies developing recycling processes to recover indium and other valuable materials from end-of-life electronics. These recycling initiatives could significantly extend material availability while reducing primary extraction requirements.

Supply chain resilience for TCOs has become increasingly important following recent global disruptions. Diversification of material sources, development of regional manufacturing capabilities, and strategic stockpiling represent key strategies being adopted by forward-thinking companies in the power electronics sector. The European Union's Critical Raw Materials Act and similar initiatives in the United States aim to reduce dependency on imported materials through domestic production incentives and recycling programs.

Life cycle assessment studies indicate that while TCOs contribute to improved energy efficiency in power electronic devices during operation, their production phase can generate significant environmental impacts. Manufacturers are increasingly implementing responsible sourcing practices, including traceability systems and supplier certification programs, to ensure ethical and sustainable material acquisition. These efforts align with growing regulatory requirements and consumer expectations for environmentally responsible electronics.

The transition toward more sustainable TCO materials and supply chains will require coordinated efforts across the value chain, including continued research into alternative materials, investment in recycling infrastructure, and policy frameworks that incentivize sustainable practices. As power electronics applications continue to expand, particularly in renewable energy systems and electric vehicles, ensuring material sustainability will remain essential for long-term industry growth.

Performance Benchmarking Metrics

To effectively evaluate Transparent Conductive Oxides (TCOs) for power electronics applications, standardized performance metrics must be established. These benchmarks provide quantitative frameworks for comparing different TCO materials and assessing their suitability for specific power electronic devices.

Electrical conductivity represents a primary performance metric, typically measured in Siemens per meter (S/m) or its inverse, resistivity (Ω·cm). Industry standards generally require TCOs to achieve resistivity values below 10^-3 Ω·cm for power electronic applications. Indium Tin Oxide (ITO) currently leads with resistivity as low as 1-2 × 10^-4 Ω·cm, while alternatives like Aluminum-doped Zinc Oxide (AZO) typically range from 5-8 × 10^-4 Ω·cm.

Optical transparency, quantified as transmittance percentage in the visible spectrum (400-700 nm), constitutes another critical metric. Power electronic applications typically demand transmittance exceeding 80% to ensure efficient light passage for optoelectronic integration. Premium ITO films achieve 85-90% transmittance, with fluorine-doped tin oxide (FTO) closely following at 80-85%.

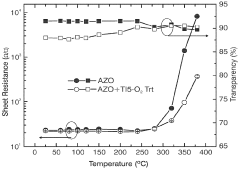

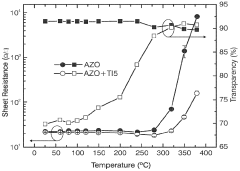

Thermal stability metrics evaluate performance degradation under elevated temperatures, essential for power electronics operating in high-temperature environments. Standard testing involves measuring conductivity retention after thermal cycling between room temperature and 400-600°C. AZO and gallium-doped zinc oxide (GZO) demonstrate superior thermal stability compared to ITO, maintaining over 90% of their electrical properties after extended exposure to 400°C.

Mechanical durability metrics include adhesion strength (measured in MPa), hardness (GPa), and flexibility (minimum bending radius). Power electronic applications typically require adhesion strength exceeding 15 MPa and hardness above 5 GPa. FTO exhibits superior mechanical properties with adhesion strength of 20-25 MPa compared to ITO's 12-18 MPa.

Chemical stability metrics assess resistance to environmental factors through accelerated aging tests in humidity chambers (85% RH, 85°C) and exposure to various chemicals. TCOs for power electronics should maintain at least 90% of initial conductivity after 1000 hours of environmental stress testing.

Cost-effectiveness metrics balance performance against manufacturing expenses, typically expressed as cost per unit area ($/m²) or cost per performance ratio. While ITO remains the performance benchmark, its high cost (~$200-300/m²) has driven interest in alternatives like AZO (~$80-120/m²) despite their moderately lower performance characteristics.

These standardized metrics enable objective comparison across different TCO materials, guiding material selection for specific power electronic applications based on their unique requirements and operating conditions.

Electrical conductivity represents a primary performance metric, typically measured in Siemens per meter (S/m) or its inverse, resistivity (Ω·cm). Industry standards generally require TCOs to achieve resistivity values below 10^-3 Ω·cm for power electronic applications. Indium Tin Oxide (ITO) currently leads with resistivity as low as 1-2 × 10^-4 Ω·cm, while alternatives like Aluminum-doped Zinc Oxide (AZO) typically range from 5-8 × 10^-4 Ω·cm.

Optical transparency, quantified as transmittance percentage in the visible spectrum (400-700 nm), constitutes another critical metric. Power electronic applications typically demand transmittance exceeding 80% to ensure efficient light passage for optoelectronic integration. Premium ITO films achieve 85-90% transmittance, with fluorine-doped tin oxide (FTO) closely following at 80-85%.

Thermal stability metrics evaluate performance degradation under elevated temperatures, essential for power electronics operating in high-temperature environments. Standard testing involves measuring conductivity retention after thermal cycling between room temperature and 400-600°C. AZO and gallium-doped zinc oxide (GZO) demonstrate superior thermal stability compared to ITO, maintaining over 90% of their electrical properties after extended exposure to 400°C.

Mechanical durability metrics include adhesion strength (measured in MPa), hardness (GPa), and flexibility (minimum bending radius). Power electronic applications typically require adhesion strength exceeding 15 MPa and hardness above 5 GPa. FTO exhibits superior mechanical properties with adhesion strength of 20-25 MPa compared to ITO's 12-18 MPa.

Chemical stability metrics assess resistance to environmental factors through accelerated aging tests in humidity chambers (85% RH, 85°C) and exposure to various chemicals. TCOs for power electronics should maintain at least 90% of initial conductivity after 1000 hours of environmental stress testing.

Cost-effectiveness metrics balance performance against manufacturing expenses, typically expressed as cost per unit area ($/m²) or cost per performance ratio. While ITO remains the performance benchmark, its high cost (~$200-300/m²) has driven interest in alternatives like AZO (~$80-120/m²) despite their moderately lower performance characteristics.

These standardized metrics enable objective comparison across different TCO materials, guiding material selection for specific power electronic applications based on their unique requirements and operating conditions.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!