Comparing Efficiency Gains Of SiC MOSFETs Across Industries

SEP 8, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

SiC MOSFET Evolution and Objectives

Silicon Carbide (SiC) MOSFETs represent a revolutionary advancement in power semiconductor technology, emerging as a superior alternative to traditional silicon-based devices. The evolution of SiC MOSFETs began in the early 2000s when researchers first demonstrated their potential for high-temperature, high-frequency, and high-power applications. Since then, the technology has undergone significant refinement, moving from laboratory curiosities to commercially viable products that are reshaping multiple industries.

The fundamental advantage of SiC lies in its wide bandgap properties, which enable devices to operate at higher temperatures, voltages, and switching frequencies while maintaining exceptional efficiency. Early SiC MOSFETs faced challenges related to manufacturing consistency, gate oxide reliability, and high production costs. However, continuous innovation in material science and fabrication techniques has progressively addressed these limitations.

From 2010 to 2015, the industry witnessed substantial improvements in SiC substrate quality and device design, leading to the first generation of commercially viable SiC MOSFETs. The period between 2015 and 2020 marked accelerated adoption across automotive, renewable energy, and industrial sectors, driven by significant performance enhancements and cost reductions. Current third-generation devices offer remarkable efficiency gains, with switching losses reduced by up to 80% compared to silicon IGBTs.

The technical objectives for SiC MOSFET development focus on several key areas. First, further reducing specific on-resistance (RDS(on)) to minimize conduction losses, particularly for high-voltage applications above 1200V. Second, enhancing long-term reliability through improved gate oxide stability and reduced threshold voltage drift. Third, optimizing packaging technologies to fully exploit SiC's thermal capabilities while minimizing parasitic inductances that limit switching performance.

Industry roadmaps project continued improvements in SiC MOSFET performance metrics, with targets including 50% reduction in switching losses by 2025 and 30% decrease in manufacturing costs. These advancements aim to expand SiC adoption into more price-sensitive applications and enable new use cases where silicon technology has reached its physical limits.

Cross-industry efficiency comparisons reveal varying degrees of impact. In electric vehicles, SiC MOSFETs enable 5-10% improvements in driving range and significant reductions in charging time. For renewable energy systems, particularly solar inverters, efficiency gains of 1-2% translate to substantial energy harvest improvements over system lifetime. In industrial motor drives, SiC enables more compact designs with 30-40% reduction in cooling requirements and up to 3% higher system efficiency.

The trajectory of SiC MOSFET evolution points toward continued performance improvements, with research focusing on novel device architectures, advanced manufacturing techniques, and integration with intelligent control systems to maximize efficiency gains across diverse application environments.

The fundamental advantage of SiC lies in its wide bandgap properties, which enable devices to operate at higher temperatures, voltages, and switching frequencies while maintaining exceptional efficiency. Early SiC MOSFETs faced challenges related to manufacturing consistency, gate oxide reliability, and high production costs. However, continuous innovation in material science and fabrication techniques has progressively addressed these limitations.

From 2010 to 2015, the industry witnessed substantial improvements in SiC substrate quality and device design, leading to the first generation of commercially viable SiC MOSFETs. The period between 2015 and 2020 marked accelerated adoption across automotive, renewable energy, and industrial sectors, driven by significant performance enhancements and cost reductions. Current third-generation devices offer remarkable efficiency gains, with switching losses reduced by up to 80% compared to silicon IGBTs.

The technical objectives for SiC MOSFET development focus on several key areas. First, further reducing specific on-resistance (RDS(on)) to minimize conduction losses, particularly for high-voltage applications above 1200V. Second, enhancing long-term reliability through improved gate oxide stability and reduced threshold voltage drift. Third, optimizing packaging technologies to fully exploit SiC's thermal capabilities while minimizing parasitic inductances that limit switching performance.

Industry roadmaps project continued improvements in SiC MOSFET performance metrics, with targets including 50% reduction in switching losses by 2025 and 30% decrease in manufacturing costs. These advancements aim to expand SiC adoption into more price-sensitive applications and enable new use cases where silicon technology has reached its physical limits.

Cross-industry efficiency comparisons reveal varying degrees of impact. In electric vehicles, SiC MOSFETs enable 5-10% improvements in driving range and significant reductions in charging time. For renewable energy systems, particularly solar inverters, efficiency gains of 1-2% translate to substantial energy harvest improvements over system lifetime. In industrial motor drives, SiC enables more compact designs with 30-40% reduction in cooling requirements and up to 3% higher system efficiency.

The trajectory of SiC MOSFET evolution points toward continued performance improvements, with research focusing on novel device architectures, advanced manufacturing techniques, and integration with intelligent control systems to maximize efficiency gains across diverse application environments.

Market Demand Analysis for SiC Power Semiconductors

The global market for Silicon Carbide (SiC) power semiconductors is experiencing unprecedented growth, driven by increasing demand for high-efficiency power electronics across multiple industries. Current market valuations place the SiC power semiconductor market at approximately 2.1 billion USD in 2023, with projections indicating a compound annual growth rate (CAGR) of 18-20% through 2030, potentially reaching 6.5 billion USD by the end of the decade.

The automotive sector represents the largest and fastest-growing market segment for SiC MOSFETs, accounting for nearly 60% of total demand. This surge is primarily fueled by the rapid expansion of electric vehicle (EV) production, where SiC-based power electronics deliver significant advantages in range extension, charging efficiency, and overall vehicle performance. Major automotive manufacturers have reported 5-10% improvements in vehicle range and up to 30% reduction in charging times when implementing SiC technology in their powertrain systems.

Industrial applications constitute the second-largest market segment, with particular growth in variable frequency drives, industrial motor controls, and renewable energy systems. The industrial sector values SiC MOSFETs for their ability to operate at higher temperatures and switching frequencies, resulting in smaller form factors and reduced cooling requirements. Market research indicates that industrial users can achieve energy savings of 15-20% compared to traditional silicon-based solutions.

In the renewable energy sector, particularly solar inverters and wind power systems, SiC MOSFETs are gaining significant traction. The efficiency improvements of 1-2% may seem modest, but when applied to large-scale installations, they translate to substantial energy and cost savings over system lifetimes. Industry reports suggest that SiC-based solar inverters can reduce energy losses by up to 30% compared to conventional silicon alternatives.

The telecommunications and data center markets represent emerging opportunities for SiC technology, with power supply units and uninterruptible power supplies benefiting from higher power density and improved thermal performance. These sectors are projected to grow at 25% CAGR over the next five years, driven by the expansion of 5G infrastructure and cloud computing facilities.

Regional analysis reveals that Asia-Pacific currently dominates the market with approximately 45% share, followed by North America (30%) and Europe (20%). China, in particular, has made significant investments in SiC manufacturing capacity as part of its strategic focus on semiconductor independence and electric vehicle leadership.

Supply chain constraints remain a significant market challenge, with raw material availability and manufacturing capacity limitations affecting pricing and availability. However, major suppliers are investing heavily in capacity expansion, with announced investments exceeding 5 billion USD over the next three years to meet the growing demand across these diverse industry applications.

The automotive sector represents the largest and fastest-growing market segment for SiC MOSFETs, accounting for nearly 60% of total demand. This surge is primarily fueled by the rapid expansion of electric vehicle (EV) production, where SiC-based power electronics deliver significant advantages in range extension, charging efficiency, and overall vehicle performance. Major automotive manufacturers have reported 5-10% improvements in vehicle range and up to 30% reduction in charging times when implementing SiC technology in their powertrain systems.

Industrial applications constitute the second-largest market segment, with particular growth in variable frequency drives, industrial motor controls, and renewable energy systems. The industrial sector values SiC MOSFETs for their ability to operate at higher temperatures and switching frequencies, resulting in smaller form factors and reduced cooling requirements. Market research indicates that industrial users can achieve energy savings of 15-20% compared to traditional silicon-based solutions.

In the renewable energy sector, particularly solar inverters and wind power systems, SiC MOSFETs are gaining significant traction. The efficiency improvements of 1-2% may seem modest, but when applied to large-scale installations, they translate to substantial energy and cost savings over system lifetimes. Industry reports suggest that SiC-based solar inverters can reduce energy losses by up to 30% compared to conventional silicon alternatives.

The telecommunications and data center markets represent emerging opportunities for SiC technology, with power supply units and uninterruptible power supplies benefiting from higher power density and improved thermal performance. These sectors are projected to grow at 25% CAGR over the next five years, driven by the expansion of 5G infrastructure and cloud computing facilities.

Regional analysis reveals that Asia-Pacific currently dominates the market with approximately 45% share, followed by North America (30%) and Europe (20%). China, in particular, has made significant investments in SiC manufacturing capacity as part of its strategic focus on semiconductor independence and electric vehicle leadership.

Supply chain constraints remain a significant market challenge, with raw material availability and manufacturing capacity limitations affecting pricing and availability. However, major suppliers are investing heavily in capacity expansion, with announced investments exceeding 5 billion USD over the next three years to meet the growing demand across these diverse industry applications.

SiC MOSFET Technology Status and Barriers

Silicon Carbide (SiC) MOSFETs have emerged as a revolutionary technology in power electronics, offering significant advantages over traditional silicon-based devices. Currently, SiC MOSFET technology has reached commercial maturity in several applications, particularly in the 650V to 1700V range, with devices from major manufacturers including Wolfspeed, ROHM, Infineon, and STMicroelectronics widely available in the market.

Despite the progress, SiC MOSFET technology faces several critical barriers that limit its broader adoption across industries. The most significant challenge remains the high manufacturing cost, with SiC devices typically priced 3-5 times higher than their silicon counterparts. This cost differential stems from complex substrate production processes, lower manufacturing yields, and smaller wafer sizes compared to silicon technology.

Material quality issues persist as another major barrier. SiC substrates still exhibit higher defect densities than silicon, including micropipes, dislocations, and basal plane defects. These imperfections negatively impact device performance and reliability, particularly under high-stress operating conditions common in industrial and automotive applications.

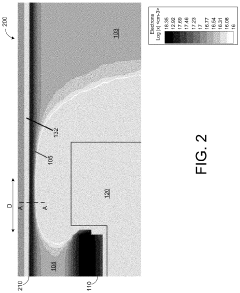

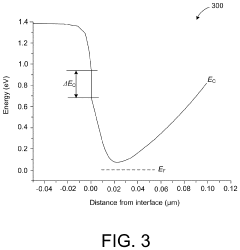

The interface quality between SiC and its native oxide presents unique challenges not encountered in silicon technology. The higher density of interface traps leads to reduced channel mobility, increased on-resistance, and threshold voltage instability. This interface phenomenon directly impacts efficiency gains, especially in high-frequency switching applications where SiC MOSFETs should theoretically excel.

Packaging technology represents another significant barrier. Traditional packaging solutions are often inadequate for SiC devices operating at higher temperatures, frequencies, and power densities. The full potential of SiC MOSFETs cannot be realized without advanced packaging that addresses parasitic inductance, thermal management, and electromagnetic interference concerns.

From a manufacturing perspective, SiC MOSFET production requires specialized equipment and processes that differ substantially from established silicon manufacturing lines. This necessitates significant capital investment for semiconductor manufacturers looking to enter or expand in the SiC market, creating a barrier to increased production capacity and subsequent cost reduction through economies of scale.

Reliability concerns also persist across industries. While SiC MOSFETs demonstrate excellent theoretical reliability, long-term operational data in demanding applications remains limited. Issues such as threshold voltage drift, body diode degradation, and gate oxide reliability under repeated switching stress require further investigation and improvement to meet the stringent requirements of automotive, aerospace, and industrial applications.

Standardization represents another challenge, with different manufacturers offering devices with varying characteristics, packaging, and driving requirements. This lack of standardization complicates design processes and increases engineering costs when implementing SiC solutions across different product platforms and industries.

Despite the progress, SiC MOSFET technology faces several critical barriers that limit its broader adoption across industries. The most significant challenge remains the high manufacturing cost, with SiC devices typically priced 3-5 times higher than their silicon counterparts. This cost differential stems from complex substrate production processes, lower manufacturing yields, and smaller wafer sizes compared to silicon technology.

Material quality issues persist as another major barrier. SiC substrates still exhibit higher defect densities than silicon, including micropipes, dislocations, and basal plane defects. These imperfections negatively impact device performance and reliability, particularly under high-stress operating conditions common in industrial and automotive applications.

The interface quality between SiC and its native oxide presents unique challenges not encountered in silicon technology. The higher density of interface traps leads to reduced channel mobility, increased on-resistance, and threshold voltage instability. This interface phenomenon directly impacts efficiency gains, especially in high-frequency switching applications where SiC MOSFETs should theoretically excel.

Packaging technology represents another significant barrier. Traditional packaging solutions are often inadequate for SiC devices operating at higher temperatures, frequencies, and power densities. The full potential of SiC MOSFETs cannot be realized without advanced packaging that addresses parasitic inductance, thermal management, and electromagnetic interference concerns.

From a manufacturing perspective, SiC MOSFET production requires specialized equipment and processes that differ substantially from established silicon manufacturing lines. This necessitates significant capital investment for semiconductor manufacturers looking to enter or expand in the SiC market, creating a barrier to increased production capacity and subsequent cost reduction through economies of scale.

Reliability concerns also persist across industries. While SiC MOSFETs demonstrate excellent theoretical reliability, long-term operational data in demanding applications remains limited. Issues such as threshold voltage drift, body diode degradation, and gate oxide reliability under repeated switching stress require further investigation and improvement to meet the stringent requirements of automotive, aerospace, and industrial applications.

Standardization represents another challenge, with different manufacturers offering devices with varying characteristics, packaging, and driving requirements. This lack of standardization complicates design processes and increases engineering costs when implementing SiC solutions across different product platforms and industries.

Current SiC MOSFET Implementation Solutions

01 Improved switching characteristics in SiC MOSFETs

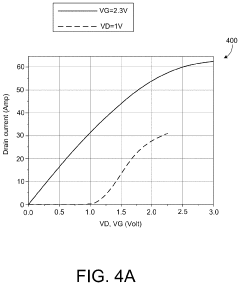

Silicon Carbide (SiC) MOSFETs offer superior switching characteristics compared to traditional silicon-based devices, including faster switching speeds and reduced switching losses. These properties enable higher operating frequencies in power conversion systems, which leads to smaller passive components and increased power density. The enhanced switching performance contributes significantly to overall efficiency gains in power electronic systems.- Improved switching characteristics of SiC MOSFETs: Silicon Carbide (SiC) MOSFETs offer superior switching characteristics compared to traditional silicon-based devices, including faster switching speeds and reduced switching losses. These properties enable higher operating frequencies in power conversion systems, which leads to smaller passive components and increased power density. The enhanced switching performance contributes significantly to overall efficiency gains in power electronic systems.

- Reduced conduction losses in SiC power devices: SiC MOSFETs feature lower on-resistance compared to silicon counterparts, resulting in significantly reduced conduction losses during operation. This characteristic is particularly beneficial in high-power applications where conduction losses typically dominate. The superior material properties of silicon carbide allow for thinner drift regions with higher doping concentrations, enabling devices with lower specific on-resistance while maintaining high blocking voltage capabilities.

- Thermal performance and high-temperature operation: SiC MOSFETs can operate efficiently at much higher temperatures than silicon devices due to the wider bandgap of silicon carbide. This thermal robustness allows for reduced cooling requirements and enables operation in harsh environments. The improved thermal conductivity of SiC also facilitates better heat dissipation, reducing thermal resistance and allowing for higher power density designs without compromising reliability or efficiency.

- Advanced gate drive techniques for SiC MOSFETs: Specialized gate drive circuits and techniques have been developed to fully leverage the performance capabilities of SiC MOSFETs. These include optimized gate voltage levels, improved gate driver topologies, and advanced control strategies that minimize switching losses while ensuring reliable operation. Proper gate drive design is crucial for achieving maximum efficiency gains from SiC MOSFETs while preventing issues such as voltage overshoots and parasitic turn-on effects.

- System-level efficiency improvements with SiC technology: Implementing SiC MOSFETs in power conversion systems enables comprehensive efficiency improvements beyond the device level. These include the ability to use higher switching frequencies leading to smaller passive components, simplified cooling systems due to reduced losses, and more compact overall designs. The efficiency gains translate to energy savings in applications ranging from electric vehicle powertrains to renewable energy systems and industrial power supplies, contributing to reduced carbon footprint and operating costs.

02 Reduced conduction losses and on-resistance

SiC MOSFETs feature significantly lower on-resistance (RDS(on)) compared to silicon counterparts, especially at higher voltage ratings. This characteristic results in reduced conduction losses during operation, which is a major contributor to efficiency improvements in power conversion systems. The superior material properties of silicon carbide allow for thinner drift regions while maintaining high blocking voltage capability, fundamentally enabling this performance advantage.Expand Specific Solutions03 High temperature operation capabilities

SiC MOSFETs can operate efficiently at much higher junction temperatures than silicon devices, typically up to 175-200°C or beyond. This high-temperature capability reduces cooling requirements and allows for more compact thermal management solutions. The wide bandgap properties of silicon carbide maintain good electrical characteristics even at elevated temperatures, resulting in more stable performance and efficiency across a broader operating temperature range.Expand Specific Solutions04 Advanced gate drive techniques for SiC MOSFETs

Specialized gate drive circuits and techniques have been developed to optimize the performance of SiC MOSFETs. These include optimized gate voltage levels, improved gate driver topologies, and advanced control strategies that account for the unique switching characteristics of SiC devices. Proper gate drive design is crucial for maximizing efficiency gains while ensuring reliable operation by controlling switching speeds and mitigating issues like voltage overshoots and ringing.Expand Specific Solutions05 System-level optimization for SiC-based power converters

Achieving maximum efficiency gains with SiC MOSFETs requires holistic system-level optimization. This includes redesigning circuit layouts to minimize parasitic inductances, selecting complementary passive components optimized for high-frequency operation, and implementing advanced control algorithms that leverage SiC's superior switching capabilities. Power converter topologies may also be reimagined to fully exploit the benefits of SiC technology, resulting in new architectures that achieve unprecedented efficiency levels.Expand Specific Solutions

Leading SiC MOSFET Manufacturers and Competitors

The SiC MOSFET market is experiencing rapid growth across industries, currently in an early mainstream adoption phase with a projected market size exceeding $2 billion by 2025. Technical maturity varies significantly among key players, with established semiconductor manufacturers like ROHM, ON Semiconductor (Semiconductor Components Industries), and Mitsubishi Electric leading in commercialization. Research institutions including University of Electronic Science & Technology of China, Zhejiang University, and Shandong University are advancing fundamental innovations. Industrial adoption is accelerating with companies like Huawei Digital Power, State Grid Corp. of China, and GE Aviation Systems implementing SiC technology for efficiency gains in power electronics, electric vehicles, renewable energy, and industrial applications, driving a competitive landscape that balances technical innovation with manufacturing scalability.

Hitachi Energy Ltd.

Technical Solution: Hitachi Energy has developed high-performance SiC MOSFET solutions specifically optimized for grid and industrial applications. Their technology features a unique cell structure that balances on-resistance and ruggedness, achieving RDS(on) values approximately 75% lower than comparable silicon devices while maintaining short-circuit withstand times exceeding 5μs. Hitachi's SiC modules incorporate advanced interconnection technology that reduces parasitic inductance by approximately 60% compared to conventional designs, enabling switching frequencies above 100kHz in medium voltage applications. Their comprehensive approach includes specialized gate driver solutions with active Miller clamping and temperature-compensated driving parameters. Hitachi Energy has demonstrated efficiency improvements of 1.5-2.5% in HVDC (High Voltage Direct Current) converter stations, which translates to megawatt-scale energy savings in power transmission applications. Their SiC technology has been field-proven in utility-scale solar inverters, showing 30-40% reduction in filtering requirements due to higher achievable switching frequencies.

Strengths: Exceptional medium and high voltage performance; proven reliability in utility-scale applications; comprehensive system integration expertise; advanced packaging technology with superior thermal performance. Weaknesses: Limited presence in lower power consumer applications; higher initial investment costs; requires specialized design expertise for optimal implementation.

Fast Sic Semiconductor, Inc.

Technical Solution: Fast SiC Semiconductor has developed innovative SiC MOSFET technology focused on ultra-fast switching performance for next-generation power conversion applications. Their proprietary trench gate structure achieves switching speeds approximately 3-4 times faster than conventional SiC MOSFETs while maintaining competitive on-resistance values. Fast SiC's devices feature specialized gate oxide processing that enhances reliability under high dV/dt conditions, enabling robust operation at switching speeds exceeding 200V/ns. The company has implemented advanced edge termination structures that optimize electric field distribution, allowing for higher blocking voltages in more compact die areas. Their SiC MOSFETs have demonstrated exceptional performance in soft-switching topologies, reducing switching losses by up to 70% compared to hard-switching implementations. Fast SiC Semiconductor focuses on applications requiring extreme switching performance, including wireless power transfer, resonant converters, and high-frequency DC-DC conversion, where their technology enables power density improvements of 30-50% compared to conventional solutions.

Strengths: Industry-leading switching speed performance; optimized for high-frequency applications; excellent soft-switching characteristics; innovative device structures. Weaknesses: More limited product portfolio breadth compared to larger competitors; smaller manufacturing scale; less established presence in conservative industrial markets; higher sensitivity to layout and gate driver design.

Critical SiC MOSFET Efficiency Enhancement Technologies

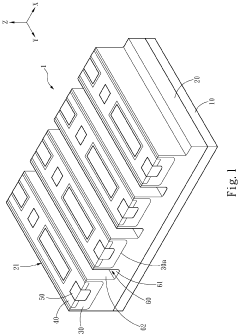

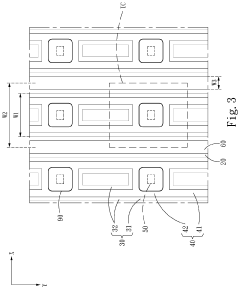

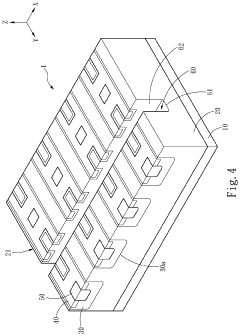

Silicon carbide semiconductor device

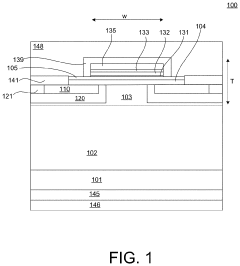

PatentPendingUS20240234569A9

Innovation

- A silicon carbide semiconductor device with a hybrid gate structure featuring a trench gate configuration that reduces JFET resistance and parasitic gate-to-drain capacitance, enhancing switching performance by increasing channel width density and optimizing the layout of doped regions and trenches.

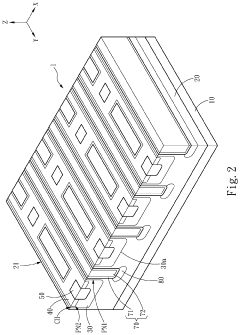

Silicon carbide field-effect transistors

PatentActiveUS20220013661A1

Innovation

- A silicon carbide (SiC) metal-oxide-semiconductor field-effect transistor (MOSFET) design incorporating a substrate, drift region, spreading layer, body region, and source region with a gate structure that includes a gate oxide layer, aluminum nitride, and p-type gallium nitride layers, achieving low on-state specific resistance and high threshold voltage.

Cross-Industry Efficiency Benchmarking

The comparative analysis of SiC MOSFET efficiency gains across different industries reveals significant variations in performance improvements and adoption rates. In the automotive sector, SiC MOSFETs demonstrate efficiency improvements of 25-30% compared to traditional silicon-based alternatives, particularly in electric vehicle (EV) powertrains. This translates to approximately 5-10% extended driving range without increasing battery capacity, representing a substantial competitive advantage for manufacturers.

In renewable energy applications, particularly solar inverters, SiC MOSFETs achieve efficiency gains of 1-2% at the system level. While this percentage appears modest, it represents significant energy savings when scaled across large solar installations, potentially increasing annual energy harvest by 3-5% and improving return on investment metrics for utility-scale deployments.

The industrial motor drive sector shows efficiency improvements of 15-20% with SiC implementation, with the most pronounced benefits observed in high-frequency switching applications. Manufacturing facilities utilizing SiC-based variable frequency drives report energy consumption reductions of 10-15% compared to conventional silicon-based systems, with accelerated payback periods despite higher initial investment costs.

Data center power supplies incorporating SiC technology demonstrate 2-3% higher efficiency than traditional designs, which translates to substantial operational cost savings given the 24/7 operation profile. When factoring in reduced cooling requirements due to lower heat generation, total facility energy savings can reach 4-6%, representing millions in annual operational expenditure reductions for hyperscale facilities.

Aerospace applications show the highest premium on SiC efficiency gains, with weight reductions of 30-40% in power conversion systems enabling fuel savings or increased payload capacity. The reliability improvements in extreme operating conditions further enhance the value proposition despite the significantly higher component costs in this sector.

Cross-industry benchmarking reveals that efficiency gains must be evaluated within specific application contexts rather than through direct percentage comparisons. The value of a 1% efficiency improvement in a utility-scale solar farm may exceed that of a 5% improvement in a consumer electronics application when considering total energy processed over the system lifetime and associated financial implications.

In renewable energy applications, particularly solar inverters, SiC MOSFETs achieve efficiency gains of 1-2% at the system level. While this percentage appears modest, it represents significant energy savings when scaled across large solar installations, potentially increasing annual energy harvest by 3-5% and improving return on investment metrics for utility-scale deployments.

The industrial motor drive sector shows efficiency improvements of 15-20% with SiC implementation, with the most pronounced benefits observed in high-frequency switching applications. Manufacturing facilities utilizing SiC-based variable frequency drives report energy consumption reductions of 10-15% compared to conventional silicon-based systems, with accelerated payback periods despite higher initial investment costs.

Data center power supplies incorporating SiC technology demonstrate 2-3% higher efficiency than traditional designs, which translates to substantial operational cost savings given the 24/7 operation profile. When factoring in reduced cooling requirements due to lower heat generation, total facility energy savings can reach 4-6%, representing millions in annual operational expenditure reductions for hyperscale facilities.

Aerospace applications show the highest premium on SiC efficiency gains, with weight reductions of 30-40% in power conversion systems enabling fuel savings or increased payload capacity. The reliability improvements in extreme operating conditions further enhance the value proposition despite the significantly higher component costs in this sector.

Cross-industry benchmarking reveals that efficiency gains must be evaluated within specific application contexts rather than through direct percentage comparisons. The value of a 1% efficiency improvement in a utility-scale solar farm may exceed that of a 5% improvement in a consumer electronics application when considering total energy processed over the system lifetime and associated financial implications.

Thermal Management Challenges and Solutions

Thermal management represents a critical challenge in the implementation of Silicon Carbide (SiC) MOSFETs across various industries. Despite the superior efficiency gains offered by SiC technology compared to traditional silicon-based semiconductors, these devices generate significant heat during operation, particularly in high-power applications. The thermal conductivity of SiC (approximately 3.7 W/cm·K) exceeds that of silicon, yet effective heat dissipation remains essential for maintaining optimal performance and reliability.

In automotive applications, particularly electric vehicles, SiC MOSFETs operate under demanding conditions with temperature fluctuations ranging from -40°C to over 200°C. This necessitates sophisticated cooling solutions such as liquid cooling systems integrated with the power electronics modules. The aerospace industry faces even more stringent thermal management requirements due to the extreme operating environments and reliability demands, often implementing redundant cooling mechanisms and specialized thermal interface materials.

Industrial power conversion systems utilizing SiC technology must address thermal cycling issues that can lead to package degradation and connection failures. Advanced thermal simulation tools have become essential for predicting hotspots and optimizing heat sink designs. Recent innovations include phase-change materials that absorb heat during temperature spikes and direct bonded copper (DBC) substrates that enhance thermal conductivity between the semiconductor and cooling system.

The miniaturization trend across industries compounds thermal challenges, as higher power densities result in concentrated heat generation. This has prompted the development of novel packaging technologies such as double-sided cooling and embedded cooling channels. Research indicates that optimized thermal management can extend SiC MOSFET lifetime by 30-40% while enabling operation at higher switching frequencies.

Emerging solutions include sintered silver die-attach materials that offer superior thermal performance compared to traditional solder, with thermal conductivity exceeding 200 W/m·K. Additionally, advanced ceramic substrates with aluminum nitride (AlN) demonstrate improved heat spreading capabilities. The integration of thermal sensors and dynamic thermal management algorithms allows for real-time adjustment of operating parameters based on temperature conditions.

Cross-industry collaboration has accelerated the development of standardized thermal management approaches for SiC devices. Automotive and industrial equipment manufacturers have established joint research initiatives focused on cost-effective cooling solutions that maintain reliability under various operating conditions. These collaborative efforts have resulted in modular thermal management systems that can be adapted across different application domains while maintaining optimal thermal performance.

In automotive applications, particularly electric vehicles, SiC MOSFETs operate under demanding conditions with temperature fluctuations ranging from -40°C to over 200°C. This necessitates sophisticated cooling solutions such as liquid cooling systems integrated with the power electronics modules. The aerospace industry faces even more stringent thermal management requirements due to the extreme operating environments and reliability demands, often implementing redundant cooling mechanisms and specialized thermal interface materials.

Industrial power conversion systems utilizing SiC technology must address thermal cycling issues that can lead to package degradation and connection failures. Advanced thermal simulation tools have become essential for predicting hotspots and optimizing heat sink designs. Recent innovations include phase-change materials that absorb heat during temperature spikes and direct bonded copper (DBC) substrates that enhance thermal conductivity between the semiconductor and cooling system.

The miniaturization trend across industries compounds thermal challenges, as higher power densities result in concentrated heat generation. This has prompted the development of novel packaging technologies such as double-sided cooling and embedded cooling channels. Research indicates that optimized thermal management can extend SiC MOSFET lifetime by 30-40% while enabling operation at higher switching frequencies.

Emerging solutions include sintered silver die-attach materials that offer superior thermal performance compared to traditional solder, with thermal conductivity exceeding 200 W/m·K. Additionally, advanced ceramic substrates with aluminum nitride (AlN) demonstrate improved heat spreading capabilities. The integration of thermal sensors and dynamic thermal management algorithms allows for real-time adjustment of operating parameters based on temperature conditions.

Cross-industry collaboration has accelerated the development of standardized thermal management approaches for SiC devices. Automotive and industrial equipment manufacturers have established joint research initiatives focused on cost-effective cooling solutions that maintain reliability under various operating conditions. These collaborative efforts have resulted in modular thermal management systems that can be adapted across different application domains while maintaining optimal thermal performance.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!