EUV Lithography: Challenges and Opportunities in Market Adoption

OCT 14, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

EUV Lithography Evolution and Objectives

Extreme Ultraviolet (EUV) lithography represents a revolutionary advancement in semiconductor manufacturing technology, marking a significant departure from traditional Deep Ultraviolet (DUV) lithography methods. The evolution of EUV technology spans several decades, beginning with initial research in the 1980s when scientists first explored the potential of shorter wavelength light sources for semiconductor fabrication. By the 1990s, consortiums like ASML, along with research partners, began dedicated development efforts to overcome the fundamental challenges of creating viable EUV systems.

The technological progression accelerated in the early 2000s with the development of prototype EUV light sources and reflective optics systems. A critical milestone occurred in 2006 when ASML demonstrated the first full-field EUV lithography scanner. However, it wasn't until 2018 that EUV technology achieved commercial viability with ASML's TWINSCAN NXE:3400B system, capable of high-volume manufacturing at the 7nm node.

EUV lithography operates at a wavelength of 13.5nm, significantly shorter than the 193nm used in DUV systems. This dramatic reduction enables the printing of much finer features, addressing the limitations of traditional optical lithography techniques that had reached their physical boundaries. The technology employs a fundamentally different approach, using reflective rather than refractive optics and requiring vacuum environments due to EUV light's absorption by air molecules.

The primary objective of EUV lithography development has been to enable continued semiconductor scaling according to Moore's Law, which had faced increasing challenges with conventional lithography methods. Specific technical goals include achieving resolution capabilities below 10nm, improving throughput to economically viable levels (currently targeting >125 wafers per hour), enhancing overlay accuracy to <2nm, and reducing defectivity to levels acceptable for high-volume manufacturing.

Looking forward, the industry aims to extend EUV technology through several generations, with high-NA (numerical aperture) EUV systems representing the next major advancement. These systems promise to further improve resolution capabilities to support 3nm nodes and beyond. Additional objectives include reducing the total cost of ownership, improving source power and reliability, and developing complementary technologies such as advanced resists and mask infrastructure.

The ultimate goal remains enabling semiconductor manufacturers to continue delivering smaller, more powerful, and more energy-efficient chips to support emerging technologies such as artificial intelligence, quantum computing, and advanced mobile devices, maintaining the historical pace of innovation in the semiconductor industry despite increasing physical and economic challenges.

The technological progression accelerated in the early 2000s with the development of prototype EUV light sources and reflective optics systems. A critical milestone occurred in 2006 when ASML demonstrated the first full-field EUV lithography scanner. However, it wasn't until 2018 that EUV technology achieved commercial viability with ASML's TWINSCAN NXE:3400B system, capable of high-volume manufacturing at the 7nm node.

EUV lithography operates at a wavelength of 13.5nm, significantly shorter than the 193nm used in DUV systems. This dramatic reduction enables the printing of much finer features, addressing the limitations of traditional optical lithography techniques that had reached their physical boundaries. The technology employs a fundamentally different approach, using reflective rather than refractive optics and requiring vacuum environments due to EUV light's absorption by air molecules.

The primary objective of EUV lithography development has been to enable continued semiconductor scaling according to Moore's Law, which had faced increasing challenges with conventional lithography methods. Specific technical goals include achieving resolution capabilities below 10nm, improving throughput to economically viable levels (currently targeting >125 wafers per hour), enhancing overlay accuracy to <2nm, and reducing defectivity to levels acceptable for high-volume manufacturing.

Looking forward, the industry aims to extend EUV technology through several generations, with high-NA (numerical aperture) EUV systems representing the next major advancement. These systems promise to further improve resolution capabilities to support 3nm nodes and beyond. Additional objectives include reducing the total cost of ownership, improving source power and reliability, and developing complementary technologies such as advanced resists and mask infrastructure.

The ultimate goal remains enabling semiconductor manufacturers to continue delivering smaller, more powerful, and more energy-efficient chips to support emerging technologies such as artificial intelligence, quantum computing, and advanced mobile devices, maintaining the historical pace of innovation in the semiconductor industry despite increasing physical and economic challenges.

Semiconductor Industry Demand Analysis

The semiconductor industry's demand for advanced lithography technologies, particularly EUV (Extreme Ultraviolet) lithography, is primarily driven by the continuous pursuit of Moore's Law and the need for smaller, more powerful, and energy-efficient chips. Market analysis indicates that the global semiconductor industry, valued at approximately $556 billion in 2021, is projected to reach $1 trillion by 2030, with advanced lithography playing a crucial role in this growth trajectory.

The demand for EUV lithography is particularly strong in the manufacturing of logic chips below 7nm node, high-bandwidth memory, and advanced NAND flash memory. Leading semiconductor manufacturers including TSMC, Samsung, and Intel have committed substantial investments to EUV technology adoption, with TSMC alone allocating over $40 billion for capital expenditure in 2023, a significant portion directed toward EUV equipment.

Market segmentation reveals varying adoption rates across different semiconductor sectors. Logic chip manufacturers have been early adopters, with approximately 70% of advanced logic production now utilizing EUV technology. Memory chip manufacturers have shown more gradual adoption, with EUV implementation primarily in critical layers. The automotive semiconductor segment, growing at 15% annually due to increasing electronic content in vehicles, is beginning to require more advanced nodes that necessitate EUV technology.

Regional analysis demonstrates that East Asia dominates the demand landscape, with Taiwan, South Korea, and increasingly China representing the largest markets for EUV equipment. North America and Europe maintain strategic interests in developing domestic advanced semiconductor manufacturing capabilities, creating new demand centers for EUV technology.

The economic factors driving EUV adoption include the long-term cost advantages despite high initial investment. While an EUV lithography system costs approximately $150 million compared to $40 million for traditional DUV systems, the reduction in multi-patterning steps and improved yields offer compelling economic benefits for high-volume manufacturing at advanced nodes.

Customer demand patterns indicate a growing preference for chips manufactured using EUV technology due to performance advantages. End-user industries including mobile devices, data centers, artificial intelligence applications, and high-performance computing are driving this demand, with AI chip market growth exceeding 40% annually, necessitating the advanced node capabilities that EUV enables.

Future demand projections suggest that EUV lithography equipment market will grow at a CAGR of approximately 21% through 2027, with high-NA EUV systems expected to enter production by 2025 to address sub-3nm node requirements. This growth is supported by increasing semiconductor content across industries and the strategic importance of semiconductor manufacturing capability in national technology policies worldwide.

The demand for EUV lithography is particularly strong in the manufacturing of logic chips below 7nm node, high-bandwidth memory, and advanced NAND flash memory. Leading semiconductor manufacturers including TSMC, Samsung, and Intel have committed substantial investments to EUV technology adoption, with TSMC alone allocating over $40 billion for capital expenditure in 2023, a significant portion directed toward EUV equipment.

Market segmentation reveals varying adoption rates across different semiconductor sectors. Logic chip manufacturers have been early adopters, with approximately 70% of advanced logic production now utilizing EUV technology. Memory chip manufacturers have shown more gradual adoption, with EUV implementation primarily in critical layers. The automotive semiconductor segment, growing at 15% annually due to increasing electronic content in vehicles, is beginning to require more advanced nodes that necessitate EUV technology.

Regional analysis demonstrates that East Asia dominates the demand landscape, with Taiwan, South Korea, and increasingly China representing the largest markets for EUV equipment. North America and Europe maintain strategic interests in developing domestic advanced semiconductor manufacturing capabilities, creating new demand centers for EUV technology.

The economic factors driving EUV adoption include the long-term cost advantages despite high initial investment. While an EUV lithography system costs approximately $150 million compared to $40 million for traditional DUV systems, the reduction in multi-patterning steps and improved yields offer compelling economic benefits for high-volume manufacturing at advanced nodes.

Customer demand patterns indicate a growing preference for chips manufactured using EUV technology due to performance advantages. End-user industries including mobile devices, data centers, artificial intelligence applications, and high-performance computing are driving this demand, with AI chip market growth exceeding 40% annually, necessitating the advanced node capabilities that EUV enables.

Future demand projections suggest that EUV lithography equipment market will grow at a CAGR of approximately 21% through 2027, with high-NA EUV systems expected to enter production by 2025 to address sub-3nm node requirements. This growth is supported by increasing semiconductor content across industries and the strategic importance of semiconductor manufacturing capability in national technology policies worldwide.

EUV Technical Barriers and Global Development Status

Extreme Ultraviolet (EUV) lithography represents a significant technological leap in semiconductor manufacturing, yet its global adoption faces substantial technical barriers. The primary challenge remains the EUV light source technology, which requires generating and maintaining stable plasma at temperatures exceeding 200,000°C using tin droplets and CO2 lasers. This process demands unprecedented precision in thermal management and optical systems, creating significant engineering hurdles.

Power output presents another critical barrier, with current EUV systems operating at approximately 250W, while industry requirements push toward 500W for optimal throughput. This power gap directly impacts production economics and has slowed widespread implementation. Additionally, the creation of defect-free photomasks remains problematic, as even nanoscale imperfections can render entire chip designs unusable.

Globally, EUV technology development exhibits distinct geographical concentration. The Netherlands dominates through ASML's virtual monopoly on EUV lithography systems, while Japan leads in mask blanks and inspection technologies through companies like Lasertec. The United States maintains strength in light source technology and photoresist materials, with companies like Cymer (now an ASML subsidiary) playing crucial roles.

South Korea and Taiwan have emerged as primary adopters rather than developers, with Samsung and TSMC implementing EUV in high-volume manufacturing for advanced nodes (5nm and below). China's participation remains limited due to export restrictions on advanced EUV equipment, creating a significant technological divide in the global semiconductor landscape.

Technical progress varies significantly across regions. While Western Europe and North America have achieved breakthroughs in fundamental EUV technologies, East Asian countries excel in integration and manufacturing optimization. This regional specialization has created interdependencies in the global supply chain, with no single country possessing complete technological sovereignty in EUV lithography.

Recent developments indicate accelerating progress in addressing key barriers. Improvements in collector mirror technology have extended operational lifetimes from months to years, while advances in computational lithography have partially mitigated resolution limitations. However, the technology remains accessible primarily to leading-edge manufacturers with substantial capital resources, creating a bifurcation in the global semiconductor industry between EUV-capable and traditional lithography manufacturers.

Power output presents another critical barrier, with current EUV systems operating at approximately 250W, while industry requirements push toward 500W for optimal throughput. This power gap directly impacts production economics and has slowed widespread implementation. Additionally, the creation of defect-free photomasks remains problematic, as even nanoscale imperfections can render entire chip designs unusable.

Globally, EUV technology development exhibits distinct geographical concentration. The Netherlands dominates through ASML's virtual monopoly on EUV lithography systems, while Japan leads in mask blanks and inspection technologies through companies like Lasertec. The United States maintains strength in light source technology and photoresist materials, with companies like Cymer (now an ASML subsidiary) playing crucial roles.

South Korea and Taiwan have emerged as primary adopters rather than developers, with Samsung and TSMC implementing EUV in high-volume manufacturing for advanced nodes (5nm and below). China's participation remains limited due to export restrictions on advanced EUV equipment, creating a significant technological divide in the global semiconductor landscape.

Technical progress varies significantly across regions. While Western Europe and North America have achieved breakthroughs in fundamental EUV technologies, East Asian countries excel in integration and manufacturing optimization. This regional specialization has created interdependencies in the global supply chain, with no single country possessing complete technological sovereignty in EUV lithography.

Recent developments indicate accelerating progress in addressing key barriers. Improvements in collector mirror technology have extended operational lifetimes from months to years, while advances in computational lithography have partially mitigated resolution limitations. However, the technology remains accessible primarily to leading-edge manufacturers with substantial capital resources, creating a bifurcation in the global semiconductor industry between EUV-capable and traditional lithography manufacturers.

Current EUV Implementation Strategies

01 EUV lithography system advancements

Technological advancements in EUV lithography systems have been crucial for market adoption. These include improvements in light sources, optics, and overall system architecture to enhance resolution, throughput, and reliability. Such advancements have enabled the production of smaller and more complex semiconductor devices, driving the adoption of EUV lithography in high-volume manufacturing environments.- EUV lithography system advancements: Technological advancements in EUV lithography systems have been crucial for market adoption. These include improvements in light sources, optical systems, and overall system integration that enhance resolution, throughput, and reliability. Such advancements have enabled the production of smaller and more complex semiconductor devices, driving the adoption of EUV lithography in high-volume manufacturing environments.

- EUV mask and reticle technology: Innovations in EUV mask and reticle technology have significantly contributed to market adoption. These include developments in mask materials, defect inspection, repair techniques, and pattern fidelity enhancement. Advanced mask technologies enable more precise pattern transfer and help overcome challenges related to defects and pattern distortion, which are critical factors for the semiconductor industry's adoption of EUV lithography.

- EUV resist materials and processes: Development of specialized resist materials and processes for EUV lithography has been essential for market adoption. These materials are designed to be highly sensitive to EUV radiation while maintaining high resolution and low line edge roughness. Advancements in resist chemistry, development processes, and pattern transfer techniques have helped overcome sensitivity challenges and improve overall lithographic performance.

- Integration with semiconductor manufacturing: Successful integration of EUV lithography into existing semiconductor manufacturing workflows has been key to market adoption. This includes developing compatible process steps, metrology tools, and defect inspection systems. Solutions for seamless integration with other manufacturing processes and tools have helped semiconductor manufacturers transition to EUV technology while maintaining productivity and yield.

- Cost reduction and economic factors: Cost reduction strategies and economic factors have played a significant role in EUV lithography market adoption. These include improvements in system uptime, throughput enhancement, reduction in consumables cost, and overall cost of ownership. As the technology has matured, the economic benefits of using EUV for advanced nodes have become more compelling compared to multiple patterning approaches with traditional lithography, driving wider industry adoption.

02 EUV mask and pellicle technology

Innovations in EUV mask and pellicle technology have addressed critical challenges in EUV lithography adoption. These technologies focus on reducing defects, improving pattern accuracy, and protecting masks from contamination. Advanced mask inspection and repair techniques have also been developed to ensure the quality and reliability of EUV lithography in semiconductor manufacturing processes.Expand Specific Solutions03 EUV resist materials and processes

Development of specialized resist materials and processes has been essential for EUV lithography market adoption. These materials are designed to be highly sensitive to EUV radiation while maintaining high resolution and low line edge roughness. Innovations in resist chemistry, development processes, and pattern transfer techniques have contributed to overcoming sensitivity and resolution limitations in EUV lithography.Expand Specific Solutions04 Integration with semiconductor manufacturing

Successful integration of EUV lithography into existing semiconductor manufacturing workflows has been a key factor in market adoption. This includes developing compatible process steps, metrology tools, and defect inspection systems. Solutions for seamless integration with other lithography technologies and manufacturing processes have enabled semiconductor manufacturers to gradually transition to EUV technology while maintaining productivity.Expand Specific Solutions05 Cost reduction and economic viability

Efforts to reduce costs and improve the economic viability of EUV lithography have significantly impacted market adoption. These include increasing system uptime, improving wafer throughput, extending component lifetimes, and reducing power consumption. As the cost per wafer has decreased and reliability has improved, more semiconductor manufacturers have been able to justify the investment in EUV technology for high-volume production.Expand Specific Solutions

Leading EUV Equipment Manufacturers and Ecosystem

EUV Lithography market is in a growth phase, with increasing adoption despite high implementation costs. The global market is expanding rapidly, driven by demand for advanced semiconductor manufacturing. Technologically, EUV lithography has reached commercial viability but continues to evolve. ASML dominates the equipment sector, while semiconductor manufacturers like TSMC, Samsung Electronics, and Intel lead adoption. Companies including Applied Materials, Lam Research, and Carl Zeiss SMT provide critical supporting technologies. Chinese players like Shanghai Micro Electronics Equipment are emerging, though facing technological gaps. The ecosystem includes materials suppliers such as AGC, Mitsui Chemicals, and Nissan Chemical, creating a complex competitive landscape where collaboration and specialization are equally important for market success.

Taiwan Semiconductor Manufacturing Co., Ltd.

Technical Solution: TSMC has pioneered EUV lithography implementation in high-volume manufacturing, beginning with their 7nm+ process and fully deploying it in their 5nm and 3nm nodes. Their technical approach involves a comprehensive EUV infrastructure including specialized clean rooms, advanced resist processing, and proprietary computational lithography techniques. TSMC has developed unique pellicle solutions to protect EUV masks from contamination and implemented multi-patterning techniques to overcome resolution limitations. The company has invested over $17 billion in EUV technology and maintains over 50 ASML EUV systems in production. Their EUV implementation strategy includes specialized defect inspection systems and custom resist formulations optimized for their manufacturing processes. TSMC has also pioneered high-NA EUV integration planning for future nodes below 3nm.

Strengths: Industry-leading EUV implementation experience with proven high-volume manufacturing capability; superior yield management systems; extensive collaboration with equipment suppliers for customized solutions. Weaknesses: High capital expenditure requirements; dependency on ASML for EUV equipment; challenges with EUV power source stability affecting throughput in early implementations.

Intel Corp.

Technical Solution: Intel has developed a comprehensive EUV lithography strategy centered around their "IDM 2.0" manufacturing model. Their technical approach includes specialized EUV implementation in their 7nm (Intel 4) process and beyond, with full deployment planned for Intel 3 and 20A nodes. Intel has invested in proprietary computational lithography techniques specifically optimized for their CPU architectures, including advanced optical proximity correction and source-mask optimization. The company has developed custom resist formulations in partnership with suppliers to address the specific requirements of their logic-focused manufacturing. Intel's EUV implementation includes specialized defect detection systems and has required significant fab infrastructure modifications, including specialized clean rooms and vibration control systems. The company has committed to purchasing over 50 EUV systems from ASML through 2025, representing an investment exceeding $20 billion in EUV technology.

Strengths: Extensive in-house research capabilities; strong computational lithography expertise; ability to optimize EUV specifically for high-performance computing architectures. Weaknesses: Delayed EUV implementation compared to competitors; challenges in scaling production; higher manufacturing costs during transition period to EUV-based processes.

Critical EUV Patents and Technical Innovations

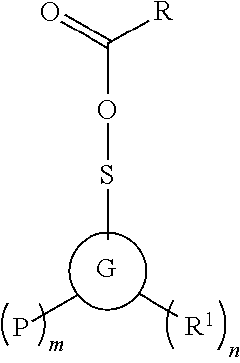

Monomers, polymers and lithographic compositions comprising same

PatentActiveUS11932713B2

Innovation

- Development of new monomer and polymer materials containing tellurium (Te) atoms for improved photoresist compositions, including addition-type polymers and monomers with unsaturated polymerizable groups, acid-cleavable, and polar groups, which enhance imaging capabilities and sensitivity.

Supply Chain Resilience for EUV Adoption

The supply chain for EUV lithography represents one of the most complex and specialized manufacturing networks in the semiconductor industry. ASML, as the sole producer of EUV lithography machines, sits at the center of a global ecosystem involving hundreds of suppliers across multiple continents. This concentration creates inherent vulnerabilities that require strategic management to ensure market adoption can proceed without disruption.

Critical components for EUV systems come from highly specialized suppliers, with some parts having no alternative sources. The optical systems require ultra-precise mirrors from Zeiss in Germany, while specialized lasers come from Trumpf and specific chemicals for photoresists are produced by a handful of Japanese companies. This supplier concentration creates potential bottlenecks that could severely impact production schedules if disruptions occur.

Geopolitical tensions have emerged as a significant risk factor for EUV supply chains. Export controls and technology restrictions between major semiconductor-producing nations have created uncertainty around the movement of components and technical knowledge. The strategic importance of EUV technology has elevated it to a matter of national security for several countries, further complicating the supply landscape.

The COVID-19 pandemic exposed additional vulnerabilities in the EUV supply chain, with lockdowns and transportation disruptions causing delays in machine deliveries. This experience has accelerated efforts to build more resilient supply networks, with major stakeholders implementing multi-sourcing strategies where possible and increasing inventory buffers for critical components.

Semiconductor manufacturers adopting EUV technology are developing contingency plans to mitigate supply risks. These include long-term purchasing agreements with ASML, strategic partnerships with key suppliers, and in some cases, investments in alternative lithography approaches as backup options. Leading chip manufacturers like TSMC, Samsung, and Intel have established dedicated teams to monitor supply chain risks and develop mitigation strategies.

Looking forward, building true resilience in the EUV supply chain will require collaborative efforts across the industry. This includes standardization initiatives for certain components, investment in workforce development to address skilled labor shortages, and coordinated research into alternative materials that could reduce dependence on scarce resources. Regional diversification of manufacturing capabilities for critical components will also play a key role in reducing geographic concentration risks.

Critical components for EUV systems come from highly specialized suppliers, with some parts having no alternative sources. The optical systems require ultra-precise mirrors from Zeiss in Germany, while specialized lasers come from Trumpf and specific chemicals for photoresists are produced by a handful of Japanese companies. This supplier concentration creates potential bottlenecks that could severely impact production schedules if disruptions occur.

Geopolitical tensions have emerged as a significant risk factor for EUV supply chains. Export controls and technology restrictions between major semiconductor-producing nations have created uncertainty around the movement of components and technical knowledge. The strategic importance of EUV technology has elevated it to a matter of national security for several countries, further complicating the supply landscape.

The COVID-19 pandemic exposed additional vulnerabilities in the EUV supply chain, with lockdowns and transportation disruptions causing delays in machine deliveries. This experience has accelerated efforts to build more resilient supply networks, with major stakeholders implementing multi-sourcing strategies where possible and increasing inventory buffers for critical components.

Semiconductor manufacturers adopting EUV technology are developing contingency plans to mitigate supply risks. These include long-term purchasing agreements with ASML, strategic partnerships with key suppliers, and in some cases, investments in alternative lithography approaches as backup options. Leading chip manufacturers like TSMC, Samsung, and Intel have established dedicated teams to monitor supply chain risks and develop mitigation strategies.

Looking forward, building true resilience in the EUV supply chain will require collaborative efforts across the industry. This includes standardization initiatives for certain components, investment in workforce development to address skilled labor shortages, and coordinated research into alternative materials that could reduce dependence on scarce resources. Regional diversification of manufacturing capabilities for critical components will also play a key role in reducing geographic concentration risks.

Economic Impact of EUV Transition

The transition to Extreme Ultraviolet (EUV) lithography represents one of the most significant technological shifts in semiconductor manufacturing, with far-reaching economic implications across the global technology ecosystem. The initial investment required for EUV implementation is substantial, with each lithography system costing approximately $120-150 million, compared to $40-60 million for advanced DUV systems. This capital expenditure creates a significant barrier to entry, reinforcing the oligopolistic nature of the advanced semiconductor manufacturing landscape.

For leading semiconductor manufacturers like TSMC, Samsung, and Intel, the EUV transition necessitates multi-billion-dollar fab investments. However, economic analysis indicates that despite high upfront costs, EUV adoption can reduce overall production expenses by 20-30% for advanced nodes below 7nm. This cost reduction stems primarily from process simplification, as EUV can replace multiple DUV lithography steps, reducing cycle time and improving yields.

The economic ripple effects extend throughout the supply chain. ASML, as the sole supplier of EUV lithography systems, has experienced exponential growth, with its market capitalization increasing over 300% since 2016. Simultaneously, specialized material suppliers for EUV photoresists and masks have developed new revenue streams, while traditional DUV-focused suppliers face market contraction.

From a macroeconomic perspective, EUV adoption accelerates the development of advanced computing capabilities, enabling continued adherence to Moore's Law economics. This technological progression supports an estimated $3-5 trillion in downstream economic activity across artificial intelligence, cloud computing, and advanced mobile technologies. Nations with EUV manufacturing capabilities gain significant economic advantages in the global technology race, explaining the geopolitical tensions surrounding EUV technology access.

Labor market impacts are equally profound, with EUV driving demand for highly specialized engineering talent. While reducing the need for certain traditional semiconductor manufacturing roles, it creates premium positions in EUV maintenance, operation, and development, with salary premiums of 30-50% for EUV-related expertise compared to general semiconductor positions.

The total cost of ownership calculations reveal that while EUV systems require 2-3 times higher maintenance costs than DUV systems, the economic benefits become compelling at high production volumes. Industry forecasts suggest that by 2025, over 60% of leading-edge semiconductor revenue will depend on EUV-enabled processes, representing approximately $150 billion in annual semiconductor sales directly tied to this technology transition.

For leading semiconductor manufacturers like TSMC, Samsung, and Intel, the EUV transition necessitates multi-billion-dollar fab investments. However, economic analysis indicates that despite high upfront costs, EUV adoption can reduce overall production expenses by 20-30% for advanced nodes below 7nm. This cost reduction stems primarily from process simplification, as EUV can replace multiple DUV lithography steps, reducing cycle time and improving yields.

The economic ripple effects extend throughout the supply chain. ASML, as the sole supplier of EUV lithography systems, has experienced exponential growth, with its market capitalization increasing over 300% since 2016. Simultaneously, specialized material suppliers for EUV photoresists and masks have developed new revenue streams, while traditional DUV-focused suppliers face market contraction.

From a macroeconomic perspective, EUV adoption accelerates the development of advanced computing capabilities, enabling continued adherence to Moore's Law economics. This technological progression supports an estimated $3-5 trillion in downstream economic activity across artificial intelligence, cloud computing, and advanced mobile technologies. Nations with EUV manufacturing capabilities gain significant economic advantages in the global technology race, explaining the geopolitical tensions surrounding EUV technology access.

Labor market impacts are equally profound, with EUV driving demand for highly specialized engineering talent. While reducing the need for certain traditional semiconductor manufacturing roles, it creates premium positions in EUV maintenance, operation, and development, with salary premiums of 30-50% for EUV-related expertise compared to general semiconductor positions.

The total cost of ownership calculations reveal that while EUV systems require 2-3 times higher maintenance costs than DUV systems, the economic benefits become compelling at high production volumes. Industry forecasts suggest that by 2025, over 60% of leading-edge semiconductor revenue will depend on EUV-enabled processes, representing approximately $150 billion in annual semiconductor sales directly tied to this technology transition.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!