Silicon Carbide Wafer's Thermal Management Capabilities

OCT 14, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

SiC Wafer Thermal Management Background and Objectives

Silicon carbide (SiC) wafer technology has evolved significantly over the past three decades, transitioning from a niche research material to a commercially viable semiconductor substrate. The thermal management capabilities of SiC wafers represent one of their most valuable properties, with historical development tracing back to the early 1990s when researchers first recognized SiC's potential for high-temperature applications. The thermal conductivity of SiC, approximately three times that of silicon, has positioned it as a critical material for next-generation power electronics and high-frequency devices operating in extreme thermal environments.

The evolution of SiC wafer technology has been marked by steady improvements in crystal quality, wafer diameter, and manufacturing processes. Initial commercialization efforts in the early 2000s focused on small-diameter wafers with significant defect densities, limiting their thermal management effectiveness. By the 2010s, substantial progress in reducing micropipe defects and increasing wafer diameters to 4-inch and 6-inch standards dramatically improved thermal performance consistency across wafers.

Current technological trends indicate accelerating adoption of SiC in electric vehicles, renewable energy systems, and industrial power applications, all environments where thermal management is critical. The compound annual growth rate for SiC power devices exceeds 30% in these sectors, driven primarily by the material's superior thermal characteristics that enable higher operating temperatures and power densities than traditional silicon-based solutions.

The primary technical objective for SiC wafer thermal management is to achieve uniform heat dissipation across increasingly larger wafer diameters while maintaining structural integrity at operating temperatures above 200°C. Secondary objectives include reducing thermal boundary resistance at SiC interfaces with other materials and developing cost-effective packaging solutions that can fully leverage SiC's inherent thermal advantages.

Research goals in this field focus on understanding the fundamental mechanisms of heat transfer in SiC at the nanoscale and microscale levels, particularly how crystal defects, dopant concentrations, and polytypes (4H vs. 6H) affect thermal conductivity. Additionally, there is significant interest in developing advanced characterization techniques to accurately measure thermal gradients across wafers during high-power operation.

The industry aims to establish standardized thermal performance metrics for SiC wafers, enabling more effective comparison between different manufacturers and production methods. Long-term objectives include achieving thermal conductivity values approaching theoretical limits (490 W/mK) in production-grade wafers and developing novel substrate architectures that can optimize heat extraction pathways for specific device configurations.

The evolution of SiC wafer technology has been marked by steady improvements in crystal quality, wafer diameter, and manufacturing processes. Initial commercialization efforts in the early 2000s focused on small-diameter wafers with significant defect densities, limiting their thermal management effectiveness. By the 2010s, substantial progress in reducing micropipe defects and increasing wafer diameters to 4-inch and 6-inch standards dramatically improved thermal performance consistency across wafers.

Current technological trends indicate accelerating adoption of SiC in electric vehicles, renewable energy systems, and industrial power applications, all environments where thermal management is critical. The compound annual growth rate for SiC power devices exceeds 30% in these sectors, driven primarily by the material's superior thermal characteristics that enable higher operating temperatures and power densities than traditional silicon-based solutions.

The primary technical objective for SiC wafer thermal management is to achieve uniform heat dissipation across increasingly larger wafer diameters while maintaining structural integrity at operating temperatures above 200°C. Secondary objectives include reducing thermal boundary resistance at SiC interfaces with other materials and developing cost-effective packaging solutions that can fully leverage SiC's inherent thermal advantages.

Research goals in this field focus on understanding the fundamental mechanisms of heat transfer in SiC at the nanoscale and microscale levels, particularly how crystal defects, dopant concentrations, and polytypes (4H vs. 6H) affect thermal conductivity. Additionally, there is significant interest in developing advanced characterization techniques to accurately measure thermal gradients across wafers during high-power operation.

The industry aims to establish standardized thermal performance metrics for SiC wafers, enabling more effective comparison between different manufacturers and production methods. Long-term objectives include achieving thermal conductivity values approaching theoretical limits (490 W/mK) in production-grade wafers and developing novel substrate architectures that can optimize heat extraction pathways for specific device configurations.

Market Demand Analysis for High-Temperature Electronics

The high-temperature electronics market is experiencing unprecedented growth driven by increasing demands across multiple industries requiring components that can operate reliably in extreme thermal environments. The global market for high-temperature electronics is projected to reach $9.6 billion by 2026, growing at a CAGR of 8.2% from 2021. Silicon Carbide (SiC) wafers, with their superior thermal management capabilities, are positioned as critical components in this expanding market.

Automotive applications represent the largest segment for high-temperature electronics, particularly with the rapid expansion of electric vehicles (EVs) and hybrid electric vehicles (HEVs). Power electronics in these vehicles must withstand junction temperatures exceeding 175°C, making SiC wafers increasingly essential. The automotive power electronics market alone is expected to grow to $5.5 billion by 2025, with SiC-based solutions capturing an increasing share.

Aerospace and defense sectors constitute another significant market, requiring electronics that can function reliably at temperatures ranging from -55°C to over 300°C. SiC-based components are increasingly specified for aircraft engine control systems, radar applications, and space exploration equipment where thermal management is critical. This sector is expected to grow at 7.5% annually through 2027.

Industrial applications, particularly in oil and gas exploration, represent a substantial market opportunity. Downhole drilling equipment operates in environments exceeding 200°C, where conventional silicon-based electronics fail. The market for high-temperature electronics in this sector is projected to reach $1.2 billion by 2025, with SiC wafers playing an increasingly important role.

Power generation and distribution systems are rapidly adopting SiC-based solutions for their thermal resilience and efficiency benefits. The transition to renewable energy sources has accelerated demand for high-performance power electronics that can operate efficiently at elevated temperatures. This market segment is growing at 9.3% annually, with particular strength in solar inverters and wind power systems.

Consumer demand for smaller, more powerful electronic devices is driving miniaturization trends that create significant thermal management challenges. As power densities increase, the ability of SiC wafers to handle higher temperatures becomes increasingly valuable in maintaining reliability while reducing cooling requirements.

Regional analysis indicates that Asia-Pacific represents the fastest-growing market for high-temperature electronics, with China, Japan, and South Korea making significant investments in SiC wafer production capabilities. North America and Europe maintain strong positions, particularly in aerospace, defense, and automotive applications requiring advanced thermal management solutions.

Automotive applications represent the largest segment for high-temperature electronics, particularly with the rapid expansion of electric vehicles (EVs) and hybrid electric vehicles (HEVs). Power electronics in these vehicles must withstand junction temperatures exceeding 175°C, making SiC wafers increasingly essential. The automotive power electronics market alone is expected to grow to $5.5 billion by 2025, with SiC-based solutions capturing an increasing share.

Aerospace and defense sectors constitute another significant market, requiring electronics that can function reliably at temperatures ranging from -55°C to over 300°C. SiC-based components are increasingly specified for aircraft engine control systems, radar applications, and space exploration equipment where thermal management is critical. This sector is expected to grow at 7.5% annually through 2027.

Industrial applications, particularly in oil and gas exploration, represent a substantial market opportunity. Downhole drilling equipment operates in environments exceeding 200°C, where conventional silicon-based electronics fail. The market for high-temperature electronics in this sector is projected to reach $1.2 billion by 2025, with SiC wafers playing an increasingly important role.

Power generation and distribution systems are rapidly adopting SiC-based solutions for their thermal resilience and efficiency benefits. The transition to renewable energy sources has accelerated demand for high-performance power electronics that can operate efficiently at elevated temperatures. This market segment is growing at 9.3% annually, with particular strength in solar inverters and wind power systems.

Consumer demand for smaller, more powerful electronic devices is driving miniaturization trends that create significant thermal management challenges. As power densities increase, the ability of SiC wafers to handle higher temperatures becomes increasingly valuable in maintaining reliability while reducing cooling requirements.

Regional analysis indicates that Asia-Pacific represents the fastest-growing market for high-temperature electronics, with China, Japan, and South Korea making significant investments in SiC wafer production capabilities. North America and Europe maintain strong positions, particularly in aerospace, defense, and automotive applications requiring advanced thermal management solutions.

Current Thermal Management Challenges in SiC Technology

Silicon Carbide (SiC) power devices have emerged as superior alternatives to traditional silicon-based semiconductors due to their exceptional thermal conductivity, wide bandgap, and high breakdown field strength. However, despite these inherent advantages, SiC technology faces significant thermal management challenges that limit its full potential in high-power and high-temperature applications.

The primary thermal challenge in SiC technology stems from the extreme heat flux densities generated during operation, which can exceed 1000 W/cm² in advanced applications. This concentrated heat generation creates localized hotspots that can compromise device reliability and performance. While SiC's thermal conductivity (approximately 370-490 W/m·K) is theoretically superior to silicon (150 W/m·K), practical implementations often fail to fully leverage this advantage due to interface thermal resistance issues.

Interface thermal resistance presents a critical bottleneck in SiC thermal management. The transition between SiC wafers and packaging materials creates thermal boundaries that impede efficient heat dissipation. Current die-attach technologies, including solders and sintered silver, struggle to maintain mechanical integrity under the extreme thermal cycling conditions typical in SiC applications, leading to delamination and increased thermal resistance over time.

Another significant challenge involves non-uniform heat distribution across SiC wafers during operation. Power density variations can create thermal gradients exceeding 50°C across a single device, inducing mechanical stress that compromises long-term reliability. These thermal gradients are particularly problematic in multi-chip modules where different operating conditions between chips exacerbate thermal management complexity.

The cooling infrastructure supporting SiC devices presents additional limitations. Conventional cooling solutions designed for silicon-based semiconductors often prove inadequate for SiC's higher operating temperatures and power densities. Current liquid cooling systems struggle to remove heat efficiently from SiC devices without introducing excessive system complexity and reliability concerns.

Manufacturing inconsistencies further complicate thermal management in SiC technology. Variations in wafer quality, including micropipe defects and crystal dislocations, create unpredictable thermal pathways that can lead to premature device failure. These defects, while decreasing in modern manufacturing processes, still impact thermal performance consistency across production batches.

Thermal characterization and modeling present additional challenges. Existing thermal simulation tools often lack accurate models for SiC's unique thermal behavior under extreme conditions, making it difficult to predict hotspots and optimize thermal management strategies during the design phase. This modeling gap increases development cycles and costs for SiC-based power systems.

The primary thermal challenge in SiC technology stems from the extreme heat flux densities generated during operation, which can exceed 1000 W/cm² in advanced applications. This concentrated heat generation creates localized hotspots that can compromise device reliability and performance. While SiC's thermal conductivity (approximately 370-490 W/m·K) is theoretically superior to silicon (150 W/m·K), practical implementations often fail to fully leverage this advantage due to interface thermal resistance issues.

Interface thermal resistance presents a critical bottleneck in SiC thermal management. The transition between SiC wafers and packaging materials creates thermal boundaries that impede efficient heat dissipation. Current die-attach technologies, including solders and sintered silver, struggle to maintain mechanical integrity under the extreme thermal cycling conditions typical in SiC applications, leading to delamination and increased thermal resistance over time.

Another significant challenge involves non-uniform heat distribution across SiC wafers during operation. Power density variations can create thermal gradients exceeding 50°C across a single device, inducing mechanical stress that compromises long-term reliability. These thermal gradients are particularly problematic in multi-chip modules where different operating conditions between chips exacerbate thermal management complexity.

The cooling infrastructure supporting SiC devices presents additional limitations. Conventional cooling solutions designed for silicon-based semiconductors often prove inadequate for SiC's higher operating temperatures and power densities. Current liquid cooling systems struggle to remove heat efficiently from SiC devices without introducing excessive system complexity and reliability concerns.

Manufacturing inconsistencies further complicate thermal management in SiC technology. Variations in wafer quality, including micropipe defects and crystal dislocations, create unpredictable thermal pathways that can lead to premature device failure. These defects, while decreasing in modern manufacturing processes, still impact thermal performance consistency across production batches.

Thermal characterization and modeling present additional challenges. Existing thermal simulation tools often lack accurate models for SiC's unique thermal behavior under extreme conditions, making it difficult to predict hotspots and optimize thermal management strategies during the design phase. This modeling gap increases development cycles and costs for SiC-based power systems.

Current SiC Thermal Dissipation Solutions

01 Heat dissipation structures for SiC wafers

Various heat dissipation structures can be integrated with silicon carbide wafers to manage thermal issues. These include specialized heat sinks, thermal interface materials, and cooling channels designed specifically for the high thermal conductivity properties of SiC. These structures help to efficiently remove heat generated during device operation, preventing performance degradation and extending device lifetime in high-power applications.- Heat dissipation structures for SiC wafers: Various heat dissipation structures can be integrated with silicon carbide wafers to manage thermal issues. These include specialized heat sinks, thermal interface materials, and cooling channels designed specifically for the high thermal conductivity properties of SiC. These structures help to efficiently remove heat generated during device operation, preventing thermal damage and ensuring optimal performance of SiC-based semiconductor devices.

- Thermal management in SiC wafer manufacturing processes: Thermal management techniques are crucial during the manufacturing of silicon carbide wafers. This includes controlled heating and cooling processes during crystal growth, wafer cutting, and surface treatment. Proper thermal management during manufacturing helps to minimize defects, reduce internal stresses, and improve the overall quality and yield of SiC wafers, which directly impacts their thermal performance in final applications.

- Advanced cooling systems for SiC power devices: Silicon carbide power devices require specialized cooling systems due to their high power density and operating temperatures. These systems may include liquid cooling, two-phase cooling, or advanced air cooling designs. The cooling systems are specifically engineered to handle the unique thermal characteristics of SiC, allowing these devices to operate at higher power levels while maintaining reliability and extending operational lifetime.

- Thermal interface materials for SiC wafer assemblies: Specialized thermal interface materials are developed for use with silicon carbide wafers to enhance heat transfer between the SiC device and cooling systems. These materials are designed to accommodate the high thermal conductivity of SiC while addressing challenges such as coefficient of thermal expansion mismatches. Advanced composites, metal alloys, and phase-change materials are employed to maximize thermal conductivity and ensure reliable long-term performance under thermal cycling conditions.

- Integrated thermal management solutions for SiC wafer-based systems: Comprehensive thermal management solutions integrate multiple approaches to address heat dissipation in silicon carbide wafer-based systems. These solutions combine optimized package designs, advanced materials, and system-level thermal considerations. The integrated approach takes into account the entire thermal path from the SiC junction to the ambient environment, ensuring efficient heat removal while maintaining the electrical performance advantages of silicon carbide technology.

02 Thermal management in SiC wafer manufacturing processes

Thermal management techniques are critical during the manufacturing of silicon carbide wafers. These include controlled heating and cooling rates during crystal growth, thermal annealing processes to reduce defects, and temperature monitoring systems. Proper thermal management during manufacturing helps to minimize thermal stress, reduce crystal defects, and improve the overall quality and yield of SiC wafers.Expand Specific Solutions03 Thermal interface materials for SiC devices

Specialized thermal interface materials are developed for silicon carbide wafer applications to enhance heat transfer between the SiC device and cooling systems. These materials include advanced thermal greases, phase change materials, and metal-based composites designed to withstand high temperatures while maintaining excellent thermal conductivity. The proper selection and application of these materials significantly improves the thermal management of SiC-based electronic devices.Expand Specific Solutions04 Cooling systems for SiC power electronics

Advanced cooling systems are designed specifically for silicon carbide power electronics to handle their unique thermal characteristics. These include liquid cooling solutions, microchannel coolers, jet impingement systems, and two-phase cooling technologies. These cooling systems are essential for maintaining optimal operating temperatures in high-power density applications where SiC wafers are utilized, such as electric vehicles, renewable energy systems, and industrial drives.Expand Specific Solutions05 Thermal simulation and modeling for SiC wafer designs

Thermal simulation and modeling techniques are employed to optimize the design of silicon carbide wafer-based devices. These computational methods predict heat distribution, identify potential hotspots, and evaluate the effectiveness of various thermal management strategies before physical implementation. Advanced thermal models account for the unique properties of SiC materials, including their anisotropic thermal conductivity and temperature-dependent characteristics, enabling more efficient and reliable device designs.Expand Specific Solutions

Key Industry Players in SiC Wafer Manufacturing

Silicon Carbide (SiC) wafer thermal management capabilities are advancing rapidly in a growing market, currently in the early maturity phase with significant expansion potential. The global SiC power semiconductor market is projected to reach $4-5 billion by 2026, driven by electric vehicle adoption and renewable energy applications. Leading players like Wolfspeed, RESONAC, and SICC are pioneering advanced thermal management solutions, while companies such as Tokai Carbon and Shin-Etsu Chemical focus on material innovations. Automotive giants Toyota and Mitsubishi Electric are integrating SiC technology into power systems, benefiting from superior thermal conductivity. Chinese manufacturers including Huawei and Gree are rapidly developing domestic capabilities, narrowing the technological gap with established Western and Japanese competitors.

RESONAC CORP

Technical Solution: RESONAC (formerly Showa Denko) has developed advanced thermal management solutions for SiC wafers through their high-purity manufacturing process. Their technology focuses on minimizing micropipe defects and stacking faults that can impair thermal conductivity. RESONAC's SiC wafers feature a thermal conductivity of approximately 360-380 W/mK at room temperature, with minimal degradation at elevated temperatures. Their proprietary wafer polishing technique creates an ultra-smooth surface finish with roughness values below 0.5nm, enhancing thermal interface quality when integrated into devices. RESONAC has implemented a specialized thermal gradient control during crystal growth that results in more uniform thermal properties across the entire wafer diameter. Their SiC wafers demonstrate excellent thermal cycling resilience, maintaining structural integrity through thousands of thermal cycles between -55°C and 175°C, making them suitable for demanding automotive and industrial applications where thermal stress is a significant concern.

Strengths: Exceptional wafer uniformity leading to consistent thermal performance; superior surface finishing enhancing thermal interface quality; high-volume manufacturing capability. Weaknesses: Relatively higher cost structure compared to some competitors; more limited product portfolio diversity; primarily focused on standard wafer specifications rather than customized thermal solutions.

Wolfspeed, Inc.

Technical Solution: Wolfspeed has pioneered advanced thermal management solutions for Silicon Carbide (SiC) wafers through their proprietary substrate technology. Their approach involves optimizing the crystal growth process to minimize defects that impede thermal conductivity. Wolfspeed's 150mm and 200mm SiC wafers feature thermal conductivity values exceeding 370 W/mK at room temperature, significantly outperforming silicon's ~150 W/mK. Their technology incorporates specialized edge handling and backside processing techniques that enhance heat dissipation capabilities by up to 30% compared to conventional SiC wafers. Wolfspeed has developed a multi-layer thermal interface material specifically designed for SiC power modules that reduces thermal resistance by approximately 25%, allowing for more efficient heat transfer from the device to cooling systems. Their thermal management approach also includes optimized device layouts that strategically distribute heat generation across the wafer surface to prevent hotspot formation.

Strengths: Industry-leading thermal conductivity values; comprehensive thermal management ecosystem from wafer to module level; proven reliability in high-temperature applications up to 250°C. Weaknesses: Higher production costs compared to silicon alternatives; limited wafer size options compared to silicon technology; requires specialized handling equipment for manufacturing.

Core Patents and Research in SiC Thermal Conductivity

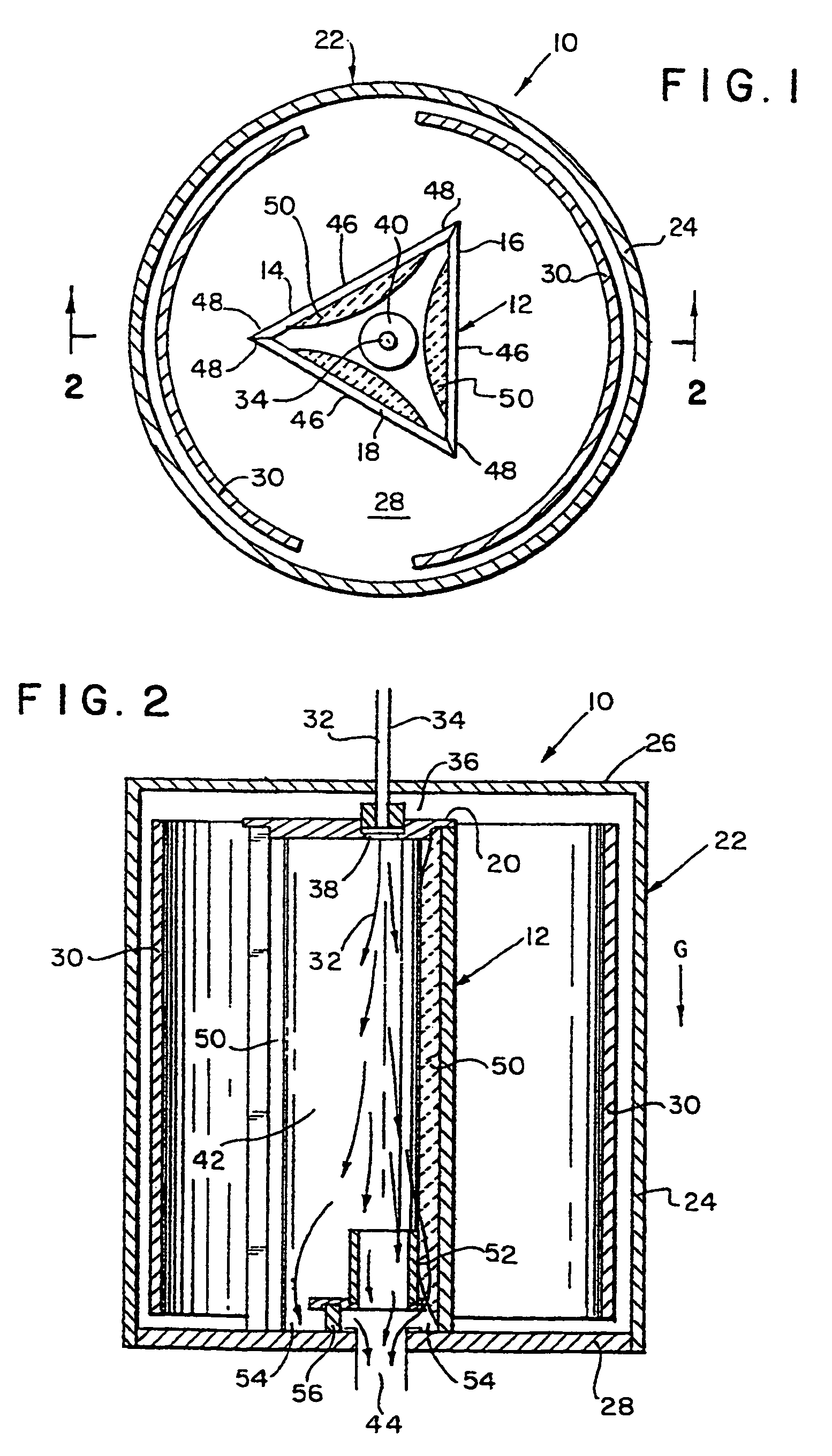

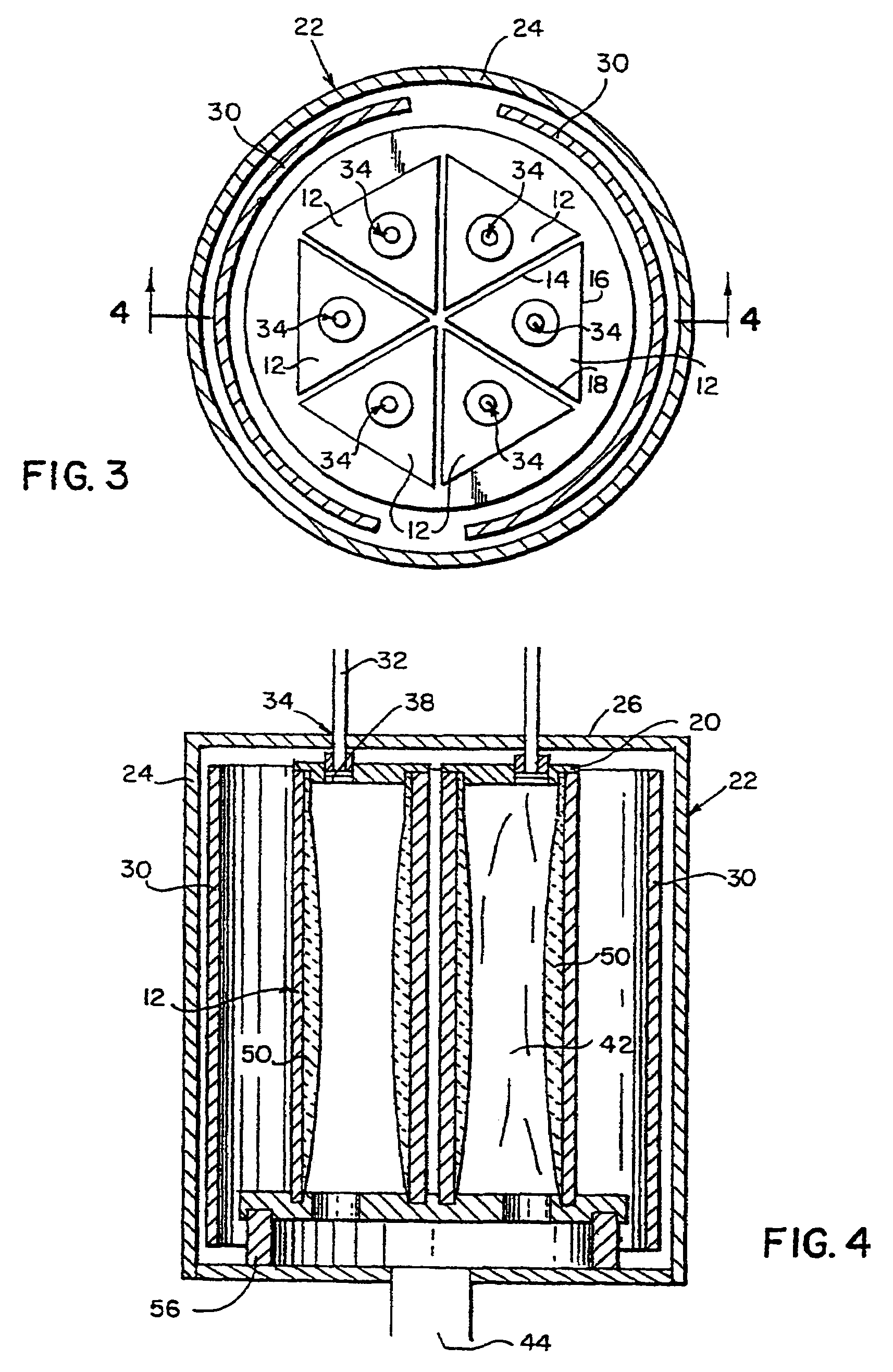

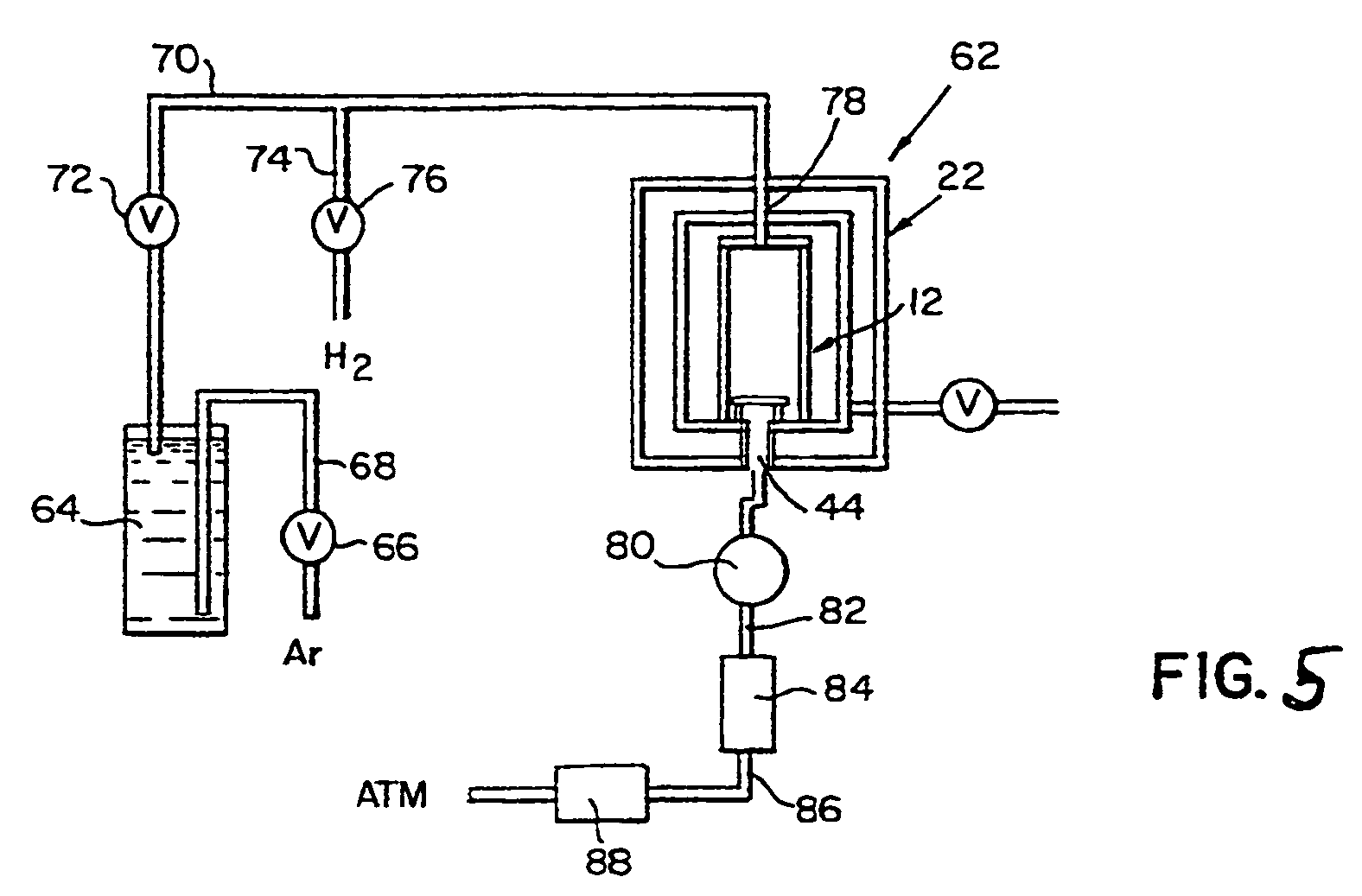

Silicon carbide with high thermal conductivity

PatentInactiveUS7438884B2

Innovation

- A CVD process producing β phase polycrystalline silicon carbide with reduced stacking faults and controlled phonon mean free path, achieving thermal conductivities of at least 375 W/mK by optimizing deposition conditions such as temperature, pressure, and gas flow ratios, using methyltrichlorosilane (MTS), hydrogen (H2), and an inert carrier gas in a parallel flow configuration.

Semi-insulating silicon carbide without vanadium domination

PatentInactiveEP1181401B1

Innovation

- A method involving sublimation growth of silicon carbide with source powder and seed crystal temperatures controlled to minimize nitrogen incorporation and eliminate deep level trapping elements, resulting in semi-insulating substrates with resistivity above 5000 Ω-cm and low nitrogen concentrations below 1 x 10^17 cm^-3, without the need for compensating dopants.

Environmental Impact and Sustainability Considerations

The environmental impact of Silicon Carbide (SiC) wafer technology extends far beyond its thermal management capabilities, representing a significant shift towards more sustainable semiconductor manufacturing. SiC wafers require substantially higher processing temperatures than traditional silicon, consuming approximately 30-40% more energy during production. However, this initial environmental cost is offset by the considerable energy savings achieved throughout the lifecycle of SiC-based devices.

When implemented in power electronics applications, SiC components demonstrate 30-50% higher energy efficiency compared to conventional silicon alternatives. This efficiency translates directly into reduced carbon emissions across various industries, particularly in electric vehicles, renewable energy systems, and industrial power management. A recent industry analysis estimates that widespread adoption of SiC technology could reduce global energy consumption by up to 10% in power conversion applications alone.

The durability of SiC wafers further enhances their sustainability profile. With operational lifespans exceeding traditional silicon by 2-3 times under high-temperature conditions, SiC-based systems require less frequent replacement. This longevity significantly reduces electronic waste generation and conserves resources associated with manufacturing replacement components.

Water usage presents another critical environmental consideration. SiC wafer production currently requires approximately 15-20% more ultrapure water than silicon wafer manufacturing. Leading manufacturers have responded by implementing advanced water recycling systems, with some facilities achieving up to 85% water reuse rates, substantially mitigating this environmental impact.

The thermal management capabilities of SiC directly contribute to more compact cooling systems in end applications. This reduction in cooling infrastructure translates to fewer materials used in heat sinks, thermal compounds, and cooling fans. Quantitatively, SiC-based power modules can operate with up to 40% smaller thermal management systems, representing significant material conservation across millions of electronic devices.

End-of-life considerations for SiC wafers present both challenges and opportunities. While SiC is chemically stable and non-toxic, the composite nature of finished devices complicates recycling efforts. Industry leaders are developing specialized recycling processes to recover valuable materials from SiC devices, with current recovery rates reaching approximately 60-70% for precious metals and rare earth elements used in conjunction with SiC wafers.

Carbon footprint assessments indicate that despite energy-intensive manufacturing, SiC technology achieves carbon neutrality faster than silicon alternatives when deployed in energy-efficient applications. The break-even point typically occurs within 12-18 months of operation in high-power applications, after which SiC devices contribute to net carbon reduction through their superior efficiency.

When implemented in power electronics applications, SiC components demonstrate 30-50% higher energy efficiency compared to conventional silicon alternatives. This efficiency translates directly into reduced carbon emissions across various industries, particularly in electric vehicles, renewable energy systems, and industrial power management. A recent industry analysis estimates that widespread adoption of SiC technology could reduce global energy consumption by up to 10% in power conversion applications alone.

The durability of SiC wafers further enhances their sustainability profile. With operational lifespans exceeding traditional silicon by 2-3 times under high-temperature conditions, SiC-based systems require less frequent replacement. This longevity significantly reduces electronic waste generation and conserves resources associated with manufacturing replacement components.

Water usage presents another critical environmental consideration. SiC wafer production currently requires approximately 15-20% more ultrapure water than silicon wafer manufacturing. Leading manufacturers have responded by implementing advanced water recycling systems, with some facilities achieving up to 85% water reuse rates, substantially mitigating this environmental impact.

The thermal management capabilities of SiC directly contribute to more compact cooling systems in end applications. This reduction in cooling infrastructure translates to fewer materials used in heat sinks, thermal compounds, and cooling fans. Quantitatively, SiC-based power modules can operate with up to 40% smaller thermal management systems, representing significant material conservation across millions of electronic devices.

End-of-life considerations for SiC wafers present both challenges and opportunities. While SiC is chemically stable and non-toxic, the composite nature of finished devices complicates recycling efforts. Industry leaders are developing specialized recycling processes to recover valuable materials from SiC devices, with current recovery rates reaching approximately 60-70% for precious metals and rare earth elements used in conjunction with SiC wafers.

Carbon footprint assessments indicate that despite energy-intensive manufacturing, SiC technology achieves carbon neutrality faster than silicon alternatives when deployed in energy-efficient applications. The break-even point typically occurs within 12-18 months of operation in high-power applications, after which SiC devices contribute to net carbon reduction through their superior efficiency.

Supply Chain Resilience for SiC Wafer Production

The global supply chain for Silicon Carbide (SiC) wafers faces significant vulnerabilities that directly impact thermal management applications in power electronics. Recent disruptions, including the COVID-19 pandemic and geopolitical tensions, have exposed critical weaknesses in the SiC wafer production ecosystem. With over 80% of SiC substrate production concentrated in a few regions—primarily the United States, Japan, and Europe—any regional disruption creates immediate ripple effects throughout the thermal management solutions market.

Raw material sourcing represents a primary vulnerability, as high-purity silicon carbide powder requires specialized manufacturing processes and stringent quality control. The limited number of qualified suppliers creates bottlenecks that can delay production for months when disruptions occur. Additionally, the specialized equipment required for SiC crystal growth and wafer processing, including high-temperature furnaces and precision cutting tools, often has lead times exceeding 12-18 months, further complicating supply chain recovery after disruptions.

Manufacturing capacity constraints present another significant challenge. Current global production capacity for SiC wafers suitable for thermal management applications remains limited compared to silicon alternatives. Major manufacturers including Wolfspeed, II-VI, and ROHM have announced capacity expansion plans, but these will take 3-5 years to fully implement, leaving the market vulnerable to demand surges in the interim.

Diversification strategies are emerging as essential for supply chain resilience. Leading device manufacturers are implementing multi-sourcing approaches, qualifying multiple SiC wafer suppliers despite the technical challenges of maintaining consistent thermal performance across different sources. Vertical integration is also accelerating, with companies like STMicroelectronics and Infineon acquiring or developing in-house SiC substrate capabilities to secure their supply chains for thermal management applications.

Regional manufacturing initiatives are gaining momentum as governments recognize the strategic importance of SiC technology. The European Chips Act and America's CHIPS and Science Act both include provisions supporting domestic SiC production capacity, potentially creating more geographically distributed supply chains for thermal management solutions. These initiatives aim to reduce dependency on single regions and create redundancy in critical production capabilities.

Inventory management practices are evolving in response to supply uncertainties, with companies maintaining larger safety stocks of SiC wafers despite their high value. This represents a significant shift from just-in-time approaches previously favored in the semiconductor industry, reflecting the critical nature of thermal management capabilities in applications ranging from electric vehicles to renewable energy systems.

Raw material sourcing represents a primary vulnerability, as high-purity silicon carbide powder requires specialized manufacturing processes and stringent quality control. The limited number of qualified suppliers creates bottlenecks that can delay production for months when disruptions occur. Additionally, the specialized equipment required for SiC crystal growth and wafer processing, including high-temperature furnaces and precision cutting tools, often has lead times exceeding 12-18 months, further complicating supply chain recovery after disruptions.

Manufacturing capacity constraints present another significant challenge. Current global production capacity for SiC wafers suitable for thermal management applications remains limited compared to silicon alternatives. Major manufacturers including Wolfspeed, II-VI, and ROHM have announced capacity expansion plans, but these will take 3-5 years to fully implement, leaving the market vulnerable to demand surges in the interim.

Diversification strategies are emerging as essential for supply chain resilience. Leading device manufacturers are implementing multi-sourcing approaches, qualifying multiple SiC wafer suppliers despite the technical challenges of maintaining consistent thermal performance across different sources. Vertical integration is also accelerating, with companies like STMicroelectronics and Infineon acquiring or developing in-house SiC substrate capabilities to secure their supply chains for thermal management applications.

Regional manufacturing initiatives are gaining momentum as governments recognize the strategic importance of SiC technology. The European Chips Act and America's CHIPS and Science Act both include provisions supporting domestic SiC production capacity, potentially creating more geographically distributed supply chains for thermal management solutions. These initiatives aim to reduce dependency on single regions and create redundancy in critical production capabilities.

Inventory management practices are evolving in response to supply uncertainties, with companies maintaining larger safety stocks of SiC wafers despite their high value. This represents a significant shift from just-in-time approaches previously favored in the semiconductor industry, reflecting the critical nature of thermal management capabilities in applications ranging from electric vehicles to renewable energy systems.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!