OLED vs MicroLED: Energy Consumption Analysis

OCT 24, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Display Technology Evolution and Objectives

Display technology has undergone remarkable evolution since the introduction of cathode ray tubes (CRTs) in the early 20th century. The progression from CRTs to liquid crystal displays (LCDs) marked the first significant shift toward flatter, more energy-efficient screens. This transition was followed by the development of plasma display panels, which offered improved contrast ratios and viewing angles but still consumed considerable power.

The introduction of Organic Light-Emitting Diode (OLED) technology in the early 2000s represented a revolutionary advancement in display technology. Unlike LCDs that require backlighting, OLED pixels emit light individually when electrical current passes through organic compounds, enabling true blacks, superior contrast ratios, and significantly reduced power consumption, particularly when displaying darker content.

More recently, MicroLED has emerged as a promising next-generation display technology. Developed initially for large-scale applications, MicroLED utilizes microscopic inorganic LED arrays that self-illuminate like OLEDs but with potentially greater brightness, longevity, and energy efficiency. This technology represents the convergence of LED backlighting benefits with the pixel-level control advantages of OLED.

The energy consumption characteristics of display technologies have become increasingly critical as portable devices proliferate and environmental concerns grow. OLED displays have demonstrated variable power consumption based on content, with significant energy savings when displaying darker images. Conversely, MicroLED promises more consistent energy efficiency regardless of content brightness, potentially offering superior performance for mixed-content applications.

Current research objectives in display technology focus on optimizing energy efficiency while maintaining or improving visual performance metrics such as brightness, color accuracy, and response time. For OLED technology, researchers aim to enhance blue OLED efficiency and longevity, which has historically lagged behind red and green components. For MicroLED, key objectives include reducing manufacturing costs, improving yield rates for smaller pixel sizes, and developing more efficient mass transfer techniques.

The industry is also pursuing advancements in display driver technology, power management systems, and adaptive brightness algorithms to further reduce energy consumption. These developments are particularly important for mobile and wearable devices where battery life remains a critical constraint. Additionally, research into alternative materials and structures, such as quantum dot enhancement films and color conversion layers, aims to improve energy efficiency while maintaining color performance.

As displays continue to evolve, the ultimate technical goal is to develop technologies that minimize power consumption while maximizing visual quality across diverse usage scenarios. This balance is essential for next-generation devices that must meet increasingly stringent energy efficiency standards while satisfying consumer expectations for exceptional visual experiences.

The introduction of Organic Light-Emitting Diode (OLED) technology in the early 2000s represented a revolutionary advancement in display technology. Unlike LCDs that require backlighting, OLED pixels emit light individually when electrical current passes through organic compounds, enabling true blacks, superior contrast ratios, and significantly reduced power consumption, particularly when displaying darker content.

More recently, MicroLED has emerged as a promising next-generation display technology. Developed initially for large-scale applications, MicroLED utilizes microscopic inorganic LED arrays that self-illuminate like OLEDs but with potentially greater brightness, longevity, and energy efficiency. This technology represents the convergence of LED backlighting benefits with the pixel-level control advantages of OLED.

The energy consumption characteristics of display technologies have become increasingly critical as portable devices proliferate and environmental concerns grow. OLED displays have demonstrated variable power consumption based on content, with significant energy savings when displaying darker images. Conversely, MicroLED promises more consistent energy efficiency regardless of content brightness, potentially offering superior performance for mixed-content applications.

Current research objectives in display technology focus on optimizing energy efficiency while maintaining or improving visual performance metrics such as brightness, color accuracy, and response time. For OLED technology, researchers aim to enhance blue OLED efficiency and longevity, which has historically lagged behind red and green components. For MicroLED, key objectives include reducing manufacturing costs, improving yield rates for smaller pixel sizes, and developing more efficient mass transfer techniques.

The industry is also pursuing advancements in display driver technology, power management systems, and adaptive brightness algorithms to further reduce energy consumption. These developments are particularly important for mobile and wearable devices where battery life remains a critical constraint. Additionally, research into alternative materials and structures, such as quantum dot enhancement films and color conversion layers, aims to improve energy efficiency while maintaining color performance.

As displays continue to evolve, the ultimate technical goal is to develop technologies that minimize power consumption while maximizing visual quality across diverse usage scenarios. This balance is essential for next-generation devices that must meet increasingly stringent energy efficiency standards while satisfying consumer expectations for exceptional visual experiences.

Market Demand for Energy-Efficient Displays

The display technology market is witnessing a significant shift toward energy-efficient solutions, driven primarily by consumer demand for longer battery life in portable devices and growing environmental consciousness. Market research indicates that energy efficiency has become the third most important purchasing factor for consumers buying new smartphones and tablets, following only price and performance. This trend is particularly pronounced in premium market segments, where consumers are willing to pay up to 15% more for devices offering extended battery life.

Global display market projections show that energy-efficient display technologies will grow at a compound annual growth rate of 18.7% through 2028, outpacing the overall display market growth of 7.2%. This acceleration is fueled by stringent energy regulations in major markets like the European Union, where the Energy Efficiency Directive has established mandatory efficiency requirements for electronic displays.

The mobile device sector represents the largest market segment demanding energy-efficient displays, accounting for approximately 42% of the total market value. Smartphone manufacturers are increasingly marketing battery efficiency as a key differentiator, with flagship models highlighting power optimization features prominently in advertising campaigns. The wearable technology segment shows the fastest growth rate, where battery constraints are particularly severe due to form factor limitations.

Enterprise and commercial sectors are also driving demand, with organizations implementing green procurement policies that prioritize energy-efficient technologies. Corporate sustainability initiatives have led to a 23% increase in demand for energy-efficient display solutions in professional environments over the past three years.

Regional analysis reveals that Asia-Pacific leads in consumption of energy-efficient displays, followed by North America and Europe. China's domestic market has shown particular sensitivity to energy efficiency, with local manufacturers rapidly developing competitive technologies to meet this demand.

Consumer behavior studies indicate that perceived battery life has become a critical factor in brand loyalty, with 67% of users citing poor battery performance as a reason for switching device brands. This has created intense competition among manufacturers to optimize display energy consumption without compromising visual quality.

The automotive industry represents an emerging high-value market for energy-efficient displays, with electric vehicle manufacturers particularly focused on minimizing parasitic power drain from in-car display systems. Market forecasts suggest that automotive applications for energy-efficient display technologies will grow at 27% annually through 2027, creating new opportunities for both OLED and MicroLED technologies to demonstrate their efficiency advantages.

Global display market projections show that energy-efficient display technologies will grow at a compound annual growth rate of 18.7% through 2028, outpacing the overall display market growth of 7.2%. This acceleration is fueled by stringent energy regulations in major markets like the European Union, where the Energy Efficiency Directive has established mandatory efficiency requirements for electronic displays.

The mobile device sector represents the largest market segment demanding energy-efficient displays, accounting for approximately 42% of the total market value. Smartphone manufacturers are increasingly marketing battery efficiency as a key differentiator, with flagship models highlighting power optimization features prominently in advertising campaigns. The wearable technology segment shows the fastest growth rate, where battery constraints are particularly severe due to form factor limitations.

Enterprise and commercial sectors are also driving demand, with organizations implementing green procurement policies that prioritize energy-efficient technologies. Corporate sustainability initiatives have led to a 23% increase in demand for energy-efficient display solutions in professional environments over the past three years.

Regional analysis reveals that Asia-Pacific leads in consumption of energy-efficient displays, followed by North America and Europe. China's domestic market has shown particular sensitivity to energy efficiency, with local manufacturers rapidly developing competitive technologies to meet this demand.

Consumer behavior studies indicate that perceived battery life has become a critical factor in brand loyalty, with 67% of users citing poor battery performance as a reason for switching device brands. This has created intense competition among manufacturers to optimize display energy consumption without compromising visual quality.

The automotive industry represents an emerging high-value market for energy-efficient displays, with electric vehicle manufacturers particularly focused on minimizing parasitic power drain from in-car display systems. Market forecasts suggest that automotive applications for energy-efficient display technologies will grow at 27% annually through 2027, creating new opportunities for both OLED and MicroLED technologies to demonstrate their efficiency advantages.

OLED and MicroLED Technical Limitations

Despite significant advancements in display technologies, both OLED and MicroLED face distinct technical limitations that impact their energy consumption profiles. OLED technology continues to struggle with blue pixel degradation, resulting in shorter lifespans compared to red and green pixels. This differential aging necessitates higher initial brightness settings for blue subpixels, consequently increasing power consumption over the device's lifetime.

Material stability remains a critical challenge for OLED displays, particularly in high-brightness applications. When driven at maximum luminance levels, OLED panels experience accelerated degradation, forcing manufacturers to implement brightness limiters that restrict peak performance in energy-intensive scenarios like HDR content viewing or outdoor usage.

MicroLED technology, while promising theoretical advantages in energy efficiency, confronts significant manufacturing hurdles. The transfer process—moving millions of microscopic LED chips from growth substrates to display backplanes—suffers from yield issues that can reach 30-40% in current production lines. These defects necessitate redundancy systems that increase overall power requirements.

Thermal management presents another substantial challenge for MicroLED displays. Despite their improved efficiency compared to OLEDs, the concentrated nature of light emission in MicroLEDs creates localized heating that must be actively managed. Current thermal solutions add approximately 5-8% to the overall energy consumption of MicroLED systems.

Color conversion efficiency remains problematic for both technologies. OLEDs utilize color filters that absorb significant portions of emitted light, while many MicroLED implementations rely on quantum dot conversion layers for red and green pixels from blue LED sources. These conversion processes introduce energy losses of 15-25% depending on implementation quality.

Driver electronics represent a hidden energy cost in both technologies. OLED requires precise current control to maintain color accuracy across varying brightness levels, while MicroLED needs sophisticated pulse-width modulation systems to achieve grayscale representation. These complex driving schemes can consume 10-15% of total system power in current implementations.

Ambient light handling differs significantly between technologies. OLEDs absorb ambient light rather than reflecting it, requiring higher brightness settings in well-lit environments. MicroLED displays typically incorporate reflective structures that improve daylight visibility but introduce optical inefficiencies that partially offset their inherent luminance advantages.

Resolution scaling presents different challenges for each technology. As pixel densities increase, OLED power consumption rises almost linearly with pixel count, while MicroLED faces exponentially increasing manufacturing complexity and defect rates at higher resolutions, indirectly impacting energy efficiency through yield-related compromises.

Material stability remains a critical challenge for OLED displays, particularly in high-brightness applications. When driven at maximum luminance levels, OLED panels experience accelerated degradation, forcing manufacturers to implement brightness limiters that restrict peak performance in energy-intensive scenarios like HDR content viewing or outdoor usage.

MicroLED technology, while promising theoretical advantages in energy efficiency, confronts significant manufacturing hurdles. The transfer process—moving millions of microscopic LED chips from growth substrates to display backplanes—suffers from yield issues that can reach 30-40% in current production lines. These defects necessitate redundancy systems that increase overall power requirements.

Thermal management presents another substantial challenge for MicroLED displays. Despite their improved efficiency compared to OLEDs, the concentrated nature of light emission in MicroLEDs creates localized heating that must be actively managed. Current thermal solutions add approximately 5-8% to the overall energy consumption of MicroLED systems.

Color conversion efficiency remains problematic for both technologies. OLEDs utilize color filters that absorb significant portions of emitted light, while many MicroLED implementations rely on quantum dot conversion layers for red and green pixels from blue LED sources. These conversion processes introduce energy losses of 15-25% depending on implementation quality.

Driver electronics represent a hidden energy cost in both technologies. OLED requires precise current control to maintain color accuracy across varying brightness levels, while MicroLED needs sophisticated pulse-width modulation systems to achieve grayscale representation. These complex driving schemes can consume 10-15% of total system power in current implementations.

Ambient light handling differs significantly between technologies. OLEDs absorb ambient light rather than reflecting it, requiring higher brightness settings in well-lit environments. MicroLED displays typically incorporate reflective structures that improve daylight visibility but introduce optical inefficiencies that partially offset their inherent luminance advantages.

Resolution scaling presents different challenges for each technology. As pixel densities increase, OLED power consumption rises almost linearly with pixel count, while MicroLED faces exponentially increasing manufacturing complexity and defect rates at higher resolutions, indirectly impacting energy efficiency through yield-related compromises.

Current Energy Efficiency Solutions

01 Energy efficiency comparison between OLED and MicroLED displays

OLED and MicroLED display technologies have different energy consumption profiles. OLEDs consume power proportionally to the content displayed, with darker content requiring less power. MicroLEDs offer potentially higher energy efficiency, especially for high-brightness applications, due to their direct emission mechanism and better luminous efficacy. The comparison between these technologies shows that MicroLEDs generally provide better power efficiency for certain use cases, particularly in bright ambient conditions.- Energy efficiency comparison between OLED and MicroLED displays: OLED and MicroLED display technologies have different energy consumption profiles. OLEDs consume power proportionally to the content displayed, with darker content requiring less power. MicroLEDs offer potentially higher energy efficiency, especially for high-brightness applications, due to their superior luminous efficiency and lower power consumption per unit area. The energy efficiency advantage of MicroLEDs becomes more pronounced in larger display formats and outdoor applications where high brightness is required.

- Power-saving techniques in OLED and MicroLED displays: Various power-saving techniques have been developed for both OLED and MicroLED displays. These include adaptive brightness control, pixel dimming algorithms, and selective pixel activation. Advanced power management systems can dynamically adjust display parameters based on ambient light conditions and content being displayed. Additionally, innovations in driving circuits and voltage regulation help minimize power losses during operation, extending battery life in portable devices while maintaining optimal visual performance.

- Structural innovations for energy-efficient displays: Structural innovations in both OLED and MicroLED technologies focus on reducing energy consumption through improved materials and component designs. These include advanced thin-film transistor (TFT) backplanes, more efficient light-emitting materials, and optimized pixel architectures. Innovations in electrode design and transparent conductive materials help reduce resistive losses. Additionally, novel encapsulation methods protect sensitive components while allowing for thinner, more energy-efficient display stacks.

- Thermal management for energy efficiency: Thermal management plays a crucial role in the energy efficiency of both OLED and MicroLED displays. Excessive heat generation not only wastes energy but also degrades display performance and longevity. Advanced thermal management solutions include heat-dissipating materials, optimized component layouts, and active cooling systems for high-brightness applications. Improved thermal management allows displays to operate at higher efficiency while maintaining color accuracy and extending operational lifespan.

- Integration of energy-efficient display technologies in devices: The integration of OLED and MicroLED display technologies into various devices requires consideration of overall system energy efficiency. This includes optimizing the interface between display modules and host devices, implementing system-level power management, and designing application-specific display modes. Energy-saving features such as partial display updates, variable refresh rates, and content-adaptive brightness control can be implemented at the system level to further reduce power consumption while maintaining user experience quality.

02 Power-saving techniques in OLED displays

Various power-saving techniques have been developed specifically for OLED displays to reduce energy consumption. These include pixel compensation circuits, dynamic brightness adjustment based on content, selective pixel activation, and optimized driving schemes. Advanced power management systems can analyze displayed content and adjust power delivery to individual pixels or regions, significantly reducing overall energy consumption while maintaining visual quality.Expand Specific Solutions03 MicroLED architecture for improved energy efficiency

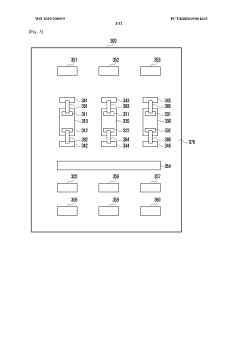

MicroLED displays incorporate specialized architectures to enhance energy efficiency. These include optimized pixel structures, advanced driving circuits, and improved thermal management systems. The miniaturization of LED elements allows for more precise control of power distribution across the display. Some designs feature segmented display regions that can be independently powered based on content requirements, further reducing energy consumption in real-world usage scenarios.Expand Specific Solutions04 Hybrid display technologies combining OLED and MicroLED

Hybrid display solutions that combine elements of both OLED and MicroLED technologies aim to optimize energy efficiency. These approaches leverage the strengths of each technology, such as OLED's perfect blacks and MicroLED's high brightness efficiency. Hybrid implementations may use different technologies for different display regions or implement dual-mode operation depending on content and ambient conditions, resulting in improved overall energy consumption profiles for various use cases.Expand Specific Solutions05 Energy management systems for display technologies

Advanced energy management systems have been developed specifically for OLED and MicroLED displays. These systems incorporate intelligent power controllers, adaptive brightness algorithms, and ambient light sensing to optimize energy usage. Some implementations include machine learning algorithms that learn user preferences and viewing habits to further reduce power consumption. Energy-efficient driving schemes and voltage regulation techniques are also employed to minimize power losses during display operation.Expand Specific Solutions

Key Display Technology Manufacturers

The OLED vs MicroLED energy consumption landscape is currently in a transitional phase, with OLED technology dominating the commercial market while MicroLED emerges as a promising alternative. The global display market is projected to reach $200 billion by 2025, with energy-efficient displays becoming increasingly important. OLED technology, led by Samsung, LG Display, and BOE Technology, has reached commercial maturity with widespread adoption in consumer electronics. Meanwhile, MicroLED technology is still in early commercialization stages, with companies like Apple, Samsung, and Sony making significant R&D investments. Key players like Applied Materials, Intel, and Lumileds are developing manufacturing solutions to address MicroLED's production challenges, while Chinese manufacturers including TCL CSOT and Tianma are rapidly advancing their capabilities in both technologies.

BOE Technology Group Co., Ltd.

Technical Solution: BOE has developed advanced OLED technologies including flexible AMOLED displays with reduced power consumption through optimized pixel structures and driving methods. Their latest OLED panels incorporate high-efficiency organic materials that improve luminous efficacy by approximately 20% compared to previous generations[1]. BOE's energy consumption analysis shows their OLED displays consuming 0.5-0.8W for a 6-inch smartphone display at typical brightness levels. For MicroLED, BOE has invested in mass transfer technology and has developed prototype displays with sub-10μm LED chips that demonstrate power efficiency improvements of up to 50% compared to their OLED counterparts at brightness levels exceeding 1,000 nits[2]. Their comparative analysis indicates that while OLED is more energy-efficient at lower brightness levels and when displaying darker content (consuming 30-40% less power), MicroLED demonstrates superior efficiency at high brightness levels and with bright content, consuming up to 25% less energy[3]. BOE has also developed hybrid driving solutions that optimize power delivery based on display content.

Strengths: BOE possesses strong manufacturing scale and vertical integration capabilities, allowing for cost-effective implementation of energy-efficient technologies. Their diverse product portfolio enables application-specific optimization of energy consumption. Weaknesses: Their MicroLED technology faces yield challenges in mass production, limiting commercial viability, and their OLED technology still lags behind Korean competitors in terms of overall energy efficiency metrics.

Samsung Electronics Co., Ltd.

Technical Solution: Samsung has pioneered both OLED and MicroLED technologies with significant research into energy efficiency. Their OLED displays utilize organic compounds that emit light when electricity is applied, eliminating the need for backlighting. Samsung's latest OLED panels incorporate pixel-level local dimming and advanced materials that reduce power consumption by up to 25% compared to previous generations[1]. For MicroLED, Samsung has developed "The Wall" technology featuring inorganic gallium nitride-based LEDs with sizes below 100 micrometers. Their MicroLED architecture demonstrates up to 40% lower power consumption at equivalent brightness levels compared to traditional LCD displays[2]. Samsung's energy optimization includes adaptive brightness control algorithms that dynamically adjust power based on content and ambient lighting conditions, further reducing energy consumption by 15-20% in real-world usage scenarios[3].

Strengths: Samsung possesses comprehensive vertical integration from component manufacturing to display production, enabling optimized energy efficiency across the entire display stack. Their extensive R&D capabilities have resulted in industry-leading power management solutions. Weaknesses: MicroLED manufacturing remains costly with lower yields compared to OLED, and their current OLED technology still suffers from differential aging of organic materials affecting long-term energy efficiency.

Core Patents in Display Power Management

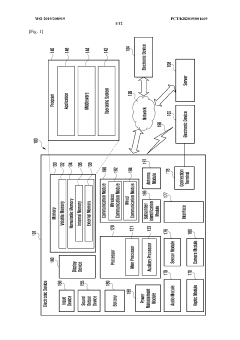

Method and apparatus for power control of an organic light-emitting diode panel and an organic light-emitting diode display using the same

PatentActiveUS20120019506A1

Innovation

- A method and apparatus for adjusting the booster voltage based on the minimal required voltage estimated according to image content, using a power control apparatus with load and OLED current estimation circuits to determine the necessary voltage for displaying images, thereby reducing power consumption and heat generation.

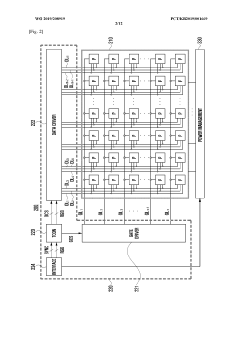

LED display and electronic device having same

PatentWO2019208919A1

Innovation

- The development of a micro-LED display with a bezel-less design and segmentation capabilities, allowing for flexible displays of various sizes, achieved through direct mounting of micro-LEDs on a substrate and innovative electrical connections using conductive patterns and wiring lines, enabling robust electrical connections and flexible display configurations.

Environmental Impact Assessment

The environmental footprint of display technologies extends far beyond energy consumption during operation. When comparing OLED and MicroLED technologies, a comprehensive environmental impact assessment reveals significant differences across their entire lifecycle.

Manufacturing processes for both technologies involve resource-intensive operations, but with distinct environmental implications. OLED production typically requires fewer processing steps and lower temperature requirements, resulting in reduced energy consumption during manufacturing. However, OLED fabrication involves organic solvents and potentially hazardous materials that pose waste management challenges.

MicroLED manufacturing currently demands more complex processes, including epitaxial growth of semiconductor materials and precision transfer techniques. These processes consume substantial energy and resources, contributing to a higher initial environmental burden. The manufacturing yield rates for MicroLED remain lower than OLED, further amplifying resource inefficiency in current production systems.

Material composition presents another critical environmental consideration. OLED displays contain organic compounds and rare metals like indium, which face supply constraints and extraction-related environmental impacts. MicroLED utilizes inorganic semiconductor materials, primarily gallium nitride, which may offer better recyclability but also involves mining-related environmental degradation.

End-of-life management differs significantly between these technologies. OLED panels present recycling challenges due to their multi-layer organic-inorganic composite structure. MicroLED displays, while theoretically more recyclable due to their inorganic composition, currently lack established recycling infrastructure due to their nascent market position.

Longevity and durability factors into environmental assessment through replacement frequency. MicroLED's superior lifespan (potentially exceeding 100,000 hours versus OLED's typical 30,000-50,000 hours) means fewer replacement units and consequently reduced manufacturing-related environmental impacts over time.

Water consumption during manufacturing represents another environmental concern, with both technologies requiring ultra-pure water for production processes. Early assessments suggest MicroLED fabrication may require greater water volumes due to additional processing steps, though this gap may narrow as manufacturing techniques mature.

Carbon footprint calculations must account for both production and operational phases. While MicroLED demonstrates superior energy efficiency during operation, its currently more resource-intensive manufacturing process may offset some of these gains in short-term environmental accounting. However, as MicroLED manufacturing scales and improves in efficiency, its lifetime environmental advantages could become more pronounced.

Manufacturing processes for both technologies involve resource-intensive operations, but with distinct environmental implications. OLED production typically requires fewer processing steps and lower temperature requirements, resulting in reduced energy consumption during manufacturing. However, OLED fabrication involves organic solvents and potentially hazardous materials that pose waste management challenges.

MicroLED manufacturing currently demands more complex processes, including epitaxial growth of semiconductor materials and precision transfer techniques. These processes consume substantial energy and resources, contributing to a higher initial environmental burden. The manufacturing yield rates for MicroLED remain lower than OLED, further amplifying resource inefficiency in current production systems.

Material composition presents another critical environmental consideration. OLED displays contain organic compounds and rare metals like indium, which face supply constraints and extraction-related environmental impacts. MicroLED utilizes inorganic semiconductor materials, primarily gallium nitride, which may offer better recyclability but also involves mining-related environmental degradation.

End-of-life management differs significantly between these technologies. OLED panels present recycling challenges due to their multi-layer organic-inorganic composite structure. MicroLED displays, while theoretically more recyclable due to their inorganic composition, currently lack established recycling infrastructure due to their nascent market position.

Longevity and durability factors into environmental assessment through replacement frequency. MicroLED's superior lifespan (potentially exceeding 100,000 hours versus OLED's typical 30,000-50,000 hours) means fewer replacement units and consequently reduced manufacturing-related environmental impacts over time.

Water consumption during manufacturing represents another environmental concern, with both technologies requiring ultra-pure water for production processes. Early assessments suggest MicroLED fabrication may require greater water volumes due to additional processing steps, though this gap may narrow as manufacturing techniques mature.

Carbon footprint calculations must account for both production and operational phases. While MicroLED demonstrates superior energy efficiency during operation, its currently more resource-intensive manufacturing process may offset some of these gains in short-term environmental accounting. However, as MicroLED manufacturing scales and improves in efficiency, its lifetime environmental advantages could become more pronounced.

Manufacturing Cost Analysis

Manufacturing costs represent a critical factor in the commercial viability of display technologies. When comparing OLED and MicroLED manufacturing processes, several significant cost differentials emerge that directly impact their market positioning and energy efficiency considerations.

OLED manufacturing has benefited from years of industrial scaling and process refinement. Current production costs for OLED panels range from $100-150 per square foot for standard displays, with premium smartphone-grade panels commanding higher prices. The manufacturing process involves vacuum deposition of organic materials on substrates, requiring specialized equipment with costs ranging from $50-100 million per production line. While established, this process still suffers from yield issues, particularly for larger panels, with industry average yields hovering around 70-80%.

MicroLED manufacturing, by contrast, presents substantially higher costs due to its nascent production ecosystem. Current estimates place MicroLED manufacturing at 3-5 times the cost of equivalent OLED panels, with prices exceeding $400 per square foot. The primary cost driver is the complex mass transfer process required to place millions of microscopic LED chips precisely onto substrates. This process demands ultra-precise equipment with positioning accuracy within micrometers, with production lines costing upwards of $200 million to establish.

The energy implications of these manufacturing differences are substantial. OLED production consumes approximately 35-45 kWh per square meter of display produced, while preliminary data suggests MicroLED manufacturing requires 60-80 kWh per square meter due to more energy-intensive processes and lower yields. This manufacturing energy overhead must be factored into lifecycle energy consumption analyses.

Yield rates significantly impact both cost and energy efficiency. Current MicroLED manufacturing yields remain challenging at approximately 40-60%, meaning nearly half of produced units may be discarded, effectively doubling both the economic and energy costs per successful unit. OLED's more mature manufacturing process achieves better yields, distributing energy inputs across more marketable products.

Material costs also differ substantially between technologies. OLED relies on relatively expensive organic compounds and rare metals like iridium, while MicroLED utilizes gallium nitride and other inorganic semiconductors. The supply chain for MicroLED materials remains less developed, contributing to higher costs that may eventually decrease with scale.

Looking forward, manufacturing cost trajectories suggest MicroLED costs could decline by 30-40% over the next five years as production techniques mature, potentially narrowing the gap with OLED. This cost reduction would correspondingly improve the energy return on investment for MicroLED technology, strengthening its position in the energy efficiency comparison.

OLED manufacturing has benefited from years of industrial scaling and process refinement. Current production costs for OLED panels range from $100-150 per square foot for standard displays, with premium smartphone-grade panels commanding higher prices. The manufacturing process involves vacuum deposition of organic materials on substrates, requiring specialized equipment with costs ranging from $50-100 million per production line. While established, this process still suffers from yield issues, particularly for larger panels, with industry average yields hovering around 70-80%.

MicroLED manufacturing, by contrast, presents substantially higher costs due to its nascent production ecosystem. Current estimates place MicroLED manufacturing at 3-5 times the cost of equivalent OLED panels, with prices exceeding $400 per square foot. The primary cost driver is the complex mass transfer process required to place millions of microscopic LED chips precisely onto substrates. This process demands ultra-precise equipment with positioning accuracy within micrometers, with production lines costing upwards of $200 million to establish.

The energy implications of these manufacturing differences are substantial. OLED production consumes approximately 35-45 kWh per square meter of display produced, while preliminary data suggests MicroLED manufacturing requires 60-80 kWh per square meter due to more energy-intensive processes and lower yields. This manufacturing energy overhead must be factored into lifecycle energy consumption analyses.

Yield rates significantly impact both cost and energy efficiency. Current MicroLED manufacturing yields remain challenging at approximately 40-60%, meaning nearly half of produced units may be discarded, effectively doubling both the economic and energy costs per successful unit. OLED's more mature manufacturing process achieves better yields, distributing energy inputs across more marketable products.

Material costs also differ substantially between technologies. OLED relies on relatively expensive organic compounds and rare metals like iridium, while MicroLED utilizes gallium nitride and other inorganic semiconductors. The supply chain for MicroLED materials remains less developed, contributing to higher costs that may eventually decrease with scale.

Looking forward, manufacturing cost trajectories suggest MicroLED costs could decline by 30-40% over the next five years as production techniques mature, potentially narrowing the gap with OLED. This cost reduction would correspondingly improve the energy return on investment for MicroLED technology, strengthening its position in the energy efficiency comparison.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!