Research on Transparent Conductive Oxides for Solar Thermal Systems

OCT 27, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

TCO Development History and Objectives

Transparent Conductive Oxides (TCOs) emerged in the early 20th century with the discovery of cadmium oxide's unique properties in 1907. However, significant development began in the 1940s with tin-doped indium oxide (ITO) research. The 1970s energy crisis catalyzed interest in solar applications, marking a pivotal moment for TCO development in renewable energy systems. By the 1980s, fluorine-doped tin oxide (FTO) and aluminum-doped zinc oxide (AZO) emerged as viable alternatives to the increasingly expensive ITO.

The evolution of TCOs has been characterized by continuous improvements in optical transparency and electrical conductivity. Early materials exhibited transparency of approximately 80% with sheet resistances in the range of 100 Ω/sq. Modern TCOs now routinely achieve over 90% transparency with resistances below 10 Ω/sq, representing remarkable progress in material engineering and deposition techniques.

For solar thermal applications specifically, TCO development has focused on enhancing selective absorption properties while maintaining high temperature stability. The 1990s saw significant advancements in magnetron sputtering and chemical vapor deposition techniques, enabling precise control over TCO film thickness and composition. These manufacturing improvements facilitated wider commercial adoption in various solar thermal technologies.

Recent developments have concentrated on addressing sustainability concerns by reducing dependence on scarce elements like indium. Research has expanded to explore novel materials such as graphene-based transparent conductors and conductive polymers as potential TCO alternatives. Additionally, the integration of TCOs with other functional layers to create multifunctional coatings represents an important trend in maximizing solar thermal efficiency.

The primary objectives of current TCO research for solar thermal systems include achieving higher temperature stability (>400°C), improving long-term durability under solar radiation exposure, and developing cost-effective manufacturing processes for large-scale deployment. Researchers aim to optimize the spectral selectivity of TCO-based coatings to maximize solar absorption while minimizing thermal re-radiation losses.

Another critical objective is enhancing the mechanical robustness of TCO films to withstand thermal cycling and environmental stresses. This includes developing crack-resistant formulations and improved adhesion to various substrates. Furthermore, research efforts are directed toward environmentally friendly TCO compositions that eliminate toxic elements while maintaining performance parameters.

The ultimate goal is to develop TCO materials and associated technologies that can significantly improve the efficiency and cost-effectiveness of solar thermal systems, thereby accelerating the global transition to renewable energy sources and reducing carbon emissions from heating applications across residential, commercial, and industrial sectors.

The evolution of TCOs has been characterized by continuous improvements in optical transparency and electrical conductivity. Early materials exhibited transparency of approximately 80% with sheet resistances in the range of 100 Ω/sq. Modern TCOs now routinely achieve over 90% transparency with resistances below 10 Ω/sq, representing remarkable progress in material engineering and deposition techniques.

For solar thermal applications specifically, TCO development has focused on enhancing selective absorption properties while maintaining high temperature stability. The 1990s saw significant advancements in magnetron sputtering and chemical vapor deposition techniques, enabling precise control over TCO film thickness and composition. These manufacturing improvements facilitated wider commercial adoption in various solar thermal technologies.

Recent developments have concentrated on addressing sustainability concerns by reducing dependence on scarce elements like indium. Research has expanded to explore novel materials such as graphene-based transparent conductors and conductive polymers as potential TCO alternatives. Additionally, the integration of TCOs with other functional layers to create multifunctional coatings represents an important trend in maximizing solar thermal efficiency.

The primary objectives of current TCO research for solar thermal systems include achieving higher temperature stability (>400°C), improving long-term durability under solar radiation exposure, and developing cost-effective manufacturing processes for large-scale deployment. Researchers aim to optimize the spectral selectivity of TCO-based coatings to maximize solar absorption while minimizing thermal re-radiation losses.

Another critical objective is enhancing the mechanical robustness of TCO films to withstand thermal cycling and environmental stresses. This includes developing crack-resistant formulations and improved adhesion to various substrates. Furthermore, research efforts are directed toward environmentally friendly TCO compositions that eliminate toxic elements while maintaining performance parameters.

The ultimate goal is to develop TCO materials and associated technologies that can significantly improve the efficiency and cost-effectiveness of solar thermal systems, thereby accelerating the global transition to renewable energy sources and reducing carbon emissions from heating applications across residential, commercial, and industrial sectors.

Solar Thermal Market Analysis

The global solar thermal market has been experiencing significant growth, driven by increasing energy demands, environmental concerns, and the push for renewable energy sources. As of 2023, the market size for solar thermal systems reached approximately $25 billion, with projections indicating a compound annual growth rate (CAGR) of 6.8% through 2030. This growth trajectory is particularly pronounced in regions with high solar irradiation, including the Middle East, North Africa, Southern Europe, and parts of Asia and Australia.

Residential applications currently dominate the market share at 42%, followed by commercial (31%) and industrial (27%) applications. The industrial segment, however, is expected to witness the fastest growth due to increasing adoption in process heating, desalination, and enhanced oil recovery operations. Geographically, China leads the market with over 70% of global installations, followed by Europe (10%), Turkey (5%), and the United States (4%).

The demand for more efficient solar thermal systems has created a substantial market opportunity for advanced materials, particularly Transparent Conductive Oxides (TCOs). These materials are crucial for improving the performance of solar collectors and reducing system costs. The global market for TCOs in solar thermal applications was valued at $1.2 billion in 2022 and is projected to reach $2.5 billion by 2028.

Key market drivers include government incentives and subsidies, decreasing installation costs, and increasing awareness of environmental benefits. Several countries have implemented favorable policies, such as tax credits, rebates, and renewable portfolio standards, which have significantly boosted market growth. For instance, China's solar thermal subsidy program has led to a 15% annual increase in installations since 2018.

Despite positive growth indicators, the market faces challenges including competition from other renewable technologies, particularly photovoltaics, which have seen dramatic cost reductions in recent years. Additionally, high initial investment costs and technical limitations in certain climatic conditions continue to constrain market expansion in some regions.

Consumer trends indicate growing preference for integrated systems that combine solar thermal with other renewable technologies. Hybrid PV-thermal systems, which produce both electricity and heat, are gaining traction with a market growth rate of 12% annually. Furthermore, building-integrated solar thermal systems are emerging as a promising segment, particularly in urban areas where space constraints are significant.

Residential applications currently dominate the market share at 42%, followed by commercial (31%) and industrial (27%) applications. The industrial segment, however, is expected to witness the fastest growth due to increasing adoption in process heating, desalination, and enhanced oil recovery operations. Geographically, China leads the market with over 70% of global installations, followed by Europe (10%), Turkey (5%), and the United States (4%).

The demand for more efficient solar thermal systems has created a substantial market opportunity for advanced materials, particularly Transparent Conductive Oxides (TCOs). These materials are crucial for improving the performance of solar collectors and reducing system costs. The global market for TCOs in solar thermal applications was valued at $1.2 billion in 2022 and is projected to reach $2.5 billion by 2028.

Key market drivers include government incentives and subsidies, decreasing installation costs, and increasing awareness of environmental benefits. Several countries have implemented favorable policies, such as tax credits, rebates, and renewable portfolio standards, which have significantly boosted market growth. For instance, China's solar thermal subsidy program has led to a 15% annual increase in installations since 2018.

Despite positive growth indicators, the market faces challenges including competition from other renewable technologies, particularly photovoltaics, which have seen dramatic cost reductions in recent years. Additionally, high initial investment costs and technical limitations in certain climatic conditions continue to constrain market expansion in some regions.

Consumer trends indicate growing preference for integrated systems that combine solar thermal with other renewable technologies. Hybrid PV-thermal systems, which produce both electricity and heat, are gaining traction with a market growth rate of 12% annually. Furthermore, building-integrated solar thermal systems are emerging as a promising segment, particularly in urban areas where space constraints are significant.

Current TCO Technologies and Barriers

Transparent Conductive Oxides (TCOs) represent a critical component in solar thermal systems, offering the dual functionality of electrical conductivity and optical transparency. Currently, the most widely deployed TCO materials include Indium Tin Oxide (ITO), Fluorine-doped Tin Oxide (FTO), and Aluminum-doped Zinc Oxide (AZO). ITO dominates the market due to its excellent combination of high transparency (>85% in visible spectrum) and low sheet resistance (<10 Ω/sq), making it ideal for solar applications requiring efficient light transmission and electrical conductivity.

Despite its superior performance, ITO faces significant challenges that limit its broader adoption in solar thermal systems. The primary concern is the scarcity and high cost of indium, which has been classified as a critical raw material by many countries. Current market prices for indium have shown volatility, with costs exceeding $600/kg in recent years, creating economic barriers for large-scale solar implementations.

FTO presents a more cost-effective alternative with good thermal stability up to 600°C, making it suitable for high-temperature solar thermal applications. However, its higher sheet resistance compared to ITO (typically 15-25 Ω/sq) results in reduced electrical performance. AZO offers another alternative with abundant raw materials, but suffers from poor moisture resistance and degradation under humid conditions, limiting its longevity in outdoor solar installations.

Manufacturing scalability presents another significant barrier. Current deposition techniques for high-quality TCOs include magnetron sputtering, chemical vapor deposition, and sol-gel processes. These methods often require high vacuum conditions or elevated temperatures, increasing production costs and energy consumption. The trade-off between deposition rate and film quality remains a persistent challenge, particularly for large-area solar thermal collectors.

Environmental stability represents a critical barrier for TCO implementation in solar thermal systems. Most TCOs experience performance degradation under prolonged exposure to elevated temperatures, humidity, and UV radiation—conditions inherent to solar thermal applications. AZO films, for instance, can lose up to 40% of their conductivity after 1000 hours of damp heat exposure (85°C, 85% relative humidity).

The interface compatibility between TCOs and other solar thermal system components presents additional challenges. Thermal expansion coefficient mismatches can lead to delamination and cracking during thermal cycling. Furthermore, chemical interactions at interfaces may cause degradation of electrical and optical properties over time, reducing system efficiency and longevity.

Achieving the optimal balance between optical transparency and electrical conductivity remains an ongoing challenge. Increasing conductivity typically requires higher carrier concentration or mobility, which often comes at the expense of reduced optical transparency due to increased free carrier absorption, particularly in the near-infrared region critical for solar thermal applications.

Despite its superior performance, ITO faces significant challenges that limit its broader adoption in solar thermal systems. The primary concern is the scarcity and high cost of indium, which has been classified as a critical raw material by many countries. Current market prices for indium have shown volatility, with costs exceeding $600/kg in recent years, creating economic barriers for large-scale solar implementations.

FTO presents a more cost-effective alternative with good thermal stability up to 600°C, making it suitable for high-temperature solar thermal applications. However, its higher sheet resistance compared to ITO (typically 15-25 Ω/sq) results in reduced electrical performance. AZO offers another alternative with abundant raw materials, but suffers from poor moisture resistance and degradation under humid conditions, limiting its longevity in outdoor solar installations.

Manufacturing scalability presents another significant barrier. Current deposition techniques for high-quality TCOs include magnetron sputtering, chemical vapor deposition, and sol-gel processes. These methods often require high vacuum conditions or elevated temperatures, increasing production costs and energy consumption. The trade-off between deposition rate and film quality remains a persistent challenge, particularly for large-area solar thermal collectors.

Environmental stability represents a critical barrier for TCO implementation in solar thermal systems. Most TCOs experience performance degradation under prolonged exposure to elevated temperatures, humidity, and UV radiation—conditions inherent to solar thermal applications. AZO films, for instance, can lose up to 40% of their conductivity after 1000 hours of damp heat exposure (85°C, 85% relative humidity).

The interface compatibility between TCOs and other solar thermal system components presents additional challenges. Thermal expansion coefficient mismatches can lead to delamination and cracking during thermal cycling. Furthermore, chemical interactions at interfaces may cause degradation of electrical and optical properties over time, reducing system efficiency and longevity.

Achieving the optimal balance between optical transparency and electrical conductivity remains an ongoing challenge. Increasing conductivity typically requires higher carrier concentration or mobility, which often comes at the expense of reduced optical transparency due to increased free carrier absorption, particularly in the near-infrared region critical for solar thermal applications.

State-of-the-Art TCO Solutions for Solar Thermal Applications

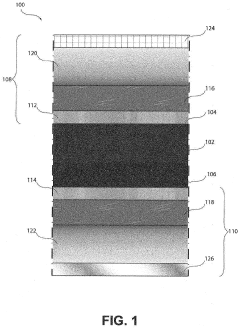

01 Composition and structure of transparent conductive oxides

Transparent conductive oxides (TCOs) are materials that combine electrical conductivity with optical transparency. These materials typically consist of metal oxides doped with specific elements to enhance their electrical properties while maintaining transparency. Common TCO compositions include indium tin oxide (ITO), zinc oxide (ZnO), and tin oxide (SnO2). The crystalline structure and composition significantly influence the performance characteristics of these materials, making them suitable for various electronic and optoelectronic applications.- Composition and structure of transparent conductive oxides: Transparent conductive oxides (TCOs) are materials that combine electrical conductivity with optical transparency. These materials typically consist of metal oxides doped with specific elements to enhance their electrical properties while maintaining transparency. Common TCO compositions include indium tin oxide (ITO), zinc oxide (ZnO), and tin oxide (SnO2). The crystalline structure and composition significantly influence the performance characteristics of these materials, making them suitable for various electronic and optoelectronic applications.

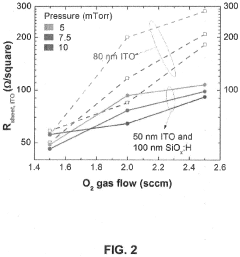

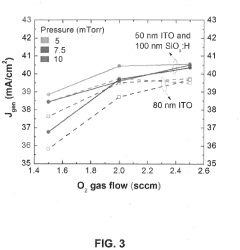

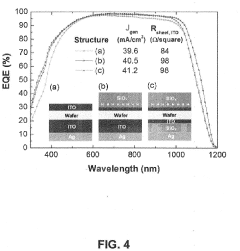

- Deposition methods for transparent conductive oxide films: Various deposition techniques are employed to create thin films of transparent conductive oxides on different substrates. These methods include sputtering, chemical vapor deposition (CVD), atomic layer deposition (ALD), and sol-gel processes. Each technique offers specific advantages in terms of film quality, uniformity, and scalability. The deposition parameters, such as temperature, pressure, and gas flow rates, significantly affect the electrical conductivity, optical transparency, and structural properties of the resulting TCO films.

- Applications of transparent conductive oxides in electronic devices: Transparent conductive oxides are widely used in various electronic and optoelectronic devices. They serve as transparent electrodes in displays, touchscreens, solar cells, and light-emitting diodes (LEDs). The unique combination of electrical conductivity and optical transparency makes TCOs essential components in these devices. Recent advancements have focused on improving the performance of TCOs for flexible electronics, enhancing their compatibility with next-generation devices that require bendable and stretchable components.

- Doping strategies to enhance properties of transparent conductive oxides: Doping is a critical approach to modify and enhance the properties of transparent conductive oxides. By introducing specific elements into the crystal lattice of TCOs, their electrical conductivity, optical transparency, and stability can be significantly improved. Common dopants include aluminum, gallium, and fluorine for zinc oxide, and antimony for tin oxide. The concentration and distribution of dopants within the TCO structure play crucial roles in determining the final properties of the material, allowing for customization based on specific application requirements.

- Novel transparent conductive oxide materials and composites: Research in transparent conductive oxides has expanded to include novel materials and composites that offer improved performance or specific functionalities. These include multi-component oxides, nanostructured TCOs, and hybrid materials combining TCOs with other functional components. Emerging TCO materials aim to address limitations of traditional options, such as the scarcity of indium in ITO, by developing alternatives based on more abundant elements. Additionally, composite structures that combine different TCOs or incorporate other materials like graphene or metal nanowires are being developed to achieve enhanced electrical, optical, and mechanical properties.

02 Deposition methods for transparent conductive oxide films

Various deposition techniques are employed to create thin films of transparent conductive oxides on different substrates. These methods include sputtering, chemical vapor deposition (CVD), pulsed laser deposition, and sol-gel processes. Each technique offers specific advantages in terms of film quality, uniformity, adhesion, and production efficiency. The deposition parameters significantly affect the electrical conductivity, optical transparency, and overall performance of the resulting TCO films.Expand Specific Solutions03 Applications of transparent conductive oxides in electronic devices

Transparent conductive oxides are widely used in various electronic and optoelectronic devices. They serve as essential components in touch screens, flat panel displays, solar cells, smart windows, and light-emitting diodes (LEDs). Their unique combination of electrical conductivity and optical transparency makes them ideal for applications requiring transparent electrodes. The specific properties of different TCO materials can be tailored to meet the requirements of particular applications, enhancing device performance and enabling new functionalities.Expand Specific Solutions04 Doping strategies to enhance TCO performance

Doping is a critical approach to enhance the electrical and optical properties of transparent conductive oxides. Various dopants, including aluminum, gallium, indium, and fluorine, are incorporated into the oxide matrix to increase carrier concentration and mobility. The type and concentration of dopants significantly influence the conductivity, transparency, and stability of TCO materials. Advanced doping strategies aim to achieve an optimal balance between high electrical conductivity and optical transparency while maintaining long-term stability under various operating conditions.Expand Specific Solutions05 Novel TCO materials and composite structures

Research on transparent conductive oxides has expanded to include novel materials and composite structures with enhanced properties. These include multicomponent oxides, nanostructured TCOs, and hybrid materials combining TCOs with other functional components. Such advanced materials aim to overcome the limitations of conventional TCOs, offering improved electrical conductivity, optical transparency, flexibility, and environmental stability. Innovative approaches include the development of TCO nanocomposites, multilayer structures, and materials with reduced reliance on scarce elements like indium.Expand Specific Solutions

Leading TCO Manufacturers and Research Institutions

Transparent Conductive Oxides (TCOs) for solar thermal systems are in a growth phase, with the market expanding due to increasing renewable energy demands. The global TCO market is projected to reach significant scale as solar applications proliferate. Technologically, the field shows varying maturity levels across different applications. Leading players include established materials companies like AGC, Sumitomo Chemical, and Mitsubishi Materials, who bring extensive manufacturing expertise. Research institutions such as ITRI and Fudan University contribute fundamental innovations, while solar specialists like First Solar, Trina Solar, and JinkoSolar focus on application-specific developments. Electronics giants including Samsung and Applied Materials leverage their thin-film expertise to advance TCO technologies. The competitive landscape features both vertical integration strategies and specialized technology approaches, with increasing collaboration between academic and industrial partners.

AGC, Inc. (Japan)

Technical Solution: AGC has developed advanced TCO coatings specifically engineered for solar thermal applications through their Asahi Glass technology division. Their flagship product utilizes tin-doped indium oxide (ITO) and fluorine-doped tin oxide (FTO) deposited via proprietary sputtering and APCVD processes. AGC's TCO technology achieves sheet resistance values as low as 5-7 ohms/square while maintaining optical transparency above 85% in the visible spectrum. Their coatings feature a multi-layer architecture that includes anti-reflection and barrier layers to enhance solar transmission and protect the TCO from environmental degradation. AGC has pioneered the development of indium-free TCO alternatives, including aluminum-doped zinc oxide (AZO) formulations that offer comparable performance to ITO at reduced cost. Their manufacturing facilities can produce TCO-coated glass in dimensions up to 3.21m × 6m, enabling large-scale solar thermal installations. AGC's TCO coatings demonstrate exceptional thermal stability, maintaining their electrical and optical properties at operating temperatures up to 600°C.

Strengths: Extensive glass manufacturing expertise; large-scale production capacity; advanced multi-layer coating technology. Weaknesses: Premium ITO formulations remain dependent on scarce indium resources; specialized high-performance coatings command price premiums.

Applied Materials, Inc.

Technical Solution: Applied Materials has developed advanced deposition technologies for transparent conductive oxides (TCOs) specifically optimized for solar thermal applications. Their proprietary Physical Vapor Deposition (PVD) and Chemical Vapor Deposition (CVD) systems enable precise control over TCO film properties including thickness uniformity, crystallinity, and electrical conductivity. Their PECVD technology allows for low-temperature deposition of indium tin oxide (ITO) and aluminum-doped zinc oxide (AZO) with sheet resistances below 10 ohms/square while maintaining >85% optical transparency in the visible spectrum. Applied Materials' TCO solutions incorporate dopant gradient technology that optimizes the trade-off between conductivity and transparency, crucial for maximizing solar thermal efficiency. Their manufacturing systems can process large-area substrates up to Gen 10.5 size, enabling cost-effective production of TCO coatings for industrial-scale solar thermal applications.

Strengths: Industry-leading deposition equipment with precise control over film properties; scalable manufacturing solutions for large-area substrates; extensive materials expertise. Weaknesses: Higher capital equipment costs compared to simpler deposition methods; requires specialized technical expertise to operate and maintain advanced systems.

Key TCO Patents and Scientific Breakthroughs

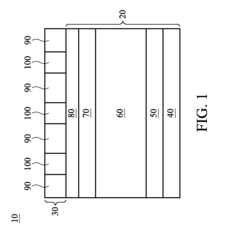

Transparent Conductive Oxide in Silicon Heterojunction Solar Cells

PatentInactiveUS20190393365A1

Innovation

- The use of hydrogenated dielectric layers to reduce TCO layer thickness and enhance conductivity, specifically through ITO/SiOx:H stacks with post-deposition annealing, and integration with Cu plating to improve optical response and resistance.

Transparent conductive oxide layer with high-transmittance structures and methods of making the same

PatentInactiveUS20140251418A1

Innovation

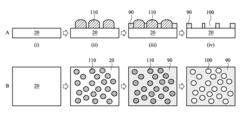

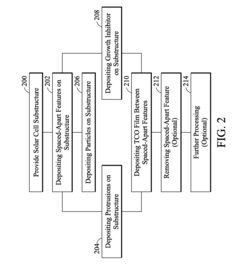

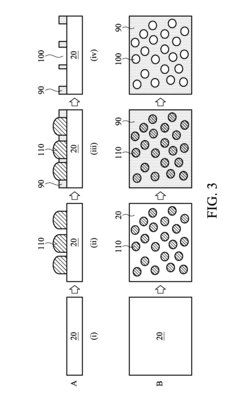

- Incorporating spaced-apart, high-transmittance structures within the TCO layer, which are not in direct contact with each other, allowing for increased conductivity while maintaining sufficient transmittance of absorbable radiation, using materials like aluminum-doped ZnO, gallium-doped ZnO, and indium tin oxide, and forming these structures through techniques such as chemical vapor deposition and physical vapor deposition.

Environmental Impact Assessment

The environmental impact of Transparent Conductive Oxides (TCOs) in solar thermal systems requires comprehensive assessment across their entire lifecycle. Manufacturing processes for TCOs such as Indium Tin Oxide (ITO), Fluorine-doped Tin Oxide (FTO), and Aluminum-doped Zinc Oxide (AZO) involve energy-intensive methods including sputtering, chemical vapor deposition, and sol-gel techniques that contribute significantly to carbon emissions and resource depletion.

Raw material extraction presents particular concerns, especially regarding indium, which faces supply constraints due to its scarcity and geopolitical extraction challenges. Mining operations for these materials often result in habitat disruption, soil degradation, and potential water contamination in extraction regions. The refining processes further compound environmental impacts through high energy consumption and chemical waste generation.

During the operational phase, TCOs demonstrate positive environmental attributes by enhancing solar thermal system efficiency, thereby offsetting initial production impacts through reduced fossil fuel dependency. Life cycle assessments indicate that most TCO-enhanced solar thermal systems achieve carbon payback within 1-3 years, depending on geographical location and system configuration, while their operational lifespan typically extends to 20-25 years.

End-of-life considerations reveal significant challenges in TCO recycling and disposal. Current recycling rates for indium from discarded solar applications remain below 1% globally, representing a critical sustainability gap. Improper disposal risks leaching of metal oxides into soil and groundwater systems, creating potential long-term environmental hazards.

Recent innovations are addressing these environmental concerns through development of indium-free alternatives like graphene-based conductors and PEDOT:PSS organic conductors. Additionally, manufacturers are implementing cleaner production techniques including closed-loop water systems and energy-efficient deposition methods that reduce environmental footprint by up to 40% compared to conventional processes.

Regulatory frameworks worldwide are increasingly mandating environmental impact assessments for TCO production and application. The European Union's Restriction of Hazardous Substances (RoHS) directive and similar regulations in other regions are driving industry adoption of more sustainable practices and materials in TCO development for solar thermal applications.

Future research priorities should focus on developing TCOs with reduced environmental impact through abundant, non-toxic materials and energy-efficient manufacturing processes, while simultaneously improving end-of-life recyclability to establish truly sustainable circular economy models for these critical components in renewable energy systems.

Raw material extraction presents particular concerns, especially regarding indium, which faces supply constraints due to its scarcity and geopolitical extraction challenges. Mining operations for these materials often result in habitat disruption, soil degradation, and potential water contamination in extraction regions. The refining processes further compound environmental impacts through high energy consumption and chemical waste generation.

During the operational phase, TCOs demonstrate positive environmental attributes by enhancing solar thermal system efficiency, thereby offsetting initial production impacts through reduced fossil fuel dependency. Life cycle assessments indicate that most TCO-enhanced solar thermal systems achieve carbon payback within 1-3 years, depending on geographical location and system configuration, while their operational lifespan typically extends to 20-25 years.

End-of-life considerations reveal significant challenges in TCO recycling and disposal. Current recycling rates for indium from discarded solar applications remain below 1% globally, representing a critical sustainability gap. Improper disposal risks leaching of metal oxides into soil and groundwater systems, creating potential long-term environmental hazards.

Recent innovations are addressing these environmental concerns through development of indium-free alternatives like graphene-based conductors and PEDOT:PSS organic conductors. Additionally, manufacturers are implementing cleaner production techniques including closed-loop water systems and energy-efficient deposition methods that reduce environmental footprint by up to 40% compared to conventional processes.

Regulatory frameworks worldwide are increasingly mandating environmental impact assessments for TCO production and application. The European Union's Restriction of Hazardous Substances (RoHS) directive and similar regulations in other regions are driving industry adoption of more sustainable practices and materials in TCO development for solar thermal applications.

Future research priorities should focus on developing TCOs with reduced environmental impact through abundant, non-toxic materials and energy-efficient manufacturing processes, while simultaneously improving end-of-life recyclability to establish truly sustainable circular economy models for these critical components in renewable energy systems.

Cost-Performance Analysis

The cost-performance analysis of Transparent Conductive Oxides (TCOs) for solar thermal systems reveals a complex interplay between material costs, manufacturing processes, and performance metrics. Current market analysis indicates that indium tin oxide (ITO) remains the industry standard despite its relatively high cost, with material expenses ranging from $600-800 per kilogram of indium. This premium pricing creates significant cost pressures for large-scale solar thermal applications.

Alternative TCO materials demonstrate varying cost-performance ratios. Fluorine-doped tin oxide (FTO) offers manufacturing costs approximately 40-50% lower than ITO while maintaining 85-90% of the optical performance. Aluminum-doped zinc oxide (AZO) presents an even more economical option at 30-35% of ITO's cost, though with reduced environmental stability that may increase long-term maintenance expenses.

Performance metrics across these materials show notable trade-offs. ITO provides superior conductivity (sheet resistance <10 Ω/sq) and excellent transparency (>90% in visible spectrum), but its brittleness and indium scarcity impact scalability. FTO demonstrates enhanced thermal stability crucial for solar thermal applications, withstanding temperatures up to 600°C without degradation, though with slightly lower transparency (85-88%).

Manufacturing process selection significantly influences the cost-performance equation. Magnetron sputtering delivers premium quality films but at higher production costs ($8-12 per square meter), while spray pyrolysis offers more economical production ($3-5 per square meter) with moderate performance trade-offs. Recent advancements in solution-based deposition methods have reduced processing costs by up to 60% compared to vacuum-based techniques.

Lifecycle cost analysis reveals that while initial implementation costs favor cheaper alternatives like AZO, the total cost of ownership over a 20-year period may actually favor more durable options like FTO. Efficiency calculations indicate that premium TCOs can improve overall system efficiency by 3-5%, potentially offsetting their higher initial costs through improved energy harvesting.

Emerging doped binary oxides (Ga:ZnO, Nb:TiO2) show promising cost-performance metrics in laboratory settings, with material costs 25-30% lower than conventional options while maintaining comparable optical and electrical properties. However, these materials require further development to address stability issues and manufacturing scalability before commercial implementation.

The sensitivity analysis of cost factors indicates that production scale significantly impacts unit economics, with large-scale manufacturing (>100,000 m²/year) reducing TCO costs by up to 40% compared to small-batch production, suggesting economies of scale as a critical factor in future commercial viability.

Alternative TCO materials demonstrate varying cost-performance ratios. Fluorine-doped tin oxide (FTO) offers manufacturing costs approximately 40-50% lower than ITO while maintaining 85-90% of the optical performance. Aluminum-doped zinc oxide (AZO) presents an even more economical option at 30-35% of ITO's cost, though with reduced environmental stability that may increase long-term maintenance expenses.

Performance metrics across these materials show notable trade-offs. ITO provides superior conductivity (sheet resistance <10 Ω/sq) and excellent transparency (>90% in visible spectrum), but its brittleness and indium scarcity impact scalability. FTO demonstrates enhanced thermal stability crucial for solar thermal applications, withstanding temperatures up to 600°C without degradation, though with slightly lower transparency (85-88%).

Manufacturing process selection significantly influences the cost-performance equation. Magnetron sputtering delivers premium quality films but at higher production costs ($8-12 per square meter), while spray pyrolysis offers more economical production ($3-5 per square meter) with moderate performance trade-offs. Recent advancements in solution-based deposition methods have reduced processing costs by up to 60% compared to vacuum-based techniques.

Lifecycle cost analysis reveals that while initial implementation costs favor cheaper alternatives like AZO, the total cost of ownership over a 20-year period may actually favor more durable options like FTO. Efficiency calculations indicate that premium TCOs can improve overall system efficiency by 3-5%, potentially offsetting their higher initial costs through improved energy harvesting.

Emerging doped binary oxides (Ga:ZnO, Nb:TiO2) show promising cost-performance metrics in laboratory settings, with material costs 25-30% lower than conventional options while maintaining comparable optical and electrical properties. However, these materials require further development to address stability issues and manufacturing scalability before commercial implementation.

The sensitivity analysis of cost factors indicates that production scale significantly impacts unit economics, with large-scale manufacturing (>100,000 m²/year) reducing TCO costs by up to 40% compared to small-batch production, suggesting economies of scale as a critical factor in future commercial viability.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!