OLED vs MicroLED's Impact on Quantum Dot Technologies

OCT 24, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Quantum Dot Display Evolution and Objectives

Quantum dot (QD) technology has evolved significantly since its discovery in the 1980s, transforming from a laboratory curiosity to a commercial display technology. The evolution began with the fundamental research on semiconductor nanocrystals, which demonstrated unique optical properties including size-dependent emission wavelengths and high color purity. By the early 2000s, researchers had developed methods to synthesize quantum dots with precise control over size and composition, enabling consistent optical performance.

The first commercial applications emerged around 2013 with QD-enhanced LCD displays, where quantum dots were incorporated into films to enhance color gamut and efficiency. This represented the first generation of quantum dot display technology, primarily serving as an enhancement layer rather than as the primary light emitter. The technology quickly gained traction due to its ability to significantly improve color performance without requiring radical changes to existing LCD manufacturing infrastructure.

The second evolutionary phase saw the development of quantum dot color conversion layers for use with blue LED backlights, creating what became known as QLED displays. This approach, popularized by Samsung and other manufacturers, offered improved energy efficiency and wider color gamut compared to conventional LCDs, while maintaining competitive pricing against OLED alternatives.

Currently, the industry is transitioning toward electroluminescent quantum dot displays (EL-QLED or QD-LED), where quantum dots serve as the primary emissive material. This represents a fundamental shift from enhancement applications to direct emission technology, promising perfect black levels similar to OLED while maintaining the superior color performance and theoretical longevity of quantum dots.

The emergence of OLED and MicroLED technologies has significantly influenced quantum dot development trajectories. OLED's success in premium display markets has pushed quantum dot researchers to develop self-emissive solutions, while MicroLED's promise of superior brightness and longevity has created pressure to accelerate QD development to maintain relevance in future display ecosystems.

The primary objectives for quantum dot display technology development include achieving stable, efficient blue quantum dot emitters (currently the most challenging color), reducing reliance on cadmium and other toxic materials, improving manufacturing scalability, and developing hybrid approaches that combine quantum dots with OLED or MicroLED technologies to leverage the strengths of each. Additionally, researchers aim to extend quantum dot applications beyond traditional displays to flexible, transparent, and 3D display formats.

Long-term technical goals include achieving 100% Rec.2020 color gamut coverage, developing solution-processable manufacturing methods for reduced production costs, and creating environmentally sustainable quantum dot formulations that maintain performance while eliminating heavy metals and other hazardous materials.

The first commercial applications emerged around 2013 with QD-enhanced LCD displays, where quantum dots were incorporated into films to enhance color gamut and efficiency. This represented the first generation of quantum dot display technology, primarily serving as an enhancement layer rather than as the primary light emitter. The technology quickly gained traction due to its ability to significantly improve color performance without requiring radical changes to existing LCD manufacturing infrastructure.

The second evolutionary phase saw the development of quantum dot color conversion layers for use with blue LED backlights, creating what became known as QLED displays. This approach, popularized by Samsung and other manufacturers, offered improved energy efficiency and wider color gamut compared to conventional LCDs, while maintaining competitive pricing against OLED alternatives.

Currently, the industry is transitioning toward electroluminescent quantum dot displays (EL-QLED or QD-LED), where quantum dots serve as the primary emissive material. This represents a fundamental shift from enhancement applications to direct emission technology, promising perfect black levels similar to OLED while maintaining the superior color performance and theoretical longevity of quantum dots.

The emergence of OLED and MicroLED technologies has significantly influenced quantum dot development trajectories. OLED's success in premium display markets has pushed quantum dot researchers to develop self-emissive solutions, while MicroLED's promise of superior brightness and longevity has created pressure to accelerate QD development to maintain relevance in future display ecosystems.

The primary objectives for quantum dot display technology development include achieving stable, efficient blue quantum dot emitters (currently the most challenging color), reducing reliance on cadmium and other toxic materials, improving manufacturing scalability, and developing hybrid approaches that combine quantum dots with OLED or MicroLED technologies to leverage the strengths of each. Additionally, researchers aim to extend quantum dot applications beyond traditional displays to flexible, transparent, and 3D display formats.

Long-term technical goals include achieving 100% Rec.2020 color gamut coverage, developing solution-processable manufacturing methods for reduced production costs, and creating environmentally sustainable quantum dot formulations that maintain performance while eliminating heavy metals and other hazardous materials.

Market Analysis for Advanced Display Technologies

The advanced display technology market is experiencing a significant transformation driven by the evolution of OLED, MicroLED, and Quantum Dot technologies. Currently valued at approximately $169 billion in 2023, this market is projected to reach $242 billion by 2028, representing a compound annual growth rate (CAGR) of 7.4%. This growth is primarily fueled by increasing demand for high-resolution, energy-efficient displays across consumer electronics, automotive, and commercial applications.

OLED technology continues to dominate the premium smartphone and high-end television segments, with Samsung Display and LG Display maintaining leadership positions. The OLED market segment alone is valued at $48 billion, with smartphones accounting for 63% of this value. However, manufacturing challenges and higher production costs remain barriers to wider adoption in mid-range products.

MicroLED technology, though still in early commercialization stages, is gaining significant investment attention from major display manufacturers and technology companies. The market for MicroLED displays is relatively small at $450 million but is expected to grow at an impressive CAGR of 63% through 2028. This growth is driven by MicroLED's superior brightness, energy efficiency, and longevity compared to OLED technology.

Quantum Dot technology serves as both a complementary and competitive technology in this ecosystem. The QD-enhanced display market reached $10.6 billion in 2023, with QD-OLED and QLED (Quantum Dot LED) televisions showing strong consumer acceptance. Samsung's strategic pivot toward QD-OLED hybrid technology has created a new premium segment that combines the contrast benefits of OLED with the color performance of Quantum Dots.

Regional analysis reveals Asia-Pacific dominates manufacturing capacity, with South Korea, Japan, and Taiwan accounting for 78% of advanced display production. However, China is rapidly expanding its manufacturing capabilities through substantial government subsidies and investments in domestic display technology companies.

Consumer electronics remains the largest application segment at 72% of the total market, followed by automotive displays at 11%, which are showing the fastest growth rate as vehicle manufacturers incorporate larger and more sophisticated display systems. Commercial and industrial applications constitute the remaining 17%, with digital signage and medical imaging displays representing high-value niches.

The competitive dynamics between OLED and MicroLED technologies are reshaping Quantum Dot applications, with QD technology increasingly positioned as an enhancement layer rather than a standalone display solution. This trend is expected to accelerate as MicroLED manufacturing costs decrease, potentially creating new hybrid display categories that leverage the strengths of multiple technologies.

OLED technology continues to dominate the premium smartphone and high-end television segments, with Samsung Display and LG Display maintaining leadership positions. The OLED market segment alone is valued at $48 billion, with smartphones accounting for 63% of this value. However, manufacturing challenges and higher production costs remain barriers to wider adoption in mid-range products.

MicroLED technology, though still in early commercialization stages, is gaining significant investment attention from major display manufacturers and technology companies. The market for MicroLED displays is relatively small at $450 million but is expected to grow at an impressive CAGR of 63% through 2028. This growth is driven by MicroLED's superior brightness, energy efficiency, and longevity compared to OLED technology.

Quantum Dot technology serves as both a complementary and competitive technology in this ecosystem. The QD-enhanced display market reached $10.6 billion in 2023, with QD-OLED and QLED (Quantum Dot LED) televisions showing strong consumer acceptance. Samsung's strategic pivot toward QD-OLED hybrid technology has created a new premium segment that combines the contrast benefits of OLED with the color performance of Quantum Dots.

Regional analysis reveals Asia-Pacific dominates manufacturing capacity, with South Korea, Japan, and Taiwan accounting for 78% of advanced display production. However, China is rapidly expanding its manufacturing capabilities through substantial government subsidies and investments in domestic display technology companies.

Consumer electronics remains the largest application segment at 72% of the total market, followed by automotive displays at 11%, which are showing the fastest growth rate as vehicle manufacturers incorporate larger and more sophisticated display systems. Commercial and industrial applications constitute the remaining 17%, with digital signage and medical imaging displays representing high-value niches.

The competitive dynamics between OLED and MicroLED technologies are reshaping Quantum Dot applications, with QD technology increasingly positioned as an enhancement layer rather than a standalone display solution. This trend is expected to accelerate as MicroLED manufacturing costs decrease, potentially creating new hybrid display categories that leverage the strengths of multiple technologies.

OLED vs MicroLED Technical Challenges

Both OLED and MicroLED technologies face significant technical challenges that impact their integration with quantum dot technologies. OLED displays struggle with limited lifetime, particularly for blue emitters which typically degrade faster than red and green counterparts. This differential aging creates color balance issues over time, affecting display quality and consistency. The organic materials in OLEDs are also susceptible to moisture and oxygen, necessitating complex encapsulation techniques that add manufacturing complexity and cost.

Manufacturing scalability remains problematic for OLEDs, especially for larger displays where maintaining uniform organic layer deposition becomes increasingly difficult. This challenge directly impacts yield rates and production costs, limiting market penetration in certain segments. Additionally, OLED's relatively high power consumption, particularly when displaying bright white content, constrains its application in portable devices where battery life is critical.

MicroLED technology, while promising superior performance, faces even more formidable manufacturing hurdles. The mass transfer process—moving millions of tiny LED chips from growth substrates to display backplanes—represents perhaps the most significant technical obstacle. Current pick-and-place methods struggle with throughput limitations and placement accuracy requirements below 1μm, substantially impeding production scaling.

Defect management presents another critical challenge for MicroLED displays. With millions of individual LEDs in a single display, even a 99.9999% yield still results in hundreds of defective pixels. Developing cost-effective repair processes and redundancy systems remains an ongoing challenge that directly impacts manufacturing economics.

Size uniformity of MicroLED chips presents additional complications. Variations in chip dimensions affect color consistency and brightness uniformity across the display. As chip sizes decrease below 10μm, maintaining consistent electrical and optical properties becomes exponentially more difficult due to quantum and surface effects becoming increasingly dominant.

When integrating quantum dots with these display technologies, additional interface challenges emerge. For OLED systems, energy transfer efficiency between the organic emitters and quantum dots must be optimized while preventing degradation mechanisms. MicroLED integration requires precise quantum dot deposition techniques that maintain uniform thickness and prevent agglomeration, which can cause color inconsistencies.

Both technologies also face thermal management challenges when combined with quantum dots, as heat can degrade quantum dot performance over time. MicroLED's higher operating temperatures potentially accelerate this degradation, necessitating advanced thermal management solutions that add complexity to the overall display architecture.

Manufacturing scalability remains problematic for OLEDs, especially for larger displays where maintaining uniform organic layer deposition becomes increasingly difficult. This challenge directly impacts yield rates and production costs, limiting market penetration in certain segments. Additionally, OLED's relatively high power consumption, particularly when displaying bright white content, constrains its application in portable devices where battery life is critical.

MicroLED technology, while promising superior performance, faces even more formidable manufacturing hurdles. The mass transfer process—moving millions of tiny LED chips from growth substrates to display backplanes—represents perhaps the most significant technical obstacle. Current pick-and-place methods struggle with throughput limitations and placement accuracy requirements below 1μm, substantially impeding production scaling.

Defect management presents another critical challenge for MicroLED displays. With millions of individual LEDs in a single display, even a 99.9999% yield still results in hundreds of defective pixels. Developing cost-effective repair processes and redundancy systems remains an ongoing challenge that directly impacts manufacturing economics.

Size uniformity of MicroLED chips presents additional complications. Variations in chip dimensions affect color consistency and brightness uniformity across the display. As chip sizes decrease below 10μm, maintaining consistent electrical and optical properties becomes exponentially more difficult due to quantum and surface effects becoming increasingly dominant.

When integrating quantum dots with these display technologies, additional interface challenges emerge. For OLED systems, energy transfer efficiency between the organic emitters and quantum dots must be optimized while preventing degradation mechanisms. MicroLED integration requires precise quantum dot deposition techniques that maintain uniform thickness and prevent agglomeration, which can cause color inconsistencies.

Both technologies also face thermal management challenges when combined with quantum dots, as heat can degrade quantum dot performance over time. MicroLED's higher operating temperatures potentially accelerate this degradation, necessitating advanced thermal management solutions that add complexity to the overall display architecture.

Current Quantum Dot Implementation Approaches

01 Quantum dot composition and structure for enhanced display performance

Quantum dots with specific compositions and structures can significantly enhance display performance. These include core-shell structures, perovskite quantum dots, and quantum dots with specific elemental compositions that optimize light emission properties. The structural design of quantum dots affects color purity, brightness, and stability, which are critical factors in display performance. Advanced composition techniques allow for precise control of bandgap engineering, resulting in improved color gamut and display efficiency.- Quantum dot composition and structure for enhanced display performance: Quantum dots with specific compositions and structures can significantly enhance display performance. These include core-shell structures, perovskite quantum dots, and quantum dots with specific elemental compositions that improve color gamut, brightness, and stability. The structural design of quantum dots affects their optical properties, with optimized structures providing better color purity and luminescence efficiency for display applications.

- Quantum dot film and layer configurations in displays: Various quantum dot film and layer configurations can be implemented in display devices to improve performance. These include quantum dot enhancement films (QDEF), color conversion layers, and specialized arrangements that optimize light extraction and color conversion efficiency. The positioning and structure of quantum dot layers within the display stack significantly impact color reproduction, viewing angles, and overall display quality.

- Quantum dot integration with LED backlight technology: Integration of quantum dots with LED backlight technology enables superior display performance. This includes quantum dot-enhanced backlighting systems, on-chip quantum dot solutions, and hybrid approaches that combine quantum dots with mini-LED or micro-LED technologies. These integrations result in improved color volume, higher brightness, better energy efficiency, and enhanced contrast ratios in displays.

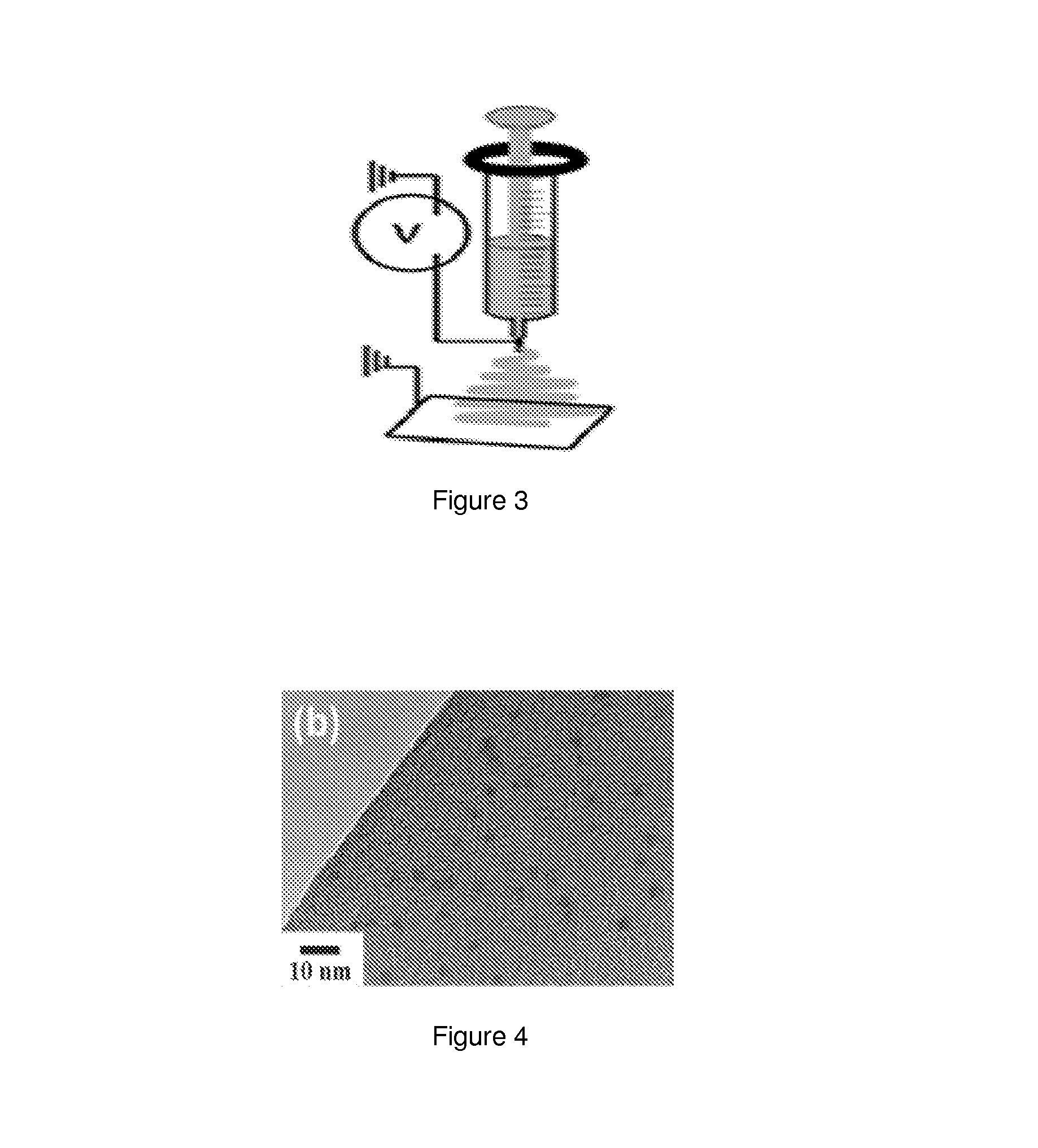

- Manufacturing processes for quantum dot displays: Advanced manufacturing processes for quantum dot displays significantly impact performance metrics. These include inkjet printing of quantum dots, photolithography techniques, solution processing methods, and encapsulation technologies that protect quantum dots from environmental degradation. Optimized manufacturing processes lead to more uniform quantum dot distribution, better stability, and improved display lifetime.

- Quantum dot color conversion for next-generation displays: Quantum dot color conversion technologies enable next-generation display capabilities. These include blue OLED with quantum dot color converters, quantum dot color filters, and specialized quantum dot materials designed for specific wavelength conversion. These technologies allow for wider color gamut, improved color accuracy, higher energy efficiency, and thinner display profiles compared to conventional display technologies.

02 Quantum dot integration methods in display devices

Various methods for integrating quantum dots into display devices can enhance overall performance. These include quantum dot films, on-chip integration, and quantum dot color conversion layers. The integration method affects light extraction efficiency, thermal stability, and manufacturing scalability. Advanced integration techniques such as inkjet printing and photolithography enable precise placement of quantum dots, resulting in higher resolution displays with improved color accuracy and brightness uniformity.Expand Specific Solutions03 Color enhancement and gamut expansion using quantum dot technology

Quantum dots enable significant color enhancement and gamut expansion in displays through their narrow emission spectra and tunable properties. By precisely controlling quantum dot size and composition, displays can achieve wider color gamuts that approach or exceed industry standards like Rec.2020. This technology allows for more accurate color reproduction, higher color saturation, and improved visual experience. The narrow emission bandwidth of quantum dots results in purer colors compared to conventional phosphor-based displays.Expand Specific Solutions04 Energy efficiency and brightness optimization in quantum dot displays

Quantum dot technology offers significant improvements in energy efficiency and brightness optimization for displays. Through mechanisms such as down-conversion of blue light to red and green wavelengths, quantum dots can enhance light utilization efficiency. Advanced quantum dot formulations reduce energy loss through non-radiative pathways, resulting in brighter displays with lower power consumption. This technology enables high-brightness displays suitable for various lighting conditions while maintaining color accuracy and reducing eye strain.Expand Specific Solutions05 Stability and reliability enhancements for quantum dot displays

Improving the stability and reliability of quantum dot displays involves addressing challenges such as photo-oxidation, thermal degradation, and moisture sensitivity. Advanced encapsulation techniques, surface treatments, and protective coatings can significantly enhance quantum dot longevity in display applications. Innovations in quantum dot chemistry and device architecture help maintain consistent color performance over extended operating periods. These enhancements result in displays with longer lifespans, more consistent performance, and greater resistance to environmental factors.Expand Specific Solutions

Key Industry Players in Quantum Dot Ecosystem

The OLED vs MicroLED competition is currently in a transitional phase, with OLED technology dominating the commercial market while MicroLED emerges as a promising next-generation display technology. The global quantum dot display market is projected to reach $10.6 billion by 2025, growing at a CAGR of 30.4%. In terms of technical maturity, companies like BOE Technology Group, TCL China Star Optoelectronics, and Apple have made significant advancements in OLED technology, while MicroLED development is being actively pursued by TCL Research America, Huawei Technologies, and Samsung. Quantum dot enhancement layers are being integrated with both technologies, with BOE, TCL, and Kodak leading research efforts to improve color gamut, brightness, and energy efficiency across display technologies.

BOE Technology Group Co., Ltd.

Technical Solution: BOE has developed a hybrid quantum dot-OLED technology that combines the benefits of both technologies. Their approach integrates quantum dots directly into OLED panels to enhance color gamut and brightness while maintaining OLED's perfect black levels. BOE's QD-OLED displays utilize a blue OLED backlight with red and green quantum dot color conversion layers, achieving over 90% BT.2020 color gamut coverage. The company has also been exploring MicroLED integration with quantum dots, where they use quantum dots as color conversion materials applied to blue MicroLED chips, allowing for improved color performance while benefiting from MicroLED's high brightness and efficiency. Their latest developments include inkjet-printed quantum dot color conversion layers that can be precisely deposited, reducing material waste and manufacturing costs compared to traditional color filter approaches.

Strengths: BOE's hybrid approach leverages existing OLED manufacturing infrastructure while enhancing performance through quantum dot integration. Their inkjet printing technology for QD layers offers cost advantages and manufacturing scalability. Weaknesses: The company still faces challenges with blue light leakage in their QD-OLED implementations, and their MicroLED-QD integration remains in early commercialization stages with yield issues affecting mass production capabilities.

TCL China Star Optoelectronics Technology Co., Ltd.

Technical Solution: TCL CSOT has developed a comprehensive quantum dot display technology portfolio addressing both OLED and MicroLED integration. Their flagship technology, H-QLED (Hybrid Quantum Dot Light Emitting Diode), combines quantum dots with traditional display technologies to achieve superior color performance. For OLED applications, TCL has created a quantum dot color conversion layer that sits atop blue OLED pixels, converting blue light to precise red and green wavelengths. This approach achieves over 90% BT.2020 color space coverage while maintaining OLED's perfect black levels. Their proprietary quantum dot formulation features enhanced stability against blue light exposure, addressing a common degradation concern. For MicroLED development, TCL CSOT has pioneered a direct quantum dot printing technique that allows precise deposition of red and green quantum dot materials directly onto blue MicroLED arrays. This method eliminates the need for traditional color filters, improving brightness efficiency by approximately 40%. Their latest generation uses a proprietary encapsulation technology that extends quantum dot lifetime under high-brightness MicroLED operation to over 30,000 hours, addressing a key commercialization barrier.

Strengths: TCL CSOT's vertical integration as both a materials developer and display manufacturer allows for rapid iteration and optimization of quantum dot formulations specifically for display applications. Their printing technology offers manufacturing cost advantages over competing approaches. Weaknesses: Their quantum dot materials still face stability challenges under extended high-brightness operation, particularly for MicroLED applications. The company's MicroLED mass transfer technology remains less mature than their OLED integration, with lower yields affecting production economics.

Critical Patents in QD-OLED and QD-MicroLED

Series connected quantum dot light-emitting device, panel and display device

PatentActiveUS20180286927A1

Innovation

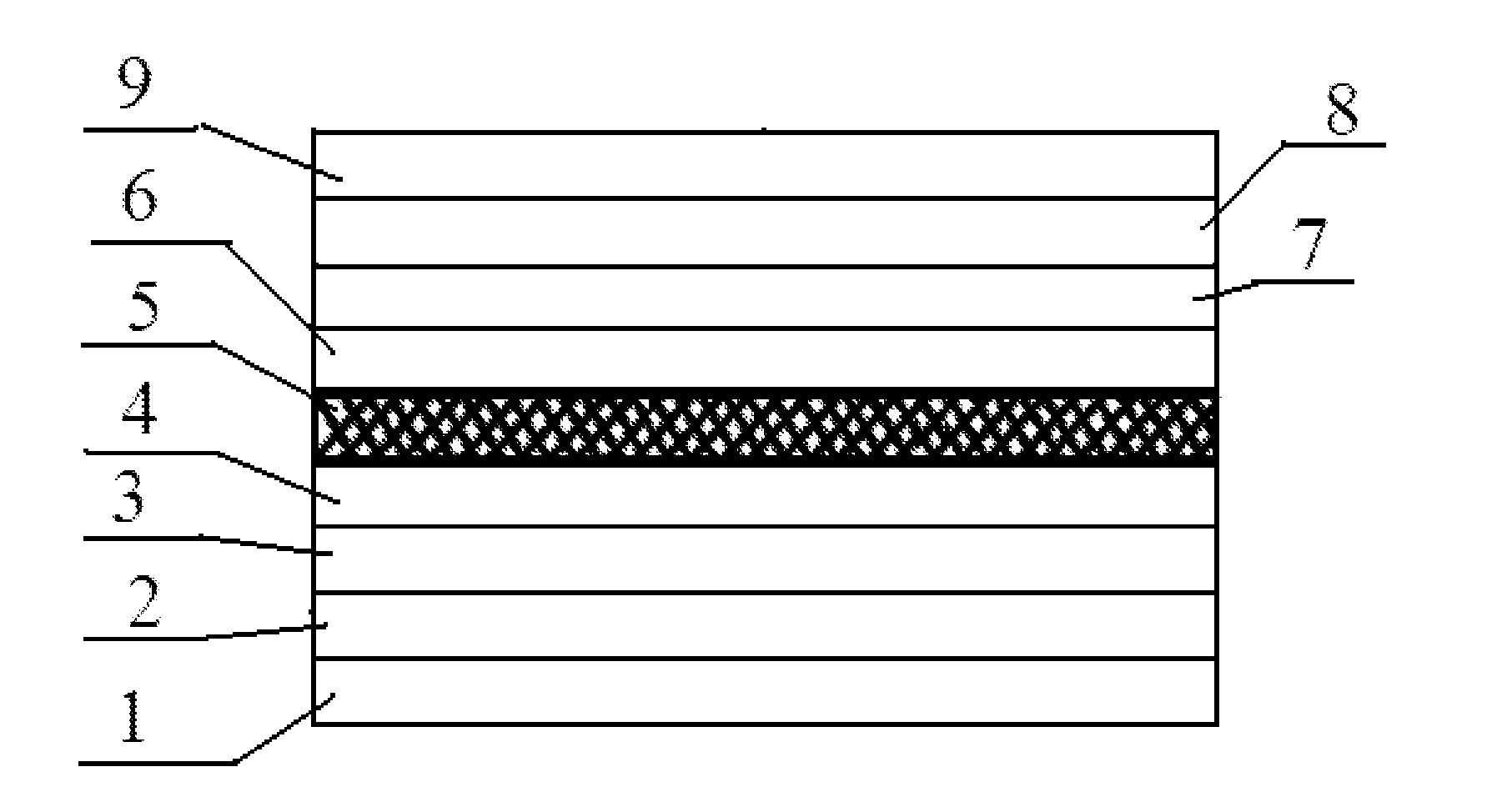

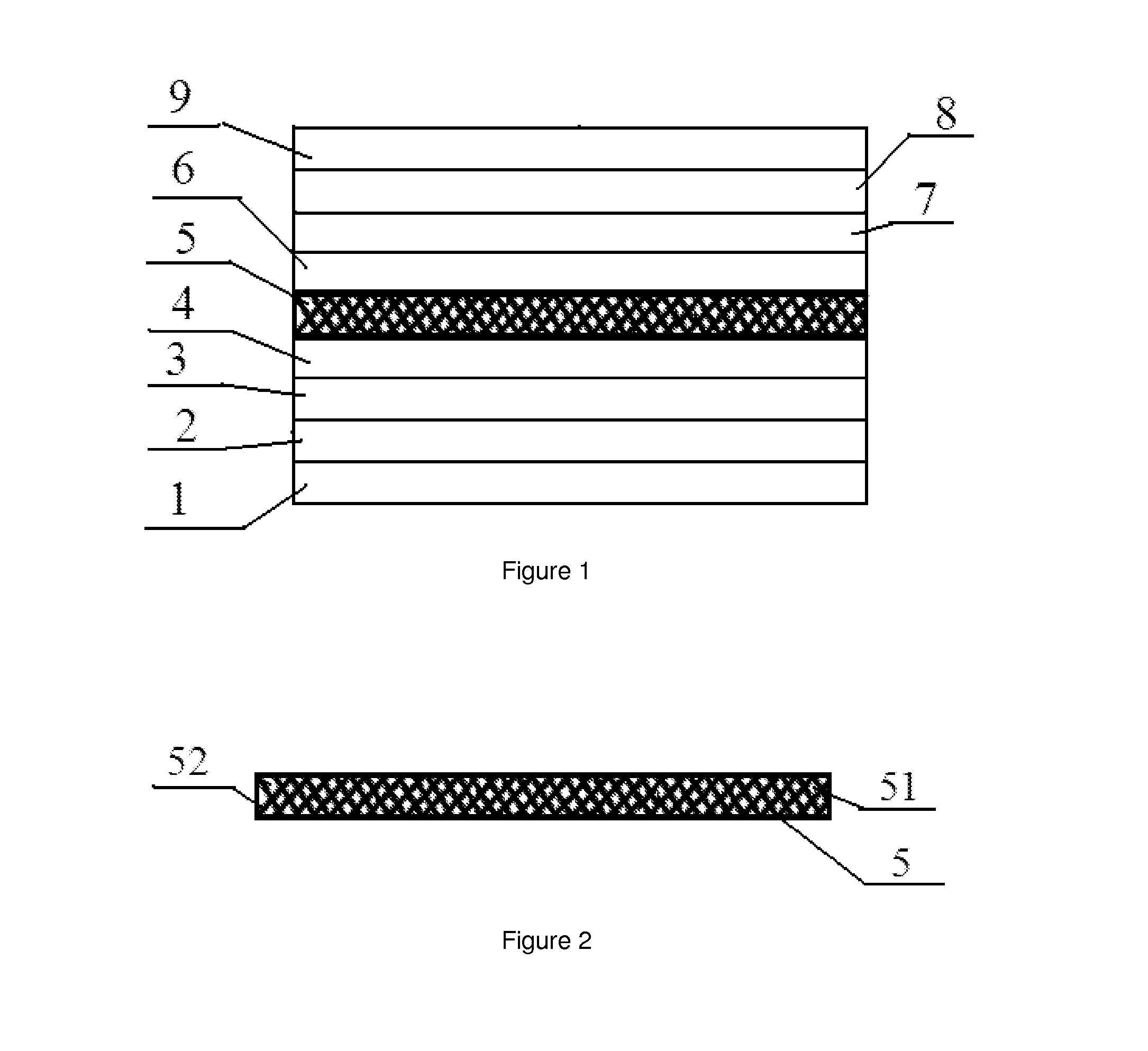

- A series connected quantum dot light-emitting device structure is introduced, comprising a first electrode, a first light-emitting unit with a quantum dot layer, a charge generation layer, and a second light-emitting unit with an organic layer, where the charge generation layer facilitates the series connection of both units, utilizing N-type and P-type layers formed by different materials to optimize electron and hole injection, thereby increasing luminous efficiency.

Organic electroluminescent device, method of preparing same, display substrate, and display apparatus

PatentActiveUS20160301024A1

Innovation

- An organic electroluminescent (OEL) device is developed using an electrostatic spinning process to uniformly disperse quantum dots within electroluminescent polymer fibers, incorporating a charge control agent to prevent agglomeration and enhance luminescence efficiency through fluorescence resonance energy transfer.

Manufacturing Process Comparison

The manufacturing processes for OLED, MicroLED, and Quantum Dot technologies represent critical differentiators in display technology advancement, with each approach presenting unique challenges and advantages that directly impact market adoption and technological evolution.

OLED manufacturing has matured significantly over the past decade, utilizing vacuum thermal evaporation for small molecule OLEDs and solution processing for polymer-based variants. The process involves depositing organic materials onto glass or flexible substrates through techniques like inkjet printing or spin coating. While OLED manufacturing has achieved economies of scale, particularly for smartphone displays, it continues to face yield challenges for larger panels, with defect rates increasing proportionally with display size.

MicroLED manufacturing, by contrast, represents a fundamentally different approach requiring precision handling of microscopic LED chips. The process involves three critical stages: epitaxial growth of LED wafers, mass transfer of individual LED chips (often measuring less than 10 microns), and precise placement onto the target substrate. The mass transfer process remains particularly challenging, with companies exploring various approaches including stamp transfer, laser transfer, and fluid assembly techniques. Current manufacturing yields for MicroLED remain significantly lower than OLED, with estimates suggesting production costs 4-5 times higher per unit area.

Quantum Dot implementation varies significantly between these display technologies. In OLED applications, quantum dots typically serve as color conversion layers, with manufacturing involving solution processing techniques to deposit QD materials. The integration process must carefully manage the sensitivity of quantum dots to oxygen and moisture, requiring sophisticated encapsulation methods.

For MicroLED integration with Quantum Dots, manufacturing complexity increases substantially. The process requires precise alignment between the blue or UV MicroLED emitters and the corresponding quantum dot conversion layers. This alignment must be maintained at microscopic scales across the entire display area, presenting significant engineering challenges.

Temperature management represents another critical manufacturing consideration. OLED processes typically operate at lower temperatures compatible with quantum dot stability, while MicroLED manufacturing often involves higher temperature processes that can potentially degrade quantum dot performance. This necessitates careful process sequencing and thermal management strategies.

The equipment infrastructure for OLED manufacturing has benefited from years of investment and optimization, while MicroLED manufacturing equipment remains in earlier development stages, with specialized tools for mass transfer representing a particular bottleneck. This equipment gap significantly impacts production costs and scalability potential for MicroLED-QD integration compared to OLED-QD approaches.

OLED manufacturing has matured significantly over the past decade, utilizing vacuum thermal evaporation for small molecule OLEDs and solution processing for polymer-based variants. The process involves depositing organic materials onto glass or flexible substrates through techniques like inkjet printing or spin coating. While OLED manufacturing has achieved economies of scale, particularly for smartphone displays, it continues to face yield challenges for larger panels, with defect rates increasing proportionally with display size.

MicroLED manufacturing, by contrast, represents a fundamentally different approach requiring precision handling of microscopic LED chips. The process involves three critical stages: epitaxial growth of LED wafers, mass transfer of individual LED chips (often measuring less than 10 microns), and precise placement onto the target substrate. The mass transfer process remains particularly challenging, with companies exploring various approaches including stamp transfer, laser transfer, and fluid assembly techniques. Current manufacturing yields for MicroLED remain significantly lower than OLED, with estimates suggesting production costs 4-5 times higher per unit area.

Quantum Dot implementation varies significantly between these display technologies. In OLED applications, quantum dots typically serve as color conversion layers, with manufacturing involving solution processing techniques to deposit QD materials. The integration process must carefully manage the sensitivity of quantum dots to oxygen and moisture, requiring sophisticated encapsulation methods.

For MicroLED integration with Quantum Dots, manufacturing complexity increases substantially. The process requires precise alignment between the blue or UV MicroLED emitters and the corresponding quantum dot conversion layers. This alignment must be maintained at microscopic scales across the entire display area, presenting significant engineering challenges.

Temperature management represents another critical manufacturing consideration. OLED processes typically operate at lower temperatures compatible with quantum dot stability, while MicroLED manufacturing often involves higher temperature processes that can potentially degrade quantum dot performance. This necessitates careful process sequencing and thermal management strategies.

The equipment infrastructure for OLED manufacturing has benefited from years of investment and optimization, while MicroLED manufacturing equipment remains in earlier development stages, with specialized tools for mass transfer representing a particular bottleneck. This equipment gap significantly impacts production costs and scalability potential for MicroLED-QD integration compared to OLED-QD approaches.

Energy Efficiency and Environmental Impact

Energy efficiency represents a critical differentiator in the competition between OLED, MicroLED, and Quantum Dot technologies. OLED displays have traditionally offered superior energy efficiency in dark content scenarios due to their ability to completely turn off individual pixels, resulting in perfect blacks and reduced power consumption. However, when displaying bright content, OLEDs become significantly less efficient, often consuming more power than alternative technologies.

MicroLED technology presents a promising advancement in energy efficiency across all brightness levels. With higher luminous efficacy than OLED, MicroLEDs can produce the same brightness while consuming substantially less power. Industry measurements indicate that MicroLED displays can achieve up to 30% greater energy efficiency compared to OLED counterparts when displaying mixed content, with even greater advantages in high-brightness applications.

Quantum Dot technology serves as both a complementary and competing solution in this landscape. When implemented as color conversion layers in LCD or MicroLED displays (QLED), they enhance color gamut while maintaining or improving energy efficiency. The latest generation of Quantum Dot materials demonstrates photoluminescent quantum yields exceeding 95%, minimizing energy losses during color conversion processes.

From an environmental perspective, manufacturing processes present significant differences. OLED production involves organic solvents and potentially hazardous materials that require careful handling and disposal. MicroLED manufacturing, while less chemically intensive, demands substantial energy inputs for epitaxial growth processes and precision transfer methods. Quantum Dot production raises concerns regarding heavy metal content, particularly in cadmium-based formulations, though cadmium-free alternatives continue to improve in performance.

End-of-life considerations further differentiate these technologies. OLED panels contain organic materials that can degrade into environmentally benign compounds, but their encapsulation materials may present recycling challenges. MicroLED displays contain valuable semiconductor materials that could theoretically be recovered, though effective recycling processes remain underdeveloped. Quantum Dot components, particularly those containing regulated materials like cadmium, require specialized disposal protocols to prevent environmental contamination.

The carbon footprint across the lifecycle of these technologies varies significantly. While OLED manufacturing currently consumes less energy than MicroLED production, the longer operational lifespan of MicroLED displays (potentially exceeding 100,000 hours versus 30,000-50,000 for OLEDs) may offset initial environmental impacts through reduced replacement frequency and associated manufacturing emissions.

MicroLED technology presents a promising advancement in energy efficiency across all brightness levels. With higher luminous efficacy than OLED, MicroLEDs can produce the same brightness while consuming substantially less power. Industry measurements indicate that MicroLED displays can achieve up to 30% greater energy efficiency compared to OLED counterparts when displaying mixed content, with even greater advantages in high-brightness applications.

Quantum Dot technology serves as both a complementary and competing solution in this landscape. When implemented as color conversion layers in LCD or MicroLED displays (QLED), they enhance color gamut while maintaining or improving energy efficiency. The latest generation of Quantum Dot materials demonstrates photoluminescent quantum yields exceeding 95%, minimizing energy losses during color conversion processes.

From an environmental perspective, manufacturing processes present significant differences. OLED production involves organic solvents and potentially hazardous materials that require careful handling and disposal. MicroLED manufacturing, while less chemically intensive, demands substantial energy inputs for epitaxial growth processes and precision transfer methods. Quantum Dot production raises concerns regarding heavy metal content, particularly in cadmium-based formulations, though cadmium-free alternatives continue to improve in performance.

End-of-life considerations further differentiate these technologies. OLED panels contain organic materials that can degrade into environmentally benign compounds, but their encapsulation materials may present recycling challenges. MicroLED displays contain valuable semiconductor materials that could theoretically be recovered, though effective recycling processes remain underdeveloped. Quantum Dot components, particularly those containing regulated materials like cadmium, require specialized disposal protocols to prevent environmental contamination.

The carbon footprint across the lifecycle of these technologies varies significantly. While OLED manufacturing currently consumes less energy than MicroLED production, the longer operational lifespan of MicroLED displays (potentially exceeding 100,000 hours versus 30,000-50,000 for OLEDs) may offset initial environmental impacts through reduced replacement frequency and associated manufacturing emissions.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!