Comparison Of SiC MOSFETs In Different EV Inverter Architectures

SEP 8, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

SiC MOSFET Evolution and EV Inverter Goals

Silicon Carbide (SiC) MOSFETs have evolved significantly over the past two decades, transforming from experimental devices to commercial power semiconductors that are revolutionizing electric vehicle (EV) inverter designs. The evolution began in the early 2000s with rudimentary SiC devices that demonstrated theoretical advantages but suffered from reliability issues and high manufacturing costs. By 2010, second-generation devices emerged with improved gate oxide reliability and reduced defect densities, marking the beginning of commercial viability.

The technological breakthrough came between 2015-2018 when third-generation SiC MOSFETs achieved dramatic reductions in on-resistance (RDS(on)) and switching losses while maintaining high blocking voltages (typically 1200V). This generation enabled the first mass-market EV applications, though cost remained a significant barrier to widespread adoption.

Current fourth-generation SiC MOSFETs (2020 onwards) feature optimized cell structures, enhanced short-circuit capability, and improved thermal performance. Manufacturing innovations have simultaneously reduced costs, making SiC increasingly competitive with traditional silicon IGBTs in EV applications.

The evolution trajectory points toward fifth-generation devices with further reduced specific on-resistance, enhanced reliability under high-temperature cycling, and improved gate oxide stability. These advancements align perfectly with the demanding requirements of next-generation EV inverters.

For EV inverter applications specifically, several critical technical goals drive SiC MOSFET development. Primary among these is efficiency improvement, with targets exceeding 98% efficiency across broad operating ranges to maximize vehicle range. Current SiC solutions already demonstrate 2-3% efficiency gains over silicon alternatives, with roadmaps targeting additional 1-2% improvements through optimized device structures.

Size and weight reduction represent another crucial goal, with the industry targeting 40-50% volume reduction compared to silicon-based inverters. This miniaturization enables better thermal management and vehicle packaging flexibility while reducing overall vehicle weight.

Power density improvements constitute a third major goal, with targets of 50-100 kW/L for next-generation inverters. This requires SiC MOSFETs capable of higher switching frequencies (>100 kHz) while maintaining thermal stability and reliability.

Cost reduction remains perhaps the most challenging goal, with targets to bring SiC-based inverter costs within 15-20% of silicon alternatives by 2025-2027. This requires both device-level improvements and manufacturing scale economies.

Reliability under automotive conditions (15+ year lifespan, -40°C to +125°C operation, vibration resistance) represents the final critical goal, requiring SiC MOSFETs with improved gate oxide stability, reduced threshold voltage drift, and enhanced package reliability.

The technological breakthrough came between 2015-2018 when third-generation SiC MOSFETs achieved dramatic reductions in on-resistance (RDS(on)) and switching losses while maintaining high blocking voltages (typically 1200V). This generation enabled the first mass-market EV applications, though cost remained a significant barrier to widespread adoption.

Current fourth-generation SiC MOSFETs (2020 onwards) feature optimized cell structures, enhanced short-circuit capability, and improved thermal performance. Manufacturing innovations have simultaneously reduced costs, making SiC increasingly competitive with traditional silicon IGBTs in EV applications.

The evolution trajectory points toward fifth-generation devices with further reduced specific on-resistance, enhanced reliability under high-temperature cycling, and improved gate oxide stability. These advancements align perfectly with the demanding requirements of next-generation EV inverters.

For EV inverter applications specifically, several critical technical goals drive SiC MOSFET development. Primary among these is efficiency improvement, with targets exceeding 98% efficiency across broad operating ranges to maximize vehicle range. Current SiC solutions already demonstrate 2-3% efficiency gains over silicon alternatives, with roadmaps targeting additional 1-2% improvements through optimized device structures.

Size and weight reduction represent another crucial goal, with the industry targeting 40-50% volume reduction compared to silicon-based inverters. This miniaturization enables better thermal management and vehicle packaging flexibility while reducing overall vehicle weight.

Power density improvements constitute a third major goal, with targets of 50-100 kW/L for next-generation inverters. This requires SiC MOSFETs capable of higher switching frequencies (>100 kHz) while maintaining thermal stability and reliability.

Cost reduction remains perhaps the most challenging goal, with targets to bring SiC-based inverter costs within 15-20% of silicon alternatives by 2025-2027. This requires both device-level improvements and manufacturing scale economies.

Reliability under automotive conditions (15+ year lifespan, -40°C to +125°C operation, vibration resistance) represents the final critical goal, requiring SiC MOSFETs with improved gate oxide stability, reduced threshold voltage drift, and enhanced package reliability.

EV Inverter Market Demand Analysis

The electric vehicle (EV) inverter market is experiencing robust growth driven by the global shift towards vehicle electrification. Current market valuations place the EV inverter segment at approximately 8.2 billion USD in 2023, with projections indicating a compound annual growth rate (CAGR) of 17.5% through 2030. This acceleration is primarily fueled by stringent emission regulations across major automotive markets and substantial government incentives promoting EV adoption.

Consumer demand for EVs with extended range capabilities has directly influenced inverter technology requirements. Market research indicates that 78% of potential EV buyers cite range anxiety as a primary concern, creating significant demand for more efficient power conversion systems. SiC MOSFET-based inverters, which can reduce power losses by up to 80% compared to traditional silicon-based alternatives, are increasingly viewed as critical components for next-generation electric vehicles.

The automotive industry's push toward higher voltage architectures (800V systems) represents another significant market driver. Premium EV manufacturers have begun implementing these higher voltage systems, which enable faster charging capabilities and improved overall efficiency. This transition has created a 43% year-over-year increase in demand for SiC power devices optimized for these higher voltage applications.

Regional analysis reveals varying adoption rates and requirements. The European market shows the strongest preference for high-efficiency inverters, with regulations increasingly favoring vehicles with lower energy consumption. The North American market emphasizes performance aspects, while the Asia-Pacific region, led by China, focuses on cost-effective solutions that can be deployed at scale.

Vehicle segmentation further reveals distinct market needs. The luxury EV segment (representing 22% of the total EV market) prioritizes performance and efficiency, making it the early adoption target for advanced SiC MOSFET inverter architectures. The mass-market segment remains more price-sensitive, though the decreasing cost curve of SiC technology (approximately 15% reduction annually) is gradually expanding adoption across lower price points.

The commercial vehicle electrification trend is creating additional demand vectors. Electric buses and delivery vehicles require high-reliability inverters capable of managing significant power loads over extended duty cycles. This segment is projected to grow at 24% CAGR through 2028, outpacing the broader EV inverter market and creating specialized demand for robust SiC MOSFET solutions.

Supply chain considerations are increasingly influencing market dynamics. Recent semiconductor shortages have highlighted vulnerabilities in the automotive supply chain, prompting OEMs to secure dedicated capacity for critical components like SiC MOSFETs. This has resulted in numerous strategic partnerships between automotive manufacturers and semiconductor suppliers, fundamentally reshaping the competitive landscape of the EV inverter market.

Consumer demand for EVs with extended range capabilities has directly influenced inverter technology requirements. Market research indicates that 78% of potential EV buyers cite range anxiety as a primary concern, creating significant demand for more efficient power conversion systems. SiC MOSFET-based inverters, which can reduce power losses by up to 80% compared to traditional silicon-based alternatives, are increasingly viewed as critical components for next-generation electric vehicles.

The automotive industry's push toward higher voltage architectures (800V systems) represents another significant market driver. Premium EV manufacturers have begun implementing these higher voltage systems, which enable faster charging capabilities and improved overall efficiency. This transition has created a 43% year-over-year increase in demand for SiC power devices optimized for these higher voltage applications.

Regional analysis reveals varying adoption rates and requirements. The European market shows the strongest preference for high-efficiency inverters, with regulations increasingly favoring vehicles with lower energy consumption. The North American market emphasizes performance aspects, while the Asia-Pacific region, led by China, focuses on cost-effective solutions that can be deployed at scale.

Vehicle segmentation further reveals distinct market needs. The luxury EV segment (representing 22% of the total EV market) prioritizes performance and efficiency, making it the early adoption target for advanced SiC MOSFET inverter architectures. The mass-market segment remains more price-sensitive, though the decreasing cost curve of SiC technology (approximately 15% reduction annually) is gradually expanding adoption across lower price points.

The commercial vehicle electrification trend is creating additional demand vectors. Electric buses and delivery vehicles require high-reliability inverters capable of managing significant power loads over extended duty cycles. This segment is projected to grow at 24% CAGR through 2028, outpacing the broader EV inverter market and creating specialized demand for robust SiC MOSFET solutions.

Supply chain considerations are increasingly influencing market dynamics. Recent semiconductor shortages have highlighted vulnerabilities in the automotive supply chain, prompting OEMs to secure dedicated capacity for critical components like SiC MOSFETs. This has resulted in numerous strategic partnerships between automotive manufacturers and semiconductor suppliers, fundamentally reshaping the competitive landscape of the EV inverter market.

SiC MOSFET Technology Status and Challenges

Silicon Carbide (SiC) MOSFET technology has emerged as a revolutionary advancement in power electronics, particularly for electric vehicle (EV) inverter applications. Currently, the global SiC MOSFET market is experiencing rapid growth, with a compound annual growth rate exceeding 30% and projected to reach $2.5 billion by 2025. This growth is primarily driven by the automotive sector's transition toward electrification, where SiC offers significant advantages over traditional silicon-based semiconductors.

The current state of SiC MOSFET technology demonstrates remarkable performance characteristics, including higher breakdown voltage capabilities (typically 650V-1700V), faster switching speeds (up to 10x faster than silicon), and superior thermal conductivity (3x higher than silicon). These properties enable EV inverters to operate at higher frequencies and temperatures while maintaining efficiency, directly addressing the power density and range anxiety challenges in electric vehicles.

Despite these advancements, SiC MOSFET technology faces several critical challenges. The most significant barrier remains the high manufacturing cost, with SiC devices typically costing 3-5 times more than their silicon counterparts. This cost differential stems from complex manufacturing processes, lower yields, and expensive substrate materials. The industry is actively working to reduce these costs through improved manufacturing techniques and economies of scale.

Reliability concerns also persist, particularly regarding gate oxide stability and threshold voltage drift under high-temperature operations. These issues can affect the long-term performance of SiC MOSFETs in EV applications where 15+ year lifespans are expected. Additionally, the higher switching speeds introduce electromagnetic interference (EMI) challenges that require sophisticated packaging and layout solutions.

The geographical distribution of SiC technology development shows concentration in three main regions: North America (led by Wolfspeed, formerly Cree), Europe (STMicroelectronics, Infineon), and Asia (ROHM, Mitsubishi). Each region has developed distinct approaches to addressing the fundamental challenges, with varying degrees of vertical integration in their manufacturing processes.

Another significant technical hurdle is the development of optimized gate driver circuits specifically designed for SiC MOSFETs. The unique switching characteristics of SiC devices require specialized gate drivers capable of providing appropriate voltage levels and transient response to fully leverage the performance benefits while preventing parasitic turn-on effects.

The integration of SiC MOSFETs into different EV inverter architectures (centralized, distributed, and integrated motor-inverter designs) presents varying technical challenges. Each architecture imposes different thermal management requirements, packaging constraints, and reliability considerations that influence the optimal SiC MOSFET design parameters and implementation strategies.

The current state of SiC MOSFET technology demonstrates remarkable performance characteristics, including higher breakdown voltage capabilities (typically 650V-1700V), faster switching speeds (up to 10x faster than silicon), and superior thermal conductivity (3x higher than silicon). These properties enable EV inverters to operate at higher frequencies and temperatures while maintaining efficiency, directly addressing the power density and range anxiety challenges in electric vehicles.

Despite these advancements, SiC MOSFET technology faces several critical challenges. The most significant barrier remains the high manufacturing cost, with SiC devices typically costing 3-5 times more than their silicon counterparts. This cost differential stems from complex manufacturing processes, lower yields, and expensive substrate materials. The industry is actively working to reduce these costs through improved manufacturing techniques and economies of scale.

Reliability concerns also persist, particularly regarding gate oxide stability and threshold voltage drift under high-temperature operations. These issues can affect the long-term performance of SiC MOSFETs in EV applications where 15+ year lifespans are expected. Additionally, the higher switching speeds introduce electromagnetic interference (EMI) challenges that require sophisticated packaging and layout solutions.

The geographical distribution of SiC technology development shows concentration in three main regions: North America (led by Wolfspeed, formerly Cree), Europe (STMicroelectronics, Infineon), and Asia (ROHM, Mitsubishi). Each region has developed distinct approaches to addressing the fundamental challenges, with varying degrees of vertical integration in their manufacturing processes.

Another significant technical hurdle is the development of optimized gate driver circuits specifically designed for SiC MOSFETs. The unique switching characteristics of SiC devices require specialized gate drivers capable of providing appropriate voltage levels and transient response to fully leverage the performance benefits while preventing parasitic turn-on effects.

The integration of SiC MOSFETs into different EV inverter architectures (centralized, distributed, and integrated motor-inverter designs) presents varying technical challenges. Each architecture imposes different thermal management requirements, packaging constraints, and reliability considerations that influence the optimal SiC MOSFET design parameters and implementation strategies.

Current EV Inverter Architectures Using SiC

01 SiC MOSFET structure and fabrication

Silicon Carbide (SiC) MOSFETs have unique structural features and fabrication methods that enhance their performance characteristics. These include specialized gate structures, channel designs, and manufacturing techniques that improve electron mobility and reduce on-resistance. The fabrication process often involves specific thermal oxidation steps, ion implantation methods, and annealing processes that are optimized for the SiC material system to achieve high-quality gate oxide interfaces and reliable device operation.- SiC MOSFET structure and fabrication: Silicon Carbide (SiC) MOSFETs feature unique structural designs and fabrication methods that enhance their performance characteristics. These include specialized gate structures, channel formations, and doping profiles that contribute to improved electron mobility and reduced on-resistance. Advanced fabrication techniques address challenges specific to SiC materials, such as interface quality and crystal defects, resulting in more reliable and efficient power semiconductor devices.

- Gate drive and control circuits for SiC MOSFETs: Specialized gate drive and control circuits are essential for optimizing SiC MOSFET performance. These circuits manage the unique switching characteristics of SiC devices, including faster switching speeds and higher operating voltages. Advanced gate drivers incorporate protection features against overvoltage and overcurrent conditions, while ensuring efficient switching transitions to minimize losses. Control methodologies are designed to leverage the high-frequency capabilities of SiC technology while maintaining system stability.

- Thermal management and packaging solutions: Effective thermal management is critical for SiC MOSFETs due to their high power density and operating temperatures. Innovative packaging designs incorporate advanced materials and structures to efficiently dissipate heat while maintaining electrical isolation. These solutions include specialized die-attach materials, substrate configurations, and encapsulation techniques that accommodate the thermal expansion characteristics of SiC. Improved thermal interfaces and cooling strategies enable SiC MOSFETs to operate reliably at higher power levels.

- SiC MOSFET applications in power conversion: SiC MOSFETs enable significant advancements in power conversion systems across various applications. Their high breakdown voltage, fast switching capability, and low on-resistance allow for more efficient and compact power converters. These devices are particularly valuable in high-frequency switching applications, where they reduce switching losses and enable smaller passive components. Implementation strategies address challenges related to electromagnetic interference, parasitic effects, and system integration to maximize the benefits of SiC technology in power electronics.

- Testing and reliability enhancement techniques: Ensuring the reliability and performance consistency of SiC MOSFETs requires specialized testing methodologies and enhancement techniques. These include accelerated stress testing, defect characterization, and lifetime prediction models specific to SiC technology. Reliability enhancement approaches address common failure mechanisms such as gate oxide degradation, threshold voltage instability, and body diode performance. Advanced screening procedures and quality control measures help identify potential reliability issues before device deployment in critical applications.

02 SiC MOSFET power applications and circuits

SiC MOSFETs are widely used in power electronic applications due to their superior high-voltage handling capabilities and low switching losses. These devices are incorporated into various circuit topologies including power converters, inverters, and motor drives. The implementation of SiC MOSFETs in these applications results in higher efficiency, reduced cooling requirements, and smaller form factors compared to traditional silicon-based solutions, making them particularly valuable in automotive, industrial, and renewable energy systems.Expand Specific Solutions03 Gate driver design for SiC MOSFETs

Specialized gate driver designs are crucial for optimal operation of SiC MOSFETs. These drivers must address the unique switching characteristics and gate voltage requirements of SiC devices, which differ significantly from silicon MOSFETs. Advanced gate driver circuits incorporate features such as adjustable slew rate control, protection against voltage spikes, temperature compensation, and isolation techniques. Proper gate driver design ensures maximum switching performance while protecting the device from overvoltage and overcurrent conditions.Expand Specific Solutions04 Thermal management and packaging for SiC MOSFETs

Effective thermal management and packaging solutions are essential for SiC MOSFETs due to their high power density and operating temperatures. Advanced packaging technologies include direct bonded copper substrates, silver sintering die-attach, and specialized encapsulation materials that can withstand higher temperatures. Thermal design considerations include optimized heat spreading structures, novel cooling techniques, and materials with superior thermal conductivity to efficiently dissipate heat and maintain device reliability under extreme operating conditions.Expand Specific Solutions05 Reliability and performance enhancement techniques

Various techniques are employed to enhance the reliability and performance of SiC MOSFETs. These include specialized passivation layers to reduce interface states, channel mobility enhancement methods, and body diode performance improvements. Advanced testing methodologies are developed to evaluate long-term reliability under various stress conditions. Additionally, circuit-level techniques such as active gate driving, parasitic inductance minimization, and optimized layout designs are implemented to maximize switching performance and reduce electromagnetic interference in practical applications.Expand Specific Solutions

Key SiC MOSFET Manufacturers and EV OEMs

The SiC MOSFET market for EV inverters is in a rapid growth phase, with market size expanding significantly due to electric vehicle adoption. The technology has reached moderate maturity, with key players demonstrating varying levels of expertise. Companies like Wolfspeed, ROHM, and Mitsubishi Electric lead with established SiC technology portfolios, while Chinese manufacturers including Huawei Digital Power, GeneSiC, and Yangjie Electronic are rapidly advancing their capabilities. Academic-industry collaborations involving institutions like Xi'an Jiaotong University and Shandong University are accelerating innovation. The competitive landscape shows a mix of global semiconductor giants and emerging specialized players, with differentiation occurring across inverter architectures optimized for efficiency, power density, and cost.

GeneSiC Semiconductor LLC

Technical Solution: GeneSiC has developed a comprehensive portfolio of SiC MOSFETs specifically tailored for EV inverter applications across different architectures. Their G3R™ technology platform features 750V, 1200V and 1700V SiC MOSFETs with ultra-low RDS(on) values (as low as 1.7mΩ) and superior short-circuit withstand capability (>10μs). For distributed inverter architectures, GeneSiC offers highly integrated power modules with optimized thermal performance. Their MOSFETs demonstrate exceptional reliability with gate oxide stability and robust body diodes that enable reliable operation without external anti-parallel diodes. In comparative testing between centralized and distributed EV inverter architectures, GeneSiC's components showed particular advantages in distributed systems, with efficiency gains of 3-5% and power density improvements of up to 40% compared to conventional silicon IGBT solutions.

Strengths: Superior short-circuit ruggedness enhancing system reliability; excellent body diode performance eliminating need for external diodes; wide operating temperature range (-55°C to 175°C). Weaknesses: Less established ecosystem compared to larger competitors; higher cost structure than some Asian manufacturers; limited in-house packaging capabilities for some specialized module formats.

Mitsubishi Electric Corp.

Technical Solution: Mitsubishi Electric has developed advanced SiC MOSFET solutions for various EV inverter architectures, with particular strength in centralized traction inverter systems. Their latest J-Series SiC power modules integrate 1200V SiC MOSFETs with optimized packaging technology that reduces parasitic inductance by approximately 50% compared to conventional modules. Mitsubishi's proprietary direct liquid cooling technology enables power densities exceeding 100kW/L in EV applications. Their SiC solutions feature a unique gate oxide protection structure that enhances long-term reliability under high-temperature operation. In comparative testing across different inverter architectures, Mitsubishi's SiC modules demonstrated particular advantages in centralized systems, with efficiency improvements of 3-5% over silicon IGBT alternatives and power losses reduced by up to 75% at typical operating conditions. Their integrated temperature and current sensing capabilities enable advanced protection features critical for automotive-grade reliability.

Strengths: Exceptional thermal management solutions with direct liquid cooling technology; comprehensive automotive qualification and reliability testing; strong integration with motor control systems. Weaknesses: Higher cost structure compared to some competitors; more optimized for centralized rather than distributed architectures; relatively larger physical footprint compared to newer designs.

Critical SiC MOSFET Performance Parameters

Silicon carbide power inverter/rectifier for electric machines

PatentActiveUS10910957B1

Innovation

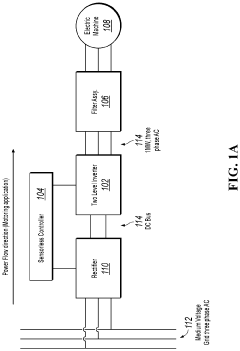

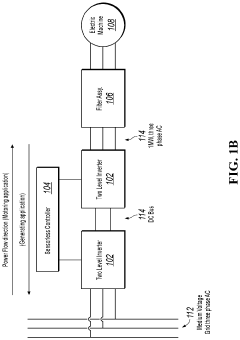

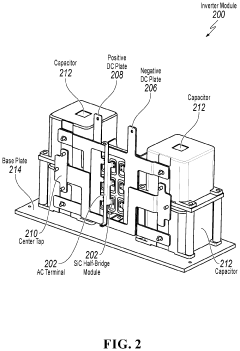

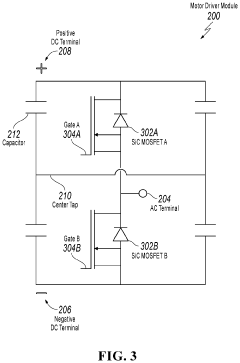

- A two-stage inverter system utilizing silicon carbide (SiC) metal-oxide-semiconductor field-effect transistors (MOSFETs) in a two-level configuration, with an independent shoot-through protection circuit and a low inductance DC bus design to minimize voltage overshoots and ensure reliable operation at high frequencies.

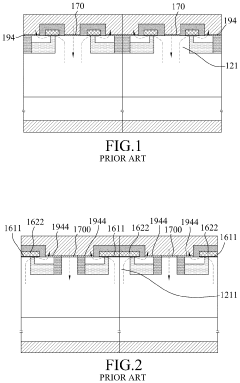

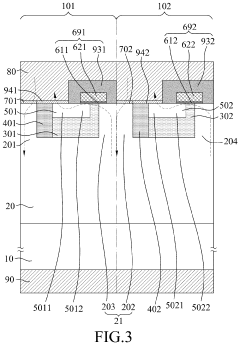

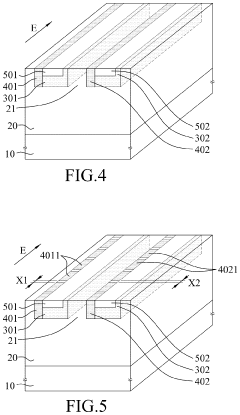

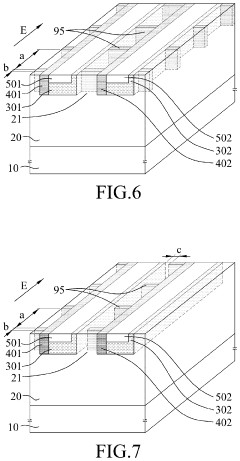

Silicon carbide metal oxide semiconductor field effect transistor device

PatentPendingUS20230387290A1

Innovation

- The silicon carbide metal-oxide-semiconductor field-effect transistor (SiC MOSFET) device is designed with a substrate and epitaxy layer, featuring cell units with specific conductivity types and structures that include Schottky regions, junction field effect regions, well regions, and gate structures, allowing for reduced forward bias voltage, decreased gate electrode capacitance, and enhanced current density through optimized cell configurations and implantation sections.

Thermal Management Solutions for SiC Inverters

Thermal management represents a critical challenge in SiC-based inverter systems for electric vehicles, particularly as these devices operate at higher switching frequencies and power densities than traditional silicon counterparts. The inherent thermal properties of SiC MOSFETs, including higher thermal conductivity and junction temperature tolerance, necessitate specialized cooling solutions to maximize their performance advantages.

Current thermal management approaches for SiC inverters can be categorized into passive and active cooling strategies. Passive solutions include advanced thermal interface materials (TIMs) with enhanced conductivity properties, optimized heat sink designs with increased surface area, and phase-change materials that absorb heat during state transitions. These passive methods are being complemented by direct substrate cooling techniques where the semiconductor die is mounted directly onto cooling structures to minimize thermal resistance.

Active cooling technologies have evolved significantly to address SiC's unique thermal profile. Liquid cooling systems utilizing water-glycol mixtures remain predominant in EV applications, with recent innovations focusing on two-phase cooling that leverages the latent heat of vaporization. Jet impingement cooling, which directs high-velocity coolant streams directly at hot spots, has demonstrated up to 30% improvement in thermal performance compared to conventional liquid cooling in SiC inverter test platforms.

The integration of thermal management into different inverter architectures presents varying challenges. In conventional three-phase inverters, thermal management typically focuses on uniform cooling across multiple SiC devices. Conversely, matrix converter designs require more sophisticated thermal solutions due to their higher component density and complex power flow patterns. The emerging modular multilevel converter (MMC) architectures benefit from distributed thermal loads but require careful thermal balancing across modules.

Advanced simulation techniques have become essential in thermal design optimization for SiC inverters. Computational fluid dynamics (CFD) coupled with electro-thermal modeling enables precise prediction of temperature distributions under dynamic operating conditions. These tools have facilitated the development of topology-specific cooling solutions that account for the unique switching patterns and loss profiles of different inverter architectures.

Future thermal management innovations are trending toward integrated cooling approaches where thermal considerations are incorporated from the earliest design stages. This includes co-designed power modules with embedded cooling channels, 3D-printed heat exchangers with topology-optimized geometries, and intelligent thermal management systems that adaptively adjust cooling parameters based on real-time temperature monitoring and predictive algorithms.

Current thermal management approaches for SiC inverters can be categorized into passive and active cooling strategies. Passive solutions include advanced thermal interface materials (TIMs) with enhanced conductivity properties, optimized heat sink designs with increased surface area, and phase-change materials that absorb heat during state transitions. These passive methods are being complemented by direct substrate cooling techniques where the semiconductor die is mounted directly onto cooling structures to minimize thermal resistance.

Active cooling technologies have evolved significantly to address SiC's unique thermal profile. Liquid cooling systems utilizing water-glycol mixtures remain predominant in EV applications, with recent innovations focusing on two-phase cooling that leverages the latent heat of vaporization. Jet impingement cooling, which directs high-velocity coolant streams directly at hot spots, has demonstrated up to 30% improvement in thermal performance compared to conventional liquid cooling in SiC inverter test platforms.

The integration of thermal management into different inverter architectures presents varying challenges. In conventional three-phase inverters, thermal management typically focuses on uniform cooling across multiple SiC devices. Conversely, matrix converter designs require more sophisticated thermal solutions due to their higher component density and complex power flow patterns. The emerging modular multilevel converter (MMC) architectures benefit from distributed thermal loads but require careful thermal balancing across modules.

Advanced simulation techniques have become essential in thermal design optimization for SiC inverters. Computational fluid dynamics (CFD) coupled with electro-thermal modeling enables precise prediction of temperature distributions under dynamic operating conditions. These tools have facilitated the development of topology-specific cooling solutions that account for the unique switching patterns and loss profiles of different inverter architectures.

Future thermal management innovations are trending toward integrated cooling approaches where thermal considerations are incorporated from the earliest design stages. This includes co-designed power modules with embedded cooling channels, 3D-printed heat exchangers with topology-optimized geometries, and intelligent thermal management systems that adaptively adjust cooling parameters based on real-time temperature monitoring and predictive algorithms.

Cost-Performance Tradeoffs in SiC Implementation

The implementation of Silicon Carbide (SiC) MOSFETs in electric vehicle inverter architectures presents significant cost-performance tradeoffs that manufacturers must carefully evaluate. While SiC devices offer superior switching characteristics and thermal performance compared to traditional silicon-based solutions, their higher unit cost remains a primary consideration in mass-market EV applications.

Initial acquisition costs for SiC MOSFETs typically range from 2.5 to 4 times higher than their silicon IGBT counterparts, creating a substantial barrier to entry for cost-sensitive vehicle segments. However, this cost premium must be evaluated against system-level benefits that can offset the initial investment over the vehicle's operational lifetime.

Performance advantages of SiC implementation include reduced switching losses (approximately 60-80% lower than silicon), enabling higher switching frequencies that can reduce passive component sizes and costs. This allows for more compact inverter designs with power density improvements of up to 40% compared to silicon-based architectures, potentially reducing overall system footprint and weight.

Energy efficiency gains from SiC implementation typically range from 3-5% at the system level, which translates to meaningful range extensions in EVs. When quantified over vehicle lifetime, these efficiency improvements can represent significant energy cost savings that partially offset the higher initial component costs, particularly in premium and long-range vehicle segments where battery capacity is substantial.

Different inverter architectures leverage SiC benefits to varying degrees. Two-level topologies benefit from SiC's fast switching capabilities but may require more sophisticated gate drivers and EMI mitigation. Multilevel architectures can utilize lower-rated SiC devices operating at higher frequencies, potentially offering better cost-performance optimization in certain power ranges.

Manufacturing scalability also impacts the cost equation, with current SiC production volumes significantly lower than silicon alternatives. Industry projections suggest SiC component costs may decrease by 25-35% over the next five years as production scales, potentially altering the cost-benefit analysis for mainstream vehicle applications.

The optimal implementation strategy varies by vehicle segment and production volume. Premium and performance-oriented EVs can more easily absorb the cost premium of full SiC implementations, while mass-market vehicles may benefit from hybrid approaches that strategically deploy SiC components only in critical sections of the power conversion chain, maximizing performance gains while minimizing cost impact.

Initial acquisition costs for SiC MOSFETs typically range from 2.5 to 4 times higher than their silicon IGBT counterparts, creating a substantial barrier to entry for cost-sensitive vehicle segments. However, this cost premium must be evaluated against system-level benefits that can offset the initial investment over the vehicle's operational lifetime.

Performance advantages of SiC implementation include reduced switching losses (approximately 60-80% lower than silicon), enabling higher switching frequencies that can reduce passive component sizes and costs. This allows for more compact inverter designs with power density improvements of up to 40% compared to silicon-based architectures, potentially reducing overall system footprint and weight.

Energy efficiency gains from SiC implementation typically range from 3-5% at the system level, which translates to meaningful range extensions in EVs. When quantified over vehicle lifetime, these efficiency improvements can represent significant energy cost savings that partially offset the higher initial component costs, particularly in premium and long-range vehicle segments where battery capacity is substantial.

Different inverter architectures leverage SiC benefits to varying degrees. Two-level topologies benefit from SiC's fast switching capabilities but may require more sophisticated gate drivers and EMI mitigation. Multilevel architectures can utilize lower-rated SiC devices operating at higher frequencies, potentially offering better cost-performance optimization in certain power ranges.

Manufacturing scalability also impacts the cost equation, with current SiC production volumes significantly lower than silicon alternatives. Industry projections suggest SiC component costs may decrease by 25-35% over the next five years as production scales, potentially altering the cost-benefit analysis for mainstream vehicle applications.

The optimal implementation strategy varies by vehicle segment and production volume. Premium and performance-oriented EVs can more easily absorb the cost premium of full SiC implementations, while mass-market vehicles may benefit from hybrid approaches that strategically deploy SiC components only in critical sections of the power conversion chain, maximizing performance gains while minimizing cost impact.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!