OLED vs MicroLED: Key Factors in Adoption Rates

OCT 24, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Display Technology Evolution and Objectives

Display technology has undergone remarkable evolution since the introduction of cathode ray tubes (CRTs) in the early 20th century. The progression from CRTs to liquid crystal displays (LCDs) marked the first major shift toward flatter, more energy-efficient screens. This transition was followed by the development of plasma display panels, which offered improved contrast ratios and viewing angles but struggled with power consumption issues. The technological trajectory then led to the emergence of organic light-emitting diode (OLED) technology in the late 1990s, revolutionizing display capabilities with self-emissive pixels that eliminated the need for backlighting.

The current competitive landscape is dominated by the established OLED technology and the emerging MicroLED displays. OLED has achieved significant market penetration in premium smartphones, high-end televisions, and wearable devices due to its excellent color reproduction, perfect black levels, and flexibility. However, OLED faces persistent challenges including limited lifespan, susceptibility to burn-in, and relatively high production costs for larger panels.

MicroLED represents the next frontier in display technology, offering theoretical advantages over OLED including superior brightness, energy efficiency, longevity, and resistance to burn-in. Despite these promising attributes, MicroLED adoption has been constrained by manufacturing complexities, particularly in achieving high-yield mass production of microscopic LED arrays with consistent performance across millions of individual elements.

The primary objective in this technological competition is to develop display solutions that balance visual performance with practical considerations such as power efficiency, production scalability, and cost-effectiveness. For OLED, the focus remains on extending operational lifespan, mitigating burn-in issues, and reducing manufacturing costs, particularly for larger panels. For MicroLED, the central challenge involves refining mass production techniques to achieve economically viable yields while maintaining the technology's inherent performance advantages.

Industry projections suggest that display technology will continue to evolve toward higher resolution, improved energy efficiency, and enhanced form factors including transparent and flexible implementations. The adoption trajectory for both OLED and MicroLED will be significantly influenced by advancements in manufacturing processes, with particular emphasis on yield improvement and cost reduction strategies. The ultimate goal is to deliver display technologies that combine exceptional visual performance with practical durability and reasonable production economics.

The competitive dynamics between these technologies will likely shape the next decade of display innovation, with potential implications extending beyond consumer electronics into automotive interfaces, augmented reality systems, and architectural applications. Understanding the key factors driving adoption rates for each technology is essential for strategic positioning in this rapidly evolving market.

The current competitive landscape is dominated by the established OLED technology and the emerging MicroLED displays. OLED has achieved significant market penetration in premium smartphones, high-end televisions, and wearable devices due to its excellent color reproduction, perfect black levels, and flexibility. However, OLED faces persistent challenges including limited lifespan, susceptibility to burn-in, and relatively high production costs for larger panels.

MicroLED represents the next frontier in display technology, offering theoretical advantages over OLED including superior brightness, energy efficiency, longevity, and resistance to burn-in. Despite these promising attributes, MicroLED adoption has been constrained by manufacturing complexities, particularly in achieving high-yield mass production of microscopic LED arrays with consistent performance across millions of individual elements.

The primary objective in this technological competition is to develop display solutions that balance visual performance with practical considerations such as power efficiency, production scalability, and cost-effectiveness. For OLED, the focus remains on extending operational lifespan, mitigating burn-in issues, and reducing manufacturing costs, particularly for larger panels. For MicroLED, the central challenge involves refining mass production techniques to achieve economically viable yields while maintaining the technology's inherent performance advantages.

Industry projections suggest that display technology will continue to evolve toward higher resolution, improved energy efficiency, and enhanced form factors including transparent and flexible implementations. The adoption trajectory for both OLED and MicroLED will be significantly influenced by advancements in manufacturing processes, with particular emphasis on yield improvement and cost reduction strategies. The ultimate goal is to deliver display technologies that combine exceptional visual performance with practical durability and reasonable production economics.

The competitive dynamics between these technologies will likely shape the next decade of display innovation, with potential implications extending beyond consumer electronics into automotive interfaces, augmented reality systems, and architectural applications. Understanding the key factors driving adoption rates for each technology is essential for strategic positioning in this rapidly evolving market.

Market Demand Analysis for Advanced Display Technologies

The display technology market is witnessing a significant shift as consumers increasingly demand higher quality visual experiences across multiple devices. Current market analysis indicates robust growth in the advanced display sector, with the global market valued at approximately $150 billion in 2022 and projected to reach $230 billion by 2027, representing a compound annual growth rate of 8.9%. This growth is primarily driven by increasing adoption in smartphones, televisions, wearables, and automotive displays.

OLED technology currently dominates the premium display market segment, with Samsung and LG Display leading production capacity. Consumer demand for OLED displays stems from their superior contrast ratios, color accuracy, and form factor flexibility. The smartphone sector represents the largest application area, accounting for nearly 46% of OLED panel shipments, followed by televisions at 27% and wearable devices at 15%.

MicroLED technology, while still in early commercialization stages, is generating substantial market interest due to its potential advantages in brightness, longevity, and energy efficiency. Market research indicates growing demand particularly in high-end television displays, digital signage, and AR/VR applications. Industry forecasts suggest MicroLED market value could reach $10.7 billion by 2026, though this represents a relatively small portion of the overall display market.

Regional analysis reveals differentiated demand patterns, with North America and Western Europe showing stronger preference for premium display technologies regardless of cost premium, while Asian markets demonstrate more price sensitivity despite high technology adoption rates. The Chinese market specifically shows accelerating demand for locally-produced advanced displays as domestic manufacturers expand capacity.

Consumer surveys indicate key purchasing factors influencing adoption rates include: visual quality (cited by 78% of respondents), energy efficiency (65%), device thickness/form factor (59%), and price premium (82%). The price-performance ratio remains the critical adoption barrier for both technologies, with consumers indicating willingness to pay approximately 15-20% premium for OLED over conventional LCD, but resistance to the current 300-400% premium for MicroLED solutions.

Commercial and industrial sectors demonstrate distinct demand characteristics compared to consumer markets, with higher emphasis on longevity, brightness, and reliability metrics. These sectors show growing interest in MicroLED technology despite higher initial costs, driven by total cost of ownership calculations that favor longer-lasting display solutions.

The automotive industry represents an emerging high-growth segment for both technologies, with premium vehicle manufacturers increasingly incorporating advanced displays in dashboard and entertainment systems. Market projections indicate automotive display applications could grow at 12.3% CAGR through 2027, outpacing the overall display market growth rate.

OLED technology currently dominates the premium display market segment, with Samsung and LG Display leading production capacity. Consumer demand for OLED displays stems from their superior contrast ratios, color accuracy, and form factor flexibility. The smartphone sector represents the largest application area, accounting for nearly 46% of OLED panel shipments, followed by televisions at 27% and wearable devices at 15%.

MicroLED technology, while still in early commercialization stages, is generating substantial market interest due to its potential advantages in brightness, longevity, and energy efficiency. Market research indicates growing demand particularly in high-end television displays, digital signage, and AR/VR applications. Industry forecasts suggest MicroLED market value could reach $10.7 billion by 2026, though this represents a relatively small portion of the overall display market.

Regional analysis reveals differentiated demand patterns, with North America and Western Europe showing stronger preference for premium display technologies regardless of cost premium, while Asian markets demonstrate more price sensitivity despite high technology adoption rates. The Chinese market specifically shows accelerating demand for locally-produced advanced displays as domestic manufacturers expand capacity.

Consumer surveys indicate key purchasing factors influencing adoption rates include: visual quality (cited by 78% of respondents), energy efficiency (65%), device thickness/form factor (59%), and price premium (82%). The price-performance ratio remains the critical adoption barrier for both technologies, with consumers indicating willingness to pay approximately 15-20% premium for OLED over conventional LCD, but resistance to the current 300-400% premium for MicroLED solutions.

Commercial and industrial sectors demonstrate distinct demand characteristics compared to consumer markets, with higher emphasis on longevity, brightness, and reliability metrics. These sectors show growing interest in MicroLED technology despite higher initial costs, driven by total cost of ownership calculations that favor longer-lasting display solutions.

The automotive industry represents an emerging high-growth segment for both technologies, with premium vehicle manufacturers increasingly incorporating advanced displays in dashboard and entertainment systems. Market projections indicate automotive display applications could grow at 12.3% CAGR through 2027, outpacing the overall display market growth rate.

OLED vs MicroLED: Current Status and Technical Barriers

OLED technology currently dominates the premium display market, with widespread adoption in smartphones, TVs, and wearables. Samsung and LG Display lead OLED panel production, controlling approximately 90% of the global market. OLED displays offer excellent color reproduction, perfect blacks, flexibility, and energy efficiency when displaying dark content. However, they still face significant challenges including limited brightness (typically 500-1000 nits), burn-in issues after prolonged use, and relatively short lifespans compared to LCD technology, particularly for blue OLED materials.

MicroLED technology, while promising, remains in early commercialization stages. Samsung, Sony, and Apple have demonstrated MicroLED prototypes, but mass production remains limited to specialized applications and premium segments. MicroLED offers theoretical advantages including superior brightness (potentially exceeding 5000 nits), longer lifespan (100,000+ hours), no burn-in issues, and better energy efficiency across all content types. However, the technology faces substantial barriers to widespread adoption.

The primary technical challenge for MicroLED is mass transfer - efficiently placing millions of microscopic LED chips precisely onto substrates. Current approaches include mechanical pick-and-place, laser transfer, and fluid assembly, but none have achieved the speed and yield necessary for cost-effective mass production. Defect rates remain problematic, with even small numbers of dead pixels significantly impacting display quality.

Another critical barrier is the miniaturization of LED chips. While red and green MicroLEDs have achieved reasonable efficiency at small sizes, blue MicroLEDs suffer significant efficiency loss when miniaturized below 10 micrometers, creating color balance challenges. Additionally, the manufacturing infrastructure for MicroLED remains underdeveloped compared to OLED's mature ecosystem.

Cost factors present perhaps the most significant barrier to MicroLED adoption. Current manufacturing costs for MicroLED displays are estimated at 5-10 times higher than equivalent OLED panels. The complex production process requires substantial capital investment in specialized equipment and clean room facilities, creating high barriers to entry for manufacturers.

Geographically, South Korea leads in OLED technology through Samsung and LG, while Taiwan and China are investing heavily in MicroLED development. Companies like AUO, BOE, and TCL are establishing research centers focused on overcoming MicroLED's technical challenges. In the United States, Apple has made significant acquisitions in MicroLED technology, suggesting strategic interest in developing proprietary display solutions.

The technical gap between laboratory demonstrations and mass production capabilities remains substantial for MicroLED, while OLED continues to improve incrementally through manufacturing refinements and material science advances.

MicroLED technology, while promising, remains in early commercialization stages. Samsung, Sony, and Apple have demonstrated MicroLED prototypes, but mass production remains limited to specialized applications and premium segments. MicroLED offers theoretical advantages including superior brightness (potentially exceeding 5000 nits), longer lifespan (100,000+ hours), no burn-in issues, and better energy efficiency across all content types. However, the technology faces substantial barriers to widespread adoption.

The primary technical challenge for MicroLED is mass transfer - efficiently placing millions of microscopic LED chips precisely onto substrates. Current approaches include mechanical pick-and-place, laser transfer, and fluid assembly, but none have achieved the speed and yield necessary for cost-effective mass production. Defect rates remain problematic, with even small numbers of dead pixels significantly impacting display quality.

Another critical barrier is the miniaturization of LED chips. While red and green MicroLEDs have achieved reasonable efficiency at small sizes, blue MicroLEDs suffer significant efficiency loss when miniaturized below 10 micrometers, creating color balance challenges. Additionally, the manufacturing infrastructure for MicroLED remains underdeveloped compared to OLED's mature ecosystem.

Cost factors present perhaps the most significant barrier to MicroLED adoption. Current manufacturing costs for MicroLED displays are estimated at 5-10 times higher than equivalent OLED panels. The complex production process requires substantial capital investment in specialized equipment and clean room facilities, creating high barriers to entry for manufacturers.

Geographically, South Korea leads in OLED technology through Samsung and LG, while Taiwan and China are investing heavily in MicroLED development. Companies like AUO, BOE, and TCL are establishing research centers focused on overcoming MicroLED's technical challenges. In the United States, Apple has made significant acquisitions in MicroLED technology, suggesting strategic interest in developing proprietary display solutions.

The technical gap between laboratory demonstrations and mass production capabilities remains substantial for MicroLED, while OLED continues to improve incrementally through manufacturing refinements and material science advances.

Technical Implementation Approaches for OLED and MicroLED

01 Market adoption trends of OLED and MicroLED displays

The adoption rates of OLED and MicroLED display technologies are influenced by market trends, consumer preferences, and industry developments. These technologies are increasingly being adopted in various applications including smartphones, televisions, and wearable devices. Market analysis indicates growing consumer demand for these advanced display technologies due to their superior visual performance, energy efficiency, and form factor advantages compared to traditional display technologies.- Market adoption trends of OLED and MicroLED displays: The adoption rates of OLED and MicroLED display technologies are influenced by market trends, consumer preferences, and industry developments. These technologies are increasingly being adopted in various applications including smartphones, televisions, and wearable devices. Market analysis indicates growing consumer demand for these advanced display technologies due to their superior visual performance, energy efficiency, and form factor advantages compared to traditional display technologies.

- Technical advantages driving adoption of OLED and MicroLED: OLED and MicroLED displays offer significant technical advantages that are driving their adoption in the market. These include superior color reproduction, higher contrast ratios, faster response times, and better energy efficiency. MicroLEDs particularly excel in brightness and durability, while OLEDs offer flexibility and thinness. These technical benefits are key factors influencing manufacturers to incorporate these technologies into their product lines and consumers to choose devices featuring these display types.

- Manufacturing innovations affecting adoption rates: Innovations in manufacturing processes are significantly impacting the adoption rates of OLED and MicroLED technologies. Advancements in production techniques have led to improved yields, reduced costs, and enhanced scalability, making these technologies more accessible to a wider market. These manufacturing developments include new deposition methods, improved materials, and automated assembly processes that address previous barriers to mass production and widespread adoption.

- Integration challenges and solutions in device implementation: The adoption of OLED and MicroLED displays faces various integration challenges that manufacturers are actively addressing. These include power management issues, heat dissipation concerns, and integration with existing device architectures. Solutions being developed involve new driver circuits, thermal management systems, and modular design approaches that facilitate easier incorporation of these display technologies into diverse product categories, thereby accelerating their adoption rates.

- Future outlook and emerging applications: The future adoption trajectory of OLED and MicroLED technologies is shaped by emerging applications and evolving consumer needs. These display technologies are expanding beyond traditional consumer electronics into areas such as automotive displays, augmented reality, virtual reality, and smart home devices. Industry forecasts suggest accelerating adoption rates as these technologies mature, production costs decrease, and new use cases emerge that leverage their unique capabilities.

02 Technical advantages driving adoption of OLED and MicroLED

OLED and MicroLED displays offer significant technical advantages that are driving their adoption across various industries. These advantages include higher contrast ratios, better color reproduction, faster response times, and the ability to create flexible or transparent displays. MicroLEDs specifically offer advantages in brightness, power efficiency, and longevity compared to other display technologies, making them particularly suitable for high-end applications and environments with challenging lighting conditions.Expand Specific Solutions03 Manufacturing innovations affecting adoption rates

Manufacturing processes and innovations play a crucial role in the adoption rates of OLED and MicroLED technologies. Advancements in production techniques have led to improved yields, reduced costs, and enhanced scalability, particularly for MicroLED displays which have traditionally faced manufacturing challenges. These innovations include new transfer methods for MicroLED chips, improved substrate materials, and more efficient production equipment, all contributing to making these advanced display technologies more commercially viable.Expand Specific Solutions04 Integration challenges and solutions in consumer electronics

The adoption of OLED and MicroLED displays in consumer electronics faces various integration challenges that manufacturers are actively addressing. These challenges include power consumption optimization, heat management, integration with touch sensors, and compatibility with existing device architectures. Solutions being developed include new driver circuits, thermal management systems, and modular design approaches that facilitate easier integration of these advanced display technologies into a wide range of consumer electronic devices.Expand Specific Solutions05 Future prospects and emerging applications

The future adoption trajectory of OLED and MicroLED displays is shaped by emerging applications and technological developments. These technologies are finding new applications in automotive displays, augmented reality, virtual reality, and smart home devices. Industry forecasts indicate accelerating adoption rates as production costs decrease and as these technologies enable new product categories and use cases that were not possible with previous display technologies. The integration with other emerging technologies like AI and IoT is expected to further drive adoption in various sectors.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The OLED vs MicroLED display technology landscape is currently in a transitional phase, with OLED enjoying market maturity while MicroLED represents an emerging disruptive technology. The global display market, valued at approximately $150 billion, shows OLED technology dominating with established players like Samsung Electronics, LG Display, and BOE Technology Group leading production at scale. MicroLED technology, though promising superior brightness, efficiency, and longevity, remains in early commercialization stages with companies like Samsung, Apple, and Chengdu Vistar Optoelectronics making significant R&D investments. The technology adoption curve indicates OLED will maintain dominance in the near term while MicroLED gradually overcomes manufacturing challenges related to mass transfer processes and yield rates before achieving mainstream adoption in premium display applications.

BOE Technology Group Co., Ltd.

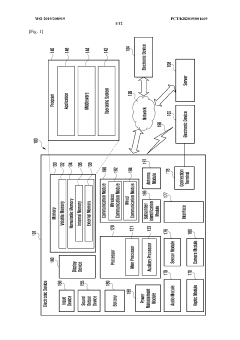

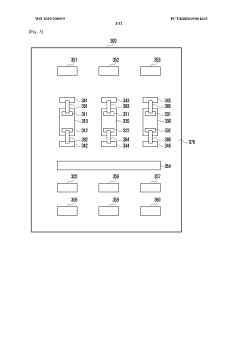

Technical Solution: BOE has emerged as a major player in both OLED and MicroLED technologies, with significant manufacturing capacity for OLED displays. Their OLED technology utilizes both rigid and flexible substrates, with their flexible OLED panels achieving bend radii of less than 1mm. BOE has invested heavily in expanding OLED production lines, with monthly capacity exceeding 100,000 Gen 6 substrates. For MicroLED, BOE has developed a proprietary "micro-transfer" process that can place LEDs as small as 30 micrometers onto substrates with high precision and yield rates. Their MicroLED prototypes have demonstrated brightness levels exceeding 3,000 nits while maintaining power efficiency. BOE's OLED panels feature response times below 1ms and contrast ratios exceeding 1,000,000:1. The company has also developed hybrid technologies that combine quantum dot color conversion with MicroLED to enhance color performance, achieving over 90% of the DCI-P3 color gamut while maintaining MicroLED's inherent advantages in brightness and longevity.

Strengths: Rapidly expanding OLED manufacturing capacity; strong government backing for technology development; competitive pricing strategy enabling wider adoption. Weaknesses: Quality consistency issues compared to Korean manufacturers; MicroLED technology still in early commercialization stages; intellectual property position not as strong as established players.

Samsung Electronics Co., Ltd.

Technical Solution: Samsung has pioneered both OLED and MicroLED technologies, with significant market leadership in OLED displays. Their OLED technology features self-emitting pixels that eliminate the need for backlighting, resulting in perfect blacks and infinite contrast ratios. For MicroLED, Samsung has developed "The Wall" - a modular MicroLED display system using inorganic gallium nitride-based LEDs measuring less than 100 micrometers. Samsung's manufacturing process includes a proprietary mass transfer technique that places millions of microscopic LEDs precisely onto substrates. Their latest innovations include QD-OLED hybrid technology combining quantum dots with OLED for enhanced color volume (over 90% of BT.2020 color space) and brightness (1,500+ nits peak). Samsung has also reduced MicroLED pixel pitch to under 0.6mm in their newest iterations, enabling higher resolution displays while maintaining the technology's fundamental benefits.

Strengths: Market leader in OLED production with established manufacturing infrastructure; proprietary mass transfer technology for MicroLED; strong vertical integration from component manufacturing to final products. Weaknesses: High production costs for MicroLED limiting mainstream adoption; OLED technology still faces burn-in issues and shorter lifespan compared to LCD; scaling MicroLED to smartphone-sized displays remains challenging.

Patent Analysis and Intellectual Property Landscape

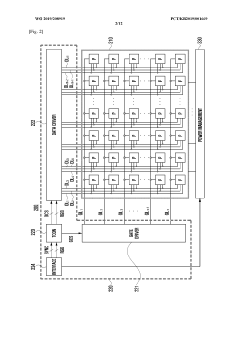

LED display and electronic device having same

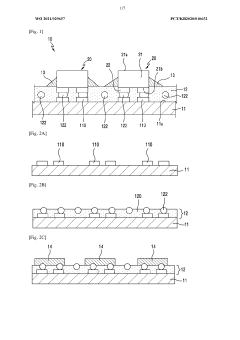

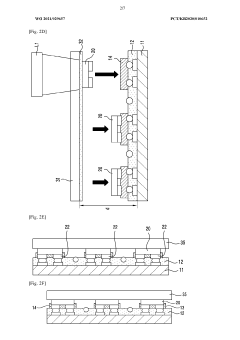

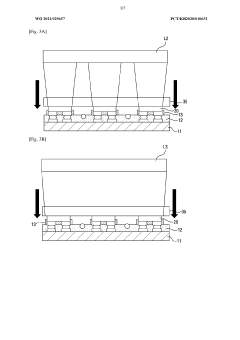

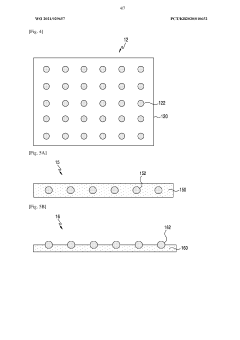

PatentWO2019208919A1

Innovation

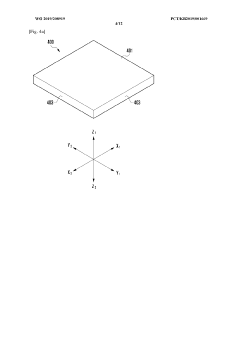

- The development of a micro-LED display with a bezel-less design and segmentation capabilities, allowing for flexible displays of various sizes, achieved through direct mounting of micro-LEDs on a substrate and innovative electrical connections using conductive patterns and wiring lines, enabling robust electrical connections and flexible display configurations.

Micro LED display and manufacturing method thereof

PatentWO2021029657A1

Innovation

- The use of an anisotropic conductive film with conductive particles for electrically and physically connecting micro LED chips to a substrate, involving bonding, laser transfer, and heating to form a conductive structure between the chip's connection pad and the substrate's circuit part.

Manufacturing Cost Analysis and Scalability Factors

Manufacturing costs represent a critical differentiator in the competition between OLED and MicroLED technologies. OLED manufacturing has benefited from over two decades of industrial refinement, resulting in established production lines and economies of scale. Current OLED panel production costs range from $100-150 per square meter for mass-market applications, with premium smartphone displays commanding higher prices due to quality specifications.

In contrast, MicroLED manufacturing remains in its nascent stages, with production costs estimated at 5-10 times higher than comparable OLED panels. This significant cost differential stems primarily from the complex transfer process required to place millions of microscopic LED chips precisely onto substrates. Current yield rates for MicroLED production hover between 60-70%, substantially lower than OLED's mature 85-95% yields.

The equipment investment required for new manufacturing facilities further highlights the disparity. A new OLED production line typically requires $500-800 million in capital expenditure, whereas MicroLED facilities demand investments of $1-2 billion for comparable output capacity. This higher initial investment creates a substantial barrier to rapid industry adoption.

Material costs also factor significantly into the equation. While MicroLED potentially uses less expensive base materials than OLED's organic compounds, the precision equipment and handling requirements offset these savings. Additionally, MicroLED's need for redundancy systems to compensate for defects adds complexity and cost to the manufacturing process.

Scalability presents another crucial dimension in the adoption trajectory. OLED manufacturing has successfully scaled to Generation 8.5 and 10 substrates, enabling efficient production of large panels. MicroLED faces significant challenges in scaling production beyond small displays, with mass transfer techniques representing the primary bottleneck. Several approaches are under development, including laser transfer, electromagnetic assembly, and fluidic self-assembly, but none has yet demonstrated commercial viability at scale.

Labor requirements differ substantially between technologies. OLED production has become increasingly automated, reducing labor costs to approximately 15-20% of total manufacturing expenses. MicroLED assembly currently requires more specialized human oversight, with labor representing 25-30% of production costs. This differential is expected to narrow as MicroLED manufacturing matures and automation increases.

Energy consumption during manufacturing also impacts overall costs. OLED production requires precise environmental controls and significant energy inputs, particularly during the vacuum deposition processes. MicroLED manufacturing currently consumes 30-40% more energy per unit area, though this gap is expected to narrow with process optimization.

In contrast, MicroLED manufacturing remains in its nascent stages, with production costs estimated at 5-10 times higher than comparable OLED panels. This significant cost differential stems primarily from the complex transfer process required to place millions of microscopic LED chips precisely onto substrates. Current yield rates for MicroLED production hover between 60-70%, substantially lower than OLED's mature 85-95% yields.

The equipment investment required for new manufacturing facilities further highlights the disparity. A new OLED production line typically requires $500-800 million in capital expenditure, whereas MicroLED facilities demand investments of $1-2 billion for comparable output capacity. This higher initial investment creates a substantial barrier to rapid industry adoption.

Material costs also factor significantly into the equation. While MicroLED potentially uses less expensive base materials than OLED's organic compounds, the precision equipment and handling requirements offset these savings. Additionally, MicroLED's need for redundancy systems to compensate for defects adds complexity and cost to the manufacturing process.

Scalability presents another crucial dimension in the adoption trajectory. OLED manufacturing has successfully scaled to Generation 8.5 and 10 substrates, enabling efficient production of large panels. MicroLED faces significant challenges in scaling production beyond small displays, with mass transfer techniques representing the primary bottleneck. Several approaches are under development, including laser transfer, electromagnetic assembly, and fluidic self-assembly, but none has yet demonstrated commercial viability at scale.

Labor requirements differ substantially between technologies. OLED production has become increasingly automated, reducing labor costs to approximately 15-20% of total manufacturing expenses. MicroLED assembly currently requires more specialized human oversight, with labor representing 25-30% of production costs. This differential is expected to narrow as MicroLED manufacturing matures and automation increases.

Energy consumption during manufacturing also impacts overall costs. OLED production requires precise environmental controls and significant energy inputs, particularly during the vacuum deposition processes. MicroLED manufacturing currently consumes 30-40% more energy per unit area, though this gap is expected to narrow with process optimization.

Energy Efficiency and Environmental Considerations

Energy efficiency represents a critical differentiator between OLED and MicroLED technologies, significantly influencing their adoption trajectories in various markets. OLED displays inherently consume less power when displaying darker content due to their self-emissive nature, where black pixels are simply turned off. This characteristic makes OLEDs particularly energy-efficient for applications with predominantly dark interfaces or content, such as mobile devices and certain professional displays.

MicroLED technology, while still evolving, demonstrates promising energy efficiency characteristics that may eventually surpass OLED. Current MicroLED prototypes show approximately 30% higher energy efficiency than comparable OLED panels when displaying full-brightness content. This advantage stems from MicroLED's higher luminous efficacy, converting more electrical energy into visible light rather than heat.

Environmental considerations extend beyond operational energy consumption to manufacturing processes and end-of-life management. OLED production currently involves several environmentally challenging aspects, including the use of rare earth materials and organic compounds that require careful handling and disposal. The manufacturing process is also energy-intensive, with significant carbon footprint implications for large-scale production facilities.

MicroLED manufacturing presents its own environmental challenges, particularly in the precise transfer and placement of millions of microscopic LED elements. This process currently requires substantial energy input and specialized equipment. However, MicroLED displays contain fewer toxic materials compared to OLEDs, potentially simplifying recycling processes and reducing environmental impact at disposal.

Lifecycle assessment studies indicate that the longer operational lifespan of MicroLED displays (potentially exceeding 100,000 hours versus 30,000-50,000 hours for premium OLEDs) may offset their higher initial manufacturing environmental costs. This extended durability reduces replacement frequency and associated resource consumption, particularly important for large installation displays and automotive applications.

Water usage represents another significant environmental factor, with OLED manufacturing requiring approximately 30% more water than comparable MicroLED production processes. This difference becomes increasingly important as display manufacturers face growing pressure to reduce their water footprint, particularly in regions experiencing water scarcity.

Regulatory frameworks worldwide are evolving to address electronic display energy efficiency, with standards like Energy Star and the European Union's EcoDesign Directive imposing increasingly stringent requirements. MicroLED technology appears better positioned to meet these future regulatory thresholds, potentially accelerating its adoption in environmentally conscious markets and applications where compliance with such standards is mandatory.

MicroLED technology, while still evolving, demonstrates promising energy efficiency characteristics that may eventually surpass OLED. Current MicroLED prototypes show approximately 30% higher energy efficiency than comparable OLED panels when displaying full-brightness content. This advantage stems from MicroLED's higher luminous efficacy, converting more electrical energy into visible light rather than heat.

Environmental considerations extend beyond operational energy consumption to manufacturing processes and end-of-life management. OLED production currently involves several environmentally challenging aspects, including the use of rare earth materials and organic compounds that require careful handling and disposal. The manufacturing process is also energy-intensive, with significant carbon footprint implications for large-scale production facilities.

MicroLED manufacturing presents its own environmental challenges, particularly in the precise transfer and placement of millions of microscopic LED elements. This process currently requires substantial energy input and specialized equipment. However, MicroLED displays contain fewer toxic materials compared to OLEDs, potentially simplifying recycling processes and reducing environmental impact at disposal.

Lifecycle assessment studies indicate that the longer operational lifespan of MicroLED displays (potentially exceeding 100,000 hours versus 30,000-50,000 hours for premium OLEDs) may offset their higher initial manufacturing environmental costs. This extended durability reduces replacement frequency and associated resource consumption, particularly important for large installation displays and automotive applications.

Water usage represents another significant environmental factor, with OLED manufacturing requiring approximately 30% more water than comparable MicroLED production processes. This difference becomes increasingly important as display manufacturers face growing pressure to reduce their water footprint, particularly in regions experiencing water scarcity.

Regulatory frameworks worldwide are evolving to address electronic display energy efficiency, with standards like Energy Star and the European Union's EcoDesign Directive imposing increasingly stringent requirements. MicroLED technology appears better positioned to meet these future regulatory thresholds, potentially accelerating its adoption in environmentally conscious markets and applications where compliance with such standards is mandatory.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!