How Do SiC MOSFETs Compare With Superjunction MOSFETs?

SEP 8, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

SiC vs Superjunction MOSFET Evolution and Objectives

Power semiconductor technology has evolved significantly over the past decades, with Metal-Oxide-Semiconductor Field-Effect Transistors (MOSFETs) playing a crucial role in power electronics applications. Two prominent technologies in this domain are Silicon Carbide (SiC) MOSFETs and Superjunction MOSFETs, each representing different evolutionary paths in semiconductor development.

Superjunction MOSFETs emerged in the late 1990s as an innovative approach to overcome the limitations of conventional silicon-based power MOSFETs. By introducing a unique vertical charge-compensation structure, these devices achieved a breakthrough in the silicon material's theoretical limits, significantly reducing on-resistance while maintaining high blocking voltage capabilities. This technology represented a major advancement in silicon-based power devices, enabling more efficient power conversion in numerous applications.

Meanwhile, SiC MOSFETs evolved from research laboratories in the early 2000s to commercial products in the 2010s. Unlike the architectural innovation of Superjunction devices, SiC MOSFETs leverage the inherent material advantages of silicon carbide, including wider bandgap, higher critical electric field, and superior thermal conductivity compared to silicon. These fundamental material properties allow SiC devices to operate at higher temperatures, voltages, and switching frequencies.

The technological trajectory of these two MOSFET types reflects different approaches to power semiconductor evolution. Superjunction technology represents the pinnacle of silicon optimization—pushing the boundaries of what's possible with traditional semiconductor material through sophisticated structural engineering. In contrast, SiC technology embodies the wide bandgap revolution—utilizing alternative semiconductor materials with inherently superior properties for power applications.

Current market trends indicate a growing adoption of SiC MOSFETs in high-performance applications, particularly in electric vehicles, renewable energy systems, and industrial drives. However, Superjunction MOSFETs continue to dominate in cost-sensitive applications where their mature manufacturing processes offer economic advantages. The coexistence of these technologies demonstrates the diversification strategy in power semiconductor development.

The primary technical objective for both technologies remains consistent: achieving lower conduction and switching losses, higher power density, improved reliability, and reduced system costs. However, their development paths diverge in terms of manufacturing challenges, reliability concerns, and application focus. SiC technology aims to expand into mainstream power conversion markets by addressing cost and reliability issues, while Superjunction technology continues to refine its structure for enhanced performance within silicon's physical limitations.

Looking forward, the evolution of these competing technologies will likely be shaped by advancements in manufacturing processes, packaging innovations, and system-level integration requirements. The ultimate objective is to enable more efficient, compact, and reliable power electronic systems that can meet the growing demands of electrification across various industries.

Superjunction MOSFETs emerged in the late 1990s as an innovative approach to overcome the limitations of conventional silicon-based power MOSFETs. By introducing a unique vertical charge-compensation structure, these devices achieved a breakthrough in the silicon material's theoretical limits, significantly reducing on-resistance while maintaining high blocking voltage capabilities. This technology represented a major advancement in silicon-based power devices, enabling more efficient power conversion in numerous applications.

Meanwhile, SiC MOSFETs evolved from research laboratories in the early 2000s to commercial products in the 2010s. Unlike the architectural innovation of Superjunction devices, SiC MOSFETs leverage the inherent material advantages of silicon carbide, including wider bandgap, higher critical electric field, and superior thermal conductivity compared to silicon. These fundamental material properties allow SiC devices to operate at higher temperatures, voltages, and switching frequencies.

The technological trajectory of these two MOSFET types reflects different approaches to power semiconductor evolution. Superjunction technology represents the pinnacle of silicon optimization—pushing the boundaries of what's possible with traditional semiconductor material through sophisticated structural engineering. In contrast, SiC technology embodies the wide bandgap revolution—utilizing alternative semiconductor materials with inherently superior properties for power applications.

Current market trends indicate a growing adoption of SiC MOSFETs in high-performance applications, particularly in electric vehicles, renewable energy systems, and industrial drives. However, Superjunction MOSFETs continue to dominate in cost-sensitive applications where their mature manufacturing processes offer economic advantages. The coexistence of these technologies demonstrates the diversification strategy in power semiconductor development.

The primary technical objective for both technologies remains consistent: achieving lower conduction and switching losses, higher power density, improved reliability, and reduced system costs. However, their development paths diverge in terms of manufacturing challenges, reliability concerns, and application focus. SiC technology aims to expand into mainstream power conversion markets by addressing cost and reliability issues, while Superjunction technology continues to refine its structure for enhanced performance within silicon's physical limitations.

Looking forward, the evolution of these competing technologies will likely be shaped by advancements in manufacturing processes, packaging innovations, and system-level integration requirements. The ultimate objective is to enable more efficient, compact, and reliable power electronic systems that can meet the growing demands of electrification across various industries.

Market Applications and Demand Analysis

The power electronics market is witnessing a significant shift toward more efficient and high-performance semiconductor devices, with SiC MOSFETs and Superjunction MOSFETs competing for market share across various applications. The global power semiconductor market, valued at approximately $43.5 billion in 2021, is projected to grow at a CAGR of 6.8% through 2028, driven by increasing demand for energy-efficient power conversion systems.

Market demand for SiC MOSFETs has experienced remarkable growth, particularly in electric vehicles (EVs), renewable energy systems, and industrial power supplies. The EV sector represents the fastest-growing application segment, with major automotive manufacturers increasingly adopting SiC technology in their traction inverters and onboard chargers to achieve higher power density and efficiency. This adoption is expected to accelerate as EV production volumes increase globally, with projections indicating that SiC content per vehicle could reach $500 by 2025.

Superjunction MOSFETs continue to dominate in medium-voltage applications (600V-900V), maintaining strong demand in consumer electronics, server power supplies, and telecommunications infrastructure. The market for these devices benefits from their established manufacturing ecosystem and lower cost structure compared to wide bandgap alternatives. Consumer electronics alone accounts for approximately 35% of Superjunction MOSFET applications, with power supplies representing another 28%.

Regional analysis reveals that Asia-Pacific, particularly China, Japan, and South Korea, leads in both production and consumption of power semiconductor devices. Europe shows strong demand growth for SiC MOSFETs, driven by stringent efficiency regulations and the rapid expansion of renewable energy infrastructure. North America maintains significant market share, particularly in high-performance computing and defense applications.

Industry surveys indicate that design engineers increasingly consider total system cost rather than component cost alone when selecting between these technologies. While SiC MOSFETs command premium pricing (typically 2-3 times higher than comparable Superjunction devices), the system-level benefits often justify the investment in applications where efficiency, thermal management, and power density are critical factors.

Market forecasts suggest that SiC MOSFETs will continue gaining market share in high-voltage applications (>1200V), while Superjunction MOSFETs will maintain dominance in the 600V range due to cost advantages. The 900V-1200V segment represents a competitive battleground where both technologies compete intensely, with selection depending on specific application requirements and design constraints.

Customer adoption patterns reveal that industries with longer design cycles and higher reliability requirements, such as industrial drives and traction systems, are increasingly favoring SiC MOSFETs despite higher initial costs. Meanwhile, consumer and commercial applications with tighter cost constraints continue to rely predominantly on Superjunction technology, though this balance is gradually shifting as SiC manufacturing scales and costs decrease.

Market demand for SiC MOSFETs has experienced remarkable growth, particularly in electric vehicles (EVs), renewable energy systems, and industrial power supplies. The EV sector represents the fastest-growing application segment, with major automotive manufacturers increasingly adopting SiC technology in their traction inverters and onboard chargers to achieve higher power density and efficiency. This adoption is expected to accelerate as EV production volumes increase globally, with projections indicating that SiC content per vehicle could reach $500 by 2025.

Superjunction MOSFETs continue to dominate in medium-voltage applications (600V-900V), maintaining strong demand in consumer electronics, server power supplies, and telecommunications infrastructure. The market for these devices benefits from their established manufacturing ecosystem and lower cost structure compared to wide bandgap alternatives. Consumer electronics alone accounts for approximately 35% of Superjunction MOSFET applications, with power supplies representing another 28%.

Regional analysis reveals that Asia-Pacific, particularly China, Japan, and South Korea, leads in both production and consumption of power semiconductor devices. Europe shows strong demand growth for SiC MOSFETs, driven by stringent efficiency regulations and the rapid expansion of renewable energy infrastructure. North America maintains significant market share, particularly in high-performance computing and defense applications.

Industry surveys indicate that design engineers increasingly consider total system cost rather than component cost alone when selecting between these technologies. While SiC MOSFETs command premium pricing (typically 2-3 times higher than comparable Superjunction devices), the system-level benefits often justify the investment in applications where efficiency, thermal management, and power density are critical factors.

Market forecasts suggest that SiC MOSFETs will continue gaining market share in high-voltage applications (>1200V), while Superjunction MOSFETs will maintain dominance in the 600V range due to cost advantages. The 900V-1200V segment represents a competitive battleground where both technologies compete intensely, with selection depending on specific application requirements and design constraints.

Customer adoption patterns reveal that industries with longer design cycles and higher reliability requirements, such as industrial drives and traction systems, are increasingly favoring SiC MOSFETs despite higher initial costs. Meanwhile, consumer and commercial applications with tighter cost constraints continue to rely predominantly on Superjunction technology, though this balance is gradually shifting as SiC manufacturing scales and costs decrease.

Technical Comparison and Performance Limitations

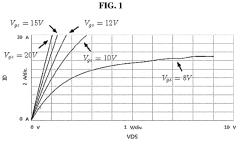

Silicon Carbide (SiC) MOSFETs and Superjunction MOSFETs represent two distinct approaches to power semiconductor technology, each with unique performance characteristics and limitations. When comparing these technologies, SiC MOSFETs demonstrate superior high-temperature operation capabilities, functioning reliably at junction temperatures up to 200°C compared to the 150°C limit of Superjunction devices. This temperature advantage stems from SiC's wider bandgap (3.26 eV versus silicon's 1.12 eV), enabling operation in more thermally demanding environments.

In terms of switching performance, SiC MOSFETs exhibit significantly lower switching losses, particularly at higher frequencies (>50 kHz), enabling more efficient operation in high-frequency applications. This advantage derives from SiC's smaller die size and reduced parasitic capacitances. However, Superjunction MOSFETs maintain competitive or superior performance in the 20-50 kHz range commonly used in many power conversion applications.

Regarding on-state resistance (RDS(on)), both technologies have achieved impressive advancements. Superjunction MOSFETs leverage their unique vertical charge-balanced structure to break the silicon theoretical limit, achieving RDS(on) values as low as 14 mΩ·cm² at 650V ratings. SiC MOSFETs, while starting with higher resistance values, have seen rapid improvements, now reaching comparable performance levels while maintaining this advantage across a wider temperature range.

A critical limitation for SiC MOSFETs remains their gate oxide reliability. The interface between SiC and SiO2 contains significantly more defects than silicon-based interfaces, leading to lower threshold voltage stability and potential long-term reliability concerns. This necessitates more conservative gate drive designs, typically limiting gate voltages to +20V/-5V ranges compared to the ±30V tolerance of Superjunction devices.

Cost considerations present another significant limitation for SiC technology. Despite recent manufacturing improvements, SiC MOSFETs typically command a 2-3x price premium over equivalent Superjunction devices. This cost differential stems from more complex manufacturing processes, lower yields, and smaller wafer sizes (6-inch for SiC versus 12-inch for silicon).

Body diode performance represents another comparative dimension. SiC MOSFETs feature inherent body diodes with higher forward voltage drops (3-4V) compared to Superjunction MOSFETs (0.7-1.2V), but offer significantly faster recovery times and lower reverse recovery charges, critical for high-frequency applications.

Electromagnetic interference (EMI) characteristics differ substantially between these technologies. SiC MOSFETs' faster switching speeds generate higher dv/dt and di/dt rates, potentially creating more severe EMI challenges that require careful PCB layout and filtering solutions. Superjunction devices, while not immune to EMI issues, typically present more manageable electromagnetic profiles in standard applications.

In terms of switching performance, SiC MOSFETs exhibit significantly lower switching losses, particularly at higher frequencies (>50 kHz), enabling more efficient operation in high-frequency applications. This advantage derives from SiC's smaller die size and reduced parasitic capacitances. However, Superjunction MOSFETs maintain competitive or superior performance in the 20-50 kHz range commonly used in many power conversion applications.

Regarding on-state resistance (RDS(on)), both technologies have achieved impressive advancements. Superjunction MOSFETs leverage their unique vertical charge-balanced structure to break the silicon theoretical limit, achieving RDS(on) values as low as 14 mΩ·cm² at 650V ratings. SiC MOSFETs, while starting with higher resistance values, have seen rapid improvements, now reaching comparable performance levels while maintaining this advantage across a wider temperature range.

A critical limitation for SiC MOSFETs remains their gate oxide reliability. The interface between SiC and SiO2 contains significantly more defects than silicon-based interfaces, leading to lower threshold voltage stability and potential long-term reliability concerns. This necessitates more conservative gate drive designs, typically limiting gate voltages to +20V/-5V ranges compared to the ±30V tolerance of Superjunction devices.

Cost considerations present another significant limitation for SiC technology. Despite recent manufacturing improvements, SiC MOSFETs typically command a 2-3x price premium over equivalent Superjunction devices. This cost differential stems from more complex manufacturing processes, lower yields, and smaller wafer sizes (6-inch for SiC versus 12-inch for silicon).

Body diode performance represents another comparative dimension. SiC MOSFETs feature inherent body diodes with higher forward voltage drops (3-4V) compared to Superjunction MOSFETs (0.7-1.2V), but offer significantly faster recovery times and lower reverse recovery charges, critical for high-frequency applications.

Electromagnetic interference (EMI) characteristics differ substantially between these technologies. SiC MOSFETs' faster switching speeds generate higher dv/dt and di/dt rates, potentially creating more severe EMI challenges that require careful PCB layout and filtering solutions. Superjunction devices, while not immune to EMI issues, typically present more manageable electromagnetic profiles in standard applications.

Current Design Solutions and Implementation Strategies

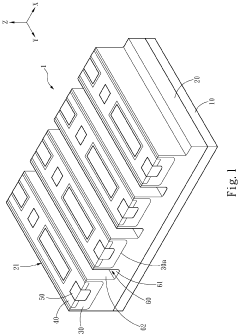

01 Structural design and fabrication of SiC MOSFETs

Silicon Carbide (SiC) MOSFETs feature unique structural designs that enhance their performance in high-power applications. These designs include specialized gate structures, channel formations, and substrate configurations that improve electron mobility and reduce on-resistance. The fabrication processes involve specific techniques for growing high-quality SiC crystals, forming reliable gate oxides, and creating efficient contact interfaces, which collectively contribute to the superior thermal conductivity and breakdown voltage characteristics of SiC MOSFETs.- Comparative advantages of SiC MOSFETs over Superjunction MOSFETs: Silicon Carbide (SiC) MOSFETs offer significant advantages over Superjunction MOSFETs in high-voltage applications. These advantages include higher breakdown voltage, lower on-resistance, better thermal conductivity, and superior switching performance at high frequencies. SiC MOSFETs can operate at higher temperatures and provide greater efficiency in power conversion systems, making them increasingly preferred for applications requiring high power density and energy efficiency.

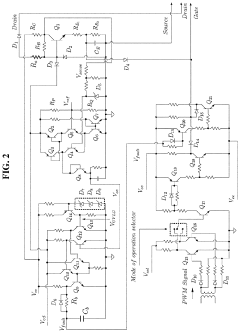

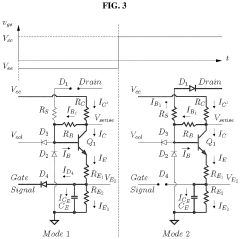

- Circuit design considerations for SiC and Superjunction MOSFETs: Designing circuits with SiC MOSFETs and Superjunction MOSFETs requires specific considerations due to their unique characteristics. Gate drive requirements differ significantly between these technologies, with SiC MOSFETs typically requiring higher gate voltages. Protection circuits, layout optimization, and thermal management strategies must be tailored to each technology's switching behavior and parasitic elements. Proper circuit design can maximize the performance benefits of both technologies while mitigating their respective limitations.

- Application-specific implementations of SiC and Superjunction MOSFETs: SiC and Superjunction MOSFETs are deployed in various applications based on their specific performance characteristics. SiC MOSFETs excel in high-temperature, high-frequency applications such as electric vehicle inverters, solar inverters, and industrial motor drives. Superjunction MOSFETs are often preferred in medium-voltage applications where cost sensitivity is higher, such as server power supplies, telecom equipment, and consumer electronics. The selection between these technologies depends on application requirements including voltage rating, switching frequency, efficiency targets, and cost constraints.

- Hybrid solutions combining SiC and Superjunction MOSFETs: Innovative power conversion systems are being developed that strategically combine SiC and Superjunction MOSFETs to leverage the advantages of both technologies. These hybrid approaches may use SiC devices in high-stress switching positions while employing Superjunction MOSFETs in less demanding roles within the same circuit. Such combinations can optimize system performance, reliability, and cost-effectiveness. Hybrid solutions are particularly valuable in applications with varying load conditions or complex power conversion requirements.

- Manufacturing and reliability improvements in SiC and Superjunction MOSFETs: Ongoing advancements in manufacturing processes are enhancing the performance and reliability of both SiC and Superjunction MOSFETs. For SiC devices, improvements focus on reducing defect density in the crystal structure, enhancing channel mobility, and increasing wafer size to reduce costs. For Superjunction MOSFETs, manufacturing innovations include finer pitch designs, deeper trenches, and improved charge balance techniques. These developments are progressively narrowing the performance gap between the technologies while addressing reliability challenges such as gate oxide stability and body diode performance.

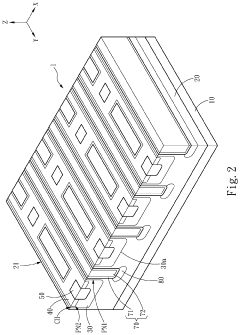

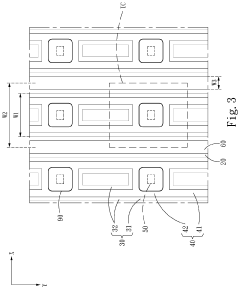

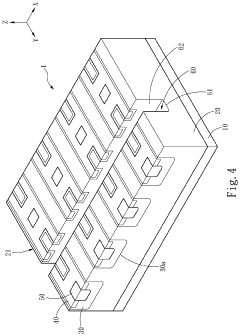

02 Superjunction MOSFET architecture and performance optimization

Superjunction MOSFETs employ a unique architecture featuring alternating p-type and n-type pillars or columns that enable charge balance in the drift region. This design significantly reduces on-resistance while maintaining high breakdown voltage capabilities. Performance optimization techniques include refining the aspect ratio of the pillars, adjusting doping concentrations, and implementing specialized termination structures. These enhancements allow Superjunction MOSFETs to achieve superior power density and switching efficiency compared to conventional power MOSFETs.Expand Specific Solutions03 Comparative advantages of SiC MOSFETs versus Superjunction MOSFETs

SiC MOSFETs and Superjunction MOSFETs offer distinct advantages in different application scenarios. SiC MOSFETs excel in high-temperature environments, providing superior thermal conductivity, higher breakdown voltage, and faster switching speeds. They demonstrate particular benefits in high-frequency applications and systems requiring operation above 150°C. Superjunction MOSFETs, while limited to silicon material constraints, offer cost advantages and better performance in medium-voltage applications. The selection between these technologies depends on specific requirements for efficiency, thermal management, switching frequency, and cost considerations.Expand Specific Solutions04 Circuit integration and driver solutions for advanced MOSFETs

Integrating SiC MOSFETs and Superjunction MOSFETs into power electronic circuits requires specialized gate driver solutions to optimize their switching performance. These driver circuits must address the unique gate charge characteristics, threshold voltage requirements, and switching speed capabilities of each MOSFET technology. Advanced protection features, such as desaturation detection, overcurrent protection, and temperature monitoring, are implemented to ensure reliable operation. Proper circuit layout techniques, including minimized loop inductance and optimized thermal management, are essential for maximizing the benefits of these advanced MOSFET technologies.Expand Specific Solutions05 Application-specific implementations in power conversion systems

SiC MOSFETs and Superjunction MOSFETs are implemented in various power conversion systems with application-specific optimizations. In electric vehicle inverters, SiC MOSFETs provide efficiency advantages through reduced switching losses and higher operating temperatures. For renewable energy systems, both technologies offer improved power density and conversion efficiency. In industrial motor drives, the selection depends on voltage ratings and switching frequency requirements. Power supply applications benefit from the reduced size of magnetic components enabled by higher switching frequencies. Each implementation requires careful consideration of thermal management, EMI mitigation, and reliability factors specific to the application environment.Expand Specific Solutions

Leading Manufacturers and Competitive Landscape

The SiC MOSFET versus Superjunction MOSFET market is currently in a growth phase, with the global power semiconductor market expanding rapidly due to increasing demand for energy-efficient solutions. SiC technology is maturing but still emerging compared to established Superjunction technology, with market size projected to reach significant growth in the next five years. Companies like GeneSiC Semiconductor, Infineon Technologies, ROHM, and Fuji Electric lead in SiC MOSFET development, while Huawei Digital Power, DENSO, and Gree are advancing applications. Chinese players including Nami Mos, Anhui Xinta, and Sirius Semiconductor are increasingly competitive, indicating a dynamic landscape with both established global leaders and emerging regional challengers.

GeneSiC Semiconductor LLC

Technical Solution: GeneSiC's technical approach to comparing SiC MOSFETs with Superjunction MOSFETs focuses on their G3R™ SiC MOSFET technology platform. Their solution demonstrates superior switching performance with dv/dt capabilities exceeding 100V/ns, approximately 3-4 times faster than comparable Superjunction devices. GeneSiC's SiC MOSFETs exhibit significantly lower output capacitance (Coss), resulting in reduced switching losses at high frequencies (>50kHz). Their technical analysis shows that while Superjunction MOSFETs achieve excellent performance in 600V applications, their SiC devices maintain performance advantages across broader voltage ranges (650V-1700V), with particularly compelling benefits at 1200V where specific on-resistance is approximately 75% lower than the best Superjunction alternatives. GeneSiC's comparative testing demonstrates their SiC MOSFETs maintaining consistent RDS(on) characteristics across temperature ranges from -55°C to +175°C, with only about 20% increase at maximum temperature, whereas Superjunction devices typically show 80-100% resistance increase at elevated temperatures. Their latest generation devices incorporate advanced termination structures that enhance reliability under repetitive avalanche conditions, outperforming Superjunction alternatives in ruggedness testing.

Strengths: Industry-leading high-temperature performance; excellent short-circuit withstand capability; superior avalanche ruggedness compared to competitors. Weaknesses: Higher cost structure than silicon alternatives; requires careful gate drive design to manage faster switching speeds; relatively smaller company scale compared to larger semiconductor manufacturers.

Huawei Digital Power Technologies Co Ltd

Technical Solution: Huawei Digital Power's comparative analysis between SiC MOSFETs and Superjunction MOSFETs centers on their power conversion solutions for telecommunications and renewable energy applications. Their technical approach demonstrates that their SiC-based power systems achieve 98.5% conversion efficiency, approximately 1-1.5% higher than equivalent Superjunction-based designs. Huawei's SiC implementation focuses on optimized packaging and thermal management, addressing key challenges in high-power density applications. Their comparative testing shows SiC MOSFETs enabling 30% reduction in overall system volume compared to Superjunction alternatives in 1200V applications, primarily through higher switching frequencies (80kHz vs 30kHz) and reduced cooling requirements. For solar inverter applications, Huawei's analysis demonstrates their SiC solutions reducing energy losses by approximately 20% compared to Superjunction-based designs under typical operating conditions. Their technical solution includes advanced gate driver designs specifically optimized for SiC characteristics, managing faster switching transitions while maintaining electromagnetic compatibility. Huawei's system-level approach emphasizes total cost of ownership benefits, showing that despite higher initial component costs, their SiC implementations deliver superior lifetime value through energy savings and increased power density.

Strengths: Exceptional system-level integration expertise; comprehensive thermal management solutions; strong focus on reliability through advanced testing methodologies. Weaknesses: Less vertical integration in semiconductor manufacturing compared to dedicated device manufacturers; relatively newer entrant to SiC device development; solutions primarily optimized for specific application segments rather than general-purpose use.

Key Patents and Innovations in MOSFET Technology

High temperature gate driver for silicon carbide metal-oxide-semiconductor field-effect transistor

PatentActiveUS11218145B2

Innovation

- A low-cost high temperature gate driver utilizing commercial-off-the-shelf discrete transistors and diodes, integrated with a robust overcurrent and under voltage lock out protection circuit, capable of operating up to 180°C, featuring a reduced propagation delay and flexible short-circuit protection, designed to minimize self-heating and enhance reliability.

Silicon carbide semiconductor device

PatentPendingUS20240234569A9

Innovation

- A silicon carbide semiconductor device with a hybrid gate structure featuring a trench gate configuration that reduces JFET resistance and parasitic gate-to-drain capacitance, enhancing switching performance by increasing channel width density and optimizing the layout of doped regions and trenches.

Thermal Management Challenges and Solutions

Thermal management represents a critical differentiator between Silicon Carbide (SiC) MOSFETs and Superjunction MOSFETs, with significant implications for system design and performance. SiC MOSFETs demonstrate superior thermal conductivity (approximately 3-4 times higher than silicon), allowing for more efficient heat dissipation from the semiconductor die to the package and heatsink. This inherent material advantage enables SiC devices to operate at junction temperatures up to 200°C, substantially higher than the typical 150-175°C limit of silicon-based Superjunction MOSFETs.

Despite these advantages, SiC MOSFETs present unique thermal management challenges. Their ability to operate at higher switching frequencies and power densities concentrates heat generation in smaller die areas, creating localized hotspots that require careful thermal design consideration. Additionally, the higher operating temperatures of SiC devices necessitate specialized packaging materials and techniques to maintain reliability and performance over the device lifetime.

Superjunction MOSFETs, while limited to lower maximum junction temperatures, benefit from mature thermal management solutions and established packaging technologies. Their larger die sizes distribute heat more evenly, reducing thermal resistance concerns in certain applications. However, as switching frequencies increase, the higher switching losses in Superjunction devices generate additional heat that must be managed effectively.

Innovative cooling solutions have emerged to address these challenges. Direct liquid cooling systems have proven particularly effective for SiC MOSFETs, enabling higher power densities while maintaining safe operating temperatures. Advanced thermal interface materials (TIMs) with improved thermal conductivity are being developed specifically for wide-bandgap semiconductors to reduce the thermal resistance between die and heatsink.

Double-sided cooling techniques, where heat is extracted from both the top and bottom surfaces of the semiconductor package, show promising results for high-power SiC applications. These approaches can significantly reduce the overall thermal resistance and enable more compact power electronic systems.

The thermal management ecosystem continues to evolve with specialized simulation tools that accurately model the unique thermal characteristics of SiC devices. These tools enable designers to predict hotspots, optimize heatsink designs, and evaluate thermal performance under various operating conditions before physical prototyping.

For system designers, the selection between SiC MOSFETs and Superjunction MOSFETs must consider the complete thermal solution, including cooling method, ambient temperature conditions, and transient thermal behavior. While SiC devices offer superior thermal conductivity and temperature tolerance, they may require more sophisticated thermal management approaches to fully realize their performance potential in demanding applications.

Despite these advantages, SiC MOSFETs present unique thermal management challenges. Their ability to operate at higher switching frequencies and power densities concentrates heat generation in smaller die areas, creating localized hotspots that require careful thermal design consideration. Additionally, the higher operating temperatures of SiC devices necessitate specialized packaging materials and techniques to maintain reliability and performance over the device lifetime.

Superjunction MOSFETs, while limited to lower maximum junction temperatures, benefit from mature thermal management solutions and established packaging technologies. Their larger die sizes distribute heat more evenly, reducing thermal resistance concerns in certain applications. However, as switching frequencies increase, the higher switching losses in Superjunction devices generate additional heat that must be managed effectively.

Innovative cooling solutions have emerged to address these challenges. Direct liquid cooling systems have proven particularly effective for SiC MOSFETs, enabling higher power densities while maintaining safe operating temperatures. Advanced thermal interface materials (TIMs) with improved thermal conductivity are being developed specifically for wide-bandgap semiconductors to reduce the thermal resistance between die and heatsink.

Double-sided cooling techniques, where heat is extracted from both the top and bottom surfaces of the semiconductor package, show promising results for high-power SiC applications. These approaches can significantly reduce the overall thermal resistance and enable more compact power electronic systems.

The thermal management ecosystem continues to evolve with specialized simulation tools that accurately model the unique thermal characteristics of SiC devices. These tools enable designers to predict hotspots, optimize heatsink designs, and evaluate thermal performance under various operating conditions before physical prototyping.

For system designers, the selection between SiC MOSFETs and Superjunction MOSFETs must consider the complete thermal solution, including cooling method, ambient temperature conditions, and transient thermal behavior. While SiC devices offer superior thermal conductivity and temperature tolerance, they may require more sophisticated thermal management approaches to fully realize their performance potential in demanding applications.

Cost-Performance Trade-offs and Economic Viability

The economic analysis of SiC MOSFETs versus Superjunction MOSFETs reveals a complex landscape of cost-performance trade-offs that significantly impact adoption decisions across various industries. SiC MOSFETs currently command a substantial price premium, typically 3-5 times higher than comparable Superjunction devices, primarily due to more complex manufacturing processes, lower production volumes, and higher substrate costs.

This price differential creates an immediate barrier to adoption, particularly in cost-sensitive consumer applications where performance improvements may not justify the additional expense. However, when evaluating total cost of ownership across the device lifecycle, SiC MOSFETs often present compelling economic advantages in specific applications.

System-level cost analysis demonstrates that SiC MOSFETs can enable significant reductions in peripheral component requirements. Their superior thermal performance reduces cooling system complexity, while higher switching frequencies allow for smaller passive components. In high-power applications, these system-level savings can offset the initial device cost premium within 1-3 years of operation.

Energy efficiency represents another critical economic factor. SiC MOSFETs' lower conduction and switching losses translate to energy savings of 20-30% in typical power conversion applications compared to Superjunction alternatives. In applications with continuous operation, such as industrial drives or renewable energy systems, these efficiency gains can deliver substantial operational cost reductions that justify the higher initial investment.

Market segmentation analysis reveals varying economic viability across application domains. In automotive and industrial sectors where performance, reliability, and long-term operational costs are prioritized, SiC MOSFETs increasingly demonstrate favorable economics despite higher acquisition costs. Conversely, in consumer electronics and low-power applications, Superjunction MOSFETs maintain economic advantage due to their lower cost and sufficient performance characteristics.

The economic equation is rapidly evolving as SiC manufacturing scales. Industry projections indicate SiC MOSFET prices may decrease by 10-15% annually over the next five years as production volumes increase and manufacturing processes mature. This trend will progressively expand the range of applications where SiC MOSFETs become economically viable alternatives to Superjunction technology.

Decision frameworks for technology selection must therefore incorporate both immediate cost considerations and long-term value factors including efficiency gains, system simplification, reliability improvements, and expected service life to accurately assess the true economic viability of each technology in specific application contexts.

This price differential creates an immediate barrier to adoption, particularly in cost-sensitive consumer applications where performance improvements may not justify the additional expense. However, when evaluating total cost of ownership across the device lifecycle, SiC MOSFETs often present compelling economic advantages in specific applications.

System-level cost analysis demonstrates that SiC MOSFETs can enable significant reductions in peripheral component requirements. Their superior thermal performance reduces cooling system complexity, while higher switching frequencies allow for smaller passive components. In high-power applications, these system-level savings can offset the initial device cost premium within 1-3 years of operation.

Energy efficiency represents another critical economic factor. SiC MOSFETs' lower conduction and switching losses translate to energy savings of 20-30% in typical power conversion applications compared to Superjunction alternatives. In applications with continuous operation, such as industrial drives or renewable energy systems, these efficiency gains can deliver substantial operational cost reductions that justify the higher initial investment.

Market segmentation analysis reveals varying economic viability across application domains. In automotive and industrial sectors where performance, reliability, and long-term operational costs are prioritized, SiC MOSFETs increasingly demonstrate favorable economics despite higher acquisition costs. Conversely, in consumer electronics and low-power applications, Superjunction MOSFETs maintain economic advantage due to their lower cost and sufficient performance characteristics.

The economic equation is rapidly evolving as SiC manufacturing scales. Industry projections indicate SiC MOSFET prices may decrease by 10-15% annually over the next five years as production volumes increase and manufacturing processes mature. This trend will progressively expand the range of applications where SiC MOSFETs become economically viable alternatives to Superjunction technology.

Decision frameworks for technology selection must therefore incorporate both immediate cost considerations and long-term value factors including efficiency gains, system simplification, reliability improvements, and expected service life to accurately assess the true economic viability of each technology in specific application contexts.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!